Aside from career progression and salary information, one of the main considerations for potential CFP candidates to embark on the qualification is the CFP pass rates. It is a common question we get asked when our readers compare between CFP vs CFA.

CFP exam difficulty matters in the overall decision making too. An exam that is too hard could mean it is unattainable and not deliver the career benefits one hope it would. On the flip side, if it is too easy, that could mean that the market may be saturated with CFPs, or potentially dilute the value of getting the Certified Financial Planner mark itself.

In this article, we try to approach this question on CFP exam difficulty both objectively and qualitatively, with historical CFP exam pass rates in various countries and third party benchmarking studies in order to help you decide whether CFP exam is worthwhile for you.

Read on to find out more!

CFP Pass Rates in Various Countries

While CFP Board manages the CFP exams in United States, Financial Planning Standards Board (FPSB) manages it in 27 countries outside the US. That said, even though the CFP requirements are broadly similar across these countries, comparability across these countries itself is difficult as the CFP exams vary in structure and format in each locale.

Nevertheless, it is interesting to see the country-specific differences in CFP test pass rates and exam structure across the various countries we have managed to collect data on.

A huge caveat: even within FPSB countries, the CFP pass rates definition are quite different and not comparable due to differences in exam format and structure.

United States

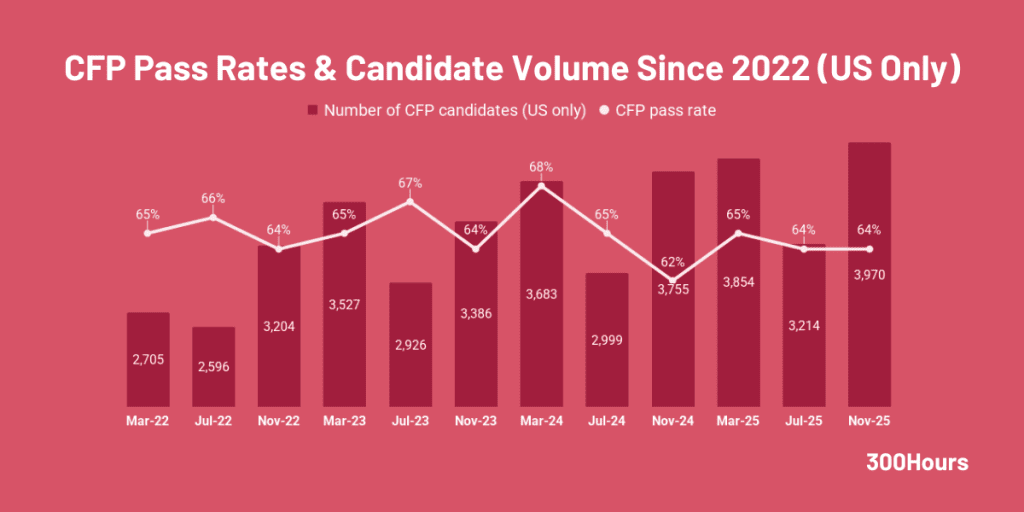

The latest overall CFP test pass rates are:

- 64% for Nov 2025

- 62% for Jul 2025

Since 2022’s new exam blueprint, CFP pass rates are relatively stable between the ranges of 62%-68%, averaging 65% in the last 3 years.

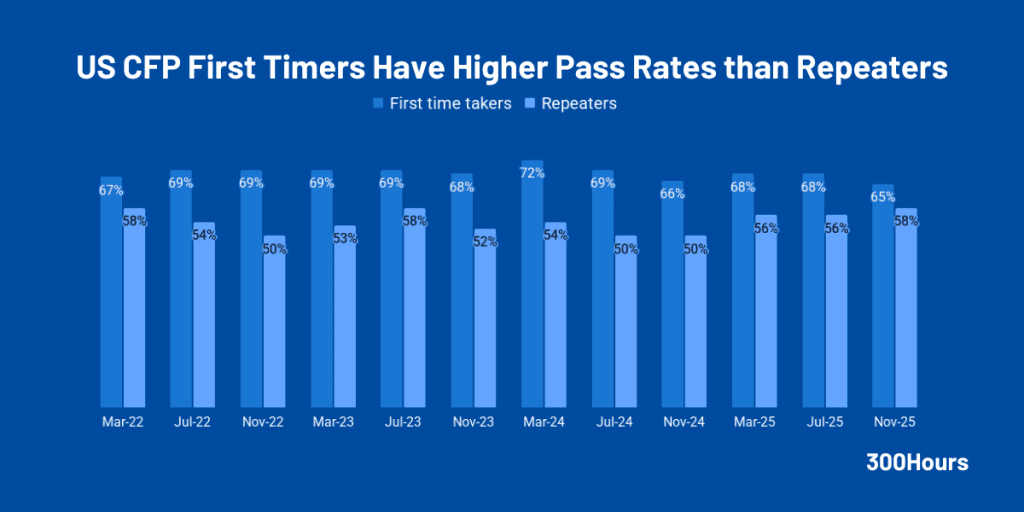

Interestingly, just like the CFA exams, there is a noticeable difference between pass rates of first timer CFP test takers vs. repeaters. In the US, CFP first timers (typically 60-70% of the candidates pool) are consistently doing much better than those who are repeating the exams, where the average 3 year pass rates for first timers are 69% vs. 54% for repeaters.

China

China is one of the FPSB countries that runs a multi-level financial planner certification system.

Focusing only on the exam side of the “4 Es” requirement, there are 2 exams that candidates need to pass as one of the prerequisites for the CFP certification:

- Associate Financial Planner (AFP) exam format: 2 subjects, totalling 6 hours in the same day.

- Fundamentals of Financial Management (I): 90 questions, 3 hours

- Fundamentals of Financial Management (II): 90 questions, 3 hours

- Certified Financial Planner (CFP) exam format: 5 subjects, totalling 12 hours over 2 days.

- Investment Planning (Day 1, 3 hours, 90 questions)

- Employee Benefits and Retirement Planning (Day 1, 1.5 hours, 45 questions)

- Personal tax and estate planning (Day 1, 1.5 hours, 45 questions)

- Personal risk management and insurance planning (Day 2, 2.5 hours, 75 questions)

- Comprehensive case analysis (Day 2, 3.5 hours, 60 questions)

In China, AFP exam pass rate is on average 70%, whilst the overall CFP exam pass rate is around 30-40%.

Japan

There is also a two-tier certification system in Japan, whereby the exam requirements for CFP requires passing of two exams in the following order:

- Associate Financial Planner (AFP) exam called Financial Planning Skills Test (“FP Skills Test”)

- Certified Financial Planner (CFP) exam

The CFP exam in Japan consists of 6 papers. Each paper has 50 multiple choice questions and 2 hours of exam duration:

- Financial asset management (FAM)

- Real estate management (REM)

- Life / retirement planning (LRP)

- Risk and insurance (R&I)

- Tax planning (TAX)

- Inheritance and business succession planning (IBSP)

All 6 test papers must be passed to fulfil one of the requirements for CFP certification in Japan. However, what is different for Japanese candidates vs. China is that candidates have flexibility to decide the number of exam papers they wish to take per exam cycle.

On average, CFP pass rates in Japan for the 6 individual subject papers ranges from 30-40% since 2020.

Interestingly, there is a small portion of brave souls who attempt all 6 CFP exam papers in the same exam window. Yes, that’s a 12 hour exam session in total. Of this subset of Japanese CFP candidates, an average of 5-11% of them manage to pass all 6 exam papers in one go, wow!

Brazil

Brazil recorded a 8.7% growth in CFP-qualified professionals last year, where there are now nearly 10,000 CFP professionals in the country.

Just like Japan, Brazil (run by Planejar) offers its CFP candidates the flexibility of signing up for individual modules for an exam cycle, or a “Complete” exam session whereby all 6 subject papers are taken in the same exam window.

However, unlike CFP Japan, their published pass rates data is unfortunately not meaningful in our opinion, as it mixes up the pass rate data of candidates who take individual modules AND those who sat for all 6 exam modules in one go.

In the spirit of providing some data points, recent CFP exam pass rates in Brazil ranges between 10%-34% according to this definition, which simply counts the number of candidates who passed (whether it is single module or all 6 modules), divided by the total number of candidates who were present in the exam.

Canada

With the 4th largest Certified Financial Planner community globally, FP Canada only release pass rates for first time test takers, rather than an overall pass rates as well.

For 2024 exams, the CFP pass rates in Canada for first timers only is around 72-74%. Note that if the trend is the same like the US, first timers tend to do better than repeaters, so we expect the overall blended pass rate (which includes CFP test repeaters) would be lower than 72-74%.

UK

Compared to the Americas and Asia Pacific, Europe only has 3.4% of the 223,770 global CFP professionals worldwide based here. Netherlands (2,892), Germany (1,529) and the UK (1,031) are the top 3 countries with the most Certified Financial Planners in Europe.

Focusing on the UK, the Chartered Institute for Securities & Investment (CISI) has outlined that UK CFP candidates need to pass these 2 exams to meet the Exam requirements of CFP:

- Certificate in Advanced Financial Planning (Level 6) – a 3 hour exam, multiple choice questions

- Financial Plan Case Study (Level 7) – candidates are given 10 weeks prepare and submit a financial planning case study based on a set of given information.

The pass rates for Level 6 Certificate in Advanced Financial Planning averages around 61%. CISI is quite helpful here with releasing the previous exams papers and the examiners’ reports to help revision.

For the Level 7 Financial Plan Case Study, there are no pass rates published per se as candidates are allowed up to 3 submissions for the same case study work. The overall pass mark here is 65% and above. If a candidate fails thrice, they are not allowed to resubmit a financial plan based on the same case study, and have to apply for a new case study and restart the assessment process again.

Once both these exams are passed, UK CFP candidates would fulfil the Exam prerequisites and awarded the Level 7 Diploma in Advanced Financial Planning.

Hong Kong

Hong Kong is one of the top 5 countries in Asia Pacific with the most CFP qualified professionals.

There are 3 CFP test papers to pass in Hong Kong to fulfil the Exam requirements:

| Hong Kong CFP Exam | Format | Duration |

|---|---|---|

| 1) Foundation | 95-100 MCQs | 3 hours |

| 2) Advanced Level Paper 1 | 85-90 MCQs | 3 hours 30 minutes |

| 3) Advanced Level Paper 2 | 40-45 MCQs | 2 hours 30 minutes |

Since 2021, the average HK CFP pass rates for the 3 exam papers are 69% (Foundation), 53% (Advanced Level Paper 1) and 46% (Advanced Paper Level 2) respectively.

This is perhaps not surprising as one would expect the difficulty of the paper to get harder as they progress. Although we note that there is a larger fluctuation in the pass rates of the Advanced Paper Level 2 in the last 2 years.

Thailand

According to FPSB’s report, Thailand stood out as the country recording the highest growth rate (28%) in the number of CFP professionals last year.

Thailand’s CFP exam requirements consists of 4 exam papers in the following format:

| Thailand’s CFP Exams | Format | Duration |

|---|---|---|

| 1) Fundamentals of Financial Planning, Taxes and Ethics | 85 MCQs | 3 hours |

| 2) Investment Planning | Old format: 85 MCQs New format: 120 MCQs | Old format: 3 hours New format: 4 hours 30 minutes |

| 3) Insurance and Retirement Planning | 85 MCQs | 3 hours |

| 4) Tax and inheritance planning and financial planning: – Part 1: Tax & Inheritance Planning – Part 2: Financial Planning | Part 1: 45 MCQs Part 2: Written exam plus an interview | Part 1: 1 hour 30 minutes Part 2: written exam 7 hours plus 15-20 minutes inteviews |

As you can see from the chart above, Thailand’s CFP pass rates do vary widely by exam paper, ranging from 23%-48% since 2022. Exam 2 (Investment Planning) has undergone a new format with more questions and longer test duration.

However, oddly enough it seems to be a choice for candidates to choose either version of this test for now, hence the pass rates data below includes pass rates for both versions of the Exam 2 paper.

India

Finally, we look at India, where there is a large expected growth in number of CFP professionals in the near future.

In terms of exam requirements, there is a Financial Plan Assessment and a final exam of 3 hours which will include one case study to be shared only in the examination. According to FPSB India, the average CFP exam pass rate in India is about 55%

So How Hard is CFP, Really?

OK we have seen all the historical trends in CFP exam pass rates in various countries, but that still isn’t giving a full picture of how difficult this exam is. We can attempt to answer this question in 3 further ways below.

Compared with other finance qualifications

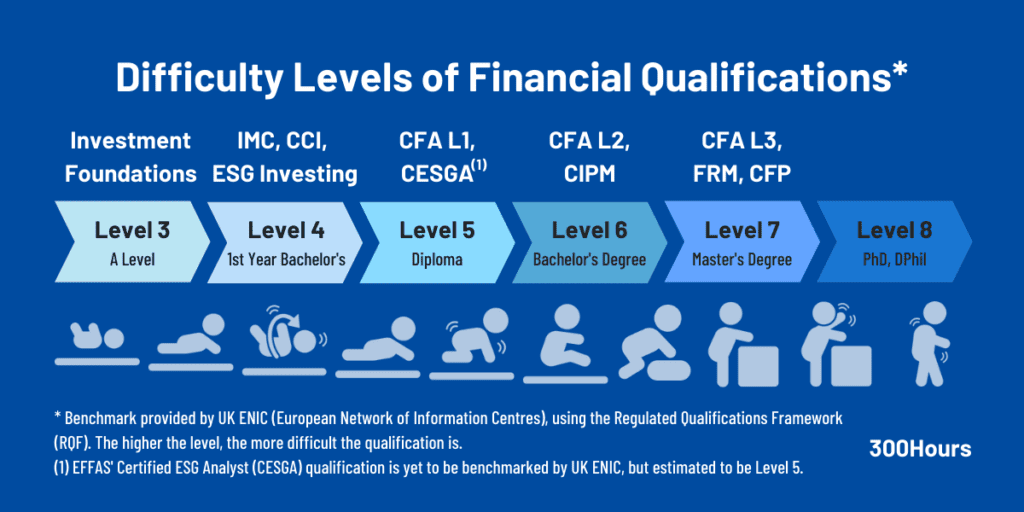

A more objective way to assess CFP exam’s difficulty could potentially lie in the UK ENIC’s (European Network of Information Center) benchmarks.

The only clue we have is from CFP qualification run by Chartered Institute of Securities & Investment (CISI) in the UK, whereby passing two exams would earn candidates a Level 7 Diploma in Advanced Financial Planning.

In the UK, a Level 7 qualifications are:

- integrated master’s degree, for example master of engineering (MEng)

- level 7 award

- level 7 certificate

- level 7 diploma

- level 7 NVQ

- master’s degree, for example master of arts (MA), master of science (MSc)

- postgraduate certificate

- postgraduate certificate in education (PGCE)

- postgraduate diploma

So the Certified Financial Planner in the UK could be viewed as a graduate level qualification, similar to CFA Level 3.

While this may give a sense of CFP’s difficulty, it is a rather limited view to the UK given the CFP qualification varies across the countries outside of US.

Anecdotal evidence from candidates

Globally, we also hear from many candidates who have studied for both CFA and CFP.

CFA Program was clearly described as the more difficult exam to pass, with 3 levels, more time commitment, more depth yet broad coverage across 6-10 topics.

CFP (in the US) on the other hand has one exam level, a case study, broader in scope and is much easier especially if you have received your CFA charter because you would be able to obtain majority of the CFP coursework exemption as a CFA charterholder.

There was even a candidate took and passed all 3 qualifications: CPA, CFA and CFP. He stated that CFA was by far the hardest of all 3 exams, where he had to retake both L2 and L3 once. It was the sheer volume and depth of materials that made it more difficulty than CFP and CPA. The fact that CFP offers an exemption to CPA and CFA charterholders aligns with this view.

Hope you found the pass rates data above useful. Overall, it seems that CFP is likely easier than CFA or CPA, based on the discussion above. What are your thoughts?

Meanwhile, here are some related articles that may be of interest: