If you currently or aspire to work in finance, and have evaluated if MBA is worth it to you, a natural follow up comparison question could be: CFA vs MBA which is better for me?

Like most comparisons, the answer is – it depends.

Firstly, it’s not straightforward to compare a CFA charter and an MBA – they’re fundamentally different creatures addressing different disciplines.

At the same time, we recognize there is a real need to evaluate these two qualifications side-by-side these days, as many up-and-comers looking to reinforce their resumes look to these two qualifications and are not clear about what each can offer to them and their careers.

In trying to address this scenario, I have evaluated both qualifications based on the benefits gained from a career perspective, and the costs involved, to come up with a 9-point framework for you to assess which is better for your individual case.

Let’s go!

- #1. CFA charter: great for finance

- #2. MBA: more widely recognized outside of finance (but that is changing)

- #3. The CFA Program is more time-efficient

- #4. But you can expect to earn an MBA sooner than a CFA charter

- #5. CFA charter costs (a lot) less

- #6. CFA vs MBA salary: Which is higher?

- #7. CFA exam & MBA success rates are about equal

- #8. Both have great alumni networks

- #9. CFA vs MBA: Who says you have to choose?

#1. CFA charter: great for finance

The CFA charter is the qualification if you’re looking to build a successful careers in asset management, private wealth management, equity research or in ratings advisories in financial institutions.

In these sectors an MBA is likely less valuable compared to a CFA charter. A CFA charter will also be an asset in all other financial services, as well as additional recognition even outside of financial services especially in Asia and Middle East & Africa.

#2. MBA: more widely recognized outside of finance (but that is changing)

However, the MBA has the CFA charter beat in most industries outside finance.

Acquiring advance financial analytical skills does not have the same pizazz as an MBA in non financial industries (say, tech, advertising or manufacturing).

If you’re unsure of what industry you’re planning on spending the rest of your career in, an MBA might be a good consideration.

#3. The CFA Program is more time-efficient

The CFA charter holds an edge over an MBA in terms of time needed for preparation – although the CFA program demands an approximate minimum 300 hours worth of study per level, you can schedule these as you see fit.

As the CFA program is a distance-learning program, many candidates find it perfectly possible to squeeze in study preparation with a full-time position – hence you can continue accumulating work experience (not to mention continue earning) while studying for your qualification.

The MBA on the other hand, will require a typical 1-2 year full-time commitment, which can be a significant opportunity cost and impact your work experience.

#4. But you can expect to earn an MBA sooner than a CFA charter

Hang on a second.

Doesn’t this point directly contradict point #3? Not necessarily.

The shortest time period you can hope to complete your CFA exams is 12-18 months, assuming consecutive passes.

That said, the average time for a CFA exam candidate to completion is 4 years, which is 2 years longer than the average 2 years for an MBA.

Another point to remember is that the CFA charter will also require 4,000 hours relevant work experience in at least 3 years.

#5. CFA charter costs (a lot) less

The monetary cost for qualifying for the CFA exams depends on how many exams you need to get there and how much you spend on prep materials.

Typically this adds up to about $3,600 to $9,000 in total with consecutive passes, but can go up to $15,000 if you spend like crazy every exam, and/or failed several times.

Yet, this still pales in comparison to an MBA’s weighty $200,000 cost over the full term. Adding the opportunity cost of not working for a typical 2-year MBA makes the CFA program much, much more cost efficient however you slice it.

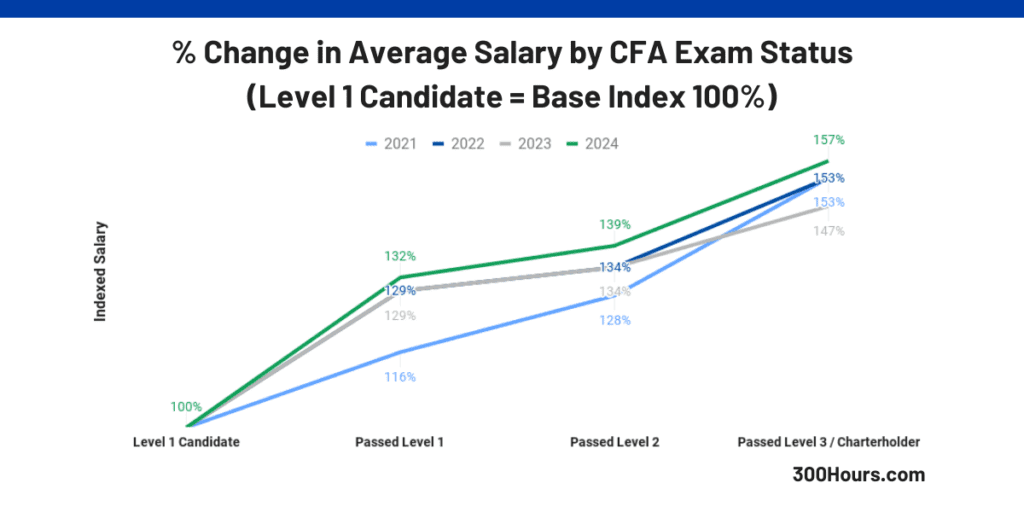

#6. CFA vs MBA salary: Which is higher?

From our extensive CFA salary research data, even after removing the work experience factor, there is a very clear increase in average pay as candidates progress through the CFA Program.

On average, submissions that indicated they passed CFA Level 3 or are CFA charterholders earned 57% more than those who had yet to pass CFA Level 1 exams.

According to Financial Times’ latest top 100 global MBA rankings, the median post-MBA salary for top 100 MBAs is $164,271, with a range of salary increase from 48%-249% after MBA.

This should be useful input to analyze which qualification would add more value to your career objectives.

#7. CFA exam & MBA success rates are about equal

Some arguments on the CFA Program vs MBA thread sometimes point to the CFA exam pass rates. About 40%+ of CFA exam candidates pass each year, compounding to a very low total pass rate across 3 levels. Comparing this to 95% pass rates at Harvard, surely that’s one point for the business school folks?

Not necessarily – that argument assumes you already have been accepted to a top-tier school like Harvard. If you factor in acceptance rates into a mid/top tier school, the chances of an average person acquiring a CFA charter and graduating with a mid/top-tier MBA are about the same.

#8. Both have great alumni networks

Both the CFA Institute and typical business schools maintain thriving global networks that will be further enhance your career.

However just like the studying process, I feel that to benefit from the CFA Institute network from a career perspective, a CFA charterholder has to be more driven and proactive compared to an MBA graduate.

It’s not a matter of alumni participation or events, it’s just that MBA events tend to be tuned towards a networking & business angle whereas CFA charterholder events can take on a more academic tone.

#9. CFA vs MBA: Who says you have to choose?

At the end of the day, there are many people who end up obtaining both a CFA charter and an MBA. If you’re hell-bent on making your CV the best damn piece of paper the world has ever seen, by all means take both – it’s in no way an either-or situation.

In the end, it’s all about your personal goals and situation:

- If you’re looking for a qualification to enhance your career in finance or establish your finance credentials, the CFA Program is the way to go.

- If you’re looking for a qualification to boost your career outside of finance, or looking to move across industries, an MBA might be a better bet.

Have you chosen CFA or MBA? Or both? Share your thoughts in the comments below, or check out our other MBA-focused articles:

- Why pursuing CFA after MBA makes sense

- Is an MBA worth it?

- CFA careers: What are typical job opportunities for CFA charterholders?

- 7 reasons why you should get the CFA charter

- CFA Salary – Here’s how much your pay increases with CFA

- Why top tier firms hire CFA charterholders

- Finance career change: Plan your Career Switch With Our Free Tool

- Finance Career Quiz: Which Career Fits Your Skills and Personality?

in todays hour what would pay me more a cfa charter or an MBA. i am a second year grad student and not able to decide what to start with CFA OR MBA.

Hi Sam, that’s a tough question to answer because salary is based on not just your qualifications (CFA or MBA), but a myriad of other reasons like seniority, job sector, what speciality, etc. In our view, the decision to take CFA or MBA shouldn’t be based entirely on salary, but your interest as well, as the biggest salaries are obtain at a most senior level, but you won’t last or perform well to gain such experience at a senior level if you don’t even enjoy your work at a junior level. Play the long term game and enjoying your work is what we think works best in the long run!

If you can use your after work time, and if your goal is to really learn about finance knowledge, CFA is a better path. If your goal is to switch career path, and you have tons of money to waste just to network, in-person MBA is probably the one. But if you can be more proactive and find yourself the network platform, I think $200K is better to be invested in SP500 or as a down payment of a $1 mil house.

Views on MBA + CFA?

See here: CFA + MBA – who says you have to choose?

Ultimately I think it’s not a great use of your spare time to try and get both. Spend some time to ask yourself which qualification would really suit you, and focus on that.

MBA is a tremendous leap ahead of a CFA today. Indeed, one of the reasons made me laugh – #3. The CFA Program is more time-efficient – its a hell if you`re working especially if really busy at work. Truth is, data science is done a lot better by ML and the only position left for humans in the 10Y future is in private equity and to some extent – analysis but not the one you study in the CFA for. Industry`s shift towards AI is so strong that a CFA today holds very little, if any, value. 10Y ago it was seen as a “good to have”. Now no one in the industry cares if you got one and won`t even make you go for it. Invest your time wisely.

Same as MBA degree holder. You really think an average MBA program will prep you enough knowledge of any of those finance topics? MBA is purely for networking and changing career path. These days many MBA programs have gone online (they call it EMBA) and you can’t even leverage the networking benefit anymore. But you still have to pay like $200K and spend at least 1.5 years full time (so no income coming in) to finish one. Or 3-4 years part time, just to finish the course requirements while you learn almost everything that can be replaced by ChatGPT.

Can I vote neither? You’re probably better off doing Computer Science or some new trendy field if you’re a high school graduate today. If you did a BA in Liberal Arts at some tiny state school, I don’t know, depends how bad you want to break into finance. Now they have these coding academies the days of even needing a Bachelors degree has come to an end at some big firms. Other firms will always price the fancy schools and the fancy letters, but if you just want money, the ROI for a BSc. in Computer Science assuming you can get hired at say Google fresh out of school has to be pretty high.

You’re not wrong. I think it depends on areas of specialization – not everyone is CS-inclined, whereas in most situations you can arguably boost your career with an MBA, and also arguably everyone should be financially literate, although not necessarily to CFA-level. If you’re looking at a non-engineer role at Google (and even within engineer ranks), those guys prize CFAs and MBAs too! 🙂

Bingo! Not going it pays higher, if you could survive a CS degree, you can easily learn the finance stuff from the either CFA or an MBA program.

Hi, I am from Pakistan. I am almost done with my CA (similar to CPA but much more rigorous) and I am appearing in CFA L3 in June 2019. I have 3.5 years big four audit experience. I had to work in audit to satisfy the CA work experience requirement. Now, once I get the CA, hopefully in 6 months, and pass L3, I am planning to join some asset management firm. I should be able to get into some roles here based on this CA/CFA but someone told me that MBA from top business school would help a lot if I want to work in developed markets. I am sure I need an MBA, because so far I have studied via distance learning and I believe MBA will add a lot in terms of soft skills let alone the networking and branding opportunities. But I think an MBA from a school other than any of the top-15 schools would not be a good idea keeping in view my career level and the investment needed. I am also looking for schools with global outlook. Can you suggest a few schools that fit me well? My second question relates to timing of my MBA. Right now I am taking a 6 months break after audit (and working on a small start-up) together with focusing on exam preparation. Once I am done with this, I’ll try to find a research role and once I get it, I’ll apply straight away to 4 or so schools. Since the process takes a year or so, I hope to have accumulated at least 1 year of relevant experience. Do you think audit is a little relevant too to research role (especially the financial analysis part)? I read somewhere that big schools don’t like people with audit backgrounds. Is it true? There is a long story behind switching from audit to finance and I hope that would make a good essay 🙂 Any critical input is welcome. Thanks

Hi Obaid The first question to ask is: since your end goal is a job in developed markets, is getting an MBA really an answer, or should you just start applying to jobs you want? An MBA takes 2 years to complete – in that time, if you’ve completed a series of internships or other roles, you’d be much more hireable than any fresh MBA. Given that you’ve already gotten a CA and CFA at that time, you should think carefully about whether going for another qualification is the right thing if getting a job is your main concern. We talk about this more here: https://300hours.com/does-cfa-help-you-get-a-job/ I’m not familiar with the pros and cons of audit backgrounds, but having hired quite a few people myself, here are some important points: 1. Your CV gets you the interview, and for your CV to do that, it needs to stand out. Having a lot of qualifications helps in standing out, but so does having done something unusual. Having started your own company, sporting achievements – anything goes. I decided to interview someone for a finance role once because the CV was so unusual – a plastic surgeon who decided to switch careers. 2. Your own charisma and self-confidence during the interview gets you the job. No other way, unfortunately, so if you’re not the assertive, speak-up types, you’ll need to learn to be one. No amount of qualifications will compensate for that in hunting for jobs. Hope this helps. Good luck and I hope to see you around again soon!

Hi Obaid,

How is this going? I am on exactly the same path as you, taking a break after 3.5 years in audit. Completing my exams and trying to switch into finance full time. I would really love to know how it went for you

Very useful, thanks! I am currently thinking about these two paths. This gives me a lot of perspective!