Quick Summary:

In 2026, the CAIA remains worth it for professionals seeking a dedicated, Limited Partner (LP) perspective on alternative investments.

While the CFA Institute now offers a standalone Private Markets Certificate and a Level 3 Specialized Pathway, the CAIA provides the deepest curriculum for hedge funds and real assets, requiring 200 study hours per level.

The world of finance is ever-evolving, with alternative investments moving from niche to mainstream. For CFA charterholders, the question often arises: what’s the next step to specialize in the complex, yet lucrative, world of private markets and alternatives?

A common answer to that is CAIA (Chartered Alternative Investment Analyst) designation, a 2-level exam specializing in alternative investments. It is especially attractive to CFA candidates who have passed Level 3, as they can bypass CAIA Level 1 and take on CAIA Level 2 directly via CAIA’s stackable program.

That said, with the 2025 introduction of CFA Level 3’s Private Markets pathway, does this make CAIA irrelevant? Or, is CAIA worth it despite these significant changes in the CFA Program?

Meet Lydia R., a dedicated finance professional and CFA Level 3 completer whose recent experience navigating this very challenge offers invaluable perspective. We explore the value of the CAIA designation through two distinct lenses:

- First, we delve into Lydia R.’s personal journey and the decision she faced in early 2024, when her choice was between the CAIA and CFA Institute’s Private Markets and Alternative Investment Certificate.

- Second, and perhaps most relevant for today’s candidates, we pivot to the present. With the CFA Institute having now launched its Level 3 Private Markets Specialized Pathway, we need to reevaluate: is CAIA still worth it for those interested in private markets, given this significant new option?

How does the CAIA compare to the CFA Private Markets Certificate?

By Lydia R.

For those of you considering the double joy of both the CFA and CAIA using the CAIA stackable program, I hope my journey offers a useful perspective.

Why did I decide to do the CAIA after earning the CFA designation? My main reason was a glaring gap in my knowledge when it came to alternatives, especially since my day job was purely focused on public markets. After some reflection on the industry’s future, I wanted to equip myself for upcoming opportunities.

Secondly – and equally important – I knew I had the rare luxury of time and energy that year to focus on serious career development. This was a true “carpe diem” moment; there really was no time like the present to bet on myself and expand my expertise. The fact that the pain of studying would this time be thankfully short and sweet definitely made the CAIA stackable program both attractive and feasible, unlike the long-drawn-out trauma of the CFA Program!

When I was weighing my options for further study at the start of 2024, the choice was between the CFA Institute’s Private Markets and Alternative Investments Certificate and the CAIA Stackable Program (which leads to the full CAIA charter for CFA charterholders).

Here’s a quick comparison of what I considered:

| Feature | CAIA Level 2 (Stackable) | CFA Private Markets and Alternatives Certificate |

|---|---|---|

| Syllabus and depth | Deeper dive into alternatives. 1) Emerging Topics 2) Universal Investment Considerations 3) Models 4) Institutional Asset Owners and Investment Policies 5) Risk and Risk Management 6) Methods for Alternative Investing 7) Accessing Alternative Investments 8) Due Diligence and Selecting Strategies 9) Volatility and Complex Strategies | Foundational overview across 5 courses. 1) Introduction to Private Markets and Alternative Investment 2) Private Equity and Private Credit Investments 3) Real Estate and Infrastructure Investments 4) Commodities and Natural Resources Investments 5) Hedge Fund Investments |

| Approximate hours of study | 200-250 | 79-90 |

| Exam format & length | 2 papers (1 constructed response), 2 hours each, 2 sittings per year | 1 paper, 90 mins, self-paced, online (unproctored) exam, 365 days per year availability |

| Cost | US$1,395-1,795 exam registration fees, plus third party prep provider study materials. | US$890 ($799 if you are already a CFA Institute member) |

While the CFA Institute’s certificate offered accessibility, my assessment was that the CAIA Level 2 (even with its lack of mention of Private Credit, Infrastructure, or Natural Resources in the core material at the time) offered a more serious, in-depth education.

The cost and time commitment were certainly higher for CAIA, but the perceived benefits seemed to far outweigh these downsides.

What are the career benefits of earning the CAIA designation?

By Lydia R.

Studying for the CAIA Level 2 exam was, at its core, like any other exam: intellectually interesting and rewarding at the start, followed by a grueling, caffeine and instant noodle-fueled period of social isolation. So, no walk in the park!

That being said, CAIA Level 2 definitely wasn’t as much of a test of limits as other exams. Why? There’s meaningful overlap with CFA content, so you’re not starting from scratch. Crucially, there are significantly fewer pages to read – I logged around 200 hours, much less than the 250-300+ per CFA level. Being a seasoned exam-taker also helped! And having a solid “why” – seeing the CAIA as the cherry on the cake – made it less stressful than the CFA, where the stakes felt higher.

My main challenges stemmed from study resources: only Kaplan Schweser provided prep materials, and they offered fewer review materials, Qbank questions, and mocks compared to their CFA offerings. I also had a less-than-ideal experience with instructor help. However, the CAIA curriculum itself felt less dry and more up-to-date, especially the Emerging Topics section which included crypto.

All the downsides were far outweighed by the true pros of taking on this extra Chartership challenge:

- Access to other intellectual capital: The CAIA books offer a different, often more accessible, perspective. Plus, you gain free access to microcredentials (Private Debt, Private Equity, Real Estate, Digital Assets) which help fill any curriculum gaps and provide excellent, targeted learning. The CAIA Institute’s own webinars and research are a fantastic complement to CFA Institute offerings.

- Standing out in a competitive job market: More letters after your name and another impressive certificate for your wall certainly don’t hurt! These are nice-to-haves, though they shouldn’t be your sole “why.”

- New networking opportunities: Completing the CAIA opens up a whole new community of professionals. Since few hold both the CFA and CAIA, you tap into a fresh pool of peers with unique career specialisms and journeys.

In short, studying for CAIA via the Stackable Program was worthwhile for me, here’s how I evaluated it for a return on investment:

| ROI Factor | Investment (cost) | Career Return (benefit) |

| Financial Cost | ~$3,000 (Total) | Access to 14,000+ specialized global peers. |

| Stackability | Level 1 Waiver for CFAs | Accelerated path to a second major charter. |

| Time | 200-250 hours per level | Fast-track specialization (6-12 months) of alternative investment. |

CFA Level 3 Private Markets Pathway vs. CAIA: Which is better?

Lydia’s decision was made before a significant shift in the CFA Program: the launch of the CFA Level 3 Specialized Pathways for the 2025 exam. This was a game-changer, and it directly brings us to the core question for today’s candidates: is CAIA worth it now that the CFA Institute offers its own dedicated private markets specialization?

From CFA Institute’s perspective, this strategic evolution addresses the rapidly expanding buy-side industry, especially the boom in private markets (forecasted to grow from $14 trillion to $23 trillion by 2026):

- Their aim is to better prepare candidates for specialized roles, such as an Investment Associate at a General Partner firm, and provide content more directly aligned with career interests, thereby sharpening their competitive edge.

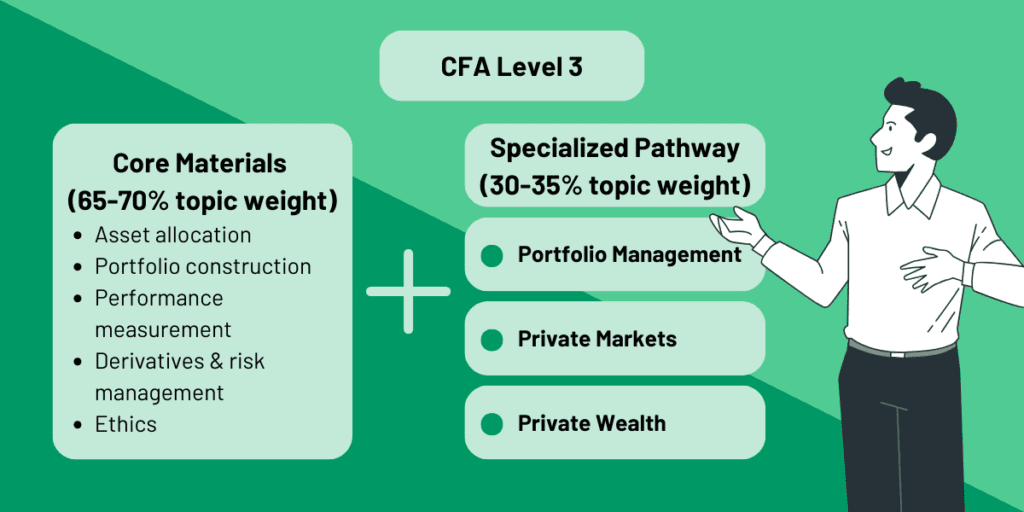

- The CFA Level 3 exam now features a substantial “common core” (65-70%) alongside the specialized content (30-35%), ensuring both breadth and focused depth. It’s important to note that the CFA Charter itself will not reflect the chosen pathway.

From CAIA Association’s perspective, William Kelly (former CEO of CAIA Association), suggested that while the CFA Institute’s new pathways might appeal to employers, a truly dedicated and specialized designation like CAIA remains crucial for thoroughly understanding the unique complexities and risks of alternative investments, thereby better serving clients.

Here’s a quick summary of the core differences between CFA Level 3 Private Markets Pathway and CAIA designation:

| Features | CFA L3 Private Markets Pathway | CAIA |

|---|---|---|

| Curriculum Focus & Depth | Designed primarily from a General Partner (GP) workflow perspective. Focuses on deal-making and value creation within the private funds. Integrates private markets within a broader investment management framework, covering GP/LP perspectives, private equity, private debt, real estate, and infrastructure. | Offers a deep dive primarily from the Limited Partner (LP) / allocator viewpoint. The focus here is about fund selection, portfolio construction, risk management and for institutional investors. Covers a broad range of alternative asset classes including hedge funds, private equity, private credit, real estate, commodities, digital assets, and managed futures. |

| Industry Recognition | Highly regarded. CFA remains the “gold standard” for general investment management, with the pathway offering seamless integration leveraging the established CFA brand for specialized knowledge. | Highly regarded. CAIA is the “benchmark” for alternative investments specifically, recognized for its pure-play, dedicated focus on this asset class. |

| Time & Cost | Part of the existing Level 3 CFA Program; no additional program fees beyond CFA exam costs. Study time integrated into Level 3 preparation. At least 300 study hours each level (3 levels in total). | Requires additional registration fees and dedicated study time for Level 2 (even with Level 1 waiver). An additional time and financial commitment. 200-250 study hours per Level (2 levels in total) |

| Best For | GPs, Fund Managers, Career Switchers | LPs, Consultants, Institutional Allocators |

Given these facts, we feel that they both have their place, depending on what your career goals are:

- For example, we see that CFA Level 3 Specialized Pathway is brilliant for those working in corporate finance, investment banking, private equity etc whereby it provides more hands-on on-the-job training.

- On the other hand, CAIA could be an ‘easy’ add-on – echoing Lydia’s point of view – after the CFA Program via the stackable program, with a more specialist recognition in alternative investments. We would say keep your post-nominal letters to a maximum of 2-3 though!

Verdict: Is CAIA still worth it for investment specialists?

As echoed earlier, there’s no single “right” answer when deciding on your specialization journey after the CFA Charter. Your choice will depend heavily on your specific career goals, your existing knowledge base, and the particular demands of your role or desired role within the financial industry.

What is clear is the undeniable value of specializing in alternatives. Whether it’s through the CFA Level 3 Private Markets Pathway or the CAIA designation, deepening your understanding of these complex asset classes will undoubtedly enhance your professional standing and open new doors.

For Lydia R., the CAIA Stackable Program was the perfect fit for her aspirations in 2024. Her experience highlights the tangible benefits gained from a dedicated alternatives focus, including new intellectual capital and networking opportunities. In her words:

“Just under 6 months ago, I moved from London to Sydney… As we were heading towards the end of 2024, I made sure I moved my CFA membership across to my new country and signed up to the CAIA association when I got the news through that I had passed.

Within weeks, my personal inbox was full of end of year invites to drinks and luncheons from both societies, thoughtful review/outlook market and industry pieces, and plenty of links and invites for upcoming events and webinars on both sides.

Both societies have played a really big part in helping me settle into this new market fast and have given me a wonderful perspective on just how global our industry truly is.”

Lydia’s journey underscores that life is for the living, and sometimes the “cherry on the cake” of an additional designation can provide invaluable personal and professional satisfaction.

Consider where you want your career to go, assess the depth of knowledge each designation offers relative to your needs, and choose the path that best aligns with your ambitions. Best of luck!

We hope you found the discussion above useful. Let us know how you’re getting on, or what you have decided on in the comments below.

Meanwhile, here are some related articles that may be of interest:

- CAIA Exam: What Is Chartered Alternative Investment Analyst?

- CAIA Stackable Program: Level 1 Exemption for CFA Charterholders

- CFA vs CAIA: Which Is Superior? Or Do Both?

- Passed CFA Level 3, Now What?

- CFA Level 3 Specialized Pathways: Which Should You Be Choosing?

- CFA Institute Evolves: 6 Big Changes to the CFA Program

- CFA Careers: What Are Typical Job Opportunities for CFA Charterholders?