Note: This article is for the new 2025 curriculum. For last year’s info, check out our article on 2024 CFA curriculum changes.

The new 2025 CFA curriculum is now out for all 3 levels, with some exams already open for registration.

With CFA Program’s big revamp hopefully done (for at least 5 years we hope), the major change this year is focused on CFA Level 3’s exam structure.

As usual, we have done all the hard work to compare and check all the 2025 CFA curriculum changes for each level, in a simple one pager summary just for you! ☕

Here’s a quick headsup on the latest CFA curriculum changes 2025 for all Levels that you should know.

Some fun facts on the 2025 CFA curriculum updates:

- CFA Level 1 and Level 2 is largely similar as 2024, except a few Learning Modules (LMs). That’s good news for those who need/want to reuse 2024 books for studying.

- There are major changes in CFA Level 3’s curriculum in 2025 with the Specialized Pathways introduction. Although there are some readings left untouched in this upheaval, it is probably best to focus on the latest books for revision.

Read on to find out more!

Why are CFA curriculum changes and topic weights important?

Topic weights are key to CFA study plans, as it guides candidates on the importance of each topic for the exams. Needless to say, higher weighted topics deserve more study time, focus and practice.

With the recent major changes in CFA curriculum, knowing the nuanced changes in advance are useful in certain circumstances, for example:

- Candidates who have yet to register for the 2025 exam, yet want to get a head start on reading existing 2024 study materials. They need to make sure that what they are studying now will be part of the updated curriculum;

- Candidates who are interested in getting second hand, previous year versions of third party study materials for the next exam; or

- Candidates who (unfortunately) failed a current year exam, and are planning to retake in 6-12 months time. Existing third party study materials may be re-used if the curriculum changes are minor between these 2 years.

Here are the quick summaries of the topic weights and curriculum changes that you need to know for your exam.

For each level, there is also a free 1 pager summary PDF you can download at the end of each section.

CFA Level 1 topic weights

Since 2021, CFA Institute changed CFA Level 1’s topic weights to be a range rather than an absolute % as per previous years.

There are no changes to 2025’s CFA level 1 topic weights compared to 2024’s.

| CFA Level 1 Topic Weights | 2023 | 2024 | 2025 |

|---|---|---|---|

| Ethics | 15-20% | 15-20% | 15-20% |

| Quant Methods | 8-12% | 6-9% | 6-9% |

| Economics | 8-12% | 6-9% | 6-9% |

| Financial Statement Analysis | 13-17% | 11-14% | 11-14% |

| Corp. Issuers | 8-12% | 6-9% | 6-9% |

| Equity | 10-12% | 11-14% | 11-14% |

| Fixed Income | 10-12% | 11-14% | 11-14% |

| Derivatives | 5-8% | 5-8% | 5-8% |

| Alt. Investments | 5-8% | 7-10% | 7-10% |

| Portfolio Mgmt. | 5-8% | 8-12% | 8-12% |

What’s interesting to see about 2024’s CFA Level 1 topic weights changes is its more practical focus on Equity, Fixed Income, Alternative Investments and Portfolio Management, at the expense perhaps more theoretical topics such as Quantitative Methods, Economics, Financial Statement Analysis and Corporate Issuers.

These changes are done to sharpen the focus of the curriculum to ensure that candidates can apply their skills on-the-job earlier whilst preparing for CFA Level 1.

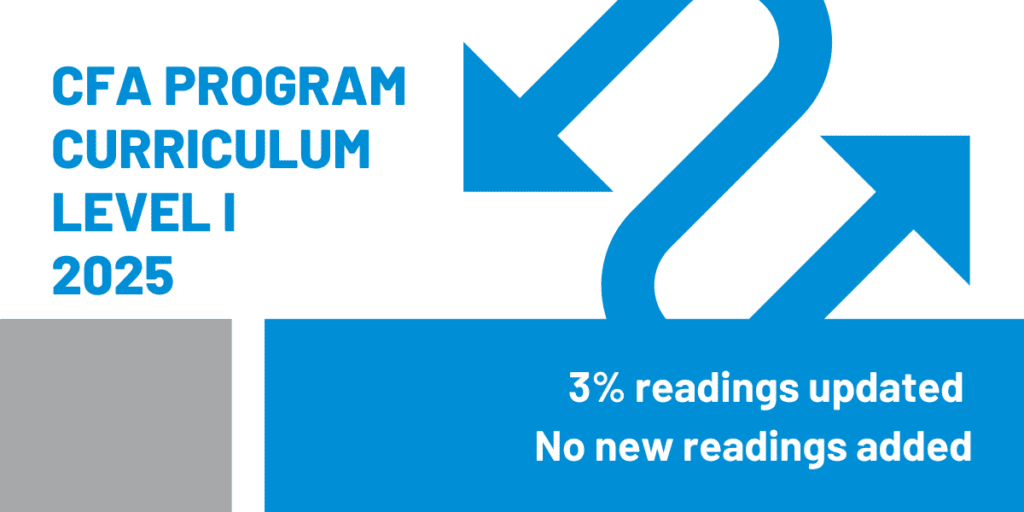

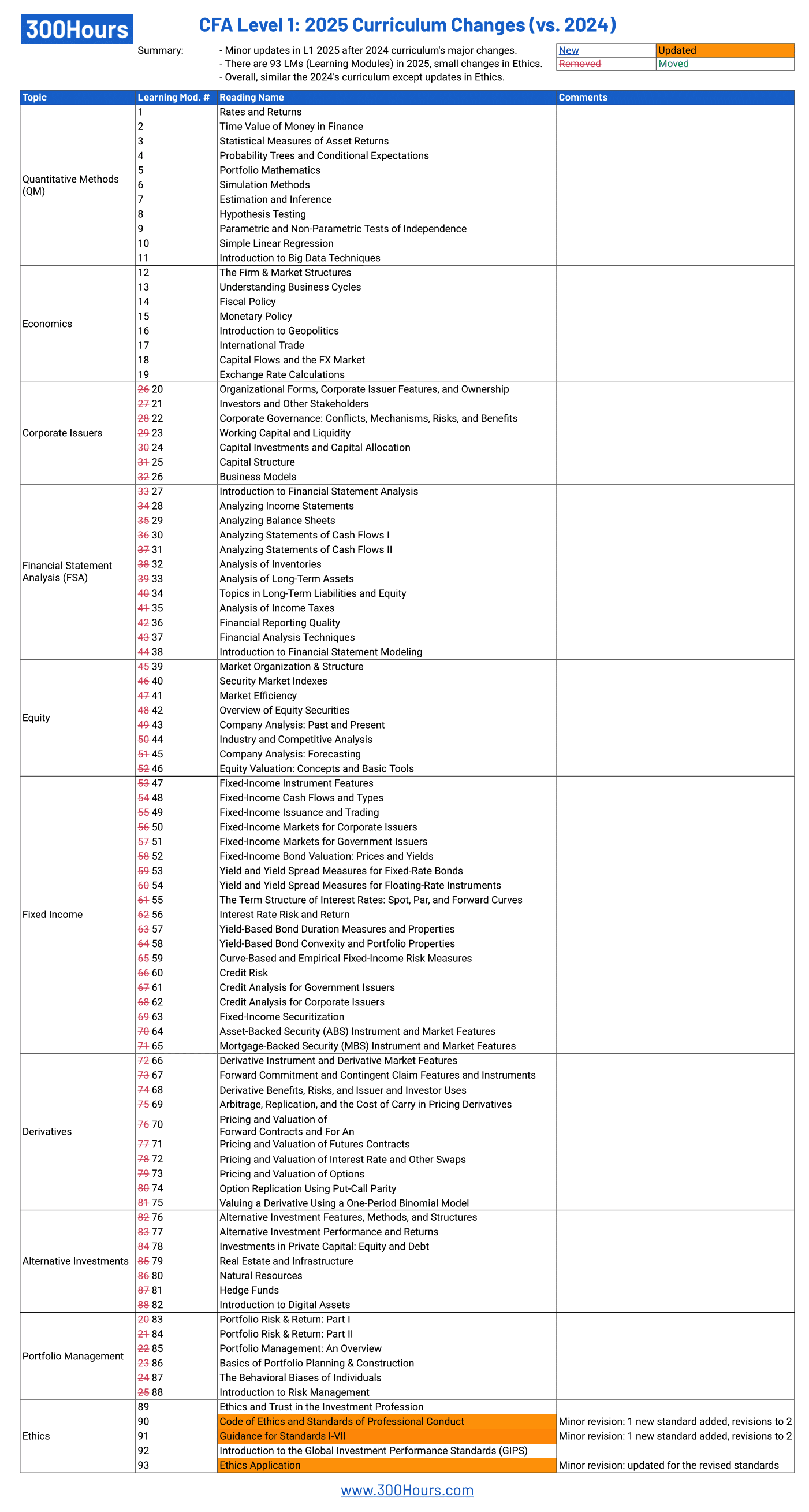

CFA Level 1 curriculum changes 2025

Since the major change last year, CFA Institute has thankfully focused on continuity of syllabus and retained the same readings in 2025.

In short, all learning modules are the same except some minor updates in 3 chapters of Ethics (not just in Level 1 but all levels). These chapters are updated to reflect the inclusion of one new standard and revisions to two existing standards.

There are 93 Learning Modules in 2025’s Level 1 Curriculum, no change from 2024.

Overall, there are very minor changes to 2025’s CFA Level 1 curriculum, with a few chapters in Ethics updated.

Majority of the topics remain largely the same as last years, and 2024’s books can most likely be used to get a headstart in reviewing study materials given the minimal change in 2025.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

CFA Level 2 topic weights

Similar to CFA Level 1, there are no changes to 2025’s CFA level 2 topic weights compared to 2024’s.

This is as expected given historical trends of reducing the variability in topic weight across the 10 topics, with a maximum range difference of 5% per topic.

These changes may have been done to discourage candidates from purely just focusing on the (previously) big 5 topics of Level 2 (FSA, Corporate Finance, Equity Investments, Fixed Income and Derivatives).

Based on 2025’s topic weighting, it is even possible for the 10 topics to be tested evenly at 10% weighting each for CFA Level 2.

This is where the discussion on optimal Level 2 study order gets interesting!

| CFA Level 2 Topic Weights | 2023 | 2024 | 2025 |

|---|---|---|---|

| Ethics | 10-15% | 10-15% | 10-15% |

| Quant Methods | 5-10% | 5-10% | 5-10% |

| Economics | 5-10% | 5-10% | 5-10% |

| Financial Statement Analysis | 10-15% | 10-15% | 10-15% |

| Corp Issuers | 5-10% | 5-10% | 5-10% |

| Equity | 10-15% | 10-15% | 10-15% |

| Fixed Income | 10-15% | 10-15% | 10-15% |

| Derivatives | 5-10% | 5-10% | 5-10% |

| Alt. Investments | 5-10% | 5-10% | 5-10% |

| Portfolio Mgmt. | 10-15% | 10-15% | 10-15% |

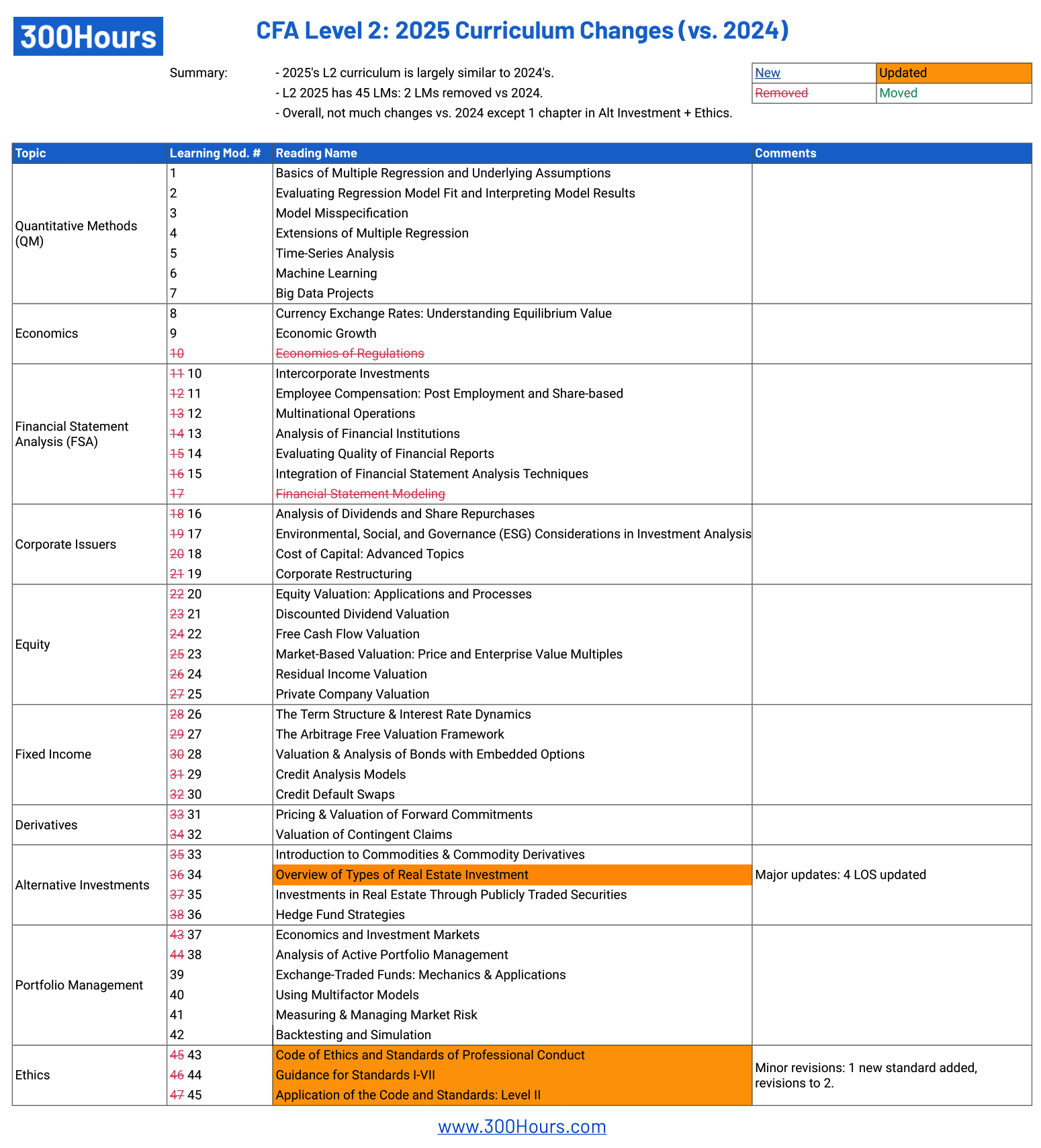

CFA Level 2 curriculum changes 2025

Similarly, Level 2’s curriculum experienced a small update this year. Some notable changes are:

- Alternative Investment’s “Overview of Types of Real Estate Investment” Learning Module (LM) received a complete update with most of the LOS changed/updated, despite retaining the same LM name as 2024.

- As per Level 1, there are some minor updates in 3 Ethics LMs as well to reflect the inclusion of one new standard and revisions to two existing standards.

There are 45 LMs in 2025’s CFA Level 2 Curriculum (vs. 47 in 2024):

- 2 Learning Modules from 2024 were removed:

- LM 10: Economics of Regulations

- LM 17: Financial Statement Modeling

All 3 LMs in Ethics were updated: Code of Ethics and Standards of Professional Conduct, Guidance for Standards I-VII and Application of the Code and Standards: Level II.

Overall, 2025 CFA Level 2’s curriculum experienced a small update, with only Alternative Investments and Ethics experiencing having major changes in some LMs.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

CFA Level 3 topic weights

Well, CFA Level 3 just experienced one of the biggest change in structure for 2025 (and beyond). There are significant changes to 2025’s CFA level 3 topic weights compared to 2024’s, namely the introduction of a “core” curriculum and an elective part, i.e. Specialized Pathways:

- The core Level 3 curriculum is studied by all candidates and takes up 65-70% of the exam weight. It consists of a more focused range of topics such as Asset Allocation, Portfolio Construction, Performance Measurement, Derivatives and Risk Management, and Ethics.

- Candidates can then choose one of three Specialized Pathways (30-35% exam weight): Porfolio Management, Private Wealth or Private Markets.

| CFA Level 3 Topic Weights | 2023 | 2024 | 2025 |

|---|---|---|---|

| Core Topics (65-70% total exam weight) | |||

| Asset Allocation | – | – | 15-20% |

| Quant Methods | – | – | – |

| Economics | 5-10% | 5-10% | – |

| Financial Statement Analysis | – | – | – |

| Corp Issuers | – | – | – |

| Equity | 10-15% | 10-15% | – |

| Fixed Income | 15-20% | 15-20% | – |

| Derivatives | 5-10% | 5-10% | 10-15% |

| Alt. Investments | 5-10% | 5-10% | – |

| Portfolio Management / Construction | 35-40% | 35-40% | 15-20% |

| Performance Measurement | – | – | 5-10% |

| Ethics | 10-15% | 10-15% | 10-15% |

| Specialized Pathways (30-35% exam weight, choose 1) | |||

| Pathway A: Portfolio Management | – | – | 30-35% |

| Pathway B: Private Markets | – | – | 30-35% |

| Pathway C: Private Wealth | – | – | 30-35% |

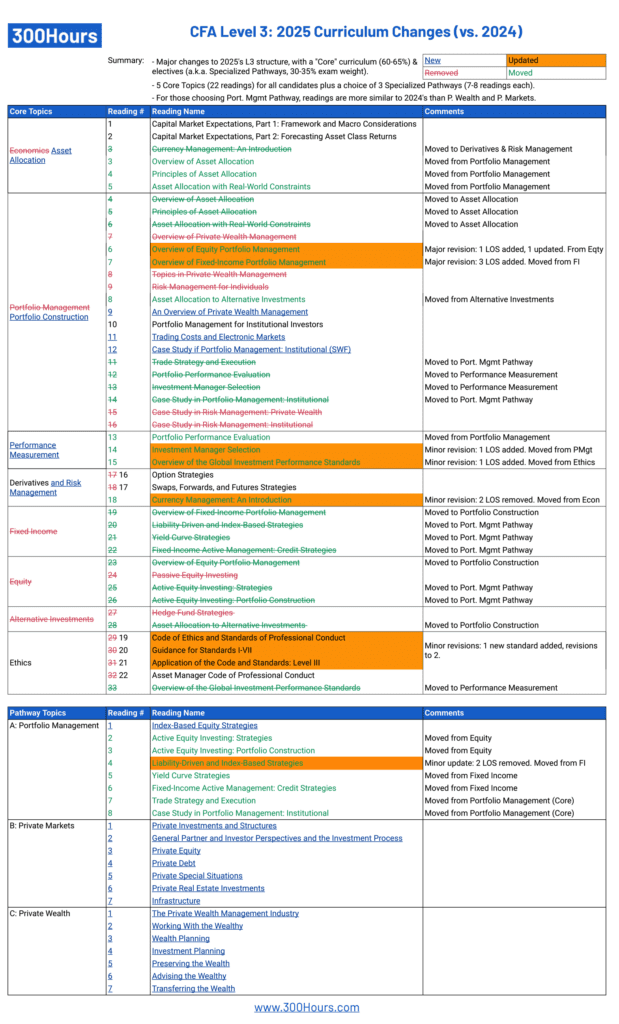

CFA Level 3 curriculum changes 2025

This year, there is a major revamp on the Level 3 curriculum, with the introduction of Specialized Pathways (i.e. elective options). Some notable changes:

- The 2025 CFA Level 3 curriculum is now split into 2 parts: Core (65-70% exam weight) and Specialized Pathways (one choice out of three, 30-35% exam weight)

- Core readings are now focused on 5 topics: Asset Allocation, Portfolio Construction, Performance Measurement, Derivatives and Risk Management and Ethics.

- There are 3 Specialized Pathways to choose from: the traditional Portfolio Management, and two new ones: Private Markets and Private Wealth.

There are 22 Core readings in 2025’s Level 3 Curriculum (vs. 33 in 2024), plus 7-8 Pathway readings. For the Core readings comparison:

- 7 readings from 2024 were removed:

- Reading 7: Overview of Private Wealth Management

- Reading 8: Topics in Private Wealth Management

- Reading 9: Risk Management for Individuals

- Reading 15: Case Study in Risk Management: Private Wealth

- Reading 16: Case Study in Risk Management: Institutional

- Reading 24: Passive Equity Investing

- Reading 27: Hedge Fund Strategies

- 7 readings moved to Portfolio Management Pathway:

- Reading A2: Active Equity Investing: Strategies

- Reading A3: Active Equity Investing: Portfolio Construction

- Reading A4: Liability-Driven and Index-Based Strategies

- Reading A5: Yield Curve Strategies

- Reading A6: Fixed-Income Active Management: Credit Strategies

- Reading A7: Trade Strategy and Execution

- Reading A8: Case Study in Portfolio Management: Institutional

- 3 new Core readings are added for 2025:

- Reading 9: An Overview of Private Wealth Management

- Reading 11: Trading Costs and Electronic Markets

- Reading 12: Case Study if Portfolio Management: Institutional (SWF)

Overall, 2025’s CFA Level 3 curriculum has notable content changes in Core readings and the two new Pathways (Private Markets and Private Wealth).

There is a huge consolidation and shuffling of readings with a more focused Core readings. Those who choose the Portfolio Management pathway would have a relatively similar curriculum vs. 2024, simply because Private Markets and Private Wealth readings are completely new in 2025.

Other topics remain largely the same as 2024’s curriculum.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

For CFA Level 1 and 2, it seems that 2024’s CFA books are highly transferable to 2025 (excluding 1-3 chapters with significant revisions). I hope you’ve found the above useful in your next CFA exam study preparations!

Meanwhile, here are a few related articles of interest:

Hello,

Did the 2026 CFA Level 3 curriculum change compared to 2025, or can I use the same prep provider notes?

Thanks!

Hi Rasmi, we are working on comparing the 2026 curriculum changes now. Stay tuned.

Hi Rasmi, just to let you know, we had a quick look at this for L3 and there are no (significant) changes to L3. You should be fine using 2025 curriculum to study for now. Will know for sure once we double check through the whole syllabus details.

Hi Sophie

I am back to CFA program after 6 years. I have registered for CFA Level II Nov 2025 but have low confidence as I don’t remember most of the things of level 1. Even though I’m working in corporate finance I am having difficulty in start again. Could you please suggest how should I start my preparation and how should I brush up Level 1 topics. Looking for your suggestions and my approach towards LII now.

Thanks

Hi Sophie,

I am enrolled in the CFA level 3 August 2025 exam. Last time I had the exam was the level 2 in 2019.

I am a bit lost now since many changes happened since then.

I understand that now the exam and study material are split into two: Core and Specialized Pathways.

Core is almost similar to what we used to have. Specialized Pathways is something newly introduced. Is it fair to summarize the Portfolio Management topics have only 8 topics?

Also, what is mostly recommended, to study with Wiley, schweser or CFA books?

Thanks alot!! 🙂

Ralph

Hey Ralph! Glad you’re back to finish up your CFA journey! Yes, a lot has changed since pre-COVID times. We have summarized the L3 Specialized Pathway here, which should help update your understanding. And yes, Core is what we used to have a few years ago for L3. Specialized Pathways are electives, of which if you choose “Portfolio Management”, it would be like the ‘traditional’ L3 curriculum. It allows for more flexibility and tailor making CFA Program to your specific career end goal.

And yes, I see 8 topics for Portfolio Mgmt Specialized Pathway for 2025. The advice for L3 prep is similar and detailed in our top tips for L3, using CFA curriculum books as a base, supplementing (if budget allows) for more practice from third party study materials.

Thanks alot Sophie! That was very helpful!

Hi, this was regarding CFA Level 1 topics. The ones mentioned in the post under cfa level 1 “curriculumn changes” are the topics which are there for the 2025 exam right ? For Eg in Fixed Income, the topic starting from ” Fixed Income Instrument Features” upto all the way to ” Mortgage Backed Securities” are there for the CFA L 1 2025 exam right !??

Yes that is correct Prith. This is for 2025 curriculum, compared to 2024. There isn’t much changes vs. 2024’s curriculum for level 1.

Hi,

I had a query about the topic weightage. Are the topic weights given, for the entire 180 questions? Would some questions from 9 topics(excluding Ethics) be given in both the morning session and afternoon session? (because the CFA website says that 5 topics are session 1 and 5 topics for session 2, hence the number of questions and their splits between sessions are confusing)

I’m sorry, I forgot to mention that I was asking about the CFA level 1 exam structure

Hi Harshi, the topic weights are for the total 180 questions. So they may test topic 1-5 in first session, 6-10 in second session (for example) but that should not affect the topic weightage for the 180 questions. Hope this clarifies.

Hi Sophie, could you explain what the modules are and how they work?

Could you also guide me on the best direction for CFA Level 1 between financial modeling and Python? How does one decide between the two, and what’s the prep process like?

Hi sh, modules are mini readings/chapters. Basically CFA Institute renamed it from Readings to Learning Modules (LMs) as there are many more LMs, i.e. mini chapters within a topic to aid readability.

Either is fine for your PSM choice, your choice doesn’t impact your overall score to pass. If it were me, I would choose something that helps in my work, or is something I am interested in. Prep process is simple where you go through the PSM course and complete it. It doesn’t take too long.

Why was the Hedge Fund Strategies reading removed?

Is it the same as the one currently in Level 2 under Alternative Investments?

Hi Aravind, that’s an excellent question. Yes it seems like it was removed from CFA L3 to L2 with identical LOS.

Got it, Sophie. Thank you.

Any idea why this was done?

This document is incredibly helpful. Thank you for doing this.

In the 2025 Level 3 Curriculum Changes document, it reads two LOSs were removed (Minor changes) for “Currency Management: An Introduction”. However, both the table of contents and the LOSs are the exact same from 2024 to 2025. The only changes I noticed were minor differences to the 2025 EOC Solutions at the end of this reading.

Was this an error, or were there actual LOSs removed?

Hi Chungus, you’re welcome. It was a little tedious to put together but glad you found it helpful and appreciate your appreciation 😀

Yes there were 2 LOS removed from what we can see from CFA L3 2024 vs 2025.

In 2025, these two LOS were removed:

□ describe the three basic forms of performance-based fees

□ analyze and interpret a sample performance-based fee schedule

Hope this clarifies!

Hi Sophie, in your opinion, would you say that Private Markets is an overall easier option than Portfolio Management for the pathway topics?

Hi! It’s hard to know as it is the first year. According to CFA Institute they should be equally hard. I suspect they may have different MPS for each pathway to make it fair and equally difficult for all Level 3 candidates, regardless pathways. Main focus here should be to choose a pathway that aligns with your desired career path!

I was eagerly waiting for this post. As always, thanks!

You’re welcome! Thanks for your patience, it took a while with the Level 3 changes 😀

Thank you indeed for updating us