The demand for alternative investments is expected to rise.

According to Blackrock, their institutional clients currently allocate an average of 25% of their portfolios towards alternatives, which is expected to rise to between 30-40%, whereas ordinary investors will increase their alternatives allocation from 3% to 25%. The demand for alternative investment managers is likely to continue to rise in the foreseeable future.

If you’re considering a career in alternative investment management, the CAIA exam (Chartered Alternative Investment Analyst) is worth looking into.

This comprehensive guide is packed with the latest CAIA course details that will help you decide if this designation suits your career goals.

What is CAIA designation?

Chartered Alternative Investment Analyst (CAIA) is a professional designation for investment professionals offered by the CAIA Association. Aspiring alternative investment professionals need to complete and pass 2 levels of examination.

The CAIA Association – a non-profit organization founded by the Alternative Investment Management Association (AIMA) and the Center for International Securities and Derivatives Markets (CISDM) in 2002 – is the global leader and authority in alternative investment education.

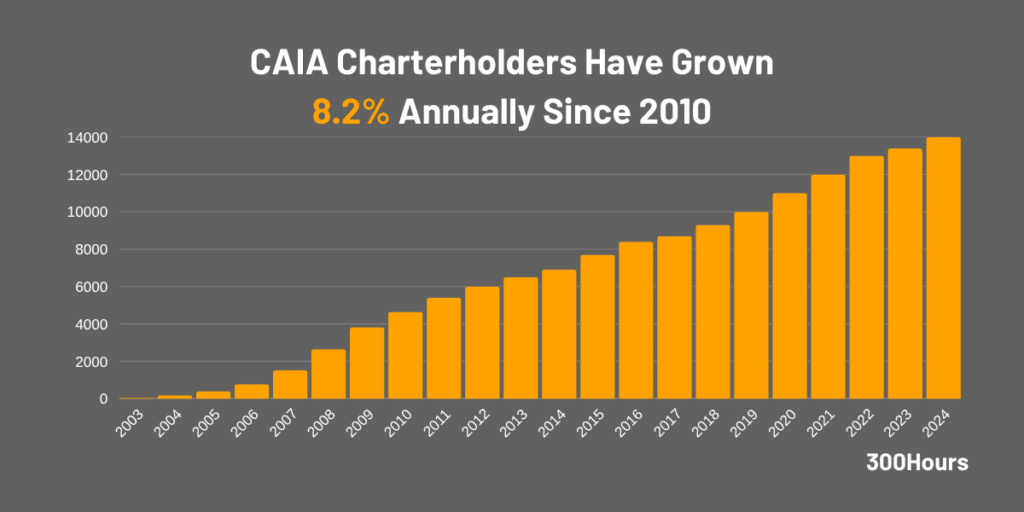

The CAIA Association conducted its first exam in February 2003. Since then, thousands of individuals worldwide have registered for the program, with more than 14,000+ current CAIA members worldwide.

There is strong demand for the CAIA certification – CAIA members have grown by an average of 8.2% per year since 2010.

While the CAIA certification can be perceived as more niche in the alternative investment space, its members’ occupation are more evenly distributed across roles such as portfolio manager, consultant, sales & marketing, analyst, asset allocator, risk manager, fund administration, accounting & legal roles.

CAIA course details, summarized

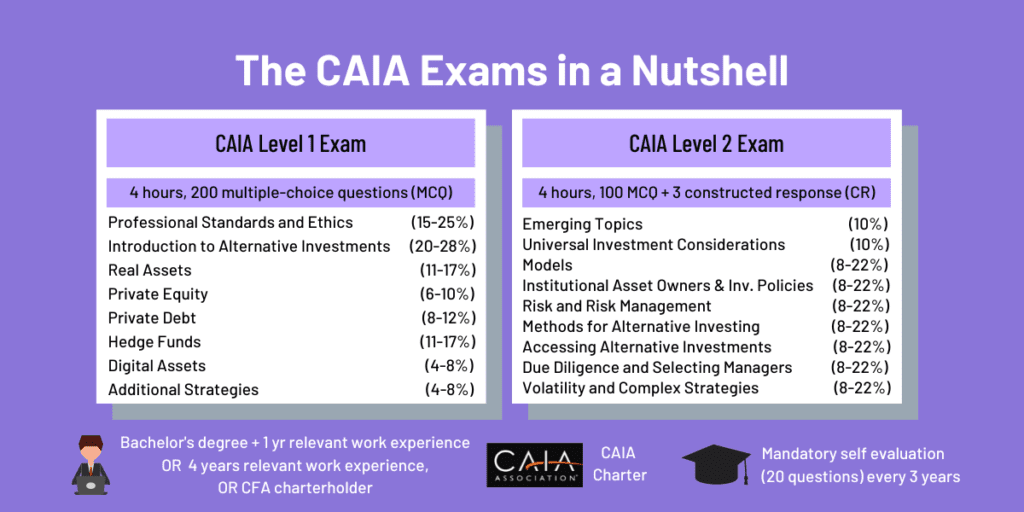

The CAIA certification is a two-part examination, with each exam lasting 4 hours long:

- CAIA Level 1 consists of 200 multiple-choice questions, whereas

- CAIA Level 2 consists of 100 multiple-choice questions in Section 1 (70% exam weight), in addition to 3 sets of constructed-response (essay type) questions in Section 2 (30% of exam weight).

The CAIA Level 1 curriculum concentrates on the fundamentals of alternative investment markets, building up candidates’ understanding of different asset classes.

CAIA Level 2 focuses on more advanced topics in alternative investments by incorporating recent academic and industry research in alternative investments, asset allocation and risk management. Less than 30% of CAIA Level 1 and 2 questions would require calculations.

In terms of study hours, it is recommended that candidates devote at least 200 hours of study time for each level.

CAIA exams take place twice a year during March and September for both levels. The exams are administered via computer at proctored Pearson VUE test centers around the world. You can find your nearest exam center here.

During COVID-19, online proctored exams (at home or an office) used to be widely available for candidates globally. However, CAIA Association has now updated their policy whereby online proctored exams are only granted under limited, special circumstances.

There are no negative markings for incorrect answers in the exams. The passing score is determined by CAIA Association each year, although candidates who earn 70% or more are assured of passing the exam.

The exam results are sent to candidates via email around 3 and 6 weeks after the last exam for Level 1 and Level 2 candidates respectively. The result is simply a pass or fail, but candidates will be provided with performance report to understand the areas of relative strength and weakness compared to a reference group.

CAIA pass rates since 2010

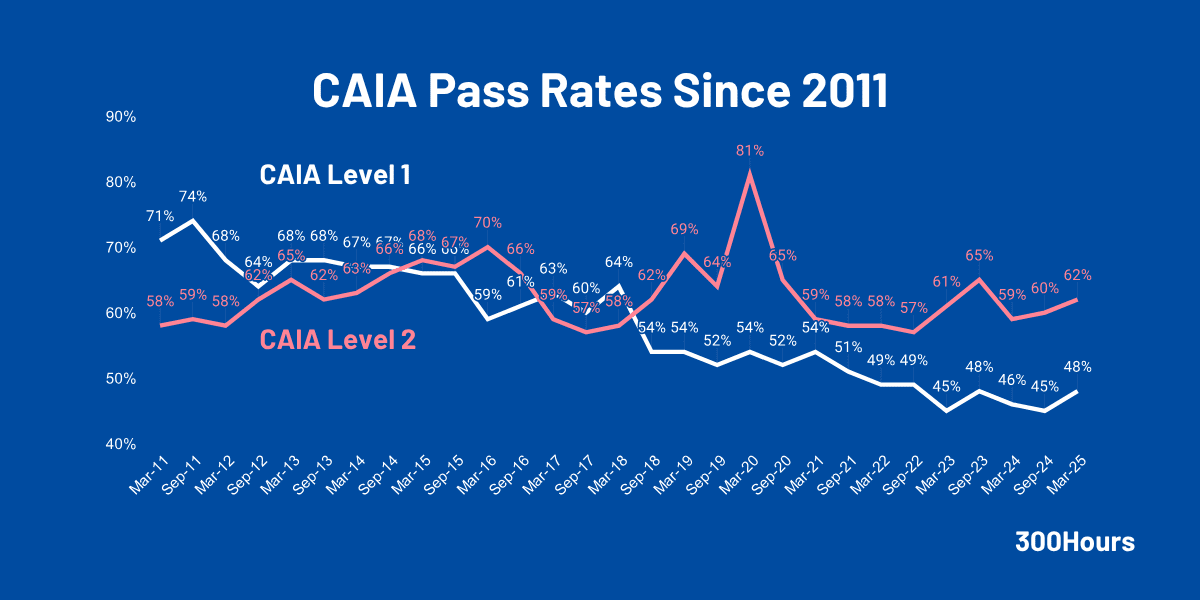

The latest March 2025 CAIA exam pass rates are 48% for Level 1 and 62% for Level 2.

- Since 2011, CAIA Level 1 pass rates continues its downward trend and remained below 70%, compared to the earlier periods of 2006-2011.

- CAIA Level 2 pass rates ranges from 56%-70% since 2006 (with the exception of March 2020’s one-off spike), seemingly moving in a cyclical manner.

- The average pass rates for CAIA Level 1 and Level 2 since 2010 are 61% and 63% respectively.

For more detailed commentary and analysis, check out our article on CAIA historical pass rates and how to gauge its difficulty.

CAIA topics

CAIA Level 1

The CAIA Level 1 exam mainly focuses on the introduction to alternative investments by covering the various asset classes. The topics areas and exam weights are as below:

| CAIA Level 1 Topics | Weighting |

|---|---|

| Professional Standards and Ethics | 15%–25% |

| Introduction to Alternative Investments | 20%–28% |

| Real Assets | 11%–17% |

| Private Equity | 6%–10% |

| Private Debt | 8%-12% |

| Hedge Funds | 11%–17% |

| Digital Assets | 4%–8% |

| Additional Strategies | 4%–8% |

CAIA Level 2

The Level 2 exam builds on the foundation of Level 1 and adds on recent academic and industry research in alternative investments, asset allocation, and risk management.

CAIA Level 2 is unique in the sense that the exam is split into 2 sections of 2 hour each, consisting of 100 multiple-choice questions (Section 1) and 3 sets of constructed-response questions (Section 2). Despite the equal time allocation per section, the multiple-choice section forms majority (70%) of the Level 2 exam weight, and the essay-type questions only 30%.

| CAIA Level 2 Topics | Multiple Choice Topic Weight | Constructed-Response Topic Weight |

|---|---|---|

| Emerging Topics | 0% | 10% |

| Universal Investment Considerations | 0% | 10% |

| Models | 8%–12% | 0%–10% |

| Institutional Asset Owners and Investment Policies | 8%–12% | 0%–10% |

| Risk and Risk Management | 8%–12% | 0%–10% |

| Methods for Alternative Investing | 8%–12% | 0%–10% |

| Accessing Alternative Investments | 8%–12% | 0%–10% |

| Due Diligence and Selecting Managers | 8%–12% | 0%–10% |

| Volatility and Complex Strategies | 8%–12% | 0%–10% |

| Total | 70% | 30% |

CAIA fees (USD)

CAIA exam fees are quite straightforward.

The exam fees are the same for each Level, and only vary depending on:

- the date of registration and

- whether you’re a new or returning candidate.

| Fee Type (for all Levels) | CAIA Fees (per Level) |

|---|---|

| 1) One-off Enrollment Fee (paid once only during the first CAIA registration) | $400 |

| 2) Exam Registration Fee (only applicable to first time Level 1 or Level 2 candidates) | |

| Early Registration | $995 |

| Standard Registration | $1,395 |

| 3) Exam Registration Fee for Retakes (if applicable) | $795 |

There is a one-off enrollment fee of $400 that applies to first time CAIA candidates:

- For new Level 1 or Level 2 (via Stackable credential program) CAIA candidates, the total fees would be $1,395-$1,795 which includes this one-off enrollment fee.

Exam retake fees for both levels are slightly cheaper, at $795 per retake per level. For more details on CAIA certification’s costs, see this article.

CAIA exam dates & registration deadlines

Both levels of CAIA exams are conducted twice a year in March and September. This provides candidates the opportunity to complete the CAIA program within 1 year, if they passed consecutively. That said, CAIA Level 1 and Level 2 exams cannot be taken within the same exam window.

Candidates have the option of booking their exam date in a 10 business day window during the exam periods. All exams are administered internationally in computerized format exclusively at proctored Pearson VUE test centers.

| CAIA Registration Deadlines | September 2025 CAIA Exams (Level 1 and 2) | March 2026 CAIA Exams (Level 1 and 2) |

|---|---|---|

| Registration Opens | 14 Apr 2025 | 13 Oct 2025 |

| Early Registration Deadline | 9 Jun 2025 | 8 Dec 2025 |

| Registration Closes | 4 Aug 2025 | 2 Feb 2026 |

| CAIA Level 1 Exam Window | 1-12 Sep 2025 | 2-14 Mar 2026 |

| CAIA Level 2 Exam Window | 15-26 Sep 2025 | 16-27 Mar 2026 |

For the latest exam dates and FAQ, check out our CAIA exam dates article.

What are the CAIA charter requirements?

In order to obtain the CAIA designation, candidates must have the following prerequisites:

- Passed both Level 1 and Level 2 exams (unless you’re part of the CAIA stackable credential pilot program whereby CAIA Level 1 is waived for CFA charterholders); and

- Work experience requirements:

- Holds a bachelor’s degree or its equivalent, and have more than 1 year of full-time professional experience within the regulatory, banking, financial or related fields; OR

- Alternatively, a candidate must have at least 4 years of full-time professional experience within the regulatory, banking, financial or related fields, OR

- Be a CFA charterholder in good standing.

- Paid for CAIA Association Membership (1 or 2 years); and

- Abide by the Member Agreement.

Unlike the FRM certification, CAIA candidates have unlimited time to pass the Level 2 exam after passing Level 1 to qualify for the CAIA Charter.

Benefits of CAIA designation

The CAIA charter is a globally recognized designation, known as the benchmark for best practice in the alternative investment profession. Earning the CAIA designation sets you apart as a financial professional with the knowledge, skills, and experience necessary to provide sound advice on alternative investment strategies.

Once you earn the CAIA designation, you can expect to:

- Differentiate yourself and further boost your alternative investments credentials in the financial industry

- Be recognised and respected among employers, peers, and clients as a knowledgeable expert in alternative investing.

- Increase your career opportunities and enhance your earning potential.

- Broaden your client base and professional networking connections through membership and global chapters.

CAIA vs CFA – Which is right for you?

In short, CAIA is highly specialized and has a stronger focus on alternative investments, whereas the CFA designation covers a broader scope of financial analysis, portfolio management and investment topics.

This is a popular topic which warrants a whole article in itself.

We compare the differences and similarities between these designations, in terms of syllabus, difficulty and career objectives. Do check it out!

Are you considering CAIA, as well as the CFA designation? Share your thought process with us below!

Meanwhile, you may find these related articles of interest:

Hi,

Thanks for the article.

My career goal is to get into a Hedge Fund (L/S, turnaround, event-driven…these types of hedge funds in particular)

I’m currently an M&A analyst on the buy side with the idea of getting 1-3 years in this position and then moving to a hedge fund.

I’m just wondering, what do you think is best for this, CFA, CAIA, or having experience in M&A is not really necessary to get any of those certifications?

Thank you very much in advance, any feedback is appreciated.

Best

Hi JC, I’m in two (actually three) minds here JC. It’s competitive to go to buy-side from M&A, but certainly a common route. CFA would give you a more recognised, broader option (in case it doesn’t work out), but the downside is that it takes a lot more effort and time to achieve that.

CAIA on the other hand is more relevant and requires less effort to obtain (on average). However, the recognition you get is probably less (depending on firms). You need to find out from your target hedge fund firms whether this is known/valued to them at this stage, and perhaps this is where informal networking could help by just speaking to people who work in hedge funds what is and what is valued. You can also head to LinkedIn to check out profiles of those working in companies you’re interested in to see if they have any CFA/CAIA qualifications to give you that sense.

On the other hand, I’ve a few hedge fund friends (some have CFA and most not) who got into the role from consulting, equity research, trading etc. So it also can come from networking, and being interested in the market to be able to have a good, opinionated interview on valuation of certain asset classes, all these come from knowing your stuff (which you can learn on the job or via certifications like CFA/CAIA), as well as being interested in the market itself. All this paragraph is saying is also that you could not need any certifications either, since you’re already in the buy-side, and just moving from PE to hedge funds. Most common challenge that people face is moving from sell side to buy side.

Sorry it’s not a straightforward answer, but more fact finding is needed before you make a decision, hope it helps!

I am interested in CAIA profession, kindly guide against March examinations and necessary funds and materials.

Kaplan Schweser CAIA are currently running a 20% discount on materials – you can get that discount on our Offers page.