In the past few years, the CFA Program has undergone some pretty big changes. From a radical change in exam schedules to a shift to computer-based testing (CBT), the CFA Program has evolved a lot.

And on 20th March 2023, CFA Institute announced more changes to bring this evolution to the next stage.

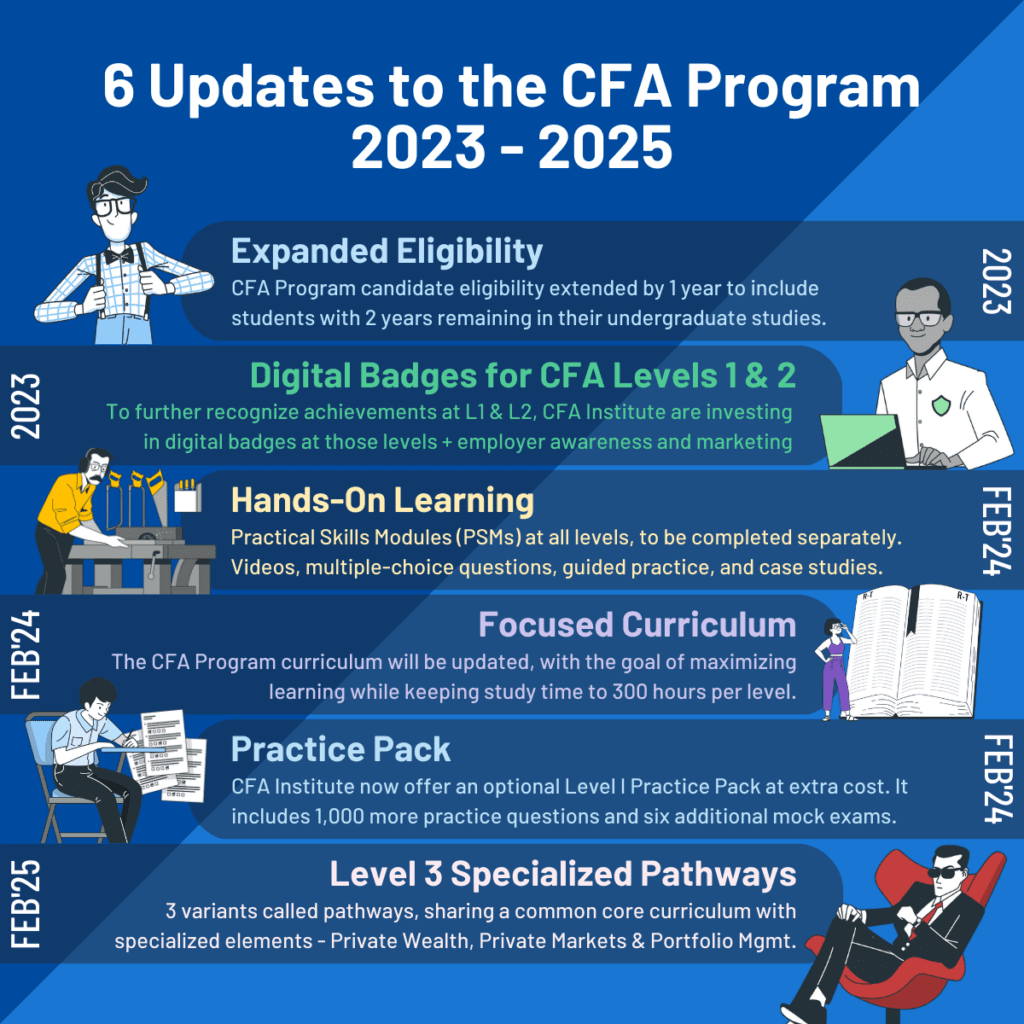

The six changes are:

- Expanded eligibility for CFA Level 1 candidates

- Digital badges for CFA Levels 1 & 2

- Practical Skills Modules (PSMs) for all CFA levels

- A focusing of CFA curriculum

- Practice pack availability for CFA Level 1

- Specialized Pathways for CFA Level 3

More details below, including exclusive Q&As from CFA Institute!

6 changes to the CFA Program, summarized

Expanded eligibility

What’s happening?

CFA Institute has extended CFA Program candidate eligibility by one year to include university students with two years remaining in their undergraduate studies.

When is it happening?

This is already in effect.

Who will be affected?

The expanded eligibility rules apply to CFA Level 1 candidates only. For CFA Level 2, you must have received your undergraduate degree before your Level 2 exam date.

What does this mean?

Aspiring CFA candidates can now try their hand at CFA Level 1 sooner compared to the previous eligibility rules. But does it dilute the CFA charter?

We believe the expanded eligibility will enable a greater pool of CFA Level 1 candidates, but not necessarily increase the pool of charterholders, as candidates will still have to pass the same three exams to obtain the charter. If anything, this might lower the pass rate for CFA Level 1 as a greater, greener and more generalized candidate pool attempt the exams.

Digital badges for CFA Levels 1 & 2

What’s happening?

CFA Institute will be investing in an “improved recognition strategy”, including updated digital badging. This will acknowledge candidates’ achievements at Levels 1 and 2.

When is it happening?

This is announced as happening “in 2023”, which means there will likely be more announcements when this is implemented.

Who will be affected?

All candidates and charterholders will have their digital badges changed as part of this, although I’m guessing candidates at Level 1 and Level 2 may get a bigger upgrade to what they have currently.

What does this mean?

We were a little confused with this one, since there are already digital badges available for CFA Levels 1 and 2 (see here for instructions on how to get them). Here are how they currently look:

We asked CFA Institute for more clarity on this, and got more details:

- They will look nicer. Yes, there are currently badges that are available, but they will further “enhance this visual representation of the achievements at each level of the CFA Program” (i.e. they’ll look nicer?)

- CFA Institute will be marketing them. Going further, CFA Institute will also be “investing in socializing these badges more broadly within the industry, and with employers, to raise their level of awareness around the value of these badges through marketing campaigns”. In other words, advertising to raise awareness of these badges as a signal for employability. Will it work? Time will tell, I suppose.

- Changing providers. There will also be a shift of badge providers from Basno to Accredible, whose services goes beyond badges and also provides digital accreditation services.

To quote philosophers Linkin Park, but in the end, does it matter? Do employers value whether an interviewee passed CFA Level 2, and if they do, do they care if it’s in the form of a shiny badge?

CFA Institute seemingly hopes so. With their investment in marketing, the signal of “passed CFA Level X” may increase in visibility and value in the coming months and years – at least that’s what CFA Institute is aiming to achieve.

So candidates may be able to reap career benefits at CFA Levels 1 and 2 and not wait for the charter – although our salary data shows that they likely already do.

Hands-on learning

What’s happening?

The CFA Program has been expanded to include Practical Skills Modules (PSMs) that reflect practical, relevant skills training to provide candidates with on-the-job application of what they are learning in the curriculum.

A PSM consists of a combination of videos, multiple-choice questions, guided practice, and case studies to develop candidates’ practical skills.

6 fast facts about CFA Practical Skills Modules (PSMs):

- You’ll need to complete your chosen PSM to receive your CFA exam result.

- If you don’t complete at least one PSM by results day, you won’t receive your result. You will be given an additional 90 days to do so, after which presumably your exam result will be voided.

- You have to choose at least one PSM, but also do the others if you want to.

- Each PSM takes an estimated 10-15 hours to complete.

- You can’t fail a PSM, you just complete it like a course.

- PSMs aren’t graded and their material isn’t tested in the CFA exam.

- PSM content are all independent of each other, even across levels.

What PSM choices are there?

Level 1

- Financial Modeling: How to build a top-tier three-statement financial model of a company in Excel as models are used to determine the value of a company.

- Python Programming Fundamentals: A fundamentals course to demonstrate the basics of Python and how to use Jupyter Notebook for developing, presenting, and sharing data science projects related to finance.

Level 2

- Python Programming Fundamentals: A fundamentals course to demonstrate the basics of Python and how to use Jupyter Notebook for developing, presenting, and sharing data science projects related to finance. (if not taken at Level 2)

- Analyst Skills: Focuses on the skills equity and credit analysts need using insights gained from hundreds of successful analysts.

- Python, Data Science & AI: Introduces candidates to machine learning, artificial intelligence, and data science to understand financial statements, reporting, and analysis using Python.

When is it happening, and who are affected?

All CFA levels will eventually get PSMs. Here’s the launch timeline:

- Level 1 candidates: Starts with the February 2024 exam

- Level 2 candidates: August when registration opens for May 2024

- Level 3 candidates: 2025 exams

Over time, the idea is for PSMs to also be available to charterholders and candidates to take in their own time, as part of their professional learning.

What does this mean?

Adding a practical aspect to the CFA Program has been something that has been desired for a while now. Practical skills like financial modelling and coding are key to modern financial careers, and by adding these PSMs, CFA Institute are attempting to ensure that the CFA Program supports candidates as best it can.

Some candidates’ reactions to PSMs have been along the lines of “well, this isn’t in-depth enough / will teach poor practices / doesn’t make you good at modelling or coding”. I think that may be missing the point. Having an introductory course in this will familiarize candidates to the concepts, allowing them to understand whether this is a skill they want to dive into further, and allow them to have better context when they encounter this in their career.

The PSMs look well-designed for their intention – that is to introduce candidates to some practical concepts. If you want to thoroughly learn a coding skill, then a coding course would be more useful, rather than expecting the CFA Program to fully teach you Python.

Focused curriculum

What’s happening?

CFA Institute are taking an approach to the CFA curriculum with an emphasis on “streamlining” and “focus”. As part of that, for CFA Level 1, they are taking some introductory financial concepts from Level 1 and reclassifying them as prerequisite material. This means they won’t be directly tested anymore, but will still be needed to understand the remaining tested topics in CFA Level 1.

When is it happening?

All candidates who sit for exams in from 2024 will be tested on the updated Level 1 curriculum. More information on what has changed by level can be found on the CFA Institute website when registration opens in May.

Who will be affected?

For now the most changes have been at CFA Level 1. Level 2 curriculum has changed slightly to reflect this new focused approach, whereas CFA Level 3 has not changed yet.

What does this mean?

We believe this will have a strong impact on candidates that have no prior knowledge or experience in finance, economics or statistics.

The reason is that a lot of the foundational and introductory content – such as time-value of money, basic statistics, microeconomics and introduction to company accounts – will be moved out of official tested material, to make way for more advanced material while keeping to the estimated 300 hours’ worth of study time.

While the phased-out introductory content are still available for candidates to access and study free of charge, this effectively means that candidates with no prior knowledge will have to study the introductory material AND the main curriculum to prepare for the Level 1 exam.

CFA Institute has stated that according to their analysis, 9 out of 10 candidates would not necessarily need to review these introductory content. Even if true, this new focused approach would likely mean that the odd 1 out of the 10 would have to put in significantly more effort to keep up with the rest.

3 burning questions about CFA Program’s new ‘Focused Curriculum’

Why is CFA Institute changing the curriculum and removing introductory content?

According to CFA Institute, they believe 9 out of 10 candidates already know this introductory content, so by making this prerequisite, they are able to advance the content of the curriculum while keeping the same study time estimates as before.

Doesn’t CFA Institute’s Focused Curriculum approach mess up candidates that DO need to learn the introductory content from scratch?

We believe it does make life harder for them, yes. We directly asked CFA Institute and they reiterated that they do still make the material available to study, albeit untested.

Under the new Focused Curriculum, will CFA Level 1 will be harder to pass for all candidates?

We believe the changes clearly means that there is more material to master in the Level 1 curriculum. Whether or not Level 1 would be harder to pass would also depend on the MPS and exam difficulty, which can be subjectively adjusted by CFA Institute.

Practice pack

What’s happening?

CFA Institute are now offering a Level 1 Practice Pack. It includes 1,000 more practice questions and six additional mock exams to go with the default study materials. This will cost an extra US$ 299.

When is it happening?

The CFA Level 1 Practice Pack will be available for purchase in May 2023 for candidates registering for the February 2024 exams.

Who will be affected?

For now, only Level 1 candidates will be offered the Practice Pack. There are plans and considerations for CFA Levels 2 and 3, but nothing has been confirmed yet.

What does this mean?

Having more practice material is something that’s always helpful, and we always recommend to make the most of the included CFA Institute practice questions. More CFA Institute practice questions, albeit at an additional cost, can only be a good thing for candidates’ pass chances.

Why differentiate by price? Why not make it included for all, maybe with a slightly-raised exam fee?

But what about the extra cost? We quizzed CFA Institute about this, and whether they considered making the Practice Pack available to all, at the cost of a slight increase in exam fees.

Their response does have its merits:

- Based on their analysis, the ‘free’ material included with CFA exam registration should be more than enough to significantly improve pass chances.

- That being said, the Practice Pack is offered due to high candidate demand.

- Question-writing is “one of the most time consuming and expensive activities performed by CFA Institute” and therefore the reason there must be a charge.

- So charging the sub-set of candidates who do want the additional material makes sense, rather than charging everyone for it.

A unique offering

CFA Institute’s Practice Pack offers something no other provider can:

- They state that the mock exams replicate the difficulty of the real exam. This is something CFA Institute can accurately claim, and it would be the first time candidates will have access to a total of 8 (EIGHT!) mock exams from CFA Institute.

- The authors of the questions and mocks are the same as the ones that authored the exam questions.

So is the cost worth it?

Even so, it may not be a straightforward argument whether it’s worth the purchase. There is a diminishing marginal return even on practice questions – that’s why we have an optimum number of mock exams that we recommend to our readers.

Your Level 1 exam registration already includes 2,000 practice questions and 2 mock exams at no additional charge. That is a healthy chunk of practice material. CFA Institute themselves have stated that practicing 1,000 exam questions is a key tipping point to passing the CFA exam, giving candidates a 2x chance at passing compared to candidates who did no practice.

US$ 299 for 6 mock exams and 1,000 more practice questions by CFA Institute is invariably good value, and if you can afford the extra cost I would definitely go for it. But should you prioritize it? Before more practice questions, you may want to consider if attending classes, or having summarized notes, or indeed practice questions from other providers would be better for your pass chances and development.

Should candidates get the Practice Pack?

Everyone studies differently, so we suspect everyone would have differing preferences on this.

Personally, I don’t think I would be able to get through all of that additional practice material – six mock exams are no joke! I found third-party notes really helpful, so I would likely get those first, and get CFA Institute practice questions if I’ve finished everything, and still had time and motivation left for even more practice.

CFA Level 3 specialized pathways

What’s happening?

Level 3 is getting three variations, called Specialized Pathways. Two new versions of Level 3 will be called Private Wealth and Private Markets. The ‘original’ content will form the Portfolio Management path.

When is it happening? Which levels will be affected?

This will be introduced at Level 3 for the 2025 exams. There are no current plans to introduce Specialized Pathways for Levels 1 and 2.

What percentage of CFA Level 3 content will now be ‘specialized’?

Approximately 30% of Level 3 content will differ between the three pathway options, with approximately 70% being identical ‘common core’ material.

5 burning questions about CFA Level 3 specialized pathways

When do I choose my Pathway?

You choose your Pathway at exam registration. You can change this, but you’ll have to ring up CFA Institute to do this.

Can I choose more than one Pathway?

You can only choose one Pathway for your Level 3 exam. But eventually CFA Institute wants to make the Pathways available for charterholders and members to access as part of their Professional Learning material, allowing you to go back and add another Pathway to your skill set if you want.

What percentage of CFA Level 3 content will now be ‘specialized’?

Approximately 30% of Level 3 content will differ between the three pathway options, with approximately 70% being identical ‘common core’ material.

Will CFA charters now reflect chosen Specialized Pathways?

The CFA charter itself will not change, nor indicate your Specialized Pathway. However, CFA Institute are looking at differentiating their digital badges by Pathways.

Will one CFA Level 3 Pathway be easier than another?

CFA Institute has stated that Pathways won’t mean variations in Level 3 exam difficulty. However, since candidates will all have topical strength and weaknesses, it’s likely that you’ll find one Pathway more accessible than another!

What are your thoughts?

Candidates have had polarizing opinions on these changes. Some news, like the Practice Packs, have been generally welcomed, but others such as Specialized Pathways and PSMs have had detractors.

What do you think? Let us know in the comments below!

Meanwhile, here are some related articles that may be of interest:

This is great, thank you for elaborating on the upcoming changes! Along with all the other articles, you guys do a great job at demystifying one of the most challenging exams/topics, much appreciated!

Do you have an idea what type of content would be under ‘private markets’?

I think it’ll be things like investment banking transactions such as equity and debt capital markets, project finance, etc.