What is CFA good for, exactly?

Somewhere along the way, in the haze of studying, you may wonder whether the CFA journey is worthwhile, or why you even took it in the first place.

It’s not surprising that a large proportion of CFA Program candidates cite career development and advancement as a reason to register for the CFA Program.

But while the CFA Program is rigorous, prestigious and is a good indicator on your resume, is it suitable for your career path?

CFA charterholders’ typical roles and employers

To answer this question, the first port of call is to have a quick look at what current charterholders are doing and their typical employers.

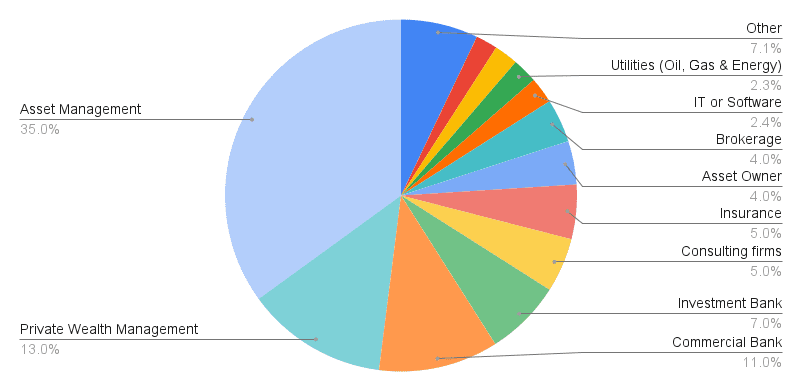

The chart below summarizes the sectors that CFA charterholders work in based on the latest CFA Institute’s compensation survey.

As expected, portfolio management and private wealth management sectors top the chart – the CFA charter is an investment-focused qualification after all.

Both these roles cover 48% of the sample of CFA charterholders out there, meaning that while not mandatory for these roles (yet?), the CFA charter is quickly becoming the de-facto qualification for asset management and wealth management roles.

What is interesting is actually the diversity of the remaining 52%: from investment banking, commercial banking, consulting, insurance, brokerage, accounting, software/IT/fintech etc – there’s a broad variety of roles where CFA Program knowledge is relevant and applicable.

The huge 7% categorized under “Others” reinforces the breadth of the CFA charter. Fundamentally, working in finance usually relates to valuation of some kind of assets, which is one of the key concepts we learn in this challenging qualifications.

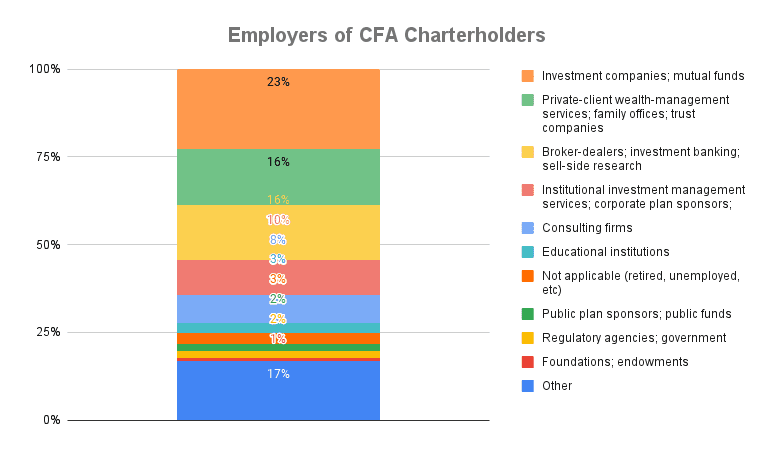

The chart above shows the types of companies that employ CFA charterholders.

Typical institutions are from the finance/investment sectors (e.g. banks, family offices, asset management firms).

However, what one may miss again is the other sizeable 25% of sectors that is outside this ‘typical’ finance sector (e.g. corporates, endowment funds, regulatory agencies, accounting firms, insurance firms).

So, is the CFA charter suitable for me?

So, would CFA charter work for you? It depends on your circumstances: what role you’re currently in, what’s the targeted role, years of experience.

Here are the key points to remember:

- The CFA charter is globally recognized and highly relevant for finance-related roles. Regardless what sector you’re in, as long as you’re valuing some kind of asset, assessing risks of an investment, compiling analytics, determining return on investment on a project, projecting future performance of a firm or looking over annual reports of companies etc – it’s highly likely that the knowledge obtained from the CFA charter would be useful.

- However, the CFA charter is NOT a golden ticket to jobs. So this means that questions such as “if I complete Level X, will I get this particular job?” is irrelevant, as the answer always will be “I don’t know” or “it depends”. Why? Because it all depends on how you get on in your interview(s).

- It also depends on your ability to sell the relevance of your qualification to your role (and your potential employer). There is an extraordinary amount of flex you can command as long as you are willing to put effort into persuading the right people.

- Zee shared his experience about how to convince his advertising firm (yes, advertising) to sponsor his CFA exam studies.

- The same applies to your interviews – it is up to you to convince your (future) employer that the CFA qualification adds value, and why you’re more awesome than other candidates for the role.

- Having the CFA charter can open some doors in terms of getting invited for interviews, however the last bit is all down to your interviewing skills. Don’t forget to brush it up with more practice, getting feedback and rigorously maintaining your professional network too.

If you’re looking for a new role, good luck for your job search and interviews! Do share your experience (so far) in the comments below.

Meanwhile, you may find these related articles of interest:

So we know the CFA charter is aimed at investment roles. It is pretty much ingrained in the DNA of the CFA Institute. However, it is cool to see so many people in non investment roles taking the CFA exams! In terms of the use of the CFA designation, it’s really important to leverage it once attained. Make it known to your bosses/superiors. Become an advocate for the CFA in your Firm. Perhaps – if you work in a big firm – you can start a CFA social!

I have pass CFA L1 in 2019 and after that due to domestic problem and relocation to UAE. Then I appear in CFA L2 in 2019 and got Pass. Now I am applying for entry level job in investment industry as my current job experience is non finance. And now enroll in L3. And not a single call I receive even for interview and still not losing hope.

Good job picking up on L2 after pausing for 6 years! Good luck with your job hunt.