How does one obtain the CFA charter as quickly as possible?

Assuming consecutive passes (big assumption), the average time to pass all 3 exams in 12-18 months. While the fastest route to pass all 3 CFA exams in 12 months is possible, it’s a high risk, high burnout strategy that is not for the faint hearted…

Years ago, I somehow managed scrape through my CFA exams in 18 months whilst working full time. So here’s a summary of my CFA Level 1 exam study strategy with some useful tips, which I hope you find beneficial for your study preparation.

This guide starts off by ensuring you know what you’re up against in CFA Level 1, answering the key questions you need to bear in mind before studying.

We cover some frequently asked questions about CFA level 1 preparation, how to set up your study plan, with specific CFA Level 1 tips to improve your pass chances.

Let’s dive in!

CFA Level 1: A quick overview, plus some Q&A

According to CFA Institute, it takes a typical candidate an average of:

- 4+ years to complete the CFA program;

- 300+ hours of studying per Level

- 6 months of preparation for each exam (i.e. about 11.5 hours study per week assuming 300 hours)

The CFA Level 1 exam is an introduction to 10 broad topics of investment analysis and ethics, building a solid foundation of your finance knowledge for Level 2 and 3.

CFA exams are now computer-based, and CFA Level 1 exams are held 4 times a year in February, May, August and November.

We need to understand what CFA Level 1 is about to beat it. So, let’s go through some common questions I’ve received from candidates recently (and my answers):

How hard is CFA Level 1?

Having passed all 3 levels, CFA Level 1 is the the easiest amongst the 3 exams.

While Level 1 covers a wide range of topics, it doesn’t yet delve into too much detail of each concept, as it focuses on bringing all candidates to the same knowledge level before Level 2. It is quite do-able and approachable with some study hours put in, regardless whether you have any background in finance.

In the spirit of being objective, I’ve found some relevant statistics on this (see table below):

- The strongest evidence we have is the average study hours by actual candidates in CFA Institute’s June 2019 Candidate Survey: Level 1 records the lowest average study hours of 303.

- Number of pages / readings / topics are not really good measures of difficulty, just ask any CFA charterholder out there!

| CFA Level 1 | CFA Level 2 | CFA Level 3 | |

|---|---|---|---|

| Average Study Hours (June 2019 CFA Institute Survey) | 303 | 328 | 344 |

| Number of Pages in CFA Curriculum | 3,295 | 3,250 | 2,564 |

| Number of Topics Tested | 10 | 10 | 6 |

| Number of Readings / Learning Modules | 73 | 49 | 35 |

What are CFA Level 1 pass rates like?

The latest CFA Level 1 Nov 2024 pass rate is 43%.

There has been a change in trend of historical pass rates since 2021, so it is best to refer to our CFA pass rates article for more details.

For more details on CFA exam pass rates and minimum passing scores (MPS):

- CFA historical pass rates since 2010

- CFA exams: A beginner’s guide

- CFA passing score: our latest estimates

How much does CFA Level 1 cost?

The total 2025 exam fees for CFA Level 1 are US$1,340-$1,640, consisting of:

- A one-off enrolment fee of US$350, plus

- Exam registration fee of US$990-1,290 depending how early you register.

There are other optional additional fees to consider, such as physical books (if preferred), rescheduling fee and third party study material costs.

For a full breakdown of total cost estimates for CFA Level 1, check out our CFA exam cost article.

What is the CFA Level 1 exam format? How is it structured?

- CFA Level 1’s computer-based exam consists of 180 multiple-choice questions in total, split into two 2 hours and 15 minutes exam sessions with 90 questions each.

- On average, you should allocate 1.5 minutes (90 seconds) per question.

- There are 3 answer choices for each multiple choice question.

- 1st exam session (2 hours 15 min) covers 4 topics: Ethics, Quant Methods, Economics, and Financial Reporting and Analysis.

- 2nd session (2 hours 15 min) covers the remaining 6 topics: Corporate Finance, Equity, Fixed Income, Derivatives, Alternative Investments and Portfolio Management

- All questions are equally weighted and there are no penalties/negative marking for wrong answers.

Although not tested as part of the exam, there is also a mandatory requirement to complete one Practical Skills Module (PSM) prior to results announcement. A PSM consists of a combination of videos, multiple-choice questions, guided practice, and case studies to develop candidates’ practical skills. It takes about 10-20 hours per module to complete.

What are the latest CFA Level 1 exam curriculum & topic weights?

| CFA Level 1 Topic Area | Topic Weights |

|---|---|

| Quantitative Methods | 6-9% |

| Economics | 6-9% |

| Financial Statement & Analysis | 11-14% |

| Corporate Issuers | 6-9% |

| Equity Investments | 11-14% |

| Fixed income | 11-14% |

| Derivatives | 5-8% |

| Alternative Investments | 7-10% |

| Portfolio Management | 8-12% |

| Ethics | 15-20% |

For those considering using previous year’s books to study, it’s worth referring to the latest CFA curriculum changes article to check how much the curriculum has changed over the year.

How many hours do I need to study for CFA Level 1?

Based on CFA Institute’s June 2019 Candidate Survey, the average Level 1 candidate studied for 303 hours. This is in line with our experience that around 300 hours study is sufficient for passing Level 1.

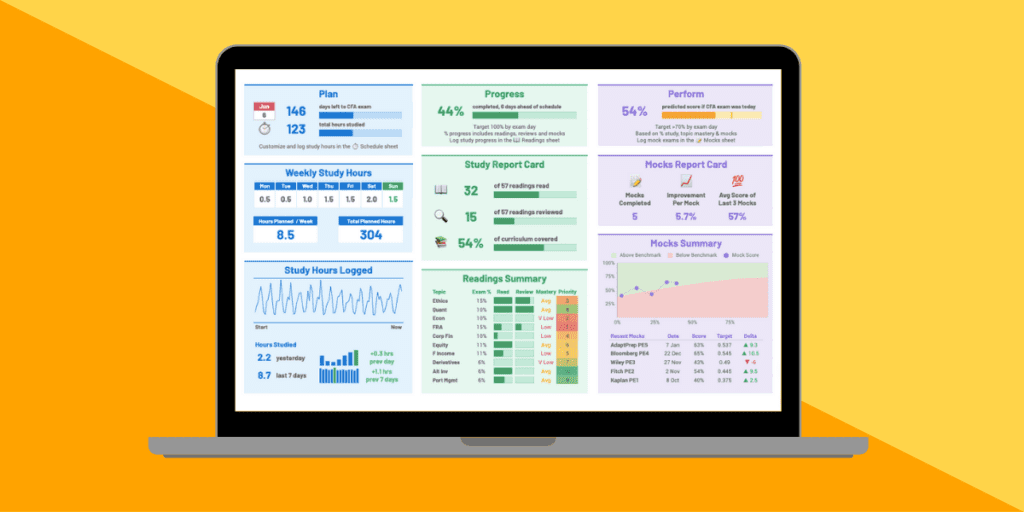

I would recommend having a look at the CFA Fast Track Plan as a guide (for students, working professionals and parents), then use our latest updated Free CFA Study Planner to customize your study plan to get going!

Can I self study for CFA Level 1?

Yes, it is certainly possible.

I have done this myself for all 3 levels of the CFA exams. I just bought the basic study notes package from a third party provider (Kaplan Schweser) and self studied with no classes.

It really depends on your learning and study style, as I know some visual learners who absorbed concepts better via video or in-person classes. I’m just a book-and-paper person, easily distracted and prefer to hide in a quiet corner of a library to study. 🙂

How I Prepared For CFA Level 1

- Manage your time expectations: CFA exams require a serious time commitment. To target for consecutive passes in 18 months, a minimum of 300 study hours over a 6 month period is recommended. This implies a minimum of 11.5 hours of study over a 7 day week. With long working hours on weekdays, I could only study strictly on weekends, so I blocked time out for that as it was the only way it could work. Which brings me to the next point.

- Be upfront to friends & family about social expectations: Let them know in advance that you may be less available for dinners and social outings for a period of time, especially the 4-5 months before the exam. They will forgive you after then, when you celebrate your passes. This was especially true for me as I studied exclusively on weekends.

- Create a customized CFA study plan: Based on your work/life commitments (here’s a few CFA Fast Track study plan as reference for different profiles), create a study plan that works for you. I highly recommend trying the recently upgraded 300Hours’ Free Study Planner, which was inspired from the first version of my study plan years ago. Not only does it track your study progress, it also identifies weaker topics, offers practice exam score benchmarks and even predicts your CFA exam score!

- Save the last 4-8 weeks for practice exams & revision: Make sure you have covered the study material thoroughly beforehand to have a proper go at the practice papers. In case it is helpful, here’s a quick breakdown of my timetable to the CFA Level 1 exam, and what I did each month:

- 5 months before exam day – I ordered some third party prep provider’s study materials, as I got a mental block looking at the sheer volume of the CFA Institute study materials as I couldn’t cope with too many words in general. I spent this whole month just skimming through everything to get a feel of the materials.

- 3-4 months before exam day – Reread the materials in detail and tried out the End of Chapter questions, noting down areas I have not understood fully or frequently got wrong.

- 2 months before exam day – Reserved the last 2 months for question practice and last minute material studies on areas that I needed more work on. It is these 2 months that I learnt the most, after I started to try out practice questions. Remember practice makes perfect, and I recommend trying at least 6 full papers timed in your overall studies to get the feel of the speed required for exam. I did 3-4 papers in this month, with scores and timing improving gently over the month (first one was an epic fail, as expected).

- Last month before exam day – The last haul here, best to use any study leave (+ some personal holidays which I highly recommend) the week or two before exams to fully focus on nailing the rest of your practice exams and rereading materials on areas you have noted you are weak in.

- Finally, stick to your study plan and routine – After you had worked out a suitable study timetable, it is important to create a routine around it, so it becomes a habit and second nature.

- For example, I study better in the mornings with longer 8-10 hour study sessions (with breaks in between of course). Therefore I plan my days around them (e.g movies / dinners with friends at night, sleeping earlier in general etc). Know when, where and how you work best for effective study sessions, and being honest about it helps.

- In the end, my weekend study times were a little higher than the average 300 hours – more like 350 hours. I suppose the fear of redoing it again if I didn’t pass is a source of motivation for that. It was tricky to balance studying for the CFA and working in a hectic full time job, but it can be done by sticking to your study plan.

CFA Level 1 study tips, from my experience

- Do NOT ignore Ethics like I did, thinking that it is one of those “do-the-right-thing” questions that don’t require much reading. I only discovered my mistake during the practice exams period (1-2 months before exam date) and scrambled to cover that topic. Sometimes, Ethics isn’t intuitive and you have to learn it.

- Use the End of Chapter (EOC) Questions as a topic grasp indicator – At the end of each chapter, the CFA curriculum has some questions for candidates to try out. These are usually slightly easier than exam questions, but nonetheless extremely useful to test your basic understanding of the material. Do them all, and more importantly record your score as a percentage, and jot that down in your study plan. That will be a useful indicator down the road to know which topics you’re strong or relatively weak in.

- Learn from other candidates – Always good to check out what are the common patterns in past exams. The free Level 1 Commandments are pretty solid advice too.

- Master your calculator – whether it is BA II Plus or HP12C, make sure by the time exam time comes you’re comfortable, fast yet accurate with it. It’s worth checking out the BA II Plus and HP12C calculator tips to ensure you don’t miss anything out. Also, always clear your work before you begin a new calculation for a question.

- Practice makes perfect – Given the multiple choice nature of Level 1, the more questions you can attempt the better to maximize learning. It is best to allow at least 1 month prior to exams to focus on this, as you will always discover new areas that you need more work on. Oh by the way, here’s a free Level 1 practice exam for you.

- Exam time management is key – Level 1 is about breadth and you need to be ruthless in time management (1.5 minute max per multiple-choice question), before you fall into this slippery slope and not be able to recover ground. Give yourself some time to mull over questions, but once times up, choose an answer and move on! There are no penalties for wrong answers, so guessing is better than leaving it blank.

- Have a (good) study buddy – It helped a lot in my experience and it is not just for academic reasons. It’s nice to have someone to go for lunch with, moan about the dreaded FRA questions, or just to play foosball with during your break.

- Take care of yourself – It’s only the first battle out of three, so take care of your well being by achieving some balance between study, play and sleep. Drinking 3 coffee shots 5 nights in a row is NOT the way to go for this marathon! Incorporating some exercise, having enough sleep and more importantly eat well to concentrate better in those study sessions. It pays dividends in the long run, it is a marathon, after all.

So there you have it: my study guide for CFA Level 1. It’s no big secret and never will be, just some careful planning and disciplined hard work, interspersed with some fun. I hope you all found these useful, leave a comment below if you have any questions!

Meanwhile, you may find my CFA Level 2 and 3 experiences below, along with some other useful articles:

- CFA Level 1 Topics: What Is The Best Study Order?

- CFA Level 1 Tips: Top 10 Tips & Advice from Previous Candidates

- CFA Level 2: How to Prepare & Pass CFA in 18 Months

- CFA Level 3: How to Prepare & Pass CFA in 18 Months

- Fast Track CFA Charter: How to Pass the CFA Exams in the Fastest Way Possible

- Free & Upgraded – 300Hours CFA Study Planner

- Free 300 Hours Guides, including the 10 Commandments

Hello Sophie, What are the skills a person should have along with academics / curriculum knowledge?

I found here better hands-on, effective, no nonsense and useful suggestions about the correct approach to pass an exam, than in any other site, article, blog, or scientific paper I read in the last ten years. I’m not preparing for the CFA, but your advices about learning are really good, beyond this specific exams.

From all of us at 300Hours, thank you for your very kind comment, it REALLY made our day!

Are you preparing for any exam in particular? You may also find our research-backed article on how to study effectively (in general) of use.

suggestions & guidelines give me better understanding a lot.

Hello Sophie !

Thank you for sharing your path! I’ve recently graduated from medical school, and would like to get into finance. Would it require more time for people without finantial background?

People without financial background would not be necessarily disadvantaged – I didn’t have a financial background myself. The only level where it might make a bit of difference is Level 1, but even then there is evidence to show that people WITH financial background are more likely to fail, because they tend to put in less effort into studying!

Hi Sophie. Thank you very much for your deep insight into CFA preparations. Much appretiated

You’re welcome! If you have any questions during your prep, just post a question at https://300hours.com/forum/. Your question will be answered by one of our candidate/charterholder volunteer team.

Good luck with your prep!

Hello Sophie, I intend to take cfa at the later level of the year, can you suggest where I can get the 3rd party notes suppose I am self studying it? 🙂

Hi Melissa, do check out our Offers section for our list of preferred providers and latest study material deals.

whats the pass mark for level 1?

chris

Hi Chris, pass marks are not disclosed by CFA Institute, however we have published our MPS estimates based on our research.

Hi Sophie, do you mind explaining how to make use of the candidate resources provided on the CFA website? I am registered to take the Level Exam 1 in August and I am confused on how to use them since they provide readings for a few of the sections but I do not know how use them for the study sessions.

hey I just wanna ask I have to give ca exams in May and thereafter it will be okay to attempt cfa level 1 in feb or I shall shift the attempt in may. please guide me so I can take registration as soon as possible.

thankyou

Hello, Currently studying for the CFA L1 using the wiley platinum option. Is it okay to only focus on using the Wiley products rather than the CBOK.

Hi Suky, yes that’s fine as Wiley’s products are standalone, and not a supplement to the curriculum. Quite a lot of candidates use third party study materials for that.

Ok

Hi Sophie, I am an IT professional having 10 years of experience as a developer and Team Lead. I do not have any finance background and I was thinking to go for an MBA degree but now I have dropped my plan. Would it be beneficial or would i have any scope to have CFA exam to make my career in finance? Frankly speaking I have no idea about CFA. Could you please atleast help me to make my mind to prepare for CFA exams?

Hi Vinay – you can complete the CFA Program while doing your job, so assuming you can afford the time I would recommend it. If you’re just starting to look at finance, I would also research roles you’re interested in, network and build other skills so that you’re well-positioned to interview when you have some progress with your CFA qualification. We’ve got guides for finance job-hunting too – for more info search ‘300hours jobs’!

Hi- I took L1 with 3 months of studying while working and did only the practice problems from Schweser. I barely failed (I was very close to the MPS). What should my plan of attack be. Should I read the wiley books included in the curriculum or do the practice problems again from Schweser? My goal is to pass L1 in Dec and L2 in June so I was thinking of simply reading the L2 books at this time. Thoughts? I have a CPA but no Finance background.

Hi May – you should definitely not jump straight to L2 before passing L1. If you nearly passed last time around with just Schweser practice problems, studying from the curriculum books (and using CFA Institute practice questions) together with practice questions from Schweser should do the trick for L1. L2 is a lot harder and you should plan extra time to prep – proper studying, review and practice. Good luck!

Hello, Please advice on study material to use if i have only 3 months to prepare. I know this is a short time, however I have done my masters majoring in Finance and looking to enhance my qualifications at mid-career. Thanks in advance.. Regards ,Betsy Regards Betsy

The materials wouldn’t change regardless of time frame – you just have to go through them even quicker! You can view our recommended providers in the ‘Materials’ section in our nav bar above. Remember that education and work experience only mostly helps in L1. Your background may not matter as much in L2 and L3.

What if i go for interneship in an investment bank rather than CFA, what would you recommend?

Hi Sophie, I have registered for level I june 2019 and just started studying. I just want to ask you if it is in human posibilities to pass level I with only 3 months of study? Thanks:) juraj

Hi Juraj, Possible is a very loaded word. Some have done it in weeks, but obviously they are the minority. It mainly depends on your familiarity with the material (first time? work/study background?) and time commitment (working full time?). It’s hard to answer without knowing more about your circumstances. To be helpful, my work and education background was helpful for Level 1 and I was in a full time job that time. Despite that, I found that it took time for me the grasp the time discipline needed for the exam. Assuming I need 1 full month to do tons of practice exams on weekends, 2 months alone to study the material would be challenging for me due to work pressures. Tell me more about your situation and maybe we can advise better.

Ahoj Sophie, Thanks for your answer. I am working as a consultant for more than 3 years and almost all topics are familiar to me mainlly from my uni, but some (statistic) I have not been using in practice at all. But on the other hand I have study courses starting next week. Thanks again. Juraj

I have registered for cfa level-1 in june 2019, I would like to ask that what percentage numerical questions are in cfa and what percentage theoretically questions are tested? by numericals,I mean problem solving questions and is there any rough paper provided by cfa to solve numerical in exam for cfa?and kindly confirm that which one is more effective cfa curriculum or schewzer notes? or both? reply to this would be highly appreciated. Thanks and regards SM

Hi sayed mukhtiar, The % of numerical vs. theoretical questions vary from year to year, there’s no set rule really, as they tend to come together: you need to understand the theory to be able to calculate! In the CFA exams, there is no rough paper provided, only your exam and answer sheets are given. There’s sufficient space in the question papers to scribble if needed. On which is more effective, unfortunately its something that you have to try for yourself and see which works better for you, since we all study/absorb materials differently. Personally, I prefer brief notes hence I chose Schweser, many found the curriculum useful for explanations. In any case, the curriculum has additional practice questions which is never a bad thing!

Hi Sophie, I was wondering if you could divulge your exact study strategies that you used to pass level 1. Did you make paper notes or flashcards or anything like that? Also, how did you balance reviewing older material whilst at the same time pushing on with the material? At the moment I am struggling to review anything as I am caught up in trying to push forward through the material. I also scare myself quite a lot when I go through old material as I usually find I still cannot remember any of it and just have to re do it. Kind of feel like I am trying to dig myself out of quicksand here as the more I push forward the more old stuff I forget and have to do again. How did you memorize stuff for the exam? I just cannot seem to get this stuff to stick in my head as all the topics just seem so similar but with just a few little differences that scramble as soon as a new element is introduced. This seems particularly true for FRA (and Quant Methods as well!) as I am currently struggling through this as I write this. Hate to unload all of this onto you but I am really struggling here and I feel like I might as well just give up if things don’t improve soon as not much time left before the exam…. Kind regards James

Dear James, No worries, it’s totally cool and that’s why I’m here really – to share my CFA experience and offer some help, I know and feel your pain! On study strategies: 1) Timetable – as detailed above, the first month was reading (very quickly) ALL books; the next 2 months are detailed reading solid reading materials and doing end of chapter questions; the final 2 months are for practice questions and last minute revision of study materials (especially sections I’m weak in). Repetitive reading of materials is how I remember, coupled with tons of practice questions of course – the ‘quicksand’ effect you’d mentioned is common. It’s a lot of info to cover after all. 2) Study notes – for Level 1, given the sheer amount of material, I didn’t make full study notes, only abbreviated ones for sections that I was weaker in. Writing it down seems to aid memory for me. 3) Memorising stuff – there’s a few elements to this. If you understand a concept, normally it doesn’t require memorising, except some formula. Doing lots of practice questions (in months 4 and 5) and jotting down notes (only for weaker sections) helps tremendously. Don’t fret, until you get to practice questions (and get a ton wrong), you won’t know how much you grasp until then. However, the rate of score improvement should accelerate the more you practice – so it’s normal to still feel clueless until the practice tests much later in your study schedule. The key is to identifying areas you are weak in and focus on getting them right next time. I hope this helps, don’t hesitate to let me know if you have further questions. Oh, and never, never, ever give up – it’s the spirit of 300 Hours team 😉

HI sophie, I have a plan to appear for CFA exam in Dec’13 but still I haven’t enroll for the exam because of the fear. Actually I planned to allocate 6 months for reading schweser material, 3 months for skimming CFA books and the rest 2 months for practice. In my schedule, i have wasted nearly one and half months. So, this reason making me to enroll for the exam in this Dec. After reading the above post and ur CFA story, I have got some kind of inspiration, confidence to clear the exam in this December. Still, I just want to have a word with u and get confirmation. Please tell me, if i enroll for Dec 2019 exam by March 2019 and start preparation, is it possible for me to GET THROUGH it? And one more question, Is it necessary to go for private coaching to go through the exam without any trouble. please reply

Hi Gunapriya, I’m glad you’re inspired to take the exams! It’s more useful to think in terms of study hours, rather than just months. It also seems like you are having some time management problems when you mentioned that 1.5 months are ‘wasted’. As long as you hit about 300 hours of productive study hours on average, you should be well prepared for Level 1. You can easily achieve those hours with such advance preparation for Dec 2019. But this requires hard work, discipline and a sensible study schedule, you shouldn’t be wasting anymore time, in other words. Please refer to my other post on creating a sensible study schedule which you can stick to. Remember, CFA itself is a test of time management, and if you can’t stick to your study prep schedule, you probably won’t have enough time to tackle all questions in the exam no matter how well versed you are with the material! On your second question, it depends on individual and I can’t assess this for you. You need to know what study style is more effective for you: self study or classes. For me, I knew I couldn’t pay attention in a classroom-style setting and preferred self study. Others work better with more interaction such as classes or study groups. Feel free to check out the ‘Offers and Reviews’ section for your study options. Hope this helps!

Hi Sophie! I see from your post that you were working already prior to taking the CFA exams. I was wondering if it’s okay to take the CFA level 1 exam without any work experience? I’m actually planning to take the exam right after I graduate (I’m currently on my last year of college, majoring in Finance) and study for it full time (roughly 3 and a half months). I’m just worried that I might at a disadvantage considering most of the people who take the exam are already working and/or pursuing a masters degree, and here I am going in with no exposure and experience whatsover. Thank you!

Hi Lee! Your situation is fine and you’re not disadvantaged in any way. In fact, I’d say with your Finance major and 3.5 months of solid focus without job distraction, you wouldn’t have a problem fitting in a consistent study schedule for Level 1. A lot of what you will learn in Level 1 is to bring everyone on par, so work experience wouldn’t have much impact on that. It only comes into play when getting the CFA membership after you have passed all 3 exams, where a 4 year relevant work experience is required.

Hi Sophie. I am so proud of this feat you achieved. I am really inspired. I am a Level 1 candidate with a Bsc and Msc in Finance , and an ACCA + some treasury experience. I started preparing for June 2019 since last week in january but I am so confused. Initially I started with Scheweser notes and was okay, but when my curriculum books arrived, I switched to them and got confused in the process. Please what reading plan and material should I adopt. I am currently not working, but likely to get a new job any moment from now. I have a personal target to complete reading by end of march, in order to have april and may to focus on practise questions. hope to hear from you

Hi Omadara, If you find that you got confused with the curriculum, then stick to what works for you. I did Level 1 also just using reference books, Schweser at that time. Your reading plan seems more than achievable as you’re studying full time, and having 2 months to practice is a good buffer. Best of luck! Keep me posted on how things are going from time to time.

hello Sophie, I wrote the LEVEL 1 exam December 2009. but i did not pass. I had enrolled for the exam in July whilst pursuing my Masters degree in international finance. i was thinking well i would be learning for CFA indirectly but i guessed wrong. i barely had 2 months to prepare for CFA exam. question; I plan to take LEVEL 1 DECEMBER 2019. do i need to pay the Enrollment fee since i have taken it before in 2009? what do you think is the hardest topic area in CFA level 1 …and how did you tackle it. for me, it was financial reporting and analysis and alternative investments.

Hi Francis, Indeed 2 months is barely enough for revision no matter how well versed you are in finance – as a lot of it is practising and making sure you are quick and accurate at the same time with calculations. Am glad you’re giving it another go end of this year. On your question, no you don’t need to pay the enrolment fee again. The CFA enrolment fee is one-off and only applicable to first time Level I candidates. Retakes and candidates progressing to Level II and III only need pay the exam registration fee. Just like you, the hardest topic for me was FRA too as it was vast and quite detailed. I recognised this during practice exams and noting that the score in that area was weak. I made sure I read the notes on that section well and understood before the next practice. The same mistake should never happen twice, else I get crossed with myself! I hope this works for you too. For more in depth analysis on recent Level I results, I highly recommend getting the 2018 Results Analysis Report. There’s a lot of good insights to candidate’s performance. In addition, you will get the Dec 2018 update for free too once we have finished with our analysis, in a month or so. Hope this helps, Sophie

Thanks Sophie for the advice and information. Your website is really cool. and makes CFA look realistic to study for. thanks again.

Francis, you’re welcome! Let me know how things are going from time to time then.

Hi Sophie, I am currently studying for the CFA Level 1. I want to ask your opinion on something. I basically am doing the CFA to try and get into investment banking. However I have a 2.2 degree and not a particularly strong CV at present as I have not got any investment experience/internships/non finance degree and didn’t manage to get into a graduate role at all. I currently work at a bank in low level role in operations and basically I have dreams of a big money IBank job (just being honest!). From your perspective as someone who got into a grad scheme and seems to be on the right track do you think I have a chance of getting into an Ibank grad role or similar scheme? What would your bank think of someone in my position? Also I think you should disclose in this article that you are a super genius if you managed to do Level 1 without weekday study and just doing the practice questions. I am banging my head against the wall most weekdays and still flummoxed by the simplest quantitative methods stuff.

Hi James, Good to hear from you and welcome to 300 Hours! Thanks for your kind words, I wouldn’t say I’m a super genius, but it’s about managing your time well and making sure you are getting most out of the little study time I have – will write about those in the next posts. On your question, it’s not a easy one, but here are my thoughts: CFA requires at least a 2 year commitment with no certainty of success of an IB job that you desire. However, it does boost your chances indirectly as it acts as a signal for finance knowledge (when acquired) or at least your commitment to acquire them (as a candidate) – particularly helpful if you don’t have a finance degree. You already work in a bank (although not your desired team yet), but you should use this opportunity to network and basically find out current opportunities to switch to the team you want. Peers and HR are common sources, but I prefer asking a manager or director of the relevant IB team directly out for a coffee to find out more about their team and available opportunities. Try other companies too and apply for relevant IB jobs. To be safer, you should aim to continue with CFA studies and exams at the same time. Mentioning you are a CFA Level I candidate may not the strongest point now, but it shows some commitment. As you pass the levels (and I’m sure you will with hard work and determination), you can upgrade to ‘CFA Level II candidate’ etc – it’s a process of continuous improvement. For IB interviews, I recommend investing in the “Investment Banking Prep Pack” from https://300hours.com/wso – it packs a lot of useful info and experiences from people who have done it before. It’s going to be hectic and difficult, juggling work, studies and searching for the IB job that you want. But it’s not impossible, its when you don’t try at all that gives you a 0% chance. Best of luck, and do update me on your progress!

Hi Sophie, remember me? well just see the comments above this and you will find my comment. ____________________________________________ This was a highly motivating article. (Y) I like the way you have panned out your cfa course in matter of 18 months, which certainly boost my morale. Reply Sophie11/06/2018 6:50am Ritz, I’m glad you found it inspiring and helpful. Best of luck for the exams, you can definitely do it! Sophie ___________________________________________________ That day and today it is, I got my CFA LEVEL 1 results day before yesterday, and guess what? I PASSED CFA LEVEL 1. 😀 I know its kind of kiddish but i had this link saved, and out of no where i thought i should let you know about it too. This post literally helped me clearing my examination. thanks alot for this email. I highly recommend everyone to have a look at it atleast once.

Ritz, CONGRATS! Oh my god, I’m so happy for you, well done! It must feel epic that all the hard work paid off, I remember how that feels 🙂 No, it’s not kiddish at all, we all have our sources of inspiration that keeps us going and I feel so humbled that my posts inspire you – you made my day 😀

Hey.. Juss wanted to ask after studying engineering is it worth doing a CFA in ur opinion.

Hi GT, Welcome to 300 Hours! It depends what you want to do next? A little description on career situation and aspiration would help me help you better. Looking forward to hear from you soon GT.

Ritz, I’m glad you found it inspiring and helpful. Best of luck for the exams, you can definitely do it! Sophie

Thanks & god bless, for your encouragement. 🙂

This was a highly motivating article. (Y) I like the way you have panned out your cfa course in matter of 18 months, which certainly boost my morale.

hello sophie, i am pursuing bba (4th semester) , as am thinking to appear for cfa1 , from nw(october) is this d enough time to start for june 13 ??

Hi Deepak, I only started around 5-6 months before, averaging about 16-18 hours a week of study (as I was working full time). So that’s a lot of time for your preparation, not to worry! Sophie

Hi Sophie, Interesting post. I am currently in similar situation like you. Passed Level 1 and 2 in Dec and June and now looking forward to Level III with a hint of trepadition as writing timed essays is not my strongest point. So looking forward to your experience preparing for Level III.

hey.. congrts.. i just wanted to ask that i am a final year computer science engineering student.. What should i study before enrolling for cfa? and can i enroll now only and study straight forward in 6 months?? means does cfa require pre knowledge or i can manage?

Hey Shubham, There is no pre-requisite knowledge required for CFA although this means you may have to spend more time learning new materials. I assume you are referring to June 2019 Level I exam that you intend to enrol in. If so, start your preparation early, work hard and you should be able to manage. I would say aiming for the December 2018 Level I now without much background knowledge would be challenging although not impossible. Sophie

thx 4 your fast reply.. Ya. I am referring to June 2019 Level 1 exam. Can you please help me by giving some link or any book that i should study till January before getting their material. It will be really helpful in fast preparation that time. I belong to middle class family. So anyhow i have to clear in first attempt. Ready to give my best..

Hi, We have a full set of study 2020 CFA program level one, volunes 1-6 left behind by someone who completed this program. Looking for a home thnaks you, mhagler@cvent.com california

Hello Sophie, One thing about ethics, I started last week Level 1 for June 2019. What do you think about schweser notes in etchics? Usually every night or every 2 night I usually watch a Schweser video and following notes but I think are really short notes. Do you recommend read the curriculum? Was easy for you? or instance of read is better do questions. Thanks and congrats about your 18 months! Is really amazing found people that achieve the CFA in only 18 months! Thanks @nova

Hello Nova, Well done, that’s an early start for June 2019 Level 1, keep up the good work! On your ethics question: I used Schweser notes only for my revision and like you said, they are concise, which is great! In particular, I found the case studies in the notes very useful to illustrate the application of a concept. Ethics is best learnt by examples and practice questions. So if you would like more supplemental materials from the curriculum, try focusing on the ethics case studies only (rather than the whole section). Combining this with practice questions would be more than sufficient 🙂 Sophie

Thanks for your quickly answer. I just start with the material because I will start to work next January so…I do not how much time I will have so I need to study hard these months before. “Ethics is best learnt by examples and practice questions” I note this sentence in my mind 😉 Bye @nova