Forum Replies Created

-

AuthorPosts

-

Up::13

I’m confused. I thought @kalalah‘s answer was pretty clear.

Do you need help with calculating e.g. 9/(1.055^6) on the BA II Plus?

Up::6Will unsuccessful applicants for a CFA scholarship be able to register with the CFA exam early-bird registration fee?

Applicants that are not awarded a CFA scholarship are offered the early exam registration fee for the next exam registration, so you should still get the early-bird registration fee even if you miss the early-bird deadline.

When will you know if you’ve been awarded your CFA scholarship?

Depends on the type of scholarship.

For some scholarships, applications are under the management of relevant external institutions. For example an individual applying for a Student role-based scholarship will have his or her application processed by the affiliated university where they are enrolled. Response times will vary therefore by institution.

On the other hand, applications for the Women’s scholarship are reviewed by CFA Institute on a quarterly cadence and so candidates can expect to hear the outcome of their application within approximately 12 weeks.

How long do you have to use your CFA scholarship if awarded?

Successful role-based or Women’s scholarship applicants have up to 12 months in which to use their Award.

in reply to: EAY vs EAR – what’s the difference? #86975Up::5

in reply to: EAY vs EAR – what’s the difference? #86975Up::5The concept of both is the same thing – calculating the annualized return rate of a security.

Effective annual yield (EAY) usually calculates the annualized holding period yield (HPY) or yield to maturity (YTM), which is the return earned when a security is held until maturity. Remember that EAY:

- (Usually) assumes 365 days in a year

- Incorporates compounding

Formula:

where HPY = holding period yield (or YTM)

Effective annualized rate (EAR) is usually converting a % rate (e.g. nominal 8% paid quarterly) to a rate that indicates the actual interest paid when compounding is taken into account. EAR tends to ‘scale up’ or ‘scale down’ payment periods such as semi-annually, quarterly, etc.

So for a nominal 8% rate paid quarterly:

Formula:

in reply to: How to get your CFA Basno badge #92072Up::5Basno will be sending you an email on behalf of CFA Institute a few weeks post results day, if they haven’t already.

To claim your badge, just click “Claim Your Badge” within that email, and signup with Basno.

If you didn’t receive the email, or want to claim a badge for an older exam, here’s how to claim them:

- click on the relevant badge on Basno’s website (passed Level I, passed Level II, or CFA charterholder),

- click on “Get this badge”,

- enter your email address,

- then click “Continue” for an instant verification.

You can say “Passed CFA Level 1” but there are some rules to follow. We have a full guide here:

How To Properly Display CFA and Badges On Resume, LinkedIn & Business Cards

Up::5There’s no single likely scenario so any of the scenarios you suggest might be possible.

In my opinion, forfeiting exams when the process is so prone to causing candidates to miss the deadline is pretty poor, so I would imagine CFA Institute would be able to help you schedule for July or a later exam.

Up::4The pass rate for FRM Part 1 is around 46%. The recommended rough ranges for FRM Part 1 is anything from 200-275 hours.

BUT I will say that this is a guide only – like any ‘hours’ rule of thumb, this is not universal and doesn’t guarantee performance. The time needed will also depending on your educational background and personal circumstances. Study until you master the material, start early so you have a better idea of how much work you have ahead of you.

How does this translate to daily work? I’d recommend starting about 4 months before and put in 2-3 hours in daily, depending on your work schedule. Ramp up the hours, review and practice as you get into the last month.

Up::4The curriculum for Feb 2022 will be different to 2020. The summary of changes can be found here:

2022 CFA Curriculum Changes: Our Super Summary

As to whether you should be getting new material, that’s your call. I personally would not try using outdated material, but everyone’s circumstances are different.

Up::4

Up::4My strong advice is twofold:

- Take advice from candidates with a very large helping of salt.

- Separate fact from gossip.

My take on the issues you raise:

- There is a lot of chat on ‘decreasing value of CFA’ because of the recent changes to the exam format. This is a load of nonsense. CFA Institute is directly invested and incentivized to maintain the CFA charter’s prestige. No prestige, no candidates, no money. Here’s an article that looks at this in more detail.

- I fail to see how ESG is an orchestrated money-spinning initiative. ESG investing is on the rise right now and CFA Institute’s investment in the ESG qualification is reflective of that.

A lot of this candidate opinion I think stems from how the reaction to Covid has been mishandled. This anger, in my opinion, is totally justified. CFA Institute could have done better. But if you’re evaluating the value of the CFA charter to yourself, think about it objectively. Does it add value to your chosen career path?

Up::4Assuming this is a similar issue to those who had issues when redeeming a scholarship, you’ll have to contact CFA Institute tech support to get your ‘early-bird offer’ reset.

Send an email to info@cfainstitute.org and copy in scholarships@cfainstitute.org describing your issue and saying you need your early-bird offer reset.

Good luck and let us know how it turns out!

Up::8There are planned cancellations for India in these cities that overlap with May 2021 CFA exam windows:

- Mumbai, Maharashtra: Closed May 17, 2021 – May 20, 2021

- Chennai, Tamil Nadu: Closed May 17, 2021 – May 20, 2021

- Navi Mumbai, Maharashtra: Closed May 18, 23, 30 2021

These conflict with the May CFA exam exam windows across Levels 1, 2 and 3, but does not completely eliminate them. So this will likely result in rescheduling, which might have already been done and candidates informed.

In my opinion it is unlikely that the exam will be cancelled outright, but everyone should be prepared for some last-minute rescheduling or location changes. From the Prometric website:

From time to time, Prometric has to temporarily close a testing site for a variety of reasons including unforeseen events, such as extreme weather, natural disaster, power outages, technical issues, pandemic impacts or other circumstances. We provide test takers with as much advance notice of upcoming site closures as possible; we recognize in some cases there is limited opportunity to reach test takers well in advance.

So if there is a COVID outbreak in your test center the day before, everyone’s probably getting rescheduled or relocated. So check your test center frequently especially towards exam day.

in reply to: CFA results email, or so I thought #86636Up::3Ah, the heart-skip-a-beat moment when you receive an email from CFA Institute during results season. Good times.

in reply to: CAIA after CFA Level 3? #86905Up::3

in reply to: CAIA after CFA Level 3? #86905Up::3My advice is that if you’re remotely interested, go for it right after you pass CFA Level 3. If you leave it you’ll get motivation inertia and never move onto CAIA after passing CFA…like me. 😅

I am interested and I do think that CAIA would be a nice addition to my CV at this point, but it’s difficult to get moving the older I get and the further my study muscle memory fades.

Up::3Can it be done? Yes.

“Should you do it?” is another question altogether. I would advise taking and passing Part 1 first.

There are reasons that sitting for FRM Part 1 and Part 2 together may not be a good idea:

- Firstly as you stated, if you don’t pass FRM Part 1, your Part 2 exam won’t be graded.

- The risk of failing Part 1 is increased when you try and study Part 2 alongside Part 1.

- Your chances of passing both are not good, except you spend 4-5 months preparing for it, every day, on a full-time basis.

- The advantage of taking both exams in the same sitting is not clear. You get your Part 2 earlier? Not that much of an advantage in my opinion compared to what you’re risking.

Most FRM candidates do not attempt to take both Parts 1 and 2 in the same sitting. Is there a particular reason why you’re considering this?

Up::3Just like a retail bureau de change, exchanges can make money from commission and/or bid-ask spreads (hence ‘no-commission’ FX counters still can make money).

So no, the round-trip trading commission in your example does not include bid-ask spreads, so it’s not double-counting.

Up::3Oh man, that sucks. Sorry to hear that happened to you.

In paper exams there wouldn’t be such an issue, so I suspect CFA Institute may not have a robust process to deal with your specific situation yet. i.e. say they believe you – how should they resolve this? Do they put you back in the exam with a best-estimate X number of extra minutes to complete your exam? Do they award you the extra points for all uncompleted questions? Or not count the uncompleted questions? It’s hard to say which works the best.

It’s weird that CFA Institute are ignoring Prometric’s verification of what happened though. I’d press them on this. If you have a Twitter / Instagram account, DMing them or calling them out on this might work 🤷♂️

Up::2I think of the question conceptually in my head as:

What is the value, at the start, of a financial instrument that will pay you USD50,000 (USD1,000,000 * 5%) every year for 6 years then repay you USD1,000,000 at the end?

So the initial carrying value can be calculated with your BA II Plus using NPV.

With your BA II Plus, enter:

NPV entry BA II Plus keystrokes Question parameter N = 6 [6] [N] 6 year bond = 6 payment periods I/Y = 3 [3] [I/Y] 3% market rate PMT = 50,000 [50000] [PMT] USD50,000 payment per year (5% of USD1M) FV = 1,000,000 [1000000] [FV] USD1,000,000 future value (at end of term) Compute PV [CPT] [PV] Given all other parameters, compute PV The calculator should show -1,108,343.83.

The result is negative because the cashflow is opposite to the payments you entered. In my example I set PMT and FV as positive (cashflow to me) so PV will be negative (cashflow from me to pay for the bond).

Which provider is this? They really should be providing an explanation with keystrokes.

in reply to: Option theta and time value #87998Up::2An option’s premium is made up of:

- Intrinsic value: how much it’s worth if the option holder exercises their option right now

- For call options: Price of underlying asset – Strike price

- For put options: Strike price – Price of underlying asset

- Time value: additional value investors are willing to pay due to the potential upside it has left – because the option could further increase in value before expiration.

Option Premium = Intrinsic Value + Time Value

You’re on the right track. If the premium = $3.18, strike = $30, underlying = $26.82 then the put option should be at expiry since it implies time value is 0.

A negative earnings surprise would lower the price of underlying (drives intrinsic value up) as well as increase volatility (drives time value up), so would increase option premium.

Looking at options A and B, it sounds like the kind of question that asks for the “most likely” answer, and means it.

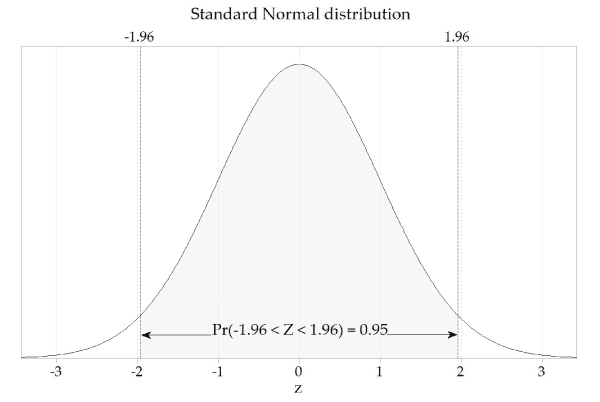

in reply to: How to calculate confidence intervals? #90721Up::2What is a confidence interval?

A confidence interval is basically the probability that our outcome will occur within an interval or range in a distribution.

In other words, it’s the confidence (probability) we have that our outcome will be within the interval → confidence interval.

For example, here’s a statement about normal distributions:

In a normal distribution, 68% of all values fall within 1 standard deviation from the mean.

In fact, for a normal distribution (i.e. z-values), there are four very commonly-used sets of parameters:

Confidence interval Z-value (normal distribution) 68% 1 90% 1.645 95% 1.96 99% 2.576 This means that a normal distribution graph has a mean of 0, with:

- 68% of the graph area within ±1 of the x-axis

- 90% of the graph area within ±1.645 of the x-axis

- 95% of the graph area within ±1.96 of the x-axis

- 99% of the graph area within ±2.576 of the x-axis

For example, here’s a graph showing a normal distribution with the values within the 95% confidence interval highlighted:

So that’s all good, but what if you want to use it with a population with its own mean value and its own variation/variance?

This formula allows you to scale it to any sample, assuming a normal distribution curve (we’ll get to this later):

So what does ‘assuming a normal distribution curve’ mean? When can we do that?

For that, we look to something called the Central Limit Theorem. The Central Limit Theorem states that when independent random variables are added to a population, as the number of variables (n) increases, the population will tend towards a normal distribution.

In other words, a large enough population can in most cases be safely assumed to be normally distributed.

How large? This is usually accepted to be ‘more than 30 datapoints’, i.e. n > 30.

So if n > 30, you can assume that your distribution can be modelled with this equation:

If you can be more specific with your question I can help better.

in reply to: CFA Level 2: Reading session weightings? #92086Up::2There are weightings by topic area (Ethics, Quant, FRA, etc) but there aren’t any weightings assigned to individual readings within the topic areas.

This means that CFA Institute is free to focus on any part of the topic area for the exam.

However if you do lots of mocks and questions, you’ll get an idea of what the exam tends to focus on.

For the weightings by topic area, you can check out this guide: 2021 CFA Curriculum Changes and Topic Weights, Summarized

-

AuthorPosts