The recent pandemic has brought ESG (environmental, social and governance) issues to the forefront of everyone’s minds.

ESG matters. And investors and companies around the world are reacting fast to this current situation, pointing to a longer term demand for investment professionals with green finance and responsible investment knowledge.

CFA Institute’s ESG Certificate may be a practical and affordable answer to augment your current skillset with some sustainable finance credentials.

Here’s the ultimate guide with all the info you need!

- Overview of Certificate in ESG investing

- CFA ESG certificate in a nutshell

- Pass rates & pass marks

- Topic areas & weights

- Exam Fees & Costs

- CFA ESG investing courses

- Exam Schedule & Key Deadlines

- What are the requirements for Certificate In ESG Investing?

- Benefits of the Certificate in ESG Investing

- ESG Investing vs. GARP SCR Certificate: Which is right for you?

Overview of Certificate in ESG investing

Initially developed by CFA UK in 2019, from September 2021, the Certificate in ESG Investing is owned and administered by CFA Institute to provide worldwide access to this global credential.

This certificate is designed to meet the investment sector’s increasing demand for further education, guidance and standards around ESG (environmental, social and governance).

As of Dec 2023, the CFA ESG certificate has already registered more than 51,000 registrations globally.

This course goes for a broad framework approach, teaching its candidates how to analyze and integrate material ESG factors into their day-to-day investment roles. It is designed for investment professionals in all roles, from asset management to sales and distribution, as well as students seeking a career as an ESG analyst in the investment sector.

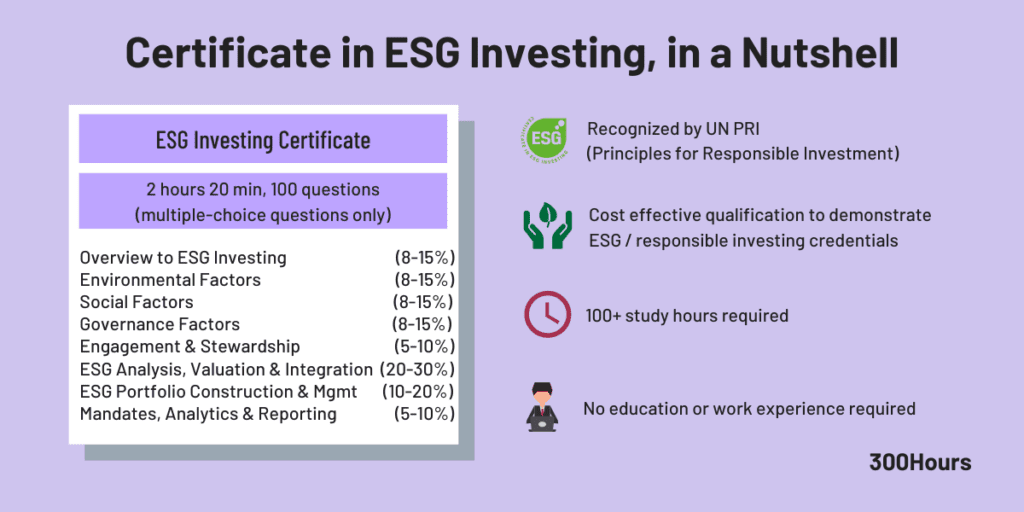

The Certificate in ESG Investing is also recognized by the UN PRI (Principles for Responsible Investment), a leading proponent of responsible investment. Although supported (but not part of) United Nations (UN), UN PRI is an independent, non-profit organization that seeks to encourage investors to use responsible investment to enhance returns and better manage business risks.

There are in-person and online proctored exams (certain locations only) managed by Prometric, CFA Institute’s global testing partner. It is best to check if in-person or remote testing options are available in your area before registering.

CFA ESG certificate in a nutshell

The Certificate in ESG Investing:

- is designed to equip investment professionals with a base knowledge and skillset to integrate ESG factors into the investment process. With no formal entry criteria, it is suitable for a broad range of financial services professionals (not just investment-related) who are keen to understand ESG issues;

- consists of a one-part, computer-based testing exam consisting of 100 questions in 2 hour and 20 minutes, with remote exam testing now available;

- just has multiple choice types of questions in this exam, and no longer has item set questions.

Similar to most other professional designations such as CFA, FRM, IMC or CAIA, the ESG Investing certificate is also a self-directed learning program:

- The course starts with a broad overview of the ESG factors, before focusing on how to apply these knowledge in portfolio construction, valuation, analysis and analytics reporting.

- In terms of study hours, it is recommended that ESG exam candidates devote around 100 hours in total to complete the certification.

- The 2024 CFA ESG curriculum has been published. The syllabus is updated every year on 1st December, and covers exams taken during 1st Dec to the following 30 Nov. It is important to make sure you have the right syllabus for your exam timeframe.

The ESG exam can be taken all year round, and also remotely via online proctoring in certain locations only. You can find your nearest ESG test center here. Candidates are required to sit the exam within 6 months of the registration date.

Pass rates & pass marks

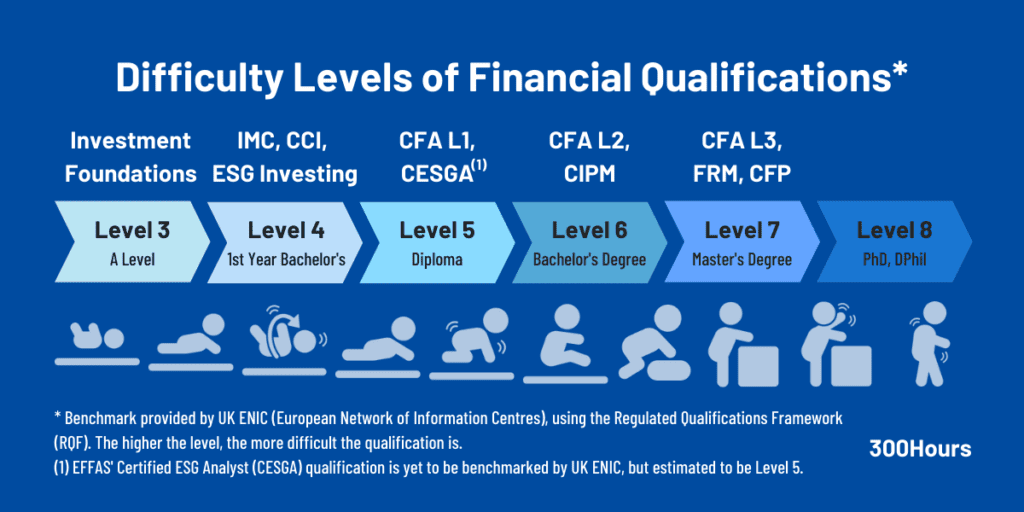

Just like Investment Management Certificate and Certificate in Climate and Investing (CCI), the Certificate in ESG Investing is a Level 4 qualification, which means that the level of difficulty of the qualification broadly equates to the first-year of an undergraduate degree.

According to a candidate who passed recently (who is also a CFA charterholder and an IMC certificate holder), about 25% of the ESG Investing exam questions tests quantitative knowledge.

The pass mark ranges from 60%-70%, with an average pass rate of 81%.

Topic areas & weights

The Certificate in ESG Investing consists of one exam with 100 multiple-choice and item-set questions, with an allocated time of 2 hours and 20 minutes.

The ESG syllabus has 8 chapters which covers a broad overview of the development of ESG investing, combined with technical aspects such as portfolio constructions.

The topics areas and exam weights are as below:

| ESG Investing Certificate Topic Areas | Topic Weights |

|---|---|

| Overview to ESG Investing and the ESG Market | 8–15% |

| Environmental Factors | 8–15% |

| Social Factors | 8–15% |

| Governance Factors | 8–15% |

| Engagement and Stewardship | 5–10% |

| ESG Analysis, Valuation and Integration | 20–30% |

| ESG Integrated Portfolio Construction and Management | 10–20% |

| Investment Mandates, Portfolio Analytics and Client Reporting | 5–10% |

Exam Fees & Costs

The 2024 ESG Investing exam fee structure is nice and straightforward:

- Registration fee and online learning materials cost $865

You can reschedule your exam appointment for a non-refundable fee of $30 if it is done at least 72 hours before the appointment.

It is a cost effective and time efficient investment to demonstrate green finance and responsible investing credentials internationally.

CFA ESG investing courses

Juggling a full time job with studying is tough as is, so it is worth considering using third party prep providers to help focus your studies with more practice questions and mock exams – which as we all know are one of the more effective ways to learn.

Here are a few CFA ESG Investing prep providers worth considering:

Exam Schedule & Key Deadlines

The Certificate in ESG Investing is currently available via Prometric in hundreds of test sites, with plans to further expand the availability of this qualification globally.

Candidates can sit for Certificate in ESG Investing throughout the year (except holidays and weekends).

That said, candidates must carefully plan the time of exam registration, bearing in mind that the ESG Investing syllabus gets updated annually on 1st October and remains until 30th September the following year, unless otherwise necessary.

Here’s a quick summary of the registration and exam scheduling details:

| Exam Registration | ESG Investing exam registration is done through CFA Institute, with the certificate currently available globally. Upon registration, candidates will receive an email confirmation providing scheduling instructions, a unique username and password. Note that candidates can only view exam availability after registration. |

| Exam Scheduling | After registration and payment, candidates will need to wait for 2 working days before they are permitted to schedule an exam. Candidates can sit for exam on most working days at selected Prometric centres worldwide. |

| Exam Registration Expiry | Candidates have 6 months from initial exam registration to sit for the exam. Otherwise, the registration will expire after 6 months with no refunds given. |

| Number of Exam Attempts | If you fail the exam twice within a 6 month period, you can only register 6 months after the date of your first failed appointment. No further attempts are allowed once a candidate passed. |

What are the requirements for Certificate In ESG Investing?

While a solid grounding in the investment process is strongly recommended (via formal qualification or experience), there are no formal entry criteria for candidates.

We think it is great that CFA Institute has made this course so approachable to all, because this COVID-19 pandemic experience we are all going through now is just going to bring ESG issues to the forefront in investing.

Candidates who successfully pass the ESG exam can claim a digital badge and earn the CFA Institute’s Certificate in ESG Investing.

Benefits of the Certificate in ESG Investing

Having the Certificate in ESG Investing could be a key differentiator in the financial services sector, especially if you’re job hunting during this COVID-19 pandemic.

Given the low time and money investment, it does represent good value for money given the unique and practical qualification you would attain.

By completing and earning the Certificate in ESG Investing, you can expect to:

- Expand your ESG knowledge and stay ahead in your field

- Improve your career prospects and differentiate yourself from other job candidates

- Develop the skills and competencies to fulfil both your fiduciary responsibilities and your firm’s responsible investment mandates

- Gain a prestigious qualification (and digital badge) from CFA Institute, recognized by leading firms

- Pave your way for further finance designation such as CFA, FRM, IMC or CAIA as you further specialize.

ESG Investing vs. GARP SCR Certificate: Which is right for you?

We are comparing CFA ESG Investing vs GARP’s SCR certificates below, although it is worth mentioning that EFFAS’ Certified ESG Analyst (CESGA) is a higher Diploma level certificate in ESG investing that is worth checking out, as you’ll get a proper title upon passing (CESGA or Certified ESG Analyst), which is not present in either CFA ESG Investing or GARP’s SCR certificate below.

In short, while both qualifications focus on sustainable investing, there are some slight differences in focus about them:

- Certificate in ESG Investing has a slightly broader focus on ESG factors, and how the investment industry can adapt to that change in investor preferences. It also contains covers key concepts relating to climate change (including climate mitigation, and adaptation and resilience) and a range of climate change initiatives, as well as featuring more extensive study of the opportunities arising from the circular economy, green products, and clean and technological innovation.

- On the other hand, Sustainability & Climate Risk (SCR) certificate mainly focuses on educating risk professionals on how to manage the main environmental risk (arguably just the “E” part of ESG), i.e. climate change.

Both SCR and ESG Investing Certificate are now available globally.

While both are good quality qualifications from reputable organizations, the choice depends on which certificate has more relevance to your preferred career path: investments or risk management.

| CFA Institute’s Certificate in ESG Investing | GARP’s Sustainability & Climate Risk | |

|---|---|---|

| Suitable for | Students who are keen on an investment career; or Investment professionals of all roles (asset management, sales & distribution, wealth management, product development, financial advice, consulting, risk etc), who are looking to understand and integrate ESG issues into the investment process | Risk management professionals of all disciplines (finance, supply chain, operations, technology etc) who are keen to learn about sustainability and how to manage climate risk in their industries. Students interested in a risk management career. |

| Pre-exam qualifications | None, although some insights in the investment process is strongly recommended (via formal qualification or experience) | None |

| Number of Exams | 1 | 1 |

| Exam Frequency | Available to book throughout the year (except weekends and holidays) for in-person exams globally. Also available to book for remote proctoring at home globally. Maximum 2 attempts in 6 months | Specific 2 week windows about 3-4 times a year. |

| Exam Format | 100 multiple-choice questions in 2 hours and 20 minutes On-site computer-based testing or online remote testing | 80 multiple-choice questions in 3 hours On-site computer-based testing |

| Pass Rates | 81% on average | 47% (April 2024) |

| Fees and Costs | US$ 865 | Around US$ 600-825 depending on GARP membership status or presence of other credentials |

| Study Hours Needed | 100+ hours | 100-130 hours |

| Post Exam Requirements | None | None, although there are 20 hours of voluntary continuous professional development (CPD) every 2 years |

Overall, the Certificate in ESG Investing seems to be a cost efficient means to signal your green finance credentials in this increasingly competitive marketplace.

If you’re in the investment sector, this ESG qualification would be useful to have a solid base level of knowledge about ESG and how to incorporate it into your day-to-day role. If you’re a student keen to start a career in investments, this certification – combined with an investment-focused qualification like Chartered Financial Analyst (CFA) – could give you a great head start with ESG credential as a valuable differentiator.

Is this CFA ESG Certificate something you’d consider taking on to enhance your resume/CV? Let us know in the comments below!

Meanwhile, you may find these related articles in our Beginner’s Guide series of interest:

- CESGA (Certified ESG Analyst) Course: Our Epic Guide

- SCR (Sustainability & Climate Risk) Certificate: A Beginner’s Guide

- IMC (Investment Management Certificate): A Beginner’s Guide

- CFA Exams: A Beginner’s Guide

- CAIA (Chartered Alternative Investment Analyst): A Beginner’s Guide

- FRM (Financial Risk Manager): A Beginner’s Guide

This is an excellent forum.

What is the minimum pass percentage to receive the ESG Investing Certification from CFA Institute?

Regards,

A

Hi .. I wanted to understand the marking criteria.. whether its based on each chapter or module or in total average??

Would help if someone share a detailed information on it.

TIA

Hi Sips, it’s a total average score of the whole exam.

How do I make a second appointment for an offline exam? Is there a time interval requirement from the first time?

Hello, very good information here! Congrats!

One question : CFA ESG certification is only in english? or It can be in spanish?

thank you,

Male

It’s in English only

Hello Sophie,

I have experience in Business Management and Strategy, Business Development, Sales, and Client Services. I’m interested in transitioning to the ESG field and I’m considering the CFA-Certificate in ESG Investing. Would you recommend it as a first step?

Also, I can’t find the online remote testing registration on the website. Can you help?

Thanks,

George

Hi George, it seems like Certificate in ESG Investing is a good first step for your case given its global recognition and introductory nature.

I believe you have to register first, then choose the online proctoring option.

Hi Sophie,

Thank you for your help. My ultimate aim is to become a sustainability consultant, with a primary focus on climate change and renewable energy. I was wondering if you could suggest any other certifications, programs, or fellowships that might be valuable for me to consider?

Once again, thank you for your guidance.

Warm regards,

George

Hi Sophie,

One question: I understand we have 6 months to do the CFA ESG Exam. If I register at the end of July 23 and do the Exam on January 24, the Exam is still based on the current edition (edition 4)? Or new Edition ?

Thanks,

Another question Sophie,

Do these New Editions (historically) represent considerable changes in the curriculum? Or just minor updates?

Thank you

Hi Edy, it’s hard to tell from year to year as sometimes it can be minor, sometimes it can be a big change as it depends on the industry’s evolution. The content is constantly kept updated with the industry. So who knows? 🙂

I’m awaiting CFA Institute’s confirmation on your other question so will get back to you when we hear back!

Hi! I am also curious about Edy’s first question. Did CFAI reply?

Thanks.

Hi Inigo (and Edy),

Yes CFA Institute just got back to me.

They said that the ESG curriculum is updated on January 1. Candidates will be tested on the curriculum they register for. Anyone who registers between now and Jan 1 will be tested on the current version of the curriculum. Anyone who registers on Jan 1 and after will be tested on the updated curriculum.

Hope this clarifies!

Hi Edy,

CFA Institute just got back to me.

They said that the ESG curriculum is updated on January 1. Candidates will be tested on the curriculum they register for. Anyone who registers between now and Jan 1 will be tested on the current version of the curriculum. Anyone who registers on Jan 1 and after will be tested on the updated curriculum.

So if you register on 23 July, you’ll be tested on the current edition (not 2024).

Hi CFA friend,

I am pursuing a Ph.D. in Economic Development but I am really interested in ESG and would like to follow a consulting career path. Should I take the CFA ESG or GARP SCR? My thesis is about climate change and migration so my knowledge of climate change is academically good.

Thank you!

Hi Hung, on balance CFA Institute’s Certificate in ESG Investing would give you the broader scope and brand name recognition you need for a consulting career. SCR may be too specialist at this stage as it focuses on climate risk only. My opinion at least 🙂

Thanks for your sharing!

ESG Test Drive Exam Experience

Be careful with the timing of the exam. I scheduled the ESG TEST DRIVE exam with Online Proctoring for 27 of March at 1:30 Brussels time.

In the Prometric system and confirmation letter there is absolutely no mentioning if it is 1:30 a.m. or 1:30 p.m. Of course, I was not expecting the exam to take place at 1:30 after midnight, which is unacceptable. Moreover, 1:30 a.m. appears to be the evening of Sunday (26 March) on the East Coast, and I read that online proctoring does not take place on weekends and public holidays.

So, having logged in the Prometric Online Proctoring App at 1:30 p.m. (13:30 Brussels time), I found out that the exam window is now longer available.

$30 lost

Best,

To ensure this is not one more Fake Review in this chat, can you please share your CFA ESG Badge/Credential?

Every candidate that passes the exam gets a CFA ESG Badge/Credential that is public/available to everyone to check. The CFA Institute provides these public credentials precisely to avoid fraud, misleading information, fake resumes, and fake reviews.

Hey I’m still confused between CFA’s ESG certification vs CESGA.

Based in India in the Equity Research profile.

What would be the better course to take on? Higher weight age to global appeal, ofcourse!

Someone I know was doing the exam and she typed her whole answer and then went to the next page. When she went back she couldn’t see my answer it had disappeared. Does this mean it. got submitted. Assuming. this is because it doesn’t let you make changes. once you go. the next. page?

Hello Anna,

Did you attempt again and passed?

Did you change something in your preparation?

Hi Guys

I had a few doubts regarding CFA ESG

1) From when will the curriculum change? I have not registered yet but I plan to register in next few weeks and appear in December. will the new curriculum change affect me? I read it online that curriculum changes from 1st october.

2) What if I pay for my exam in September and schedule a date in the month of September to appear in December, will I appear from the old curriculum [ as i scheduled before 1st oct or from the new curriculum as I am appearing after 1st October]

3) How much % of the curriculum change you guys are planning/expecting? One has to plan accordingly.

Thank you

Hi Sanjog, from my information the curriculum will not change until end of the year – also I expect them not to change a great amount of the syllabus as they did an overhaul as they transferred it from the UK version – so you should be okay as long as you plan to do it in the next few months.

Hi, which of the Prep providers are most popular? I see Brainie, AM, Fitch, Quartic and Uppermark.

Hello! For those who completed the ESG course; I have a background in compliance and due diligence. Does this course include anything about risk and ESG, anything that is useful for such background?

Thank you.

I just decided to get both of these certifications. I passed both and recommend both if you are actually trying to specialize in ESG-related research, consulting, etc.

Although SCR only really focuses on the ‘E’ of ESG, it ties in nicely where the CFA curriculum falls short and helps provide context that solidified my understanding of all the concepts, organizations, and global actions/initiatives.

I spent about 3 – 4 weeks reading the CFA ESG curriculum and then a week summarizing the chapters and taking the CFA mock exam. I spent about 1 – 2 weeks reading the SCR material and then a week summarizing the chapters and taking the mock exam.

Hi, about the exam, during the exam, once you answered a question and move to the next is it possible to come back and review answered questions?

Hello,

I want to start studying for the CFA ESG in september 2022 but I have a concerned regarding the update of the syllabus in october. I want to know how does that work and if the topics and the contents really change because it wouldn’t make sense to start studying one month before everything changes

Hello,

I was also concerned on this. Does CFA update the entire syllabus or only remove/add in some new topics for the new edition.

Hi Manuel, from my information the curriculum will not change until end of the year – also I expect them not to change a great amount of the syllabus as they did an overhaul as they transferred it from the UK version – so you should be okay as long as you plan to do it in the next few months.

Hi

I have 03 years of experience supporting clean energy entrepreneurs and just started my career as an investment associate in a venture capital fund investing in climate technologies. Before that, I have a bachelor’s degree in Business Administration as my undergraduate. However, I have not possessed a solid understanding of finance, venture investment, or ESG yet I am keen on studying investment and ESG investing for my future career path. So, considering my status, should I pursue CFA level 1 first to obtain the financial fundamentals then continuing with CFA in ESG investing or gain the CFA in ESG investing immediately without the CFA level 1?

Hi Hung,

I would recommend you to do the CFA 1 First for two main reasons:

1. Your clean energy background was your competitive advantage in entering the Venture Capital Fund. However, they now expect you to learn and apply financial/investment approaches. If the fund is focused on climate technologies, it will be mainly focused on the E Factor of the ESG. And, if you have three years of clean energy experience, you are probably ahead of most traditional investment professionals without any environmental background. (believe me).

2. ESG is an early-stage field. Different companies apply different methodologies. The ESG field is still trying to find solid ground, and it is expected to have some consolidation. So, try to understand if they plan to give specific ESG training to their employees. Probably yes. Another thing you can do is, start with the CFA 1 (it will require 300 hours of study) and purchase the CFA ESG book on Amazon, so you can use the book as an ESG professional manual while you take the CFA 1. After that, you can decide if you still want to take the CFA ESG.

By the way, as the article above states. CFA ESG is Level 4, and CFA 1 is Level 5. So the CFA 1 will require you more hours of study.

I think both certifications are great! I also hold the CFA ESG certification but again, in your case, and considering your background, I think “CFA 1 First” will be the best strategy.

Cheers,

I’d agree! The additional questions were very valuable in addition to the end of chapter questions.

Hi Anna, how were the questions in relation to the qns in tutoring platforms like Branie and Fitch? Also, not many mention this, but when you took it for the second time, was it the same set of questions or different? Thanks.

Hi Anna, I’m sorry to hear that it didn’t work out this time. We don’t think so, I think the syllabus is similar, having just transitioned to CFA Institute just March last year.

Are there any discount codes for CESGA? Thanks.

Hi Sophie and Zee – Thank you very much for the information provided.

Do you have any information on when Edition 4 of the CFA Certification starts?

Hi Caru SR, before this certification was transitioned from CFA UK (the creator) to CFA Institute, the syllabus is refreshed every 1st October. So if things don’t change, I expect 1st October 2022 v4 of the syllabus would be out.

Hi James, thank you, glad you found it useful. We have not heard and tried out Brainie ourselves personally, so would not be able to comment on its quality at this stage. CFA Institute does not seem to have an approved prep provider program (yet?) for their CFA ESG certificate course, so there is no strict rules who can be a prep provider at this stage.

We know of BPP, Fitch, Quartic offering CFA ESG Investing courses now, as they also offer CFA program courses. Hope this helps!

Hi Zee / Sophie, great work guys! Your page is an indispensable guide. Just wanted to check can you profile the CFAUK Climate and Investing guide as well which has just been launched. Especially if this cert will also transition to the CFAI like the ESG which was originally introduced by CFAUK

Hi Anish, this is hopefully in the works soon! I have reached out separately to CFA UK on your question, and they said that “we (CFA UK) are not able to comment on any transition of the Climate Certificate to CFA Institute yet, or if this was to occur what the timeline would be.”

Meanwhile, do check out our new ESG qualifications section where we will continue to feature more high quality, relevant ESG certifications out there 🙂

I took this exam recently, however, I did not pass this time. I am planning to take my second exam within a month and this time, I will purchase third-party study material for preparation. Currently, I can’t decide between Brainie, Fitchlearning and Quartic. Based on the fact that I already took the exam once and do not have sufficient knowledge regarding investing, which platform would you recommend to me the best?

Hello James, thanks for your feedback. I personally know the founders, so I can vouch for them – also I used them to prepare for my CFA ESG it was helpful.

Hello James, thanks for your feedback. I personally know the founders, so I can vouch for them – also I used them to prepare for my CFA ESG it was helpful.

Hi James, I did it similar to the other posts, starting by reading the curriculum and then qbank & secret sauce. I mostly worked with their qbank. the day before the exams I did score around 70%, which I think is reasonable since CFA does not provide any guidance on what score is needed. Unfortunately, I have not received/seen my detailed results, so I cannot provide any colour by what margin I did pass. What I can tell is during the exam I felt well prepared. But having done all CFA levels, I think I expected a somewhat tougher exam tbh. Hope this helps!

hello it is a computer-based test, right?

thanks for the information.

Yes Chucxin. It is a computer-based test.

You have two different options to do your exam:

1) In a Test Center – Person VUE testing centers – Every Working day

2) At home/Office – OnVue remote-proctored exams – Monday to Saturday

2h.20 minutes exam

100 multiple choice questions

Type of questions: standard multiple-choice and item sets

– The Certification includes 1 exam registration ($675) , and the PDF Handbook

– If you want the hardcopy of the book you need to pay extra $135 (plus shipping)

– You have 1 year from initial exam registration to sit for the exam

– Nonrefundable. After 1 year you pay full amount.

Hi!

Can I ask you something very silly, maybe I’m wrong but I just did my exam online and the system only showed me 83 out of 100 questions. Some of those questions were divided into further questions, for example, 4: 4.1, 4.2 etc but if you counted all it gives you 110 questions rather than 100. I am confused in the sense that I am not sure if I should have seen 100 questions, or 83 plus the sub-divisions would yield me the 100 questions in total.

Thanks

Hello. If an applicant is successful and passes the CFA ESG certificate test, does he/she receive a certificate from the CFA Institute that shows the acronym “CFA ESG” after their name?

Hi Tito, unfortunately not, there are no titles you can put behind your name with CFA ESG Investing Certificate or GARP’s SCR certificate. EFFAS’Certified ESG Analyst (CESGA) Diploma is the only one we know at the moment that you can use a ‘Certified ESG Analyst’ or ‘CESGA’ title after passing.

Hi Sophie,

I’m Aleck from Taiwan, cause there is too little info in Taiwan, so I would like to ask whether to pass the certification, is it enough to read the official textbooks, or if I need other supplementary textbooks? Thanks

Hi Aleck, no worries, that’s why we are here to help.

With ESG certificate, the official textbook is comprehensive and pretty doable, so in my view, official textbooks are sufficient at this stage.

Best of luck for your studies!

Thanks for your reply, and it helps me have a better understanding of the test!

You’re very welcome – let us know if we can help with anything else!

hi, I am Jane from China. I want to know if I can take the exam on esg investing in Mainland China 2022. Thanks a lot.

ESG is not currently available in mainland China, but this might change. At this point in time we don’t have full certainty on 2022, but will update this page when we do!

Hi may i know what do you think about the cert in green finance offered by charter bankers vs this cert esg investing?

Hi, I used Kaplan to study for the three CFA levels. Are there any external companies offering tuition for the ESG qualification?

As far as we know, the providers that offer ESG are Fitch Learning, BPP and Quartic Training. More are adding ESG to their range all the time so stay tuned!

I failed with an overall weakness of “slight” but in all the sub sections it says “severe”. How is this possible? Doesn’t make sense! The institute doesn’t answer my emails regarding that particular question so I have a hard time believing that my result is correct. Also because I found the exam not all that difficult..

Send your results to results@300hours.com, and we’ll take a look!

Hi Robert,

I also got the same result as you and I was also pretty confident that I passed as the exam was not hard! And now I’m scared of taking the exam again when I don’t really understand what went wrong. Let me know if you manage to get an answer to your query.

Hi Sophie!

Thanks so much for this analysis. Super helpful. Can you compare the CFA certificate in ESG Investing vs the US SIF Chartered SRI Counselor?

I’ll pass the message on to Sophie to have a look! Are you interested in both, or do you have one of the qualifications already?

Thanks! Yes I’m interested in both. I’m looking to get one or the other designation. Getting my feet wet, prior to attempting the CAIA or CIMA.

Hey Sophie! Thanks for the information, very helpful!

I wanted to know that incase someone fails in attempt #1, what is the procedure for another attempt? How much extra payment is required or do we have to register all over again?

If you fail, you’ll have to register and pay all over again I’m afraid.

Does anyone know how much crossover there is between the CFA ESG and GARP SCR?

If I take the CFA ESG first how many hours extra are likely needed for the SCR?

Is it likely to be possible to pass the SCR 3 weeks after taking the CFA ESG?

There’s no hard data on this, but I would guess that overlap is minimal, 20% at most. I personally would not bank on any study synergies when planning your studies. Good luck!

Could you also compare CISI/ CBA’s Climate Risk Certificate and Green and Sustainable Finance Certificate? Thanks

I’ll add that to the to-do list!

Hi Sophie!

Are the article links at the end of the chapters content tested on the exam ?

And does the exam allow multiple resits or just one try to pass the exam ?

Thank you very much !

Carolina

The end-of-chapter questions are a good representative of exam content, and direct from CFA Institute, so we always encourage people to complete as many as you can!

You can resit multiple times for the same exam but there is a limit – 6 times, if I remember correctly.

Hi Zee, hope you are well. just wondering if end-of-chapter questions is suffcient for passing the exam? or if there is any other practice questions you recommend? many thanks

Hi Zee,

I’ve got 66% correct answers on the end-of-chapter questions, and also on the Specimen Paper 66%.

Would you think that mark could translate in passing the actual exam?

Many thanks in advance

We don’t really have any hard data to say for sure. Without additional information, I would advise to target being able to score 70%+ going into the exam.

Thank you very much Zee!!!

Hello,

Is it possible to know the number of pages (more or less) of the material provided to prepare for the ESG certification?

Thank you

Recommended study hours for ESG is 130 hours, so I’d imagine it would be at least 1,500 pages if the material scales with e.g. CFA exams.

There are 574 A4 pages in the v3 pdf.

25 pages of miscellaneous at the beginning – contents, forewords etc

9 chapters, each has several pages of sample questions, key points and references etc at the end

glossary etc at the end off the book

Hi, am a foreigner in singapore. Would we be able to have access to the following course and exam?

Yes, you shouldn’t have an issue.

Hello Sophie!

Is there any study plan for the ESG CFA Certification that you would recommend in order to sit the exam around September 1st?

Thank you =)

Hi Natalia, we currently don’t have a specific study plan for CFA ESG Certificate, but may plan to add it in the near future.

It is a shorter course, estimated to be around 130 hours of study time. If you’re just studying now with a full time job, timing may be a little tight.

Studying based on the curriculum order makes sense at the moment, as it starts with an introduction and gradually goes deeper into each topic. Make sure you spend some time on the highest weighted topic “ESG Analysis, Valuation & Integration”, and make use of the mock paper they provide (as there are not many practice papers going around at this stage).

Best of luck, hope this helps, do let me know how it goes once you took the exam!

Thank you Sophie!

Hi Sophie, hope you are well. just wondering if there is more practice questions available ? So far i can only find the end of charter questions in curriculum. But not sure if it is sufficient to pass the exam, I’d like to do more practice questions if available, many thanks

There aren’t many practice exams available right now since the qualification is quite new, but there are two sample papers available from CFA UK here.

Thank you so much Zee

No problem!

Hi Zee,

The link is only guiding to the CFA UK homepage but I don’t find the exams there, they might have been moved in the mean time? Would you have a direct link to the two exams?

Many thanks & best

Sandra

Hi,

Just wanted to check if the online course material (presumably eBooks) which are included in the registration fees can be downloaded as pdfs and printed at our end instead of paying the hard copy additional fees?

Thanks,

Sahil D

Hi Sahil, yes you can download the online study materials in pdf and print.

Hello,

if i register today for the esg certificate, do i already have access to the v3 training material or do i need to wait until october 1st?

thx, Andy

Hi Andy, frustratingly this is not entirely clear on CFA UK’s website. CFA UK’s website states that v3 of the training materials is already available, and the learning material will be updated in the learning materials platform, which can be accessed by all candidates with a valid registration.

It’s best to reach out to CFA UK about this directly. If you do decide to register later after 30 September 2021, be mindful that the qualification is transitioning to CFA Institute from 1st October and you’ll need to register with them instead.

Hi!

I have a doubt regarding the sheduling process.

For example, if I register for the exam in September, I could take the exam on November, December or January, for example?

Whatever the month I want in one year period from the registration date?

Thank you so much!

Yes, as long as the exam center provider (Pearson VUE) has availability.

Thank you so much Zee!

Hi,

How much does the syllabus vary year on year? If you were to register and learn the current syllabus, would you receive the following syllabus and theoretically take the exam towards the end of the year? Or would you need to take the exam before the next syllabus is released?

Thanks,

Tom

Hi Tom, the certificate is relatively new and launched in 2019, so we don’t have many datapoints, but I’d imagine it varies from year to year depending on how fast the ESG practices changes practically.

The syllabus is updated 1st October annually, and we are currently on v2 syllabus. In fact, CFA UK helpfully published the differences from V2 (valid up to 30th Sep 2021) to V3 syllabus (valid from 1st Oct 2021) here – from a quick scan changes look light to moderate.

You should be taking the exam based on the syllabus it is based on. So if you want to take the exam on or after 1st Oct 2021, you should study v3 syllabus. You can find out more about the ESG syllabus here.

Hope this helps!

.

Hi Sophie, is it an open book exam or closed book one?

It’s a closed book exam.

Hey besides the course material provided by Cfa, is there any reference material especially in terms of mock tests that may help? Q

Here is an example paper which may help.

Hi All, I have register for Cfa esg 2020 exam. Going through the material( covered 6 chapters till now), I haven’t come across a quantitative/numerical question yet. However, one of the candidates who appeared for the exam suggested that roughly 25% questions were quantitative. Can someone please give an example/ share topics of such questions

A calculator is not needed for the ESG exam, so it’s unlikely to involve lots of calculations. There are numbers-based questions but not to the point that you need to calculate and provide a numerical answer. As an example, here is an example of an ESG exam paper.

Where did u find the course

Hi Sophie,

Good Evening. I am a Reinsurance Underwriter and considering doing a certification on ESG. I am based in Dubai and I had 2 questions which were

– A confusion prevails between whether my job as an Underwriter would benefit from an ESG vs SCR qualification.

– Whether I can do the ESG certification exams in Dubai?

Hi Rajeev, this is a tough question, although it really depends on your career goals.

1) As you probably read from the article, ESG is a broader certification focusing on investing with ESG considerations, whilst SCR focuses on climate risk. With your job, and assuming you want to further this career path, initial thoughts may be that SCR is more suitable as you’re analyzing risk on a daily basis. However, what works best is actually looking through the syllabus of both qualification to compare, and more importantly, speaking to your manager and companies to see which is valued better from a career progress perspective.

2) Yes, Certificate in ESG Investing is available in Dubai via remote testing.

I live in Seoul, Korea. Can I take the exam If I register ESG Investing to get certificate?

Unfortunately, for technical reasons, online proctoring option for Certificate in ESG Investing is not available in South Korea (as well as China, Cuba, Iran, Japan, North Korea and Sudan).

For in-person testing, CFA Institute is forming partnerships with local CFA societies globally to enable local testing to take place. It may be worth contacting CFA Society Korea to check if this partnership is being formed soon, so you can take the exams locally, in-person.

Hello,

1- Is it possible to fully attend the online course and take the exams remotely? I will be connecting from Italy/Switzerland

2- Is it possible to register and start at any time?

3- Are we talking about recorded material to be enjoyed at any time or are they live lessons?

4- Are there any professional requirements to join the course?

Many thanks

Best regards

Luca

Hi Luca!

1) Yes you can take the exams remotely from Italy/Switzerland. It is a self-study course with ebooks.

2) Yes, you can register and start anytime. But you must take your exam within 1 year from registration, and be mindful that their syllabus changes on 1st October annually, so if you register now, do plan to take the exam BEFORE 1st October, or else you’ll be tested on the new syllabus.

3) It’s just ebooks (included in registration fee). You can also purchase physical copies of the books for an additional cost.

4) No, there is no requirements.

Hope this helps 🙂

Hi Sophie,

When I registered recently I hadn’t realised the course was going to be updated in Octobter and I don’t know if I’ll be able to complete the course before then. Do you know if I attempt the exam before October can I then repeat it later in the year using the new curriculum?

Hi Aoife, yes the exam is tested on the syllabus it is valid for.

So if you took the exam before 30 Sep, it would be the current syllabus. And if you need to reattempt it later, it would be based on the new syllabus.

Hi,

Are there possibilities for sponsorship to do the online course for international applicants, ie east africa.

Hi Dave, do you mean if there are scholarships for the Certificate in ESG investing? There are currently none as we are aware of. However this certificate can be done and tested remotely in East Africa.

I am a lawyer with environmental and governance expertise. Can I obtain a CFA certificate in ESG investing if I do not have finance experience?

Hi Leslie, although the Certificate in ESG is designed for practitioners working in investment roles who want to learn how to analyze and integrate material ESG factors into their day-to-day roles, it is also suitable for anyone looking to improve their ESG understanding. Finance experience isn’t a pre-requisite.

Hello, while finance expertise is not required, chapters 7, 8 focus heavily on these some finance jargon. things like SAA, MVO for portfolio optimisation. Fixed income concepts and so on. So you may have to brush up on these (I find a lot of similarities esp. on the finance side having a common ground with some concepts covered in CFA L1). So a bit of groundwork is required if you are not from the finance side.

Hello

Please I live in Nigeria. Can i have access to the ESG Certificate exams here?

Regards.

Hi Uchech, yes Certificate in ESG investing by CFA UK is available via remote proctoring in Nigeria.

Hi, I am looking at ESG certificates and need some help around here.

According to FAQ of OnVUE tests, pearson VUE does not deliver OP exams in South Korea. I am currently based in South Korea. Is there any possibility of me taking the exam? 🙁 Thanks for your help in advace!

Hi Hyungeun, unfortunately you are right, where Pearson Vue doesn’t provide online proctored exams in South Korea. Nor does CFA UK have a partnership with CFA South Korea Society that would allow you to sit this test in person.

May be worth reaching out to CFA UK directly to see if they have plans for South Korean partnership soon?

Hi, I am looking at Certificate in ESG Investing by CFA UK and the SCR certificate by GARP. The beginner’s guidance mentioned “On the other hand, Sustainability & Climate Risk (SCR) certificate mainly focuses on educating risk professionals on how to manage the main environmental risk (arguably just the “E” part of ESG), i.e. climate change.”

Questions: 1) Does anyone know if the “S” and “G” components are completely missed in SCR certificate or just take a small weighting? 2) I am based in Australia, can I take the exam here? Also, can anyone please help with the relationship between CFA UK and CFA – as I am new to CFA community? Thanks very much.

Kind regards

Hi Tanya, lots of questions! Let me go through them in order:

1) If you glance through the SCR curriculum, it mainly focuses on the environmental aspect, with the social and governance aspects covered in the ESG framework overview sections, i.e. a small weighting.

2) Yes you can take the exam in Australia, just check out the latest Pearson VUE test sites locally.

3) CFA Society of the UK (CFA UK) is a member society of the CFA Institute. CFA Institute governs activities related to the CFA Program exam worldwide, while the CFA society is country-based. So for non-CFA stuff, CFA UK is independent from CFA Institute whereby they have other qualifications such as Certificate in ESG Investing and IMC which are no affiliated to CFA Institute at all.

Hope this helps!

Hi There,

Do you have an examination center for the ESG exam in India?

Hi Sophie Thanks for putting this together. Some questions in the CFA UK ESG course… Have you by chance taken the exam? It seems from the study material, there is a lot of detail and procedural stuff. Is the exam a test of one’ rote learning / memorising capability? Has anyone here given the exam and if so what are one’s chances of passing with resign broad strokes, key points and self assessment questions at the end of the chapters + the mock exam paper uploaded on their website? I’m surprised on the lack of conceptual testing and case study based work? I just can not deal with this acronym heavy syllabus. Help!

Hi I feel the same with the CFA ESG investing syllabus, there is a lot of details, acronyms, history. For those who passed the exam, please what can you advice for a more efficient preparation, reading only ket facts and doing mock exams ? Actually am going through the syllabus and I feel that that is long and not efficient enough.

And I don(t want to pay for quartic or Fitch additional resources or should I ?..

Thank you for your help!

Hi Sophie

Do you know if there is a more condensed study guide available to buy, aside from the copy of the syllabus that is included in the registration fee? Like the CFA books, it is rather dense and a shortened version would be most helpful.

Hi Jacqueline, at the moment, because this certification is so new, I’m not aware of a more condensed version. Fitch Learning (https://www.fitchlearning.com/certificate-esg-investing?utm_source=CFAUK&utm_medium=banner&utm_campaign=ESG_Logo_2020) is the only third party provider I know of having a course on this, and I wondered if they have a condensed version…

Can we include this certification in our email signature if we pass the exam?

Hi James, that’s a good question. Upon passing the CFA UK’s Certificate in ESG Investing, you are eligible to get the relevant ESG digital badge. However, achievement of the qualification does not confer any designatory letters and, therefore, ESG as a designation should not appear after your name in email signatures. Successful candidates should state clearly that they have achieved the CFA UK Level 4 Certificate in ESG Investing (or CFA UK Certificate in ESG Investing). You can share your badge on social media, LinkedIN or embedded in your email signature or digital CV. Hope this helps!

Hi, I am an Operations Analyst at a Lender (for Development Finance) in London and I would like to know whether this would be a suitable qualification for me if I want to learn how to implement ESG through my business. The CFA website said it is suitable for Operations and Risk professionals, but I don’t know how true this would be? I work with the Investment Managers but I do not take part in the investment process, I oversee the policies, procedures, quality assurance, etc. Do you think this would work for me? If not, what would you recommend for ESG in financial services business? Many thanks, Selena S

Hi Selena, I think ESG affects all parts of the finance industry, whether or not you directly or indirectly take part in the investment process. As to what would be useful for your career in Operations, I think it really depends on what you’re currently doing, what your employer values and what career path you would like to target. While CFA UK’s Certificate in ESG is broader in scope, GARP’s SCR qualification is focused on climate change risk specifically (i.e. the “E” part of ESG only). Both are useful for a career in financial services but SCR is more risk-focused whilst ESG is broader. I think it is really worth having a conversation with your employer to see what would add value to your current role, by looking and comparing the syllabus of both qualification before deciding. Hope this helps!

Hi Gladys, great, you can register here https://www.cfauk.org/study/register-for-esg#gsc.tab=0

Can any one outside UK also appear for this ESG exam? Currently I am located at Bahrain.

Hi Shaan, yes the Certificate in ESG Investing is available internationally. You can take the exam via online proctoring at home as well.

Good afternoon Sophie, This was really helpful for me in the run up to my exam last week (passed thankfully). So good to have this information concisely delivered in one place. You mention the IMC and ESG combine to make a diploma but I cannot see any references to that on the CFA UK website. Would you be able to point me in the right direction? Kind regards, Tom

Congrats on the pass Thomas! And thank you 🙂 I’m glad you found the article helpful. Would be awesome if you could share your experience with us via email too (team@300hours ) Yes, once you have passed both IMC and ESG, and sign up as a member, you can apply for IMD. That information is listed here in the table https://www.cfauk.org/study/imc/candidate-area-and-results#gsc.tab=0

Very informative, thank you very much! Cheers from Switzerland

You’re welcome Jonathan! Hello from London 🙂

hello Sophie, I came across your website page for scholarships(https://www.cfainstitute.org/en/programs/cfa/scholarships/womens). I am bit confused about my eligibility for this program. I had been working in ESG sector in India for 2 years before taking a sabbatical. Do I qualify?

Hi Renuka, as long as you’re a female (I presume you are!) and meet one of the following CFA enrollment requirement: – have a bachelors degree (or equivalent), OR – be a final year uni student when taking Level 1, but must complete your degree before registering for Level 2, OR – Have a combination of four years (or 48 months) of full-time work experience and/or college/university education on the date of registering for the Level I exam. The work and education experiences cannot be overlapping. Assuming you’re a new L1 candidate (or have not registered), do you have a Bachelor’s degree, or a combination of 4 years of non-overlapping work and education experience? You mentioned you work 2 years in ESG, but what did you do before and after that 2 years of ESG work? I don’t have sufficient info currently to determine if you meet the requirements. Let me know and I’ll help advise.

I have a Masters degree in Environmental Studies and Resource Management (completed in 2018). Post my masters I have worked for NGOs focused on Rural Development & Women Empowerment, Environmental awareness and advocacy and in corporate sector for ESG (Environmental, Social and Corporate Governance) research. In total I have 4.2 years of work experience.hope that helps you out for guiding me.

Hi Renuka, yes you definitely meet the enrollment requirements for CFA: you already have a Masters degree (higher than Bachelors) as well as your non-overlapping work experience plus university education exceeds 4 years. Good luck for the scholarship application and CFA exams!

Sophie, thank you very much for your answer! and also for the comparison on the side of the to “ESG” Certifications – from Garp and CFA.I more incline now to the one from CFA. I have already the FRM designation and work now as Internal auditor at an Insurance company. Which of the two would you recommend for me? Thanks.

You’re welcome 🙂 I think the choice of ESG Certificate vs SCR qualification really depends on your career goals/plans. They are both new qualifications from prestigious organizations, with a slightly different emphasis on content. I briefly touched on these points in my last section (https://www.300hours.com/articles/cfa-esg-investing-certificate#esgvsscr), hopefully that helps your decision making!

Hi, I am interested in the Certificate of ESG Investing and I have 3 questions: 1/ if I good understand from Austria I can only do the online examination from home or office ? (expect to do the exam in year 2021) 2/ the exam can be online done “any time” or are there any slots? 3/ I wanted to wait for the study material an see how study is going and register later. Is it possible or do I need do register for the exam shortly after registration? thank you very much!

Hi Kathy, to answer your questions: 1) yes you can do the exam from your home or office, with online proctoring. You’ll need to check your system meets the requirement for online proctoring first at https://home.pearsonvue.com/cfauk/onvue 2) There are slots: OnVUE online proctored exams are offered Monday to Saturday, 24 hours a day, subject to availability. 3) Yes, you can register and purchase the study materials first. When you are finished studying, then you need to check your system requirements for online proctoring, before booking a relevant date and time for your online proctored exam. Registration for the ESG course and the booking of exam slot itself are separate. Hope this clarifies!

Hi, I’m looking at ESG certificates and apart from the CFA ESG I also found the CESGA which seems interesting. Any idea on the differences/advantages between these certificates? Thank you!

Hey Vincent, that’s a good question. I think it depends on where you’re based, what is more well known / recognized by employers as well as budget. CESGA seems more comprehensive, Europe-centric and at a higher education level (Diploma, i.e. Level 5 equivalent benchmark by UK NARIC), and therefore more expensive at EUR1,500 for the course/exam. On the other hand, Certificate for ESG is cheaper at GBP470 and a level below Diploma (i.e. 1st year Bachelors equivalent, Level 4 benchmark by UK NARIC). I think it largely depends on which qualification is better appreciated by your employer and cost. I hope this helps. What do you do for a job currently and where are you based? What certification are you leaning towards at the moment?

Thank you Sophie. I’m in portfolio management based in Singapore and I’m already CFA charterholder. I was leaning more towards the CESGA but considering the large difference in cost I may pursue the CFA one.

Sounds like a good plan Vincent – let us know how it goes and would be good to hear your personal feedback about Certificate in ESG Investing once you’ve completed the course – just shoot us an email 🙂

is there any website or details to show :ESGA seems more comprehensive, (Diploma, i.e. Level 5 equivalent benchmark by UK NARIC i tried looking for similar details(level 5) on effas website but not be shown anywhere

Hi Kal, my comment was based on CESGA being advertised as Diploma level, but this is not officially compared by UK NARIC per se. However, Certificate in ESG Investing by CFA UK is officially rated as Level 4 under UK NARIC (1st year Bachelor’s equivalent), and under that same scale Level 5 is a ‘Diploma equivalent’, hence that broad reference that CESGA is probably equivalent to Level 5 if officially rated by UK NARIC. Hope this clarifies.

agreed thanks Sophie, i have know both candidates who too CFA ESG and EFFAS honestly there is mor ebent forEFFAS compared to CFA one’s qualitiy wise esp, i am bent on EFFAS too spoke to several candidates int his space quite +ve actuallly

Hi Sophie,

Any chance you have access to any CESGA mock exams? It would be really helpful if I could have an idea of the type of questions presented in the exam.

Thanks!

Hi Goncalo, sorry I don’t as we are covering CFA UK’s Certificate in ESG Investing here. If we do cover the CESGA qualification I’ll give you a shout 🙂

So, can foreigners who live in other countries, like Thailand, take the exam?

Hi Mai, yes you can take the Certificate in ESG in Thailand with online proctoring now (https://www.cfauk.org/study/remote-examinations#gsc.tab=0). You need to check your computer meets the system requirements for the remote exam taking, and register as a candidate to schedule your exams.

Nice info

Thanks Janardhan! Hope you found it useful 🙂