Previously known as Claritas, the Investment Foundations Program by CFA Institute was paused in December 2021 for a product refresh.

Since then, a new, enhanced version of the Investment Foundations Certificate was launched globally.

With the same educational objective as before, it now has an enhanced, self-paced online experience, requiring only 60-90 hours of study for a small fee.

Assuming it is suitable for your career situation and objective, it is something you can even register for right now, study and complete the online exam from the comfort of your own home.

Curious about the CFA Investment Foundations Program? Read on to find out more!

- What is CFA Investment Foundations Program?

- CFA Investment Foundations in a nutshell

- Pass rates & difficulty

- Investment Foundations topic areas

- Exam fees & costs

- Exam schedule & key deadlines

- What are the requirements for Investment Foundations Program?

- Benefits of the CFA Investment Foundations Certification

- Investment Foundations vs IMC: What is the difference?

- Investment Foundations vs CFA: Which is right for you?

What is CFA Investment Foundations Program?

Awarded by CFA Institute, the CFA Investment Foundations Program is a comprehensive online certification that provides a fundamental understanding of the global investment industry.

Originally launched in 2013 as Claritas Investment Certificate (and later renamed), this self-study course is specifically designed for all support professionals in finance and investment industries, such as IT, HR, operations, project management, accounting, legal, administration, strategy marketing. It is also suitable for those without finance backgrounds who aspire to be in front office roles.

In fact, the Investment Foundations certificate was launched to fill a gap in the industry. For every investment decision maker, there are 9 other people working alongside them coming from different disciplines.

This group of professionals may not have had any formal investment training, but would greatly benefit from some foundational investment knowledge in their day-to-day role – non-investment decision-makers need to know their stuff too!

To date, there are more than 50,000 Investment Foundation Certificate holders from more than 100 countries. The program has received solid feedback so far from candidates and employers, with:

- 93% of certificate holders stating that they have gained a clearer understanding of the investment management industry;

- 87% of certificate holders indicating that they would highly recommend the program to others;

- 98% of managers (who manage certificate holders at a major asset management firm) would recommend the program.

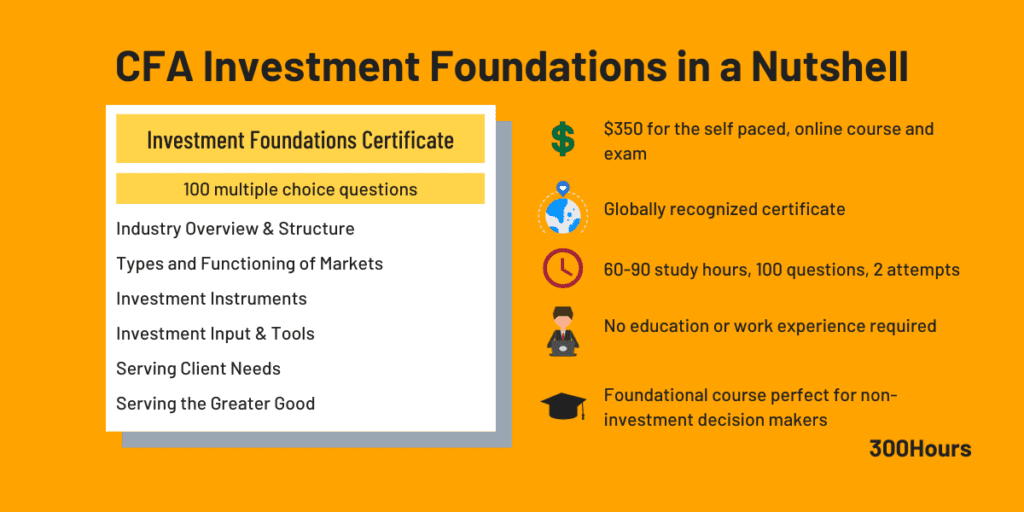

CFA Investment Foundations in a nutshell

CFA Investment Foundations is a self paced, online certificate program designed to equip non-investment decision makers with a solid foundation knowledge in investment management.

Examples of the target group ideal for this certification are financial services industry professionals working in IT, HR, legal, strategy, marketing, operations, administration, accounting and more.

Similar to most other professional designations such as CFA, FRM, CAIA and IMC, Investment Foundations is also a self-directed learning program:

- It is administered in English and all its contents are offered online globally through CFA Institute’s digital learning platform called Learning Ecosystem.

- This course is made up of 6 courses, covering the investment industry’s overview, type and functioning of markets, investment instruments, investment inputs & tools, industry structure, clients’ needs, ESG, ethics and regulation.

- Officially it requires around 40-70 hours of study, although we typically have a more conservative estimate of 60-90 hours of study, with a final online exam that consists of 100 multiple choice questions in 2 hours and 20 minutes.

What’s different from other typical finance designations is that in this new Investment Foundations Certificate, candidates are assessed throughout the certificate learning experience via coursework, in addition to the final assessment.

There are end of module and end of course (2 retakes max) questions after each corresponding module or course is completed. This continuous check on candidate’s readiness before allowing the final online exam to be taken is likely to increase the pass rates.

The Investment Foundations exam can be taken online once certain conditions are met, and within 12 months of the registration date.

Once the online exam is completed, preliminary results are provided instantly. Upon successfully passing the final examination, candidates can claim a digital badge and the Investment Foundations Certificate.

Pass rates & difficulty

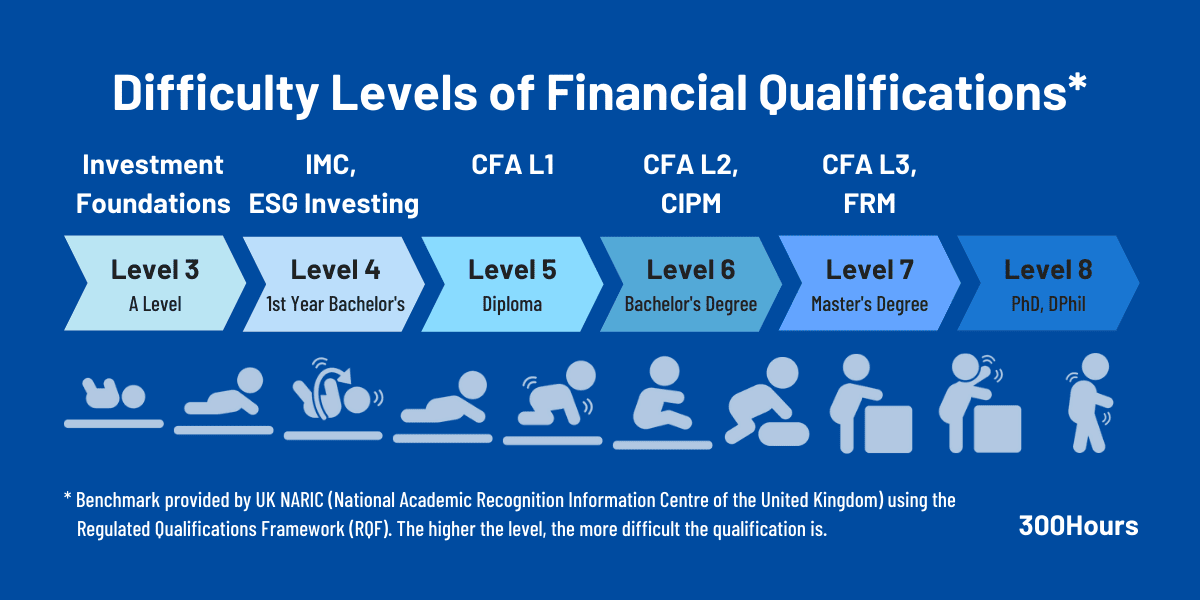

According to UK NARIC (National Academic Recognition Information Centre of the United Kingdom), the Investment Foundations Certificate is benchmarked as a Level 3 qualification under UK Regulated Qualifications Framework (RQF).

This means that in terms of difficulty, Investment Foundations qualification is comparable to post-secondary education training or specialised secondary level education (e.g. ‘A’ Level).

As an introductory course into investment management for non-investment decision makers, Investment Foundations is unsurprisingly relatively easier compared to other financial designations such as CFA, CAIA, FRM.

Here’s a quick summary comparing other financial qualifications’ difficulty under RQF (with PhD programs being Level 8 as a benchmark):

| Qualification | Comparable UK RQF Level | Difficulty Equivalent to |

|---|---|---|

| CFA Investment Foundations | Level 3 | Post-secondary education training or specialised secondary level education (e.g. ‘A’ Level) |

| Investment Management Certificate (IMC) and Certificate in ESG Investing | Level 4 | Certificate of Higher Education, or the first year of a Bachelor’s degree |

| CFA Level 1 | Level 5 | Diploma of Higher Education |

| CFA Level 2 | Level 6 | Bachelor’s degree |

| Certificate in Investment Performance Management (CIPM) | Level 6 | Bachelor’s degree |

| CFA Level 3 | Level 7 | Master’s degree |

| Financial Risk Manager (FRM) | Level 7 | Master’s degree |

In addition to the (zero) fees, what makes Investment Foundations certificate really attractive is the relatively high pass rates.

82% of the candidates passed the first Claritas exam, and CFA Institute expects the CFA Investment Foundations’ pass rates to be around 60-85% on average.

That said, we expect this new, enhanced Investment Foundations certificate to be on the higher end of this pass rate range as the continuous assessment throughout the course also contributes to the overall score. With a maximum of 3 retakes for the questions at the end of each of the 6 courses, this should improve the pass rates significantly as the constant testing of knowledge is present throughout the course before the final exam.

Investment Foundations topic areas

The investment Foundations Certificate does a great job in covering a breadth of topics in 6 courses that serves as a good overview of the investment industry.

The topics areas, in-depth description and exam weights are as below:

| CFA Investment Foundations Topics | Description |

|---|---|

| Industry Overview and Structure | This chapter gives a broad overview of the financial services sector, in particular the investment industry. It focuses on how the investment industry works, its participants and the benefits it brings to society when well regulated and done ethically. |

| Type and Functioning of Markets | An introduction to primary and secondary markets and how they operate. You will also be introduced to decentralized finance, the concept of investment vehicles, how they are structured, and how those structures serve investors. |

| Investment Instruments | This module provides a good introduction to quantitative concepts key to understanding the various main asset classes: equities, bond (fixed income), derivatives and alternative investments. |

| Investment Inputs & Tools | This is an important chapter explaining how the (economic) world works, on a micro and macro level. Candidates will learn about microeconomics, macroeconomics, international trade and financial statements. |

| Serving Client Needs | This topic is all about the process of understanding your client’s circumstances and investment needs, so their investments can be risk-managed and allocated in the right way. You’ll also learn about performance evaluation to keep track of investment performance. |

| Serving the Greater Good | An introduction to the benefits, key concepts, and approaches to ESG investing and its link to DEI (diversity, equity and inclusion). You will also learn how ethical dilemmas that arise in practice within and beyond each of these elements can be addressed through an ethical decision-making framework. |

Exam fees & costs

The CFA Investment Foundations Certificate is online and costs US$ 350, including the curriculum. This includes six courses and final assessment, which are required to earn program-level certification.

Although there is a limited range of third party study materials, using the curriculum itself is sufficient to pass the exam. If you didn’t pass the final exam, you can only retake the exam twice.

If it is suitable for you and fits your career objectives, it is an unbelievably good value-for-money course to complete to boost your CV. All you need is an internet connection to register and start studying now!

Exam schedule & key deadlines

As it is an online-only program, candidates can sit for the Investment Foundations exams throughout the year.

Exam registration limits and number of attempts:

- Candidates have 1 year from date of registration to complete the exam.

- Each registration allows 2 attempts to pass the final exam. Each exa can be repeated without re-registering as long as it is within the 1 year window.

What are the requirements for Investment Foundations Program?

Given its objective and target audience, the Investment Foundations Certificate is open to all, with no education or experience requirements.

The course is really approachable and designed for the many different people in the financial services industry who are not directly involved in analysing or making investment decisions, with no prior knowledge assumed.

Candidates who successfully pass the online exam can claim a digital badge and earn the Investment Foundations Certificate.

Benefits of the CFA Investment Foundations Certification

Given CFA Institute’s brand cachet and Investment Foundations’ international recognition, this qualification can be particularly useful for:

- Financial services professionals working in middle or back office, or even lawyers working with financial services clients, who would find the knowledge base beneficial for their day-to-day role.

- University students or fresh graduates (with or without finance background) looking to explore a career in finance. This could be a low cost and effort way to learn about the investment industry for free, whilst obtaining a certification that could set you apart from the rest. It could also serve as a stepping stone for other higher level, financial designation such as CFA, FRM or CAIA once you’ve gained a few years working experience in the sector.

By completing and earning the Investment Foundations Certificate, you can expect to:

- Lead with confidence and work better with your colleagues and clients

- Gain a fundamental framework and knowledge of the investment industry

- Improve your job performance by gaining an understanding of common global industry standards

- Differentiate yourself and stand out in a competitive global job market

Investment Foundations vs IMC: What is the difference?

There is often confusion between Investment Foundations Certificate and IMC (Investment Management Certificate), of which the latter is a threshold qualification for aspiring financial services professionals run by CFA UK.

Let’s clarify this: the key difference is target audience and to a lesser extent, geography.

In short, IMC is UK-only, more regulatory-focused and intended for people who work in front office (involved in investment decision making).

On the other hand, Investment Foundations is more suitable for people who work in the middle and back office and even in related industries like professional services (e.g. lawyers working with financial services clients).

Here’s a quick summary table comparing Investment Foundations vs. IMC:

| CFA Investment Foundations | Investment Management Certificate (IMC) | |

|---|---|---|

| Geographical focus | Global | Global (with remote-proctoring) |

| Objective | To provide an accessible, foundation-level program for anyone wishing to enter or advance within the investment management industry. To supply successful candidates with a common understanding of industry structure and terminology, regardless of job function or geographic location. | Designed as the benchmark entry-level qualification into the UK investment profession.Delivers the threshold competency knowledge required by investment practitioners involved in portfolio management, research analysis, and other front office investment activities. |

| Topics Covered | The Investment Foundations syllabus consists of 6 courses covering the essentials of finance, ethics and investment roles. More details here. | IMC covers topics including economics, accounting, investment practice, regulation, and ethics.The content is global, with the addition of a distinct chapter on UK taxation. |

| Target Audience | The course is designed for professional disciplines supporting investment roles and requires no prior educational or industry experience. Candidates are typically drawn from areas such as operations, administration, IT, HR, marketing, sales, PR, compliance and customer service. | Often sat by university graduates and entry level professionals in the investment industry. Pursued by individuals across all areas of the investment sector and over half of candidates are actively involved in front office investment activities including portfolio management, research, investment consulting, risk management and relationship management. Most investment firms ask their employees to take the IMC to demonstrate the competency of their front office staff to the regulator. |

Investment Foundations vs CFA: Which is right for you?

As you may know, the CFA charter is a Master’s degree equivalent designation that focuses more on portfolio management at its highest level.

On the other hand, Investment Foundations is an online certification equivalent to “A Level” that focuses on a foundational knowledge in investment management suitable for non-investment roles.

Both qualifications are quite distinct in its objectives, therefore we hope the answer is clearer here:

- If you’re looking into a career that analyzes or makes investment decisions, such as wealth or investment management industry, then the CFA charter is the right one for you. The CFA charter will also benefit any financial services professional role.

- If you’re looking into this to learn more about the investment industry, but would perform a role supporting the industry (such as in IT, HR, legal, operations, marketing etc), the Investment Foundations Certificate is better suited for you.

Here’s a quick summary comparing both qualifications:

| CFA Investment Foundations | CFA Program | |

|---|---|---|

| Suited For | Non-investment decision making roles associated with the finance industry, such as IT, HR, legal, operations, customer service, accounting etc (typically middle or back office). | Finance professionals in a role that makes or advises investment decisions (typically front office) |

| Entry requirements | None. This course is designed to be accessible to all. | Have a bachelor’s degree; or Final year undergraduate of a bachelor’s program; or Have a combination of college degree and full time work experience that totals 4,000 hours. |

| Number of Exams | 1 | 3 levels (fastest route is in 18 months, although the average is 4 years to complete) |

| Exam Frequency | Online exam can be done anytime all year round. Maximum 2 attempts a year. | CFA exams are now computer-based with increased frequency: Level 1: 4x a year, in Feb, May, Aug and Nov. Level 2: 3x a year, May, Aug and Nov. Level 3: 2x a year in May and Aug. |

| Exam Format | 100 multiple-choice questions, online unproctored exam. | Level 1: Multiple choice questions Level 2: Item set questions (multiple choice) Level 3: Item set and constructed-response questions |

| Topics studied | 6 courses, focusing on ethics, and a high-level overview of the financial and investment industry. Non-technical, no calculations required. | 10 topics per level, with in-depth focus on ethics as well as technical coverage of the majority of investment instruments. Definitely has calculations involved. |

| Pass Rates | Estimated to be 80% or more | The range of CFA pass rates since 2010: Level 1: 22%-43% Level 2: 39%-47% Level 3: 46%-56% |

| Fees and Costs | $350 for 6 courses and online exam. | – One-off Enrollment Fee: $350 – Registration fee (per level): $940-$1,390 – Retakes: same as registration fee Total CFA exam minimum cost: ~US$ 3,170 |

| Study Hours Needed | 60-90 hours | At least 300 hours per level |

| Post Exam Requirements | To become an Investment Foundations certificate holder, all you have to do is pass the online exam to claim your digital badge and printed certificate. | To become a CFA charterholder: – Pass all the 3 levels of CFA exams; – 4 years of qualified investment work experience; – Submit reference letters for 2-3 professional references; – Become a regular member of CFA Institute; – Adhere to CFA ethics and professional conduct. |

Overall, the Investment Foundations certificate provides financial services professionals working in non-investment roles a great opportunity to upgrade their knowledge base about the global investment industry. It offers an unbeatable value as it is a free, high quality online certification with global recognition that requires relatively low time investment.

So if you’re currently student, working in an investment-supporting function, or just aiming for a career in investment management in general, CFA Investment Foundations can be a cost effective way to add a valuable credential to your CV.

Any questions? Let us know in the comments below!

Meanwhile, you may find these related articles in our Beginner’s Guide series of interest:

- IMC (Investment Management Certificate): A Beginner’s Guide

- What is CFA Exams? A Beginner’s Guide

- CAIA (Chartered Alternative Investment Analyst): A Beginner’s Guide

- FRM (Financial Risk Manager): A Beginner’s Guide

- Certificate in ESG Investing: A Beginner’s Guide

- Sustainability & Climate Risk (SCR) Certificate: A Beginner’s Guide

what is the worth of Investment Foundation Certificate to someone who has passed the CFA Level-I exam.

I think CFA Level 1 (and the CFA program itself) is a level higher than IMC, so I’d say it wouldn’t make sense to have an IMC once you have passed CFA L1.

Thanks

Hello! If the exam is online, am I required to purchase a personal laptop or a work laptop is allowed considering there are many restrictions when using a work laptop. If I cannot afford to buy a personal laptop as of the moment, what alternatives do I have?

Thank you.

Hi Fayye, it may be worth trying with a company laptop first to see if it works. If not a public library computer should work for educational purposes.

I’ve registered for the level 1 August 2023 attempt, Can I also register for the CFA foundation exam in Feb 2023?

Good day,

Kindly share the dates for the next registration for CFA Investment foundation program.

I am not found how to register for it, it only shows I am not registered for this exam how to register in 2022?

Do you know what are some good alternatives to the CFA Foundations for IT professionals in the finance supporting roles?

Hi Rada, IMC (Investment Management certificate) is a good alternative to check out as it builds a good foundation in investment management. We wrote a guide on it, check it out!

Since the CFA Institute has stopped accepting new registrations since Dec. 17th, do we just have to wait till they come up with the new offering? Do you have any idea as to when that will be?

Hi Laura, yes unfortunately that’s the case. But rest assured we will let you know once CFA Institute has provided more visibility on this front!

any update Sophie regarding this ?

Sorry Ashish, nothing so far from CFA Institute. Rest assured we will keep you guys posted if we hear anything on this article!

Hi, when the Investment foundation program registration will start? I am unable to rgister, can’t see the options to enroll, it is end of july, will it take a long?

Hi Kunal, as disclosed at the top of the article, CFA Institute has recently discontinued Investment Foundations program.

I think now its fee paying $300

I think they now charging $300 for one year valid. no more free

Hi..I have registered for the investment foundation and and the final date for my exam is in January but I am not well prepared and ready to write,how do I postpone it to the next exam?

I don’t think you can postpone your Investment Foundations exam if your deadline has run out. Sorry.

I am unable to click on the attempt 1 tab only for the final exam. What to do?

Investment Foundations are going through some changes so this might be related to it. It’s best to get in touch with CFA Institute to check – contact details here: https://www.cfainstitute.org/en/utility/phone-numbers

hi

So basically once registered with the cfa investment foundation, after 30 days we get access to the 2 mock tests in which we have to score 70

% or higher respectively and then we get the final exam right?

That’s how it was before CFA Institute took it off for individual candidates, yes. I believe the format is still largely the same.

Hi Zee,

Do you have an idea why the CFA Investment Foundation exam can no longer be taken by unaffiliated individuals?? I recently heard about the programme. I was sad to learn that I can’t take it independently. Kindly reply. Thanks.

CFA Institute have not really released an official statement. I heard that there were issues with many individual candidates signing up and not following through. CFA Institute’s costs are incurred per registered individual so it got too expensive to run the way it was.

Just my take on things, but hope it helps!

Hi Zee.

Is the investment foundation course open for individual registrations now? I see they are delaying a lot this year.

No, they’re still not open to individual registrations. At this point, I’m not sure if they will be again… 🤷♂️

Hi there,

Hope, you’re doing very well 🙂

As I can see that registration for CFA Investment Foundation program is open now. However, I don’t have the capacity to prepare and appear for the exam quite soon. Hence, I would like to know, when is the last date for registering in CFA investment foundation program? I mean to ask, till which date the registration window will remain open?

Thanks in advance.

CFA Investment Foundations is currently offered only through institutions (businesses, regulators, universities, training and learning providers, CFA Societies). Learning schedules will be down to each institution.

If I have registered in March 2021 and still haven’t given the exam, can I give it in November or do I have to register again?

You have 180 days (6 months) from date of registration to complete the exam. So if you’ve registered in March 2021, you’ll need to re-register to take the exam – but it’s currently not taking registrations (CFA Institute is revising the program).

I am unable to download the certificate, I have completed the final exam and it shows passed but there is no option for badge download or certificate download. PLEASE HELP

I would contact info@cfainstitute.org to get your certificate. I wouldn’t worry, as long as you’ve passed the final exam it’ll just be a process of sorting out the systems to get your accreditation. Good luck!

Thank you for reply Zee,but I want to know how much time it will take.

Will the questions remain the same for Attempts 1 & 2 ? (for the CFA investment foundations program) or will both attempts have a different set of questions for the final exam?

They will be different.

hello Zee! Hope you are doing well.

I just wanted to ask , what percentage do you need to get in the final exam for getting the certificate or passing the exam.?

I’m doing well thanks! You’ll need to achieve 70% or better to pass.

Hi,

I’ve registered for investment foundation program after taking my CFA level 1 Exam (21 july) but when I’m opening my learning ecosystem its coming for CFA level 1 and not of investment program.

Can anyone please help!

I’m not sure what you mean. Investment Foundations is currently closed to new applicants and will reopen on Sept 2021.

Hello, I trust you’re doing fine.

I can’t seem to access my LES. I get this error message ”This account does not have access to a course. Your access might be expired, or you are using the wrong email. Double-check you are using the correct email and log in again.” when I try to log in. I registered on the 18th of June, so I don’t get why I keep getting this message. I tried logging out to re-login, but it’s still the same message.

Please, what can I do about it?

Thanks

I’m not sure how you registered, but CFA Institute has closed Investment Foundations to new registrations since early 2021. I would imagine that’s why you’re seeing your error messages.

However, if you want to follow up on this you can email info@cfainstitute.org. If you do, let us know what they say!

I already sent a mail

I could still access the platform like 2 days ago……….I’m really shocked by this in all honesty. I will give an update when I get a response from cfainstitute.

Thanks

We’ve also received similar reports in our discussion forum – it looks like CFA Institute may have just cut off access.

They are planning to relaunch soon, but this is likely to now be a paid program, as they were having issues with lots of candidates registering but not actually taking the exams.

Good news!!!!

I now have access to the LES. Thank you for your help Zee!!!, it is much appreciated

You’re welcome!

How much time we can appear for Mock test ?

Not sure what you mean 🤷♂️

Hi

I enrolled for the investment foundation exam. I had a query regarding the mock tests, both mock that are to be given have all the chapters i.e all 20 chapters in both the mocks?

Yes, I believe so.

Hello.

Actually, I registered for this course in June 2020. But due to some circumstances, I couldn’t attempt the test in the 180 day period and hence I missed the last deadline for taking the examination that is 19th December 2020.

Now, will I have to re-register? Because I still have the access to their ecosystem and I didn’t take any of their mock tests or the final exam. Also, they have mentioned on their site that individual registering cannot happen until September 2021. So does that mean that I will have to wait till September 2021 for re-registering or I can still give the exam?

CFA Institute have never taken Investment Foundations offline like this before – I’m assuming this is because of Covid. So if the system allows you to take the mock tests and final exam, take it, there’s no downside to that.

If the system doesn’t allow you to, then yes, you’ll have to wait until September 2021 to re-register.

Hey Radhika,

The new registration can be done via Account. I mean, go to My Account, the select Investment Foundations. Then, you will be allowed to do registration.

Hey Radhika, I’ve got the same issue.

Just wanted to ask, did you appear for the exams yet?

Hi!! Thank you very much for the information!!

I would like to know if there are other well recognized free certificates such as the CFA Investment Foundations Program?

Hi Miguel, glad you found it helpful 🙂 In the finance realm, I am not aware of such free certificates at the moment unfortunately!

I can’t find the option to take the mock exam. It has been more than 30 days since I registered.

Hi Mae, are you saying you’re not seeing the option to take Mock exam A and B in the CFA Learning Ecosystem? To take the final exam, you need to score at least 70 on both mocks before the actual exam option appears.

Hi Sophie

I have registered for the CFA Investment Foundations exam but where from do I access the exam page login? I am not able to find any such URL or pop up or pages directing me to the exam. Please help

Hi Prasann, do you mean you couldn’t find the login page of CFA Institute’s Learning Ecosystem?

Is there any negative marking scheme?

There is no negative marking scheme according to our understanding Swara.

CFA Institute Investment Foundations vs. CFA Fundamentals (kaplan)

Hi, i’m thinking to do CFA L1 in nov/21 and i want to focus around june/july. I want to start next month a lighter reading about cfa topics, but i’m doubt about cfa investment foundations and cfa fundamentals, anyone can give me an idea what is more recommmended to real before focusing 100% in the CFA L1 material?

Thinking about to*

Recommended to read*

Hi Matthew, just a thought – if you’re thinking of CFA L1 in Nov21, why not register now for it and start reading (lightly)?

Reason I say this is that despite similar names, CFA Investment Foundations is targeted at different demographics vs. CFA Program itself. See the table above in the article comparing CFA vs CFA Inv Foundation for more info.

If you’re keen to pursue the CFA designation, you have time to register and start slowly first, before ramping up in June/July. That way, you don’t waste any effort reading/studying something else as it all contributes to your L1 exam.

I am having a problem registering my account. I received the message ” the email address is already associated with the account” I tried to register again and it looked like I am registered but my account cannot give me access to study material. If possible can you provide me with the number to call. My email address is as below

Hi Segametse, best to contact CFA Institute directly on this. It may also be that their online system is experiencing issues. Have you retried today when you have logged in?

Hello…..I registered for CFA investment foundation programme but somehow I couldn’t give my exam within 180 days so now what can I do??

I tried to register again but it’s showing you have already registered 🤷♂️

I tried to call to CFA institute but they not at all responding

Somebody please help me 🙏

Hi Pavan, you can attempt the exam twice per registration. And you can only register twice in a 12-month period.

So if you cannot complete/pass it within 180 days, just wait until that 180 day lapses, then re-register again to have 2 attempts within 180days.

Hope this helps!

Hello Sophie: Thanks for your reply. I want to ask another question if you don’t mind. I have just registered the exam sucessfully, but I haven’t seen any Mock exam in my account yet. Should I wait for another couple of days for them to generate? Because I remember see the agreement that I need to pass the mock exam A & B in order to access the final exam, but I cannot find them right now. Thanks for help!

Hi Jenny, have you logged into your Learning Ecosystem yet? Everything should be in there, including mock and final exams. Let me know if you’ve found it.

Hello Sophie: Ok got it, I have already found the e-learning platform. Thanks for help!

Hello there: I just want to ask that whether this program’s final exam is open book or not? Will there be any proctor during the exam? Do I need to turn my camera on? Thank you for answering!

Hi Jenny, it is not an open book policy although there is no proctor. By signing up to the free online exam you would have agreed to their ‘no misconduct policy’ (https://www.cfainstitute.org/en/about/governance/policies/investment-foundations-no-misconduct). Hope this helps!

Hello Sophie: Got it. Thanks so much for help!

IS THE FOUNDATION COURSE STILL FREE AS OF NOVEMBER, 2020? I AM ASKING BECAUSE I HAVE REGISTERED BUT UNABLE TO LOG IN TO ACCESS MY STUDY MATERIALS, EXAMS, PDF, ETC. PLEASE HELP! THANK YOU.:)

Hi Sristi, yes CFA Investment Foundations is still a free course today. It may be that CFA Institute is having a website technical issue, best to reach out to them directly to double check.

Alright Ma’am, thank you for your response.

where to attempt exam in online mode. I am finding where to start exam ????

we have to go to exam center for giving exam or it is from home only online

Hi Yash, it is a completely online course that is done from home (and tested online), not to mention free.

What is the minimum passing score of CFA Investment Foundation Program? Is is aggregate 70% or 70% in each module to pass the Investment Foundation Program? Thanks and appreciate your response.

Hi Musaddiq, the final exam consists of 100 multiple choice questions, of which you need an aggregate of 70 and above to pass the Investment Foundations Program.

Which certificate is best for Management positions?

Hi Tevin, there isn’t enough information here to comment really. Depends on what job you’re doing, and what certificates you’re comparing?

I failed in Mock A but passed in Mock B so how can I retake mock A exam.

There are 2 attempts per mock exam

Are there practice online tests or only the questions at the end of each chapter to practice for the Investment Foundations Program exam?

Hi Shary, aside from the curriculum, you get to practice more questions as well as mock exams on CFA Institute’s online learning tool called Learning Ecosystem upon registration.

how are the exams conducted do we have to go to the exam center or we can take the exam at home?

Hi Naman, the exam is conducted online, so you can take the exams at home

If I can’t pass in 180 days duration. Can I register again and give exam for free?

Hi Ananya, yes you can register again (for free) after 180 days if you didn’t pass. This is a free course so there are no retake or registration fees. You’re allowed 2 tries per registration. But you can only register twice in a 12 month period. So that means at maximum you can attempt the exam 4x a year in two 180-day registrations. Hope that helps!

Yes, Ananya you can as it is mentioned- You have 180 days (6 months) from date of registration to complete the exam. Each registration allows 2 attempts to pass. The exam can be repeated without re-registering as long as it is within the 180-day window and you can only register twice in a 12-month period. So this means the fastest time one can complete the Investment Foundations certification is in 1 month, and that there is a maximum of 4 attempts per year.