Should you take the CFA exams? What are the benefits of CFA program?

Each year, hundreds of thousands of professionals ponder about this.

Here’s a straight-to-the-point, frank list of reasons why a CFA designation could be useful to you (even at Level 1), compiled by us here at 300Hours (we are charterholders, by the way).

If you’re on the fence and seeking to know more, use this information to make a wise decision on whether this challenging set of exams is worth the effort.

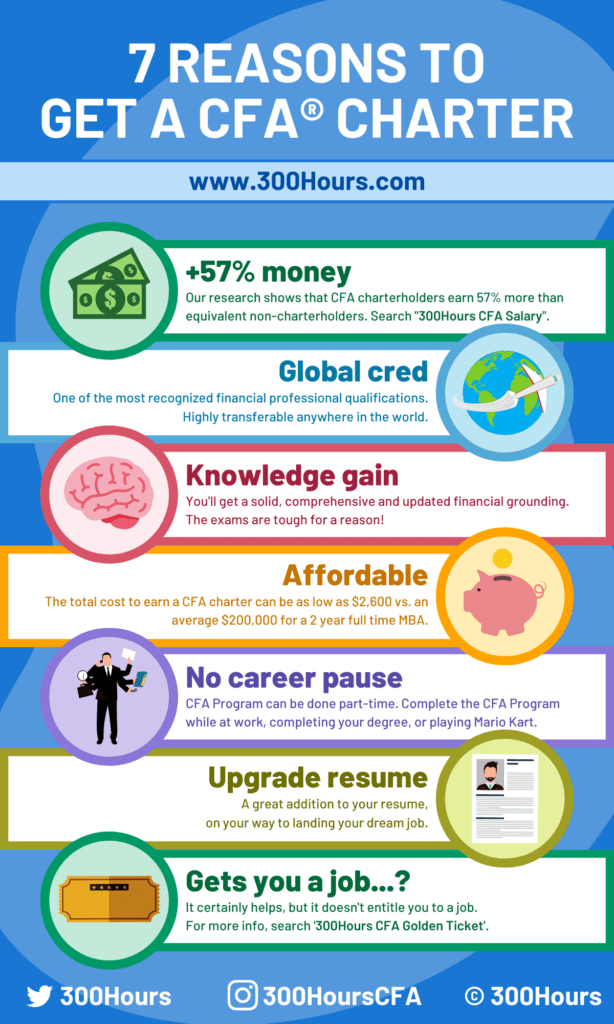

- Benefits of CFA charter, summarized

- 1) It enhances your finance career path.

- 2) It equips you with graduate level knowledge in finance. Plus exemptions to other certifications too.

- 3) Global recognition: Not just in US & Canada, but also Europe & Asia.

- 4) It’s affordable and a good return on investment.

- 5) You don't have to choose between CFA and MBA. Either order works.

- 6) It helps you get a job. ‘Helps‘, not ‘guarantees’.

- 7) CFA commands higher salary and compensation package, on aggregate.

Benefits of CFA charter, summarized

1) It enhances your finance career path.

Given the varied job roles of CFA charterholders, it can be tricky to understand whether the CFA designation would be advantageous to have for your career.

In the past 30-40 years, globalization and expansion of the financial services sector have contributed to CFA charter’s rise as an industry gold standard. Global top investment banks, asset managers and even accounting firms (with financial services consulting arms) began to use the CFA designation as a quality indicator in hiring decisions.

The CFA charter can be valuable differentiator for those interested in developing a career in the broader finance sector:

Industry professionals

A CFA charter can be useful as a career enhancer if you’re already in finance, or to switch to a particular role. A CFA charter would particularly help in these roles:

- Asset management roles, including:

- Portfolio managers

- Private bankers

- Fund of fund managers

- Financial advisers

- Relationship managers

- Buy side and sell side research analysts

- Financial strategists

- Risk managers (although FRM is a strong contender here)

Although not as essential, the CFA designation is increasingly visible on these job roles too:

- Financial services consultants

- Investment banking analysts & associates

- Corporate financial analyst (other names include “business development”, “corporate development”, “in-house strategy” teams of large corporations)

Non-investment professionals

Other professionals such as lawyers and accountants have also pursued the CFA.

Quite often these are gained as complementary qualifications to broaden professional expertise, especially if they specialize in financial services or financial securities. Not particularly crucial, but it does help.

On the other hand, the CFA charter can provide a boost to data scientists and engineers who focus on quantitative financial analysis, as demand for the combination of these skills are on the rise.

Students

If you’re keen on a career in banking, you may want to consider the CFA charter.

If you can afford the time and money, it makes sense to add another notch to your CV, but don’t make the mistake of thinking it will magically bring you a job.

As a student, knowing how to network and getting good internships and work experiences are more effective in securing your first job in banking.

2) It equips you with graduate level knowledge in finance. Plus exemptions to other certifications too.

As you may know, the CFA exams are tough to pass. Really tough.

And there’s a reason – the material is very thorough, extensive and constantly updated. Overall it is not that difficult to understand – it is retaining all the information all at once and applying them under time pressure that often proves the challenge.

But it also means that if you succeed in obtaining the charter, it is an indicator of your solid financial knowledge and credential. The syllabus is also updated continually to account for recent innovations and events, so you’ll always be learning from the most recent experiences and discussions among industry experts.

CFA program also gets you exemptions for some professional certifications and waivers to GMAT/GRE requirements at grad school too.

3) Global recognition: Not just in US & Canada, but also Europe & Asia.

The CFA charter is one of the most recognized professional qualifications in finance in the world.

The great thing about this global recognition is that CFA charterholders enjoy better international career mobility. For example, if you are planning on moving to Asia, having the CFA charter earned somewhere else would still be favorably recognized by Asian employers in their hiring process.

It is the exact same qualification, and candidates are earning their charters all over the world. Currently, there are more than 200,000 charterholders worldwide in 164 countries.

4) It’s affordable and a good return on investment.

The total monetary cost of a CFA charter is variable depending on type of prep materials you get and how many exams you end up taking, but it probably will range from $3,220 to $8,050:

- $3,220 assumes early registration fees for all 3 levels and consecutive passes using CFA curriculum only (no third party study materials);

- $8,050 assumes standard registration fees for all 3 levels, consecutive passes plus using third party materials for the whole process.

That’s still pretty good value as far as professional qualifications go.

What have we got so far? A cost effective certification that will give you global recognition and a deep understanding of finance.

The CFA charter is more about the time commitment, which brings me to the next point.

5) You don’t have to choose between CFA and MBA. Either order works.

It’s all about your personal goals and situation. If you’re looking for a qualification to enhance your career in finance or establish your finance credentials, the CFA designation is highly recommended.

If you’re looking for a qualification to boost your career beyond finance, or looking to move across industries, an MBA might be a better bet.

If you had to choose just one.

At the end of the day, there are many people who end up obtaining both a CFA charter and an MBA.

If you deem having both qualifications necessary, I would highly recommend going for CFA first, then MBA later. My rationale are as follows:

- In my view, there is an optimal time frame to study for the CFA exams for maximum “career impact”, given the huge time commitment it takes, whereby 80% of candidates study for the CFA exams alongside a full time job.

- The best time to take the CFA exams is at an entry/junior level of a finance job (0-4 years experience), before the likelihood of family commitments become more significant. I personally don’t think college/university is a good time to study for the CFA designation, as the priority then should be getting internships and aiming to secure a full time job before graduation.

- When you qualify for the CFA charter say 4 years down the road, you would then already be at a manager level with 4 years experience under your belt, plus a CFA charter. Now that’s a solid position to be in and a good use of the “relatively (commitment) free” period of your life.

- As for MBA, the decision to take it or not can be left till later, as you progress closer to senior management level (if desired), given the costs involved. Who knows, you may even get sponsored by your firm at that level to do an MBA, where it makes the most impact at a more senior/management level.

That said, Alex personally recommends CFA after MBA, so either way works depending on your personal circumstances.

6) It helps you get a job. ‘Helps‘, not ‘guarantees’.

The CFA charter is a great thing to add to your CV to boost your finance credentials. But let’s just get one thing clear – nothing on your CV ‘gets you a job’. And yes, this also applies to the CFA charter.

Nothing you can put on paper is a sure fire way of landing a job. Getting hired is a multi-stage process. Your CV and networking skills gets you the interview, and the interview is what gets you the job. No amount of CV padding is going to replace interview skills so you need to address all steps to successfully score the job you want.

That said, with the recent relaxation of rules for CFA Level 1 eligibility, undergraduates can no study for CFA Level 1 2 years before the end of their undergrad program, which may help further differentiate them for internship opportunities.

7) CFA commands higher salary and compensation package, on aggregate.

Pay is a very tricky question to answer.

There are numerous surveys out there on CFA member compensation, but you need to be careful of those as no meaningful conclusions can be drawn from them as the data merely shows correlation, not causation. Most of these surveys do not remove the effect of work experience either, which is one key driver of salary increase over time.

Our latest 300Hours CFA salary and compensation research does this properly though. In an attempt to better estimate the true “monetary value of CFA”, we collected over 1,500+ data points submitted by our readers, and adjusted for work experience and seniority.

Here is what we found: on average, compared to non-candidates, CFA candidates saw an increase in pay by:

- 32% increase if they’ve passed CFA Level 1

- 39% if they’ve passed CFA Level 2

- 57% if they’ve passed CFA Level 3

That’s good return on investment!

Ultimately, suffice to say that acquiring a CFA charter will open more opportunities in finance to you and make it easier for you to explore others. As a result you can expect your career to benefit from more flexibility and higher compensation compared to if you didn’t have a CFA charter.

Agree? Disagree? Want to share your experiences? Leave me a comment below!

Meanwhile, if you’ve decided to register for the CFA exams, here are a few articles that may be of interest:

Hi,

all your articles are super informative. Thank you very much!

I had my Bachelor degree few years ago and was not finance related. I am investing for some years and I want to switch my career to finance.

Not sure if I will have time to do all 3 levels. Would it be wrong to start with the thought of taking only the first level to obtain financial information for investment purposes and try to find an entry level job in finance?

I know out there many people are in my situation, and if you can answer this I would be extremely grateful.

Hi Maurizio, Zee, 300Hours’ founder himself didn’t have a finance related undergraduate degree, so anything is possible!

Yes, studying for CFA Level 1 would help ‘open doors’ and help in an entry level finance job. I think it is a sensible move, not to start with the goal of requiring a CFA charter, but take each level as needed. It is a means to an end after all for most of us. Our research also shows that on average, it helps increase salary even at CFA Level 1.

Best of luck, and do keep us posted on your journey and how it’s coming along on studies and job search.

This is a great public service, 300hrs. Thank you. Please enlighten me, how beneficial is the CFA for a financial advisor generally? and In efforts to become a fund manager as an advisor, would it helpful?

I have a bachelors in Accounting (CA stream), currently finishing off my Post-grad in Management Accounting/Finance.

Love from South Africa.

Hey Mokwati, lovely to hear from you and glad you found our site useful. It is more relevant as a fund manager than a personal financial advisor in general (assuming you’re referring to financial planning for the latter). That said, plenty of financial planners hold CFA as well (3% in this article), as it does help broaden your career path if you’re not sure about financial planning.

Hope this helps!

please, am 37 years old and working as claims officer in an insurance company, do i still qualify to write the cfa exams and will you recommend for me?

You just need a bachelors degree to sit for the exams. Whether it’s a good idea for you to take the CFA exams depends on your circumstances and your career goals. Take a look at our 300Hours guides and you’ll get a better idea on whether this is for you. Good luck, and if you have a specific question, post it at our forum!

Does the transaction lawyers’ work experience being recognized by the CFA Institute?

Hi Shawn, it could be, as it depends whether your work helps inform investors’ decision making. We have written a comprehensive guide on CFA work experience, check it out, hope that helps!

There are numerous surveys out there on CFA member compensation, but you need to be careful of those as no meaningful conclusions can be drawn from them as the data merely shows correlation, not causation. Most of these surveys do not remove the effect of work experience either, which is one key driver of salary increase over time. Thanks

You’re right about correlation vs causation, of course. However, work experience and career progress like promotions are removed from our analysis, so what you’re seeing is a purer comparison between the CFA charter and salary. You can see our original analysis here: https://www.300hours.com/articles/will-your-pay-increase-as-a-cfa-candidate-or-cfa-charterholder

Its a serious finance out here.And moreover i think the syllabus of CFA is very good,i will suggest every MBA to at least read it twice. No wonder how many of us pass this exam but the knowledge we get by reading the books is true a added advantage. A cut above the rest !

i really admire ur blog. It really inspires all CFA candidates.

Thanks, Eben!

Great post! I just start to prepare the CFA level 1 for June 2019. I am really impressive about ethics material. For me is an extra to achieve the CFA charter. I studied in a spanish university and I would like to work outside Spain and the CFA is a really great benchmark because my university is not a top university in the world. Other important point is because the CFA is in English and I can improve my finance vocabulary a lot. I knew your blog last summer (I researched about CFA program) and is pretty useful. Congrats! I wish you maintain the level of your post.Bye!

Thanks for your comments! That’s a good point – language was something that we didn’t consider. We’ll definitely be keeping up the posts so remember to check back!