When looking to boost my financial expertise and qualifications, I went through what was a fairly common dilemma a few years ago: CFA or FRM?

My question was then: why not both CFA and FRM, together?

In a competitive world of finance, with companies desiring prospective employees to have a broad range of skillset and knowledge, this may help widen the longer term job prospects:

- the CFA designation opens up job prospects in the field of Research Analysis, Investment Banking and Portfolio Management,

- FRM on the other hand will open up opportunities in Banks, Treasury & Risk Management.

The challenge of taking up two finance qualifications seemed impossible to me, at that time, with 5 levels of exams, each demanding an average of 300 hours of study time. Having completed this feat in just under 3 years, I’m glad to report that it is possible, with just a little bit of planning.

For those keen on this double designation challenge, here’s how I did it, hope it helps!

CFA and FRM: What You’re Up Against

The CFA program consists of 3 levels and the major focus of the course is on Investment Management.

The major topics of study include:

- Portfolio Management

- Corporate Finance

- Fixed Income

- Equity Investments and Economics

- Ethics

- Derivatives

The FRM qualification on the other hand is a 2-level exam and the major focus is on Risk Management. The major topics of study are:

- Market Risk ( VAR-Value at risk)

- Credit Risk

- Operational Risk

- Financial Markets and Products

- Basel Norms

In general, the FRM Part 1 exam gives a basic idea about the various risk tools and techniques, whereas Part 2 is a much more detailed study of the various types of risks.

Unlike CAIA exams, there are no FRM exemptions for CFA charterholders and both Part 1 and Part 2 exams have to be passed. Conversely, there are also no CFA exemptions for certified FRMs either.

That said, some parts of the FRM syllabus are already covered by CFA syllabus, so you get some study efficiency there. With the new CFA exam CBT timetables, you can now pass both CFA and FRM qualifications in just 2 years, assuming consecutive passes.

CFA and FRM: Suggested Plan of Attack

So what is the best order to attempt the exams? FRM after CFA, or CFA after FRM?

It depends of course on which you’d like to prioritize, and also on whether you pass your exams in your first attempt.

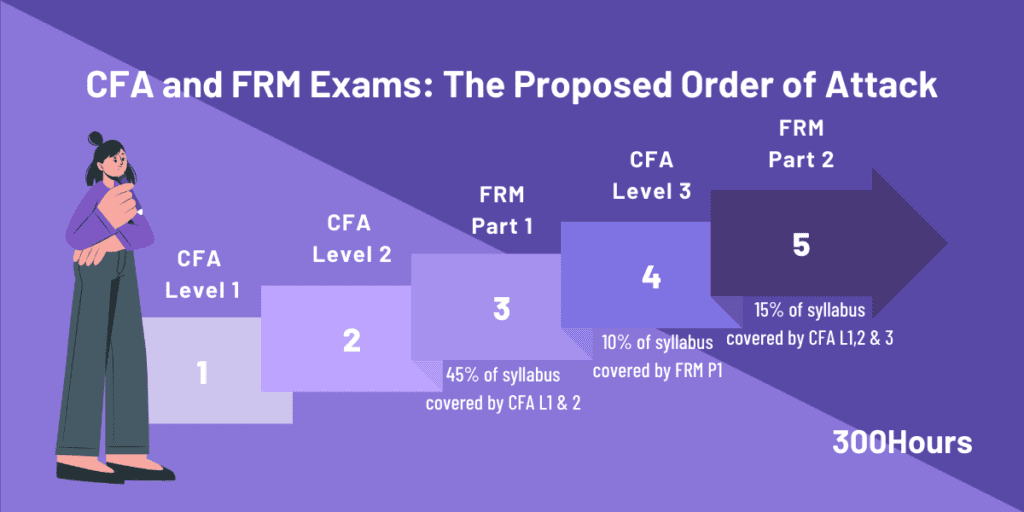

The chart below shows my suggested timeline to study for CFA and FRM simultaneously, and the order in which one can plan to opt for the all the exam levels.

I recommend doing the CFA and FRM exams in the following order, which minimizes the extra studying you need to do due to curriculum overlap between exams:

- CFA Level 1

- CFA Level 2

- FRM Part 1

- CFA Level 3

- FRM Part 2

In my experience, this best utilizes your financial knowledge, without having to do too much ‘double-studying’, i.e. studying overlapping material twice. There are varying levels of CFA and FRM syllabus overlap detailed here.

How to Prepare for CFA and FRM

Both CFA and FRM requires you to devote considerable amount of time. It is widely believed that among all the 3 levels of CFA, Level 2 is the most difficult.

However, as per my experience, CFA Level 2 looks difficult because the syllabus is vast and also because all the students have this pre-conceived notion that it is difficult. The real challenge in clearing CFA is Level 3 because it is there that all the concepts are tested and there is a change in the exam format as well. (Yes, the deadly morning essay questions!)

Thankfully, FRM Part 1 syllabus is circa 45% covered by CFA Levels 1 and 2, so there’s quite a big overlap there. However, for FRM Part 2 only has about 15% overlap with the overall CFA program, hence I’ve recommended this as the last exam to go through after completing all 3 levels of the CFA program, since most of the questions are application-based.

How to Avoid Burnout and Maintain Motivation

If you do decide to run the mother of all financial exam gauntlets, make sure you do make some time to recover in between.

I believe one of the main reasons I stayed (more or less) sane during the process was to find time for adequate breaks between the gruesome study hours.

Having a positive environment is also important: I was fortunate to have an awesomely supportive family and a great set of friends who have helped me to stay relaxed during my preparation days.

Do you plan to take both CFA and FRM exams? How did your experience go? I’d love to hear your thoughts in the comments below!

Meanwhile, you may find these related articles of interest:

Hello,

I want to work in the sales & trading domain.

I have cleared 2 levels of CFA and planning on appearing for level 3 this year and later FRM L1 and L2.

I have done a summer internship in Global Markets but was not able to convert it into full-time.

I have started a job as a fresher in asset management recently but still aiming for a graduate position in a trading firm/investment bank.

Can you let me know of other certifications that can help with this?

I want to know if the work experience for CFA would be useful for FRM and vice versa.

Are there any job profiles, work experience in which would qualify the requirements for both CFA and FRM?

Thank you in advance.

Instead of the order CFA1>CFA2>FRM1…., does it make sense to do FRM1>CFA1>CFA2….

Appreciate if someone could comment!

I think that’s fine too. Best of luck JP!

Hi

Thank you for this article, I am still in the process of deciding between the two. May you please share links to your study materials?

Thanks

I want to be in asset management. I’m cfa l1 candidate. Will FRM be beneficial for me?

For asset management, I assume you’d like to be a portfolio manager? Or work in risk management at an asset manager?

For the former, CFA would suit better. For the latter, FRM is a better fit. Hope this helps!

I am planning to do mba currently I am doing CFA. FRM wil gonna make impact in my job hike or knowledge or it will gonna help me to secure better job ??

Hi Raghav, it depends what your career objective is really. FRM is really quite specific for risk management careers, whereas MBA is a generalist business program, both which are great options. Choose one that fits your career goals. No qualification is going to guarantee jobs or salary increase as it depends on other abilities part of the work process, e.g. interviewing, work ethic, networking etc. But it certainly opens doors to opportunities.

I am working in Public Sector Bank as a Credit Officer (Total work Experience is 7 years+ and in credit field its 2 years+) . I am preparing for FRM now at the age of 34 years. What opportunities may I get from top financial recruiters as I want to switch my job from public sector bank to Private sector. Please provide me more information regarding the same or suggest me better one.

I want to be an investment banker, so what’s better cfa plus frm or mba in finance? please reply.

It depends what stage of your career you are in? E.g. if you’re still in university, aiming for an investment bank internship is one of the better ways to secure a full time job as an investment banker. If you’re in other roles in finance, check out our article on changing jobs within financial services to see if you need to invest in any other qualifications at all. FRM doesn’t seem as relevant for being an investment banker, MBA in finance could potentially secure a role as an Associate right after but it is not guaranteed, although the cost is high. So it really depends on your personal situation. Sometimes, if you’re in a relevant field, networking and applying for jobs diligently is one of the better routes instead of studying.

Is it a smart decision to do a combination of CFA,FRM & CPA for someone who is looking to work as investment banker and if it is then make a similar article in exploring ways to make a schematic of some sorts

I am currently not working and I am free should I attempt CFA level 1 and FRM level 1 one after the other ?

Hi Venkat, it really depends what your career goals are, and what stage of career you are at now. For example, if you’re not a student, job search should be a priority instead of full time study as work experience is valued too. There’s insufficient info here to opine on.

Somebody who has no work experience and wants to start in the finance sector should he begin with FRM or cfa

With no other guidance other than “finance sector”, I would say CFA. But before that, I would advise you to find out more about what you want to specifically target.

Thanks for the wonderful information.

Is it advisable to appear for both CFA and FRM for someone who does not have work experience in the finance sector?

If you have the time and effort to spare, there’s no reason not to do both. You won’t be able to fully qualify for CFA or FRM without enough relevant work experience, but that will be some time later.