Did you know that besides the CFA program, CFA Institute also offers CFA Investment Foundations program?

Many potential candidates get confused between the two qualifications, so we thought it may be helpful to put together a proper comparison guide to help you decide between CFA Investment Foundations vs CFA Program.

Let’s dive in!

- What is the CFA Investment Foundations Program?

- What is the CFA Program?

- How difficult is CFA Investment Foundations vs CFA?

- CFA Investment Foundations vs CFA: Summary Table

- CFA Investment Foundations vs CFA: Which is right for me?

- Can I take the Investment Foundations certificate, then CFA Level 1 later on?

What is the CFA Investment Foundations Program?

The CFA Investment Foundations Certificate is a self paced, online certificate program. It covers the essentials of finance, ethics, and investment roles, providing a clear understanding of the global investment industry.

The Investment Foundations Program is targeted at anyone who works in association with the finance industry, who wants to better understand the investment management industry.

For more details about the Investment Foundations Program, check out our comprehensive CFA Investment Foundations beginner’s guide.

What is the CFA Program?

The Chartered Financial Analyst (CFA) Program is a professional, masters-degree equivalent credential offered by the CFA Institute. It gives you expertise and real-world skills in investment analysis, and has become a gold standard in the finance and investment management industry.

We’ve written a lot about the CFA program, check out these articles to learn more:

- What is the CFA Exam? A Useful Beginner’s Guide

- 7 Benefits of the CFA Charter You Should Know

- Is CFA Worth It?

How difficult is CFA Investment Foundations vs CFA?

All hail our famous finance certifications’ difficulty comparison chart 🙂

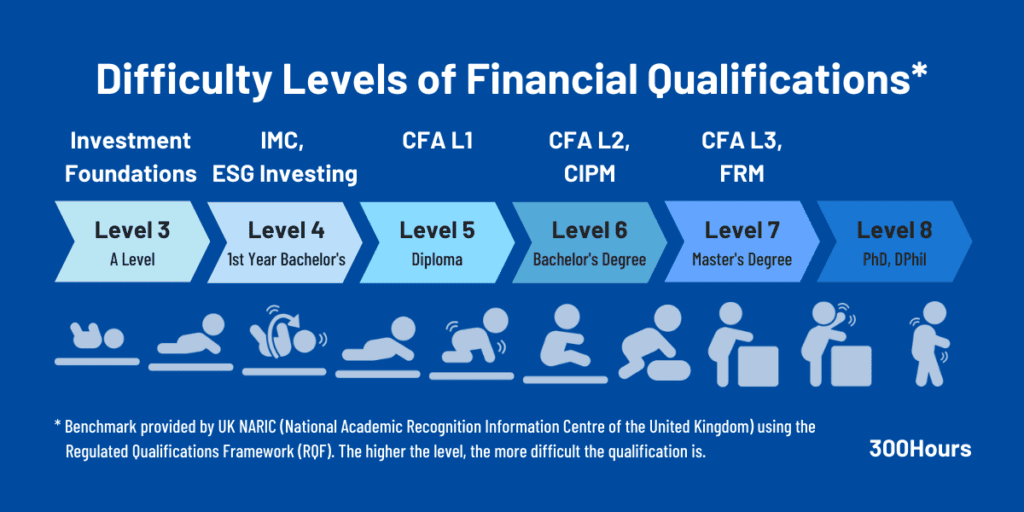

As you can see, CFA Investment Foundations is equivalent to UK’s “A-level” (similar to US’ Advanced Placements, i.e. AP exams).

On the other hand, getting a CFA Charter is a Master-degree equivalent program.

Even comparing CFA Investment Foundations vs CFA Level 1, CFA Level 1’s difficulty is comparable to a diploma.

In short, CFA program is more difficult than Investment Foundations (hence the name!).

CFA Investment Foundations vs CFA: Summary Table

We have compiled and condensed the key differences between CFA Investment Foundations vs CFA from various aspects – this should help inform your decision if you’re still undecided!

| CFA Investment Foundations | CFA Program | |

|---|---|---|

| Suited For | Non-investment decision making roles associated with the finance industry, such as IT, HR, legal, strategy, operations, customer service, accounting etc. It is also helpful for those without finance background aspiring to work in a front office role. | Finance professionals in a role that makes or advises investment decisions (typically front office) |

| Entry requirements | None. This course is designed to be accessible to all. | Have a bachelor’s degree; or Final year undergraduate of a bachelor’s program; or Have a combination of college degree and full time work experience that totals 4,000 hours. |

| Number of Exams | 1 | 3 levels (fastest route is in 18 months, although the average is 4 years to complete) |

| Exam Frequency | Online exam can be done anytime all year round. Maximum 4 attempts a year. | CFA exams are now computer-based with increased frequency: Level 1: 4x a year, in Feb, May, Aug and Nov. Level 2: 3x a year, with May, Aug and Nov Level 3: 2x a year in Feb and Aug. |

| Exam Format | 100 multiple-choice questions in 2 hours and 20 minutes | Level 1: Multiple choice questions Level 2: Item set questions (multiple choice) Level 3: Item set and constructed-response questions |

| Topics studied | 6 courses focusing on ethics, and a high-level overview of the financial and investment industry. Non-technical, no calculations required. | 10 topics per level, with in-depth focus on ethics as well as technical coverage of the majority of investment instruments. Definitely has calculations involved. |

| Pass Rates | estimated to be 80%+ | The range of CFA pass rates since 2010: Level 1: 36%-43% Level 2: 39%-47% Level 3: 46%-56% |

| Fees and Costs | $350 for the course and final exam. $270 for final exam retakes. | – One-off Enrollment Fee: $450 – Registration fee (per level): $700-$1,000 – Retakes: same as registration fee Total CFA exam minimum cost: ~US$ 2,600 |

| Study Hours Needed | 40-70 hours, although our conservative estimates is around 60-90 hours. | At least 300 hours per level |

| Post Exam Requirements | To become an Investment Foundations certificate holder, all you have to do is pass the online exam to claim your digital badge and printed certificate. | To become a CFA charterholder: – Pass all the 3 levels of CFA exams; – 4 years of qualified investment work experience; – Submit reference letters for 2-3 professional references;Become a regular member of CFA Institute; – Adhere to CFA ethics and professional conduct. |

CFA Investment Foundations vs CFA: Which is right for me?

This is hopefully fairly straightforward.

If you’re looking into a career that analyzes or makes investment decisions, such as the wealth or investment management industry, then the CFA charter is the right one for you. The CFA charter will also benefit any financial services professional role. You can check out the typical career path of CFA charterholders to have a sense of future job opportunities.

If you’re looking into this to learn more about the investment industry, but would perform a role supporting the industry (such as in HR, Legal, Marketing and so on) rather than making direct investment decisions, the CFA Investment Foundations Program is better suited for you.

Can I take the Investment Foundations certificate, then CFA Level 1 later on?

Yes, it could be a stepping stone to the CFA Program if you’re unsure about it in the first place.

That said, the Investment Foundations Program is meant to only give a very broad overview, and is for people who work with finance professionals that want to find out more about what the hell they’re up to.

If you’re serious about taking the CFA Charter, there’s no reason to take Investment Foundations (no, there’s no value to it as a ‘warm up’ topic). Just go for CFA Level 1!

Hope this helps you decide which path you’re going to take! If you have more questions, just comment below and I’ll try to help 🙂

Meanwhile, you may find these related articles of interest:

I currently work in the offshore oil industry, have no plans to move into the finance industry however it is my hobby studying economics and analysing securities. Would you recommend the IMC cert or the Foundations course? I’d like to generally combine my industry knowledge with some in depth financial knowledge for a good rounded view.

Sir .Hope u are experienced and have corporate knowledge. U take finance course if u have passion and interest u take FMVA certificate. From CFI. Bcoz its easy to clear. But it’s ur option.IMC certificate is most valuable also equal of FMVA. But it has some basic requirements. If u clear the requirements u take IMC course. Best of luck.

Hi John, for your purposes, IMC would be a better choice as Investment Foundations are mainly for staff supporting investment roles.

I am in my final year of graduation. I am persuing B.Com (H) in Finance and Accounting. I have no idea about investment banking and other subjects of CFA. And I am not even very sure about my career. So, before taking up for CFA Level 1, will going for Investment Foundations Program be helpful for me?

Hi Radhika, we have written new, comprehensive guides about CFA and Investment Foundations, do check it out (and leave a comment there) if you have further questions. It is normal not to know what your career goal is at this stage, CFA is commonly taken after a few years of work experience, whereas you can take Investment Foundations now (the only cost is your time really) to get a broad overview of the industry. https://www.300hours.com/articles/cfa-investment-foundations-guide https://www.300hours.com/articles/cfa-exam-guide Hope this helps!

Yes of course. It is very helpful it gives u the basics of investment management and investment vehicle. So u go first investment foundation .After u take it.