The FRM (Financial Risk Manager) is a 2-part computer-based exam offered by GARP, considered the top credential for risk management careers.

You need to pass both parts (~250 hours study each) and show 2 years of risk management work experience. Total cost: $1,000-1,400. Pass rates: 42-47% (Part 1), 45-50% (Part 2).

Offered 3x yearly (May, Aug, Nov). Difficulty equivalent to a Master’s degree. Takes most candidates 1-2 years to complete both parts.

Worth it if you’re serious about risk management – banks, asset managers, and hedge funds actively hire FRMs.

Thinking about the FRM exam? Here’s what you need to know upfront.

The FRM (Financial Risk Manager) certification is GARP’s flagship qualification for risk professionals. It’s a 2-part exam covering market risk, credit risk, operational risk, and quantitative methods – basically everything you need to manage financial risk at banks, asset managers, hedge funds, and regulators.

The commitment:

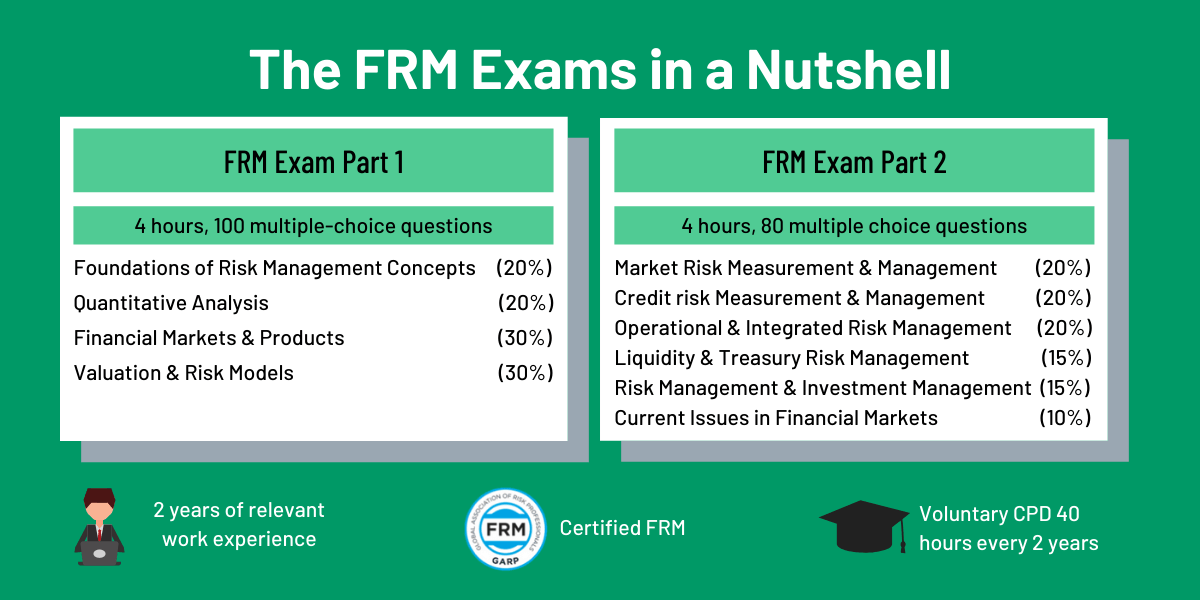

- 2 exams: Part 1 (100 questions, 4 hours) and Part 2 (80 questions, 4 hours)

- Study time: ~250 hours per part (most people need 5-6 months each)

- Cost: $1,000-1,400 total (enrollment + registration fees)

- Work experience: 2 years in risk management (can be before, during, or after exams)

- Timeline: Most candidates finish both parts in 1-2 years

Is it worth it? If you’re serious about risk management, yes. FRM is globally recognized and actively sought by employers. The curriculum is practical (less theoretical than CFA), and passing both parts genuinely makes you better at your job.

This guide covers everything: What FRM is, how the exams work, what they cost, pass rates, study timelines, and whether it’s right for your career. Let’s dig in.

- What is a Financial Risk Manager (FRM)?

- How popular is the FRM certification?

- How does the FRM exam work?

- What are the FRM pass rates?

- What are the FRM pass rates?

- What topics are on the FRM exam?

- How much does the FRM cost?

- When are FRM exams offered?

- What are the FRM exam requirements?

- Is the FRM worth it?

- Benefits of FRM certification

- Who should get the FRM certification?

- FRM vs CFA – Which is right for you?

- FRM exam FAQs

What is a Financial Risk Manager (FRM)?

FRM stands for Financial Risk Manager – it’s the leading professional certification for anyone working in financial risk management.

To get the FRM designation, you need to:

- Pass two exams (Part 1 and Part 2)

- Show 2 years of relevant full-time risk management work experience

- Pay annual GARP membership fees ($195/year)

Where FRMs work: Pretty much everywhere risk matters – major banks, investment firms, asset managers, hedge funds, insurance companies, accounting firms (Big 4 all hire FRMs), and regulators.

What FRM certification signals: You know how to identify, measure, and manage financial risks – market risk, credit risk, operational risk, liquidity risk. Employers take it seriously because the curriculum is practical and current (updated annually based on market events).

Career outlook: Strong. Regulatory pressure post-2008 means risk management roles keep growing. If you can demonstrate you understand VaR, stress testing, Basel frameworks, and credit models, you’re employable.

How popular is the FRM certification?

FRM has been around since 1997, and there are now 96,000+ certified FRMs globally working at basically every major financial institution you can name.

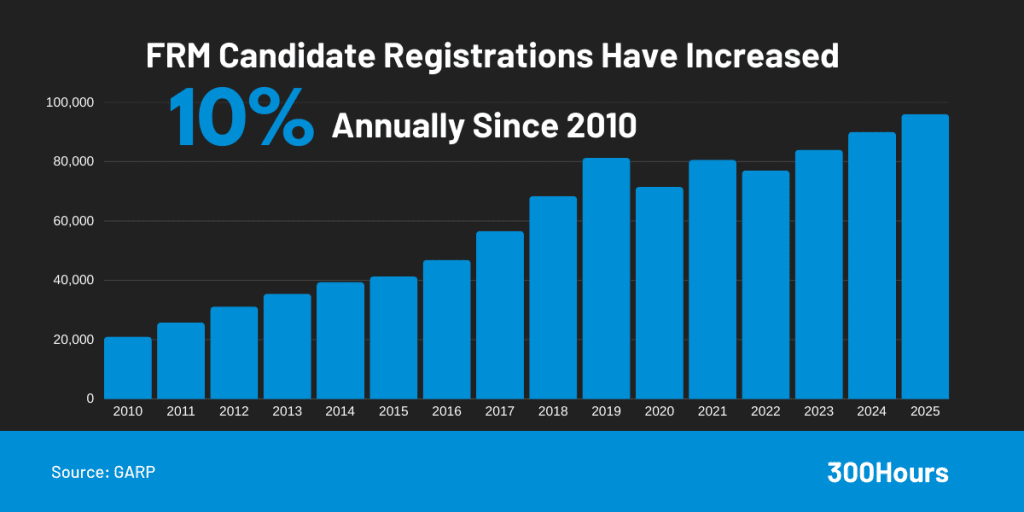

Growth trajectory: FRM registrations grew ~10% annually from 2010-2025, with a 20% spike in 2017-2018. The pandemic hit 2020 numbers (like everything else), but growth is recovering.

Why it’s growing: Post-2008 financial crisis, risk management went from “back office function” to “strategic priority.” Boards want risk professionals who actually know what they’re doing. FRM is how you prove that.

Global presence: FRMs work internationally – not just New York and London. GARP reports strong growth in Asia-Pacific (Singapore, Hong Kong, India) and Middle East markets.

How does the FRM exam work?

The FRM exam is a two-part computer-based examination consisting of a 4 hour multiple choice exam each. Its difficulty is equivalent to a Master’s degree, according to benchmarking done by UK ENIC (European Network of Information Centre of the United Kingdom).

There are 3 exam windows for Part 1 and Part 2 annually in May, August and November.

The exams are conducted exclusively in English, in person at 100+ exam sites around the world. You can find out your nearest exam center here.

In terms of pass criteria, there are no negative markings for incorrect answers. The passing score is determined by the exam committee each year.

The exam results are sent to candidates via email approximately 6-8 weeks after the conduct of exam, and result is a simple pass or fail.

However, you will be provided with quartile results so that you can see how you scored on specific areas relative to other candidates.

What are the FRM pass rates?

What are the FRM pass rates?

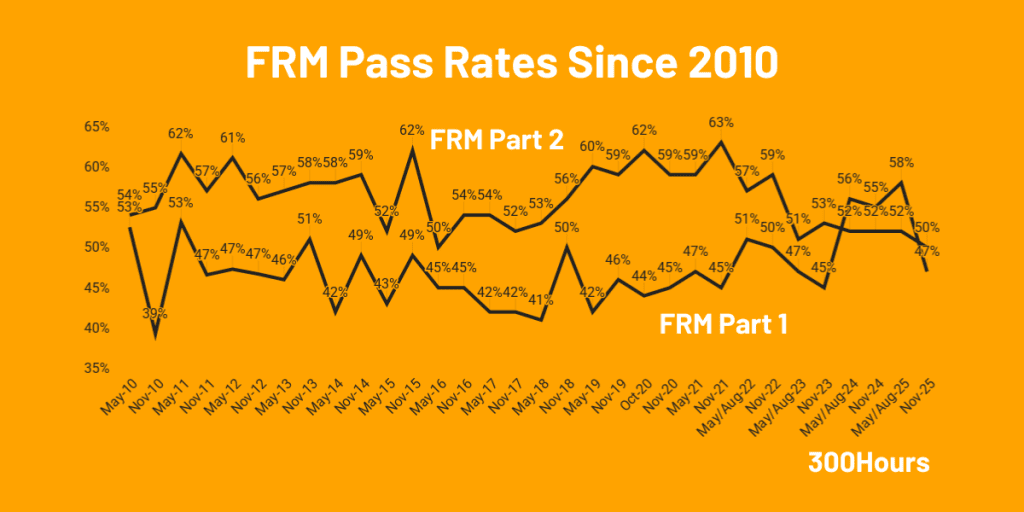

Latest (Nov 2025):

- Part 1: 47%

- Part 2: 50%

Historical averages:

- Part 1: ~42-45%

- Part 2: ~45-50%

Part 2 consistently passes at slightly higher rates than Part 1, which makes sense – if you made it through Part 1, you’re probably more committed and better prepared.

Check out our detailed FRM pass rates analysis for trends over time and how to interpret these numbers.

What topics are on the FRM exam?

FRM part 1 topics

Part 1 is all about tools – the quantitative and analytical skills you need for risk management. The topics and percentages are as below:

| Part 1 Topic Areas | Topic Weight |

|---|---|

| Foundations of Risk Management (FRM) | 20% |

| Quantitative Analysis (QA) | 20% |

| Financial Markets & Products (FMP) | 30% |

| Valuation & Risk Models (VRM) | 30% |

The heavy hitters: Quantitative Analysis sounds like only 20%, but it’s actually foundational for everything else (you need solid stats to understand VaR, option pricing, and regression models). Financial Markets & Products (30%) and Valuation & Risk Models (30%) are where most of your study time goes.

FRM part 2 topics

The Part 2 curriculum highlights on the application of the tools studied in Part 1 with a deeper understanding of risk types and risk management. Topics and percentages are in the table below:

| Part 2 Topic Areas | Topic Weight |

|---|---|

| Market Risk Measurement & Management (MR) | 20% |

| Credit Risk Measurement & Management (CR) | 20% |

| Operation Risk & Resiliency (ORR) | 20% |

| Liquidity and Treasury Risk Measurement and Management (LTR) | 15% |

| Risk Management and Investment Management (IM) | 15% |

| Current Issues in Financial Markets (CI) | 10% |

What’s different: Part 2 is less about calculations and more about integrated thinking. Questions often span multiple topics (“You have market risk AND credit risk AND operational risk – now what?”). Current Issues (10%) changes every year based on recent market events, so you need the current curriculum.

How much does the FRM cost?

There is a recent increase in FRM exam fees due to the transition to computer-based exams. Here are the latest costs:

| Fees in USD ($) | Part 1 | Part 2 |

|---|---|---|

| Enrollment (one-off) | $400 | – |

| Early Registration | $600 | $600 |

| Standard Registration | $800 | $800 |

There is a one-off enrollment fee of $400 that applies to first time candidates. For example, if you’re retaking Part 1 exams, the exam fee varies between $600-$800 only depending on your registration date.

The fees for Part 2 candidates are the same as Part 1 (excluding the one-off enrollment fee), ranging from $600-$800 depending on registration date.

Pro tip: Register early (2 months before the exam) to save $200 per exam. For May exams, early registration ends January 31. For August, ends April 30. For November, ends July 31.

Don’t forget study materials: GARP provides official curriculum (free with registration), but most candidates also buy prep materials – expect another $300-800 depending on provider (Schweser, BionicTurtle, AnalystPrep).

Full cost breakdown in our FRM fees guide.

When are FRM exams offered?

When are FRM exams offered?

3 windows per year for both Part 1 and Part 2:

- May (early/mid-May exam window)

- August (early August window)

- November (mid/late November window)

Registration opens 2 months before early deadline:

- May exams: Registration opens Dec 1

- August exams: Registration opens Mar 1

- November exams: Registration opens May 1

Early registration deadlines (saves $200):

- May: January 31

- August: April 30

- November: July 31

Final registration deadlines:

- May: March 31

- August: June 30

- November: September 30

Full calendar with scheduling deadlines in our FRM exam dates guide.

What are the FRM exam requirements?

In order to be certified as a Financial Risk Manager and be able to use the FRM designation after your name, the following conditions must be fulfilled:

- Pass FRM Part 1;

- Pass FRM Part 2 within 4 years of passing Part 1; and

- Demonstrate 2 years of professional full-time financial risk management work experience.

FRM work experience requirements:

- To demonstrate relevant work experience, GARP requires a candidate submission of a minimum of 4-5 sentences (at least 300 words) detailing how he/she manages financial risk in their day-to-day work.

- Experience completed for school will not be considered, including internships, part-time jobs, or student teaching.

- The work experience submitted cannot be more than 10 years prior to having passed the Part 2 exam.

There are time limits to getting certified as a Financial Risk Manager:

- Once a candidate passes Part 1, he/she must then pass the Part 2 within 4 years.

- Then, the candidate will have 5 years from the date of passing Part 2 exams to obtain work experience verification. If this is not done in time, the candidate will have to re-enroll and pass both Part 1 and Part 2 exams again for certification, not to mention re-paying the required fees to do so.

Is the FRM worth it?

Short answer: Yes, if you’re serious about a risk management career.

Here’s the honest breakdown:

FRM is worth it if:

- You work (or want to work) at a bank, hedge fund, asset manager, or regulator in a risk role

- Your job involves VaR calculations, stress testing, credit modeling, or Basel compliance

- You need credibility when talking to regulators, auditors, or senior management about risk

- You’re competing for risk management promotions against people with similar experience

FRM might NOT be worth it if:

- You’re in equity research, corporate finance, or investment banking (CFA makes more sense)

- You’re a data scientist/quant who codes all day (your Python skills matter more than credentials)

- You’re already senior enough that credentials don’t move the needle

- You’re just collecting certifications without a clear career goal

ROI reality check: FRM doesn’t guarantee a job or automatic raise. But it does:

- Get your resume past HR filters for risk roles

- Give you the technical chops to actually do the job well

- Signal commitment to employers (passing both parts is non-trivial)

- Provide networking access to 96,000+ FRMs globally via GARP

Compared to other options:

- vs CFA: FRM is faster (1-2 years vs 2-4 years) and more specialized. If you know you want risk management, FRM is more efficient.

- vs PRM: FRM has way more market recognition. PRM (Professional Risk Manager) is fine but employers rarely ask for it specifically.

- vs Master’s degree: FRM costs ~$1,500 vs $40,000-100,000 for a Master’s. It won’t teach you as much theory, but employers value it for practical knowledge.

Bottom line: If you’re building a risk management career, FRM is one of the best investments you can make. Just don’t expect it to do the work for you – it’s a credential that enhances your skills and experience, not a substitute for them.

Benefits of FRM certification

Financial Risk Managers are one of the most widely accepted global designation for risk management profession, and getting this certification certainly sets you apart from the rest.

Once you achieve this designation, you can expect to:

- Differentiate yourself and further boost your risk management credentials in the financial industry

- Enhance career growth and increase job mobility in the risk management sector

- Become a part of the global elite group of risk management professionals who are certified as Financial Risk Managers

- Be recognized globally as a leader in financial risk management

- Command better remuneration package and job opportunities

Who should get the FRM certification?

FRM is specifically designed for:

Risk managers

If your job title has “risk” in it, FRM is probably worth considering. This includes market risk analysts, credit risk managers, operational risk specialists, and model validators.

Traders & portfolio managers

If you’re managing positions and need to understand risk exposure, VaR, Greeks, and hedging strategies, FRM gives you the technical foundation. Particularly valuable for derivatives traders and fixed income PMs.

Risk consultants

If you advise clients on risk management frameworks, stress testing, or regulatory compliance (Basel, Dodd-Frank), FRM gives you credibility and technical depth.

Compliance & audit professionals

If you audit risk processes or ensure compliance with risk-related regulations, understanding what you’re auditing (via FRM curriculum) is hugely valuable.

Regulators

Central banks, financial regulators, and supervisory agencies actively hire FRMs. If you’re on the regulatory side reviewing bank risk models, FRM is almost expected.

Career changers into risk

Coming from data science, engineering, or another quantitative field? FRM is a fast way to gain risk management credibility without going back for a Master’s degree.

Who probably doesn’t need FRM:

- Investment bankers (M&A, ECM, DCM) – your job isn’t about managing risk

- Equity research analysts – CFA makes more sense

- Corporate finance professionals – FP&A, treasury, IR roles don’t typically need FRM-level risk knowledge

- Wealth managers / Financial advisors – CFP or CFA is more relevant

Not sure if FRM is right for you? Ask yourself: “Will understanding VaR, credit models, operational risk frameworks, and stress testing help me do my current job better or get the job I want?” If yes, do FRM. If no, probably skip it.

FRM vs CFA – Which is right for you?

This is a popular topic which has a whole article in itself.

We compare the differences and similarities between these designations, in terms of syllabus, difficulty and career objectives. Check it out!

FRM exam FAQs

Are you considering this certification, as well as the CFA designation? Leave a comment below!

Meanwhile, you may find these related articles of interest:

I am an IT professional and helped many clients in building an application related to financial risk modeling. Would I be eligible to show my experience to achieve this certification?

Hello! Please can I ask what would qualify as relevant work experience? For instance, is someone was working in auditing in the big4 but primarily on cass/controls/financial statement audits – would this qualify?

If i passed FRM part 1 in may 2019, till what time can I appear for part 2? Dec 2022 or May 2023 or Dec 2023 before i have to retake part 1?

Hi Raju, according to GARP, you’ll need to pass the FRM Part 2 exam by 31 December of the 4th year of passing the FRM Part 1. So you must pass Part 2

by

Dec 2023.

I wouldn’t take Part 2 in Dec 2023 in case they are being literally strict with the word ‘by 31st Dec of the 4th year of passing Part 1’. Taking it in May 2023 only gives you one chance of passing (else you have to retake P1), which may be personally too risky for me. I would say if you can aim for Dec 2022 then go for it.

Hi

I haven’t received any free CFA level 1 study material.

Can you please send me the same.

Thanks

If it’s free CFA study material you’re after you should check out our Free Materials List.

Is it possible to sit both the FRM levels 1 and 2 at the same time?

You are allowed to sit for both at the same time, but it isn’t necessarily advantageous.

Here is a detailed answer for those considering sitting for FRM Part 1 and 2 at the same time.

Hey i am from India …just wanted to know will exams in mumbai for july frm part 1 be postponed?

There are no current postponement announcements for the FRM exams in July in India, although GARP have stated that they are monitoring the situation closely in India for the July exams.

The latest postponements for the July FRM exams can be found here: https://300hours.com/frm-july-2021-exams-postponed/

I am still not getting FRM free guides, getting only CFA related.

Please sort out.

Thanks,

Sundar.

Hi Sundar

Apologies – we’re still stuck in the weeds building out our FRM functionality. For the latest FRM help guides, see our FRM section.

Please send me details about how the study materials for this course are to be purchased and from where.

For materials, check out our the FRM section of our Offers page.

Hello,

Are there any free resources / guides for FRM Part 1 and Part 2 exams ? Please share if you have any ?

Thanks,

Hi Sundar! What particular free resources and guides are you looking for?

To start, we have adapted our CFA study planner for FRM study plans as well. Just fill in the form at the bottom of the article, select FRM and whether you’re Part 1 or Part 2, then click ‘Next’. 🙂

Sure Sophie, I did’t knew how CFA study planner is going to help me in preparing FRM exams. Hence, I was looking for FRM specific resources.

Hi Sundar, what I meant was that we created a separate FRM study planner as well, just haven’t broadly advertised it yet, hence it’s accessible only from that link.

Hello Sophie,

Sorry, I could not find this form / link which you mentioned earlier”…Just fill in the form at the bottom of the article, select FRM and whether you’re Part 1 or Part 2, then click ‘Next’…” – please help me locate this.

Thanks,

Sundar.

Hi Sundar, we have created a new FRM study planner for you in this article.

Hope this helps

Hyy, i am doing my fy.bcom.so when my graduation complets and I do Frm only so can I get a job in this field or I do some else?

Hi Dave, getting an FRM certification doesn’t guarantee a job in the field. It does improve your prospects for a financial risk management job, but it also depends on your job application and interview process.

Hi, myself Santosh, i am a commerce graduate with 15 years of experience in Finance and accounts field. since 2017 i have been working under GRC (Governance Risk & compliance). If i take FRM along with my job, after completion of both the parts can i apply for the certification with this experiance.

Hi Santosh, yes, as long as you have 2 years full time financial-risk related work experience in your description to GARP.

Hi I am an FYBBA a student And want to make career in Finance I am willing to do both CFA+FRM so can you please suggest when to start and from where to start.

Hi Bhusha, if you want to go for both CFA and FRM, this article may help form your strategy. Our CFA and FRM beginner guides are also super useful in providing a good overview of the designations.

Hi! So, if while I am completing my Exam 1 and 2 I work full-time job related to financial risk manager, once I finish Exam 2 can I get the FRM certification?

Or does the work experience start once you finish Exam 2?

Thanks!

Hi Marc, if you refer to the work experience section in this guide above, you’ll see that the 2 years work experience “cannot be more than 10 years prior to having passed the Part 2 exam”.

So you should be able to get your FRM certification once you passed Part 2 and showed that your 2 year work experience is relevant (and not more than 10 years prior to passing Part 2).

Hello;

I am currently working as Manager Operational Risk & Business Continuity Planning from last 6 years and now interested in FRM; going to register my self for upcoming exam.

Is FRM is OK for me or not ?

I have also plan to move in Canada by end of this year; please advice….

Hi Asad, the answer depends on your career goals 🙂

If you’re keen on a career in financial risk management, FRM would be great.

If anyone fail for may or july attempt FRM part 1 exam does he can apply for nov ?

Hi Jas, yes you can retake FRM Part 1 in November, as long as you register before the date registration closes on 30 Sep 2021.

If some is having 10 years of experience. Is he eligible for FRM 2. As per the guidelines, he is not eligible.

Hi Vishesh, think you may have misunderstood the FRM work experience requirements here: A candidate needs to show 2 years of professional full-time financial risk management work experience. And this work experience submitted cannot be more than 10 years PRIOR to having passed the Part 2 exam. So if someone has 10 years of relevant risk management experience (say from 2010-2020) before passing Part 2 exams in 2020, that is fine, because it is more than the 2 years required. However, say if you passed FRM Part 2 in 2020, but the last time your relevant risk management experience was from 2000-2011, that would NOT qualify even though you had 11 years risk management experience previously, as for FRM work experience purposes, you only have 1 year relevant experience since they do not count work experiences more than 10 years PRIOR to passing FRM Part 2. Hope this is clear!

Thank you Sophie for the information, very informative….!!!

You’re welcome Roshan! Glad it is useful, have you decided on FRM then?

Thank you so much for sharing this Sophie. It was very informative and answered several of my questions. Thanks a ton!

Thanks Neha, lovely to hear that! Are you considering both CFA and FRM?

I am MCA and having 10 yrs exp. and in murex(Amrket risk and credit risk reorts in datamart) development 5 yrs in it .can i do FRM

Hi Brijesh, yes, as there are no pre-requisites for FRM certification (https://www.300hours.com/articles/the-complete-beginners-guide-to-the-financial-risk-management-frm-qualification#frmrequirements). Given your risk-related work experience, all you have to do is pass both FRM papers and pay membership fees, then you should qualify for the FRM certification.

I want to take the online class for FRM level 1

I would like to know more about the CFA program