Note: this cheat sheet is updated for the latest 2026 curriculum.

Regardless whether you’ve a background in finance or economics, Economics is a central topic across all 3 levels of the CFA exams that requires some focus to master, especially the exchange rate section!

Building a strong foundation in CFA Level 1 Economics is essential in increasing your chances of passing CFA Level 2 and 3, as it permeates throughout other topics as well. That’s why we decided to create our Cheat Sheet series of articles, which focuses on one specific topic area for one specific CFA Level.☕

More Cheat Sheets will be published and continuously updated, sign up to our member’s list to be notified first.

By referring to the CFA curriculum’s Learning Outcome Statements (LOS), we prioritize and highlight the absolute key concepts and formula you need to know for each topic. With some tips at the end too!

Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts.

Let’s dive in – this is a long article. Do breakdown your reading in chunks and come back to it often! 🙂

CFA Level 1 Economics: An Overview

Economics is a central topic in finance, with a similar topic weight across CFA Level 1 and Level 2 exams.

However, the importance of Economics is not just restricted to the CFA exams. The topics covered, such as demand and supply analyses, FX, global trade and international economic policy, will underpin your comprehension of how the economic world works.

2026 CFA Level 1 Economics’ topic weighting is 6-9%, which means 11-16 questions of the 180 questions of CFA Level 1 exam is centered around this topic.

It is covered in Topic 2 with 8 Learning Modules (LMs).

The Economics topic area can be approximately split into two sub-types:

- Microeconomics: economics on a smaller scale, such as focusing at one firm or one industry at a time. Useful for understanding how market forces will influence a particular business or industry

- Macroeconomics: economics on a country-wide or global scale. Useful to see how government policies, decisions or world events influence the economy

CFA Level 1 Economics covers a lot of concepts that you may have repeatedly heard of, but may not fully understand yet, especially if you’re new to any kind of financial education.

Here’s a summary of the CFA Level 1 Economics chapter readings:

| Learning Modules | CFA Level 1 Economics Topics |

|---|---|

| 1 | Firm and Market Structures |

| 2 | Understanding Business Cycles |

| 3 | Fiscal Policy |

| 4 | Monetary Policy |

| 5 | Introduction to Geopolitics |

| 6 | International Trade |

| 7 | Capital Flows and the FX Market |

| 8 | Exchange Rate Calculations |

If biology is the study of how living things work, and physics is the study of how the physical world works, then economics is the study of how the world of business, goods and services work.

Understanding basic economics is key to a successful career in any field, business ventures and even your personal life given how it permeates through our everyday life.

LM1: The Firm and Market Structures

Types of market structures and their characteristics

| Characteristics | Perfect competition | Monopolistic market | Oligopoly | Monopoly |

|---|---|---|---|---|

| Number of sellers | Many firms | Many firms | Few firms | Few firms |

| Entry and exit barriers | Very low | Low | High | Very high |

| Product differentiation | Identical products | Substitutes but differentiated (via advertising) | Close substitutes or differentiated via features, quality, advertising | Unique products, no close substitutes |

| Pricing power | None. Price-taker | Some | Some to considerable | Considerable (price discrimination) |

| Other features | Each firm faces a perfectly elastic demand curve (horizontal). All firms make normal profits in the long run. | Each firm faces a downward sloping demand curve. All firms make normal profits in the long run. | Each firm faces a downward sloping demand curve. Price collusion is possible: kinked demand curve, Cournot assumptions, Nash equilibrium, Stackelberg model | Firm faces downward sloping industry demand curve. Can make economic profits in the long run if unregulated. |

Breakeven and shutdown analysis in production

Profit maximization occurs when the difference betweeen Total Revenue (TR) and Total Cost (TC) is the greatest. The level of output where this occurs is when:

- Marginal Cost (MC) = Marginal Revenue (MR), and

- MC is rising

Breakeven occurs when:

- TR=TC, and

- price (average revenue) = average total cost (ATC)

At this breakeven level, economic profit is zero, although it may still earn a positive accounting profit (normal profit).

Production shutdown analysis in the short run & long run (TVC = total variable cost):

| Revenue/cost relationship | Short run decision | Long run decision |

|---|---|---|

| TR = TC | Continue operating | Continue operating |

| TC > TR > TVC | Continue operating | Exit market |

| TR < TVC | Exit market | Exit market |

LM2: Understanding Business Cycles

4 phases of business cycles

- Trough: lowest point

- Expansion: comes after trough

- Peak: highest point

- Contraction (recession): comes after peak

Summary of business cycle theories

| Theories | Brief description | Recommended policies |

|---|---|---|

| Neo-classical | Free market, the ‘invisible hand’. | Do nothing, let it be. |

| Austrian | Similar to neo-classical. It is government intervention that is causing fluctuations. | Do nothing, let it be. |

| Keynesian | Advocates government intervention during a recession, as the economy doesn’t automatically correct itself in the short run. Focus on AD curve. | Use fiscal and monetary policy as necessary to increase AD. |

| Monetarist | Monetary policy | Maintain steady money supply growth. |

| New classical | Applies microeconomic analysis to macroeconomics. Business cycles have real causes, no government intervention needed. | Do nothing, let it be. |

Types of unemployment

- Frictional: temporary transitions, e.g. people who are between jobs.

- Structural: caused by long run changes in the economy, e.g. demand for certain skills reduced whilst employers look for a different set of skillsets.

- Cyclical: depends on the stage of business cycle which affects economic activity and hence employment.

Inflation

- Inflation = a sustained rise in overall prices in the economy

- Deflation = a sustained decrease in aggregate price level, i.e. negative inflation rate or prices are falling.

- Disinflation = declining inflation rate. Note that prices are still rising in disinflation, but at a slower rate than before.

- Hyperinflation = an extremely high inflation rate. If over a 3 year period the aggregate price level doubles, this is a hyperinflation.

- Cost-push inflation = inflation caused by a decrease in aggregate supply (AS)

- Demand-pull inflation = inflation caused by an increase in aggregate demand (AD)

- Laspeyres index: uses base consumption basket to measure inflation

- Paasche index: uses current consumption basket to measure inflation

- Fischer index: is the geometric mean of Laspeyres and Paasche index.

LM3: Fiscal Policy

Fiscal policy

Contractionary vs. expansionary fiscal policy:

- Contractionary fiscal policy (reducing government spending and/or increasing taxes) helps control inflation in a high growth economy.

- Expansionary fiscal policy (increasing government spending and/or reducing taxes) helps boost aggregate demand in a slowing economy.

Fiscal policy spending vs revenue tools:

| Fiscal spending tools | Fiscal revenue tools |

|---|---|

| Transfer payments: redistribution of wealth, e.g. via welfare payments, unemployment benefits etc. | Direct taxes: Taxes on income (e.g. wealth, income, property, inheritance, capital gains, corporation profits etc) |

| Current government spending: spending on goods and services e.g. education, defence, healthcare etc. | Indirect taxes: Taxes on goods and services (e.g. sales tax, excise duties) |

| Capital expenditure: Infrastructure spending e.g. roads, hospitals, schools etc. |

Limitations to fiscal policy: recognition lag, action lag and impact lag.

Fiscal multiplier

Fiscal \space multiplier=\frac{1}{1-MPC(1-t)}where MPC = marginal propensity to consume, t = taxes

LM4: Monetary Policy

Quantity theory of money

MV = PY, where M = quantity of money, V = velocity of money circulation, P = price level, Y = real output.

Fischer effect

Rnom = Rreal + πe

where Rnom= nominal interest rate, Rreal= real interest rate, πe= expected inflation rate

Monetary policy

Tools to implement monetary policy:

- Open market operations (OMO): Buy/sell government bonds, which leads to increase/decrease in commercial banks’ reserves, to increase/decrease money supply

- Central bank’s policy rate: If policy rate is high, amount of lending will decrease and quantity of money will also decrease. Vice versa.

- Reserve requirements: If reserve requirement is low, the money multiplier (reciprocal of reserve requirement) goes up and money supply increases. And vice versa.

Required \space reserves \space ratio = \frac{Required \space reserves}{Total \space deposits}Money \space multiplier=\frac{1}{Reserves \space requirement}Contractionary vs. expansionary monetary policy:

- Contractionary monetary policy (reducing money supply and/or increasing interest rates) helps cool off an ‘overheating’ economy with high inflation due to high economic growth.

- Expansionary monetary policy (increasing money supply and/or reducing interest rates) helps boost a slowing economy.

Limitations of monetary policy:

- Central banks cannot control how much households save.

- Central banks cannot control banks’ willingness to lend and hence expand credit.

LM5: Introduction to Geopolitics

Assessing geopolitical actors and risk

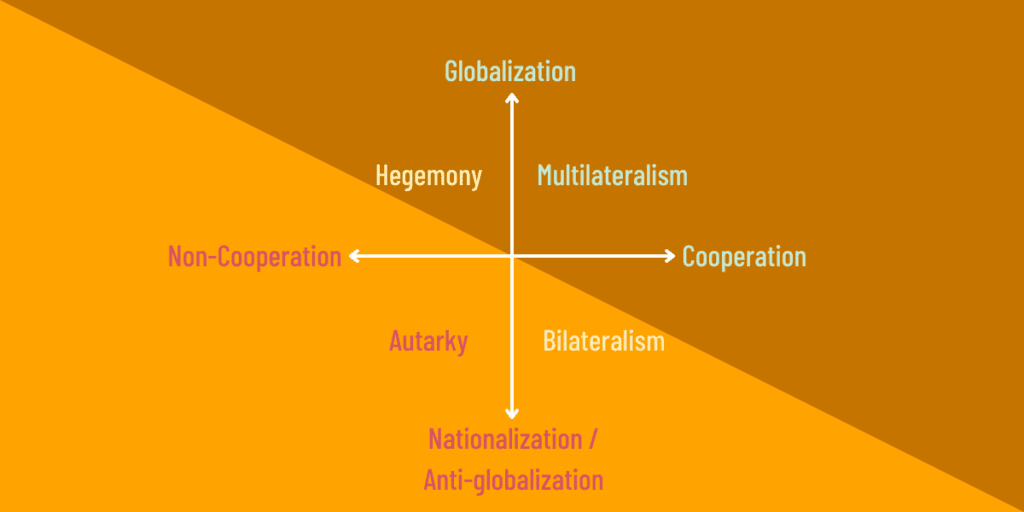

There are generally 4 types of country behavior:

| Autarky | Hegemony | Bilateralism | Multilateralism |

|---|---|---|---|

| Seek self sufficiency, little or no external trade or finance | Can be regional or global leaders | Two countries cooperating on political, financial, economic or cultural aspects | Rule harmonization and engage in mutually beneficial trade agreements |

| State-owned strategic domestic industries | Exercise political and/or economic dominance over others to control resources | Countries that engage in bilateralism can still have one-at-a-time agreements with other nations. | Allows a country to access resources and markets globally |

| Self sufficiency allows complete control over flow of product, services and technology. | Hegemons may become more competitive if influence dwindles, increasing geopolitical risk | Regionalism is somewhere in between bilateralism and multilateralism, whereby a group of countries work with one another whilst raising barriers to others outside the group. | However, dependent on international cooperation for economic growth |

| E.g. China in 20th century, North Korea | E.g. USA, Russia | E.g. Japan (used to be, currently multilateral) | E.g. Singapore |

Tools of geopolitics:

- National security tools: espionage, military

- Economic tools: currency union, nationalization

- Financial tools: currency markets, sanctions, capital controls

Incorporating geopolitical risk into the investment process

Types of geopolitical risk:

- event risk

- exogenous risk

- thematic risk

Assessing geopolitical threats

To assess geopolitical risk, an investor should consider:

- Likelihood of occurance

- Speed of impact

- Size and nature of impact

LM6: International Trade

Regional trading blocs

| Types | Description |

|---|---|

| Free trade area (FTA) | No barriers to flow of goods and services amongst members |

| Customs union (CU) | FTA + common trade policy amongst non-members |

| Common market (CM) | CU + free movement of factors of production amongst members |

| Economic union (EU) | CM + common economic institution and coordination of economic policies |

| Monetary union (MU) | EU + common currency |

LM7: Capital Flows and the FX Market

Nominal vs real exchange rates

- Nominal exchange rate is the quoted currency exchange rate at any point in time.

- Real exchange rate adjusts the nominal exchange rate for inflation in each country compared to a base period.

Real \space exchange \space rate_{d/f}=Nominal \space exchange \space rate_{d/f} \times \frac{CPI_f}{CPI_d}where d = domestic currency, f = foreign currency, CPI = consumer price index

LM8: Exchange Rate Calculations

Exchange rate convention in CFA curriculum

It’s important to know that the exchange rate notation in CFA curriculum is different, and opposite to the real world – don’t ask me why!

In the real world, EUR/GBP of 1.15 means EUR 1 = GBP 1.15.

However, in the CFA curriculum, EUR/GBP of 1.15 means EUR 1.15 per GBP 1. This is the opposite notation in the real world, so be mindful if you see real world exchange rate example questions.

It’s a key source of mistake for CFA candidates, and there are lots of foreign exchange questions throughout all 3 levels. Do make sure you get it right!

P.S. – For the purposes of the CFA curriculum, you should also be familiar with the convention of EUR:GBP = 1.15, which means GBP 1.15 = EUR 1, i.e. equals GBP/EUR = 1.15.

Forward rates, spot rates and interest rates

Forward \space exchange \space rate_{d/f}= Spot \space exchange \space rate_{d/f} \times \frac{1+r_d}{1+r_f}\times Twhere rd = risk-free rate of domestic currency, rf = risk-free rate of foreign currency, T = time to maturity.

CFA Level 1 Economics Tips

Economics students: don’t get cocky

To those of you who have taken economics courses in school, you may feel like you’ve done all this before.

Don’t be tempted to simply skip the whole thing. You may be surprised by how much you’ve forgotten, or concepts you’ve not previously fully understood that the CFA exam covers in more detail.

Get good guidance, and/or use examples

You may hear this a lot, but understanding (not memorizing) the core concepts behind this topic area is really important.

Economics is voluminous partly because there are numerous concepts to be explained, rather than, say, mathematical formulae to be memorized.

As it is very text-heavy, when studying Economics, you may find your mind ‘blanking out’, where you’re reading but not really comprehending. You need to break that cycle to quickly move on.

There are 3 good ways to speed up your comprehension:

- A good instructor. Economics is one area where you can really benefit from having proper instruction. An hour of study and discussion with an instructor can advance your comprehension far better than days of self-studying. If Economics is really giving you trouble, do consider live classes, or a review seminar. You can see the latest CFA review courses here.

- Lecture videos. If live classes are outside of your budget, you could also consider lecture videos. Although lacking interactivity with the instructor, videos can guide you through concepts step-by-step, peppered with informal examples and explanations that help seal your comprehension. Again, the latest options can be found in our Offers section.

- Focus on examples. Learning Economics concepts can be a little bit like learning a new board game. Explaining a board game on paper can only get you so far – at some point it’s easier and more engaging to get going. Similarly, with Economics, it can be helpful to focus on the examples given and run through a few step-by-step. If you need more examples than the ones given in the study text, move to a few practice exams or get our Free L1 Practice Test.

Consider covering more ‘effort-efficient’ topics first

Economics has a lot of content for a topic area that’s 8-12% of the exam.

If you find that Economics is slowing your pace down, it might be more effort-efficient to focus on topic areas such as Financial Statement Analysis, Fixed Income and Equity Investments. Check out our recommended CFA Level 1 best topic study order here.

Discuss, discuss, discuss

Discussions with your colleagues, friends and mentors (or in our Forum) can greatly help your understanding of Economics.

Whenever you have an opportunity, discuss relevant current events and the underlying economics, clarifying and asking questions where you can. Explain that you’re a CFA candidate if you have to!

Learned about exchange rates? Discuss how Brexit impacted the British Pound, and how that drop would influence the UK economy in various sectors. Speculate on options that the government can take to steady the economy.

In the process of this discussion, you’ll solidify your comprehension of your Economics material, and also increase your knowledge on current events. Win win!

More Cheat Sheet articles will be published and continuously updated. Get ahead of other CFA candidates by signing up to our member’s list to get notified.

Meanwhile, here are other related articles that may be of interest:

- CFA Level 1 Cheat Sheets series: Quant Methods | FRA | Corporate Issuers | Derivatives | Fixed Income | Equity Investments | Ethics | Alt Investments | Portfolio Management

- CFA Level 1: How to Prepare and Pass CFA in 18 Months

- CFA Level 1 Tips: Top 10 Advice from Previous Candidates

- 18 Actionable Ways to Improve Your Study Memory

- How to Study Effectively: Proven Methods that Work for CFA, FRM and CAIA

- The Ultimate Guide to CFA Practice Questions

Hello! Is there any way to receive all of these guides in one PDF? I would love to print them off before my test next week.

Hi Joe! Really sorry about this as we don’t produce these in PDF as we constantly update and improve them for the latest version. A suggestion is open the tab with these notes, and disconnect the internet to avoid distraction when studying.

Oh thank you guys. Thank you very much and may God bless you.

Hi, this is really helpful thanks. Using these in my last days of revision! I think there may be an error on the forward exchange rate. I think it is forward rate = spot rate x (1 + foreign (price) currency / 1 + domestic (base) currency). Whereas you have put the domestic currency as the numerator.

Hi Maisie! Looks like you’re doing your revision really thoroughly and well 🙂 Corrected, thank you! Best of luck by the way!

Hi! First of all, a big thanks for all the much needed and useful content and support!

I’m struggling with this sentence: ” If reserve requirement is low, the money multiplier (reciprocal of reserve requirement) goes up and money supply decreases.”, shouldn’t the money supply increase as the money multiplier goes up? Thanks again!!

Hi soleturnes, thank you for spotting my mistake, apologies for that!

You are absolutely right that reserve requirement is low, the money supply increases, along with the money multiplier 🙂

Thanks heap for the efforts, Zee. It helps in my review of topics.

No problem! If you have any questions during your review, just post a question in our support forum and one of us will answer it.

Thank you very much, Zee. I am just loving these cheat sheets. Looking forward to seeing cheat sheets for the rest of the L1 subjects. I have bookmarked them and review them every day before going to sleep. Thanks for your efforts!

That’s a big praise, thank you 🙂 It’s great that you found them helpful, and yes, spaced repetition and constant reviewing is key!