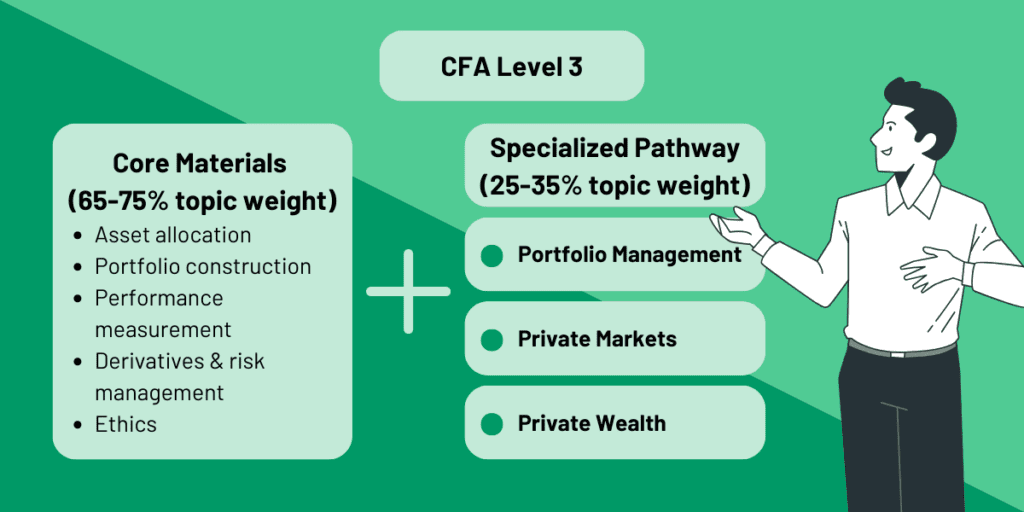

CFA Institute previously announced some major evolutions to the CFA Program. Among them is the introduction of Specialized Pathways for CFA Level 3 candidates from 2025.

Level 3 candidates will now be able to choose a Specialized Pathway that aligns with their interest and career goals. These three choices are:

- Portfolio Management (the ‘original’, traditional pathway),

- Private Wealth, or

- Private Markets

Additionally, there is also a new Practical Skills Module (PSM) launched called “Portfolio Development and Construction”, which is only available for Level 3 candidates.

More details below to help your decision making, including exclusive Q&As from CFA Institute!

What are the upcoming CFA Level 3 changes in 2025?

Starting 2025, CFA Level 3 exams have the following changes:

- Specialized Pathways: Level 3 candidates must now choose one Specialized Pathway during registration. These 3 choices are Portfolio Management, Private Markets and Private Wealth.

- Practical Skills Module (PSM): Level 3 candidates are required to complete one chosen PSM prior to exam results announcement.

So why does this matter?

If you have passed Level 2 recently and have yet to register for Level 3, there are two choices:

- Register for CFA Level 3 August 2024 by 14 May for $1,250. This is the last exam under the current ‘single pathway’ structure where there are no PSM nor Specialized Pathways to choose from.

- Register for CFA Level 3 in 2025 ($1,090-$1,390 depending on how early you register). Feb 2025 registration opened on 9th May, and this is the first exam based on new format with Specialized Pathways and PSM.

What are the CFA Level 3 Specialized Pathways?

Specialized Pathways = course electives

Just like an MBA program, where you have a core component of the curriculum with electives, CFA Institute has updated the CFA Level 3 curriculum in 2025 such that:

- All candidates – regardless their choice of electives (i.e. Specialized Pathways) – share a common, core curriculum which represents about 65-75% of exam topic weight; plus

- The remaining 25-35% of the materials relates to a candidate’s choice of one Specialized Pathway: Portfolio Management, Private Markets or Private Wealth.

A few key important things to note:

- Each Specialized Pathway would have the same mix of item set and constructed response format, and are all designed to be equally difficult.

- For each Specialized Pathway, there will be 2 mock exams included as part of your registration fee. Although there are currently no plans for CFA Practice Packs (paid, additional mock papers) for CFA Level 3 in 2025, this may change post 2025.

- As a CFA Charterholder, your designation will not state the Specialized Pathway you took and pass on, although you can disclose it publicly such as on LinkedIn or interviews.

- That said, CFA Institute would not provide a verification service for you or your employer on which Pathway you took and pass on.

Why add Specialized Pathways?

In addition to the traditional portfolio management and equity/credit research careers, CFA Institute noticed the breadth of career paths its CFA charterholders embark on, particularly reflecting the strong growth in the private equity and wealth management sectors:

- Increased public-to-private activity. Due to increased public company regulation and a relatively low interest rate environment, there has been a rise in public-to-private transactions whereby a publicly listed company goes private, usually with a private equity fund buyout.

- Global wealth growth. Global wealth has also been growing faster than global output with the ongoing Great Wealth Transfer, whereby $84 trillion assets will be inherited by the next generation in the next 20 years.

Tailoring the Level 3 curriculum for these additional career pathways would offer more relevant, in-depth knowledge for a broader range of relevant finance career paths.

Let’s take a look at each CFA Level 3 Specialized Pathway’s topic coverage.

1) Portfolio Management

This is the traditional, pre-2025 path through CFA Level 3. It covers the construction, management, optimization and measurement of portfolios of public market equity, fixed income and derivative securities.

It is particularly suitable for candidates who are targeting investment-focused jobs such as portfolio management, equity research and hedge funds.

Here are the 8 topics that will be covered in the Portfolio Management pathway:

| Portfolio Management Pathway Topics | Description |

|---|---|

| 1) Index-based equity strategies | • Overview of index-based equity investing strategies • Market-cap-weighted vs. factor-based strategies • Index return replication • Portfolio construction • Tracking error • Sources of return and risk |

| 2) Active equity investing: strategies | • Fundamental & quantitative approaches to active investing • Rationale • Processes for various active strategies • Creation of active investment strategies • Equity investment style classifications |

| 3) Active equity investing: portfolio construction | • Construction of actively managed portfolios • Influence of manager’s investment philosophy • Active Share vs. Active Risk approaches • Risk measures, risk budgeting & effects of risk limits • AUMs, position size, liquidity, & portfolio turnover • Evaluation of portfolio structure efficiency • Risks, costs, and effects on potential alpha of portfolio construction approach |

| 4) Liability driven and index based fixed income strategies | • Dominance of Fixed Income securities and their role in investment portfolios • Selection, implementation, evaluation, and associated risk of strategies for managing liabilities under various interest rate scenarios • Bond indexes and passive bond market exposure • Criteria for benchmark selection and justification |

| 5) Fixed-income active management: yield curve strategies | • Active fixed-income management to generate excess return • Effect of benchmark yield changes on returns • Portfolio positioning strategy based on forward rates or expected changes in interest rate volatility • Using duration to evaluate a portfolio’s sensitivity • Yield curve strategies across currencies and their expected return and risk |

| 6) Fixed-income active management: credit strategies | • Considerations of spread-based fixed-income portfolios • Credit-default-swap strategies and positioning strategies based on a specific credit spread view • Tail and liquidity risk in credit portfolios • Managing portfolios across international credit markets • Using structured financial instruments as an alternative to corporate bonds • Using analytical tools to manage fixed-income portfolios |

| 7) Case study in portfolio management: institutional | • Case study based on a large university endowment undergoing an asset allocation review and portfolio execution • Liquidity risk measurement and management • Application of Code of Ethics and Standards of Professional Conduct • Derivative use to meet exposure and liquidity needs • ESG considerations |

| 8) Trade strategy and execution | • Trading and execution from a portfolio manager’s perspective across various markets (equities, fixed income, derivatives, and foreign exchange) • Strategy selection and justification • Execution benchmarks • Cost measurement and evaluation • Automation, including algorithmic trading and machine learning, • Regulatory evaluation of firm’s trading processes & procedures |

2) Private Markets

The Private Markets pathway provides a General Partner (GP) perspective of private markets investing. It covers all key steps in a transaction workflow, from deal sourcing and due diligence to exit and build on key valuations and other competencies from all four asset class domains.

It is particularly suitable for candidates who are targeting jobs in private equity, venture capital, investment banking, M&A, corporate finance, corporate development/strategy, capital markets.

Here are the 7 topics that will be covered in the Private Markets pathway:

| Private Markets Pathway topics | Description |

|---|---|

| 1) Private investments and structures | • Features of private and public investments and markets • Private investment methods and structures including equity, debt, real estate and infrastructure • Performance metrics • Private vs public markets risk return profile comparison |

| 2) GP and LP perspective and the investment process | • General Partners and Limited Partners roles • Responsibilities and interactions in managing private investment funds and difference from public fund managers • Alignment of interests between private investment firms and their investors (fee structures, calculation and interpretation of private market fund performance, carried interest) • Favorable characteristics of private investment targets and sources of value creation • Due diligence & business planning in private investment process, alternative exit routes and impact on value |

| 3) Private equity | • Private equity strategies over the company life cycle • Characteristics of venture capital & growth equity investments • Characteristics of buyout equity investments • Valuation of private equity investment for venture capital • Growth equity and buyout situations • Risk and return among private equity investments vs other private market investments |

| 4) Private debt | • Debt financing in private market strategies and investment lifecycle • Leveraged loans, high yield bonds and convertible bonds in private market strategies • Mezzanine debt and uni-tranche debt • Private debt profile and ratio analysis to value private debt investments • Risk and return of private debt investments vs other private market investments |

| 5) Private special situations | • Addresses event-driven opportunities involving financial dislocation or distress • Characteristics and risks of special situations • Features of distressed debt • Financing alternatives for issuers in financial distress • Investment strategies in distressed situations • Capital structure arbitrage and convertible arbitrage • Features of complex investment situations involving financial dislocation or stress • Due diligence & valuation processes • Risk and return among special situations vs. other private market investments |

| 6) Private real estate | • Private real estate investment features • Economic value drivers of private real estate investments such as value-add and opportunistic and their role in the portfolio • Due diligence & valuation processes • Distinctive investment characteristics of timberland and farmland • Risk and return among private real estate investments |

| 7) Infrastructure | • Private infrastructure investment features • Investment methods and investment vehicles and their uses • Infrastructure investment process over the project life cycle and roles of debt and equity financing • Due diligence and valuation processes for infrastructure investments • Risk and return among infrastructure investments |

3) Private Wealth

The Private Wealth pathway provides a global perspective and principles for serving High Net Worth Individuals (worth USD $5M+). It is structured as an arc from a young adult being onboarded to generating wealth through wealth transfer.

It is particularly suitable for candidates who are targeting jobs in private wealth management, financial planning and relationship management.

Here are the 7 topics that will be covered in the Private Wealth pathway:

| Private Wealth Pathway Topics | Description |

|---|---|

| 1) The Private Wealth management industry | • Business models in the WM industry • Fee and compensation structures • Regulation/compliance considerations for wealth managers. |

| 2) Working with the wealthy | • Family and human dynamics • Social and psychological influences of wealth • Complex family structures and family governance • Necessary skills to find, serve and educate the wealthy • Unique characteristics of ultra-high net-worths • Framework for family decision-making |

| 3) Wealth planning | • Formulating goals-based financial plans • Methods to manage financial exposures through life and protect assets • Evaluation of how taxes influence plans for individuals • Formulating liquidity strategies |

| 4) Investment planning | • Recommending portfolio allocations and investments for a private client • Tax efficiency & tax management strategies • Approaches to retirement saving/planning and annuities • Performance measurement and attribution |

| 5) Preserving the wealth | • Types of risk to human capital • Strategies to mitigate and manage those risks through products such as insurance • Plans and strategies to mitigate inflation corrosion • Plans and strategies to mitigate exchange rate volatility risk |

| 6) Advising the wealthy | • Citizenship, nationality, visas and legal residency approaches • Maximizing net worth in complex family situations including double-taxation • Maximizing human capital, financial capital and net worth for entrepreneurs, business owners, professionals, executives, and athletes • Managing concentrated asset positions in large privately-owned businesses |

| 7) Transferring the wealth | • Use of gifts to transfer wealth during lifetime • Use of bequests and inheritance to transfer wealth at death • Wealth management approaches to charitable giving and philanthropy |

Top 7 questions about CFA Level 3 specialized pathways

When do I choose my Specialized Pathway? Can I change it later?

You can choose your Specialized Pathway at exam registration. You can change this within the 14 day buyer’s remorse period by canceling and refunding your exam and then, re-registering with your new pathway.

There is a self-service option to do this on CFA Institute’s website.

Can I choose more than one Specialized Pathway?

You can only choose one for your Level 3 exam.

That said, CFA Institute plans to make the Specialized Pathways available for charterholders and members to access as part of their refresher learning material, allowing you to go back to read other Pathways if preferred.

What percentage of CFA Level 3 content will now be ‘specialized’?

Approximately 25-35% of Level 3 content will differ between the three pathway options, with approximately 65-75% being identical ‘common core’ material.

What does the CFA Level 3 ‘core material’ consist of?

All CFA Level 3 candidates, regardless of choice of Specialized Pathways, will study these topics (65-75% exam topic weight):

– Asset allocation

– Portfolio construction

– Performance measurement

– Derivatives & risk management

– Ethics

Will CFA charters now reflect chosen Specialized Pathways?

The CFA charter itself will not change, nor indicate your Specialized Pathway. The rationale for this is because across all 3 CFA levels, the extent of specialized content is actually relatively small (8-12%).

CFA Institute has also stated that it would not provide a verification service for employers on candidates’ Specialized Pathways.

Will one CFA Level 3 Specialized Pathway be easier than another?

CFA Institute has stated that each Specialized Pathways will be equally difficult and there are no advantages of one over the other.

This does not mean that all 3 Specialized Pathways will have the same pass rate though, as there are many factors that affect pass rates, which is distinct from the concept of difficulty.

However, since candidates will all have topical strength and weaknesses, it’s likely that you’ll find one Pathway more accessible than another!

If you would like to have a sense of the types of questions asked, CFA Institute has a Specialized Pathways Quiz you can check out as well.

Are there plans to introduce Specialized Pathways to CFA Level 1 and 2?

There are no current plans by CFA Institute to introduce Specialized Pathways for Levels 1 and 2.

There are three Specialized Pathways options that a CFA Level 3 candidate must choose upon exam registration.

What are the PSM choices available?

A quick recap: Practical Skills Modules (PSM) are a new hands-on learning mini courses that are mandatory for each CFA candidate. Each course takes about 10-15 hours to complete, and must be completed prior to receiving your CFA exam result.

A PSM consists of a combination of videos, multiple-choice questions, guided practice, and case studies to develop candidates’ practical skills. There is no pass or fail per se, and each candidate are required to complete one per CFA Level, although you can do others as well if you want to.

There is also a new PSM called “Portfolio Development and Construction” available for 2025 CFA Level 3 candidates, in addition to 4 other choices available in Level 1 and 2.

Here’s a summary of PSM choices available to CFA exam candidates:

| PSM choices | Description | CFA L1 | CFA L2 | CFA L3 |

|---|---|---|---|---|

| Financial Modelling | How to build a top-tier three-statement financial model of a company in Excel as models are used to determine the value of a company. | ✓ | ✓ | |

| Python Programming Fundamentals | A fundamentals course to demonstrate the basics of Python and how to use Jupyter Notebook for developing, presenting, & sharing data science projects related to finance. | ✓ | ✓ | ✓ |

| Analyst Skills | Focuses on the skills equity and credit analysts need using insights gained from hundreds of successful analysts. | ✓ | ✓ | |

| Python, Data Science & AI | Introduces candidates to machine learning, AI, & data science to understand financial statements, reporting, and analysis using Python. | ✓ | ✓ | |

| Portfolio Development and Construction | Deep focus on asset allocation, evaluation of Investment Policy Statements, and practical portfolio optimization techniques for performance evaluation. | ✓ |

Which Specialized Pathway & PSM combo should I go for?

As you probably have worked out, there are 15 possible combinations when choosing one Specialized Pathway (out of 3 choices) and one PSM (out of 5 choices).

The good news is that in reality, the real focus here is to choose a Specialized Pathway that aligns with your interest and career goals – just 3 choices 🙂

This is because the choice of PSMs are relatively inconsequential to the overall CFA exams as they don’t affect the final results, and these practical mini courses are there for your benefit to top up necessary skillsets for work.

PSMs will also made available for CFA charterholders as refresher learnings, so it is totally possible do complete other PSMs as well if you wish to after passing Level 3.

Choose your Pathway wisely based on your career objectives and interest, rather than be influenced by any other external comments or peer pressure. This ensures you maximize the CFA charter in a way that is beneficial for your career progression.

Here are a few examples of matching suitable Pathways to your target jobs/industries:

- Portfolio Management: Portfolio manager, equity or credit analyst, investment strategist, hedge fund.

- Private Markets: investment banking, M&A, corporate finance, corporate development, private equity, venture capital.

- Private Wealth: wealth advisor, financial advisor, financial planner, relationship manager, investment advisors etc.

Our conclusion

There has been some discussion and concern among our readers on the new material – whether it’ll be up to scratch, harder to pass, easier to pass, or inadequate in some way. In other words, should you stick to the ‘tried-and-tested’ Portfolio Management Pathway?

Although the newer Specialized Pathways are unproven in the field (yet), CFA Institute have planned these changes in advance in response to the finance industry demands, rather than an ad-hoc, last minute response.

The new content for CFA Level 3 Specialized Pathways have passed through the usual rigorous process by CFA Institute with input from both industry experts and experienced practitioners, and therefore should be of similar quality to the ‘original’ Portfolio Management pathway.

Overall, we view the addition of CFA Level 3 Specialized Pathways and PSMs as a positive development to the CFA Program. These changes provide candidates more choices to customize their learning towards a preferred career goal, all with the same brand name credentials.

Going through the chosen pathway’s materials would also help in job interviews as candidates would be more familiar with a particular job’s workflow and practical skillsets needed to excel.

We recommend choosing a Pathway that fits your career aspirations and situation, rather than on speculation on whether something is easier or harder to pass, or some other reason.

Frequently asked questions

How different is CFA Level 3’s 2024 curriculum vs 2025’s (Portfolio Management Pathway)?

According to CFA Institute, the materials in 2024 Level 3 curriculum is very similar to 2025’s, but has some slight variation in order of topics.

If an L3 candidate fails, can they change Pathways in future retakes?

Yes they can.

Which pathway interests you most and why? Let us know in the comments below!

Meanwhile, here are some related articles that may be of interest:

There are two case studies in CFA Level 3 – one in the portfolio management pathway and the other in portfolio construction. I am so confused how to revise for these? Are we meant to be memorising the cases?

Hi Rhea, case studies are about application of knowledge, so memorization is not useful nor expected here. L3 is all about understanding and applying the concepts to whatever questions they throw at you. Hope this helps. See our CFA L3 top tips and how to prepare for constructed response section for more revision help.

Hi! I’m studying on the CFA Level III books, but in the online lessons hedge fund strategies seem to be missing. For which pathway are they part of the curriculum? I choose the portfolio management pathway btw, should I study that chapter?

Hi Ivan, for 2025’s curriculum, Hedge Fund Strategies reading has been removed. This reading was moved to L2 in 2025. You can see the detailed changes in our article here https://300hours.com/cfa-curriculum-changes-2025/#cfa-level-3-curriculum-changes-2025

What is the best order to study the topics if I’m going for the Portfolio Management Pathway for L3 2025 February

Same question here.

I have followed the order for L1 and L2 given by 300hours. Very effective for me. Now given the changes on specialized pathways, it would be great to have that incorporated in the studying order for Level 3 2025 Feb.

Looking forward to the study order 300hours, and any changes made 🙂

Thank you

Thanks for the high praise Brian, we’re glad to hear that our study orders helped. We are working on updating our L3 study order, as you can imagine, we now have 2x more things to review…

The Wealth Management CFA readings are all about “wealth inequality” and a lot of socialism stuff. Looks more like a college indoctrination than finance. Please stick to portfolio management.

can i take the Practical Skills Module (PSM) before taking the CFA exams?