ESG investing is one of the big asset management trends, driven by the increasing financial relevance of ESG (environmental, social and governance) factors, better ESG data, growing investor demand and regulatory pressure.

This is creating a strong demand not just for portfolio managers – but finance professionals in general – with practical ESG expertise to help firms adapt and capitalize on this change.

If you’re serious about ESG, EFFAS’ Certified ESG Analyst® (CESGA) qualification may just be the right fit for you to augment your skillset:

- it is currently one of the higher level ESG investing certifications in the market;

- is the first certification accredited by the European Financial Reporting Advisory Group (EFRAG) as European Sustainability Reporting Standards (ESRS) compliant

- it is reasonably cost effective and time efficient;

- designed by leading European practitioners and is comprehensive yet practical;

- you can add a ‘Certified ESG Analyst®‘ or ‘CESGA®‘ title after your name upon passing.

Here’s all you need to know about the CESGA certification by EFFAS, let’s go!

- What is CESGA certification (Certified ESG Analyst)?

- Who is CESGA suited for?

- CESGA exam format

- CESGA exam pass rates, pass marks and difficulty

- Topic areas & weights

- Exam fees & costs

- Exam dates & key deadlines

- What are the requirements for CESGA?

- Benefits of CESGA

- CESGA vs CFA ESG Investing: Which is right for you?

What is CESGA certification (Certified ESG Analyst)?

The European Federation of Financial Analyst Societies (EFFAS) is a non-profit organization founded in 1962, representing more than 18,000 finance professionals from 15 countries in Europe. Its goal is to set the standard for investment professionals’ requirements and promoting professional excellence through quality training and thought leadership.

With European countries leading the way with ESG investing standards and analysis, EFFAS launched one of the first ESG investing qualifications back in 2014 – the Certified ESG Analyst (CESGA) certification.

Since its launch, there are currently more than 6,821 CESGA title holders globally. By the end of 2024, this figure is forecasted to be more than 7,500.

With climate change and sustainability issues in the forefront of global agenda, the EFFAS Certified ESG Analyst qualification has registered exponential growth in Europe, Asia and increasingly the Americas since 2017:

Designed by industry practitioners and continuously updated, the CESGA program is comprehensive yet practical in their approach of teaching efficient valuation, measurement and integration of ESG issues into investment analysis.

Who is CESGA suited for?

The CESGA exam is a Diploma-level course that combines ESG know-how and fundamental company analysis valuation at both a basic and an advanced level.

What sets it apart from the other ESG certifications is that CESGA manages to strike a fine balance of:

- going into sufficient depth on key topics like ESG data and regulations;

- covering a broader range of asset classes aside from equity, such as private equity, commodities, sovereign and green bonds; and

- providing a practical framework to approach ESG valuation systematically in your daily work.

- first certification accredited as ESRS compliant

This makes the CESGA qualification appealing to a broad set of audience. Whilst particularly useful for financial analyst and portfolio managers, CESGA is also ideal for investment professionals in all roles – such as corporate sustainability officers, investor relations, auditors, consultants and financial planners – who wish to embrace ESG integration holistically.

The upcoming mandatory implementation of the ESRS in 2025 represents a significant shift in corporate reporting within the EU, emphasizing the need for robust and transparent sustainability disclosures. In this context the CESGA 4.1 programme, offers immense added value for companies striving to comply with these new regulations.

CESGA candidates enrolled to the CESGA 4.1 and passing the exam starting 2025 will be ESRS compliant and thus equipped to enhance the quality and accuracy of sustainability reporting.

CESGA exam format

The EFFAS CESGA exam is a 2.5 hour long exam, which consists of 2 equally weighted parts:

- 20 multiple choice questions (MCQ, 50% of exam score); and

- a practical case study with 9 constructed-response style questions (50% of exam score). This is based on a company due diligence process from an ESG perspective.

Interestingly, negative marking is used for the MCQ section. This means that points are actually deducted for incorrect answers, rather than being worth zero points. This is probably done to encourage serious candidates to study the course with thorough preparation, given the relative smaller number of questions.

The CESGA exams are held quarterly, i.e. 4 times a year in March, June, September and December (see Key Dates section below for more details):

- In-person exams are available mostly in UK, Europe, Macau and Singapore..

- Online/remote exam option is also now available globally, do check that you meet the CESGA online exam requirements beforehand.

Similar to other professional designations such as CFA program, CESGA is also a self-directed learning program:

- Interestingly, EFFAS is also the (sole) CESGA course training provider. The exam fees already include the online training videos, study materials and practice questions (see Exam Fees section for further details).

- In terms of study hours, for candidates with no prior ESG experience, 80-120 hours of study is recommended to prepare for the CESGA exam.

CESGA exam pass rates, pass marks and difficulty

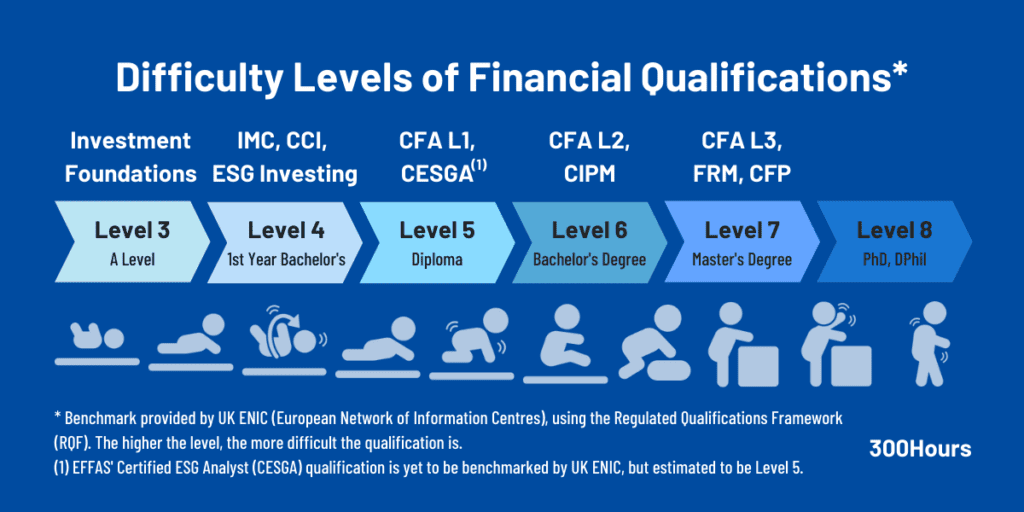

Although not officially benchmarked by UK ENIC yet (a UK education agency that benchmarks international qualifications for comparability), EFFAS’ Academic Director has confirmed that CESGA certification is a Diploma equivalent, and in theory should be pitched to Level 5.

This means that CESGA exam difficulty broadly equates to a Diploma, similar to CFA Level 1.

To pass the Certified ESG Analyst exam, students must demonstrate their knowledge by gaining more than 50% of the 120 points (60 points each section), and in each section have at least 30% of the answers correct.

This means that a candidate with 10 points from the constructed response section and 60 points in the MCQ – or vice versa – will not pass despite having a total score of more than 50%.

Since 2021, CESGA results are typically announced about 5 weeks after each exam. Candidates would only receive a pass or fail notification, with no details on exact scores or pass marks. Similar to other examination bodies, EFFAS does not accept requests to review or appeal the exam results.

Despite being one of the higher level ESG qualifications in the market, the global average pass rate for CESGA since 2016 is quite high at 80%.

This may be due to a combination of factors, such as highly skilled candidates, negative marking, stricter passing requirements and making the training program mandatory to ensure candidates are serious and well prepared before attempting the exam.

Topic areas & weights

The EFFAS CESGA syllabus has 9 modules plus an additional complementary 10th module. Module 10 is not tested in the exam itself, but is a useful supplementary reading about regional developments in ESG investing.

In the 2.5 hour CESGA exam, here’s where the individual modules would be tested:

- Module 1-8 are equally weighted and would be tested in the 20 multiple choice questions section (50% of exam); and

- Module 9 would be tested in the case study section with 9 constructed-response style questions (50% of exam).

Here’s a detailed overview of the 10 modules covered in EFFAS’ CESGA’s latest curriculum and their respective topic weights:

| EFFAS CESGA Syllabus | Description | Topic Weights |

|---|---|---|

| Module 1: Recent Developments in ESG Integration | An introduction into the current state of sustainability integration within the financial sector. Understand the drivers of the demand for ESG, the barriers and challenges associated with ESG integration. An overview of empirical studies on ESG investment and the implications for sustainable investment. | 5.55% |

| Module 2: Regulatory environment | An introduction into the current state of sustainability regulations in the European Union and international trends. Describes the relevant regulations for corporations and investors, to understand current international trends and future developments. It also discusses the interconnectedness between different regulations and future regulatory trends. | 5.55% |

| Module 3: ESG-Strategies | This module is focused on different strategies to incorporate ESG-considerations. It provides an overview of the current sustainable investment landscape and explains the variety of ESG strategies and their distinctive features. | 5.55% |

| Module 4: Responsible Investing Across Asset Classes | This module concentrates on different investment assets and the various ESG considerations applicable to each asset class. It reviews how ESG-strategies can be developed according to different asset classes. | 5.55% |

| Module 5: ESG Reporting | Explains the difference between reporting requirements and reporting frameworks. It aims to familiarize the participant with the key reporting frameworks and the ongoing trend toward convergence. Discusses the key sources of ESG information and ESG raw data issues, and why indicators are used. The concept of ESG materiality and double materiality would also be discussed. | 5.55% |

| Module 6: ESG integration in the investment process | Learn the general steps of the investment process chain, understand the challenges and effects of integrating ESG into the investment process. | 5.55% |

| Module 7: ESG integration in fundamental research (Qualitative analysis) | This hands-on module focuses on how to integrate ESG information into investment decisions. It discusses how to identify ESG value drivers based on global mega trends, how to conduct a qualitative analysis of corporate governance, particularly board effectiveness, how to analyze sector-specific environmental and social issues on a qualitative basis. After these analyses, learn how to conclude by assessing consistency with the business model. | 5.55% |

| Module 8: ESG integration in fundamental research (Quantitative analysis) | This module discusses how to integrate qualitative analysis of material challenges into quantitative valuation models. Discuss how ESG information influences financial estimates. Learn how ESG is integrated into valuation models for equities, fixed income, and other asset classes. | 5.55% |

| Module 9: Case Study – ESG Integration in The Investment Decision and Climate Change | This practical case study module combines all the knowledge and skills in the previous 8 modules and focuses on application. Learn a company due diligence framework which takes ESG into account. The module covers examples on research (Chapter 1) and portfolio management (Chapter 2). In addition, the module provides a comprehensive and practical approach to climate change (Chapter 3), delving into strategic implementation of a climate change response within the investment process. | 50% 5.55% |

| Module 10: ESG Regional Developments: ESG in Asia Pacific – where we stand | This is a complementary module will not be tested in the exam. Summarizes the regulatory framework in the following regions: Asia, discussing the new ESG developments in Japan, China, Hong Kong, Singapore and other Asia Pacific markets. Latin America provides an overview of the main trends in ESG related practices in the region. North America chapter covers key developments in the burgeoning ESG industry in Canada and the United States. | 0% |

Exam fees & costs

EFFAS’s training arm, EFFAS Academy administers the CESGA exams and its mandatory online training program.

The total CESGA exam fee is EUR €1,500 + VAT (i.e. local sales tax, if applicable). This is roughly equivalent to US$ 1,710, which consists of:

- Exam registration fee of €250 (US$ 285), plus

- CESGA online training course of €1,250 (US$ 1,425), which is mandatory as part of the CESGA exam registration.

All fees shown are net of any local sales tax payable by the candidate in their country of residence. Where EFFAS Academy is required to add local sales tax, this will be added to the fees shown during the payment/checkout process.

While seemingly more expensive at first glance, EFFAS’ CESGA exam fees actually includes everything you need to prepare for the exam, with all the online videos, study materials, practice questions and mock exams included.

When you register, you will gain a 6-month access to the following study materials and resources:

- Digital version of the curriculum

- E-seminars for each module (recorded videos for online learning)

- Course slides (including analysis tool templates)

- Supplementary references and sources

- Multiple-choice questions for self assessment

- 1 specimen exam

All the study materials can be downloaded in PDF format from the platform.

Unlike the CFA program, once you pass the CESGA exam and obtain your Certified ESG Analyst title, there are no further annual membership costs to pay for the right to use your CESGA title.

Resitting the exam costs €250 + VAT (~US$ 282), while extending the study platform access for another 6 months costs €450 + VAT (~US$ 508).

Exam dates & key deadlines

The CESGA exams are held 4 times a year in March, June, September and December.

Here are the latest exam dates and registration deadlines for 2024-2025 exams:

| CESGA exam dates | Jun 2025 | Sep 2025 | Dec 2025 |

|---|---|---|---|

| Registration opens | 7 Jan 2025 | 26 Mar 2025 | 11 June 2025 |

| Final registration | 16 May 2025 | 17 August 2025 | 2 Nov 2025 |

| Exam day | 27 Jun 2025 | 26 Sep 2025 | 12 Dec 2025 |

What are the requirements for CESGA?

EFFAS’ CESGA certification is designed to be approachable to all, with no prerequisites or minimum entry requirements to enrol in the Certified ESG Analyst course.

That said, finance professionals or those with some work experience are likely to join the program with a higher-level of understanding and may initially gain more from the course.

Candidates who successfully pass the CESGA exam will receive the EFFAS Certified ESG Analyst Diploma and a digital badge, as well as earning the right to use the Certified ESG Analyst® or CESGA® trademark.

There are no additional costs or yearly membership requirements to maintain the right to use the CESGA title. That said, EFFAS continues to help its CESGA title holders stay up to date with the latest ESG developments with continuous research, conferences and news updates.

Benefits of CESGA

Having a Certified ESG Analyst qualification could be a unique differentiator in your finance career, especially with ESG investing expected to grow exponentially.

Given the relatively low time and money investment, the reasonably high pass rates and the right to use the CESGA® title without additional costs, EFFAS’ CESGA certification could be a good return of investment which allows you to clearly signal your practical ESG expertise in your career.

By completing and earning the CESGA ESG certificate, you can expect to:

- Gain practical understanding and skills to integrate ESG considerations in your career;

- Obtain a clear, increasingly recognized certification title in ESG field (CESGA®) to signal your sustainable finance expertise globally;

- Improve your career prospects and differentiate yourself from other job candidates;

- Diversify your career profile and augment your existing skillset to broaden your career opportunities;

- Equip you as investment professional to meet the mandatory ESRS requirements coming in 2025 and provide substantial added value to companies preparing for these regulatory changes.

- Pave your way for further finance designation such as CFA, FRM, or CAIA as you further specialize.

CESGA vs CFA ESG Investing: Which is right for you?

In short, while both qualifications focus on sustainable finance, here’s what we think are the main differences between them:

- Difficulty level: CESGA is a higher-level qualification (Diploma, estimated at Level 5), whereas CFA ESG Investing certificate is benchmarked at Level 4 under the UK Regulated Qualifications Framework (RQF). Both qualifications require similar study hours.

- Content depth and breadth: Given the above, it’s not surprising that CFA Institute’s ESG Investing course is more introductory in nature, where content is focused on lots of theory and description. CESGA does cover the basics for those new to ESG too, but there’s a little more breadth and depth covered on issues such as applying ESG across various asset classes, regulation, integrating ESG factors into valuation. CESGA also covers 2 comprehensive cases studies on company valuation and portfolio management in a separate module which may offer a more practical edge.

- Price: Total cost for CESGA is higher compared to CFA ESG Investing’s certificate as the former also includes its mandatory online training course and materials.

- Geographical focus: ESG is a global approach. With Europe leading the way with ESG standards, CESGA covers general global standards and analyses the European regulatory developments in depth because they might be a blueprint for other regions. Its content is constantly updated to reflect regional developments (e.g. Module 10).

- Global reach: EFFAS’ CESGA qualification is well recognized in Europe. It is also now ESRS compliant and gaining traction around the world, especially in the Asia Pacific region. CFA Institute’s ESG Investing certificate is also available worldwide.

- Certification title: We feel this is one of the biggest factors to consider if you’re serious about the ESG sector. Upon passing CESGA, you can add the ‘Certified ESG Analyst’ or CESGA® title behind your name. But that is not the case with CFA Institute’s ESG Investing Certificate, as confirmed by FT as well, all you have is a digital certificate you can put on LinkedIN.

Both EFFAS Certified ESG Analyst (CESGA) and CFA Institute’s ESG Investing Certificate are now available globally in most countries.

While both are good quality qualifications from reputable organizations on ESG investing, the choice depends on key factors mentioned above: budget, employer recognition, geographical preference and preference for certification title.

Here’s a summary table between two ESG qualifications:

| EFFAS’ Certified ESG Analyst (CESGA) | CFA UK’s Certificate in ESG Investing | |

|---|---|---|

| Suitable for | Particularly useful for financial analyst and portfolio managers, but also investment professionals of all roles (e.g. sustainability officers, investor relations, auditors, consultants and financial planners etc), who are looking to integrate ESG issues into the investment process. | Students who are keen on an investment career; or Investment professionals of all roles (asset management, sales & distribution, wealth management, product development, financial advice, consulting, risk etc), who are looking to understand and integrate ESG issues into the investment process |

| Pre-exam qualifications | None, although some work experience in finance is helpful. | None, although some insights in the investment process is strongly recommended (via formal qualification or experience) |

| Number of Exams | 1 | 1 |

| Exam Frequency | 4 times a year in March, June, September and December. Also available to book for remote proctoring at home globally. | Available to book throughout the year (except weekends and holidays) for in-person exams globally. Also available to book for remote proctoring at home globally. Maximum 4 attempts in 4 months |

| Exam Format | 20 multiple-choice questions and 9 constructed-response questions in 2 hours and 30 minutes. On-site computer-based testing or online remote testing | 100 multiple-choice and item set questions in 2 hours and 20 minutes On-site computer-based testing or online remote testing |

| Pass Rates | Average pass rates of 82% (2016-2021) | Between 60%-75% |

| Fees and Costs | US$ 1,710 (€1,500 + VAT), which consists of $285 registration fee plus $1,425 online training course. | US$ 675 |

| Study Hours Needed | 80-120 hours | 130 hours |

| Post Exam Requirements | None | None |

| Certification Title Upon Passing | Title holders can add the “Certified ESG Analyst®” or CESGA title after their name. No annual membership to maintain the title. | None |

Overall, EFFAS’ Certified ESG Analyst certification seems to represent a good return on investment for those serious about the ESG investing sector, and are looking to clearly differentiate themselves with a higher level of sustainable finance credentials from a leading European organization.

Is the CESGA qualification something you’d consider taking on to enhance your ESG credentials? Let us know in the comments below!

Meanwhile, you may find these related articles of interest:

I am writing to express my interest in taking the EFFAS Certified ESG Analyst® (CESGA) examination scheduled for 26 September 2025. Could you kindly confirm the exact timing of this exam in Central European Time (CET)?

I am studying for CESGA, however I cannot find the two specimen exam on the platform. There is a case-study in module 9, is that it? Or there is other specimens?

Hi Janet, there should be one specimen exam included in Module 9, which also includes 4 case studies.

Hi everyone! I’ve recently registered for the course and was wondering if the extra reading material is necessary for the knowledge of the exam. There’s quite a lot of readings provided, so wanted to understand if they were going to be tested. Thanks a lot!!

Hi,

I’m really struggling with the choice between ESG certifications. I like the CESGA-certification better because of its more in-depth focus on different asset classes and the EU-regulations. However, the limited reviews I can find online about CESGA are all negative. Citing bad English in courses & slides, an underwhelming sense of structure or it being too expensive for the value provided. As I’d have to pay for the course myself, this last point is not unimportant.

Can 300Hours or anyone studying or having taken CESGA weigh in on the validity of these negative experiences?

Thanks!

nope cant help

Is a period of 2 months enough to prepare for the exam?

I took 2 weeks leave and studied for around 100 hours then passed – For your reference.

Thanks Chris for your reply.

Hello Everyone,

I have enrolled for the CESGA course, I need guidance on the following:

1) Is the study material enough for preparing and passing the exams?

2) There is a library at the end of each chapter providing additional material for reading, will this be tested as part of the exams, or it’s only for reference?

3) Tips / Guidance from the candidates who have cleared CESGA?

Appreciate your responses.

Regards,

Hi Rajiv,

1) Study material and questions from EFFAS themselves should be sufficient to pass the exam

2) these are additional material for reference, for those preferring to delve deeper to increase their expertise

3) Use the online training course well, with the videos and practice questions. Definitely don’t do it last minute!

Hope these help

Thank You Ms. Sophie for your guidance. Much appreciate it.

Regards,

Rajiv Thakur

This was very useful thank you!

Thank you very much Sophie for the excellent clarity on CESGA certification and the difference between CESGA and CFA ESG Investing.

I took CESGA exam for Jun 2023. The MC questions available for self-assessment do not reflect the level of those appeared in the real exam! I think I will fail.. 😭

Oh no, we got our fingers (and toes) crossed for you! Let us know how it goes, would love to hear your experience on this!

Yeah I passed the exam! Thank you for the useful information in this website!

Congrats Chris! How did you find it? Would love to hear your experience and study routine on this 🙂

I took 2 weeks leave and studied for around 100 hours. Case study questions were easier to manage as there were always the same 9 questions. MC questions were tricky and required clear concepts – you could not miss any small word on those diagrams on the PowerPoint slides. Time management during exam was key – do not spend more than 30 minutes on MC questions. Do not guess if you are not sure the correct answer for MC questions as points would be deducted for any wrong answer. I only did 12 and left 8 blank for MC questions but still passed.

Thanks for sharing your experience and strategies during your CESGA preparations. The negative marking is certainly an interesting twist!

Hi Chris!! I am preparing for CESGA.I want to know more about CESGA exam information in detail.Can we talk in personal?

I would like to enroll for CESGA courses. Please advice.

Hi Gunasel, that’s great. You can register for CESGA on EFFAS Academy’s website.

Is there anyway we can start preparing for CESGA before registration? Like having some referred study material available online or even in market??

Hi Puneet, I don’t think so as registration includes their mandatory online training program.

Hello,

I would like to know about study material (hard copy) available online/book stores?

Regards,

Vikky

Hi Vikky, I believe they only have electronic copies and it’s all online. That is the sustainable option after all 🙂

Hello

I wonder if anyone has comments on FSA Certificate from SASB. How does that compare to CFA’s ESG and CESGA.

Secondly, which is the most relevant/useful program if one wants to gain knowledge as well as recognition in both Corporate Sustainability practices/policies/risk assessments as well as sustainability in asset management (assuming one already has a background in asset management). Thx

For the 9 constructed-response style questions are these written? How many marks and at what depth do we need to go into for each one?

Hi Vicky, we checked this point with EFFAS and here is their response:

– The exam marks are divided 50% for the MCQs and 50% for the 9 open questions set on the case study in the exam.

– The open questions require written responses and go through the due diligence process with the marks for this section spread between the 9 questions. Each of 9 questions asks about the different/ or multiple issues that may apply to the part of the process being asked about.

– For these constructed-response style questions, the answers do not need to be long, just sufficient to answer the questions being asked. Some points can probably be answered with bullet points etc.

Hope this helps!

Hi Sophie, like to ask how many pages are there in the study materials of CESGA?

Hi Just, we checked with EFFAS Academy on this for the latest curriculum.

The total number of pages/slides in the CESGA comes to 794. This includes cover pages and indexes etc., without much text. Excluding the chapters for Module 10 on APAC, North America and Latin America, which are not included in the certification exam, it comes to 638 slides.

Hope this helps!

Hi Sophie, I am preparing CESGA.I saw you have already sit in the exam.Would you mind to share the study materials of CESGA for reference?

Hi Thomas, we have reviewed CESGA study materials and courses, but I have not sat for their exams personally. You’ll need to sign up for the exam to obtain the latest CESGA study materials.

Has anyone taken the EFFAS CESGA exam online before (instead of the in-person exam), and could offer any comments/advice as to their experience? Thank you!

My friend recently took the exam and his comment is not difficult but just a little bit expensive for the exam fee.

yes

Useful information.

Hi there,

I found this is a very useful platform for people who are interested to step into the ESG field. I am not sure if this is the right place to ask. Literally I am looking into different international recognized ESG courses and confused whether CESGA or IASE ISF would fit me better. I have no knowledge background on ESG and now working in an international non-profit organisation. It seems to me that CESGA would be a bit harsh to someone new in ESG while ISF provides a focus for those who are not in the finance industry, so it looks relatively suitable for myself.

Many thanks in advance!

Is there a valid promotion code for this CESGA exam payment? The ones you mentioned earlier in the Q&A sessions are not valid anymore.

Hi Lee, we don’t recall mentioning a CESGA discount code as EFFAS doesn’t offer one to individuals, but corporates only.

Hi, anyone able to comment on these statements:

– CFA Institute’s ESG Investing course is more introductory in nature?

– CESGA: there’s a little more breadth and depth covered on issues such as applying ESG across various asset classes, regulation, integrating ESG factors into valuation (is this true, in comparison to CFA?)

– CESGA also covers 2 comprehensive cases studies (does CFA not provide case studies?)

Hi Bryant, I’m Sophie, author of this article. What I did was to compare the CFA ESG Investing syllabus vs. CESGA’s curriculum, and noted the differences.

CFA ESG Investing is more introductory in nature, as also reflected in UK ENIC’s difficulty comparison chart in this article. CFA ESG Investing is equivalent to a first year undergraduate equivalent, whilst CESGA is a level higher at a Diploma level.

CESGA, to me at least, there is a stronger focus on application of these ESG skills and knowledge with a whole module dedicated to case studies, which I did not see in CFA Institute’s Certificate in ESG Investing. Hope this helps, would love to hear your thoughts too.

Hi Sophie, thank you for the reply. I do have a few thoughts.

1) Despite CESGA being stated as a Diploma, I wouldn’t use UK ENIC as a comparison in terms of rigor. Diplomas typically take 2 years to complete anyway. If we compare like for like, both CESGA and CFA have similar hours required, and also similar passing rates (86% in 2H2020 as per EFFAS’ Facebook post, and ~70% in the EFFAS FAQs – undated) compared to CFA (70-80% as per Nick Bartlett from CFAI in Nov 2021).

2) I recently gained access to the CFA ESG curriculum (v3). Without going into topic details, the text has a total of ~10 case studies across 8 chapters over more than 500 pages of text (font size just slightly bigger than the CFA Program text). There are also 5 case studies in the 100 question mock exam provided upon registration – maybe not on company valuation and portfolio management (but we can’t confirm that CESGA has those, can we? The consensus is that most of both CESGA and CFA exams are qualitative and not quantitative anyway.)

For comparison (data from APAF): CESGA gives access to 8 hours of videos, 475 course slides, 28 pages of further readings, 25 pages of case study(s) and access to MCQs (not sure how many). It is unclear how detailed each course slide is, but I doubt it has as many words per slide as the CFA ESG text has per page.

3) CESGA is currently not available in US, making less global than CFA’s ESG cert.

4) Growth rate of # of applicants taking up CFA ESG is a lot higher than CESGA, despite CESGA having a lower base to begin with and also a 5 year headstart.

EU is the global centre for ESG regulation, which is still in its infancy stage. CESGA will definitely hold up well in the EU. My belief is that CFA will keep up with developments in the EU, and at the same time developments across major markets such as US, thus making it a more global qualification outside of EU and EU companies.

Anyone who has taken both CFA ESG and CESGA please feel free to comment and correct!

Hi Bryant!

1) The purpose of UK ENIC is to serve as an independent comparison of international designations, so it is relevant here. That said EFFAS isn’t officially assessed yet, as I have highlighted in the post and image, but EFFAS has told us that they are looking into the application for CESGA to be officially benchmarked.

2) I think this is a moot point, in a way. As you said both qualifications are in direct competition and should teach similar things. What varies is probably the level of depth.

I think what stood out for us here – perhaps superficially – but a big differentiator if I was personally interested in developing an ESG career is the ‘title’ you get at the end. With CFA Institute’s Certificate in ESG Investing, you get no title to ‘put behind your name’, whilst with CESGA you get that.

3) This is not correct. CESGA is actually available globally (including US) via remote proctoring as well.

4) Yes, this is not surprising given that CFA Institute is a bigger organization with global reach, experience and marketing power. I think any good quality qualification would be constantly updated to reflect the latest practice.

Thanks Sophie.

2) Fair point, the designation would have ticked the box for some.

3) At registration, there was no US option under venue, hence my impression. I take back my 3rd statement.

Thank you for the guides on 300hours too, they have been helpful!

Thanks Bryant, we are glad you found 300Hours useful.

And I really appreciate the discussion and debate around ESG certifications, since it’s all so new, and we are trying to provide/inform our readers of various options out there, hence the new ESG section. I’m really pleased you read this article in depth and did so many research about it too, that made my day. Is ESG something you’re considering?