- This topic has 8 replies, 4 voices, and was last updated May-218:48 pm by

Zee Tan.

-

AuthorPosts

-

-

Up::15

Might be clearer to start from the beginning.

A convertible bond is a bond that has an option to convert to a specified number of shares of common stock at a pre-defined conversion date.

The conversion ratio = the number of shares each bond has the option to convert to.

The bond has a par value, so the implied price per converted share is the conversion price. So if a bond can be converted into 10 shares, and the bond par value is $1,000:

Conversion price = bond par value / conversion ratio

= $1,000 / 10 shares

= $100

Conversion ratio does not change, its defined in the indenture, like the strike price of an option.

I think the confusion here is that ‘conversion price’ is not as in ‘market price’, but more a ‘strike price’ equivalent.

So if the market price of the underlying common stock increases beyond the conversion price, it is advantageous to convert the bond (hence the name ‘conversion price’ = the price where you convert).

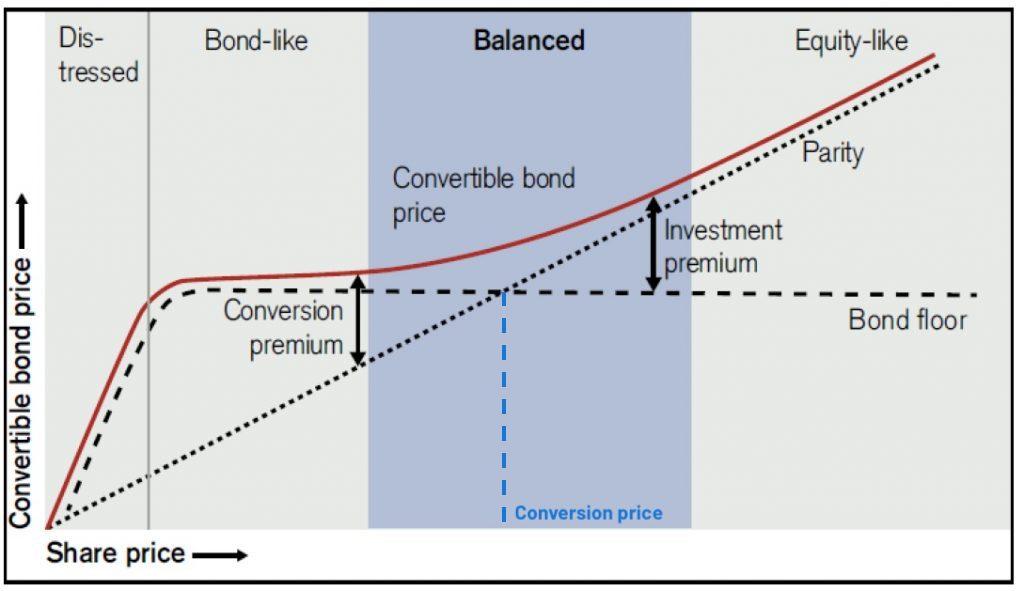

And because graphs help me see things better:

-

Up::4

In the graph, is the reason why bond value is declining in the ‘distressed’ section because of credit risk?

As the share price approaches 0, the ability for the company to repay their bonds decreases, so bond value approaches 0.

-

-

Up::3

I’m back again…there’s a CFAI mock question on convertibles which is creating much debate and has led me to question my knowledge of the above again.

In the question, the ‘current conversion price’ is labelled as $25, the share price is $30.20, par = $100k, current convertible bond price = $127,000 ; current conversion ratio = 100k/25 =4000

So, am I right on the below:

- ‘current conversion price’ of $25 is the ‘strike’; the issuer share price of $30.20 is higher than $25, therefore the bond is trading as a stock equivalent

- ‘market conversion price’ is not the breakeven price, but is the effective price of the shares you will get upon conversion. i.e. in this example, market conversion price = 127,000/4000 = $31.75

I (and others clearly looking at the question) am confused about:

- Is $25 the breakeven price or is $31.75?

- Do you measure whether bond is a stock equivalent by looking at the $25 or $31.75 marker vs. current stock price?

- Do measure ‘cheapness/value’ relative the issuer shares using the $25 or $31.75 marker?

- Are you actually ever getting the shares for ‘cheap’? I read in the curriculum that you are always converting at a premium (premium is always above zero and gets close to zero when trading as a stock equivalent), because the trade off is you own a bond which has more value if the shares are performing badly and you have the option to convert if you think long term there’s more value in holding the shares (and convert at a short term premium to the normal share price).

And, lastly, when the issuer’s share price is below the bond’s convert price, the bond value is related to the floor…which means it is trading as a bond equivalent and not a stock equivalent (or have I got that the wrong way round)?

I think CFAI need feedback on the unclear convert bond info in the curriculum!

-

Up::5

‘current conversion price’ of $25 is the ‘strike’; the issuer share price of $30.20 is higher than $25, therefore the bond is trading as a stock equivalent

That’s correct, but to be super-clear, $25 is the conversion price. I’m not sure what ‘current conversion price’ would mean. See Sophie’s definition earlier in the thread.

‘market conversion price’ is not the breakeven price, but is the effective price of the shares you will get upon conversion. i.e. in this example, market conversion price = 127,000/4000 = $31.75

Market conversion price is the price of the convertible bond per converted share:

So you’re right, it’s 127,000 / 4,000 = $31.75.

Is $25 the breakeven price or is $31.75?

There are a few terms being said here that mean the same thing:

Market conversion price = break-even price = conversion parity price

So break-even price = market conversion price = $31.75

Do you measure whether bond is a stock equivalent by looking at the $25 or $31.75 marker vs. current stock price?

As per Sophie’s chart, the point where a convertible bond’s price behaves like it’s stock equivalent is when the stock price increases beyond the conversion price, i.e. $25 in your example.

Do you measure ‘cheapness/value’ relative the issuer shares using the $25 or $31.75 marker?

I… don’t understand this question. 😅

If you’re referring to the market conversion premium:

market conversion premium = market conversion price – current market price

So in your example, market conversion premium = $31.75 – $30.20 = $1.55

Are you actually ever getting the shares for ‘cheap’?

You never ‘get the shares for cheap’ through a convertible bond, since you always pay a premium for the bond floor, i.e. a safety net if the market price of the underlying shares drop below the conversion price. CFA curriculum is correct 😁

And, lastly, when the issuer’s share price is below the bond’s conversion price, the bond value is related to the floor…which means it is trading as a bond equivalent and not a stock equivalent?

That’s correct. Again, see Sophie’s chart.

Hope the answer helps. Could you link this thread to the CFAI mock question’s comments so that it reaches others as well?

-

Up::2

In the graph, is the reason why bond value is declining in the ‘distressed’ section because of credit risk?

-

Up::1

Thanks Zee! That’s amazingly helpful.

The question that you didn’t get which I need to rephrase (my bad!) is answered by the above. i.e. (hopefully I’m going to get this right now!):

conversion price = strike = outlined in bond indenture and what you use to get the conversion ratio and market conversion price etc. This is the ‘strike’ because it is the point at which the bond starts behaving like the stock.

market conversion price = BEP = effective price you get the shares at, calculated as [convertible bond price/conversion ratio].

So once the stock goes past the conversion price, you can then work out and monitor your market conversion price, which will fluctuate according to the convertible bond market price.

I’ve really laboured the point by writing that out in full again but honestly the amount of confusion that has been spawned over formulas effectively recycling the same four words but in different orders and combinations has almost defeated me!

-

Up::2

This topic really just needs a proper reading through and understanding of all the underlying concepts and points behind a convertible bond, which I appreciate that as a candidate can be too much time to spare!

The various interchangeable terms also further confuse the issue. But hope this discussion has helped!

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.