[Updated for May 2025 exams]

CFA pass rates are a factor in most candidates’ consideration on whether to sign up for the CFA exams. If pass rates are too high, it lacks prestigiousness. If it is too low, it is too difficult and may not be worth the effort.

Tricky, eh?

Often branded the ‘world’s hardest exams’, we often get questions from our readers on exactly how difficult the CFA exams could be. The short answer? It’s hard, but not the hardest?

In this article, we try to approach this question objectively, with historical CFA pass rates and third party benchmarking studies in order to help you decide whether CFA exams are worth the challenge.

Let’s go!

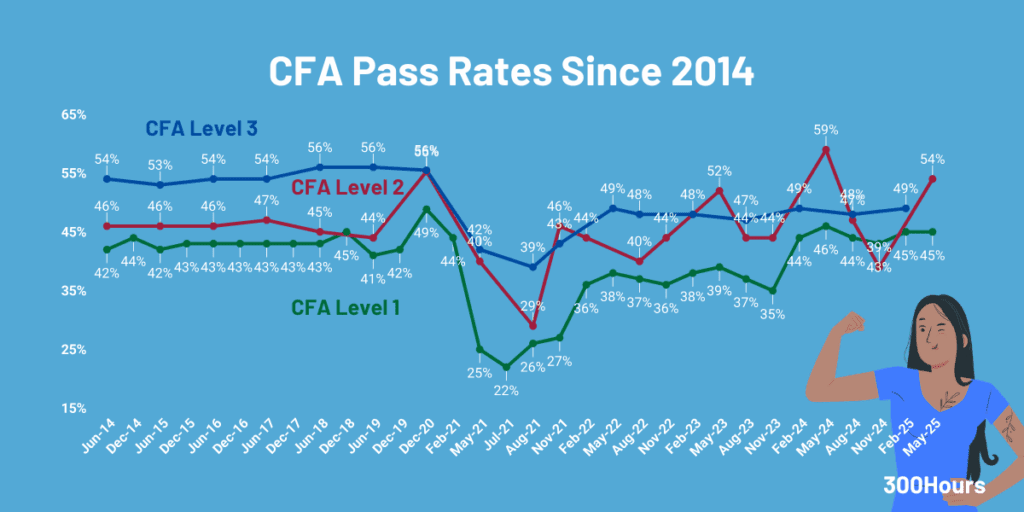

Overview of CFA Pass Rates Since 2014

The latest CFA pass rates are:

- 45% for Level 1 (May 2025)

- 54% for Level 2 (May 2025)

- 49% for Level 3 (Feb 2025)

As one would expect, the average pass rates increases as one progresses throughout the 3 levels. Since 2014, the historical CFA pass rates for:

- Level 1 ranges from 22%-49%, with a 11-year average of 41%;

- Level 2 ranges from 29%-59%, with a 10-year average of 45%;

- Level 3 ranges from 39%-56%, with a 10-year average of 50%.

The pandemic – which coincided with the introduction of computer-based exams and increased testing schedule – seems to have changed the pass rates trends significantly for all 3 levels, although there are encouraging initial signs to show that this trend is recovering to the long term average.

There is insufficient data or insights on why this may be happening, although we have a few theories of why the CFA pass rates are so low since the pandemic.

First timers vs. deferred candidates’ CFA pass rates

Interestingly, CFA Institute states that there has been a difference between first time test takers vs deferred candidates, with the former scoring a significantly higher pass rate than those who deferred:

| CFA Cohort Pass Rates | First Time Testers | Deferred Candidates |

|---|---|---|

| May 2025 Level 2 | 60% | 35% |

| May 2025 Level 1 | 52% | 28% |

| Feb 2025 Level 3 | 56% | 30% |

| Feb 2025 Level 1 | 52% | 30% |

| Nov 2024 Level 1 | 49% | 29% |

| Nov 2024 Level 2 | 49% | 26% |

| Aug 2024 Level 3 | 55% | 35% |

| Aug 2024 Level 2 | 55% | 35% |

| Aug 2024 Level 1 | 50% | 29% |

| May 2024 Level 2 | 67% | 39% |

| May 2024 Level 1 | 53% | 27% |

| Feb 2024 Level 3 | 56% | 36% |

| Feb 2024 Level 1 | 52% | 28% |

CFA Level 1 Pass Rates vs. Candidate Volume

CFA exam’s popularity is evident in this chart, with Level 1 candidate growth accelerating steadily since 2015. This has taken a hit since the pandemic, with annual candidate volumes about 60% of previous years.

CFA Level 1 pass rates have remained relatively stable and above 40% since 2014 for paper-based exams. The December 2020 exam’s jump in CFA Level 1 pass rate to 49% is most likely due to the additional time candidates have due to multiple COVID-19 exam postponements.

Unfortunately not many candidates were able to sit for the exam even in Dec 2020 due to the ongoing pandemic situation, and this is reflected in Feb 2021’s data as well.

However, in July 2021, CFA Level 1 has experienced a monster drop in pass rates to 22% before rebounding to 26% in Aug 2021.

The latest May 2025 results are encouraging and seems to show that the pass rate trends are reverting back to the pre pandemic norms.

CFA Institute’s official guidance states that the minimum passing score reflects the score that can be achieved by a ‘just competent’ candidate, which is supposed to be consistent across the years, whether it’s 2010, 2015 or 2020. If we assume this holds true, this implies the average CFA Level 1 candidate quality for May to Aug 2021 was significantly lower compared to past exams.

CFA Institute has implied that this low pass rate is temporary, and due to pandemic disruption:

Going forward, we do expect the pass rate to approach pre-COVID historical levels in time — so long as pandemic conditions subside.

As we have said before, the exams and the process for setting the minimum passing score have not changed. Unfortunately, the many challenges posed by life during a pandemic have clearly made the process more daunting.

Peg Jobst, Managing Director, Head of Credentialing, CFA Institute

This makes some sense. Our MPS analysis also initially indicated higher than normal recommended target scores, but this has now also reverted to the longer term average.

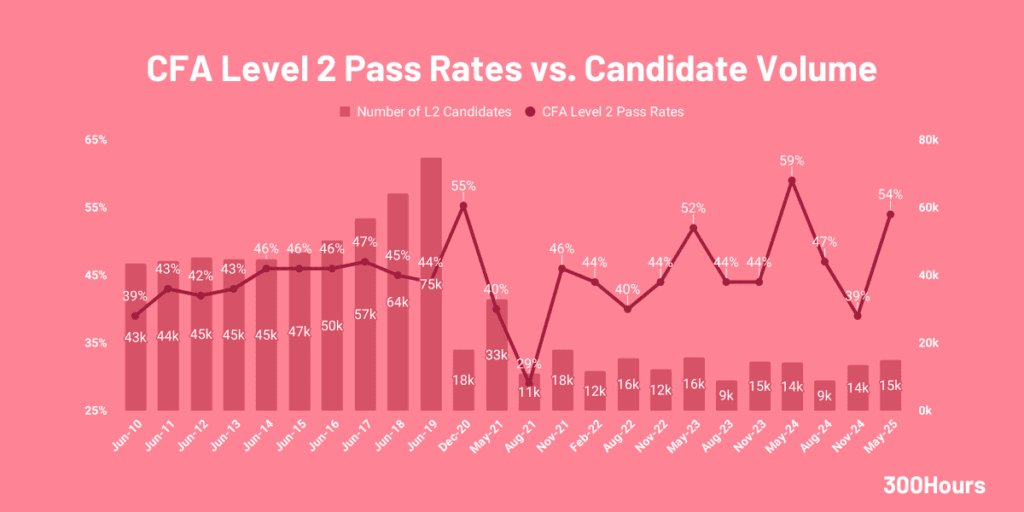

CFA Level 2 Pass Rates vs. Candidate Volume

The story for CFA Level 2 pass rates and candidate volume is similar to Level 1:

- Level 2 pass rates were relatively stable and above 40% since 2011, with a significant jump to 52-55% pass rates for Dec 2020, May 2023 and May 2024 Level 2 candidates.

- Level 2 candidate growth has been accelerating since 2015 as well, but this has dropped to lower levels since the pandemic.

- Excluding the Dec 2020 ‘pandemic exam’, pass rates have been on a steady/downward trend since 2017 until August 2021. After the lowest pass rates ever in Aug 2021, recent results especially in 2024 showed encouraging signs that the impact of pandemic disruption on pass rates is hopefully over.

CFA Level 3 Pass Rates vs. Candidate Volume

CFA Level 3 is a little different from other levels, whereby the pass rates are very stable and consistently higher than the rest. This can be explained by natural selection: Level 3 candidates by definition are highly skilled and knowledgable at this point, having passed Level 1 and Level 2.

Similarly to Level 1 and Level 2, CFA Level 3’s pass rate experienced a big drop during the May 2021 exam cycle, recording a new low of 39% in Aug 2021 exam. One noticeable difference is the Level 3 Aug 2021 exam cohort is really small, with only 2,769 candidates taking the exam.

That said, it is showing initial signs of climbing back up to closer to the long term average with the latest Feb 2025 exam continuing the trend of moving closer to the average of 50% pass rate.

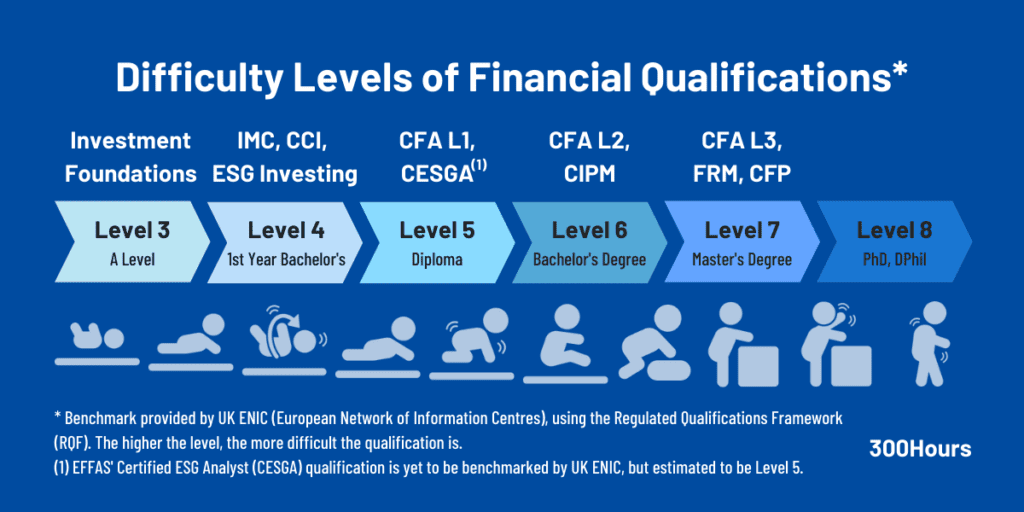

How Hard Is CFA?

OK we have seen all the historical trends in CFA pass rates, but that still doesn’t really tell us how difficult these exams are?

Perhaps a more objective way to assess CFA exam’s difficulty lies in the UK NARIC’s (National Academic Recognition Information Centre of the United Kingdom) benchmarks.

According to UK NARIC, the CFA exams have been benchmarked individually by Level under UK Regulated Qualifications Framework (RQF):

- CFA Level 1‘s difficulty is comparable to a Diploma of higher education (Level 5 qualification under RQF);

- CFA Level 2‘s difficulty is comparable to a Bachelor’s degree (Level 6 qualification under RQF);

- CFA Level 3‘s difficulty is comparable to a Master’s degree (Level 7 qualification under RQF).

Considering that RQF Level 8 implies a difficulty equivalent to PhD programs, passing all 3 levels of the CFA exams is certainly not easy!

Hope you found the statistics above useful!

Meanwhile, here are some related articles that may be of interest:

Thanks for this valuable data !

How do you explain such a massive and sustained drop in candidate volume ?

I understand that the pandemic had a significant impact, but I am very surprised that the candidate volume has not picked up yet :

volumes are way below half of what they were pre-pandemic for every single level.

I must be missing something.

“The decline in registrants for the CFA exam can partly be attributed to a downturn in test takers in China, the CFA Institute said. ”

Source:https://www.investmentnews.com/rias/cfa-designation-still-in-demand-for-hiring-as-fewer-pursue-it/258470#:~:text=There%20were%20163%2C000%20registrations%20for,China%2C%20the%20CFA%20Institute%20said.

Do you have any guesses on the MPS (approximately) on the Nov/2022 exam?

Yes we do, check out our latest CFA MPS estimates here.

I gave cfa level 1 on 21st Feb 2022.. i was fully prepared.. and i feel that actual exam was much harder than mock exams of cfa institute.. there were so many tough questions.

Hi Anuj, no worries, it’s a common feeling… Fingers crossed for you when the results are out!

CFA Level 2 is much tougher exam than bachelor’s exam.I consider it equivalent to master’s exam.

Hmmm seems like L2 & 3 could both be bucketed in the “Master’s Degree” level. L2 complexity definitely exceeds a bachelor degree in finance/economics.

You’re not wrong there!

L2 is comparable to a bachelors degree? Bis wtf moment🤣

Because you think L2 is tougher than a bachelors, or easier?

CFA Level 2‘s difficulty is comparable to a Bachelor’s degree my ass

I’m not disagreeing with that!

How close or different is CFA Level 1 to CFA Investment Foundations?

CFA Level 1 is considered a harder-level exam. For more information, see our Investment Foundations Guide here.

Thank you very much for the information. Very useful indeed.