2026 asset management outlook summary:

- Global AuM projected to reach $160 trillion by 2028 (7% annual growth from 2023 baseline of $119T)

- AI transforming operations: automation, risk management, personalized advice. Technology skills now essential for all roles

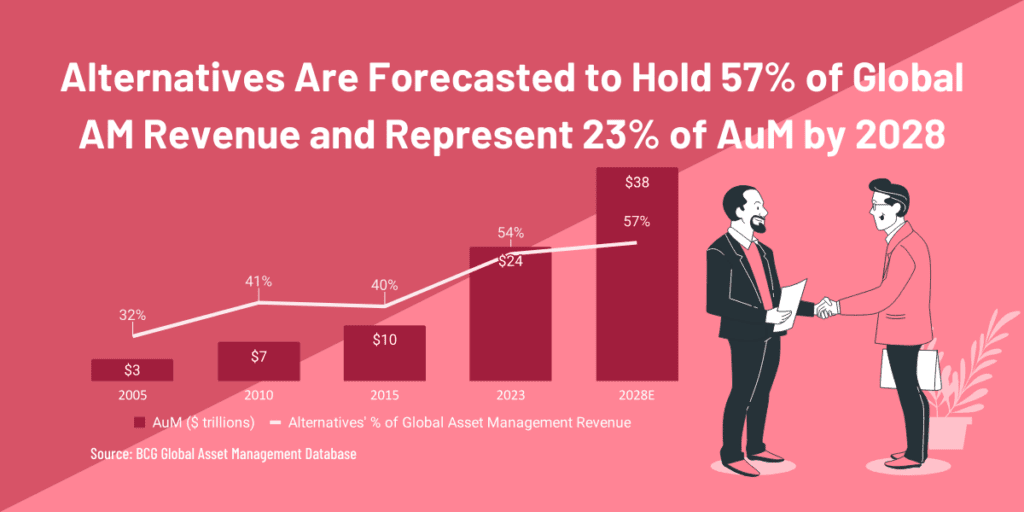

- Alternative investments expected to capture 57% of global revenues by 2028, up from 54% in 2023

- Passive funds will continue dominating flows but face margin pressure

- ESG investing stabilizing at $3T+ AuM after 2021-2024 correction, shifting toward integrated risk analysis

Career impact: Alternatives hiring accelerating. AI upskilling mandatory. ESG evolving into climate risk specialization. Active specialty roles remain strong.

Planning your asset management career for 2026 and beyond? Understanding where the industry is heading matters more than where it’s been.

Global assets under management are projected to reach $160 trillion by 2028, growing at 7% annually. But this growth masks major shifts: alternatives will capture 57% of revenues, AI is eliminating routine analyst work, and ESG is evolving from standalone strategies into integrated risk analysis.

This guide examines four trends reshaping asset management careers through 2028. Based on research from BCG, PwC, and Morningstar, we analyze what these changes mean for portfolio managers, analysts, ESG specialists, and technologists entering or advancing in the industry.

Asset management outlook: How’s the sector doing?

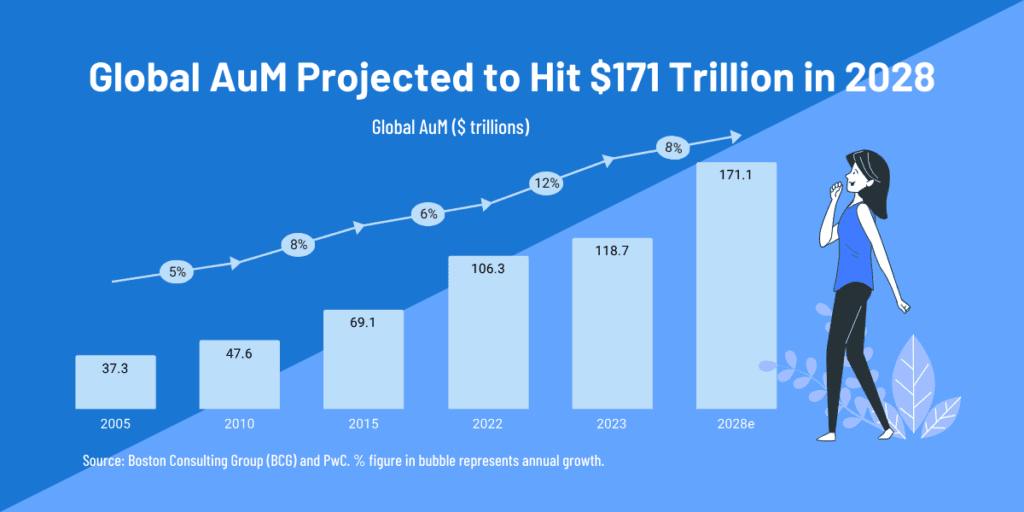

According to Boston Consulting Group’s latest research, the total assets under management (AuM) in 2023 grew by 12% to $119 trillion globally, with the growth rate higher than historical average of 6% annually for the period 2005-2022.

This is mainly driven by net new asset flows from retail investor demand. In fact, PwC projected that global asset management AuM will continue to grow at 7% annually from 2023 to 2028.

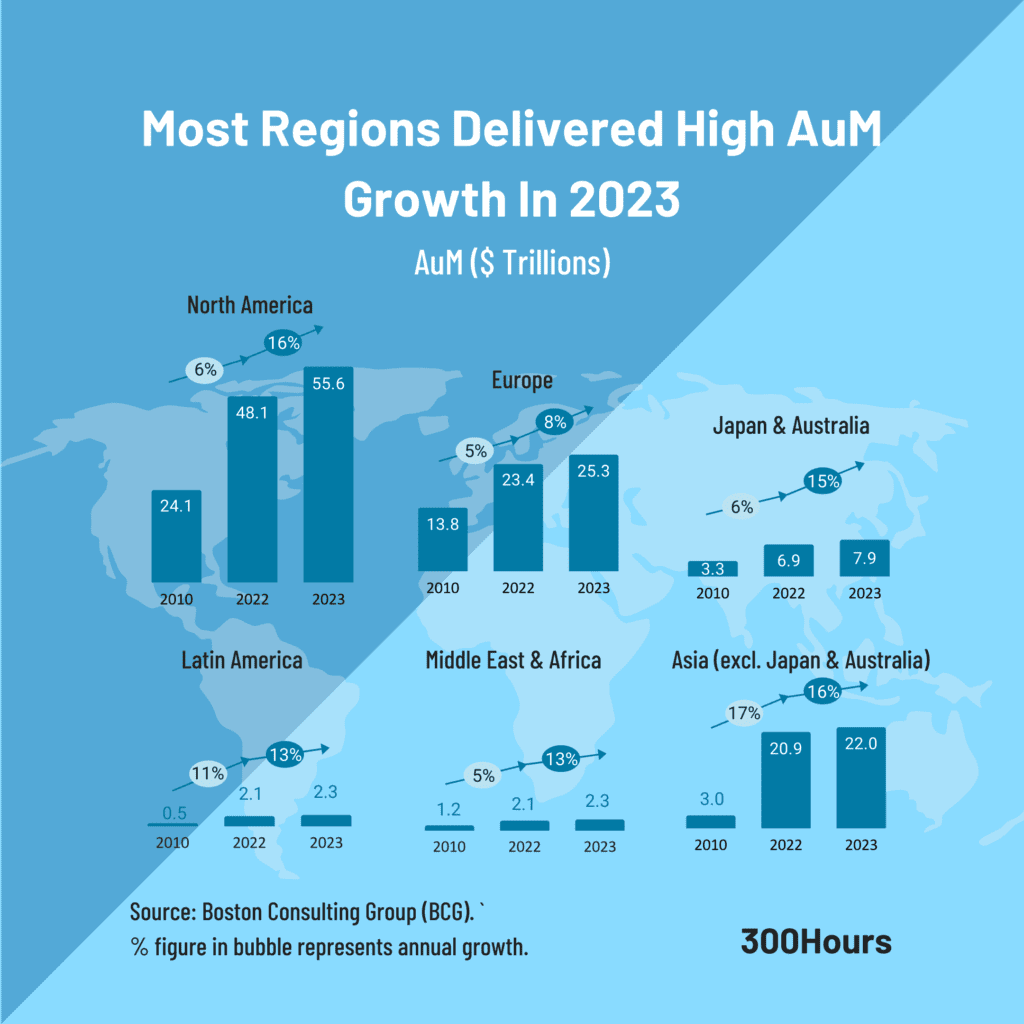

When broken down by region, we can see that most regions (except Europe and Asia Pacific (excluding Japan and Australia) delivered above average growth in AuM from 2022-2023.

| Regions | Commentary |

|---|---|

| North America | World’s largest asset management region, with US accounting for over 90% of the region’s AuM. AuM increased by 16%, adding $7.5 trillion in value. This growth is mainly attributable to strong consumer spending, and a historically low unemployment rate. |

| Europe | Also recorded decent AuM growth, increasing by 8% to $25.3 trillion. UK is Europe’s largest market with ~27% market share. Institutional segment (majority of UK market) is the main driver of growth. |

| Japan & Australia | Both countries have collectively grown 15% to $7.9 trillion AuM, mainly due to strong market performance. |

| Asia (excl. Japan & Australia) | Assets in other Asia Pacific countries grew faster at 16% to $22 trillion. This growth rate is heavily influenced by China – the second-largest asset management market in the world. Retail segment accounts for 60% of China’s AuM, which recorded a strong growth in 2023, mainly driven by the rise in retail investing. |

| Latin America | Latin America’s AuM grew 13% to $2.3 trillion, with Brazil holding 61% of the region’s AuM. Brazil’s AuM growth is mostly driven by retail investors. |

| Middle East & Africa | Middle East is the largest market in this region with $2.3 trillion AuM. Its 13% AuM growth is mainly driven by strong market performance and recovering oil prices. |

OK, that’s a good start, I hear you say.

So, what are the key trends for the future of asset management?

1) Despite AuM growth, profits declined due to 5 fundamental pressures

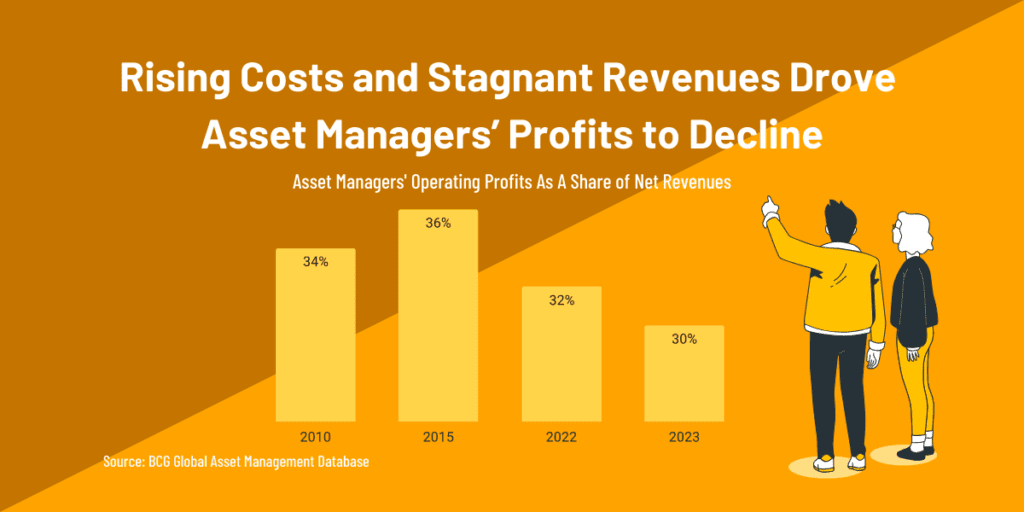

Despite AuM growth, the global asset management industry revenues increased only slightly (0.2%), while costs rose significantly (4.3%), leading to an 8.1% decline in profits.

- Revenue pressure: Asset managers can no longer rely solely on market performance/appreciation to drive revenue growth like in the past. Growth is typically associated with low interest rate environment and currently many governments around the world are battling inflation with higher interest rates.

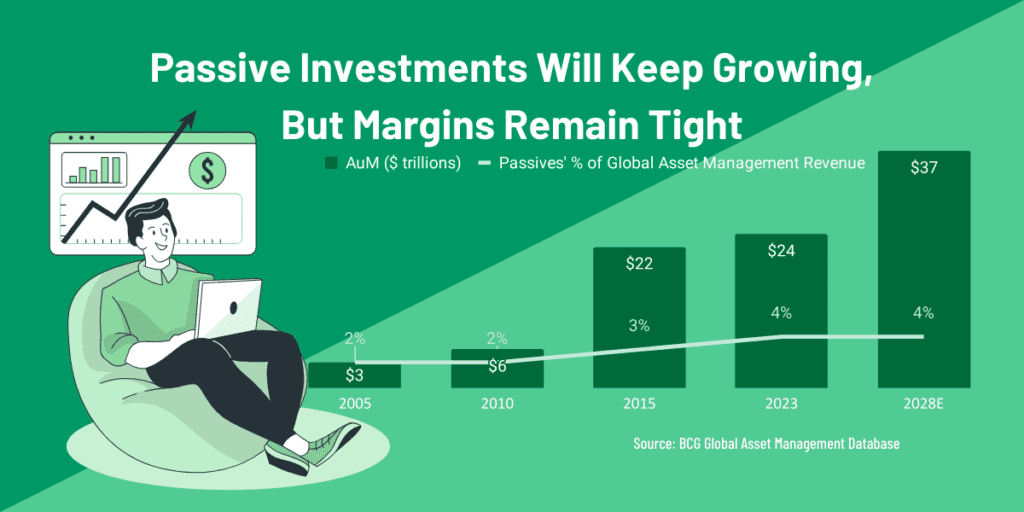

- Passive funds are increasingly popular: Passive investment products are capturing a growing share of net fund flows. In 2023, passive products attracted 70% of total global mutual funds and exchange-traded funds (ETFs) net flows (about $920 billion).

- Fee compression is accelerating: The pressure to lower fees shows no signs of easing. Continued tight monetary policies, combined with general market uncertainty, resulted in investors moving into products with lower fees.

- Costs are rising: Operating costs for asset managers continue to increase at about 5% a year annually since 2010.

- Fewer new products are surviving despite attempts at innovation: Many new investment products struggle to gain traction and survive in the market.

2) How artificial intelligence (AI) is transforming asset management

AI is driving significant changes across asset management, primarily through:

- Operational Efficiency & Cost Savings:

- Automation: Streamlining routine tasks like data entry, trade execution, and compliance reporting.

- Risk Management: Enhancing risk detection and mitigation, reducing potential losses.

- Data Processing: Accelerating data analysis and reporting, minimizing manual errors.

- Enhanced Investment Decision-Making:

- Advanced Analytics: Analyzing vast datasets to identify market trends and investment opportunities.

- Algorithmic Trading & Quantitative Strategies: Using AI to execute trades and find market inefficiencies.

- Predictive Analytics: Improving market forecasting and portfolio optimization.

- Personalized Client Experiences:

- Tailored Advice: Providing personalized investment recommendations based on client profiles.

- Chatbots & Support: Offering AI-powered customer support and instant responses.

- Customized Portfolios: Creating portfolios that align with individual client goals and risk tolerance.

- Improved Compliance and Risk Mitigation:

- Anomaly Detection: AI is used to detect anomolies, and potential fraud.

- Automated Reporting: AI automates compliance reporting, saving time and money.

How does the increasing digitization in asset management affect jobs?

1) Technology will become mission critical not only to drive operational efficiency (see section #1), but also drive customer engagement, build deep customer insights data, simplify regulatory and tax reporting. Most global asset managers will soon have a chief digital officer (CDO) to oversee the huge business digital transformation.

2) The sales and marketing process (distribution) will be more efficient. Sales and marketing staff can adapt and up-skill by being familiar with data analytics, and increasingly focus on their creativity and communication skills which is still core to this client-centric business.

3) Select alternatives and passives are winners

Since 2005, alternative and passive assets have grown considerably faster in the lead-up to 2021, to become more significant parts of portfolios.

Alternatives are expected to continue outpacing traditional products, growing from 54% of total market AuM in 2023 to a projected 57% revenue share by 2028.

The key driver of this growth is investor demand for increased performance, uncorrelated returns, illiquidity premiums, and other nontraditional return profiles, particularly as institutions across the globe face the challenge of a widening gap between assets and liabilities.

Within the alternatives sector – which consists of commodities, infrastructure, private debt, hedge funds, real estate and private equity – the main growth driver is the private debt and private equity sectors. They are expected to generate 70% of total revenue of alternatives by 2028.

Hedge funds, by contrast, have seen their asset growth decline as overall returns over the past decade have trailed the S&P, although capital still flows disproportionately into the larger funds (AuM > $5 billion) as investors prioritize reputation and track record.

For those interested in further specializing in alternative investments, it is worth checking out the CFA Program (with Private Markets Specialized Pathways), or the Chartered Alternative Investments Analyst (CAIA) designation.

For CAIA, if you happen to be a CFA charterholder, you can get exemptions to CAIA Level 1 to sit for CAIA Level 2 (final exam) to obtain a CAIA charter.

Meanwhile, passive investments are projected to maintain growth momentum through 2028, continuing to capture 60-70% of net flows despite margin pressure. The separation between alpha and beta will accelerate as investors increasingly allocate to low-cost passive products for core exposure whilst paying for active management only in specialized strategies.

The increased share of passive investments is driven by both institutional and retail investors’ demands. The separation between alpha and beta will accelerate as investors increase their investment allocation to passive products in search of low fees and broad beta market exposure.

So how does the growth in alternative and passive assets affect asset management jobs?

1) While there is generally a reluctance by firms to change Portfolio Managers (PMs) for fear of triggering huge outflows, PMs cannot afford to be complacent. The growth of passive investments, artificial intelligence and computer-driven investment styles are headwinds to watch out for.

2) While passive investments are rising in popularity, this doesn’t mean active is “out” though. While active core products are declining in market share and revenues, active specialty products (e.g. sectors, small/mid caps, emerging markets, high yield, convertibles) is still expected to hold its market share, although it continues to experience price pressure in the future.

3) Hiring opportunities in alternative investments – especially private equity, infrastructure, private debt and real estate – is expected to increase in the next 5 years.

4) ESG investing is experiencing a bumpy road

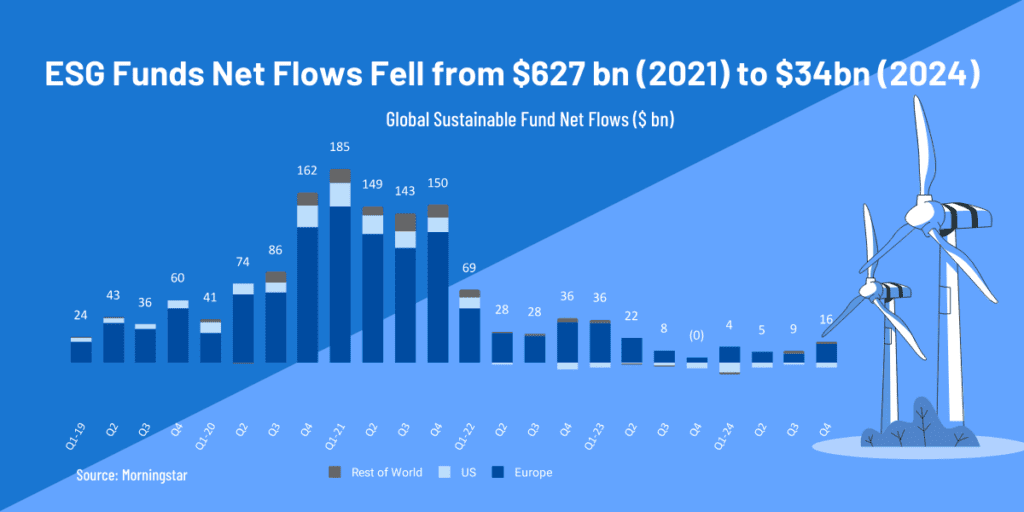

The meteoric rise of Environmental, Social, and Governance (ESG) investing, which peaked in 2021 with a staggering $627 billion in global net inflows, has encountered significant headwinds.

After inflows plummeted to $34 billion in 2024, ESG investing is expected to stabilize and evolve rather than grow explosively. Industry forecasts suggest ESG will shift from standalone products toward integrated climate risk analysis across all portfolios by 2028, with regulatory mandates (particularly in Europe and UK) driving demand for ESG expertise.

This dramatic shift is particularly evident in regional disparities, with the US experiencing substantial outflows, while Europe and the rest of the world see reduced, but still positive, inflows.

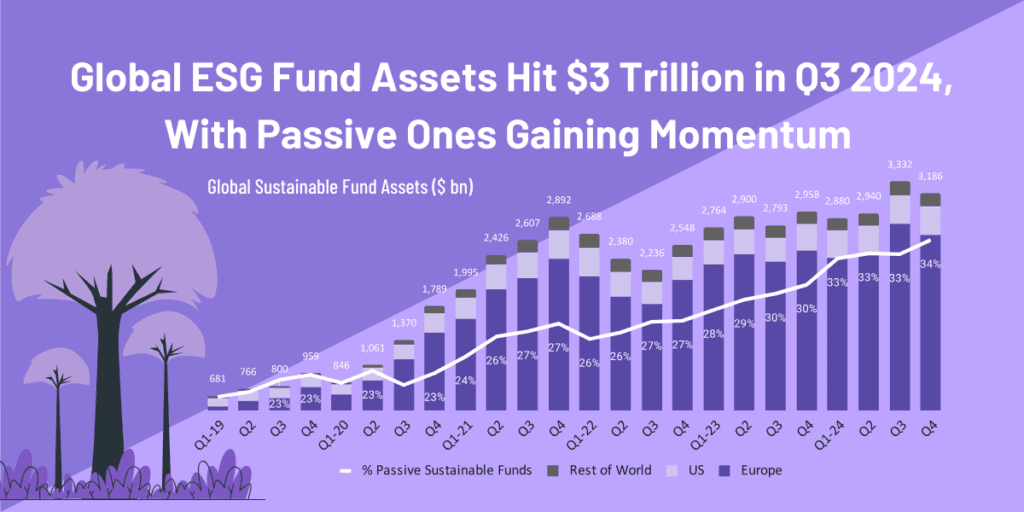

Despite this, global ESG assets under management have continued to grow, reaching a substantial $3 trillion in 2024, indicating a complex landscape where asset growth and investor sentiment diverge.

Several factors have contributed to this “bumpy road” for ESG investing:

- Concerns About Misleading Claims: Increased scrutiny has revealed instances of “greenwashing,” where funds overstate their ESG credentials, eroding investor trust and creating skepticism about the genuine impact of ESG products.

- Performance Pressures in Volatile Markets: During recent market downturns, ESG funds, often heavily weighted in growth sectors, have underperformed compared to traditional energy stocks. This has challenged the perception that ESG investing consistently delivers superior returns.

- Political Debates and Differing Priorities: In the US, ESG has become a subject of political debate, with concerns about energy security and opposition to certain corporate agendas impacting investor sentiment.

- Lack of Clear and Consistent Standards: The absence of universally accepted ESG metrics and reporting standards makes it difficult to compare funds and assess their true impact, creating confusion and hindering widespread adoption.

- Impact of Rising Interest Rates: The global rise in interest rates has caused investors to become more risk-averse, and to focus on short-term returns, rather than the long-term goals of ESG investing.

That said, ESG investing is far from ‘dead’, it does need a moment to adapt to changes. We expect ESG to remain important part of an investment portfolio in years to come:

- Evolving Regulatory Expectations: Despite political headwinds, regulatory frameworks are pushing for greater transparency and accountability in ESG investing.

- Growing Corporate Focus on Sustainability: Companies are increasingly integrating ESG factors into their business strategies, driven by stakeholder pressure and the long-term benefits of sustainable practices.

- Potential for Long-Term Value: Many believe that ESG factors are essential for long-term value creation, as companies that effectively manage ESG risks and opportunities are better positioned to succeed.

- Influence of Changing Investor Preferences: Younger generations are increasingly prioritizing sustainability in their investment decisions, and their preferences will shape the future of ESG investing.

What does the projected growth in ESG investing mean for jobs?

These changes in sustainable investing has created new roles within asset management:

1) a pure stewardship/governance role which offers an alternate route into the asset management industry for those that come from a non-investment, but more policymaking or natural sciences background.

2) an experienced investment/research role which focuses on ESG issues at a sector level, making recommendations across asset classes and articulate what ESG considerations the team should take. For existing experienced investment professionals with strong interest in responsible investments, this offers a route to shift to a more ESG-centric role within the firm.

3) As impact investing gains traction, there will be increased demand for professionals skilled in measuring and reporting the social and environmental impact of investments. This includes roles related to impact assessment, impact reporting, and impact investing strategy.

4) The need for robust ESG data and analysis will drive demand for professionals skilled in data collection, interpretation, and reporting. As regulatory requirements and investor scrutiny increase, expertise in ESG metrics and frameworks becomes essential.

For those interested in upgrading your knowledge in ESG and climate change matters, do check out these relevant global qualifications which currently can be done remotely:

– Certificate in ESG Investing by CFA Institute,

– Certified ESG Analyst (CESGA) by EFFAS,

– Certificate in Climate and Investing by CFA UK,

– Sustainability & Climate Risk (SCR) Certification by GARP

So, what have we learned?

The asset management sector is undergoing a huge transformation to reinvent itself in the face of fee compression, mounting cost pressure and fierce competition.

Although technology is a central piece of this change, it doesn’t mean that coders, data scientists and engineers are the most valuable resources in the firm. While these technical skills are important to asset managers’ future, delivering the right outcome from technology will also require ‘creatives’ and people with ‘softer’ skills to motivate, manage and organize complex cross-functional teams in the future.

AI would be prominent in driving change in the asset management sector. The industry will be more digitized and efficient in the future, with a strong focus on building a better customer value proposition. To overcome these challenges, asset managers need to create a diverse talent pool, an inclusive culture and incentives that align with their stakeholders to deliver. Those open to embracing these changes and work with new technology should stand in good stead.

Asset management careers & trends FAQs

What do you think of these upcoming changes? How do these trends affect your current career planning? Would be great to hear your comments below!

Meanwhile, here are some related articles that may be of interest:

- Why Is ESG Important & Which Careers Can Benefit From It?

- What Does An ESG Analyst Do & How To Become One

- Complete Guide to ESG Certifications & Courses

- How To Correctly Display Your CFA Program Status On Your Resume, LinkedIn & Business Cards

- What Are Typical Career Paths for CFA Charterholders?

- Switch Finance Jobs Effectively With Our Career Change Planner

- The CFA Charter is Not a Golden Ticket to Jobs – But Here’s How It Can Help

Very insightful – thank you.

My pleasure George – what part in particular you found interesting? Are you currently in the AM sector, or looking to move into it?

i’m looking to move into it