CFA UK is no longer accepting new registrations for CCI from 1st May 2025.

A recent report by the UN Intergovernmental Panel on Climate Change has highlighted the urgent need to achieve net zero carbon dioxide emissions globally by 2050 to avoid a catastrophic climate change.

This, amongst other factors, has contributed to an increased pressure for investment professionals to act fast and play their part in the transition to net zero. Understanding climate risks and how to integrate climate considerations into an investment portfolio is increasingly essential for investment professionals.

Here’s where CFA UK’s Certificate in Climate and Investing (CCI) can help. This qualification aims to equip investment professionals with the knowledge and skills to integrate climate change considerations into the investment process. It provides a logical framework to encourage informed critical thinking when incorporating climate considerations into investment decisions.

Read on to find out more!

- What is CCI (Certificate in Climate and Investing)?

- Who should take CCI?

- CCI exam format, summarised

- Pass rates, pass marks and level of difficulty

- CCI exam topics & weightings

- CCI exam fees & costs (GBP £)

- CCI exam dates

- What are the entry requirements for CCI qualification?

- Benefits of Certificate in Climate and Investing

- Certificate in Climate and Investing vs Certificate in ESG Investing: Which is right for you?

What is CCI (Certificate in Climate and Investing)?

CFA UK has a strong track record in developing and delivering qualifications to equip investment professionals with up to date skills and knowledge for a rapidly changing sector:

- Investment Management Certificate (IMC) and

- Certificate in ESG Investing, which has had global success and is now delivered and administered by CFA Institute.

Developed in consultation with stakeholder firms and with inputs from a broad range of industry experts, the Certificate in Climate and Investing (CCI) is the latest sustainability qualification launched by CFA UK for investment professionals globally, with the goal of becoming a benchmark qualification that supports the investment industry in reaching net zero.

Launched in February 2022, following a successful pilot program, this new qualification is designed to help the investment industry understand the implications of climate change on investments and how to integrate climate change considerations into the investment process. Its level of difficulty is equivalent to a first year undergraduate degree.

Since its launch, CCI has received thousands of registrations so far, with sign-ups expected to gain traction with version 3 of the study materials launching on 1st July 2024.

Who should take CCI?

This Certificate in Climate and Investing enables investment professionals to focus on the risks, impact and opportunities climate change presents, factoring these in using appropriate tools and techniques.

Hence, this qualification is especially useful for investment professionals who need to understand and apply climate analysis in their work. Common jobs/sectors include those working in:

- Portfolio management

- Research and investment analysis

- Sales and distribution

- Product development

- Financial advice

- Consulting

- Risk

- Compliance

- Accountancy

- Pensions

While ESG expertise is expected to be in high demand in the foreseeable future, specialising in environmental considerations (the “E” part) of investing is likely to add the most value to your career given the world’s immediate climate-related challenges and goals.

CCI exam format, summarised

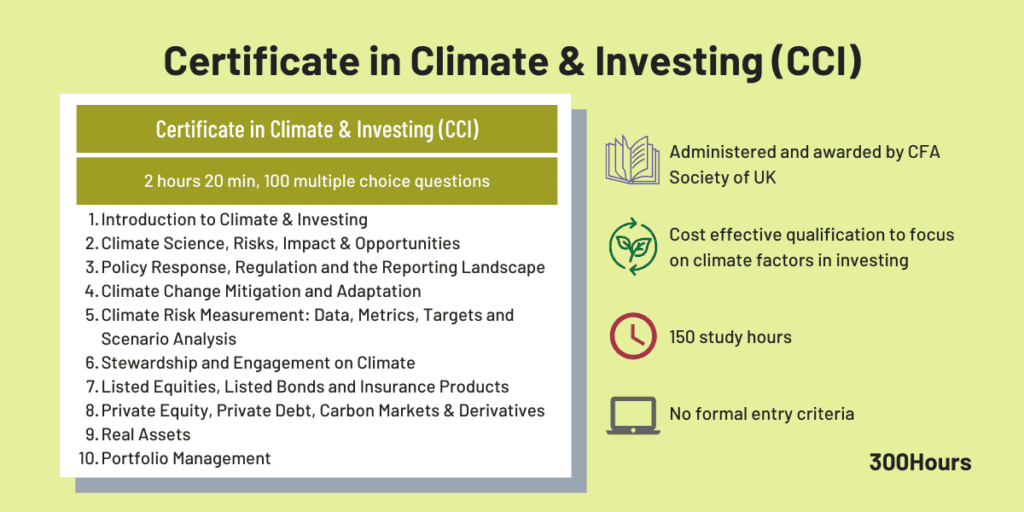

The Certificate in Climate and Investing is assessed by an examination consisting of 100 questions in 2 hours and 20 minutes, delivered via computer-based testing.

Whilst there are no constructed-response type questions (‘essay’), there are 5 types of questions in the CCI exam, which is accompanied by 4 answer options:

- standard multiple-choice questions consisting of 1 correct response from 4 options

- multiple response questions

- item sets

- drag and drop

- gap-fill (where you have to type in the answers to ‘fill the gap’).

Candidates are not permitted to use a handheld calculator during their CFA UK

examination. Instead, an onscreen calculator is available for all questions requiring a calculation during the exam.

This Climate and Investing certificate is designed by investment practitioners for practical application in day-to-day roles. The 10-part syllabus covers climate science, regulatory response and policy, the changing corporate reporting landscape, and tools specific to measuring climate-related impacts on investments across a broad range of asset classes in both public and private markets, and at portfolio level.

The CCI qualification is a self-directed learning program, though candidates may also opt for training support with a range of professional training providers:

- In terms of study hours, it is recommended that CCI candidates devote around 150 hours to complete the qualification.

- CFA UK publishes the Official Training Manual (OTM), which supports the CCI syllabus. The syllabus is updated every year on 1st April, and covers exams taken during 1st July to 30 June the following year.

- Exams for Version 3 will run from 1st July 2024 – 30 June 2025. It is important to make sure you have the right syllabus for your exam timeframe.

The CCI exam can be taken in-person every working day at Pearson VUE test centres in the UK, or alternatively via remote invigilation both in the UK and internationally (except China). Candidates are required to sit the exam within 12 months of the registration date.

Once the exam is successfully completed, candidates will receive a provisional result statement at the end of their exam, and the official result via post within 21 working days from the examination date. The result is a simple pass or fail, with no details on exact score.

Pass rates, pass marks and level of difficulty

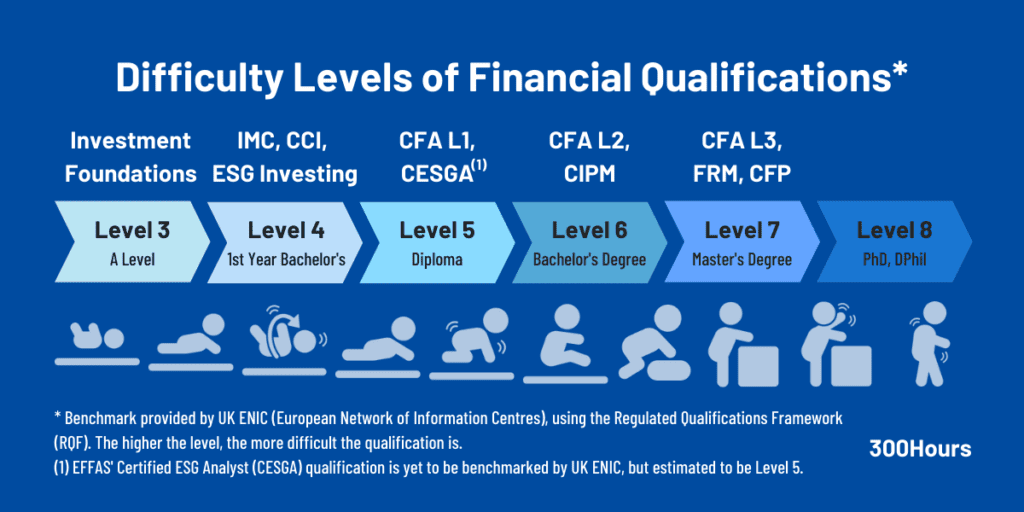

Just like the Investment Management Certificate, the CCI qualification is a Level 4 qualification regulated by Ofqual on its Regulated Qualifications Framework (RQF), which means that the level of difficulty of the qualification broadly equates to the first-year of an undergraduate degree.

CFA UK’s Climate and Investing certificate has a pass rate of 60-75%, with the pass mark usually between 60-70%.

CCI exam topics & weightings

The Certificate in Climate and Investing exam is constructed according the following topic weightings:

| CFA UK Climate and Investing Certificate Topic Areas | Weighting |

|---|---|

| Introduction to Climate and Investing | 2–4% |

| Climate Science and Climate Risks, Impacts and Opportunities | 5–9% |

| Policy Response, Regulation and the Reporting Landscape | 8–11% |

| Climate Change Mitigation and Adaptation | 4–7% |

| Climate Risk Measurement: Data, Metrics, Targets and Scenario Analysis | 8-12% |

| Stewardship and Engagement on Climate | 3–6% |

| Listed Equities, Listed Bonds and Insurance Products | 12–16% |

| Private Equity, Private Debt, Carbon Markets and Derivatives | 10–14% |

| Real Assets | 8–12% |

| Portfolio Management | 8-12% |

CCI exam fees & costs (GBP £)

The Certificate in Climate and Investing exam fees are simple and straightforward:

| Fee Type (for Both In-Person and Remote Testing) | CCI Exam Fee Amount |

|---|---|

| Exam Registration (includes soft copy of study materials) | £535 |

| Hardcopy study materials (optional) | £105 |

The registration fee for in-person testing (UK only) or remote testing (available globally except China) are the same. The exam registration fee includes everything you need to study and prepare for the CCI exams.

There is also a CCI sample question paper included which is helpful to gauge the difficulty and scope of topics covered. All in all, it seems like a cost effective investment to signal your expertise in climate change investing.

CCI exam dates

The CCI qualification is currently available in test centres in the UK and via Pearson OnVUE remote proctoring for both UK and globally (except China).

Here’s a quick summary of the registration and exam scheduling details:

| Exam Registration | CCI exam registration is done through CFA UK. Upon registration, candidates will receive an email confirmation providing scheduling instructions, a unique username and password. Note that candidates can only view exam availability after registration. |

| Exam Scheduling | After registration and payment, candidates will need to wait for 2 working days before they are permitted to schedule an exam. To do so, they need to login to Pearson VUE’s website to select a date, time, and location to take the Certificate of Climate and Investing exam. Similar process applies for online-proctored CCI exams. In-person testing is available in the UK only, and online proctored exams are available globally (except China). Test appointment can be rescheduled at no extra charge 72 hours prior to your exam appointment time. |

| Exam Registration Expiry | Candidates have 1 year from initial exam registration to sit for the exam. Otherwise, the registration will expire after 1 year with no refunds given. Re-registering will cost the same exam fee each time. |

| Number of Exam Attempts | Candidates are not allowed to take a CCI exam more than 3 times in 90 days. Once the maximum number of sittings has been reached, candidates must wait until the 90 day period is complete before sitting a new examination. There is no maximum number of times a candidate can attempt an examination, but each try costs the same registration fee. |

What are the entry requirements for CCI qualification?

There are no entry criteria for signing up for Certificate in Climate and Investing qualification (CCI), although it is strongly recommended that candidates have a solid understanding of the investment decision making process via formal qualification or experience. This makes it a very effective, just in time, qualification to update your skill set and resume in climate and investing

Similar to CFA Institute’s Certificate in ESG Investing, candidates who pass the CCI exam receive a digital badge. Passing the CCI exam does not confer any designation title or letters behind your name though.

Benefits of Certificate in Climate and Investing

Given its relatively low time investment and cost, the CCI qualification can form a specifically targeted, personal objective that can enhance an investment professional’s career.

Once you pass the CCI exam, you can expect to:

- Understand the implications of climate change on an investment and incorporate that in investment processes.

- Boost your career prospects and differentiate yourself from other job candidates.

- Apply what you’ve learned directly in your work, by incorporating climate considerations in your firm’s and clients’ investment portfolio in a step towards net zero.

- Gain a prestigious qualification (and digital badge) from CFA UK to display your climate and investing expertise.

Certificate in Climate and Investing vs Certificate in ESG Investing: Which is right for you?

In short, while both qualifications focus on sustainable investing and are similar, there is a slight difference in focus between them:

- Certificate in ESG Investing offers a broad foundational framework to incorporate material ESG factors into investment decision making, and how the investment industry can adapt to that change in investor preferences. It also contains covers key concepts relating to climate change (including climate mitigation, and adaptation and resilience) and a range of climate change initiatives, as well as featuring more extensive study of the opportunities arising from the circular economy, green products, and clean and technological innovation.

- On the other hand, Certificate in Climate and Investing (CCI) has a dedicated focus on climate-specific considerations, applying a climate lens to the full investment universe and explaining the science behind climate change. This includes recognising the socio-economic implications of climate change and the systemic risk that climate change presents to the stability of the financial system. It also explores the role capital markets are expected to play in allocating capital towards the transition to a low carbon economy.

Both the Climate and Investing Certificate and the ESG Investing Certificate are now available globally.

While both are good quality qualifications from reputable organisations, the choice in essence depends on your personal skill needs and job role. Here’s how both ESG certifications compare:

| CFA UK’s Certificate in Climate and Investing | CFA Institute’s Certificate in ESG Investing | |

|---|---|---|

| Suitable for | Investment professionals of all roles (asset management, research/investment analysis, sales & distribution, product development, financial advice, consulting, risk, compliance, accountancy, pensions), who need to understand and undertake climate analysis in their job. | Students who are keen on an investment career; or Investment professionals of all roles (asset management, sales & distribution, wealth management, product development, financial advice, consulting, risk etc), who are looking to understand and integrate ESG issues into the investment process |

| Pre-exam qualifications | None, although solid grounding in the investment process is strongly recommended (via formal qualification or experience) | None, although solid grounding in the investment process is strongly recommended (via formal qualification or experience) |

| Number of Exams | 1 | 1 |

| Exam Frequency | In-person testing only available in the UK, available to book throughout the year (except weekends and holidays). Remote exam option also available globally (except China). Maximum 4 attempts in 4 months | In-person exam available globally, available to book throughout the year (except weekends and holidays). Remote exam option also available globally (except China). Maximum 4 attempts in 4 months |

| Exam Format | 100 multiple-choice and item set questions in 2 hours and 20 minutes On-site computer-based testing or online remote testing | 100 multiple-choice and item set questions in 2 hours and 20 minutes On-site computer-based testing or online remote testing |

| Pass Rates | 60-75% | 81% on average |

| Fees and Costs | £535 (~ US$ 676) | US$ 865 |

| Study Hours Needed | 150 hours | 130 hours |

| Post Exam Requirements | None | None |

Overall, CFA UK’s Certificate in Climate and Investing can be a cost effective way to boost your investment career by further specialising in climate change investing.

Is the CFA climate certificate something you’d consider taking on to enhance your ESG credentials? Let us know in the comments below!

Meanwhile, you may find these related articles of interest:

I echo JB on this. i just passed my exam 2 days ago. Its a fantastic course, quite detailed and take the E to another level. I have also completed ESG and Compared to ESG, its much more detailed and needs significant studying. ESG +I am a charter holder, that knowledge helped to save a few hours but to really get the most of this course it does require 150+ hours and more so for fresh candidates. Good luck

I found the CCI very useful as I work day to day in investments. It really goes in the detail of climate impact in asset classes. The ESG certificate is also interesting but at this point I wanted to focus on climate. However candidates should expect around 200h of study. Good luck!

Hi, I want to know that if we do not buy the handbook of CCI, is there a Pdf version on their internet ?

Thanks a lot.

Qiao

Really appreciate all the information you provided on these ESG courses Sophie. I found it very useful when undertaking them myself. Looking forward to many more ESG guides !

Glad you’re finding these useful! Which ESG course are you leaning towards to at the moment? If you have any course feature request, feel free to comment here 🙂

I am currently looking into these 2 qualifications, it seems recommended on most ESG qualifications list although not much detailed information on them.

1. International Society of Sustainability Professionals (ISSP) –

a.The Sustainability Excellence Associate (SEA)

b.Sustainability Excellence Professional (SEP)

2. International Association for Sustainable Economy (IASE) – INTERNATIONAL SUSTAINABLE FINANCE® (ISF®)

Have a great day 🙂

Thank you Sophie, for one more insightful article about a CFA Certificate!

You’re welcome CFA Friend. Hope you found it useful? Are you looking into studying for a sustainable finance certificate?

You’re welcome! Glad you found it useful 🙂

Hi Sophie is this course also expected to transition to CFAI In future like ESG Investing did. Any thoughts?

We have asked CFA UK Society on this and there are no plans/comments on that at this stage as it is a new qualification for them.

thanks for the revert !