Did you know that 45% of CFA candidates pursue the charter for career-related reasons? But what are the typical Chartered Financial Analysts’ (CFA) careers? What can you do with a CFA charter?

It is crucial to understand the potential job opportunities and flexibility that a CFA designation offers, and this applies regardless if you’re:

- considering the CFA designation;

- an existing CFA candidate; or even

- a CFA charterholder

And that’s exactly what we want to address with this data-driven career guide. This CFA career guide gives you a holistic view of what typical CFA job opportunities there are, by addressing some of the common career planning questions such as:

- What are the potential CFA career paths of charterholders? What can you do with a CFA charter?

- Given my current job, what alternate career paths can I switch to with a CFA charter?

- How “easy” is it to switch from current job sector to career “Y”?

Are there jobs that require the CFA designation?

Before we start, I thought we should address this common question we get asked.

Unlike the legal and accounting professions, CFA is not a regulatory requirement for a job in finance, even in the investment management arena.

That said, CFA is increasingly preferred and required in the investment management sector, especially when seniority increases.

As you’ll see further below, the CFA designation is valued not just in the investment management sector, but well recognized in the broader financial services industry globally.

There are benefits of obtaining the CFA charter, which to a certain extent depends on your individual career goals and aspirations – let’s explore them below!

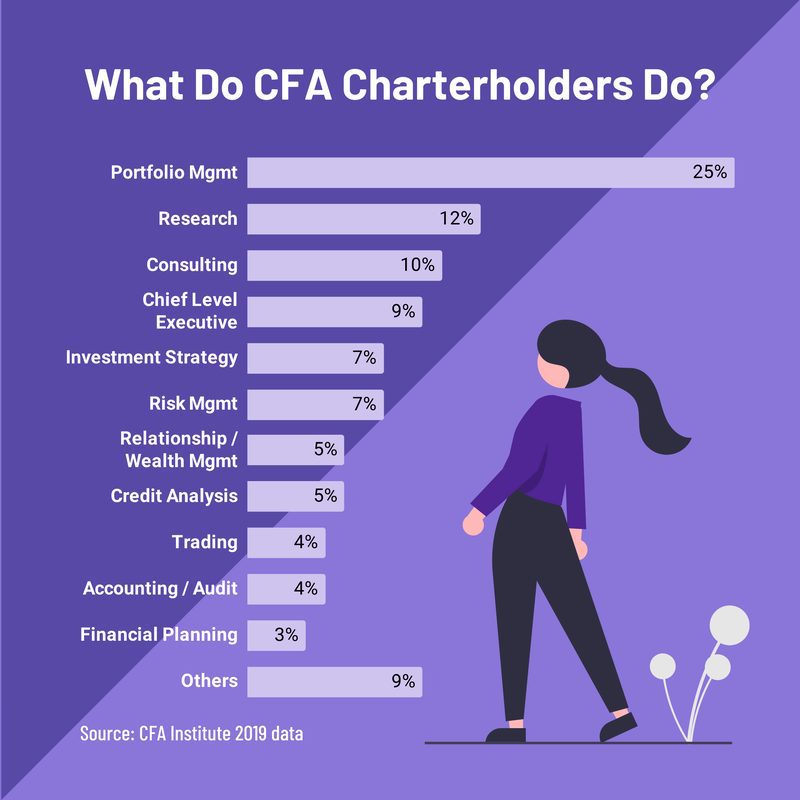

CFA careers: What do CFA charterholders do?

As expected, Portfolio Management and Research (i.e. investment analysis) dominate the sectors most CFA charterholders currently work in at 25% and 12% respectively. It’s not surprising as the CFA designation focuses on the investment management sector where these 2 sectors are most applicable to.

More importantly, what is interesting about this data is the broad applicability of the CFA charter in various other finance professions. Some worth noting are:

| Job Functions (% of CFA Charterholders) | Commentary |

| Consulting (10%) | Consulting firms are professional services firms that provide audit, financial advisory, management consulting, risk, and tax services. At third place with 10%, this trend has been gaining pace since 2014 where only 6% of CFA charterholders were in Consulting. This may be due to an increased investment in human capital by professional services consulting firms in general, or reflecting a greater demand for specialized knowledge when advising financial services clients. |

| Chief Executive Level (9%) | Reflects a combined total of Chief Investment Officers (CIO), Chief Financial Officer (CFO) and Chief Executive Officer (CEO), in that order. Not a job function you can target outright at a junior level obviously, this just shows experienced CFA charterholders can continue to climb the career ladder over the years and end up as either CIOs, CFOs or CEOs. |

| Investment Strategy (7%) | Investment strategists are responsible to develop investment ideas and asset allocation recommendations to portfolio management teams within the firm. Arguably a separate form of research function, this role is highly analytical and quantitative, with a strong background in economics or statistics a great plus. |

| Risk Management (7%) | CFA remains a popular qualification for this role, increasing from 5% (2014) to 7% of CFA charterholders working in this function. |

| Relationship / Wealth Management (5%) | Commonly known as Relationship Managers (RMs), private bankers or investment consultants, they provide investment management advice and other wealth-related services to individuals and their families. The proportion of CFA charterholders working in Wealth Management has been stable at 5% since 2014. RMs are essentially the retail portfolio managers (for retail/individual investors), whereas Portfolio Managers (PMs) usually refer to institutional portfolio managers. |

| Financial Planning (3%) | CFA charterholders working as financial planners has declined from 5% (2014) to 3% currently. This probably reflects the availability of other well-recognized qualification for this function such as CFP, which is more targeted, cost effective and easier to obtain. |

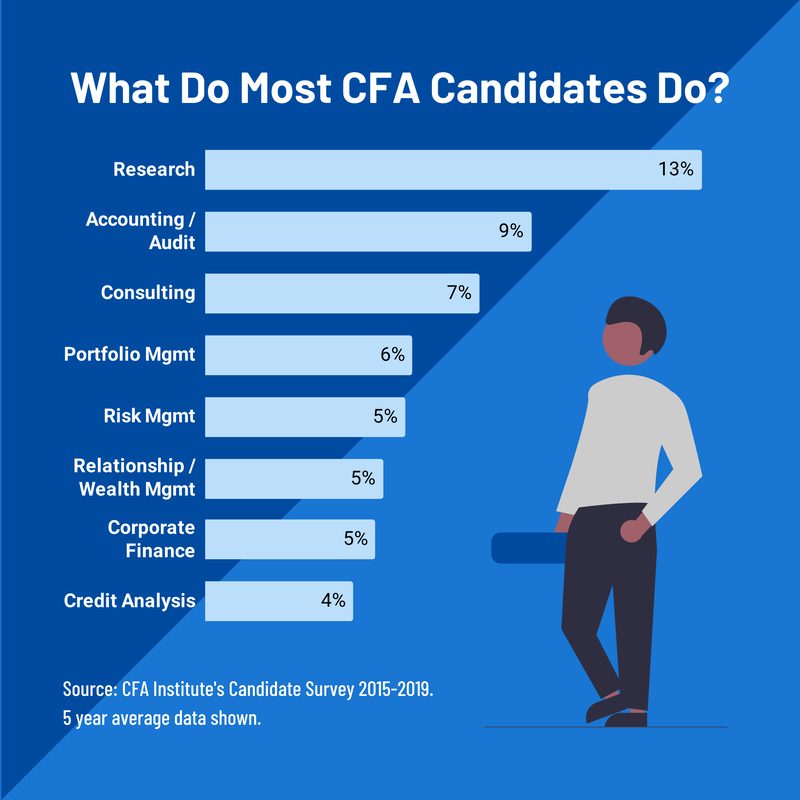

What do most CFA candidates currently do?

Looking at current employed CFA candidates’ job functions, the trend is pretty stable across 2015-2019, which is helpful to our insights:

- Students form a significant portion of candidates: Data above reflects employed candidates’ roles (c. 70% of survey participants), and excludes students (23% of survey respondents). Quite a significant amount of candidates are students who are starting their CFA journey before graduating in hope of better graduate job opportunities.

- Accountant and auditors using CFA as a means to switch careers: 9% of CFA candidates coming from an accounting or auditing background (second highest group after Research), but only 4% of CFA charterholders that stayed in that career. Based on the survey data in the next section, this ties in with the view that CFA candidates currently in accounting/auditing roles are taking the CFA exams in hope to switch careers into other areas of finance (especially Corporate Finance, Investment Banking and Financial Planning).

- Portfolio Management is a popular target career for CFA candidates: With only 6% of CFA candidates in the portfolio management sector compared to 25% of CFA charterholders, the CFA qualification is likely an effective way for candidates to move into this sector. Yes, we have data on this in the next section 🙂

- Candidates also take the CFA exams for career advancement: On average, there are a few other job functions (e.g. Relationship / Wealth Management, Credit Analysis, Consulting and Risk Management) that have similar proportions with the CFA charterholder %. Rather than just for switching careers or job functions, the CFA charter is also used by candidates to further advance in their chosen career path.

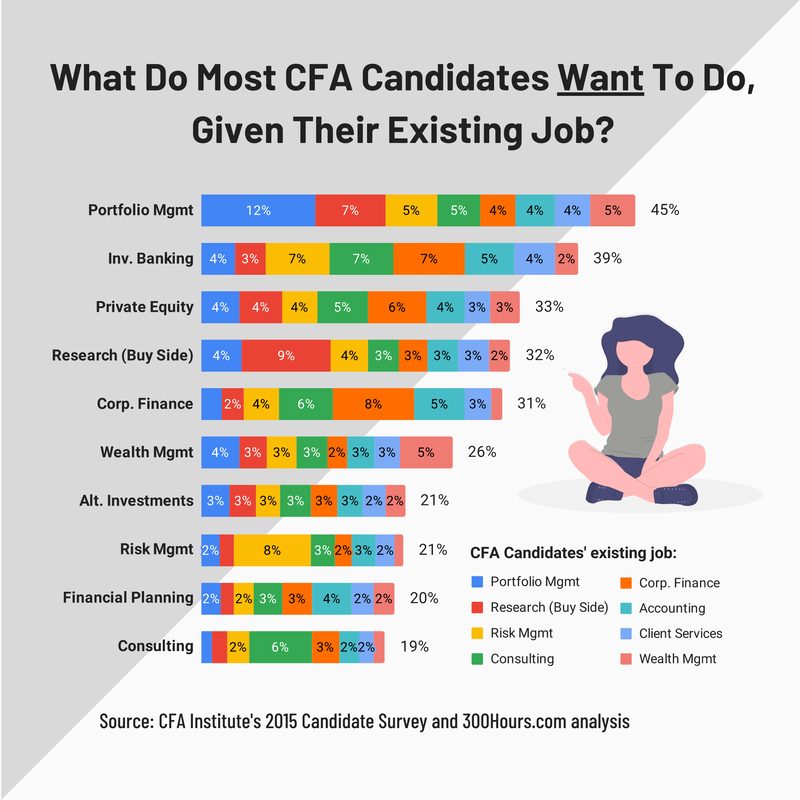

What jobs are CFA candidates interested in pursuing, given their existing roles?

OK great, so we have seen the data on what CFA charterholders and current candidates do for a living. Now what?

Well, what would be interesting to add to this analysis is if we have data on current candidates’ desired career path, given their current job.

And we found just that from CFA Institute’s 2015 candidate survey. Despite being an older dataset, we believe the trend is relatively stable across the years, which would be useful starting point as these information are no longer published in subsequent annual candidate surveys.

Why would it be useful, I hear you ask? With this data, we can get more insights into:

- What finance sectors are popular target careers for CFA candidates in general – this provides an indication on the CFA designation’s relevance and value in specific sectors;

- For a given interest in a target job sector, what jobs are these candidates currently working in? This could provide a gauge of the difficulty of switching from a current role to the target career path;

- For a given job sector a candidate currently works in, what are the most popular target career paths? Again, this could provide a sense of realistic yet relevant potential exit options for other candidates who are considering a career switch.

There’s lots of information to digest in the chart above, let’s go through them thoroughly. Ready?

Most CFA candidates expressed interest in exploring more than 1 sector over the next 5 years, which would make sense at this stage to keep options relatively open. This ties in with the survey observation that nearly half (48%) of the CFA candidates are looking to change job functions.

The top 10 job sectors CFA candidates have expressed interest in pursuing over the next 5 years are:

1) Portfolio management (45% of CFA candidates)

- 45% of CFA candidates surveyed are keen to explore a Portfolio Management (PM) career. Here are the details of the top 3 groups interested in PM:

- 12% of candidates are currently in Portfolio Management and want to stay in their preferred sector. This group is likely using the CFA credential to gain further knowledge for career advancement.

- 7% and 5% of candidates are currently in Buy-side Research and Risk Management respectively.

- As mentioned above, most CFA candidates currently working in PM want to stay on this career path. However, of those who wanted to switch sectors, the most popular choices are Buy-side Research, Private Equity, Wealth Management and Investment Banking.

2) Investment banking (39% of CFA candidates)

- 39% of CFA candidates surveyed are keen to explore an Investment Banking (IB) career. Here are the details of the top 3 groups interested in IB:

- 7.4% of candidates are currently in Corporate Finance, but keen to explore an IB career path. This is perhaps not surprising given the many similarities and transferable skills between Corporate Finance and IB jobs.

- 6.6% of candidates each are currently in Risk Management and Consulting respectively.

3) Private equity (33% of CFA candidates)

- 33% of CFA candidates surveyed are keen to explore a Private Equity (PE) career. Here are the details of the top 3 groups interested in PM:

- 6% of candidates are currently in Corporate Finance.

- 5% of candidates are currently in Consulting.

- 4.4% of candidates are currently in Buy-side Research.

4) Buy-side research (32% of CFA candidates)

- 32% of CFA candidates surveyed are keen to explore a Buy-side Research career. Here are the details of the top 3 groups:

- 9% of candidates are currently in Buy-side Research and want to stay in their preferred sector. This group is likely using the CFA credential to gain further knowledge for career advancement.

- 4% of candidates each are currently in Portfolio Management and Risk Management respectively.

- Most CFA candidates currently working in Buy-side Research would like to stay in this career path. However, of those who wanted to switch sectors, the most popular choices are Portfolio Management, Private Equity, Investment Banking and Wealth Management.

5) Corporate finance (31% of CFA candidates)

- 31% of CFA candidates surveyed are keen to explore a Corporate Finance (CF) career. Here are the details of the top 3 groups:

- 8% of candidates are currently in CF and want to stay in their preferred sector. This group is likely using the CFA credential to gain further knowledge for career advancement.

- 6% of candidates are currently in Consulting.

- 5% of candidates are currently in Accounting. As a side note, Corporate Finance, Investment Banking and Financial Planning are the top 3 choices for candidates who are currently in the Accounting sector and are looking to switch careers.

- Most CFA candidates currently working in CF would like to stay in this career path. However, of those who wanted to switch sectors, the most popular choices are Investment Banking, Private Equity and to a smaller extent Portfolio Management.

6) Wealth management (26% of CFA candidates)

- 26% of CFA candidates surveyed are keen to explore a Wealth Management (WM) career. Here are the details of the top 3 groups:

- 5% of candidates are currently in WM and want to stay in their preferred sector. This group is likely using the CFA credential to gain further knowledge for career advancement.

- 4% of candidates are currently in Portfolio Management.

- 3% of candidates each are currently in Risk Management and Consulting respectively.

- Most CFA candidates currently working in WM would like to stay in this career path. However, of those who wanted to switch sectors, the most popular choices are Portfolio Management, Private Equity and Investment Banking.

7) Alternative investments (21% of CFA candidates)

- 21% of CFA candidates surveyed are keen to explore an Alternative Investments career.

- Alternative Investments includes any assets that do not fall into the traditional asset class categories of equity, fixed income or cash. It includes derivatives, venture capital, private equity, real estate, commodities, hedge funds, arts and antiques. For the purposes of this article, we’ve excluded Private Equity from Alternative Investments as its own separate category.

- Interests in Alternative Investments are quite evenly spread across the CFA candidates currently working in various other sectors (2-3% of total candidates each).

For those interested in an Alternative Investments career, do check out this more specialized designation:

8) Risk management (21% of CFA candidates)

- 21% of CFA candidates surveyed are keen to explore a Risk Management career. Here are the details of the top 3 groups:

- 8% of candidates are currently in Risk Management and want to stay in their preferred sector. This group is likely using the CFA credential to gain further knowledge for career advancement.

- 2.5% of candidates each are currently in Consulting and Accounting respectively.

- From the above, it would seem that Risk Management is not a popular choice for career switchers from other job functions, but most candidates who are currently working in that sector are happy to stay and advance in their preferred career path. However, of those who wanted to switch sectors, the most popular choices are Portfolio Management, Investment Banking and Buy-side Research.

For those interested in a Risk Management career, do check out this more specialized designation:

9) Financial planning (20% of CFA candidates)

- 20% of CFA candidates surveyed are keen to explore a Financial Planning (FP) career. Here are the details of the top 3 groups interested in FP:

- 4% of candidates are currently in Accounting.

- 3% of candidates each are currently in Consulting and Corporate Finance respectively.

For those interested in a Financial Planning career, do check out this more specialized designation:

10) Consulting (19% of CFA candidates)

- 19% of CFA candidates surveyed are keen to explore a Consulting career. Here are the details of the top 3 groups:

- 6% of candidates are currently in Consulting and want to stay in their preferred sector. This group is likely using the CFA credential to gain further knowledge for career advancement.

- 3% of candidates are currently in Corporate Finance.

- 2% of candidates are currently in Risk Management.

- Most CFA candidates currently working in Consulting would like to stay in this career path. However, of those who wanted to switch sectors, the most popular choices are Investment Banking, Corporate Finance and Private Equity.

I hope you’ve found this article useful for your career planning and decision on whether the CFA designation is right for your career goals.

If you’re not sure what finance career path to pursue, we highly recommend using our Finance Career Quiz to match you to a job that best suits your personality.

Meanwhile, here are a few related articles that may be of interest:

I need all the advisement and help in changing my career growth pathway.

I have just finished Devry’s Master’s in Accounting Science.

I am into the Master’s in Information Technology specialization with Cloud.

I am six classes from the Devry’s in MBA in finance.