Digital assets, driven by blockchain technology, are revolutionizing industries across the board, including finance, art, and technology. To stay competitive in this rapidly evolving landscape, finance professionals must embrace this paradigm shift and seize the immense potential it offers.

In response to this, EFFAS has recently launched a unique program designed to equip finance professionals with the knowledge and skills necessary to thrive in the world of digital assets and blockchain technology – the EFFAS Digital Assets & MiCA (DiAM) course.

What sets the DiAM course apart is its laser focus on the MiCA (Markets in Crypto Assets) regulatory framework, serving as a cornerstone for digital asset regulation in Europe. By delving into MiCA’s intricacies, participants gain a deep understanding of the evolving legal landscape, enabling them to navigate the complexities of digital asset management effectively.

With the DiAM course, you’ll grasp the fundamental concepts, explore real-world applications, and stay ahead of the curve in harnessing the power of digital assets. Check out our detailed guide on what DiAM entails!

What is Digital Assets and MiCA (DiAM) about?

With the advent of blockchain technology, digital assets are emerging as a catalyst for change. These assets encompass cryptocurrencies like Bitcoin, Ether, and Solana, along with novel financial instruments such as stable-coins, tokenized traditional assets, and central bank digital money (CBDC).

The MiCA Regulation (Markets in Crypto Assets) is a pivotal regulatory framework as it is the European Union (EU) regulation governing issuance and provision of services related to cryptoassets and stablecoins.

MiCA was adopted in April 2023 in EU to address the growing significance of digital assets and decentralized finance (DeFi), providing a comprehensive regulatory foundation for the sector. Its introduction signifies the increasing recognition and need for regulatory oversight in the cryptocurrency space.

With the cryptocurrency revolution and its regulatory impact, the European Federation of Financial Analyst Societies (EFFAS) recently launched an introductory course called Digital Assets and MiCA (DiAM) to help finance professionals internationally to navigate through these new developments.

The DiAM course designed to equip individuals with comprehensive knowledge in blockchain-based assets and the regulatory framework to enable title holders to provide clear investment information and advice. This transformative course offers valuable insights into the world of digital assets, poised to revolutionize business, art, and technology, just as the internet did in the late 90s.

In today’s landscape, where cryptocurrencies have evolved from speculative niches to mainstream investments, gaining a clear understanding of MiCA (Markets in Crypto Assets) is crucial. This is especially important as European regulatory frameworks often serve as a benchmark and influence the development of regulatory frameworks in other regions.

The DiAM course prepares finance professionals to embrace this monumental revolution, unlocking new opportunities in intermediation, tokenized vehicles, non-fungible tokens (NFTs), derivatives on crypto assets, and more.

Who is DiAM course suited for?

The DiAM program aims to prepare professionals for the significant revolution in the finance sector brought by cryptocurrencies and blockchain-based financial assets, covering essential elements, use cases, and basic regulation of digital assets.

Thus, the introductory nature of the Digital Assets and MiCA course is likely to appeal to a broad set of audience:

- Professionals in finance such as financial advisors, research analysts, sales people, risk managers, legal experts, and technical specialists, who are looking to understand digital assets and their evolving regulation.

- Individuals working in banking, finance, and insurance who can benefit from expanding their knowledge in this area.

- Individual investors interested in gaining insights into digital assets and their relevance in the financial world.

DiAM exam format

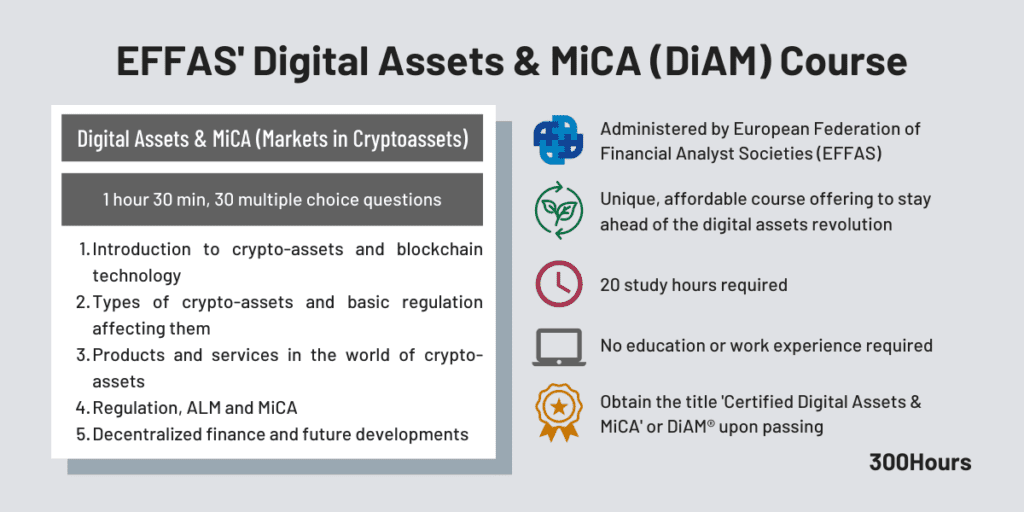

The EFFAS DiAM exam is a 1.5 hours long exam, which consists of 30 multiple choice questions. There are 4 answer choices per question, and negative marking is used. This means that points are deducted for incorrect answers, whereas leaving the answer blank would neither earn or subtract points from the total score.

The Digital Assets and MiCA exams are held quarterly, i.e. 4 times a year in March, June, September and December (see Key Dates section below for more details):

- In-person exams are available currently in Madrid and Paris, and eventually other EU major cities in the near future.

- Online/remote exam option is available globally, do check that you meet the DiAM online exam requirements beforehand.

The Digital Assets and MiCA course is a self-directed learning program structured as 5 modules, with accompanying video lectures, slides and end of chapter questions for self assessments.

In terms of study hours, for candidates with no prior digital assets experience, 20 study hours is recommended to prepare for the DiAM exam.

DiAM exam pass rates, pass marks and difficulty

To pass the DiAM exam, a score of at least 50% must be achieved.

The exam results are typically announced 1 week after the exam, with a pass or fail statement. Similar to the CESGA qualification, candidates would only receive a pass or fail notification, with no details on exact scores or pass marks. Just like other exam bodies, there are no results review or appeal process accepted.

There are no pass rates data as yet given DiAM course’s recent launch. However, it’s suffice to say that pass rates are expected to be high given the introductory course nature which requires (only) 20 study hours, which seems manageable even with a full time job and family.

Candidates who passed the exam would also qualify for the DiAM® title, if they wish to use it in a professional setting.

Topic areas & weights

The EFFAS DiAM syllabus has 5 modules.

Here’s a detailed overview of the 5 modules covered in the latest EFFAS’ Digital Assets and MiCA course and their respective topic weights:

| EFFAS DiAM Syllabus | Description | Topic Weights |

|---|---|---|

| Module 1: Introduction to crypto-assets and blockchain technology | This introductory module focuses on: – The fundamental concepts of blockchain technology, including its impact on the financial industry. – The distinction between centralized and distributed systems, as well as the relationship between DLT (Distributed Ledger Technology) and blockchain. – The key characteristics of smart contracts and their role in automated transactions. – The differences between the internet of value and the internet of information, and their significance in the context of blockchain technology. | 10% |

| Module 2: Types of crypto-assets and basic regulation affecting them | The breadth of new digital assets is affecting all players in the finance market: investors, regulators, government, banks and investment firms. This module explains: – the impact of current regulation on crypto-assets and how they are classified. – the implications of regulation for day-to-day business operations and investment decisions. – the distinctions between security tokens and utility tokens, including their issuance and trading requirements. | 30% |

| Module 3: Products and services in the world of crypto-assets | This module covers: – The concept of tokens, their types, and their application in real assets or vehicles. – How the trading of crypto-assets operates and its significance in the financial industry. – The importance of custody services and the obligations and requirements for providers in this field. -The concept of wallets, their types, and their utility in the crypto world. – Real case analysis showcasing the integration of the crypto world into traditional investment vehicles. | 20% |

| Module 4: Regulation, ALM and MiCA | Students will learn about: – The construction and key aspects of the MiCA directive, including its objectives and regulatory scope. – The requirements for issuing various types of tokens, such as utility tokens, asset-backed tokens, e-money, and e-money tokens. – The equivalence between MiFID (Markets in Financial Instruments Directive) and MiCA services. – The regulated crypto-asset services under the MiCA framework. – The licensing process under MiCA and the common and service-specific provisions to comply with. By the end of this module, students will have a comprehensive understanding of the evolving regulatory landscape in relation to crypto-assets, and the implications it holds for professionals in the financial industry. | 20% |

| Module 5: Decentralized finance and future developments | The core focus of this module is to explain: – The concept of decentralized finance (DeFi) and its distinction from traditional finance (TradFi), along with their relationship. – The mechanics of staking and lending operations in the DeFi ecosystem. – The business aspects and emerging trends of NFTs (Non-Fungible Tokens) and metaverses within the crypto sector. – Insight into the near-term future of the crypto sector, including potential advancements and developments. By the end of this module, students will have a comprehensive understanding of DeFi, its key operations, and the exciting possibilities and trends within the evolving crypto sector | 20% |

Exam fees & costs

Just like the Certified ESG Analyst (CESGA) qualification, EFFAS Academy administers the DiAM exams and its online training program.

There are two pricing options with the DiAM course:

- Course only: €380 + VAT (i.e. local sales tax, if applicable). This is roughly equivalent to US$ 410. This option is suitable for those interested in acquiring the knowledge, and less concerned about the certification title.

- Course and exam: €510 + VAT (i.e. local sales tax, if applicable). This is roughly equivalent to US$ 550.

All fees shown are net of any local sales tax payable by the candidate in their country of residence. Where EFFAS Academy is required to add local sales tax, this will be added to the fees shown during the payment/checkout process.

Exam dates & key deadlines

The Digital Assets and MiCA exams are held 4 times a year in March, June, September and December.

Here are the latest exam dates and registration deadlines for 2025 exams:

| DiAM exam dates | Sep 2025 | Dec 2025 |

|---|---|---|

| Registration opens | 22 May 2025 | 8 Aug 2025 |

| Final registration | 22 Aug 2025 | 8 Nov 2025 |

| Exam day | 22 Sep 2025 | 8 Dec 2025 |

What are the requirements for DiAM?

Given its introductory nature, there are no pre-requisites or minimum entry requirements to enrol in the Digital Assets and MiCA course. This makes the course quite unique and really accessible to those seeking to know more about the basics and the latest developments in the blockchain, cryptocurrency and MiCA.

However, as the course is conducted in English, it is recommended that potential candidates have a minimum B2 level of English under the Common European Framework of Reference for Languages (CEFR). This is equivalent to a minimum IELTS level of 6.0.

Benefits of DiAM course

With MiCA’s recent adoption, upgrading your knowledge to stay updated with the latest industry development could open up a broader set of new career opportunities for you in finance.

By completing EFFAS’ Digital Assets and MiCA training, you can expect to:

- Understand the basics of blockchain, digital assets and the latest regulatory framework and their potential impact in the finance sector;

- Obtain a unique certification title in digital assets sector (DiAM®) to signal your digital assets and crypto expertise worldwide;

- Diversify your career profile and upgrade your existing skillset to broaden your career opportunities;

- Further differentiate yourself vs. other job candidates with the latest industry developments.

Is the DiAM course something you’d consider taking on to enhance your crypto and blockchain knowledge? Let us know in the comments below!

Meanwhile, you may find these related articles of interest: