The 2026 CFA curriculum has minimal changes across all three levels:

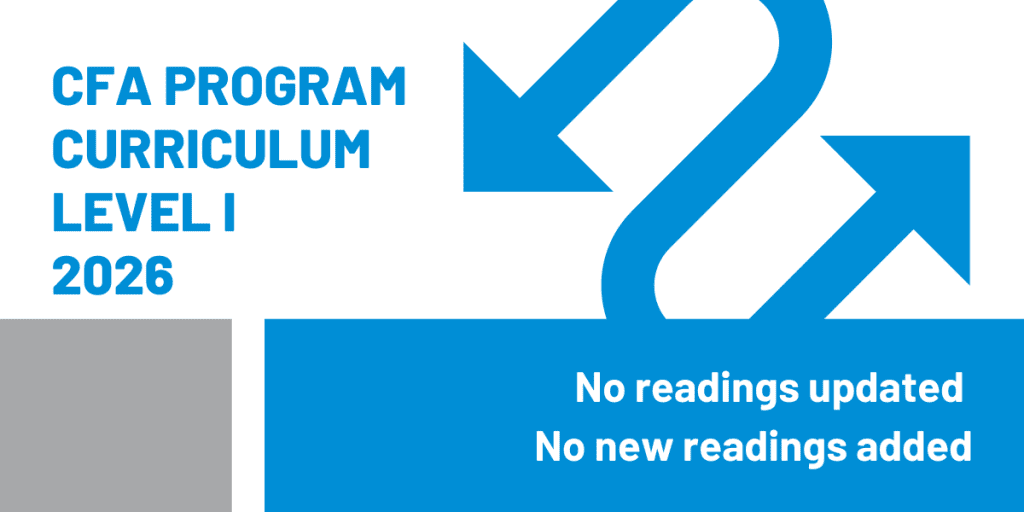

- Level 1: Zero changes (93 Learning Modules unchanged).

- Level 2: One Learning Outcome Statement removed from Machine Learning.

- Level 3: Zero changes to Core or Specialized Pathways.

- Topic weights remain identical to 2025 for all levels.

Bottom line: 2025 study materials can be safely reused for 2026 exams with virtually no adjustments needed.

2026 CFA Curriculum Changes at a Glance

| CFA Level | Learning Modules 2025 | Learning Modules 2026 | Changes | Impact | Material Reusability |

|---|---|---|---|---|---|

| Level 1 | 93 | 93 | 0 changes | No impact | 100% reusable |

| Level 2 | 45 | 45 | 1 LOS deleted (Machine Learning) | Negligible (<0.5%) | 99.5% reusable |

| Level 3 Core | 22 readings | 22 readings | 0 changes | No impact | 100% reusable |

| Level 3 Pathways | 7-8 readings each | 7-8 readings each | 0 changes | No impact | 100% reusable |

There has been minimal CFA curriculum changes 2026 across all three levels, marking a period of welcome stability after several years of major revisions. Level 1 has zero changes (93 Learning Modules unchanged), Level 2 has one minor deletion in Quantitative Methods, and Level 3 has zero changes to both Core topics and Specialized Pathways.

The practical impact: Candidates can safely reuse 2025 study materials for 2026 exams. Topic weights remain identical to 2025 for all levels, so your study plan allocation doesn’t need adjustment. This stability is intentional – CFA Institute has signaled a multi-year commitment to curriculum consistency after the major structural changes of 2021-2025.

Why curriculum changes matter: Understanding year-over-year changes helps candidates determine if previous-year materials are usable, whether to purchase new prep materials, and how to adjust study plans if retaking an exam. With 2026’s minimal changes, the answers are straightforward: yes to reusing materials, optional for new purchases, and no study plan adjustments needed. ☕

- 2026 CFA Curriculum Changes at a Glance

- Can I use 2025 CFA study materials for the 2026 exam?

- Why are CFA curriculum changes and topic weights important?

- What are the CFA Level 1 topic weights for 2026?

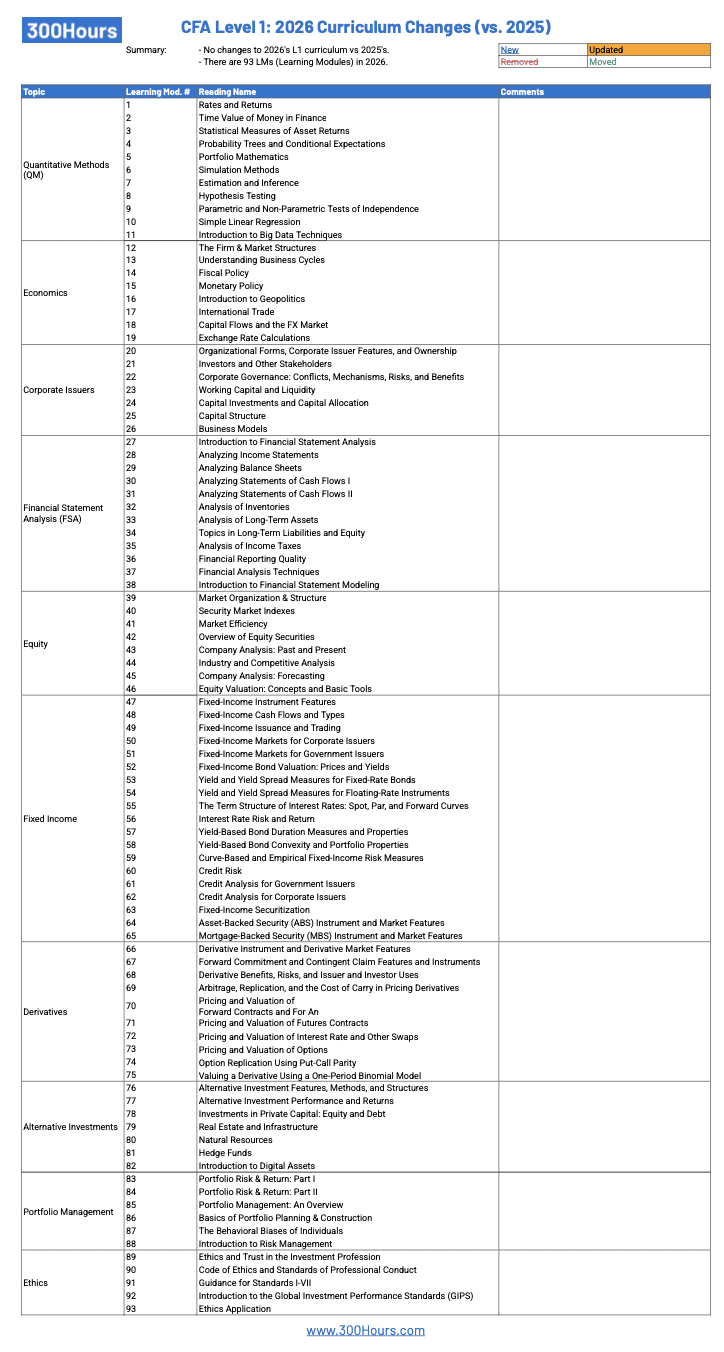

- What changed in the CFA Level 1 curriculum for 2026?

- What are the CFA Level 2 topic weights for 2026?

- What changed in the CFA Level 2 curriculum for 2026?

- What are the CFA Level 3 topic weights for 2026?

- What changed in the CFA Level 3 curriculum for 2026?

Can I use 2025 CFA study materials for the 2026 exam?

Yes, absolutely. The 2026 curriculum has minimal changes across all levels, making 2025 materials virtually identical in content:

- Level 1: Zero curriculum changes. All 93 Learning Modules are unchanged. 2025 materials are 100% applicable to 2026 exams.

- Level 2: One Learning Outcome Statement deleted from the Machine Learning module (related to neural networks and deep learning). This represents less than 0.5% of the curriculum. 2025 materials are 99.5% applicable – simply skip the one deleted LOS if using old materials.

- Level 3: No curriculum changes to Core topics or any of the three Specialized Pathways. 2025 materials are 100% applicable to 2026 exams.

When to buy new materials anyway:

- If your 2025 materials are heavily marked up or damaged

- If you prefer the latest prep provider enhancements (improved practice questions, updated software)

- If you’re switching prep providers for your retake

- If you want peace of mind with guaranteed current content

When to confidently reuse 2025 materials:

- Failed 2025 exam and retaking in 2026 (you already own the materials)

- Received hand-me-down 2025 materials from a friend

- Found discounted 2025 materials secondhand

- Delayed your exam from 2025 to 2026 due to personal circumstances

Third-party prep providers: Most major providers (Kaplan Schweser, UWorld, etc) will release “2026 editions” primarily for business reasons, not because content changed substantially. You’re not missing critical material by using 2025 versions, though providers may improve question banks or add features worth considering.

Why are CFA curriculum changes and topic weights important?

Topic weights are key to CFA study plans, as it guides candidates on the importance of each topic for the exams. Needless to say, higher weighted topics deserve more study time, focus and practice.

With the recent major changes in CFA curriculum, knowing the nuanced changes in advance are useful in certain circumstances, for example:

- Candidates who have yet to register for the 2026 exam, yet want to get a head start on reading existing 2025 study materials. They need to make sure that what they are studying now will be part of the updated curriculum;

- Candidates who are interested in getting second hand, previous year versions of third party study materials for the next exam; or

- Candidates who (unfortunately) failed a current year exam, and are planning to retake in 6-12 months time. Existing third party study materials may be re-used if the curriculum changes are minor between these 2 years.

Here are the quick summaries of the topic weights and curriculum changes that you need to know for your exam.

For each level, there is also a free 1 pager summary PDF you can download at the end of each section.

What are the CFA Level 1 topic weights for 2026?

CFA Level 1’s topic weights tends to be a range rather than an absolute %.

There are no changes to 2026’s CFA level 1 topic weights compared to 2025’s.

| CFA Level 1 Topic Weights | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|

| Ethics | 15-20% | 15-20% | 15-20% | 15-20% |

| Quant Methods | 8-12% | 6-9% | 6-9% | 6-9% |

| Economics | 8-12% | 6-9% | 6-9% | 6-9% |

| Financial Statement Analysis | 13-17% | 11-14% | 11-14% | 11-14% |

| Corp. Issuers | 8-12% | 6-9% | 6-9% | 6-9% |

| Equity | 10-12% | 11-14% | 11-14% | 11-14% |

| Fixed Income | 10-12% | 11-14% | 11-14% | 11-14% |

| Derivatives | 5-8% | 5-8% | 5-8% | 5-8% |

| Alt. Investments | 5-8% | 7-10% | 7-10% | 7-10% |

| Portfolio Mgmt. | 5-8% | 8-12% | 8-12% | 8-12% |

Since 2025’s CFA Level 1 topic weights changes, there has been more practical focus on Equity, Fixed Income, Alternative Investments and Portfolio Management, at the expense perhaps more theoretical topics such as Quantitative Methods, Economics, Financial Statement Analysis and Corporate Issuers.

These changes are done to sharpen the focus of the curriculum to ensure that candidates can apply their skills on-the-job earlier whilst preparing for CFA Level 1.

What changed in the CFA Level 1 curriculum for 2026?

Good news! There are NO changes between CFA Level 1’s 2025 and 2026’s curriculum.

There are 93 Learning Modules in 2026’s Level 1 Curriculum, no change from 2025.

What this means for you: If you’re using 2025 Level 1 materials, you can proceed with complete confidence. Every reading, Learning Module, and practice question from 2025 remains 100% relevant for 2026. This stability is a welcome change after the significant restructuring in 2021-2024, which saw Ethics moved to the end of the curriculum and topic weights redistributed toward practical asset classes.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

What are the CFA Level 2 topic weights for 2026?

Similar to CFA Level 1, there are no changes to 2026’s CFA level 2 topic weights compared to 2025’s.

This is as expected given historical trends of reducing the variability in topic weight across the 10 topics, with a maximum range difference of 5% per topic.

These changes may have been done to discourage candidates from purely just focusing on the (previously) big 5 topics of Level 2 (FSA, Corporate Finance, Equity Investments, Fixed Income and Derivatives).

Based on 2026’s topic weighting, it is possible for the 10 topics to be tested evenly at 10% weighting each for CFA Level 2.

This is where the discussion on optimal Level 2 study order gets interesting!

| CFA Level 2 Topic Weights | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|

| Ethics | 10-15% | 10-15% | 10-15% | 10-15% |

| Quant Methods | 5-10% | 5-10% | 5-10% | 5-10% |

| Economics | 5-10% | 5-10% | 5-10% | 5-10% |

| Financial Statement Analysis | 10-15% | 10-15% | 10-15% | 10-15% |

| Corp Issuers | 5-10% | 5-10% | 5-10% | 5-10% |

| Equity | 10-15% | 10-15% | 10-15% | 10-15% |

| Fixed Income | 10-15% | 10-15% | 10-15% | 10-15% |

| Derivatives | 5-10% | 5-10% | 5-10% | 5-10% |

| Alt. Investments | 5-10% | 5-10% | 5-10% | 5-10% |

| Portfolio Mgmt. | 10-15% | 10-15% | 10-15% | 10-15% |

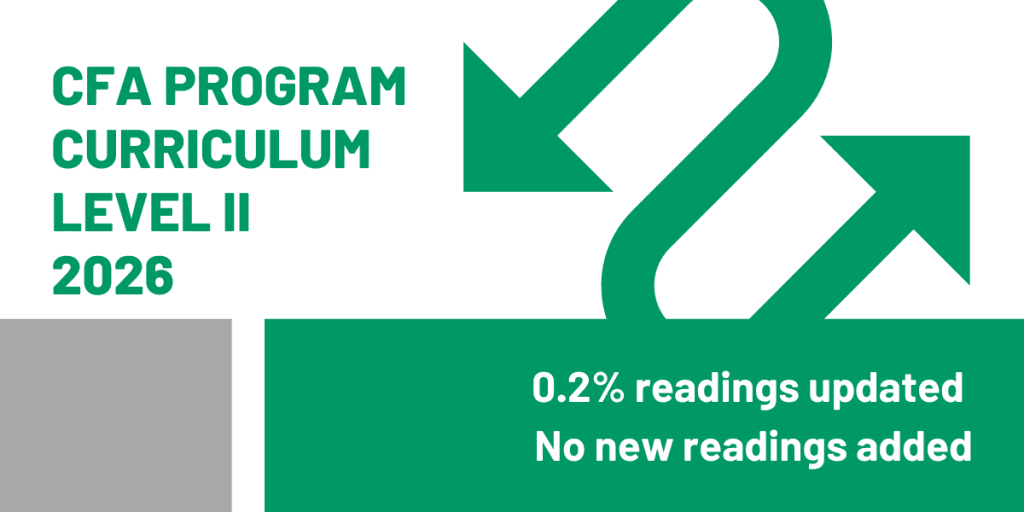

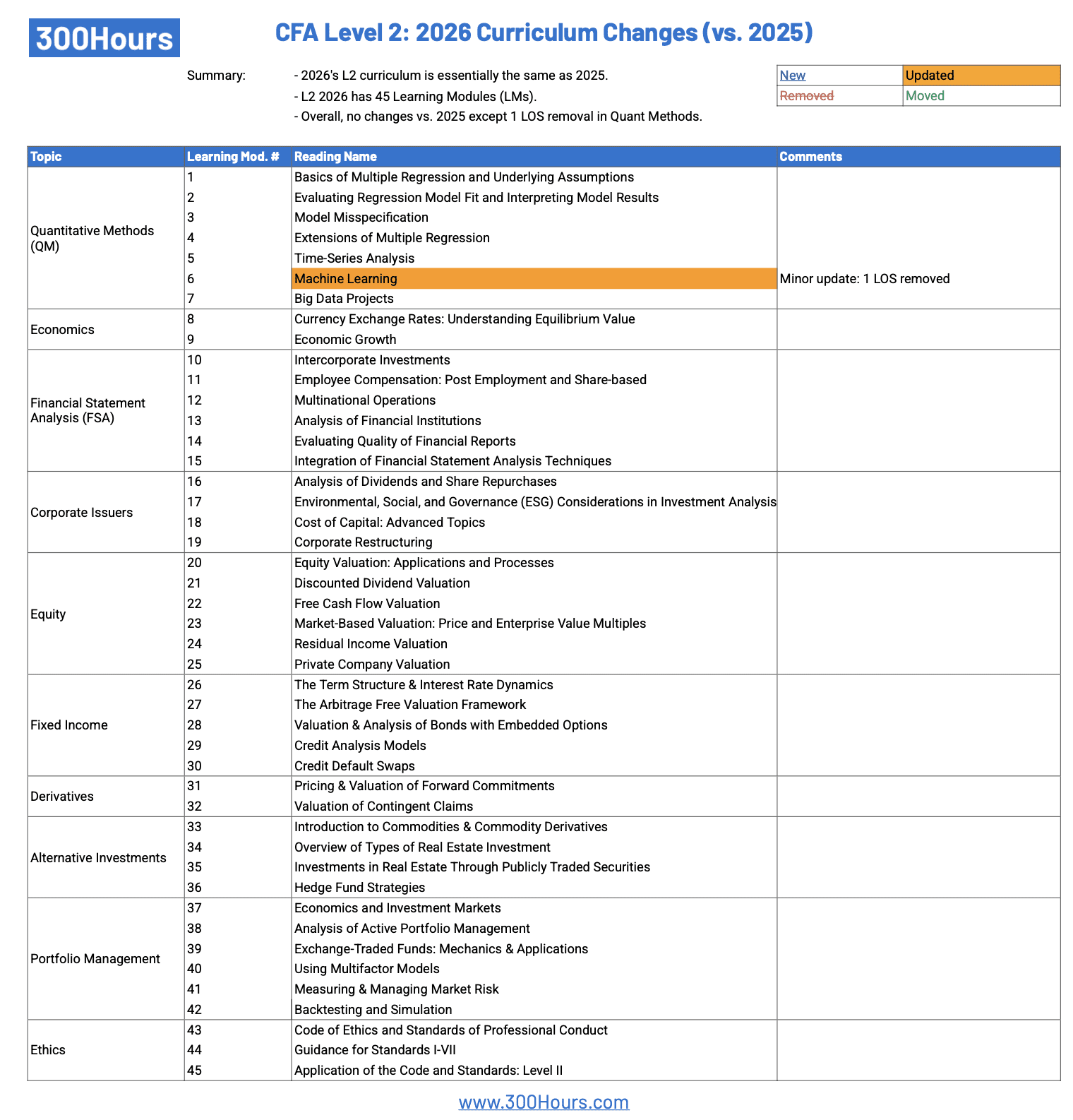

What changed in the CFA Level 2 curriculum for 2026?

Similarly, Level 2’s curriculum experienced a teeny tiny update this year, mainly:

- Quantitative Method’s “Machine Learning” Learning Module (LM) has one Learning Outcome Statement (LOS) removed, which is related to neural networks, deep learning nets, and reinforcement learning.

What this means for you: The deleted LOS on neural networks, deep learning, and reinforcement learning was a single bullet point within the broader Machine Learning module. This topic was tested infrequently (Machine Learning is just one of seven Quantitative Methods Learning Modules, and Quant is only 5-10% of the exam). If using 2025 materials, simply skip this one LOS – you’re not disadvantaged. All other content remains unchanged.

There are 45 LMs in 2026’s CFA Level 2 Curriculum, same as 2025.

Overall, 2025 CFA Level 2’s curriculum experienced a minor update, with the deletion of 1 LOS in Quantitative Methods.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download.

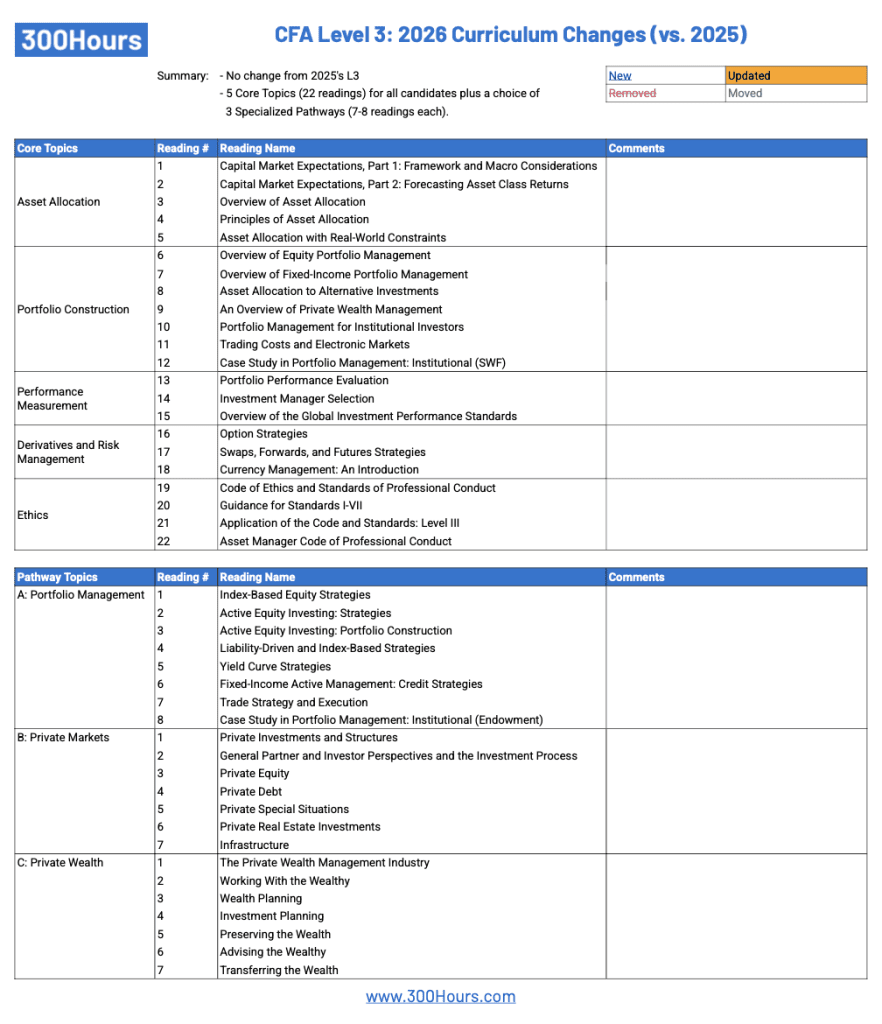

What are the CFA Level 3 topic weights for 2026?

To recap, there has been a large change in structure for CFA Level 3 exams from 2025 with the introduction of a “core” curriculum and an elective part, a.k.a. Specialized Pathways:

- The core Level 3 curriculum is studied by all candidates and takes up 65-70% of the exam weight. It consists of a more focused range of topics such as Asset Allocation, Portfolio Construction, Performance Measurement, Derivatives and Risk Management, and Ethics.

- Candidates can then choose one of three Specialized Pathways (30-35% exam weight): Porfolio Management, Private Wealth or Private Markets.

There has been no changes in CFA Level 3 topic weights since 2025.

| CFA Level 3 Topic Weights | 2024 | 2025 | 2026 |

|---|---|---|---|

| Core Topics (65-70% total exam weight) | |||

| Asset Allocation | – | 15-20% | 15-20% |

| Quant Methods | – | – | |

| Economics | 5-10% | – | |

| Financial Statement Analysis | – | – | |

| Corp Issuers | – | – | |

| Equity | 10-15% | – | |

| Fixed Income | 15-20% | – | |

| Derivatives | 5-10% | 10-15% | 10-15% |

| Alt. Investments | 5-10% | – | |

| Portfolio Management / Construction | 35-40% | 15-20% | 15-20% |

| Performance Measurement | – | 5-10% | 5-10% |

| Ethics | 10-15% | 10-15% | 10-15% |

| Specialized Pathways (30-35% exam weight, choose 1) | |||

| Pathway A: Portfolio Management | – | 30-35% | 30–35% |

| Pathway B: Private Markets | – | 30-35% | 30–35% |

| Pathway C: Private Wealth | – | 30-35% | 30–35% |

What changed in the CFA Level 3 curriculum for 2026?

More good news: there are no changes to CFA Level 3 curriculum this year, thank goodness!

What this means for you: The 2026 Level 3 curriculum is identical to 2025, which was itself a major restructuring year with the introduction of Specialized Pathways. CFA Institute is giving candidates stability to adapt to the new Pathway format without the added complexity of annual curriculum changes. All 2025 Core readings and all three Pathway curricula (Portfolio Management, Private Markets, Private Wealth) are unchanged for 2026.

More details of the changes are shown in the table below, as well as a 1 pager summary PDF you can download, if preferred.

For CFA Level 1, 2 and 3, it seems that 2025’s CFA books can be reused for 2026. I hope you’ve found the above useful in your next CFA exam study preparations!

Meanwhile, here are a few related articles of interest: