Wondering what the FRM certification all about?

If you’re keen on a career in risk management, consider the FRM exams by the Global Association of Risk Professionals (GARP): a two-part, self study set of examinations with global recognition.

This comprehensive guide is packed with the latest information that will aid your decision making on this qualification. Let’s take a look!

- What is a Financial Risk Manager (FRM)?

- Overview of FRM Certification

- What is FRM exam & qualification?

- FRM pass rates since 2010

- FRM exam topics & weightings

- FRM fees & certification cost

- FRM exam dates and registration deadlines

- What are the FRM exam requirements?

- Benefits of FRM certification

- FRM vs CFA – Which is right for you?

- FRM exam FAQs

What is a Financial Risk Manager (FRM)?

FRM stands for Financial Risk Manager, and is a professional certification offered by the Global Association of Risk Professionals (GARP).

The FRM qualification is considered to be the leading professional certification for those working in the financial risk management sector. To achieve FRM certification, candidates are required to pass two exams and must also be able to demonstrate that they have at least two years of relevant work experience or employment history.

Financial Risk Managers are employed in a range of organizations across the financial sector including banks, investment and asset management companies, insurance providers and accounting firms.

Passing the FRM exam and achieving certified FRM status means an individual has demonstrated that they possess the knowledge, skills and experience that meet the latest standards in financial risk management. Qualified FRM professionals are in demand across the financial sector, and career prospects for financial risk managers are expected to grow at above average levels over the next decade.

Overview of FRM Certification

Since the inception of FRM program in 1997, more than 84,000 certified Financial Risk Managers have successfully obtained the designation.

They are employed internationally at nearly every major bank, asset management firms, hedge funds, consulting firms, and regulators.

There is fast-growing demand for the Financial Risk Manager certification.

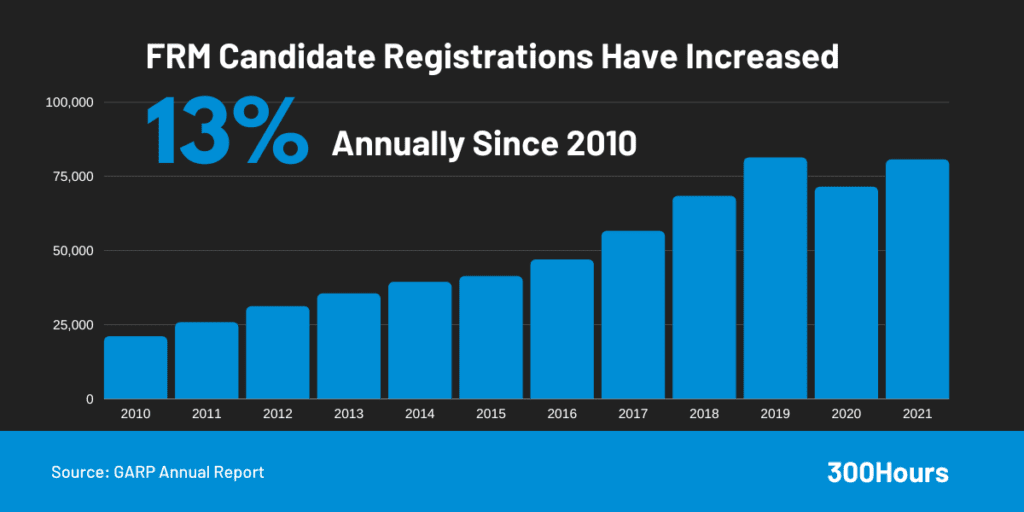

FRM exam registrations have grown by an average of 13% per year since 2010, registering a growth of 20% in 2017-2018 alone. The 2020 figures were impacted by the pandemic, and are expected to recover.

Since 2021, GARP has not released updated annual reports for candidate registrations figures.

What is FRM exam & qualification?

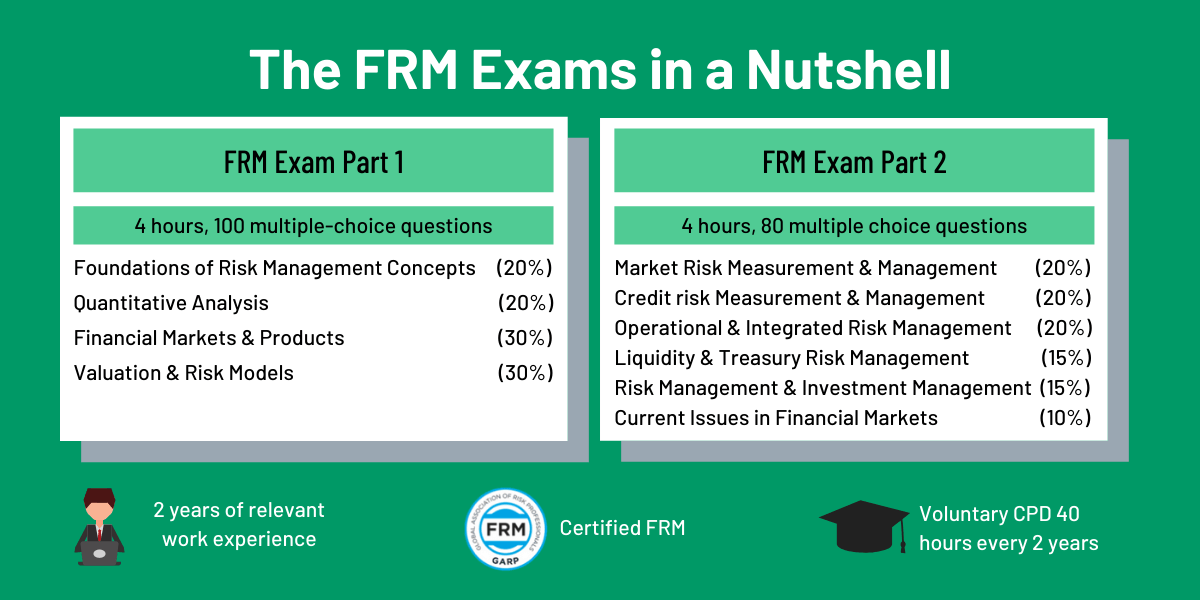

The FRM exam is a two-part computer-based examination consisting of a 4 hour multiple choice exam each. Its difficulty is equivalent to a Master’s degree, according to benchmarking done by UK ENIC (European Network of Information Centre of the United Kingdom).

There are 3 exam windows for Part 1 and Part 2 annually in May, August and November.

The exams are conducted exclusively in English, in person at 100+ exam sites around the world. You can find out your nearest exam center here.

In terms of pass criteria, there are no negative markings for incorrect answers. The passing score is determined by the exam committee each year.

The exam results are sent to candidates via email approximately 8 weeks after the conduct of exam, and result is a simple pass or fail.

However, you will be provided with quartile results so that you can see how you scored on specific areas relative to other candidates.

FRM pass rates since 2010

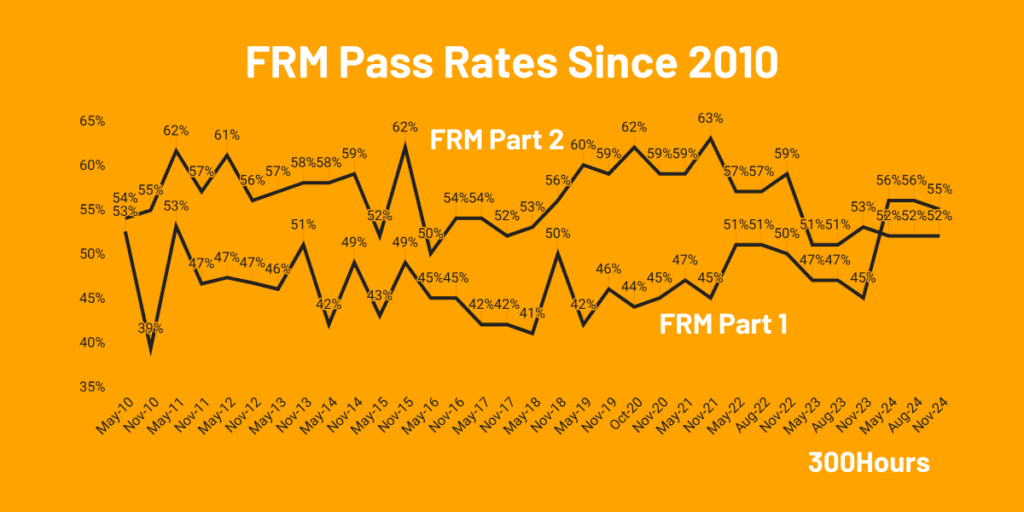

The latest Nov 2024 exam recorded pass rates of 55% (Part 1) and 52% (Part 2).

Check out our FRM pass rates article for more details and a gauge of difficulty of the exams.

FRM exam topics & weightings

FRM part 1 topics

The Part 1 curriculum covers the tools used to assess financial risk. The topics and percentages are as below:

| Part 1 Topic Areas | Topic Weight |

|---|---|

| Foundations of Risk Management (FRM) | 20% |

| Quantitative Analysis (QA) | 20% |

| Financial Markets & Products (FMP) | 30% |

| Valuation & Risk Models (VRM) | 30% |

FRM part 2 topics

The Part 2 curriculum highlights on the application of the tools studied in Part 1 with a deeper understanding of risk types and risk management. Topics and percentages are in the table below:

| Part 2 Topic Areas | Topic Weight |

|---|---|

| Market Risk Measurement & Management (MR) | 20% |

| Credit Risk Measurement & Management (CR) | 20% |

| Operation Risk & Resiliency (ORR) | 20% |

| Liquidity and Treasury Risk Measurement and Management (LTR) | 15% |

| Risk Management and Investment Management (IM) | 15% |

| Current Issues in Financial Markets (CI) | 10% |

FRM fees & certification cost

There is a recent increase in FRM exam fees due to the transition to computer-based exams. Here are the latest costs:

| Fees in USD ($) | Part 1 | Part 2 |

|---|---|---|

| Enrollment (one-off) | $400 | – |

| Early Registration | $600 | $600 |

| Standard Registration | $800 | $800 |

There is a one-off enrollment fee of $400 that applies to first time candidates. For example, if you’re retaking Part 1 exams, the exam fee varies between $600-$800 only depending on your registration date.

The fees for Part 2 candidates are the same as Part 1 (excluding the one-off enrollment fee), ranging from $600-$800 depending on registration date.

That said, registration fees are only one part of the costs of Financial Risk Manager exams. Check out our FRM fees summary for a more thorough estimate of total cost, including FRM courses.

FRM exam dates and registration deadlines

For the latest exam registration dates and deadlines, check out our FRM exam dates summary.

What are the FRM exam requirements?

In order to be certified as a Financial Risk Manager and be able to use the FRM designation after your name, the following conditions must be fulfilled:

- Pass FRM Part 1;

- Pass FRM Part 2 within 4 years of passing Part 1; and

- Demonstrate 2 years of professional full-time financial risk management work experience.

FRM work experience requirements:

- To demonstrate relevant work experience, GARP requires a candidate submission of a minimum of 4-5 sentences (at least 300 words) detailing how he/she manages financial risk in their day-to-day work.

- Experience completed for school will not be considered, including internships, part-time jobs, or student teaching.

- The work experience submitted cannot be more than 10 years prior to having passed the Part 2 exam.

There are time limits to getting certified as a Financial Risk Manager:

- Once a candidate passes Part 1, he/she must then pass the Part 2 within 4 years.

- Then, the candidate will have 5 years from the date of passing Part 2 exams to obtain work experience verification. If this is not done in time, the candidate will have to re-enroll and pass both Part 1 and Part 2 exams again for certification, not to mention re-paying the required fees to do so.

Benefits of FRM certification

Financial Risk Managers are one of the most widely accepted global designation for risk management profession, and getting this certification certainly sets you apart from the rest.

Once you achieve this designation, you can expect to:

- Differentiate yourself and further boost your risk management credentials in the financial industry

- Enhance career growth and increase job mobility in the risk management sector

- Become a part of the global elite group of risk management professionals who are certified as Financial Risk Managers

- Be recognized globally as a leader in financial risk management

- Command better remuneration package and job opportunities

FRM vs CFA – Which is right for you?

This is a popular topic which has a whole article in itself.

We compare the differences and similarities between these designations, in terms of syllabus, difficulty and career objectives. Check it out!

FRM exam FAQs

What does FRM mean?

FRM stands for Financial Risk Manager, a professional designation offered by the Global Association of Risk Professionals (GARP).

How do I get FRM certification?

To achieve FRM certification it is necessary to pass 2 multiple choice exams, and to gain 2 years of relevant work experience.

How much does the FRM cost?

There is a one-off enrollment fee of $400 for new candidates. For each parts, exam registration costs $600 for early birds, $800 for standard registration.

Is FRM worth it?

Achieving FRM certification is considered valuable by many professionals in the financial risk management sector, contributing towards improved career prospects and earning potential.

How long is the FRM exam?

FRM part 1 and FRM part 2 each consist of a multiple choice exam lasting 4 hours.

In addition to the exams, it’s necessary to demonstrate two years of relevant work experience.

How can I prepare for the FRM exam?

Firstly, make sure you create a study plan to allocate sufficient time to complete your readings. We have a free FRM study planner you can use.

There are a number of FRM prep courses, coaching and training solutions available to help you prepare for FRM exams, such as Kaplan Schweser. Check out our Offers page for study materials deals.

Is the FRM exam difficult?

The FRM exams are considered to be fairly difficult, however possibly not quite as difficult as CFA exams. The qualification is broadly recognized as being at masters degree level.

When are FRM exams held?

Take a look at our FRM exam dates page for the latest information.

Are you considering this certification, as well as the CFA designation? Leave a comment below!

Meanwhile, you may find these related articles of interest:

I am an IT professional and helped many clients in building an application related to financial risk modeling. Would I be eligible to show my experience to achieve this certification?

Hello! Please can I ask what would qualify as relevant work experience? For instance, is someone was working in auditing in the big4 but primarily on cass/controls/financial statement audits – would this qualify?

If i passed FRM part 1 in may 2019, till what time can I appear for part 2? Dec 2022 or May 2023 or Dec 2023 before i have to retake part 1?

Hi Raju, according to GARP, you’ll need to pass the FRM Part 2 exam by 31 December of the 4th year of passing the FRM Part 1. So you must pass Part 2

by

Dec 2023.

I wouldn’t take Part 2 in Dec 2023 in case they are being literally strict with the word ‘by 31st Dec of the 4th year of passing Part 1’. Taking it in May 2023 only gives you one chance of passing (else you have to retake P1), which may be personally too risky for me. I would say if you can aim for Dec 2022 then go for it.

Hi

I haven’t received any free CFA level 1 study material.

Can you please send me the same.

Thanks

If it’s free CFA study material you’re after you should check out our Free Materials List.

Is it possible to sit both the FRM levels 1 and 2 at the same time?

You are allowed to sit for both at the same time, but it isn’t necessarily advantageous.

Here is a detailed answer for those considering sitting for FRM Part 1 and 2 at the same time.

Hey i am from India …just wanted to know will exams in mumbai for july frm part 1 be postponed?

There are no current postponement announcements for the FRM exams in July in India, although GARP have stated that they are monitoring the situation closely in India for the July exams.

The latest postponements for the July FRM exams can be found here: https://300hours.com/frm-july-2021-exams-postponed/

I am still not getting FRM free guides, getting only CFA related.

Please sort out.

Thanks,

Sundar.

Hi Sundar

Apologies – we’re still stuck in the weeds building out our FRM functionality. For the latest FRM help guides, see our FRM section.

Please send me details about how the study materials for this course are to be purchased and from where.

For materials, check out our the FRM section of our Offers page.

Hello,

Are there any free resources / guides for FRM Part 1 and Part 2 exams ? Please share if you have any ?

Thanks,

Hi Sundar! What particular free resources and guides are you looking for?

To start, we have adapted our CFA study planner for FRM study plans as well. Just fill in the form at the bottom of the article, select FRM and whether you’re Part 1 or Part 2, then click ‘Next’. 🙂

Sure Sophie, I did’t knew how CFA study planner is going to help me in preparing FRM exams. Hence, I was looking for FRM specific resources.

Hi Sundar, what I meant was that we created a separate FRM study planner as well, just haven’t broadly advertised it yet, hence it’s accessible only from that link.

Hello Sophie,

Sorry, I could not find this form / link which you mentioned earlier”…Just fill in the form at the bottom of the article, select FRM and whether you’re Part 1 or Part 2, then click ‘Next’…” – please help me locate this.

Thanks,

Sundar.

Hi Sundar, we have created a new FRM study planner for you in this article.

Hope this helps

Hyy, i am doing my fy.bcom.so when my graduation complets and I do Frm only so can I get a job in this field or I do some else?

Hi Dave, getting an FRM certification doesn’t guarantee a job in the field. It does improve your prospects for a financial risk management job, but it also depends on your job application and interview process.

Hi, myself Santosh, i am a commerce graduate with 15 years of experience in Finance and accounts field. since 2017 i have been working under GRC (Governance Risk & compliance). If i take FRM along with my job, after completion of both the parts can i apply for the certification with this experiance.

Hi Santosh, yes, as long as you have 2 years full time financial-risk related work experience in your description to GARP.

Hi I am an FYBBA a student And want to make career in Finance I am willing to do both CFA+FRM so can you please suggest when to start and from where to start.

Hi Bhusha, if you want to go for both CFA and FRM, this article may help form your strategy. Our CFA and FRM beginner guides are also super useful in providing a good overview of the designations.

Hi! So, if while I am completing my Exam 1 and 2 I work full-time job related to financial risk manager, once I finish Exam 2 can I get the FRM certification?

Or does the work experience start once you finish Exam 2?

Thanks!

Hi Marc, if you refer to the work experience section in this guide above, you’ll see that the 2 years work experience “cannot be more than 10 years prior to having passed the Part 2 exam”.

So you should be able to get your FRM certification once you passed Part 2 and showed that your 2 year work experience is relevant (and not more than 10 years prior to passing Part 2).

Hello;

I am currently working as Manager Operational Risk & Business Continuity Planning from last 6 years and now interested in FRM; going to register my self for upcoming exam.

Is FRM is OK for me or not ?

I have also plan to move in Canada by end of this year; please advice….

Hi Asad, the answer depends on your career goals 🙂

If you’re keen on a career in financial risk management, FRM would be great.

If anyone fail for may or july attempt FRM part 1 exam does he can apply for nov ?

Hi Jas, yes you can retake FRM Part 1 in November, as long as you register before the date registration closes on 30 Sep 2021.

If some is having 10 years of experience. Is he eligible for FRM 2. As per the guidelines, he is not eligible.

Hi Vishesh, think you may have misunderstood the FRM work experience requirements here: A candidate needs to show 2 years of professional full-time financial risk management work experience. And this work experience submitted cannot be more than 10 years PRIOR to having passed the Part 2 exam. So if someone has 10 years of relevant risk management experience (say from 2010-2020) before passing Part 2 exams in 2020, that is fine, because it is more than the 2 years required. However, say if you passed FRM Part 2 in 2020, but the last time your relevant risk management experience was from 2000-2011, that would NOT qualify even though you had 11 years risk management experience previously, as for FRM work experience purposes, you only have 1 year relevant experience since they do not count work experiences more than 10 years PRIOR to passing FRM Part 2. Hope this is clear!

Thank you Sophie for the information, very informative….!!!

You’re welcome Roshan! Glad it is useful, have you decided on FRM then?

Thank you so much for sharing this Sophie. It was very informative and answered several of my questions. Thanks a ton!

Thanks Neha, lovely to hear that! Are you considering both CFA and FRM?

I am MCA and having 10 yrs exp. and in murex(Amrket risk and credit risk reorts in datamart) development 5 yrs in it .can i do FRM

Hi Brijesh, yes, as there are no pre-requisites for FRM certification (https://www.300hours.com/articles/the-complete-beginners-guide-to-the-financial-risk-management-frm-qualification#frmrequirements). Given your risk-related work experience, all you have to do is pass both FRM papers and pay membership fees, then you should qualify for the FRM certification.

I want to take the online class for FRM level 1

I would like to know more about the CFA program