If you’re studying for the CFA without finance background, would that put you at a disadvantage when it comes to passing the exams?

Since 2012, we have built up a robust, 13 years worth of data from our awesome readers to answer that very question.

Each time when CFA results are announced, our readers shared their results as well as details of their work and education background. This research allowed us to analyze how pass rates varied across candidates that had different backgrounds in work and education, and whether having a finance background in work or education mattered in passing CFA exams.

The results were quite interesting. Read on to find out more!

Does having a finance background matter for CFA exams?

Profile of CFA candidates sample

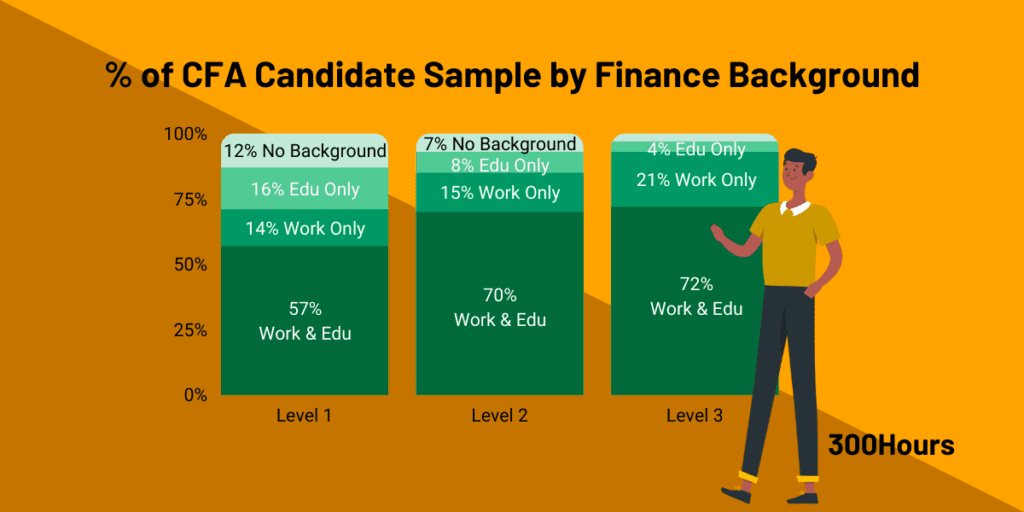

In our research, we grouped CFA candidates into 4 possible profiles based on their finance background in work and/or education:

- Finance-related work and educational background (Work & Edu)

- Finance-related work background only (Work Only)

- Finance-related educational background only (Edu Only)

- No finance-related background (No Background)

As you can see in our sample, most CFA candidates have both work and education background in finance.

And it’s not surprising to see that as a candidate advances through the CFA program, the % of those with work in finance and have studied finance increases.

CFA candidates’ work and education background vs. pass rates

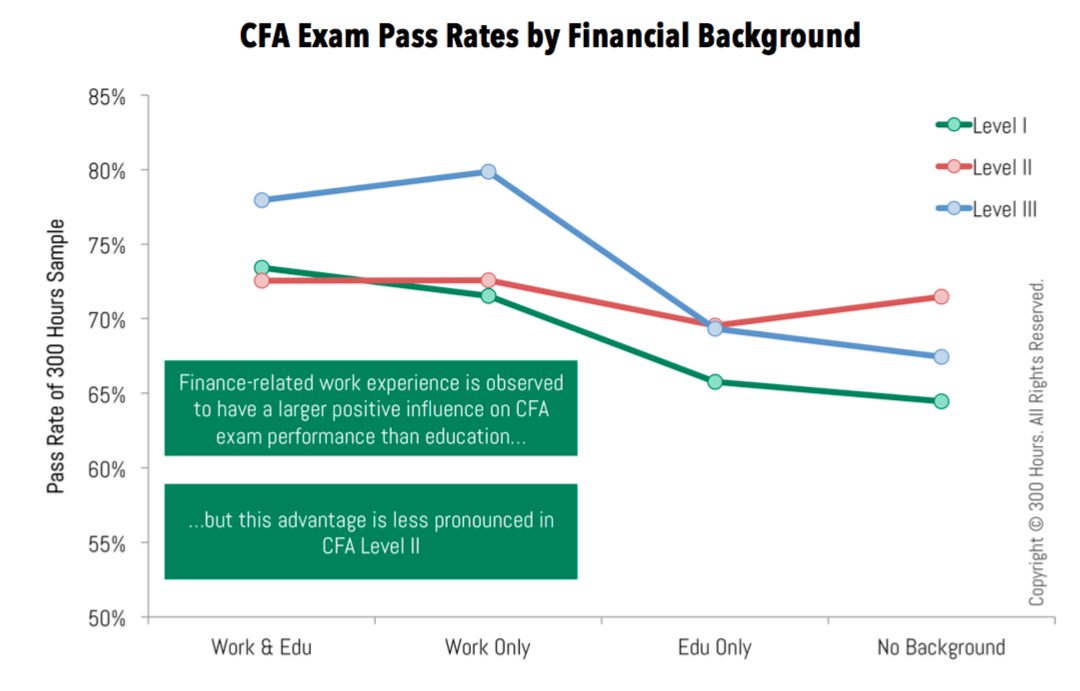

Next, we match these candidates’ profiles with their individual pass rate, as summarized in this next chart. The story is quite different for each CFA Level.

What’s interesting to see here is that the candidate profile with the lowest pass rate is not necessarily the “No Background” group, which was what one would expect.

For the CFA Level 2:

- The group profile with the lowest pass rate is actually candidates that only have a finance education background (Edu only group), with no finance-related work experience.

- Of course, there are many possible causes to what we’re seeing, but our theory on this is complacency. Common feedback we get from readers who write in is that candidates with finance or economics degrees may take it easier than other candidates. Additionally, without a work requirement to spur them on, candidates may find it difficult to maintain the drive and discipline necessary to complete their preparations properly.

- There is the least performance variation amongst CFA Level 2 sample between the 4 candidate profile types. CFA candidates of all backgrounds, regardless having finance-related education and/or work experience performed similarly, with a slight, advantage towards those with finance work experiences.

For CFA Level 1 and 3:

- The groups with no finance background and those with finance education only have similar levels of performance, and both underperform the other candidate groups with at least some finance work experience.

- Finance work experience plays a bigger role in improving pass rates than just having studied finance at university. This tells us that taking the CFA without finance background is totally fine, and in fact, could be advantageous!

Studying CFA without finance background is totally doable

CFA Institute themselves have noted in a recent research paper that current CFA Level 1 candidates have a more diverse, non-finance background compared to 30 years ago.

The number of CFA Level 1 candidate with a finance degree fell from 43% in 1990 to 38% in 2022. In contrast, the proportion of candidates in STEM subjects increased from 11% to 13% in the same period. It can be done!

So what does this all mean?

- Not having any finance background doesn’t mean you’re hugely disadvantaged. Your drive and study discipline will be a far stronger determinant in your CFA exam success than your background.

- A finance-related education has a real threat of being undermined by complacency. The CFA exams are challenging. Don’t assume your education background in finance will allow you to take it easy in your preparation.

- Having finance work experience helps, as it plays a bigger role (vs. just being finance educated) in a CFA candidate’s pass rate. This may be due to honing your skills daily at work, and reinforcing what you have learned in your CFA studies.

- Some CFA levels may suit you more than others. Depending on what you’re strong at and your contextual knowledge, you may find some CFA levels easier than others as the approach and content vary significantly, especially in Level 3.

- The important thing is to remain driven, regardless of what advantages you may think you have.

Hope you found our research above illuminating, and provides you the confidence that anyone can pass the CFA exams when you put in proper study effort!

Meanwhile, you may find these related articles of interest:

I’m under the *Finance background in work only* category….I’ll admit not having the educational side of things (as firm foundation) does sting slightly; however, the combination of CFA study material and being in the investment world does have it’s advantages…. Keep these great posts coming 300HOURS 🙂

It’s already a pretty strong advantage, and work has proven to be a pretty strong motivator! Thanks for the kind words!

Wow, amazing results. Almost everyone where I work that presented the CFA have passed. They all had finance background in both study/work. The results are mixed though, and the one common theme is that whenever someone failed a level, they said they didn’t study enough, that they relaxed too much after passing a previous level. About half of them had to repeat level 2.

Yep – to be honest, studying for the CFA, you’d always understand the topic you were reading at the time. Comprehension and understanding is not really the issue here. It’s taking the time to practice the exam format and questions, and having the discipline to cover the wide range of topics. Complacency is the true enemy here.

Interesting! I fall in the “finance in education only” bucket so I’ll make sure to not take the exam too lightly. Thanks again!

That’s the idea! 🙂