Quick summary: To optimize your CFA Level 1 prep, focus on high-weighted topics (e.g. Ethics and FSA), maintain a 90-second-per-question pace, and complete at least 6 full mock exams.

Our proprietary data shows that candidates who consistently hit a 70% mock score have the highest probability of passing on their first attempt.

So you’ve finally registered for the CFA exams as a Level 1 candidate. Welcome!

Facing the first challenge of your CFA journey can be overwhelming. But you are not alone, because we are here to guide you on what you should do in your CFA Level 1 preparation and help you pass.

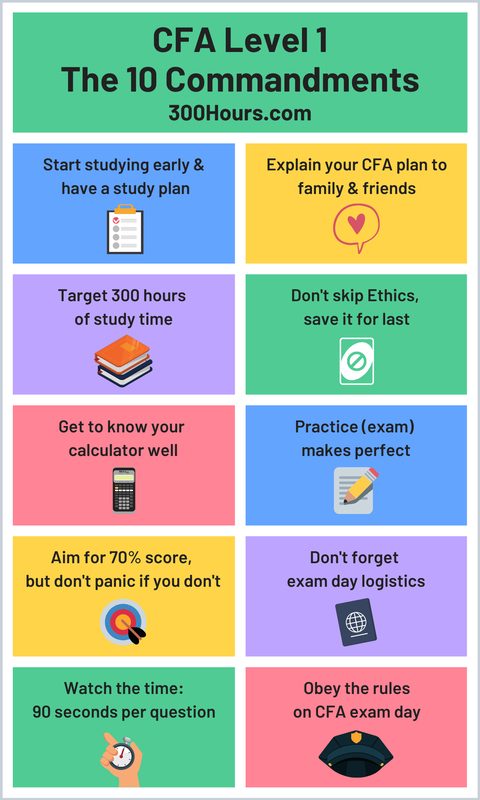

Here are our top 10 CFA Level 1 tips – a set of golden rules distilled from thousands of experienced candidates and CFA charterholders – that every Level 1 candidate should know.

- CFA Level 1 tips: Our 10 golden rules, summarized

- When should I start studying for CFA Level 1?

- How do I balance CFA study with work and social life?

- Is 300 hours of study really enough for Level 1?

- How do I handle the CFA Ethics topic and 'Ethics Adjustment'?

- Which calculator should I use for the CFA exam?

- How many mock exams should I do for CFA Level 1?

- What is a safe score to pass CFA Level 1 mock exams?

- How should I spend the final week before the CFA exam?

- What is the best time management strategy during the CFA exam?

- What are the final CFA exam day protocols to follow?

- Looking for more than just tips?

CFA Level 1 tips: Our 10 golden rules, summarized

When should I start studying for CFA Level 1?

Aim to start studying about 5-6 months before exam day: For example, I generally recommend starting in May if you’re taking the November exams.

Ease into it and slowly ramp up – remember that you’re in for 300 hours of study, that’s 11.5 hours of study time per week over 6 months. Don’t jump in all guns blazing or you’ll burn out long before the exam arrives. This however is just a recommendation – time needed varies depending on your background, especially in Level 1. If the material is less familiar to you, start earlier. If you think you’re hardcore/smart/already-know-all-this, start later at your own risk.

Have a study plan – use our upgraded, free CFA study plan that more than 50,000 of our readers have used effectively.

Consider third party resources to save time – Do take the time to look at additional study materials, especially if you are planning to start by reading the CFA Institute syllabus. I would advise starting with a more summarized material and utilize the CFA Institute curriculum for their practice questions and further clarification (if needed).

How do I balance CFA study with work and social life?

Understand the time commitment required to pass this exam: Yes, I’m talking about you yourself. This exam will consume copious amounts of your time, aside from your usual life commitments. It is pretty hard to balance studies and expect the rest of your life to continue as usual.

Understand that you will be stressed, tired and cranky: Especially as the exam approaches. And this means sometimes you won’t be at your best around your other life commitments.

Communicate these challenges to everyone important in your life:

- Now that you know what it entails and what it does to you, get an early buy-in from everyone you will be pissing off. This includes your parents, girlfriend/boyfriend, husband/wife, roommates, boss, coworkers, dog/cat.

- Take the time to explain that you are taking an extremely taxing set of exams, and during this time you may be not as awesome in your commitments to them as before. By explaining beforehand, this will make them more understanding when you miss their birthday celebration, for example.

Is 300 hours of study really enough for Level 1?

The material in CFA Level 1 is not difficult to understand, but the difficulty is in the sheer volume of the material, especially for those new to finance.

Some guides may tell you to target 250 hours, but on average this will not be enough. In previous CFA Institute candidate surveys, a typical Level 1 candidate spent an average of 285-300 hours to prepare for Level 1 exams.

In our experience, 300 hours is a good amount of time to sufficiently cover the Level 1 curriculum and complete sufficient practice exams.

That said, 300 hours is probably a minimum number as this obviously varies across levels and background. But the message could not be clearer – do not underestimate the exam. So make 300 hours your target.

How do I handle the CFA Ethics topic and ‘Ethics Adjustment’?

Skipping Ethics is a common mistake among Level 1 candidates, which is understandable after attempting to read the CFA curriculum on Ethics for the first time.

In fact, skipping Ethics is NOT an option for several reasons:

- Ethics is a key topic across all 3 levels of CFA exams, with a minimum of 10% topic weight.

- Ethics material is almost identical across levels so you’re laying a good base not just for Level 1 success, but for future levels as well.

- Your Ethics score will decide whether you pass or fail if you’re near the Minimum Passing Score, i.e. the ‘ethics adjustment’. Sure, you can skip Ethics and still pass if you’re crazy amazing at everything else, but that’s a rarity.

If the Ethics reading in CFA Institute curriculum is too dry, do invest in third party study material to get through this, but definitely don’t discount it!

Final Ethics pro tip – save this reading for last, as we find this is the optimal study order for CFA Level 1.

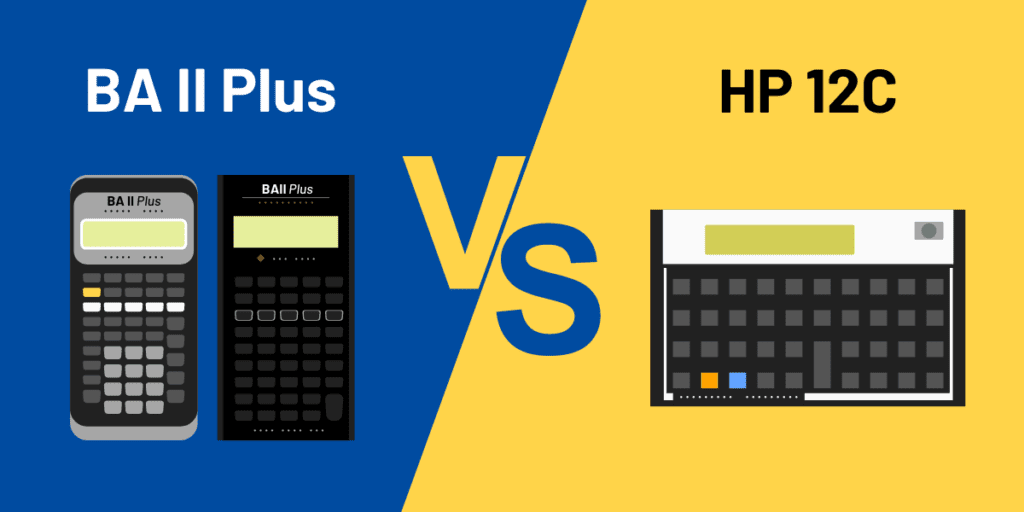

Which calculator should I use for the CFA exam?

There are 2 approved groups of CFA calculators: BA II Plus and HP 12C. Check our CFA calculator guide on how to decide what works best for you, although Texas Instruments’ BA II Plus is the more popular one.

Most study materials include a good guide on how to use a particular type of calculator, so study that at the first opportunity in your notes revision.

Also, remember to try and bring two identical ones to the exam in case your first one fails.

If you need more tips on calculators, these articles can help:

- CFA Calculator Guide: Texas Instruments BA II Plus vs Hewlett Packard 12C

- The Ultimate List of BA II Plus Calculator Tips for Your CFA Exam

- The HP12C Calculator Guide for the CFA Exams

How many mock exams should I do for CFA Level 1?

Many first-time candidates spend a lot of time reading the curriculum and study notes.

In fact, it is pretty common for Level 1 candidates to plan to finish reading notes right before exam day. This is a huge mistake.

Study notes give you the foundation, but practice exams is the hammer that actively drives it all into your brain. When reading notes, plan to work through a few topical questions at the end of each reading.

Plan to finish reading through your notes early, and get started on full practice exams 4-6 weeks before exam day. An actual timed practice exam will tell you if you need to worry about time (a genuine concern for Level 1), and also gauge your current performance when you grade it. Aim to finish about 6 exam sets (1 set equals 2 x 90 questions) in total, more is better.

What is a safe score to pass CFA Level 1 mock exams?

General wisdom is that the Minimum Passing Score (MPS) set by the CFA Institute will never be higher than 70%. However, that trend has changed slightly in 2021, and we recommend that candidates aim for a slightly higher target score in your mock exams to be safe.

Although this is unlikely to ever be verified, I generally accept this to be true, as 70%-100% is the highest score bracket you can get for any topic in your results report, and it would be strange indeed if a candidate scored 70%-100% in all topics but still failed. So aim for 70% and above in your practice exams.

However, if you’re anything like me, the first time you eagerly grade your first practice exam will result in a rude shock – you’ll probably score lower than you expected. Don’t freak out – augment your test taking with notes revisions and you will improve.

70% in the actual exam equals success, but it doesn’t mean that sub-70% equals failure.

How should I spend the final week before the CFA exam?

In the midst of all this hardcore studying, it pays dividends to take a few minutes to sort out logistics of the exam day.

A few weeks before exam day, read my article on what to bring and how to get there, and if you live close enough you might want to visit the test centre beforehand.

Do not trip at the finish line because you prepared badly from a logistical side. A forgotten passport realized too late is all it takes. You’ve been warned!

What is the best time management strategy during the CFA exam?

Effective time management is the difference between a pass and a fail at CFA Level 1. The exam consists of two sessions, each lasting 2 hours and 15 minutes (135 minutes), with 90 multiple-choice questions per session.

This leaves you with an average of 90 seconds per question. However, a better strategy involves saving time on easier questions (e.g. statement/fact-based) to allow for longer time for more complex calculations questions such as in typically found in Financial Statement Analysis (FSA), Fixed Income or Equity.

Here’s a summary of recommended time management strategy for CFA Level 1:

| CFA Level 1 Component | Time Constraint | Strategy |

|---|---|---|

| Average time per question | 90 seconds | The absolute maximum time per question. |

| Easy / concept-based questions | 45-60 seconds | Save up these 30 seconds for more complex questions as you go along. |

| More complex questions | 120 seconds | Use your saved time here. |

| Time management limit | 3 minutes | If a question isn’t solved in 3 minutes, put your best guess and move on. |

What are the final CFA exam day protocols to follow?

This might sound obvious, but the CFA Institute is very, very strict on exam procedure and behavior.

If a proctor reports that you could be in breach of the rules, all your work is in jeopardy, and this happens to candidates every year. Seriously, don’t mess with the proctors.

Following the exam, please do not compare or discuss questions, or attempt to recreate the exam. You will get busted and banned from taking future exams.

Looking for more than just tips?

If you are just starting your journey or want a deeper dive into a specific success story, see our other guides:

- The roadmap: If you haven’t registered yet, see our guide on How to Prepare for CFA Level 1 for a full breakdown of the 2026 curriculum.

- The success blueprint: For a detailed story of how to pass on your very first try, read Imran’s strategy on how to pass CFA Level 1 in one attempt.

Level 1 may be daunting, but the CFA Level 1 strategy advice above should steer you on the right direction on how to study for CFA Level 1. Any questions? Feel free to comment below and we will respond personally 🙂

Meanwhile, here are other useful articles that should help your CFA Level 1 preparations:

- Free and Upgraded – 300Hours CFA Study Planner

- CFA Level 1: How to Prepare and Pass CFA in 18 Months

- CFA Level 1 Topics: What Is The Best Study Order?

- Latest CFA Exam Curriculum and Topic Weight Changes

- Fast Track CFA Charter: How to Pass the CFA Exams in the Fastest Way Possible

- Free 300Hours Guides

- Free CFA Study Materials

Good day

I’m Vongai, I’m also planning to sit for the November. Is there a study group that I can join… please share lin n if there is.

Thank you

Hello Team,

I am feeling totally lost. I am looking to appear for Aug 22 exam of level 1. Is it doable ? That’s my first biggest anxiety.

The most biggest hurdle is now whether to study from online portals like IFT / Mark meldrum / Wiley or I go for offline physical class Kaplan Genesis ? Not able to make my decision. Bcoz last I studied full time in 2012 for my mba fiancé and it’s been 10 years gap in studies.

What I should do ? Kindly suggest when possible today

Hey. I applied for the women’s scholarship and would give my exams in November. What to do if you don’t get a reply before the early bird deadline? Should I wait for the scholarship decision or pay the registration fees before the deadline?

Hi

Can you please let me know how you applied for women scholarship

Hi! I am wondering about the practice part, it´s enough with the questions in the cfa curriculum, the only mock exam it´s provided by CFA and the end of chapter questions of the schweser notes? Or should I buy the Schweser QBank?

Hi Adrian, we normally recommend doing 4-6 sets of practice exams, preferably under timed, exam conditions for practice phase, in addition to end of chapter questions. You can include CFA Institute’s mock in that figure.

Hope this helps!

Hi Zee, I’m planning to take level 1 by this November. I’ve a doubt that can we expect some questions in the exam from end chapter questions and as well as from kaplan

Hi Santosh, I don’t think the questions in the actual CFA exam will be the same as the end of chapter questions, nor any from Kaplan.

Hi Santosh, I’m also planning to take Level 1 in November.

I am looking for study buddies.

Are you interested? Or Know anyone who might be?

Thanks

Bami

Thanks a lot Zee. However do you have some advice for someone repeating

When I repeated Level 2, I made sure I put aside more time to study, and more time to practice, and aimed for higher mock practice scores. Make sure you double down on the study methods that work for you, and cut out those that aren’t working for you. Hope that helps, and just hit us up here if you need any more advice!

Hey, Your material is on point. Thanks for sharing

No problem!