Did you know that in certain situations, the Investment Management Certificate (IMC) can be more suitable than taking on the CFA exams?

With over 5,000 exams sat each year, IMC is the most widely-recognised and established qualification of its kind in the UK.

The IMC has been used by investment professionals for 25 years, and is taken by staff in leading investment firms in the UK and overseas. This exam is now available globally as well via remote proctoring.

The IMC is the investment industry’s benchmark entry-level qualification, so if you’re looking for a lighter approach to the CFA program, but still have a strong recognition in the industry, read on to find out more!

What Is Investment Management Certificate?

Awarded by CFA UK, the Investment Management Certificate (IMC) is the benchmark entry-level qualification for UK investment professionals.

Launched in 1994, the IMC is used by leading investment management firms to demonstrate employee knowledge and competence for regulatory purposes, and by individuals working across all areas of the sector in developing their careers.

It has been recognized by regulators as the UK benchmark investment management exam, and is an FCA Appropriate Qualification for the activity of ‘managing investments’. It is also a powerful CV booster for fresh graduates looking to break into UK investment management sector.

To date, 42,500+ candidates have passed the two-part exam and hold the IMC designation, which requires approximately 240 hours of study. Commonly viewed as a stepping stone to the CFA program, IMC covers the key topics of economics, accounting, investment practice, regulation and ethics.

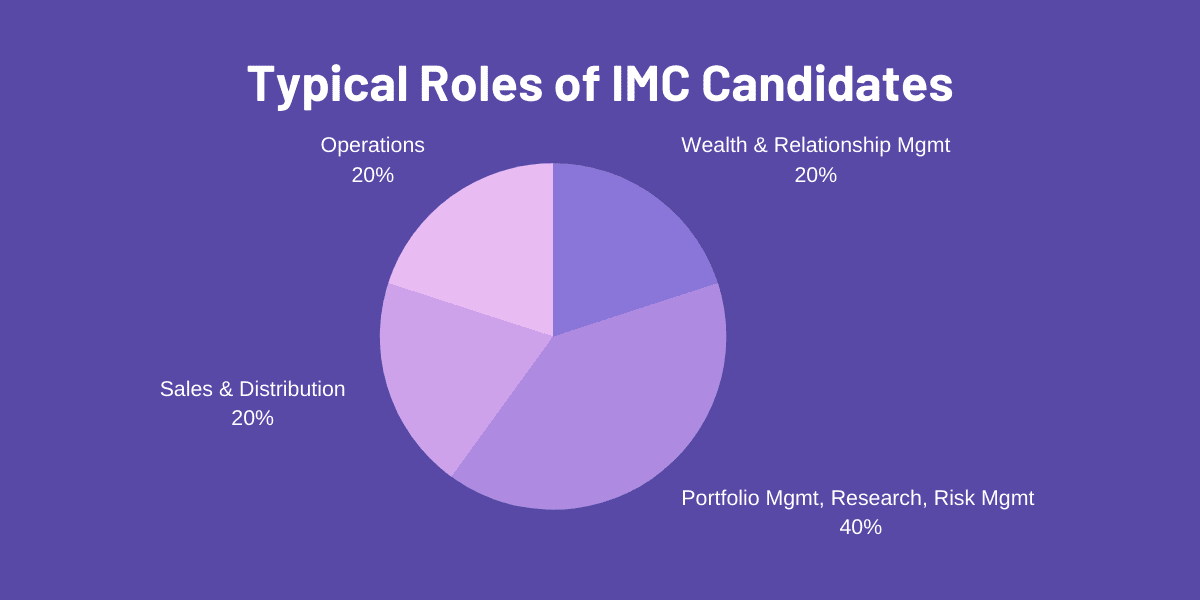

In terms of candidate profiles: over 50% of IMC candidates sitting the exam are actively involved in front office investment activities, including portfolio management, research, investment consulting, risk management and relationship management.

IMC is generally considered suitable for anyone working in an investment-related role. Typical roles include portfolio manager, research analyst, risk manager, relationship manager, wealth manager, sales & distribution, operations, IT / technology.

IMC Exams, Summarized

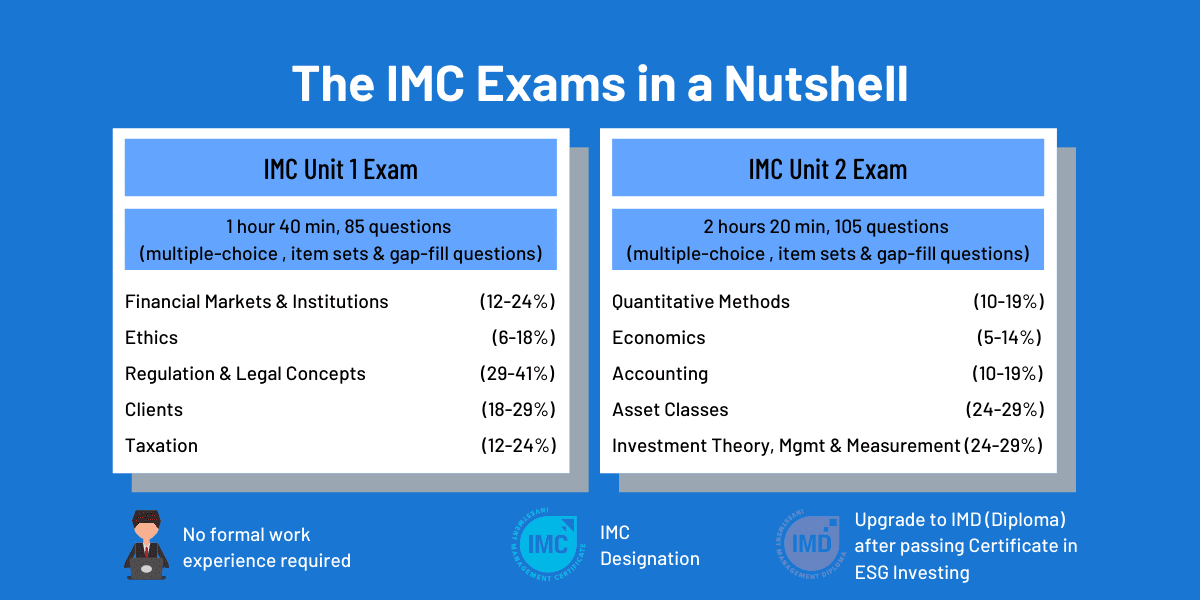

The IMC designation is a two-part, computed-based testing (or remotely proctored) examination:

- IMC Unit 1 consists of 85 questions in 1 hour 40 minutes, whereas

- IMC Unit 2 consists of 105 questions in 2 hours 20 minutes.

Whilst there are no constructed-response type questions (‘essay’), there are 3 types of questions in IMC exams:

- standard multiple-choice

- item sets

- gap-fill style (where you have to type in the answers to ‘fill the gap’).

Unit 1 focuses on a broad introduction into the investment environment, covering how financial markets work, ethics, client advisory and UK tax, legal and financial regulatory system. Unit 2 is more application-focused: diving into topics such as economics, accounting, financial mathematics and statistics, learning about asset classes and the investment management process.

Similar to most other professional designations such as CFA, FRM or CAIA, the IMC designation is also a self-directed learning program:

- In terms of study hours, it is recommended that IMC candidates devote around 240 hours in total to complete the certification (100 hours for Unit 1 and 140 hours for Unit 2).

- CFA UK publishes the Official Training Manual (OTM), which forms the syllabus IMC exams are based on. The syllabus is updated every year on 1st December, and covers exams taken during 1st Dec to 30 November that year. It is important to make sure you have the right syllabus for your exam timeframe.

- Roughly 20-30% of candidates are self study candidates (who solely use the OTM without third party materials). However, if you are considering additional study support then there are lots of third party providers available.

- If you are a working professional, you should be able to reasonably balance exam preparation with your work schedule.

The IMC exam can be taken every working day at Pearson VUE test centres in the UK, and at selected overseas sites. You can also take the exam at home via its online proctoring service. You can find your nearest IMC test center here. Candidates are required to sit the exam within 12 months of the registration date.

Once each exam is completed, you’ll get a provisional result statement before leaving the test center, and the official result via post within 21 working days from your examination date. The result is a simple pass or fail, with no details on exact score. However, if a candidate fails, indicators of areas of weakness will be given to guide candidates on their relatively weaker topics.

IMC Exam Pass Rates & Pass Marks

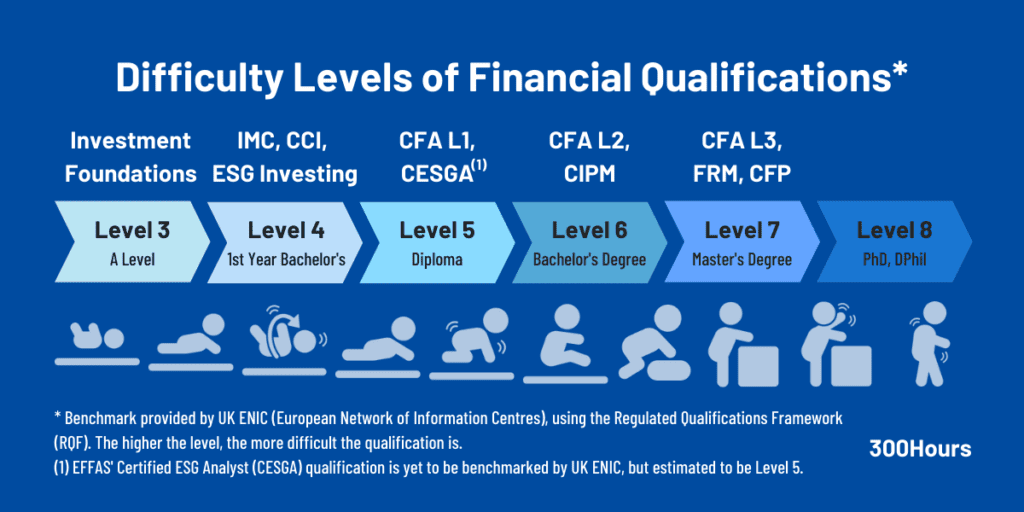

The IMC is a Level 4 qualification benchmarked under the UK ENIC (European Network of Information Centers) framework, which means that the level of difficulty of the qualification broadly equates to the first-year of an undergraduate degree.

Here is a chart comparing the difficulty of IMC vs other financial qualifications:

The latest pass marks are:

- 65-75% for IMC Unit 1

- 60-70% for IMC Unit 2

On average, IMC Unit 1 and Unit 2 have pass rates of 65%-80%, which is expected for a foundation course to investment management. To pass the examination, candidates need to achieve an overall pass mark/score regardless of where the marks were distributed throughout the examination.

IMC Exam Topics & Weightings

IMC Unit 1 Exam

The IMC Unit 1 exam mainly focuses on the introduction to financial markets, accompanied with legal, taxation, regulatory and ethical considerations required in client investment advisory. It consists of 85 questions with an allocated time of 1 hour and 40 minutes.

The topics areas and exam weights are as below:

| IMC Unit 1 Topic Areas | Weighting |

|---|---|

| Financial Markets and Institutions | 12% – 24% |

| Ethics and Investment Professionalism | 6% – 18% |

| Regulation & Legal Concepts | 29% – 41% |

| Client Advice | 18% – 29% |

| Taxation in the UK | 12% – 24% |

IMC Unit 2 Exam

The IMC Unit 2 exam consists of 105 multiple-choice, item sets, and gap-fill style questions, with an allocated time of 2 hours and 20 minutes.

IMC Unit 2 builds on the foundation of Unit 1 and focuses on application during investment practice, covering topics such as economics, accounting, quantitative methods, asset classes and portfolio management.

The topics areas and exam weights are as below:

| IMC Unit 2 Exam Topic Areas | Weighting |

|---|---|

| Quantitative Methods | 10% – 19% |

| Economics (Micro & Macro) | 5% – 14% |

| Accounting | 10% – 19% |

| Asset Classes (Equities, Fixed income, Derivatives, Alternative Investments) | 24% – 29% |

| Investment Theory, Management & Measurement | 24% – 29% |

IMC Exam Fees (GBP £)

IMC exam fees are pretty straightforward and significantly cheaper than CFA exams:

| Fee Type | IMC Unit 1 | IMC Unit 2 |

|---|---|---|

| 1) Exam Fees (and Retakes) | £335 | £360 |

| 2) Official Training Manual (OTM), i.e. IMC Syllabus | £125 + Shipping (£6-£25 depending on country) | £135 + Shipping (£6-£25 depending on country) |

There are minor savings if you purchase both Units’ OTMs, but this depends on your exam timeline as candidates need to be mindful that the IMC syllabus gets updated annually on 1st December and lasts for one year until 30th November.

The fees are the same even with online proctored IMC exams.

As you can see, IMC can be a cost effective, low barrier yet reasonably prestigious qualification to kickstart your UK finance / investment management career.

With some discipline and determination, one can actually complete the IMC qualification quickly for less than £1,000!

Of course, this assumes self-studying without additional third party material and passing both units in the first try (which is a reasonable assumption given the relatively high pass rates).

IMC Exam Dates

Unlike most other financial designations, candidates can sit for the IMC exams throughout the year (except holidays and weekends).

That said, candidates must carefully plan the time of exam registration, bearing in mind that the IMC syllabus (Official Training Manual, OTM) gets updated annually on 1st December and remains until 30th November the following year, unless otherwise necessary.

Here’s a quick summary of the registration and exam scheduling details:

| Exam Registration | IMC exam registration is done through CFA UK. Upon registration, candidates will receive an email confirmation providing scheduling instructions, a unique username and password. Note that candidates can only view exam availability after registration. |

| Exam Scheduling | After registration and payment, candidates will need to wait for 2 working days before they are permitted to schedule an exam. To do so, they need to login to Pearson VUE’s website to select a date, time, and location to take the IMC exam. Similar process applies for online-proctored IMC exams. Candidates can sit for exam on most working days in one of 52 locations across the UK or selected centres worldwide. |

| Exam Registration Expiry | Candidates have 1 year from initial exam registration to sit for the exam. Otherwise, the registration will expire after 1 year with no refunds given. Re-registering will cost the same exam fee each time. |

| Number of Exam Attempts | Candidates are not allowed to take an IMC exam (i.e. either one or both units) more than 4 times in any 4 month test window. No further attempts are allowed once a candidate achieves a passing score. For resits, candidates need to wait 3 working days after the exam date to re-register for the exam. Note that all candidates are only permitted to attempt each unit of the IMC exam only once per calendar month. |

What Are the Requirements for IMC Qualification?

One of the best features of the IMC qualification is the lack of requirements given its foundational nature, despite its relative prestige as a potential stepping stone to other finance qualification.

There is no requirement to have completed any other qualifications prior to taking the IMC. For typically 60%-80% of candidates, the IMC is their first professional qualification.

In order to complete the IMC qualification (and use the IMC designation in your CV), all you have to do is:

- pass IMC Unit 1 and Unit 2 exams;

- join CFA UK as an IMC member by paying an annual fee of £120.

Unlike the CFA qualification, there is no working experience required for the IMC certificate.

Exemptions are available for 1 unit of the IMC exam depending on circumstances. Interestingly, CFA candidates who have passed IMC Unit 1 exam can apply for Unit 2 exemption if:

- They have passed CFA Level 1 or 2, providing no advice to retail (private) investors is undertaken.

- They have passed CFA Level 3, including those who advise retail (private) investors.

That said, IMC candidates who are successful in applying for an exam Unit’s exemption still have to pay the same exam fee for it. More details on IMC exemptions policy on CFA UK’s website.

Benefits of An Investment Management Certificate

Given its relatively low cost (from a money and time investment perspective), the IMC qualification can be particularly beneficial for those at the beginning of their finance / investment management career.

Once you earn the IMC designation, you can expect to:

- Boost your CV as a fresh graduate to differentiate yourself from the rest

- Kickstart your career in investment management

- become an FCA ‘Approved Person’ which may enhance your employability and earning potential in UK investment sector

- Pave your way for further finance designation such as CFA, FRM or CAIA as you further specialize.

For investment professionals and their employers alike, the IMC-CFA route provides a globally-recognised career progression.

IMC vs CFA: Which is Right for You?

In short, the CFA charter is an all-inclusive designation that focuses more on portfolio management at its highest level. On the other hand, IMC designation is an entry level qualification – it is designed for fresh graduates, career changers as well as investment support staff who are looking level up their basic knowledge in investment management. So, from a career building perspective, IMC is a lighter version compared to the CFA charter.

It really depends on where you are in your career:

- If you are a fresh UK graduate, and would like to explore investment management as a potential career, it is worth considering IMC as a starting point to explore the world of finance and what interests you, whilst boosting your CV. IMC can be a stepping stone to other financial designation (such as CFA, FRM or CAIA) later on as you build up your experience.

- On the other hand, if you are already in the finance/investment sector, and would like to further specialize in investment management, CFA would be a better bet as it works best with a few years of finance experience under your belt.

Here’s a quick summary comparing both designations:

| IMC | CFA | |

|---|---|---|

| Pre-exam qualifications | None, but it is advised that a Bachelor’s degree prior to IMC designation provides a better career standing. | Have a bachelor’s degree; or Undergraduate with 2 years remaining of a bachelor’s program; or Have a minimum of 4,000 hours of work experience and/or higher education over a minimum of 3 years. See CFA entry requirements for more details. |

| Number of Exams | 2 units (fastest route is 2 months) | 3 levels (fastest route is in 18 months) |

| Exam Frequency | Unit 1 & 2 can be booked throughout the year, whether in-person or remote testing. Maximum 4 attempts in 4 months | Level 1: 4x a year (Feb, May, Aug and Nov). Level 2: 3x a year (May, Aug and Nov) Level 3: 2x a year (Feb and Aug). |

| Exam Format | IMC question format consists of standard multiple-choice, item sets and gap-fill style questions. Unit 1 has 85 questions Unit 2 has 105 questions | Computer-based exams from for all levels: Level 1: Multiple choice questions Level 2: Item set questions (multiple choice) Level 3: Item set and essay questions |

| Pass Rates | 65%-80% | The range of CFA pass rates since 2010: Level 1: 22%-49% Level 2: 29%-55% Level 3: 39%-56% |

| Fees and Costs | Total minimum cost: ~ £1,000 (or around US$1,320) | One-off Enrollment Fee: $350 Registration fee (per level): $900-$1,200 Retakes: same as registration fee Total minimum cost: ~US$ 3,100 |

| Study Hours Needed | Unit 1: 100 hours Unit 2: 140 hours | At least 300 hours per level |

| Post Exam Requirements | To become IMC-qualified: – Pass IMC Unit 1 and Unit 2; – Join CFA UK as an IMC member (local membership) by paying an annual fee of £125; – No work experience required. | To become a CFA charterholder: – Pass all the 3 levels of CFA exams; – At least 4,000 hours of relevant experience, completed in a minimum of 3 years; – Submit reference letters for 2-3 professional references; – Become a regular member of CFA Institute; – Adhere to CFA ethics and professional conduct. |

Overall, IMC offers an excellent career entry opportunity in investment profession, particularly valued by UK investment firms. It is a good value-for-money designation that requires relatively low time and money investment, and is a perfect stepping stone for future, more specialized financial designations like CFA, FRM or CAIA.

So if you’re currently student or just aiming for a career in investment management in general, and unsure if you’re ready to commit to the CFA charter, the IMC qualification can be a solid starting point. You can always decide to follow up with a CFA charter later, and meanwhile you’ll have added valuable credentials to your CV.

Any questions or comments? Let us know in the comments below!

Meanwhile, you may find these related articles in our Beginner’s Guide series of interest:

- CAIA (Chartered Alternative Investment Analyst): A Beginner’s Guide

- CFA Investment Foundations: A Beginner’s Guide

- FRM (Financial Risk Manager): A Beginner’s Guide

- CFA Exams: A Beginner’s Guide

- Certificate in ESG: A Beginner’s Guide

- SCR (Sustainability & Climate Risk) Certification: A Beginner’s Guide

- Complete Guide to ESG Certifications

Hi all,

I would love to get your perspective, I left my role in consulting to join an investments team at private bank (in-house strategy role). I was in consulting for 6 years and new to the worlds of investments; my role is not dealing with investment products etc day-to-day. However, I do want to find the middle ground consulting + investments (interests: M&A / PE / Private Markets going forward) is IMC worth doing or any recommendations on career?

Hi Sam, thanks for sharing. That’s a good career move by changing one thing at a time to your target role.

Just to clarify: When you say find the “middle ground in consulting + investments”, do you mean you would like to move to in-house strategy teams of M&A, PE or Private Market firms, or move to do the actual work of a M&A banker, PE or Private Markets investments? The nature of consulting vs working directly in M&A, PE or Private Markets is quite different as you may appreciate.

If your goal is the former, IMC may be fine although not necessary. Moving from in-house strategy of a private bank to in-house strategy of investment bank/PE isn’t that big a leap and quite common within financial services.

If your goal is the latter, i.e. moving from in-house strategy/consulting to M&A/PE, then I would say CFA is more targeted, especially with the Private Markets Specialized Pathway option in Level 3.

Hello everyone,

I’ve got the IMC 2022-2023 Part I book. Is the difference between the one I’ve and the next revision massive?

Thank you for your response in advance

Hi Denis, we can’t comment on that as what you have is version 20, and we are currently on version 21 up to 30 Nov (not many days left) before moving to Version 22. You can compare the changes in two documents here: v20 to v21, then v21 to v22 for Unit 1 IMC. Hope this helps!

Greetings, Respected

If there’s a gateway for IMC certification preparation similar to the one you offer for CFA level one, that would be of interest to me.

Thanks, and best regards

Mohamed Abouelnaga Riad

mohammeeddriad_1900@yahoo.com

Hi, I know I’m late to the party, and it’s in 2024. I just graduated as a BA (Hons) Accounting & Finance student with a not-great cumulative grade. I’m having a tough time finding any internships or full-time work in the investment management field; people just don’t care for just another graduate; I’ve graduated from a UK university is it a good option to complete an IMC to bolster my CV to score my first goal and work on my career from that point on?

Hi Sophie,

Thank you for an informative overview of the IMC run by CFA UK. In comparison, how would you rate or recommend the CISI run Level 4 Certificate in Investment Management? Is this more widely accepted as the industry standard and more comprehensive for UK regulation and for fund managers, compared to the IMC? How do they both compare and differ please? Many thanks!

Hi I have a relevant CII exam which I can use to exempt from unit 1 of the IMC. However, CFA are saying that if I did this I would not be RDR compliant / qualified to advise on securities if and when I completed CFA Level 1. Therefore, I don’t see any advantage in applying for an exemption. Please can you clarify if I have understood correctly? Thanks, Matt

Can I complete Unit 1 of the IMC with version 20 and wait to purchase version 21 (December 1st 2023 – November 30th 2024) of Unit 2? Or do I have to complete both units in the same OTM syllabus version.

Thanks

Luke

Hi Luke, yes you can do that. You don’t need to complete both units in the same OTM syllabus version.

Hello,

I registered for both exams last year. I booked and passed the Unit 1 exam, but a busy year has left me with far too little time to study for Unit 2 before its expiration date (less than a month’s time) and I’m planning to re-book at my own expense. Would letting the registration for Unit 2 expire invalidate my Unit 1 exam result?

Thanks!

Hi K, your Unit 1 exam result will hold as is, regardless of your Unit 2 outcome. Not to worry! Best of luck 🙂

Hi sophie,

Right now I am doing masters in finance specifically in investments management and I have 7 years experience in retail banking however I don’t have experience in investment management .should I go for IMC or CFA?

Hi Manish, thanks for writing in. Have you compared your Masters in Finance (Investment Management) with the content of CFA Program? It sounds quite similar and I wondered if you may be covering the same things.

As for which qualifications to go for, it always helpful to tie back to your career goals and what you hope to achieve, and what the target employer (if applicable) values. If you can find out and elaborate more, that should help understand the situation better.

Hi sophie,

Thank you for your response,I would like to tell you that I want to switch my career into the investment management so for that purpose I am doing masters in finance but the some of the modules are not present into my course like ethics. Apart from that I have no experience in investment management so employers will treat me like an fresher.My purpose is doing these certifications IMC or CFA just to highlight my CV.

Hi Manish, I would say it may be optional if you’re already studying Masters in Investment Management. If your core goal is to find a job in investment management, the time would be better focused on networking, job applications etc, since you’re already working towards some relevant qualifications in investment management. That may yield a faster result as you’re switching mid career rather than aiming for graduate jobs. Speaking to potential employers and people who work in the industry will also highlight to you what qualifications they value. Then, as you gather more info, you can decide whether IMC or CFA works better.

But if you would to push me to choose one, I would say CFA because of your ultimate career goal. IMC however gives you a good intro to IM, is easier to pass and get a qualification though. CFA Program is a multi year effort and I think at this stage focusing on switching careers in finance should be your main goal since you’re already studying Masters In IM. Check out the guide I linked and the related articles at the bottom to give you a good base of understanding of what jobs are relevant and how to approach career changes. It’s likely you may not get a direct switch to IM at this stage, but moving closer to your ideal target career is the goal.

Hi Sophie,

Thanks for posting such an in-depth analysis of the IMC certification.

I hold a BSc in Computer Science and have been working as a tax technical consultant for the past 2 years.

The finance industry (Trading particularly) has been of interest to me, and I plan on being involved in the industry in the near future.

Considering that I have no prior experience in the field of Finance, would the IMC certification help bolster my CV to show that I have interest in the field of Finance (as applied to trading positions) or is it very much suited for someone looking to work within the investment banking industry?

Hi Raul, I’m glad you found the guide helpful! IMC seems to be a good starting point given you don’t have a background in finance. So doing that can be a good indicator to show recruiters you have the basics covered. I would say your background in Computer Science actually adds a lot to your story of wanted to work on the trading floor – that could get you into more analytical roles first, before you seek to switch to a trading position if the opportunity arises.

Since you’ve worked 2 years in tax, I would say you should work hard on applying to switch into finance sector right away (Whilst studying for the IMC to show your commitment to upgrade yourself in finance as a starting point), to avoid being ‘pigeon-holed’ as a tax person. You’re still junior enough to switch (assuming just 2 years work experience), but I would say be open to taking any jobs in front office in the trading floor to start with, even if it is not your target one. Hope this helps, good luck! Keep me posted on how you’re doing 🙂

The other benefit to the IMC, if not perhaps one of the more important ones, is that if you are in a regulated position where you are providing ‘advice’ to clients, you need to have a qualification to not require supervision. You can still be in a client-facing role providing ‘advice’ but at the same time, your manager will need to supervise you as part of the regulatory conditions which is a lot of paperwork for them and you, hence you’ll probably be under pressure to take the IMC if you haven’t already. There are other qualifications you can take, but the IMC is the standard entry level one.

The prevailing wisdom in the asset management industry (at least at the two firms I’ve worked at) is that the IMC is the more ‘rational’ of the two. It isn’t (or at least doesn’t have to) take years to complete versus the CFA. A lot of sales professiomals and even some other front office types such as traders have an IMC only, so its definitely a good benchmark / minimun qualification to have.

That’s true George, thanks for sharing this insight with us all. It really depends on what you need for your career and choose accordingly.

Can I register for this certificate even I am working outside of the UK?

Yes you can Samuel. You just need to check if they hold the IMC exam in your country.

Hi is it possible to pass the IMC unit 1 with the OTM but heavily studying the BPP exam prep and revision kit for version 19 ? also regarding attempts, what happens if you were to fail 4 times ? will i be able to redo this ?

Hi Omar, if you intend to take your IMC exams before 30 Nov 2022, this is fine because it is still based on the OTM syllabus version 19. Syllabus version 20 is tested from 1 Dec 2022 to 30 Nov 2023.

The rule here is simply that you cannot take the IMC exam more than 4 times in any 4 month test window. Failing 4 times is fine (although a review is needed for your exam prep methods), you can redo it once some time has passed.

Hi,

I will be starting my MSc Finance course this October at LUMS. I will be a foreign student and I realize my MSc degree would not be enough to secure a job in the UK. Should I try for IMC or CFA. Please advice.

If career is your concern you’re probably better off focusing on your CV, interviews, and networking.

This article should also help: Does CFA Help? Maybe, But It’s Not a Golden Ticket to Jobs

To get a job, I would focus on getting a job, not another qualification.

Hello, Thank you for your information.

I am planning to take CFA L1 soon and wondered about taking the IMC on the way. I realise that there is perhaps not much point, but I am trying whatever I can to bolster my CV. How much overlap of syllabus is there between the CFA and IMC in practise? Is there anything on the IMC that is not in the CFA L1? If I took IMC L1 maybe 6 weeks before the CFA and then IMC L2 as soon as possible after that does that seem possible?

I am just finishing an MSc Finance and am not working yet, so six 50hr weeks is still 300 hours.

Thank you for any advice

Hi Tom, my personal opinion here is that having MSc Finance and CFA (which by itself is Masters-degree equivalent) is sufficient. I think combining your MSc, plus studying for your CFA and aiming to get actual work experience (internship or full time role) will keep you extremely busy, I’m not sure an IMC would add value in your case.

Sophie you mention a lot of people pass just on IMC reading material. I brought BPP revision kit and found that the questions asked for that were very different to IMC material which kinda concerned me that I am not reading enough outside IMC level 1 material.

Do i have to paid for the FCA textbook?

Hi Hannah, the IMC syllabus needs to be purchased, which cost £105 for Unit 1 and £110 for Unit 2. This is in addition to the exam fees (£280 for Unit 1, £300 for Unit 2).

Hi Sophie,

wanted to ask which books are the best to study for the IMC Unit 1, Kaplan or CFA UK materials?

Also if I buy the CFA UK materials, are they physical or digital copies?

Hi Parth, CFA UK books should be sufficient, around 40% of IMC candidates use CFA UK’s OTM for their studies. That said, Kaplan is a reputable, experienced exam prep provider and may save you some study time.

The IMC examination fee does not include any study material, and if you purchase CFA UK materials, they are physical copies.

Hi Sophie,

thanks for your feedback.

i am interested in banking/sell side careers as a starting point.

And i will begin to connect with finance headhunters in the UK as advised.

Thank you

Good evening,

i am 39, holds Bachelors in Economic, with 9 plus years professional experience (Retail/Branch Operations) with a commercial bank in Nigeria.

Now, i intend to switch career to investment/finance sector, and what are my chances of securing a position with IMC qualification to begin my new career?

I & my family will be relocating to the UK in few months time.

Kindly advise

Hi Emmanuel, it is really hard to say, as it depends on what specific area of finance/investments you’re really interested in. More details would help?

But what I do recommend is that it is a good idea to start speaking to some finance headhunters in UK to get an idea what/how the market is like, before you decide.

When New IMC II Book will be available?

The syllabus are refreshed on 1st Dec annually, and available to purchase from October onwards. So Unit 2’s syllabus version 18 is already available now at https://www.cfauk.org/study/imc/studying-for-the-exam#gsc.tab=0

Hi, Is there any time window between doing Unit 1 and 2? I did unit 1 about 3 years ago, do I have to redo it if I want to do Unit 2? Thanks, Rachel

Hi Rachel, as far as I’m aware, there are no time gap limitations between Unit 1 and Unit 2 of IMC at the moment. So if you want to take Unit 2 now, the only requirement you need is to register with the SAME email address as you did for Unit 1, so that they can reconcile your enrolments and know you’ve done Unit 1 in the past. Hope this helps, good luck!

Hi Does the manual to study for the IMC is only availbale in phisical delivery or can I access to it in an online platform after payment?

Hi Andrea, at the moment IMC candidates can buy the official training manual in hardcopy only. Hope this helps!

Hi, are there any online mock tests available to practice please? The CFA website only has 2 mocks. Thanks, Karla

Hi Karla, you’re right, CFA UK seems to only offer 2 mocks per unit. And there are not many 3rd party provider options either. I would suggest going for older versions of the tests that you can find online such as edition 15 and 16. Here’s an example for Unit 2 Mocks for Edition 16: https://www.cfauk.org/-/media/files/pdf/pdf/1-study-with-us/2-imc/imc/imc-unit-2-mock-exam-1-v16.pdf?la=en&hash=7E24780C67B63F41FC9DB52360C01078A4AD41A3 https://www.cfauk.org/-/media/files/pdf/pdf/1-study-with-us/2-imc/imc/imc-unit-2-mock-exam-2-v16.pdf?la=en&hash=64D8790A4A72BB9324DF9792D1C213E099B6079C The syllabus may have changed slightly, but you still could benefit from official mock exams from the older syllabus. Hope this helps, good luck!

Is it possible to study with FCA textbooks alone? Or is it advised to pay for additional training for Kaplan etc?

Hi Andrew Yes, most IMC students use the official syllabus for their studies.

Hi there, I am from Ireland. Would it be worth my while doing this course. Would you know if it is recognized here as much as it is in the UK? I have completed Level I of the CFA exams, awaiting to do Level II in May and thought that it would be something I could achieve in the interim.

Hi Oisin, if you’ve completed level 1 CFA, and intend to complete the designation to be a charterholder, it may not make much sense to add on IMC as it’s more of an entry level qualification. It may be worth your while to explore other complementary destination like Certificate of ESG or SCR (all in our beginner guide series linked at the bottom of this article), that may upgrade your knowledge in the ESG aspect, assuming your career goals are in financial services.

Hi Henry, yes, for Unit 1 exams in Dec/Jan, you would have to get the new syllabus (v18) that would be applicable for exams starting 1 Dec 2020-30 Nov 2021. That said, the new version 18 of the syllabus should be made available end of this month, so you could wait till then to start studying. If you ever can get your hand on a v17 of the syllabus, you can technically start studying now and see the changes comparing v17 and v18 of the syllabus later. But that may not be a worthwhile endeavour given the cost and having the compare the differences later, since you’re a few weeks away from the new syllabus being published anyway. Finally, depending on your schedule and availability to commit to study, it may be possible to even start studying now for Unit 1 before 30 Nov, although it would be tight. It would require 14-16 hours of study a week, so technically feasible but intense. Hopefully these options provide some good food for thought – good luck!

With today being the 5th October, this may be too short a time to revise for a take unit 1 before 30 November, however if I wanted to take the unit 1 exam later (say, December/January) would I have to wait until December 1st to get the updated syllabus textbook?

Hi Jack, it really depends whether you are able to dedicate sufficient time for Unit 1. Unit 1 requires about 100 hours of study, and that’s 1.5 hours a day (allowing for some buffer). For most candidates, this is doable even with a full time job, assuming you’ve no additional life commitment that may take up time post work. Yes, you certainly can take Unit 1 this year and Unit 2 after 30 November with the new syllabus (version 18) . You don’t have to sign up for 2 units at once, just for Unit 1, as any registration would start the 1 year time limit to sit for the exam. You can sign up for Unit 2 after passing Unit 1. Hope this helps!

Is it advisable to start the IMC now with 90 odd days left until Nov 30th? I would like some more info on how this works, can unit one be taken in this year and unit two be taken after dec 1?

Would it be possible to choose which Unit to complete first i.e. starting with the Unit 2 exam then completing Unit 1. Or does it have to be in order?

^This would be for the IMC- I understand you are unable to do this for the CFA

Hi Kofi, we did double check this with CFA UK. It is generally recommended that candidates take Unit 1 first, but you can indeed take the units in any order you wish. Hope this helps

How are you Sophie? I have started with Investment Foundation programme then I will progress to Investment management certificate hopefully next year

How are you Sophie ? Does IMC prescribe calculators like CFA ?Or you can use any calculator.When is the writing of exams resume after the Covid19?Can I pay for my exams in Rand’s at current exchange rate?

I’m good Finias, thanks! Both CFA calculators are accepted for the IMC (i.e. the Texas Instruments BA II Plus calculator, and the Hewlett Packard 12C). Additionally these calculators are accepted: • Casio fx~83GT Plus • Casio fx-83GTX • Casio fx- 991ES Plus

You not able to use your own calculator now on exam.Only on computer.

Ah yes Tom! Thanks for reminding me about the new policy from 1st June 2020. You can access the calculator demo here (https://vue.com/athena/athena.asp) and familiarize yourself with the online calculator guide here (https://www.cfauk.org/-/media/files/pdf/pdf/1-study-with-us/2-imc/imc-policies/ti30xsmultiviewguide_en.pdf)

Considering what’s happening with the pandemic right now is there an option to do the IMC exam online? And if not when will I be able to sit it?

Hi Jen – that’s a good question! The IMC exam is not offered online, but you may be able to take it with the appropriate measures in a test centre near you. You can get the latest details on this from CFA UK’s website.

Is it possible to write unit 1&2 of IMC in the same year?

Hi Finias, yes you can. You can register for both exams at once, or separately. Only 2 restrictions apply (as detailed https://www.300hours.com/articles/investment-management-certificate-guide#imcdeadlines): – Candidates are not allowed to take an IMC exam (i.e. either one or both units) more than 4 times in any 4 month test window. – There is 1 year expiry from date of exam registration, so you have to make sure you take (and hopefully pass) the exam within that time frame.

I will start my IMAC studies as soon as the covid19 is over.Thanks Sophie Regards Moyo

When can I begin or how to start

Hi Manoj, you can start anytime (or even now) by registering for the IMC exam on CFA UK’s website (https://www.cfauk.org/study/imc/register-for-imc)

Please confirm IMC course is absolutely free.

Hi Rameshwar, IMC is not free unfortunately. It’s about £800 for the whole certification assuming first passes. More details here https://www.300hours.com/articles/investment-management-certificate-guide#imcfees

I would like to know more please.

Can I learn at 45 years ?not staying in UK .I stay in Johannesburg , South Africa .I have been studying CFA since 2016 at pre-level

Hi Finias, there is no age barrier to the IMC exams 🙂 If you check out Pearson Vue’s CFA UK site (https://home.pearsonvue.com/cfauk), under “Find a Test Center” – there are Pearson Vue test centers for IMC exams in Johannesburg itself, so you’re all set! Good luck!

How are you, Sophie?I joined a Investment Foundation programme.How is IMC related to Investment Foundation Program?

Hi Mandy, I hope you’ve found all the answers you have about the IMC qualification in my article above 🙂

Hi What prep providers best for onlineSupport There are 4 Of Them Thanks