Forum Replies Created

-

AuthorPosts

-

in reply to: How to tackle IPS questions ?? #69462Up::23

First part to IPS questions, the stories in the long vignette that’ll give you clues about the investor.

Normally, the IPS questions will start of “light” with a few easy ones, and there are mainly 3 types of “starter” questions.

#1. Situational profiling

You need to know this, i.e. how to categorise investor types by economic situations and life-stages.- Source of wealth – manner of wealth often indicates investor sophistication and risk-profile. E.g. wealthy entrepreneurs tend to exhibit experience and knowledge in risk-taking, whereas windfalls, inheritance and steadily-accumulated wealth tends to exhibit less familiarity around risk-taking

- Measure of wealth – perception of investor on wealth level. Generally, the more wealthy an investor perceives himself, the more risk-taking

- Stage of life – generally inverse relationship between age and risk-taking, i.e. young and risky, old and conservative

#2. Psychological profiling and Behavioural Finance

IPS questions tend to touch this area of knowledge as well. So make sure you know these common psychological traits of investors, and their definition:- Loss aversion: individual’s reluctance to accept/realise a loss or hold on to losers too long (in hope of a comeback), leading to higher risk-taking behaviour

- Biased expectations

- Pyramiding, or mental accounting: where an investor creates an arbitrary diversifying ‘pyramid’ of investments, starting from least risky ‘for planned expenditure e.g. children’s education’ to riskier investments. From an economics and investment theory standpoint this diversification theory makes no sense.

#3. Investor Types

Then finally, another variation is this where the IPS question asks you what type of investor is this person considered as. You need to know the terms and definition of these:- Cautious investors – prefer safe investments and do not like making their own investment decisions

- Methodical investors – research markets, industries and firms to gather investment information, investments tend to be conservative

- Individualistic investors – do their own research, are confident in their ability to make investment decisions and are more risk-taking than methodical investors

- Spontaneous investors – constantly adjust portfolios to market conditions, lack investment expertise, react to changing investment trends. Tend to over-manage portfolio, high transaction costs

Up::21Hi @Sanjana , after registering for a specific test center, have you logged into your CFA institute account for more details?

You should be able to access test center information in your CFA Institute online account. Special instructions regarding parking, lunch options, and other details may be available for your test center.

Also, if your test center in Mumbai is run by Prometric, you can check out the Site status here, with 2 sites in Mumbai (left most column is Site ID):

Hope this helps!😁

in reply to: Can I bring 2 calculators to the CFA exam? #85790Up::15Hi @TylerTX2000 – yes you can bring all of those mentioned: extra calculators, extra calculator batteries and even screwdrivers for battery change. Full checklist of what you can bring is detailed here.

Interesting that you have 2 completely different calculators and are well versed in both though (which is amazing). Usually candidates just pick one and stick to a type 🙂

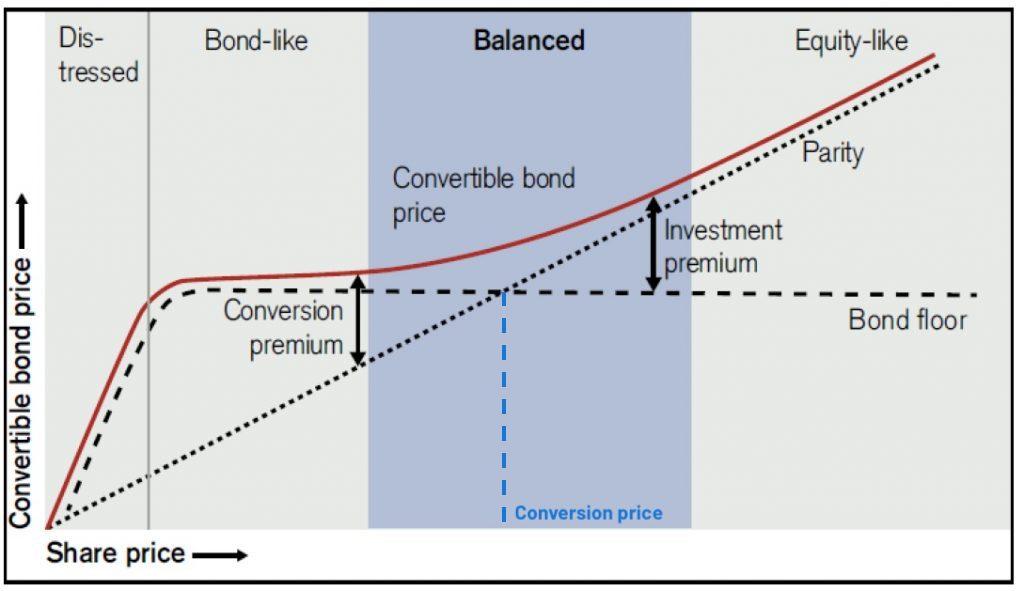

in reply to: Convertible Bonds formulas explained #88143Up::15Might be clearer to start from the beginning.

A convertible bond is a bond that has an option to convert to a specified number of shares of common stock at a pre-defined conversion date.

The conversion ratio = the number of shares each bond has the option to convert to.

The bond has a par value, so the implied price per converted share is the conversion price. So if a bond can be converted into 10 shares, and the bond par value is $1,000:

Conversion price = bond par value / conversion ratio

= $1,000 / 10 shares

= $100

Conversion ratio does not change, its defined in the indenture, like the strike price of an option.

I think the confusion here is that ‘conversion price’ is not as in ‘market price’, but more a ‘strike price’ equivalent.

So if the market price of the underlying common stock increases beyond the conversion price, it is advantageous to convert the bond (hence the name ‘conversion price’ = the price where you convert).

And because graphs help me see things better:

in reply to: Can I get a job after passing the CFA Level 1? #78802Up::10Hello all! Here’s the 3rd instalment on the world of Life and Non Life Insurance…

LIFE INSURANCE

Requirements of life insurance company investments

Objectives- Risk – considered quasi-trust funds. National Association of Insurance Commissioners (NAIC) directs insurance companies to maintain asset valuation reserve (AVR) as a cushion against substantial losses

- Return – built-in minimum return rates based on individual insurance policies

Constraints

- Time horizon – shorter as duration of liabilities decrease (due to increased interest rate volatility, competition). Individual segments also have separate time horizons

- Taxes – regular taxable entities. Investment income divided into 2 parts:

- policyholder’s share (not taxed)

- funds transferred to surplus (taxed)

- Legal & regulatory – heavily regulated primarily at state level

- Eligible investments

- Valuation methods

- Prudent Investor Rule – each investment must be analysed from portfolio perspective rather than standalone basis

- Liquidity – 3 primary concerns

- disintermediation (annuity holders withdraw prematurely)

- asset-liability mismatch (underfunded, interest rate risk)

- asset marketability risk (can’t sell, large bid-ask spreads)

- Unique circumstances – depending on factors such as

- Diversity of product offerings

- Company size

- Level of asset surplus

NON LIFE INSURANCE

How are they different from life insurance companies?

- Greater uncertainty than life insurance companies (higher claims frequency), liability durations tend to be shorter.

However not as interest rate sensitive as do not pay periodic returns.

Objectives

- Risk tolerance

- Related to liquidity constraints (relatively uncertain) – average to below average risk tolerance

- Inflation risk also a concern (due to replacement cost coverage)

- Return objectives

- Maximise return on fixed income portfolio to immunize claims

- Use returns from equity portion of portfolio to grow surplus

- Use surplus portfolio to provide funds for the unexpected, large liability claims

- Return is influenced by

- Competitive pricing

- Profitability

- Growth of surplus

- After-tax returns

- Total return

Constraints

- Time horizon – shorter than life companies due to shorter liability duration

- Taxes – regular taxable entities

- Legal & regulatory – less strict than for life companies. Asset valuation reserve is not required, but risk-based capital (RBC) requirements in place

- Liquidity – relatively high due to uncertainty of claims

- Unique circumstances – mainly influenced by types of policies (e.g. auto vs home vs pet)

in reply to: Deferred Taxes in FCF #70924in reply to: Best source of practice questions? #71904Up::9Hi @Brian_Murph, welcome to the forum!

I have covered this topic extensively in this post, under #1. Resource Planning.

There are some free Level 1 papers, and some that require purchase.

In summary, for Level 1, I’d recommend the following for extra practice papers (aside from freebies):

- AnalystNotes: Get the Level I online package for only $59 (15% off). It contains study notes, thousands of practice questions and 5 sets of practice papers. Superb value for money. Just register first, then proceed to “Order” to purchase.

- Finance Train: Get 1 set of practice exam for Level I for only $20 each (20% off).

Up::9Hi @pcunniff , for the comparable bonds, one is 5 years to maturity, and the other is 8 years to maturity. So that’s 3 years difference.

Given that the illiquid bond we are trying to compare is 6 years to maturity (1 year extra from 5 years to maturity), that’s where you get 1/3.

Does this make sense?

in reply to: What after CFA?? #71810in reply to: Effective duration for option bond #83184Up::8Hi @wannabe1988, good question, let me give this a go and see if it aids your understanding. @googs1484 and you are on the right track but I thought I’d break your discussion down to more basic level.

First, a couple of definitions:

- Effective duration measures the % change in a bond’s price for a 1% change in yield. Note that effective duration assumes that the relationship is linear (it’s not!) at all levels of yield.

- Hence, here’s where convexity comes in, which measures the % change in bond’s effective duration to 1% change in its yield. In short, convexity measures the rate of change of duration due to a yield change.

- Value of callable bond = value of straight bond – value of embedded call option

- Value of putable bond = value of straight bond + value of embedded put option

The effective duration of a bond with embedded option <= a straight bond because:

a) For a callable bond:

– if interest rate is high relative to bond coupon, it is unlikely to be called (redeemed) by the bond issuer, and therefore behaves similarly to a straight bond and have similar effective duration.

– if interest rate is low relative to bond coupon, it is likely to be called by the bond issuer and therefore there is effectively a cap on the upside potential of the bond prices (when interest rates drop). This means that the effective duration of the callable bond at this level is less than a straight bond (i.e. the change in bond price of a callable bond is less sensitive to a change in interest rate when interest rate is lower relative to bond coupon).b) same logic for a putable bond:

– if interest rate is low relative to bond coupon, it is unlikely to be put (sold) by the bond holder, and therefore behaves similarly to a straight bond and have similar effective duration.

– if interest rate is high relative to bond coupon, it is likely to be sold (put back) by the bond holder as bond price falls, there is effectively a floor on a putable bond price due to the put option (when interest rate drops) vs. a straight bond. Therefore effective duration of a putable bond is less than a straight bond.Slightly long-winded, but hope this helps!

in reply to: How to tackle IPS questions ?? #69461in reply to: Level 3 Question Bank #85761Up::7Hey @uvikamelis9 – you can get a free L3 Kaplan Q-bank through us by using the code KS-QB300H.

So that’s issue sorted 🙂

in reply to: Econ on Multipliers and spending programs #85885Up::7Hi @pcunniff, you’ll need to check out L1 Reading 16 (monetary and fiscal policy) to brush up on the fiscal multiplier and budget multiplier concepts. This is a common ‘trick’ question for Econs section.

OK, so we know a $10bn increase in taxes (revenue) is offset by $10bn spending on subsidies (expenditure), making the budget unchanged, assuming all else is constant.

But the aggregate output (GDP) actually increases given the positive balanced budget multiplier.

Here’s how: know that the Fiscal multiplier = 1 / [1-MPC(1-t)],

where MPC = marginal propensity to consume, i.e., how much will the consumption increase with an increase in disposable income. Most of the time this number is less than 1 as people save something,

t = tax rate

To understand the fiscal multiplier, let’s see a simple numerical example:

Say the government increase spending by $100. Let’s assume that the tax rate (t) is 25% and MPC for those who receive this money is 80%.

So, a $100 increase in government spending increases disposable income by $100*(1-0.25) = $75. From this disposable income of $75, people will spend $75 *0.80 = $60. This $60 will become income for other people, and their disposable income will be $60*(1-0.25) = $45, out of which they will spend $45*0.80 = $36. This iterative process will continue until the extra disposable income created becomes nearly zero.

In short, you can use the Fiscal Multiplier formula above and get 1 / (1-0.8(1-0.25)) = 2.5x. So $100 government spending increases the GDP by $250 in this example.

Remember that even taxes have a multiplier effect on aggregate demand (AD). Say if government increases $100 in taxes to offset the initial spending in the same example above, using the same MPC of 80%, aggregate demand will initially reduce by $100*0.8 = $80. Using the same iterative process, we come up with a total AD reduction of $100 * 0.8 * 2.5 = $200.

So you can see that the multiplier effect of spending is greater than taxes, i.e. $250 is greater than $200. So you can conclude that an increase in $100 government spending WITH a $100 tax increase has a net increase in aggregate demand of $50.

Or to calculate it another way:

the INITIAL increase in AD due to extra spending is $100.the INITIAL decrease in AD due to taxes is $80.So the total impact on output is (100-80) * fiscal multiplier of 2.5 = $50

in reply to: How long are those vignettes? #69195Up::6Well it’s hard to say. Technically we have less questions (but more to read). With the skimming technique, I find that I have more time (than Level 1).

What may help you ‘read quicker’ is to skim the 6 questions first, before reading the vignette to search/highlight the relevant phrases for answers. That way there is more of a purpose and focus of searching for answers when reading. I found that this significantly reduced the back-and-forth checking between vignette and questions – time saver, for me at least.

Keep us posted on how things are progressing then @vincentt. I admire your determination and hard work to learn something completely new (finance) to go for the sector/role you want (I know that’s hard), so we’re all here for you!

in reply to: Capitalising Interest Expense #69200Up::6Therefore, to answer 1), this interest is not expensed (hence not in CFO) but is capitalised into asset (cost of acquiring asset), and should be included in CFI. Asset value increases, CFI reduces (as reduction in investment cashflow). In the future (once asset is completely built), depreciation of asset occurs, which will reduce net profit, but has no impact on future cashflows.

To your answer @vincentt, see above emboldened sentence. So yes, capitalised interest into asset, it will depreciate (amortise) over time in the future.

in reply to: How to tackle IPS questions ?? #69463Up::6Part 2 to answer the main parts of a typical IPS question, the “fun” bits on Investor Objectives and Constraints, i.e. the classic RRTTLLU: Risk, Return, Time horizon, Taxes, Liquidity, Legal & regulatory, Unique circumstances.

So here are a collection of tips from my previous experience on Level 3 IPS questions for each of the section.

Objectives

- Risk – only use average, below average or above average to describe it.

- Willingness – investor intent towards risk

- Ability – investor capability towards risk, independent of intent

- Overall – when investor willingness and ability different, always honour the more conservative and suggest investor education to reconcile the difference

- Return – driven by annual liquidity & expenditure needs and tax

- Before-tax return, R = r/(1-t), whereby r = annual liquidity needs / total portfolio value, t = taxes

- If risk-return objectives are inconsistent (e.g. can’t achieve return without violating risk objectives), note the inconsistency in the risk objective, recommend client education and portfolio objective reassessment

Constraints (check out the tips)- Time horizon – usually at least 2 time horizons, pre-retirement and retirement. Time horizons are separated by a need to adjust the IPS

- ** TIP ** In the exam, define number of stages and years (if identifiable). If client wants to maximise bequest to heirs, it's a multigenerational time horizon

- Taxes – must always consider & identify individual tax circumstances. If unsure about tax treatment, include recommendation for legal counsel on either tax or regulatory

- ** TIP ** In the exam, identify if the annual portfolio returns are subject to tax. E.g. dividends and interest income received outside retirement accounts are taxable. If not sure about tax treatment, include a recommendation for legal counsel either on tax or regulatory section

- Liquidity – spending needs to be met by the portfolio

- Immediate (current one offs)

- Ongoing (living/medical expenses)

- Other (e.g. house in future, expected receipt of large cash flow)

- ** TIP ** In the exam, include all actual spending needs that needs to be covered by portfolio. 3 categories of spending needs: immediate, ongoing (living/medical expenses) and other (e.g. plan to pay cash to buy house in future or expectation of receiving large cash flow in future).

- Legal & regulatory – can always recommend legal counsel. If no noticable legal concerns, Prudent Investor Rule applies. Individuals usually have minimal L&R concerns, unless trusts are involved, in which case issues are complex and legal counsel recommended:

- Revocable trusts

- Irrevocable trusts

- ** TIP ** In the exam, if no noticable legal concerns, mention that Prudent Investor Rule applies. If question on trust/foundations, just say issues are complex and legal counsel is recommended

- Unique circumstances – usually individual constraints present, such as avoid certain class of security or industry, or overweight a certain stock, moral objections etc

- ** TIP ** In the exam, this section can be left as ‘none’ or a variety of items. If client portfolio includes a lot of investments in companies founded by client/relatives, this needs to be mentioned. If question instructs to NOT include client’s home in the value of investable portfolio, this is the place to state it.

in reply to: Photography? #70254Up::6Meh, that’s annoying @Ajfinance. I don’t have much experience but are some thoughts (may be obvious?).

1. International companies tend to have friendlier policies to hire foreigners. If you see any jobs in these firms, it may be the first to start. At least you can try contacting the HR directly for their hiring policy.

2. Singapore unfortunately tightened their visa requirements recently. But there are still open to hiring talented foreigners, and in comparison to other countries, friendlier in terms of international job search. Although also more competitive!

3. Isn’t CFA a Master’s equivalent?

4. US and UK seems more difficult to penetrate, especially the former. Despite tighter immigration policies, if there is a role that fits your skillset, and especially with an international firm, it is possible to get through.

5. Would it be wise to first check out sample jobs in each country, note their policy on foreign hires (or call the relevant HR directly), then check out their visa requirements (general rules), then if you are brave, I wonder if it’s worthwhile visiting the ‘easiest’ country from your analysis in that list, and arrange meetings with various recruiters on ground. It just seems better to be in the country itself looking for roles. Does take time and effort, but I believe you get better feedback through this process rather than just applying remotely.

-

AuthorPosts