Quick Summary: Whether the CFA is worth it depends on your career goal: it is highly valuable for asset management and equity research, where charterholders see a median salary premium of 53%. However, it requires a 1,000+ hour commitment over 4 years on average. For those in corporate finance or accounting, a CPA may offer a better return on investment.

Is CFA worth it, especially considering the 1,000+ hours you need to complete all 3 levels over an average of 4 years and the relatively low pass rates? What are the benefits of CFA charter?

The answer depends on your personal circumstances, your career goals and what you make of it.

Drawing from my personal experience, here are a few things to consider to help your decision on whether the CFA certification is right for you.

- What are the best career paths for a CFA Charterholder?

- When is the best time in your career to start the CFA?

- Can the CFA help you switch careers into finance?

- Is the 1,000-hour CFA study commitment worth the reward?

- What is the average salary increase for a CFA Charterholder?

- CFA vs. other qualifications: Which is worth more?

What are the best career paths for a CFA Charterholder?

Since 45% of candidates register for the CFA exams due to career reasons, your career goals are a key deciding factor on whether CFA exams are worth it (to you).

The CFA designation is good signalling tool and a quality indicator. However that credibility and respect you get as a charterholder is probably recognized and appreciated by a sub-set of the finance sector, not all. For example, the CFA charter is particularly valued in the asset management, equity research, investment strategy and buy-side sector.

When thinking of your career goals, I highly recommend that you refer to our data-driven mega guide on potential career paths and job opportunities for CFA charterholders to get a good understanding of the flexibility of this designation.

Once you’ve done all that, is the CFA designation a relevant piece of the puzzle to achieve your career goals?

When is the best time in your career to start the CFA?

Based on our insights, majority of CFA candidates typically:

- are 20-30 years old (80%), with the 30-35 year group at a far second (15%)

- have 0-5 years work experience (70%), although 80% of them have at most 2 years investment-related work experience. This suggests that most candidates intend to use CFA qualification to change careers (see next point).

The above data may suggest that the return on investment on CFA charter is highest at a junior to mid-level. That said, some of it could also be a reflection of the ability to commit to the 300-350 study hours per Level required to pass the CFA exams based on candidates’ stage of life. Basically, there seems to be an optimal time in your life and career to embark on the challenges of the CFA exams.

Based on personal experience, my view is that the CFA designation is most effective after 1-2 years of initial finance work experience, rather than during or right after university.

Studying and completing the CFA designation after building some solid work experience at a junior level allows you to leverage your newfound knowledge on the job right away, giving you more confidence and credibility as you move up the career ladder to a mid-manager level, where the job promotions matter more.

Can the CFA help you switch careers into finance?

It’s a common question, with 48% of CFA candidates looking to change job functions.

In short, the CFA charter alone is not going to help change your career, but it becomes powerful when combined with heavy networking and intense job hunting.

No qualification in the world automatically lines up jobs for you – the skill you need is networking and interviewing. These are soft skills that a driven person will have no problem with, but at the same time I’ve seen many who continue to try and avoid it and look for another way around. There isn’t.

If you want a job or change careers, you’re going to have to be good at convincing people you’re right for the job. The CFA qualification helps testify on your academic prowess. But to secure the job you need to be good at networking, and interviewing.

Here are a few helpful articles we wrote about switching careers and applying for jobs that may be of interest:

- Switch finance jobs effectively with our career change planner

- How to write a good resume: 11 actionable tips

- How to network: 7 easy networking tips to boost your career

- How to prepare for an interview: 3 steps to secure your job offer

- 6 tips to getting interviews using your current CFA status

Is the 1,000-hour CFA study commitment worth the reward?

The reason why the CFA exams stir up so much debate on ‘whether it’s worth it’ is because of the level of upfront effort required, with no guarantee of ‘return’.

It’s not a function of money – you simply have to put in the hours if you want to pass the CFA exams. And that creates a lot of second thoughts as to whether it’s worth it. But that could be precisely why it is worth it – the masters-equivalent finance knowledge you gain from it stays with you.

1,000+ hours commitment over 4 years on average is definitely not for the faint hearted. If you can’t commit to the time and effort required, then it’s just not for you. And that’s OK, since it is better to realize that earlier than when you’re midway through!

That said, aside from the upfront time/effort sunk cost, there are unlikely any downsides to being a CFA charterholder.

Another thing worth trying is CFA Institute’s readiness assessment questions.

It just takes 5 minutes for 11 multiple-choice questions, and would give you a good gauge of the suitability of the CFA program and whether it is suitable for you.

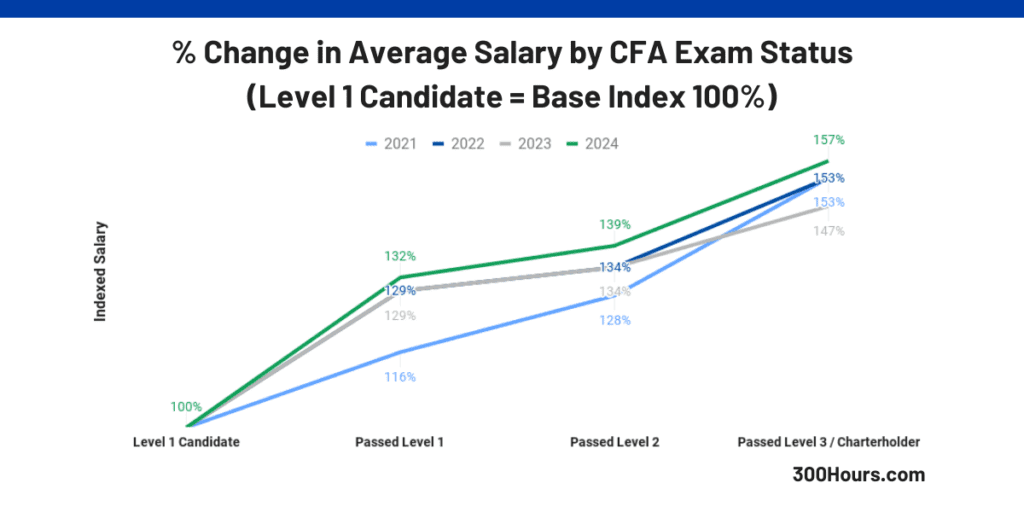

What is the average salary increase for a CFA Charterholder?

In fact, there are some monetary upsides to taking the CFA exams. And you don’t even have to wait until you become a CFA charterholder.

In our latest CFA salary data analysis, we have removed the “work experience / seniority effect” on average total compensation, so that we can better capture the true effect of CFA Program on average pay.

| CFA Exam Status | 2024 Average Salary Increase (vs. Non-Candidates) |

|---|---|

| Passed CFA Level 1 | +32% |

| Passed CFA Level 2 | +39% |

| CFA Charterholder (Passed CFA Level 3) | +57% |

After removing the effect of work experience, we found that on average:

- CFA candidates who passed Level 2 saw an increase of 39% in total compensation;

- CFA candidates who passed Level 3 or Charterholders earned 57% more than those who had yet to pass CFA Level 1 exams.

- Since 2021, there is a noticeable increase in the impact of CFA Program on candidates’ average salary, with the impact largest when one passes Level 1 and then Level 3. This could mean that the payback for going through the CFA program comes earlier and the impact of CFA Program on salary is improving over time.

Additionally, for more in-depth research and comparison of other qualifications’ impact on salary (e.g. MBA, FRM, CAIA etc), check out our CFA salary research article.

CFA vs. other qualifications: Which is worth more?

Finally, a good angle to consider is whether you have alternative options to achieve your goals without the CFA qualification.

Assuming you’re looking for career advancement or switching careers, there are always at least 2 other options:

- Are there other relevant qualifications out there that increase the chances of you achieving your career goals too? What about MBA, CPA, CFP, FRM, CAIA, IMC, Certificate in Sustainable Investing, Certified ESG Analyst (CESGA), Sustainability and Climate Risk (SCR)?

- How about just focusing on excelling in your current role, whilst job hunting and interviewing extensively for your dream job? Not having to study for an exam that has no guaranteed returns frees up your time to really focus on job hunting and hone your interviewing skills for your target job.

Well, that’s a lot of food for thought, but hopefully sets up a nice framework of things you need to consider when evaluating whether the value of CFA is worthwhile for you.

Meanwhile, if you’ve decided to take on the CFA exams, here are a few articles that may be of interest:

You can check about FRM here. It was really help ful for me to know about FRM, hope this helps you too!!

https://youtube.com/playlist?list=PLGo7xSLWCf_xIicIWuf5b22NsJ7-Yl0M2&si=pUJlzitLJqTVwVAC

Do the same for FRM please

Hi Toto, thanks for your comments! Are you considering CFA vs FRM now? Tell me more, I’ll work on it 🙂