Finance certifications such as CFA and FRM are a cost effective way (compared to an MBA) to give your finance career a boost.

We do receive a lot of questions from our readers trying to understand the core differences between them in deciding whether to pursue CFA or FRM.

Hence, for those still on the fence, or particularly new to these designations: here’s a helpful, straight-to-the-point summary guide comparing CFA vs FRM.

Let’s take a look!

What is the CFA Program?

The Chartered Financial Analyst (CFA) Program is a professional, masters degree equivalent credential offered by the CFA Institute.

It gives you expertise and real-world skills in investment analysis, and has become a gold standard in the finance and investment management industry.

We’ve written a lot about the CFA program, check out these articles to learn more:

- What is the CFA Exam? A Useful Beginner’s Guide

- 7 Benefits of the CFA Charter You Should Know

- Is CFA Worth It?

What is the FRM Certification?

The Financial Risk Manager (FRM) certification is the leading certification for risk managers offered by Global Association of Risk Professionals (GARP). It is also a masters degree equivalent credential that is recognized globally.

With the FRM certification, you’ll obtain and hone your skillsets in identifying, analyzing, and mitigating risks at a high level, which is highly demanded by top firms and financial organizations globally.

We’ve covered quite a bit about the FRM certification too, check out these articles to learn more:

- What is the FRM Certification? A Great Beginner’s Guide

- FRM Exam Pass Rates: How Hard Are FRM Exams?

- FRM Fees: How Much Does It Truly Cost?

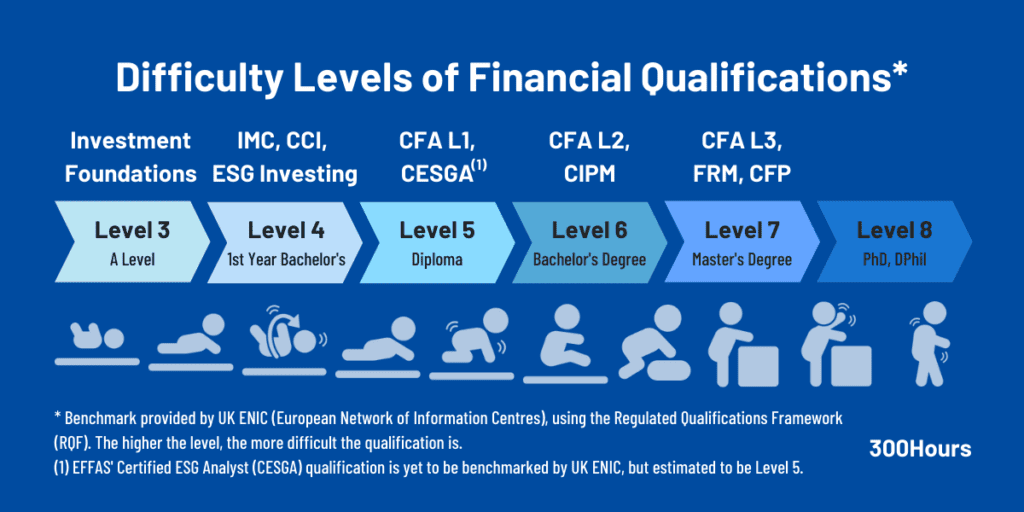

FRM vs CFA difficulty

Here’s one awesome chart to rule them all – the difficulty comparisons of various finance certifications 🙂

As you can see, completing CFA Level 3 or FRM are both Master degree equivalent programs, using a benchmark provided by UK NARIC (now renamed UK ENIC, thanks Brexit).

In short, both CFA and FRM are equally difficult in this sense, comparable to a Master’s degree course.

CFA vs FRM salary

First of, we are comparing apples and oranges here, as compensation varies by job function, location, seniority, specialization etc.

But to be constructive, let’s compare a “typical” CFA charterholder and FRM certified manager’s salary.

On average, a CFA charterholder in portfolio management makes US$126,000 base salary, with a total compensation of US$177,000.

A Financial Risk Manager’s average salary is US$102,000, with a total compensation of US$128,000.

CFA vs FRM: Summary of key differences

Here’s a quick summary comparing both designations:

| CFA | FRM | |

|---|---|---|

| Study Areas | 10 Topics: Ethics, Quantitative Methods, Economics, Financial Reporting & Analysis, Corporate Finance, Equities, Fixed Income, Derivatives, Alternative, Portfolio Management. | 10 Topics: Foundations of Risk Management, Quantitative Analysis, Financial Markets & Products, Valuation and Risk Models, Market Risk, Credit Risk, Operational Risk, Liquidity & Treasury Risk, Risk Management in Investment Management, Current Issues. |

| Exam Levels / Parts | 3 levels (fastest route is in 12-18 months) | 2 Parts (you can sit for both parts in one exam day) |

| Exam Frequency | From 2022, the CFA exams are run with an increased frequency: Level 1: 4x a year (Feb, May, Aug and Nov). Level 2: 3x a year (Feb, Aug and Nov in 2022; May, Aug and Nov from 2023 onwards). Level 3: Twice a year (May and Aug in 2022, Feb and Aug from 2023 onwards). See CFA exam dates article for more details. | Part 1: 3x a year (May, July, Nov) Part 2: Twice a year (May, Nov/Dec) See FRM exam dates article for more details. |

| Exam Format | Level 1: Multiple choice questions Level 2: Item set questions (multiple choice) Level 3: Item set and essay questions | Transitioning to computer-based exams from 2021 for all Parts: Part 1 & 2: Multiple choice questions |

| Pass Rates | The range of CFA pass rates since 2010: – Level 1: 36%-43% – Level 2: 39%-47% – Level 3: 46%-56% | The range of FRM pass rates since 2010: – Part 1: 39%-53% – Part 2: 50%-62% |

| Fees and Costs | One-off Enrollment Fee: $350 Registration fee (per level): $900-$1,200 | One-off Enrollment Fee: $400 Registration Fee (per Part): $600-800 |

| Study Hours Needed | At least 300 hours per level | 200-250 hours per part |

| Post Exam Requirements | To become a CFA charterholder: – Pass all the 3 levels of CFA exams; – 4,000 hours of qualified work experience; – Submit reference letters for 2-3 professional references; – Become a regular member of CFA Institute; – adhere to CFA ethics and professional conduct. | To become FRM-certified: – Pass both FRM papers; – a minimum of 2 years professional full-time work experience in the area of financial risk management or another related field; – maintain membership. |

| Career Opportunities | Investment analysis, portfolio management, securities research, pension, insurance, corporate finance | Financial risk management, treasury |

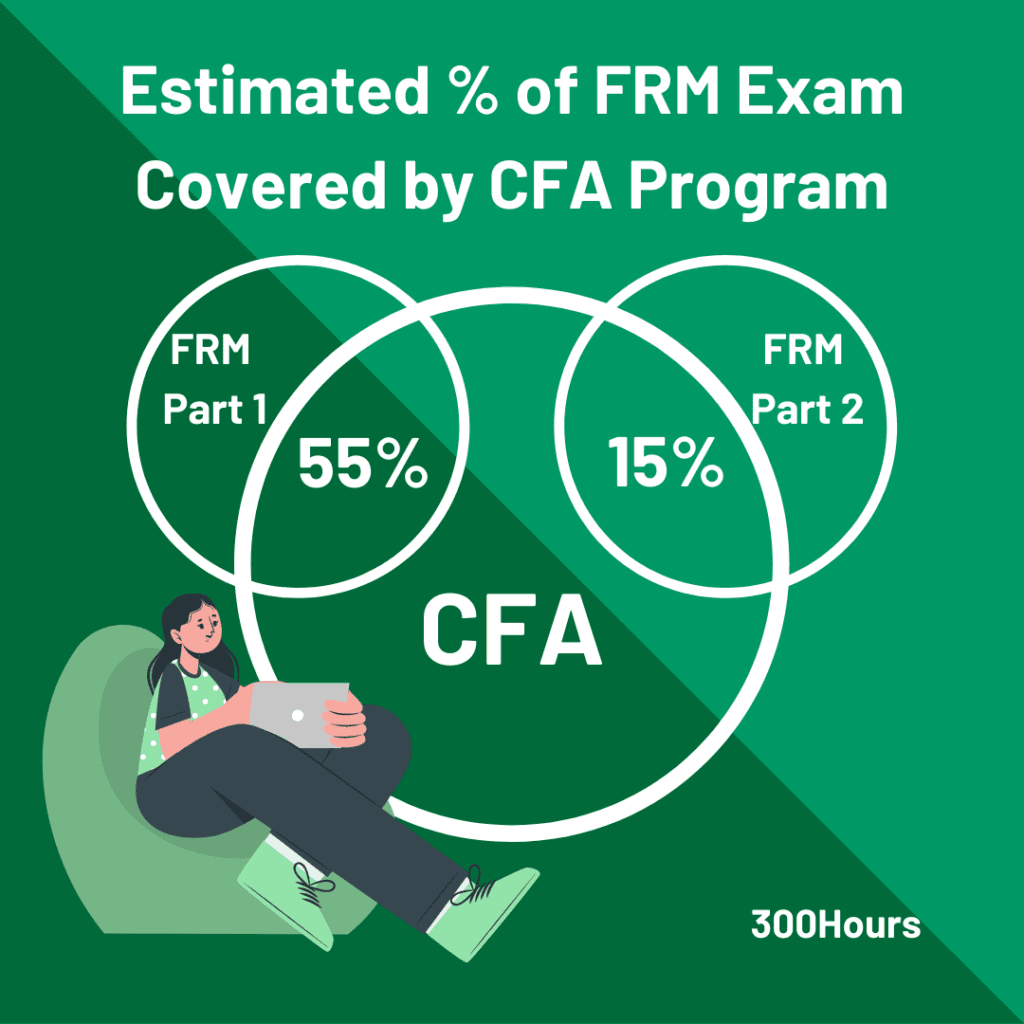

CFA and FRM: Are there any topic overlaps?

What about similarities between CFA and FRM?

A significant part of the FRM exam is covered by the CFA syllabus, with most of the overlap between these designations found in the FRM Part 1 exam.

We estimate that about 55% of FRM Part 1 is covered by the CFA program (all 3 levels), whereas that figure drops to about 15% for FRM Part 2.

This is an interesting insight for those who are keen on obtaining both CFA and FRM certifications (in the shortest possible time) for their career.

The FRM curriculum covers a variety of risk management topics and provides guidance on how to view these concepts in an integrated fashion.

The FRM exam is tested in two parts:

- the Part 1 exam focuses on the fundamental tools and techniques used to assess risk; whereas

- the Part 2 exam focuses on the application of those tools in practice and further examines the major subcategories of risk management (e.g. market, credit, and operational risk).

On the other hand, CFA exam is tested in 3 levels:

- Level 1 exam doesn’t assume any prior finance knowledge, and focuses on introducing various terms and concepts of the 10 topics.

- Level 2 exam builds on the foundation of Level 1, with a stronger focus on analyzing and applying the concepts learned.

- Level 3 exam is heavily focused on applying what you’ve learned holistically in portfolio management and wealth planning topics.

Let’s take a closer look at each FRM topic area and point out the main areas of overlap with the CFA curriculum.

Roughly 55% of FRM Part 1 is covered by CFA program

| FRM Part 1 Topics | CFA Level 1 Overlap | CFA Level 2 Overlap | CFA Level 3 Overlap |

|---|---|---|---|

| Foundations of Risk Management (FRM) | Portfolio risk & return | Corporate governance, portfolio concepts | Risk management, Evaluating portfolio performance |

| Quantitative Analysis (QA) | Probability & Statistics, Common probability distributions, sampling & estimations, hypothesis testing | Correlation & regression, multiple regression, time series analysis | – |

| Financial Markets & Products (FMP) | Market org and structure, Fixed income, Asset-backed securities, Derivative markets, Forwards, futures, options & swaps | FX rates, Commodity investing, Term structure & interest rates, Forwards, futures, options & swaps | Risk management of forwards, futures, options & swaps |

| Valuation & Risk Models (VRM) | Fixed income valuation, duration and convexity, option valuation | Arbitrage-free valuation, bonds with embedded options, option markets & contracts | Risk management, risk management of option strategies |

| Estimated % of FRM Part 1 covered by CFA Program | 25% | 20% | 10% |

About 15% of FRM Part 2 is covered by CFA program

| FRM Part 2 Topics | CFA Level 1 Overlap | CFA Level 2 Overlap | CFA Level 3 Overlap |

|---|---|---|---|

| Market Risk Measurement & Management (MR) | – | Term structure & interest rates | Risk management |

| Credit Risk Measurement & Management (CR) | Fundamentals of credit analysis | Credit analysis models, Asset-back securities: CDOs, Credit default swaps | Risk management |

| Operation Risk & Resiliency (ORR) | – | – | Risk management |

| Liquidity and Treasury Risk Measurement and Management (LTR) | – | – | Risk management |

| Risk Management and Investment Management (IM) | Portfolio risk & return, Alt investments: hedge funds | – | Risk management, Evaluating portfolio performance |

| Current Issues in Financial Markets (CI) | – | – | – |

| Estimated % of FRM Part 2 covered by CFA Program | 5% | 5% | 5% |

CFA or FRM: Which is right for you?

In short, FRM is highly specialized and has a stronger focus on risk management, whereas the CFA designation covers a broader scope of financial analysis and investment topics.

While the CFA designation opens up job prospects in the field of Research Analysis, Investment Banking and Portfolio Management, FRM on the other hand will open up opportunities in Banks, Treasury & Risk Management.

From a career building perspective, both FRM and CFA stand on equal footing as both are globally recognized designations with ample employment opportunities in their respective areas of expertise. Plenty of finance professionals obtain both qualifications to better perform in their roles and career.

It really depends on your preferred career route:

- if you’re into risk management, FRM is the clear choice.

- If you’re less sure but keen on a career in finance, perhaps CFA is a better choice for a broader finance base.

Hope this helps you decide which certifications you would like to go for (or both)! If you have more questions, just comment below and I’ll try to help 🙂

Meanwhile, you may find these related articles of interest:

Hi, I am a college student studying Financial Management, is it too early for me to learn how to pass CFA, even without prior knowledge or work experience? or can I attempt to take a CFA exam after graduating with a bachelor’s degree?

Hi. Currently, I work as an Operational Risk Specialist and have a goal to be a credit risk specialist. If the plan didn’t go as planned and I still work in the Operational Risk area. Will my 2-year professional fte as Operational Risk will be counted to get the FRM title? Please enlighten me about this.

Hi,

I work as a credit Risk Specialist and research in a Bank in India. I am supposed to professional certifications like CFA and FRM.

But I am confused which one to do first FRM or CFA. Can u pls help me out

Hi Aditya, it depends on your career goals? If you’d like to stay in risk management, FRM seems more relevant, although CFA does have greater global recognition in portfolio management roles. If you’re considering CFA and FRM, one of our readers has written a useful guide on how to get them both optimally. Hope these help!

Hi Aditya, first you should have to attempt CFA LEVEL 1,AND LEVEL 2ND afterthat you can go for FRM LEVEL 1 afterthat you can take a break for 1 year then clear the rest of attempts like CFA LEVEL3 &FRM LEVEL 2&3.

Hi,

Thanks for this informative article. I am working as a Credit Manager in a bank for assessment of Working Capital Finance since last 9 years. I wanted to know which certification will added value to my career and will I be able to get Charted holder for my experience??? Please clarify.

I currently work at a casino as a casino credit manager approving credit lines for guests, been doing it for over 11 years. Realistically speaking, can this possibly count towards the 2-year work experience for the FRM designation?

Hi. I have a Master in Petroleum, Energy Economics and Finance with 1 year experience as an economic and financial analyst. In the future, I want to work for big consullting firms. Should I do CFA or FRM?

What area of consulting are you interested in? Is it energy consultancy? Or general strategy consultancy? With the former, maybe you could apply for roles directly, with the latter, CFA is probably helpful, but without more details I wouldn’t know.

Good Read..!! I remember 5 yrs back I was really confused on what to choose, so i decided to do both.. 😀

hi am a b.com graduated in finance and taxation is ok for me to do CFA or FRM

You’d be eligible to do either. Hope that helps!

thanks a lot for the reply

May i get your contact , i really want to know more about u and u jobs … After doing cfa and frm

I’m a kyc analyst, working in an international bank. I did MBA in finance.To excel in my career now I want to do FRM or CFA but I’m little bit of confused which one is suitable for me according to my job role. So can you please help me to choose the right way.

I want to explore more in my career not to stick in my current job role.

Hello,

I hold a Masters in Portfolio Management, and specialization in Derivatives Pricing. I’ve 3 years of experience in OTC derivatives control and monitoring in Spain, and I’d like some advice of which certification could be either appropiate for me to do. Thank you

Hi Maria! I think the question for you is what do you want to do career wise? That would probably be a main driver on your decision on what certification to go for.

Hi,

I am a MBA graduate in finance and marketing. I am a tax consultant having 2 years of work experience in preparing corporate tax returns for UK entities. Am I eligible to register for CFA considering the requirements for registration after March 2021?

Thank you

Hi Amiya, do check out our CFA entry requirements article which details the enrollment criteria thoroughly. I think you would meet the requirement if you already had a Bachelor’s degree, OR your MBA studies were done prior to your 2 years of work experience. You should be able to clarify that in the article based on your circumstances.

Hello

I am a student of MBA(1st year), I want to do a course between this two course but I’m confused .

can you please clear my confusion.

Hi Souvik, it depends on your career goals, and it may be worth completing your MBA and getting some work experience beforehand. CFA and FRM are quite different and it specialises in different aspects of finance, so after a few years of work experience with your MBA you’ll know what career path you prefer, and then can decide accordingly.

i do not agree with the overlap you estimated, i think that considering all CFA 3 levels, you cover 50% of FRM program

PS: as you might know PRMIA allows CFA charteholders to skip PRM level 1 and go directly to L2!

I believe we worked with industry experts on this overlap estimate (providers and GARP if memory serves), rather than something we just estimated or made up.

Worth noting that 55% of FRM Part 1 and 15% of FRM Part 2 is 35% overall, which isn’t 50%, but not far off either.

You’re of course, free to disagree anyway 😊

Good Morning,

I have a MBA (International Business and Finance) – University of West Of Scotland.

Over 20 years work experience in Financial Management and Budgeting at Management Level.

How can I enroll to do CFA. Are there exemptions ?

You’re definitely eligible to register for the CFA exams. If you’re asking i.e. if you can skip any exams or levels due to previous education, qualification or work experience, I’m afraid there isn’t anything like that within the CFA Program.

Thank You

No problem!

I have 20 years of IT experience, all of them supporting finance groups. I want to understand the financial markets in greater depth, I have a superficial view – only from IT perspective. Would this certificate be suitable? Assuming I have very low actual finance knowledge but very good study ethics, would I be able to do at least Part 1?

For your profile I’d recommend CFA rather than FRM – FRM is specialized in risk, which might be a bit niche for what you’re interested in.

I passed all 3 levels starting from zero knowledge about finance, so it’s not impossible, or even improbable. You just need to put in the time. Good luck, and let us know how it goes!

Thanks a lot for such a nice and detailed writing