[Updated for Feb 2025 exams – details below. To help our estimates, send your results PDF to results@300hours.com.]

This article is about minimum passing scores. For CFA exam pass rates, see this article instead.

IMPORTANT: Please do not use our MPS estimate as a basis to plead to CFA Institute to ask for a recheck. Our MPS estimate is an estimate – using our MPS estimate to contest your result won’t get you anywhere. Your individual MPS may also vary.

What is the CFA passing score?

CFA Institute recently announced changes to their CFA results disclosure from 2025, by including a scaled score for Minimum Passing Score (MPS). Despite that, it is not a ‘true’ MPS per se, and we will explain why in this article.

300Hours has been estimating the CFA exams’ MPS as an intellectual exercise since 2012, with some help from our readers. We do this as it can be useful for CFA candidates to have a target range of scores to aim for when doing practice exams.

So here’s all you need to know about the CFA passing score: what it is, how it is determined, some FAQs, and what our MPS estimates are for all CFA exams since 2012.

- What is CFA exam's minimum passing score (MPS)?

- Do candidates have to beat the MPS for each topic to pass, or just the overall exam?

- How is the CFA passing score determined?

- What are "scale scores" in my CFA exam results?

- Why doesn’t CFA Institute publish the true minimum passing score for each level?

- Are 300Hours' MPS estimates reflecting the 'true' scores?

- CFA passing scores for each level: Our data-driven estimates for 2012-2025

- My results doesn't seem to fit your MPS estimate!

- Help our MPS research, send us your results PDFs!

- Get Your Results Analyzed with Our MPS Analysis Tool

What is CFA exam’s minimum passing score (MPS)?

Simply put, the Minimum Passing Score (MPS) is the lowest score a candidate can get and still pass their CFA exam.

It is not published by the CFA Institute. Their most recent change to exam results has included what they term “scale scores”, which is an MPS indexed to a standard 1600, but of limited help if you’re looking for a safe target score for your mock exams.

This should not be confused with the CFA pass rate published annually, which is normally lower and represents the percentage of candidates that passed a particular exam.

Do candidates have to beat the MPS for each topic to pass, or just the overall exam?

There are no topic-specific passing scores.

So as long as your overall score beats the Minimum Passing Score, you should pass.

How is the CFA passing score determined?

In the earlier days, the MPS was a simple formula – 70% of the highest scoring candidate for that year. If the highest-scoring candidate scored 90%, the MPS would therefore be 70% * 90% = 63%.

Some candidates still mistakenly believe that this is the method used to determine the MPS today.

Presently, the MPS is determined by a custom methodology devised by CFA Institute, and one of the primary inputs is a series of workshops based on the Angoff model.

Here’s how the MPS for each Level are determined:

- A large, diverse group of CFA charterholders evaluate the entire exam individually question by question and makes a judgment on the performance of the just-competent candidate. In other words, envisioning a candidate they judge to be just good enough to pass, they estimate the probability that this candidate will get this question right.

- Once all the evaluations are done, the charterholders take a look at actual candidate performance and the evaluation process is repeated again.

- Psychometricians oversee the entire process and the result of this workshop is the main reference (but not the final word) for setting the MPS.

- The CFA Institute Board of Governors then puts all information on the table. All available information is considered including recommendations from the Angoff workshop (the most important input), and then a final decision is made on the MPS. The objective is to set a consistent competency level across years.

You therefore pass by being better than what CFA Institute defines as a ‘just-competent’ candidate.

This may be indirectly influenced by the performance of candidates taking the same exam as you, but it definitely is not a primary driver. So remarks such as ‘bringing down the curve’ are not exactly accurate.

Chris Wiese, Head of Exam Development at CFA Institute briefly summarizes the standard setting process:

This is now noted as an arbitrary “1600” in your exam results – with no indication of what percentage of correct answers this corroborates to.

What are “scale scores” in my CFA exam results?

When you receive exam results, you may expect to find out:

- What percentage of exam questions you got correct, vs wrong

- What percentage is needed to pass the exam

CFA exam results do not reveal either. Instead, the percentage needed to pass the exam, i.e. the Minimum Passing Score, i.e. MPS, is set at 1600. Your ‘score’ is then scaled according to this 1600 MPS. If you failed, your score would be less than 1600, and if you passed, your score would be 1600 or more.

Our MPS estimates, on the other hand, are our estimates of the ‘true’ minimum passing score, i.e. the percentage of questions candidates have to get correct to pass. This, in our opinion, makes it a lot more useful in informing your future exam preparations. And maybe it’s just me, but I just prefer to know exactly how badly or well I did.

Why doesn’t CFA Institute publish the true minimum passing score for each level?

CFA Institute’s stance is that credentialing programs are designed to measure whether a candidate has the necessary knowledge, skills, and abilities to perform a certain job function.

They are not designed to indicate the relative performance within those skills.

The MPS can vary somewhat from year to year based on the difficulty of the questions asked, it is designed to be a consistent benchmark of the necessary knowledge, skills, and abilities.

Releasing the MPS would focus on beating a specific ‘score’, rather than acquiring the necessary knowledge to function as a competent finance professional.

Is CFA Institute right?

We think CFA Institute’s reasons are valid. The exams are just one part of what CFA Institute are about, and keeping that in mind, the desire to deemphasise comparison of CFA charterholders and various exam years by MPS and/or actual scores makes sense. Of course, it doesn’t stop candidates from wanting to know!

Will CFA Institute change this policy in the future?

It’s unlikely. We’ve interviewed CFA Institute on this before and they’ve responded: “This, among other things, is to prevent the temptation for people (e.g. employers) to compare candidates based on score, and to preserve a consistent benchmark across years.“

Are 300Hours’ MPS estimates reflecting the ‘true’ scores?

Our MPS estimates are our estimates of the ‘true’ minimum passing scores, e.g. 73%, 75%, etc.

This reflects the percentage of correct questions needed to pass the exam, with no extra layers added.

This gives us comparability across exams, valuable feedback for your exam preparations when you practice on mocks, and is just helpful to know.

CFA passing scores for each level: Our data-driven estimates for 2012-2025

So why are we estimating the MPS then?

- Because as ex-candidates ourselves, we also understand the need to have a target score to be aiming for when preparing for the CFA exams.

- Because through our awesome readers input, we do have the collective info that no one else has to glean insights like this.

- And because we’re curious.

Prior to CFA Institute’s introduction of the new format of results in June 2018, candidates did not receive their score, but they received a ‘score category’ (0-50%, 51-70%, 71-100%) in each topic area.

To estimate the MPS, we analyzed thousands of actual, detailed, self-reported candidate results. We could deduce the MPS by considering extreme cases, i.e.

- candidates that passed despite showing bad topic area scores, and;

- candidates that failed despite showing good or decent topic area scores

Our method – in our opinion – was quite robust, and increased in accuracy the more cases we had to analyze.

Even though the results are reported differently now, we’ve developed a new method to estimate the MPS. We prefer to keep things close to our chest for now, but we do believe that our new methodology is equally as robust, if not better, than our old method.

So, here we go:

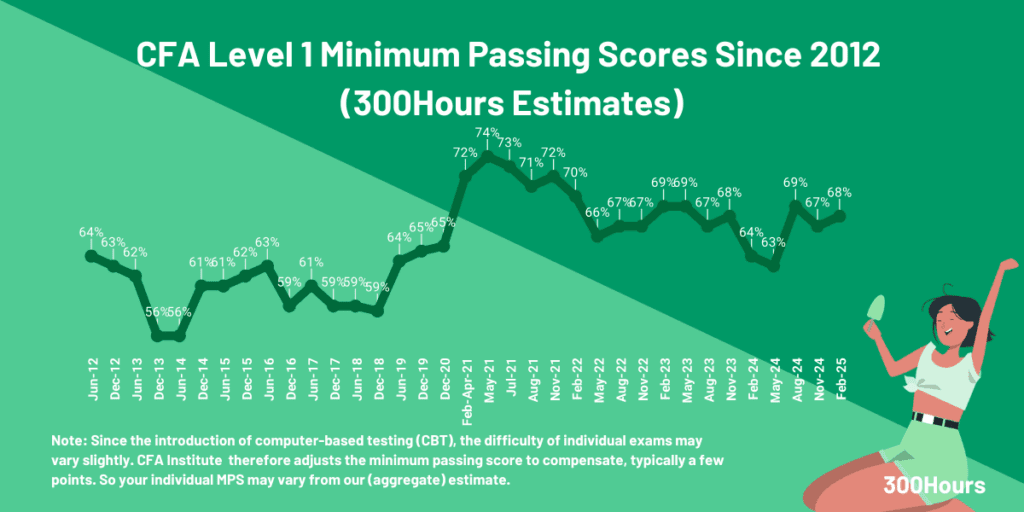

CFA Level 1 passing scores 2012-2025 (estimated)

We estimated that CFA Level 1’s MPS ranged from 56%-74% from 2012-2025, with an 13 year average of 65%. The latest estimated MPS for CFA Level 1 is estimated to be around 68%.

The latest estimated MPS for recent CFA Level 1 exams are:

- Feb 2025: 68%

- Nov 2024: 67%

- Aug 2024: 69%

Our MPS estimates have consistently exceeded 70% during 2021, perhaps due to the pandemic effect, but this has recently returned closer to the longer term average since 2022.

CFA Institute’s official guidance states that the minimum passing score reflects the score that can be achieved by a ‘just competent’ candidate, which is supposed to be consistent across the years, whether it’s 2010, 2015 or 2020. So if the MPS has indeed experienced a step change to 70+%, this may imply that the CBT exam format is easier to score compared to the older paper-based format.

That said, our latest estimate for CFA L1 MPS is 68%. This represents a strong increase in both the MPS and the average cohort score compared to recent L1 exams.

It used to be solid advice for candidates to aim for a 70% score in your mocks. With the latest MPS estimates, we hope that this continues to be the case and that 2021 seems to be an anomaly.

While we have seen some evidence that CFA Level 1’s passing score is heading back to the long term average, we would be cautious of recommending a lower MPS to target for until more data point emerges.

Why are Feb 2021, Mar 2021 and Apr 2021 grouped together?

When we performed the MPS analysis for the March and April 2021 CFA exams, we realized that the MPS, 90th percentile, 10th percentile, and topic weightings were the same as the February 2021 exams, so we have grouped them as one exam. This implies:

- Feb 2021, Mar 2021 and Apr 2021 used the same exam, or the same topic percentage mix, or same pool of questions

- Feb 2021, Mar 2021 and Apr 2021 used the same candidate cohort to determine the MPS, 90th percentile and 10th percentile. It’s likely that Mar 2021 and Apr 2021 simply used Feb 2021’s pool, which statistically should be fine since Feb 2021 has way more candidates.

CFA Level 2 passing scores 2012-2024 (estimated)

We estimated that CFA Level 2’s MPS ranged from 60%-71% from 2012-2024, with an 10-year average of 66%. The latest estimated MPSs for CFA Level 2 are:

- Nov 2024 = 69%

- Aug 2024 = 69%

- May 2024 = 66%

CFA Level 2 MPS estimates have surged upwards and stayed high since 2021. Although this dipped in November 2022, this seems to have returned to its higher levels in 2023-2024.

If you’re preparing for CFA Level 2, my advice is to aim for a high passing score. Don’t bank on the minimum passing score being low – these days it seems unlikely.

Our latest estimate for CFA L2 MPS L2 is 69%, 90th percentile is 78%, 10th percentile 51%. These numbers have largely been keeping with previous exams, so there hasn’t been huge shifts in both cohort performance or set passing scores.

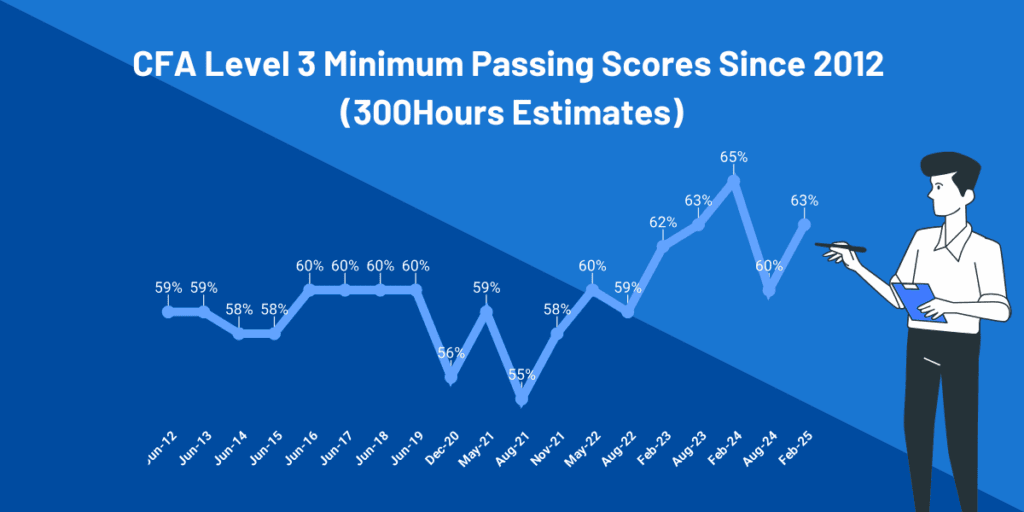

CFA Level 3 passing scores 2012-2025 (estimated)

We estimated that CFA Level 3’s MPS ranged from 55%-65% from 2012-2025, with an 12 year average of 60%.

The latest estimated MPS for CFA Level 3 is estimated to be around 63%. (To help us narrow this down, send your Level 3 result to results@300hours.com!)

Important note on L3 MPS accuracy: Since the change to computer-based testing (and the fact that CFA Institute only distributes detailed results to failing L3 candidates), estimating the L3 MPS takes a lot more work and has a larger margin for error – there’s just too large a variation of weightings to get an incredibly precise result. Nonetheless, we try our best.

The post-CBT MPS estimates have been a mixed bag. The Aug 2021 MPS estimate shows a strong drop from May 2021 and is an all-time low, but less of an outlier if you compare it with historical data. This seems to have ‘recovered’ by Aug 2024 – but we just don’t have enough data-points at this stage to solidly conclude.

The pass rates however are a different story: historical Level 3 pass rates plunged to 39-42% (May 2021 – Nov 2021), which indicates that between the change to a computer-based testing format and a revised testing schedule, the Level 3 CFA exams might be harder to pass than before. That said, CFA Level 3 pass rates are also showing a recovery towards the historical average.

We reached out to CFA Institute for a comment and got a response:

“Unfortunately, fewer candidates passed at each level of the May exams than we might have expected given historical pass rate trends. While some impacted candidates were able to pass, we believe the disrupted nature of the deferred candidates’ studies is reflected in the overall passing rate across all three levels.

All examinations are constructed using industry best-practice psychometric data and detailed examination blueprints. The difficulty of individual exams may vary slightly, and we adjust the minimum passing score to compensate, but generally the required adjustments are small—typically just a few points. The degree of difficulty of the May exams was consistent with previous exam administrations, and this is the case whether we look back to paper-based testing or computer-based testing, which we introduced in February this year for Level I.

Computer-based testing is neither harder nor easier than paper-based testing. We use robust statistical analysis and processes to ensure that “the bar” remains unchanged for every exam administration, employing techniques that are well established by psychometricians to ensure that the exam is neither easier nor harder because it is administered in a computer-based setting. In our move to computer-based testing we went to great lengths to ensure the continued integrity of the exams and the CFA charter. In short, computer-based testing is not harder or easier.”

CFA Institute on the CFA Level 3 May’21 exam results

My results doesn’t seem to fit your MPS estimate!

The CFA computer-based exams are not the same for every candidate, so the difficulty of the individual exams may vary.

When this happens, the MPS for that particular exam is also adjusted. Our MPS estimate is an aggregate value, so your MPS may be higher or lower than our estimate “typically by a few points”.

See relevant quote from CFA Institute:

All examinations are constructed using industry best-practice psychometric data and detailed examination blueprints. The difficulty of individual exams may vary slightly, and we adjust the minimum passing score to compensate, but generally the required adjustments are small—typically just a few points.

So you might well be right in thinking that the MPS is higher for your case.

Help our MPS research, send us your results PDFs!

To keep this research going, we need your help to estimate future exam’s MPS for each Level.

All you need to do is just send your results PDF to results@300hours.com. Thanks for your help!

We understand the trust that you are giving us when you do so, and will not be sharing your information with anybody else, and will only use it to perform anonymized analyses that continue to help present and future CFA exam candidates.

Get Your Results Analyzed with Our MPS Analysis Tool

We’ve built a tool for candidates to get some inferences from their results based on our MPS estimates. Just enter your results below and you’ll get:

- The estimated MPS for your exam window

- Your percentage score estimate

- Your estimated number of correct questions

- Your estimated number of incorrect questions

- Your estimated number of questions/points from MPS

Again, with any information you send us, we will not be sharing your information with anybody else, and will only use it to perform anonymized analyses that continue to help present and future CFA exam candidates.

Fingers crossed for your results day!

Meanwhile, here are some related articles that may be of interest:

MPS on level 1 and 2 appear to be somewhat stable, but MPS on level 3 continues to climb. Odd when it was the test with the highest pass rate. Any idea why?

Hi All

Do you know if CFAI not providing a subject breakdown with Level 3 results is a new thing?

How were MPSs estimated in the past if people who passed did not see their scores or distance from MPS/10/90 percentile lines? Just curious about that matter as I was under the impression that only structured response questions are not included in the breakdown, and we should see it [the breakdown] for multichoice.

Thanks in advance for answering my question!

Hi Kat, thanks for your question!

When CFA Institute introduced the current results graphs format, they did send detailed results to all L3 candidates. After a cycle or so they stopped sending detailed results to passing candidates, but continued sending detailed results to candidates who failed. So L3 candidates who failed still receive detailed results.

We’re not sure what the reasoning is, but the theory that makes sense to me is that the detailed results is meant to inform candidates and help them improve for their next exam (whether it’s a retake or the next level). Since passing L3 candidates have completed all exams they have less ‘need’ for the detailed results, so I’m assuming CFA Institute would prefer not to release them.

Hope that answers your question!

Given that they want charterholders to continue to improve, it still seems a little odd to me that they wouldn’t give you the topic results to encourage you to continue learning in the topics you did least well in. Maybe it’s more so people don’t try to compare based on topic results (I’m better than he is at X topic!) or something, similar to why they say they don’t release the MPS?

Hi

Thanks for a great article 🙂

In context of MPS – Does anyone know if questions equal weighted (e.g. 1 point per question) or are each question given a specific number of points (depending on difficulty) ?

Hi Jimbo, questions are equally weighted.

Any idea what the 90th percentile score was for Level 2 May 2023?

Do you have an estimate score for the 90% for the May 2023 Level 2 exam?

Anyone else get an email from CFAI congratulating them on recent exam success and to sign up for the next level? Maybe some type of glitch in their system that accidentally released the most recent exam results from the May window?

My last communication from them indicated that Level 2 results would be posted next week. If I find I next week that I didn’t pass I think this would qualify as cruel and unusual punishment!

what happened? did you pass ?

Hi Zee, do you know what the 90th Percentile score for Level 1 May 2022 exam is?

“We believe the disrupted nature of the deferred candidates’ studies is reflected in the overall passing rate across all three levels.”

How long is the CFAI going to blame COVID 19 for what is obviously an issue with their CBT grading procedures? I don’t expect an easy test…what I do expect is a test with pass rates and grading in line with historic measures. Since CBT testing took over, pass rates have plummeted, and the CFAI continues to blame “deferrals.” Personally, its VERY unfair that candidates that are sitting now are suffering all due to the fact the CFAI is fine-tuning a process no candidates have had to deal with in history.

Hey Zee, do you have the 90th percentile estimated score for 2022 Level 1 February CFA exam?

Tks!!

Our estimate for the 2022 Level 1 February CFA exam’s 90th percentile is 81% – again, this is just an estimate.

Thank you 300Hours! For the most recent CFA1 (May2022), what is the 70-75th percentile score?

Hi Zee, do you know what the 90th Percentile score for Level 1 May 2022 exam is?

Is there an estimate for 90th percentile score?

There is…. but we don’t really publish them – too many numbers! Which 90th percentile are you after?

Can you share 90th %tile for L3 exams?

This would be great to see!!!

It is impossible to have 90 percentile estimates for L3 because the institute doesn’t give out detailed results to candidates who have passed, only to those who fail.

Thanks for the detailed explanation 🙂

I sent multiple follow up emails asking for a review of my results. Has someone been able to take a look?

What is the MPS estimate for the Feb 22 CFA level 1 exam?

Hi ZEE,

IF I SCORE ABOVE 78% IN MY FEB ATTEMPT 2022 WILL I BE ABLE TO PASS MY EXAM ? WHAT IS YOUR VIEW ON THIS

Hi Mohit, that sounds like a good score, but again we cannot say what will happen with certainty given fluctuations in recent MPS. We have our fingers crossed for you for results day, let us know!

Hi,

I sent in my level 2 scores for an evaluation on 19th Jan. I was wondering how long does it usually take to hear back from you guys?

Thanks

Hi Level2Candidate! I try and reply to every email, and I think I do a pretty decent job, but sometimes things slip through. So sorry!

If people ask for it, I do try and comment and evaluate submissions, but it would not be possible for us to do every submission as it is not done automatically. I try to include whatever insight I can though!

I sent my L3 result again today. Would you please send me a feedback

Does 66.5% makes sense for Level 2 Nov 2021?

This means that you would pass with 58,52 answers correct. Why not make it round to 59 then? (67%)

As it is an estimate, we try and include the value that is closest to what we estimate it to be. If that value is in between 66% and 67%, 66.5% is our best estimate.

Suppose MPS for L2 is 72%, it means we will pass if 72%+ answers out of total 88 questions (AM+PM) i.e. 63 correct answers.?

That is correct. But given that the MPS varies from year to year and from candidate to candidate, aiming comfortably above our estimates is a much safer option. Good luck!

For the level 2 CBT exam what is a good percentage (safe) to pass the exam.

Out of 88 questions (Am +Pm) according to you, getting 75 correct will help me pass my Level 2 CBT exam?

As you can see, the latest data shows such inconsistent trends that it really is anybody’s guess. At my own level of effort/risk that I’m comfortable with, I would advise to be comfortably scoring 80+ in mocks going in. Good luck!

I have already given my exam in nov, and i guess 80% of the questions answered by me is correct, so according to you is it enough for me to pass ?

Honestly, nobody knows for sure. If I had to guess, I’d say assuming your 80% score is correct, you shooooould be OK.

Hello,

I’m a bit conflicted here. I am sitting level 3 on Tuesday and just completed the last of the Kaplan mock exams. I’ve got an average AM score of 69% and PM 73%. Assuming I am the average candidate or just a bit above, how can the pass rate be so low with your estimate of a 55% MPS? This simply does not make sense. I don’t think the switch to computer based testing or deferrals make that much of a difference – I think the MPS is slightly higher around 65-70%. What are your thoughts?

Data suggests that candidates significantly underperform in the AM session, so I would say 69% is a great score. The issue with AM mocks is that there isn’t a clear way for candidates to accurately grade the papers themselves – but we have a guide that can help with that.

What is your MPS estimate for August L3 2021?

We’ve just updated the article with the L3 Aug’21 MPS – check it out!

Hello what is a reasonable mps for the level 3AM session in your view.

Assuming the AM / PM mix has some dispersion.

I am just trying to get an idea nothing very precise

There isn’t a ‘session-specific’ MPS, since the MPS does not distinguish which session your points came from. In general candidates perform significantly more poorly the AM (essay) session.

If you need guidance on how to raise your score in the CFA L3 essay section, check out our guides here:

What is your estimate for a 90th percentile score for August L2 exam?

Our estimate of the CFA Aug’22 Level 2 exam’s 90th percentile is 79%. Hope that helps!

So, the estimated 90th percentile score for both Aug’22 Level 1 and Aug’22 Level 2 is 79%?

Aug’21*

Yes.

What’s your estimate for a 90th percentile score on august level 1 ?

Our estimate for the 90th percentile for L1 August 2021 is 79%. Hope that helps!

Hi!! What is your estimate for the 90th percentile for the July 2021 L1 exam? Since it’s so close to the MPS.

Thanks!

Our 90th percentile estimate for Jul’21 L1 is 80%.

I think it is reasonably clear that the CFA are raising the pass mark in order to generate more candidates and, hence, more revenue. They have recognised that their behaviour leads to the possession of a CFA pass (especially level 1) becoming a Veblen good ( the higher the “price”, the higher the demand). By “price” I mean cost and effort required.

It is extremely disappointing that an organisation like this have focussed on profits rather than the genuine education of their members in a fair manner.

CFA could argue that changes are purely to do with raising standards but would they continue with this strategy if numbers of candidates reduced? I very much doubt it.

So what can we do about this strategy?

Our only option is to ditch the CFA until they wake up to candidates’ needs.

Worth keeping in mind that CFA Institute are not just about the exams. I’ve served on the board of my local CFA society so have a bit of experience around this. Even when you make the assumption of profit maximization, simply raising the MPS wouldn’t make much sense in the long term. Raising the profile and prestige of the CFA charter should (and is) the goal of CFA Institute, which creates demand for the exam and charter.

Just my opinion on this. 🤷♂️

Goodmorning everyone

I have passed level 3 and I am very happy but there is no indication of MPS and not even a specific topic for topics unlike the other two levels, how do you do the estimation? What data should we give you?

Claudia

We estimate the MPS from results submissions that our readers give us. Just sending in your results PDF to results@300hours.com would be enough. Thanks!

Did you get a score report for May 2021 L3? I passed as well, but CFAI didn’t give me a score report.

CFA Institute did not issue PDF score reports to passing May’21 L3 candidates – not sure why. This is the first time this has happened.

Hi mr Tan

would you please tell me what’s the story of retabulation?! how can we do that and does it worth it?

my results are over 70% still failed by a hair’s breadth in May level 1 exam!! the MPS must have been over 73%!! is it really fair? can we ask for something like reconsideration?

and I sent you my results to your email results@300hours.com, could you please assess it and guide me if retabulation may work regarding my results which is almost on the MPS line for May level 1 !!?

thanks dear Zee

Retabulation is no longer available under computer-based testing, since retabulation is just a recheck of your scores. Since they are all computer-based now the concept of retabulation is redundant. There is no reconsideration option I’m afraid.

We have learnt from CFA Institute that the MPS is tweaked for each individual exam so your MPS may vary from our estimates which are aggregate values.

You guys lost a lot of credibility after this L3 MPS estimate. Not even close, at least you bumped it up 4% but still off.

Misleading candidates with these “estimates”, should just avoid it going forward in my opinion. Everyone should strive for 75%+ and forget the rest.

We do what we can given what we have. If you read the full article you’ll see that CFA Institute actually now adjusts for individual exams. So technically everyone has a different MPS.

We have reviewed a lot of borderline cases, so we know there are specific cases where the MPS can be as much as 5% higher from our estimate, but publishing a range e.g. 55%-65% isn’t that illuminating either. We decided to settle on a number that fits most cases and will still be useful going forward.

We’ve always tried to make it clear that our MPS estimates are not something to ‘aim’ for in practice exams, especially if you’re L3 and throwing in essay questions into the mix where pretty much anything can happen.

Thanks for your feedback though – the exam results actually keep changing every time their published (CFA Institute used to publish essay vs item-set, for example) so we are constantly having to keep up with the unpredictability.

Hi Zee,

You mentioned technically everyone has a different MPS. May I know what is the CFA article you referring? Thanks.

I’m referring to our own article (this one) where CFA Institute commented to us:

Hope that helps!

That MPS estimate for level 3 in May-21 is definitely wrong. Please review that

Ahahah

Why do you think our estimate is inaccurate – and what do you think is a more accurate estimate?

Based on my own score range… It seems like the MPS should be somewhere above 60%, maybe 62%

As mentioned in the article, each exam has an individually-adjusted MPS so it’s likely different for your particular case. Our estimate is an aggregate value.

I also took CFA Level 3 exam in May 2021. And I also believe that the MPS looks more closely to a score like 62%. An estimate of 59% seems too low. Geographically, the MPS line looks like it’s around 61~64%.

As mentioned in the article, each exam has an individually-adjusted MPS so it’s likely different for your particular case. Our estimate is an aggregate value.

I failed Level 3 today right on the MPS, do you think this breakdown is below 55%?

blob:null/1786b362-5e9a-4930-a9c3-6c14cb8c74a7

I could not understanding how the candidates know their exam contents are different with each other. My guessing is unless they disclosed the exam contents with each others. However I think this is also violated the CFA professional codes and ethics.

It would be a violation…and also unrealistic to expect that no one would discuss any questions at all, anywhere. 🤷♂️

I was confident in your methods for determining the MPS, however your estimate for Level I May changed from 72.5% to 74% (which is a big jump) without clearly stating the reason for the same.

Additionally the lack of transparency on the new methods used to calculate the MPS increases my level of doubt.

Sometimes we get new information which updates our view on the MPS. When that happens, we will always choose to update our MPS so that it reflects the most accurate estimate that we have. Staying put with a less accurate estimate to “stay consistent” and try and look good would be doing candidates a disservice. That’s not what we’re here for and that’s not what 300Hours is about. “Whatever helps candidates more” drives our decisions, and updating our MPS when we believe our current estimate is no longer the most accurate estimate we have, makes the most sense to us.

You’re right in saying that we don’t disclose our methodology – there’s no advantage and it invites a lot of unwanted attention. All I would say about it is that it is as accurate as we can theoretically get it to be. We are limited by certain constraints – for example, CFA Institute used to publish exact weightings by topic, but now they use a range, so we do have to fill in the gaps as best we can.

if I send you my grades can you give me an estimate of my score? for a fee of course

Send them to results@300hours.com and ask nicely – don’t worry about fees, just pass the word on about 300Hours 😁

Hi guys,

I still cant believe I failed the Level II May 2021 exam despite getting these scores. I’m still shocked why I did not pass.

1) FRA >70%

2) Portfolio >70%

3) Econs >70%

4) Fixed Income >70%

5) Corp Fin >90%

6) QM = slightly below 70%

7) Equity = slightly below 70%

8) Alternative Investment = slightly below 70%

9) Ethics >50% & <70%

10) Derivatives = 50%

I think the MPS is above 70% for this exam. The MPS was also close to 90% percentile.

Do you think I should pass with the results that I got? If yes, would it be worth it to apply for retabulation?

Based on the results we’ve received from other CFA L2 candidates, I stand by our MPS estimate, which is below 70% for Level 2 May’21.

I have also replied to your email – please do not use our MPS estimate as a basis to plead to CFA Institute to ask for a retabulation. It will not work – our MPS estimate is an estimate.

I would expect those percentages to result in a passing score unless they gave an MPS to each category, which I always hear they don’t.

Pardon my intrusion… but relying on Scwesers for LIII is going to the battle without your armour

To each their own – I completed my L3 with Schweser. 🤷♂️

i don’t know anyone who failed level 3 with Schweser books though, and I know quite a few charterholders…

You might want to take a look at my scores. Might show that the MPS L1 May was alittle higher. My test scores is touching the MPS.

Send it in to results@300hours.com and we’ll have a look!

Hi Zee…are you sure (feel really confident) guys the MPS for the May Level 1 was “only” 72.5%?

We’re pretty confident of our method. Why do you ask?

And what’s your method, if at all it’s not just a random number thrown out?

The results are clearly drawn to scale, yet your MPS estimate is so much inconsistent with it.

I wonder why you give your MPS Estimates without mentioning anything about your method of estimating it? Is it because you can’t defend your approach?

I understand your frustration, but please remember we’re also ex candidates and we’re doing this to help candidates understand the process.

You’re right in saying that we don’t disclose our methodology – there’s no advantage and it invites a lot of unwanted attention. All I would say about it is that it is as accurate as we can theoretically get it to be. We are limited by certain constraints – for example, CFA Institute used to publish exact weightings by topic, but now they use a range, so we do have to fill in the gaps as best we can.

At the end of the day, we make it very clear everywhere that it’s our estimate, and not The One True MPS. Use it if you feel it helps.

I do not understand how the MPS for level 1 is 72.5% for May 2021 with a 25% pass rate but 72% with a 44% pass rate. Can you please provide some more information?

May be We we’re all dumb dumb this day. May be the CFAI need fees. Who knooows

The cohort for each exam is different, and the content for each exam window is different, so it’s perfectly possible.

In theory, the MPS shows how hard/easy the exam is (high MPS = easy). And also in theory, the pass rate shows the average candidate quality of each exam cohort (high pass rate = high quality).

So I would say with the numbers as they stand, and assuming CFA Institute’s methodologies on pass rates and MPS are as they say, this points to a lower average candidate quality for the May’21 CFA exams.

Any update on CFA Level III potential MPS?

We won’t have one until we get results from the first CFA L3 CBT exams (May 2021). Can’t predict what CFA Institute are going to do – we can only analyze. 😊

Hi, i just did the level3 exam, and i found tougher than i expected and was prepared. Essay session was fulled with a lot of questions tha wans’t covered in detailes by Scheweser materials. Second part was relatively easily. Any thoght about the MPS for this year?

We will estimate MPS scores some time after the exam results are released. If you want to help us on this, just send your PDF result to results@300hours.com. Your results will of course only be used for analysis purposes, and never be shared with anyone else.

Hi Danilo,

I also did the level 3 exam in May this year and also study with Schweser. I had the same experience as you. The morning was really tough with some questions that were not covered by Schweser summary. The second part was easier for me as well.

At least knowing that other people had the same experience you had is comforting.

I hope we passed this exam.

I’m not sure if this was discussed before, but what’s your best guess in how the MPs will be calcuted based on so Many differnt versions of thr cbt test this year? For Example what if a group got a harder version vs a meduim vs easy version how do they make it fair for all?

I think candidates in the same exam window take the same version of the exam.

just did the level 3, and a friend of mine who also did the level 3 had a differente version of the exam than me…

What I mean is that the exam would draw from the same pool of questions, but the exact iterations and combinations would be different. There would have to be some consistency within an exam window to e.g. be able to apply a single MPS.

Maybe they will determine an MPS for each exam

thanks Zee. What are your estimates for CFA Level 3 May 2021? thanks!

Really can’t tell. The Feb 2021 MPS really bucked the trend so I’d say anything between the historical average to 75-77%. Although I have trouble imagining they would really bring the MPS for L3 that high.

Good luck!

Hi guys, any idea about the online exam which took place in April? I wonder how the MPS will be calculated as very few number candidates were given the option of online testing.

It’ll likely be the same ‘group’ as February and March exams, given what we’ve observed with the March exams.

Do you think the MPS for level 3 will remain pretty steady for May / June? I heard a lot about a revision of the MPS for L1/2?

Oh man, I have no idea. The MPS for Feb 2021 is estimated to have jumped up a lot. Our estimate is 72% when historically it’s been estimated around 65% or lower.

Best to over-prepare…

Why this new way to calculate MPS hadn’t been publicized before? If CFA Institute just would like to keep passing rate as normal from previous years and hence, change the method like this, is it reasonable and equal for candidates who got score exceeding 70 but a little below 72 towards Level I? They estimated and believed that the maximum passing score must be at 70% and tried best to hit this rate, but finally, failed.

72% MPS is just our estimate, although most agree that the MPS is definitely high this year.

It is also possible that the exam this time was easier than past years, even implied, if you assume that CFA Institute’s methodology for determining the MPS is the same.

So the logic that candidates that scored 70-72% ‘should pass’ could be flawed – in past exams they might well have also scored below the (lower) MPS.

Haha Danilo Alencar,

This is a violation of code of ethics. I recommend you take down this post or you gonna get screwed real bad.

What do you think is behind the recent spike in MPS? Do you think it is solely due to an easier exam or are they looking to fail candidates that were previously considered qualified in order to maintain the low 40s pass rate and thus the exclusivity?

From the CFA Website:

“The MPS process should:

[…]

Seek consistency over time in methodology and continuity in results while allowing for

flexibility based on evolving circumstances.”

Previously I thought the Angoff Method strives solely for continuity year over year in the kind of candidate who passes, but the part about “allowing for flexibility based on evolving circumstances” has me thinking.

We’ve been discussing this on our forum here: https://300hours.com/f/cfa/level-1/t/how-to-appeal-if-your-cfa-result-is-close-to-passing/

I agree with your interpretation – the Angoff method is supposed to be independent of candidates’ ‘performance curve’.

So if you assume that is true, then the only explanation for a high MPS is that the Feb-2021 was easy, i.e. the ‘just competent enough’ candidate should have scored a high score in that exam.

But unlikely to get confirmation on this point as CFA Institute I imagine would not be commenting on this.

The important lesson I would be taking from the Feb-2021 exam results is that until a stabilized trend emerges, 70+% is no longer a guaranteed pass. From our data received from the Feb-2021 exam cycle, I would recommend aiming for a consistent (i.e. last 3 mocks) exam of around 80% or more to have a good pass chance.

Does anyone know when does registration open for Feb 2022 Level 2?

Hi MaciejB, it is yet to be announced, but do check back on our CFA exam dates article as it’ll be updated once the 2022 dates are announced.

Do you have the sample size for how many reports were used for each years estimate?

Our current methodology does not require crazy amounts of datapoints, but pre-2017 (before the current PDF chart format) our sample sizes were about 5,000 per CFA level.

Very interesting. But where does the volatility comes from? Lets say you take the exam in June 2019 instead of December 2018. You need to score 5% higher than in december 2018.. thats a huge difference.

Hi Romain, the volatility in MPS comes in the setting phase, where a bunch of charterholders go through all the questions and make a judgement of the minimum score of a just-competent candidate should achieve.Once this is done, they compare the actual candidate performance for each question and repeat the process again.

So the volatility comes from the different question ‘difficulty’ each exam cycle. It could be that Dec18’s questions are perceived by charterholders as particularly challenging (for a typical ‘good enough’ candidate) given the syllabus, hence a lower MPS is set.

Hope this clarifies!