Note: this cheat sheet is updated for the latest 2025’s curriculum.

It is probably no surprise that portfolio management is the most popular career current CFA candidates are interested in exploring further.

Portfolio management is the heart of the CFA program – and they start you light and gentle in Level 1 with a broad strokes introduction, gradually increasing in difficulty and topic weight as you advance to Level 3.

Hence, building a solid foundation in CFA Level 1 Portfolio Management is crucial to getting your CFA charter. That’s why we decided to create our 300 Hours Cheat Sheet series of articles, which focuses on one specific topic area for one specific CFA Level. ☕

More Cheat Sheets will be published in the coming weeks, sign up to our member’s list to be notified first.

By referring to the CFA curriculum’s Learning Outcome Statements (LOS), we prioritize and highlight the absolute key concepts and formula you need to know for each topic. With some tips at the end too!

Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts.

Let’s go! Don’t forget to bookmark this page and (re)visit often! 🙂

- CFA Level 1 Portfolio Management: Summary

- LM1: Portfolio Management: An Overview

- LM2: Portfolio Risk and Return: Part I

- LM3: Portfolio Risk and Return: Part II

- LM4: Basics of Portfolio Planning and Construction

- LM5: The Behavioural Biases of Individuals

- LM6: Introduction to Risk Management

- CFA Level 1 Portfolio Management Tips

CFA Level 1 Portfolio Management: Summary

Portfolio management is really the end game for the CFA program.

However, this topic’s weighting in Level 1 is deceptively light. Portfolio Management will become exponentially more important as you advance in the CFA program, especially in Level 3 if you go for the Portfolio Management pathway.

2025’s CFA Level 1 Portfolio Management’s topic weighting is 8-12%, which means 14-22 questions of the 180 questions of CFA Level 1 exam are centered around this topic.

It is covered in 2025’s Topic 9 with 6 Learning Modules (LMs).

Here’s a summary of Level 1 Portfolio Management chapter readings:

| Learning Module # | Sub-topic | Description |

|---|---|---|

| 1 | Portfolio Management: An Overview | What is portfolio investing, how is it done, who invests, pension plans and mutual funds. |

| 2 | Portfolio Risk and Return: Part I | How to measure the performance (returns) of a portfolio, calculate and understand risk metrics (mean, variance, covariance, standard deviation). |

| 3 | Portfolio Risk and Return: Part II | Learn about the capital allocation line (CAL), capital market line (CML), systematic and nonsystematic risk, beta, capital asset pricing model (CAPM), security market line (SML). |

| 4 | Basics of Portfolio Planning and Construction | An introduction to what will be explored in great detail in CFA Level III. You’ll learn about: – investment policy statements (IPS), which is sort of a ‘strategy document’ of how each individual investors have decided to invest, – how different investors can have different abilities and willingness to take on risk, and – other aspects of portfolio planning, such as investment constraints (liquidity, timelines, tax, regulation), asset classes and asset allocation. |

| 5 | The Behavioural Biases of Individuals | Learn about types of behavioural biases and how it affects financial decision making. |

| 6 | Introduction to Risk Management | All about risk management – what it is, risk management frameworks, how to identify different types of risks and how to manage them. |

Once you’ve learnt to value individual securities, evaluating them as a combined portfolio is essential to your capability as an asset or wealth manager. Not only that, but knowing how to tailor the combination of securities to suit different clients’ risk profiles is important to being a good financial advisor.

In short, the CFA Level 1 Portfolio Management readings teaches you:

– How investing via building a portfolio works;

– How to measure how well you’re doing;

– How to be aware of the scale and type of risks your’e taking;

– How to adapt portfolio investment strategies to different types of investor profiles.

LM1: Portfolio Management: An Overview

Steps in portfolio management process

- Planning: List client’s objectives and constraints in IPS

- Execution: This includes asset allocation, security analysis and portfolio construction.

- Feedback: This includes monitoring/rebalancing and performance measurement and reporting.

Types of investors

| Client | Investment horizon | Risk tolerance | Income needs | Liquidity needs |

|---|---|---|---|---|

| Individual investor | Varies by individual | Depends on the ability and willingness to take risk | Depends on investment rationale | Varies by individual. |

| Defined benefit (DB) pension plans | Usually long term | High for longer investment horizon | High for mature funds (payouts soon), low for growing funds. | Varies by plan maturity |

| Endowments & foundations | Very long term | Typically high | To meet spending commitments | Quite low |

| Banks | Short term | Low | Pay interest on deposits and operational expenses | High, to meet daily withdrawals |

| Insurance companies | Short term for property & casualty (P&C), long term for life insurance | Low | Low | High to meet claims |

| Investment companies | Varies by fund | Varies by fund | Varies by fund | High to meet redemptions |

| Sovereign wealth funds | Varies by fund | Varies by fund | Varies by fund | Varies by fund |

Defined benefit (DB) vs defined contribution (DC) pension plans

- Defined benefit (DB) plan is where a company promises to makes a pre-defined future benefit payments to the employees. The company bears the investment risk.

- Defined contribution (DC) plan is where a company contributes an agreed amount to the plan and employees invest part of their wages to the plan. In a DC plan, investment and inflation risk is borne by the employee.

LM2: Portfolio Risk and Return: Part I

Risk aversion

- Risk aversion is the degree of an investor’s inability and unwillingness to take risk.

- Risk neutral: an investor who is indifferent about the gamble or a guaranteed outcome, as the investor is only concerned about returns.

- Risk-seeking: an investor who prefers a gamble, where the indifference curve is downward sloping as the expected return decreases for higher levels of risk. This is uncommon.

- Risk averse: an investor who expects additional return for taking additional risks, i.e. the indifference curve is upward sloping. Most investors are risk averse, the degree of risk aversion varies. The steeper the indifference curve, the more risk averse they are.

Minimum variance portfolio

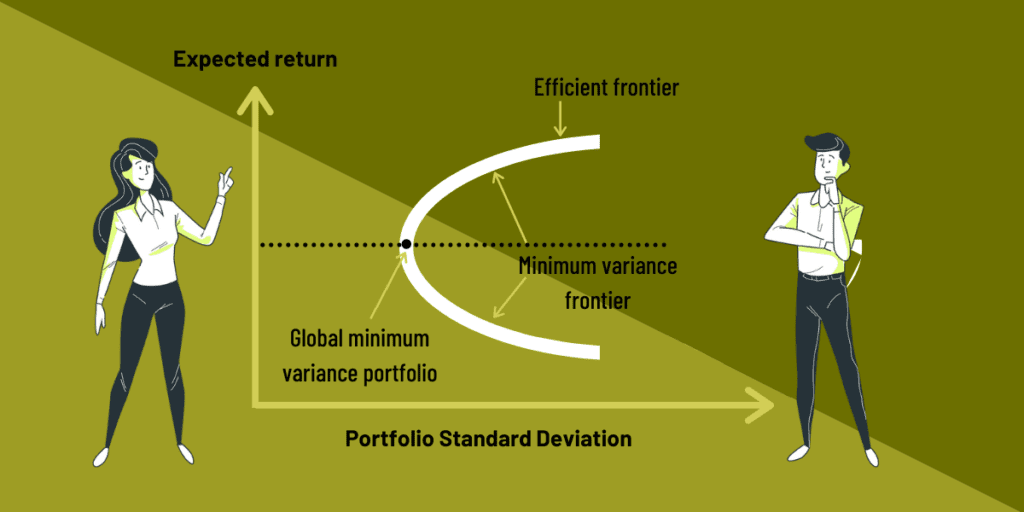

- Minimum variance frontier is a line combining all portfolios with a minimum level of risk given a rate of return.

- Global minimum variance portfolio is the portfolio with the lowest variance amongst the portfolio of all risky assets.

- The efficient frontier is the part of the minimum variance frontier that is above the global minimum variance portfolio, since it gives the highest return for a given level of risk. Note that efficient frontier only consists of risky assets, there are no risk-free assets here.

Capital allocation line (CAL)

CAL overcomes the shortfall of efficient frontier by showing a line representing possible combinations of risk-free assets and optimal risky asset portfolio.

E[R_p]=R_f+\Big(\frac{E[R_i]-R_f}{\sigma_i}\Big)\sigma_pOptimal investor portfolio is the point where an investor’s indifference curve is tangential to the optimal CAL.

LM3: Portfolio Risk and Return: Part II

Capital market line (CML)

If all investors have the same expectations, the capital market line (CML) becomes a special case of optimal CAL, where the tangent portfolio is the market portfolio.

CML is a special case of CAL whereby

E[R_p]=R_f+\Big(\frac{E[R_m]-R_f}{\sigma_m}\Big)\sigma_pSlope of CML line is the market price of risk, i.e. Sharpe ratio.

Systematic vs non-systematic risk

- Systematic risk is a non-diversifiable, market risk. Investors should get compensated for taking on systematic risk.

- Non-systematic risk is a local risk that can be diversified away, investors are not compensated for taking on this risk.

- A risk-free asset has zero systematic and non-systematic risk.

Beta

Beta is a measure of an asset’s systematic (market) risk, relative to the risk of the overall market.

\beta=\frac{Cov(R_i,R_m)}{\sigma^2_m}=\frac{\rho_{i,m}\sigma_i\sigma_m}{\sigma^2_m}=\frac{\rho_{i,m}\sigma_i}{\sigma_m}Capital asset pricing model (CAPM)

CAPM is used to calculate an asset’s required return given its beta.

E[R_i]=R_f+ \beta_i [{E(R_m)-R_f}]CAPM assumptions:

- Investors are rational, risk-averse and utility maximizing individuals.

- Frictionless markets

- All investors plan for the same holding period

- Investors have homogenous expectations

- Investors are infinitely divisible

- Investors are price takers.

CAPM limitations:

- Only systematic risk are included

- Does not consider multi-period implications

Security market line (SML)

SML is a graphical representation of CAPM, which applies to all securities, whether they are efficient or not.

Slope of the SML is market risk premium, E(Rm) – Rf

If an asset’s expected return forecast is higher (lower) than its CAPM required return, the asset is undervalued (overvalued).

Other portfolio performance evaluation measures

Sharpe ratio (total risk)

Sharpe \thickspace ratio=\frac{R_p-R_f}{\sigma_p}M-squared (total risk)

M \thickspace squared=(R_p=R_f)\Big(\frac{\sigma_m}{\sigma_p}\Big)-(R_m-R_f)Treynor ratio (systematic risk)

Treynor \thickspace ratio=\frac{R_p-R_f}{\beta_p}Jensen’s alpha (systematic risk)

Jensen's \thickspace alpha = R_p-[R_f+\beta_p(R_m-R_f)]

LM4: Basics of Portfolio Planning and Construction

Investment policy statements (IPS)

IPS is a written document detailing the portfolio construction process designed to satisfy a client’s investment objectives.

Major components of an IPS are:

- Introduction

- Statement of purpose

- Statement of duties and responsibilities

- Procedures

- Investment objectives

- Investment constraints

- Investment guidelines

- Evaluation of performance

- Appendices

Assessing overall risk tolerance

- Usually expressed as average, above average, below average.

- 2 factors affect investor’s overall risk tolerance:

- willingness (investor’s intent towards risk)

- ability to take risk (investor’s capability to take risk, independent of intent)

Investment constraints

| Investment constraints | Description |

|---|---|

| Time horizon | The longer the time horizon, the greater the ability to take risk and the lower the liquidity needs. |

| Taxes | Consider individual tax status, investment jurisdiction and tax treatment of various types of investment accounts. |

| Liquidity | Cash requirements varies by client and need to consider having a portion of assets in liquid investments. |

| Legal / regulatory | Consider if there are legal restrictions on investments or max percentage allocation on certain assets. |

| Unique circumstances | Usually individual constraints are present, such as avoid certain class of security or industry, or ethical preferences etc. |

Check out this useful forum post about how to tackle IPS questions too, as we discuss the acronym “RRTTLLU” to remember the investor objectives and constraints.

ESG constraints

Note that IPS may also include a policy regarding responsible investing which takes into account Environmental, Social and Governance (ESG) factors.

The 6 main ESG investment approaches are:

| Negative screening | Excludes certain practices, sectors or companies from a fund/portfolio based on a specific ESG criteria. |

| Positive screening | Includes certain practices, sectors or companies in a fund/portfolio based on a specific ESG criteria. |

| ESG integration | Refers to the practice of including material ESG factors in the investment process. |

| Thematic investing | Picks investment based on a single factor or theme, such as energy efficiency. |

| Engagement / active ownership | Achieving ESG objectives with financial returns using shareholder power to influence corporate behaviour. |

| Impact investing | Investments made with the intention of generating positive, measurement ESG impact along with financial return. |

LM5: The Behavioural Biases of Individuals

Cognitive errors

| Conservatism bias | Fail to incorporate new information that conflicts with their opinion. Slow to react as a consequence. |

| Confirmation bias | Look for data that supports their view, ignore those that contradicts. |

| Representativeness bias | Incorrectly classify new information based on past experiences. |

| Illusion of control bias | People overestimate their ability to control or predict events. |

| Hindsight bias | People believe past events would have been predictable. |

| Anchoring & adjustment bias | An information processing bias where people relied too much on initial data, closely related to conservatism bias. In conservatism bias, people overweight past information vs. new information, whilst anchoring & adjustment bias overweights on an anchored value. |

| Mental accounting bias | People treat one sum of money differently from the other, i.e. “mental buckets”, when money is fundamental fungible. |

| Framing bias | People answer questions differently depending on how it is framed. |

| Availability bias | People perceive outcomes that are more easily remembered are more likely. |

Emotional biases

| Loss aversion bias | Strongly prefer avoiding losses than achieving gains. |

| Overconfidence bias | Overestimate own abilities. |

| Self control bias | Lack discipline to act or make decisions for long term goals. |

| Status quo bias | Rather do nothing than make a change. |

| Endowment bias | Value assets more when they hold rights to it than when they don’t. |

| Regret aversion bias | Avoid making decisions that could turn out badly. |

LM6: Introduction to Risk Management

Risk management framework

- Risk governance: a top-down process that defines risk tolerance and provides guidance to align risk with company goals

- Risk identification and measurement

- Risk infrastructure

- Defined policies and processes

- Risk monitoring, mitigation and management

- Communications

- Strategic analysis or integration

Other risk definitions

- Risk tolerance: what risks are acceptable and how much risk should be taken

- Risk budgeting: how and where the risks are taken and quantifies tolerable risk by specific metrics

- Financial risk: risks that originate from financial markets such as change in interest rates. 3 major types of financial risk are market risk, credit risk and liquidity risks.

- Non-financial risk: risks that arise from within an entity or externally. Examples of non-financial risks are: operational risk, solvency risk, settlement risk, legal risk, regulatory, accounting and tax risk, model risk, tail risk, political risk.

- Methods of risk measurements: standard deviation, beta, duration, delta, gamma, VaR, CVaR, etc.

- Methods of risk modification: risk prevention/avoidance, risk acceptance (self-insurance and diversification), risk transfer (insurance), risk shifting/modification (via derivatives).

CFA Level 1 Portfolio Management Tips

Know your terms and definitions

There are a wide range of definitions to be learnt in Portfolio Management.

Investment policy statement (IPS) objectives and constraints, risk types, asset classes – make sure you note and memorize them, as exam questions can baldly ask about any term.

Know your lines (CAL, CML, SML) and CAPM

The security market line (SML) and how it relates to capital asset pricing model (CAPM) calculations is a popular question topic, so make sure you’re very familiar with that.

Be sure to also know how to explain the capital allocation line (CAL) and the capital market line (CML), and how the SML is derived from the CML.

Calculation, calculation, calculation

Portfolio management questions can contain calculation-heavy questions, usually centering around risk or return calculations.

Make sure you get lots of practice on calculating and comparing returns (such as expected return), as well as calculating risk metrics (such as variance, covariance, standard deviation, beta).

More Cheat Sheet articles will be published over the coming weeks. Get ahead of other CFA candidates by signing up to our member’s list to get notified.

Meanwhile, here are other related articles that may be of interest:

- CFA Level 1 Cheat Sheets series: Quant Methods | Economics | Corporate Finance | Fixed Income | FSA | Equity Investments | Ethics | Alt Investments | Derivatives

- CFA Level 1: How to Prepare and Pass CFA in 18 Months

- CFA Level 1 Tips: Top 10 Advice from Previous Candidates

- What Is the Best CFA Level 1 Topic Study Order?

- 18 Actionable Ways to Improve Your Study Memory

- How to Study Effectively: Proven Methods that Work for CFA, FRM and CAIA

- The Ultimate Guide to CFA Practice Questions

Is this updated?

I thought Technical Analysis is not tested.

You’re right, it’s not updated

Hi Joel, Drew – thanks for catching that. We have updated the cheat sheet to reflect that Technical Analysis is no longer tested.

great job guys, your support highly valuable for the CFA level 1 series.

When will the other topics’ cheat be available? Kindly try to make it quick.

And Thank you from the students’ community for such noble services.

I need more information on CFA, Level 1.

Your page have been very helpful to my study.

Thank you.

You’re welcome!

Subscribe to our mailing list – you’ll receive tailored guides and articles synced to the CFA exam cycle.