One of the key lessons of the COVID-19 pandemic is that we must react swiftly to high probability, high impact risks — and delays are costly.

The climate is changing. And the risks from climate change are only going to rise over the foreseeable future. As climate risk management continues to develop towards being a discrete job title, managing climate risks will be an integral component of a holistic risk management approach for all industries globally.

Here’s where the GARP SCR (Sustainability & Climate Risk) qualification comes in – check out our comprehensive guide to learn more about the latest updates!

- Overview of the GARP Sustainability and Climate Risk Certificate (SCR)

- SCR Certificate In A Nutshell

- GARP SCR Pass Rate

- Topic areas & weightings

- Exam Fees

- SCR Exam Dates

- What Are the Requirements for GARP SCR Certificate?

- Benefits of the SCR Certification

- GARP SCR vs CFA ESG Investing Certificate: Which Is Right for You?

Overview of the GARP Sustainability and Climate Risk Certificate (SCR)

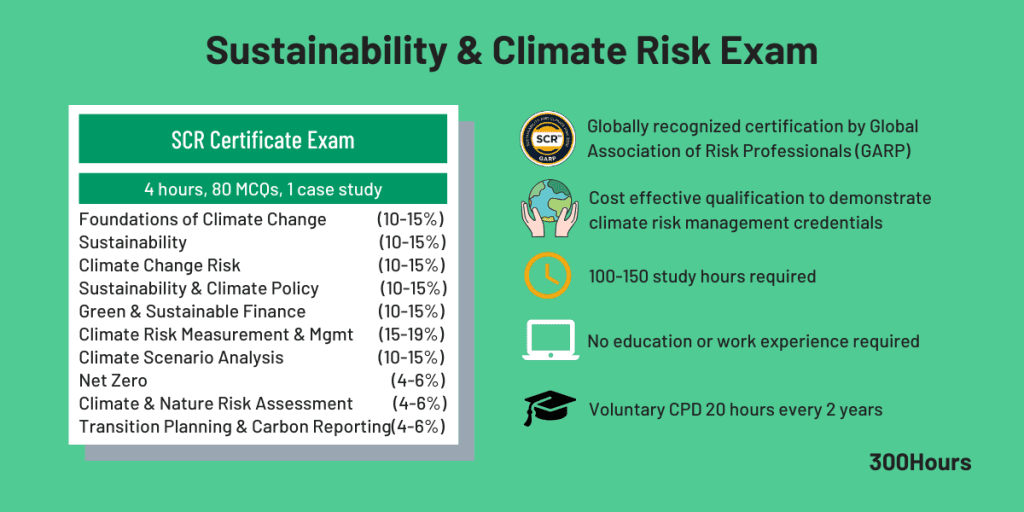

Launched in January 2020 by Global Association of Risk Professionals (GARP) – which also runs the FRM program – SCR is a global climate risk management program designed to help professionals understand the effect of climate change on organizations and how to manage that risk.

It is created in response to growing demand for financial and non-financial firms alike to incorporate sustainability standards in their operations, primarily driven by climate change.

The SCR course is great for professionals who are looking to add climate risk management to their skillsets – not just for those working in finance but also in other disciplines such as supply chain management, operations and technology.

And it isn’t just for those professionals early in their career either, GARP expects to see meaningful demand for the SCR coming from the more senior ranks as well.

The course consists of 6 modules, covering:

- foundations of climate change;

- policy and regulation;

- green and sustainable finance;

- the science, effects and measurement of climate-related risks;

- scenario analysis; and

- emerging issues such as health effects and geopolitical impacts.

Registration opened in May 2020 for the first SCR exam in September, with GARP reporting that there are already candidates from more than 60 countries globally, coming from a myriad of industries, company types and stages of career – all reflecting the relevance of climate change risks across geographies, industries and career level.

Since the inception of SCR exams, more than 16,000 candidates have registered for the exam so far, with more than 7,000 SCR title holders. GARP has also recently announced some changes for October 2025’s exam and onwards which we will cover below.

SCR Certificate In A Nutshell

The SCR certification is designed to equip professionals with the understanding on how to manage the potential economic and operational impacts of a changing climate on their organizations. The impact of climate change is vast, and certainly not limited to just finance, but other disciplines such as supply chain management, technology and operations.

From October 2025 onwards, GARP announced that online proctoring option will now be available for SCR exams starting Oct 2025.

In terms of study hours, it is recommended that SCR exam candidates devote around 100-150 study hours in total to complete the qualification

The SCR exam can be taken in specific exam windows at Pearson Vue test centers internationally.

In terms of pass criteria, the questions are equally weighted and there are no negative markings for incorrect answers. There are no pre-determined pass/fail rates for the SCR Exams, with the passing score determined by SCR Advisory Committee.

There are no official timelines on when or how long it takes for exam results to be released, but so far SCR exam results are typically released 4 weeks after the exams.

GARP SCR Pass Rate

Here are the SCR exam pass rates so far:

- October 2025 = 63%

- April 2025 = 62%

- October 2024 = 66%

- April 2024 = 47%

- October 2023 = 55%

- April 2023 = 57%

- October 2022 = 51%

- April 2022 = 54%

- October 2021 = 55%

- April 2021 = 52%

GARP has confirmed that cut-off scores will be determined through an industry best-practice methodology under the oversight of the SCR Advisory Committee. The expectation is that “properly prepared” candidates should fare well on the exam.

Topic areas & weightings

The Sustainability & Climate Risk Certificate does a great job in covering a breadth of topics in 8 chapters that provides a holistic overview of the effective assessment and management of climate risks.

The topics areas, in-depth description and exam weights are as below:

| Sustainability & Climate Risk Certificate Topics | Description | Topic Weights |

|---|---|---|

| Foundations of Climate Change | This chapter focuses on the foundational concepts of climate change, including the underlying science and global policy responses. | 10-15% |

| Sustainability | This chapter discusses the broad topic of “sustainability,” particularly as it relates to public policies, corporate actions, and financial institutions. | 10-15% |

| Climate Change Risk | This chapter focuses on the financial risks linked to climate change, mainly physical risk and transition risk. | 10-15% |

| Policy, Culture and Governance | The chapter is all about the responses of financial institutions, regulators, and international bodies to emerging climate risks. | 10-15% |

| Green and Sustainable Finance: Instruments and Markets | This module looks into the emergence of financial sector tools and markets born out of the global response to climate change. | 10-15% |

| Climate Risk Measurement and Management | The area of focus here is the risks from climate change and how do we measure and manage these risks. | 15-19% |

| Climate Scenario Analysis | The chapter explains the development and application of climate scenario analysis, the types of scenarios that exist, and what information they can provide. | 10-15% |

| Net Zero | This chapter provides an overview of the concept of net zero and its implications for different players in the economy. | 4-6% |

| Climate & Nature Risk Assessment | This chapter looks at the latest methodologies, frameworks, and organizations driving climate risk assessment, as well as nature and biodiversity risks. | 4-6% |

| Transition Planning & Carbon Reporting | This builds on Net Zero chapter by delving deeper into key transition planning principles and steps. | 4-6% |

Exam Fees

SCR exam fees vary depending on:

- your membership status with Global Association of Risk Professionals (GARP);

- whether you have other GARP certifications such as Financial Risk Manager (FRM) or Energy Risk Professional (ERP);

- whether you’re a new or returning candidate.

| Fees, US$ | SCR Certificate |

|---|---|

| Exam Fees | – For non-GARP members: $650 for early registration, $750 for Standard registration. – For GARP members (Individual member): $550 for Early registration, $650 for Standard registration. Bear in mind that Individual membership costs $195 per year. – For candidates who are Certified FRM / ERP: $525 for early registration, $625 for Standard registration. |

| Retake Fees (if applicable) | For one retake within next 2 exam windows (12 months): $350 Otherwise, full exam fee applies for retakes after 12 months. If the curriculum changes before the candidate retakes the SCR exam, an updated electronic version of the curriculum will be made available to the candidate free of charge. |

SCR Exam Dates

SCR exams are conducted via online or in-person computer-based testing (CBT) exam at Pearson Vue centers globally.

SCR exams are held twice a year in April and October with the following key registration deadlines:

| SCR Exam Dates and Deadlines | October 2025 | April 2026 |

|---|---|---|

| Registration opens | 1 May 2025 | TBC |

| Early registration deadline | 31 Jul 2025 | TBC |

| Standard registration deadline | 30 Sep 2025 | TBC |

| Scheduling deadline | 30 Oct 2025 | TBC |

| Exam Window | 18 Oct – 1 Nov 2025 | TBC |

Once registered, you can schedule an online proctored or in-person computer based test (CBT) at a Pearson VUE test center. SCR candidates must schedule an exam at least 48 hours prior to their desired exam start time, only for the exam window they’re registered for.

The in-person computer based exams slots are on a first-come, first-served basis. Candidates who do not schedule an exam by the deadline must re-register and pay the applicable fees.

What Are the Requirements for GARP SCR Certificate?

Just like the Certificate in ESG Investing, there are no work experience or prior qualifications required to sit for the SCR exam.

Candidates who successfully pass the SCR exam can claim a digital badge for LinkedIn and an electronic certificate from GARP.

Benefits of the SCR Certification

Having the SCR Certificate could be a key differentiator in the risk management sector, which could be helpful if you’re job hunting in the current economic conditions.

Similar to the Certificate in ESG Investing in terms of cost and time required, it does seem to be a cost effective investment for risk professionals to upgrade their skillset with climate risk management credentials.

By completing and earning the Sustainability & Climate Risk Certificate, you can expect to:

- Apply principles of sustainability and climate risk management in current and future roles;

- Improve your career prospects and increase your competitive advantage;

- Demonstrate the knowledge and tools necessary to assess and manage the sustainability and climate risk challenges many industries face.

- Gain a globally recognized qualification (and digital badge) from GARP

- Pave your way for further finance designation such as FRM, CFA, or CAIA as you further specialize.

GARP SCR vs CFA ESG Investing Certificate: Which Is Right for You?

We are comparing GARP’s SCR vs CFA ESG Investing certificates below, although it is worth mentioning that EFFAS’ Certified ESG Analyst (CESGA) is a higher Diploma level certificate in ESG investing that is also worth considering as you’ll get a proper title upon passing (CESGA or Certified ESG Analyst), which is not present in either CFA ESG Investing or GARP’s SCR certificate below.

In short, while both qualifications focus on sustainable investing, there are some slight differences in focus about them:

- Sustainability & Climate Risk (SCR) certificate mainly focuses on educating professionals on how to manage the main environmental risk (arguably just the “E” part of ESG), i.e. climate change.

- On the other hand, Certificate in ESG Investing has a slightly broader focus on ESG factors, and how the investment industry can adapt to that change in investor preferences. That said, it also covers a section on climate change (including climate mitigation, and adaptation and resilience) and a range of climate change initiatives.

Both GARP’s SCR and CFA Institute’s ESG Investing Certificate are available globally, with the latter offering online proctoring option in certain markets.

While both are good quality qualifications from reputable organizations, the choice depends on which certificate has more relevance to your preferred career path: investments or risk management.

| GARP’s Sustainability & Climate Risk (SCR) | CFA Institute’s ESG Investing Certificate | |

|---|---|---|

| Suitable for | Risk management professionals of all disciplines (finance, supply chain, operations, technology etc) who are keen to learn about sustainability and how to manage climate risk in their industries.Students interested in a risk management career. | Students who are keen on an investment career; orInvestment professionals of all roles (asset management, sales & distribution, wealth management, product development, financial advice, consulting, risk etc), who are looking to understand and integrate ESG issues into the investment process |

| Pre-exam qualifications | None | None, although some insights in the investment process is strongly recommended (via formal qualification or experience) |

| Number of Exams | 1 | 1 |

| Exam Frequency | 2 exam cycles a year (April and October) with 2 week exam window each | Available to book throughout the year (except weekends and holidays) Also available to book for remote/online proctoring globally throughout the year. Maximum 4 attempts in 4 months |

| Exam Format | 80 multiple-choice questions plus 1 case study in 4 hours On-site computer-based testing and remote testing. | 100 multiple-choice and item set questions in 2 hours and 20 minutes On-site computer-based testing and remote testing |

| Pass Rates | 62% (Apr 2025) | Between 60%-75% |

| Fees and Costs | Around US$550-750 depending on GARP membership status or presence of other credentials | $675 |

| Study Hours Needed | 100-150 hours | 100-130 hours |

| Post Exam Requirements | None, although there are 20 hours of voluntary continuous professional development (CPD) every 2 years | None |

Overall, the SCR certificate seems to be a cost efficient means of augmenting and signalling your climate risk management knowledge in an increasingly competitive marketplace.

If you are in risk management, regardless of industry or discipline (finance, supply chain, operations, technology etc), the SCR certificate could prove useful in broadening your skillset as climate change issues are brought to the forefront of every company’s agenda. If you’re a student keen to start a career in risk management of any industry, the SCR certificate can be a valuable differentiator.

Is the GARP SCR Certificate something you’d consider taking on to enhance your job prospects? Let us know in the comments below!

Meanwhile, you may find these related articles in our Beginner’s Guide series of interest:

- CESGA (Certified ESG Analyst) Course: Our Epic Guide

- CFA Institute’s Certificate in ESG Investing: A Beginner’s Guide

- CFA Exams: A Beginner’s Guide

- IMC (Investment Management Certificate): A Beginner’s Guide

- CAIA (Chartered Alternative Investment Analyst): A Beginner’s Guide

- FRM (Financial Risk Manager): A Beginner’s Guide

Hi everyone,

I’ve completed a BBA in IT and a PGDM in Analytics & Marketing. If I clear this certification, what job opportunities can I expect? I have 6 months of experience as a fraud analyst and no experience related to SCR. I know this is not the platform, but I would appreciate guidance on the roles and career paths this certification could open up for me.

Thank you.

Hi Sameer, this is a complex question but I’ll try my best to help.

Studying for a qualification doesn’t guarantee a job, but it may open doors to conversations that may land you a role in that relevant field. One aspect is studying for it (which is the easier part), the more tricky part is actively looking for a job, securing interviews to have a chance to land a new role in your preferred sector. For SCR, it could open up to roles in ESG reporting, climate risk analysis, etc, and it’s usually an add-on skillset to an existing role, which I can see you specialise in IT, Marketing and Analytics.

I am really frustrated to GARP SCR. I had took the exam in Oct 2023 and April 2024, the exam is really not to test the understanding, it rather to test memories in text.

Hi, I just took the April 2024 exam. Before I took the exam, I did the 3 hour practice exam offered by the online portal and was dismayed to discover that the exam questions do not accurately reflect the study materials and practice questions. I wrote to the feedback option on the GARP online portal and stated this as a real problem. How can applicants appropriately prepare for the exam when the questions are so far different from what you read and practice? If they’re going to ask exam questions like that, they need to give candidates ample opportunity to learn how to answer those types of questions.

The April 2024 exam was extremely hard. I’ll find out in about a month, I suppose, what GARP will do to assign a curve to allow at least some candidates to pass. I almost feel like there was no need to study at all since the only strategies I could apply to the test were some deductive reasoning and other generic test-taking strategies. Very frustrating and makes you feel like your 100 hours of study were irrelevant to the Certification.

Thanks for sharing your experience and thoughts on SCR with us all, this is helpful for the community 🙂 Fingers crossed for you!

Hello I did take the same exam and it was hard for me to understand my exam results, i failed it quite badly, looking out for some help to understand how to prepare for next attempt and no give up on this.

I am looking for Past SRC question papers/dumps so that I can practice for SRC 2023 exam in April.

when are the October 2022 results out?

Good question. I’ve also been waiting on the results which say “mid-November” on the candidate portal. Anyone have any additional information on this?

I think they should mention the exact release date instead of mentioning mid-november

I just sat for the 2022 Oct SCR exam. This is not a fair exam. You could completely understand the text, completed 4 rounds of review and memorise everything you needed to memorise and yet still cannot pass this exam. Very disappointing. Working adults such as myself have to make a strong commitment to put in the effort and time not to mention sacrifice family time and obligations to do this. Ended up to be such a waste of our time, effort and be robbed of our belief in the principle of reward comes with effort.

My exact thoughts! I took the exam in April and was very disappointed with the resuts. The text and end-of-chapter questions do not, in any way, reflect the exam itself. The practice exam is inadequate as a prep for the exam; there should be several full-length practice exams. The effort and money spent in utter futility is really depressing.

Hi KA,

I have written a complaint to GARP. Their SVP on Exam Admin and Member Services responded that they are looking into the matter and will respond. Separately, I have also written to the CEO and some members of their Board of Trustees. Let’s see if anyone will respond with an appropriate answer. Otherwise, my next stop is their Chairman. I am determined to incorporate what I have learned from this syllabus – whether as a consumer or an investor (on my own education) to be an active owner of my investment monies, using that to force stakeholder engagement and influence and challenge others to do the same, to deal with this matter. We have learned the impact of broader societal implication and importance of coalition in driving change. We need to hold GAPR accountable, examine their process and doing the right thing in profiting from this. This is taught under the Principles for Responsible Investment and I find it very appropriate in this context. I asked that you consider the same.

Its a valid point, lets hope that the GARP committee/Trustees have constructive response to that.

Even i have written to them but all i have received is ‘automated responses’

Regards

Hey,

Any update on your queries?

I am an aspirant for OCT 24, just needed clarity towards what I am heading.

Hi Ritika. Can v connect?

Where can we get to see the results of OCT 22 SCR please ?. been writing to them but no reply. no email as well. is there any other way we one can see the result of oct 22 SCR exam pl

Same here, been trying to contact them with no reply. It is mentioned on the website that the results will be released mid-November but still nothing there!

would you tell us which level is SCR according to difficulty levels of financial qualifications ?

How many right answers you need the pass the SCR exam?

What are career prospects for a SCR professional?

on webpage ‘GARP’s Sustainability and Climate Risk (SCR) Certificate: A Beginner’s Guide’ while doing comparison between SCR and ESG its stated : ‘Overall, the SCR certificate seems to be a cost efficient means of augmenting and signalling your climate risk management knowledge in an increasingly competitive marketplace.’ however, while doing same comparison, on webpage ‘CFA UK Certificate In ESG Investing: A Beginner’s Guide’ for same comparison, it states : ‘Overall, the Certificate in ESG Investing seems to be a cost efficient means to signal your green finance credentials in this increasingly competitive marketplace.’ can we have real winner here please.

Hi Anand, when I wrote this article, I do mean what I say in those statements. It really depends what you’re going for and nature of work: Certificate in ESG is much broader in scope, whilst SCR is focused deeper on the “E” part of ESG only. I would say if you are working in risk management, SCR is probably more helpful given the current climate focus. If you are involved in investment decision making, Certificate in ESG is probably more applicable as you need to consider all aspects of ESG for that, not just climate risk. A recent article we wrote on asset management outlook globally would be an interesting read as well (https://www.300hours.com/articles/asset-management-outlook-jobs-impact) as ESG is part of that trend. Both qualifications are cost effective in my view, and are quite new certifications launched in the last year. Hope this helps!

Hi Danny, you can purchase the latest SCR ebook here https://www.garp.org/#!/scr/study-materials

How can I buy the SCR ebook for the preparation of exam?

Hi K, you raise a good point. Other than the 10 questions provided by GARP SCR’s program as practice questions, there isn’t much of a SCR question bank or mock exam product (yet). However, my understanding is that the material is quite qualitative, and the exam is a fair representation of the reading material. Hope this helps.

Is there any practice questions that can help our study for this certificaiton?

Dear Moderator, It is much better to have the early adaptation program, just like other famous institute such as ISACA (done for CPDSE), for ERM partitions, crisis/risk managers, and holders of related qualifications of sustainability, without taking SCR examination. This would further speed up the useability of this certificate for advocate sustainability risk management and implementation for contributing to the society. Best regards, Dr Danny Ha Chairman Academy of Professional Certification Affiliate member GARP, Certified ISO member of ISO 31000 Holder of Cambridge University CISL Sustainability Certificate Holder of ERM professional certification and CRP (Certified Risk Planner) https://www.linkedin.com/in/dannyhaprofile/