CPA exam guide: A concise overview

So, you’re thinking about becoming a Certified Public Accountant (CPA)? That’s great, as the CPA designation is a highly respected credential that can significantly broaden and boost your career.

That said, CPA exam and the road to getting certified can seem daunting and complicated. Not to worry, here is our CPA guide on everything you need to know to tackle this challenge this year.

- CPA exam guide: A concise overview

- What is the CPA exam?

- CPA exam structure and format

- CPA passing score

- CPA pass rates by section

- CPA exam eligibility and requirements: How to become a CPA

- CPA exam dates and score release schedule

- How much does CPA exams cost?

- CPA exam preparation strategies

- Career opportunities after passing the CPA exam

- Why become a CPA? Benefits of the CPA designation

- CPA vs. others – A quick comparison

- FAQs

What is the CPA exam?

The Certified Public Accountant (CPA) designation is a mark of excellence within the United States’ accounting profession. This rigorous examination, administered by the American Institute of CPAs (AICPA), assesses a candidate’s comprehensive knowledge of accounting principles, auditing standards, taxation, and business law.

The CPA exam is designed to ensure that only highly qualified individuals are granted the license to practice as CPAs within the US. While the CPA designation is specific to the United States and its jurisdictions, it is highly respected globally.

As of Feb 2025, there are just over 678,000 active CPAs in the United States. The number of CPAs has been relatively slow growing the last few years, fluctuating between 654,000-678,000 since 2019.

A few factors have contributed to this:

- Large pool of retiring CPAs: 75% of CPAs have reached their retirement age in 2020, with the average age of a CPA of 53 years old.

- Declining number of accounting graduates: Unfortunately, this is exacerbated by a 17% reduction in US accounting program graduates (both Bachelor’s and Master’s) in 2022 vs 2012, and the challenges in attracting and retaining qualified accountants, which contributed to a shrinking talent pipeline entering the profession.

- Competition from other careers and certifications: The reduction in demand for an accounting education is likely attributed to competition from alternative sectors (e.g. finance, data analytics or fintech) or professional certifications (e.g. CFA, CFP, FRM, CAIA), which may potentially offer a better work-life balance, faster career progression, sector growth and/or higher earning potential.

- Increased rigor and perceived difficulty of the CPA Exam: The CPA Exam’s growing complexity, driven by the CPA Evolution model and its emphasis on higher-order skills and technology, may have contributed to the perceived increased difficulty of the qualification.

- High cost of education and certification: The substantial financial burden associated with the education requirements for CPA eligibility (often a master’s degree or 150 credit hours) and the expenses of exam preparation and the exam itself create a barrier to entry.

According to U.S. Bureau of Labor Statistics, the accounting profession is expected to grow at a faster than average rate from 2023-2033 (6% annually). Thus, the demand for Certified Public Accountants is expected to rise as well in US, which may lead to an upward salary pressure for CPA licensees. That said, that may be slightly offset to a small degree by outsourcing, artificial intelligence and automation. With AI advancements, it is likely that future CPAs can focus on delivering higher value, intellectually stimulating work as manual tasks get outsourced.

In response to these changes, AICPA and National Association of State Board of Accountancy (NASBA) have implemented some of the largest changes to the CPA licensure model in 2024, aptly summarized as “CPA Evolution”:

- Similar to CFA Institute’s announced changes for CFA Program, CPA Evolution was done to upgrade the CPA licensure model to adapt to the changing skills and competencies required in accounting practices today and the future.

- Mainly the CPA exams are changed to a 3 Core plus 1 Discipline exam section model, allowing choice of specialization just like CFA Program.

- Regardless of a candidate’s choice of Discipline, all candidates that pass the 4 exam sections leads to CPA licensure with the same rights and responsibilities as the current CPA license.

While holding a CPA license is not universally mandatory for all accounting roles, it is often a prerequisite for positions in public accounting, auditing, taxation and high-level financial management in the US. This guide aims to provide a comprehensive overview of the CPA exam, equipping aspiring CPAs with the knowledge and strategies needed to succeed.

CPA exam structure and format

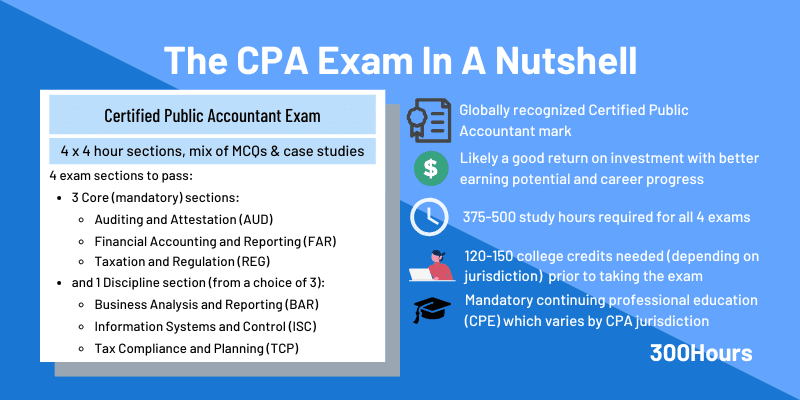

Since CPA Evolution in early 2024, the Uniform CPA exam now consists of 4 exam sections, i.e. 3 Core plus 1 Discipline section:

- 3 mandatory Core sections:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Taxation and Regulation (REG)

- and a choice of one (out of three) Discipline section:

- Business Analysis and Reporting (BAR)

- Information Systems and Control (ISC)

- Tax Compliance and Planning (TCP)

Each computer-based exam section is 4 hours long, consisting of 5 parts called testlets. The first 2 testlets are multiple choice questions (MCQs), and the other 3 testlets are case studies, also known as Task-Based Simulations (TBSs).

MCQs test your knowledge of accounting concepts, while TBSs assess your ability to apply those concepts in real-world scenarios. Note that for all exam sections, MCQs and TBSs are weighted equally (50/50) except ISC (Information System and Control).

Here’s a quick summary of the exam format, structure and topic weights:

| Section (Type) | Section Time | Description | # MCQs (Format Weighting) | #TBSs (Format Weighting) | Topic Weighting |

|---|---|---|---|---|---|

| AUD (Core) | 4 hours | Focuses on auditing standards, procedures, and reporting. | 78 (50%) | 7 (50%) | – Ethics, Professional Responsibilities, and General Principles (15-25%) – Assessing Risk and Developing a Planned Response (25-35%) – Performing Further Procedures and Obtaining Evidence (30-40%) – Forming Conclusions & Reporting (10-20%) |

| FAR (Core) | 4 hours | Tests knowledge of financial accounting standards and reporting requirements. | 50 (50%) | 7 (50%) | – Financial Reporting (30-40%) – Select Balance Sheet Accounts (30-40%) – Select Transactions (25-35%) |

| REG (Core) | 4 hours | Focuses on federal taxation, business law, and professional ethics. | 72 (50%) | 8 (50%) | – Ethics, Professional Responsibilities and Federal Tax Procedures (10-20%) – Business Law (15-25%) – Federal Taxation of Property Transactions (5-15%) – Federal Taxation of Individuals (22-32%) – Federal Taxation of Entities (including tax preparation) (23-33%) |

| BAR (Discipline, choose 1 out of 3) | 4 hours | Focuses on financial analysis, technical accounting requirements | 50 (50%) | 7 (50%) | – Business Analysis (40-50%) – Technical Accounting and Reporting (35-45%) – State and Local Governments (10-20%) |

| ISC (Discipline, choose 1 out of 3) | 4 hours | Focuses on the knowledge and skills needed for professionals working in areas related to IT, cybersecurity, and internal controls. | 82 (60%) | 6 (40%) | – Information Systems and Data Management (35-45%) – Security, Confidentiality and Privacy (35-45%) – Considerations for System and Organization Controls (SOC) Engagements (15-25%) |

| TCP (Discipline, choose 1 out of 3) | 4 hours | Tests your understanding of tax compliance & planning for individuals and businesses, personal financial planning, and property transactions. | 68 (50%) | 7 (50%) | – Tax Compliance and Planning for Individuals and Personal Financial Planning (30-40%) – Entity Tax Compliance (30-40%) – Entity Tax Planning (10-20%) – Property Transactions (disposition of assets) (10-20%) |

CPA candidates receive their exam results periodically, typically within 1-6 weeks, depending on what type of exam (Core / Discipline) and when it was taken. See the CPA exam dates and score release schedule section for precise info.

Although AICPA recommends about 300-400 hours to study for all 4 sections of the CPA exam, we typically find that it is an underestimate of the average time taken to properly prepare, and would recommend budgeting 25% more time in total, i.e. 375-500 hours study time for all 4 CPA sections.

Although there are no maximum number of attempts for CPA exam sections, there is a 18-36 month time limit for passing all 4 exam sections from when you passed your first exam section, depending on the state/jurisdiction you’re in.

CPA passing score

As mentioned previously, the Uniform CPA exam includes three core sections plus a choice of 1 Discipline section:

| 3 Core Sections | Choice of 1 Discipline Section |

|---|---|

| Auditing and Attestation (AUD) | Business Analysis and Reporting (BAR) |

| Financial Accounting and Reporting (FAR) | Information Systems and Controls (ISC) |

| Taxation and Regulation (REG) | Tax Compliance and Planning (TCP) |

For each of the 4 exam sections, a CPA candidate needs to score 75 and above to pass. It’s important to note that the CPA Exam uses a scaled scoring system, not a traditional percentage-based grading system. A score of 75 does not mean you answered 75% of the questions correctly.

Scaled scoring is a statistical method used to ensure that the difficulty is consistent across different versions of the exam. This is important because each exam may have slightly different questions, but the passing standard needs to remain the same

Thus, the CPA passing score of 75 is a predetermined standard of competence. It’s not adjusted based on the overall performance of the exam takers, i.e. a CPA candidate’s score is independent of how other candidates perform, but evaluated against this fixed standard.

The implication of this is that a higher pass rate means that candidates are better prepared for that particular exam section. Let’s take a look at the latest CPA pass rates since CPA Evolution is implemented in 2024.

CPA pass rates by section

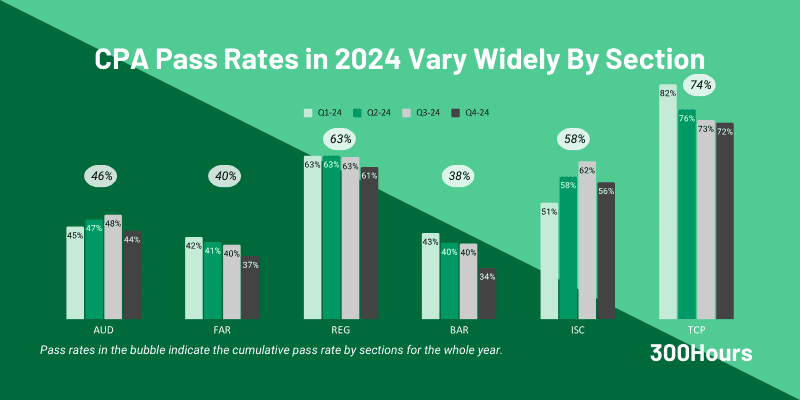

The 2024 cumulative CPA pass rates by exam section are as follows:

- AUD = 46%

- FAR = 40%

- REG = 63%

- BAR = 38%

- ISC = 58%

- TCP = 74%

For the Core sections, it is interesting to note the downward trend for FAR pass rates in 2024, whilst AUD and REG remain relatively stable across quarters.

For Discipline sections, BAR’s pass rate tanked in Q4 2024 to 34%, whilst TCP section has the highest pass rate of all sections.

It is important to remember that CPA Evolution, launched in 2024, was the largest change to the CPA Exam since computer based testing in 2004. CPA Evolution launched the 3 Core plus 1 Discipline model for the CPA Exam, which makes comparison to previous versions of the CPA Exam difficult.

We expect the pass rates across sections to be less volatile over time as candidates and third party prep providers get used to the new curriculum and get better prepared.

CPA exam eligibility and requirements: How to become a CPA

The CPA license is unique in the sense that there is no national CPA license. Instead, the CPA licenses are issued by the individual state Boards of Accountancy in 55 jurisdictions (50 states and five U.S. territories). Hence, these individual boards determine the eligibility and licensure requirements for their jurisdiction’s Certified Public Accountant candidates.

And yes, that means each state has its own licensing requirements, including educational, experience, exam and ethics components (the “4E’s”, similar to Certified Financial Planner qualification).

Whilst it is best to check the specific CPA requirements for your state, here are some general prerequisites from most states on how to obtain your CPA license:

- Education: Most states require a Bachelor’s degree and the completion 150 semester hours of college coursework, which is 30 hours more than the usual 4-year bachelor’s degree. Many schools offer a 5-year combined bachelor’s and master’s degree to meet the 150-hour requirement, but a master’s degree is not required. One can also meet the 150 credit hours with just a Bachelor’s degree, then prepare for the CPA exam whilst taking classes at a community college.

- Exam: Pass all 4 sections of the CPA exam

- Work Experience: Most states typically require 1-2 years of full time work experience, typically under supervision from a licensed CPA.

- Other state requirements: additional residency, minimum age, citizenship, ethics requirements may apply, depending on jurisdiction.

CPA exam dates and score release schedule

Before you can book a CPA exam testing slot, here is what you need to do:

- Check if you meet your preferred CPA licensing state’s educational and other requirements to take the Uniform CPA exam. If you’re based outside the US, you can use NASBA’s International Evaluation Service tool to check your eligibility.

- If you meet the requirements, you’ll need to submit an application to verify this via NASBA’s CPA Cental Portal.

- Once approved, you’ll receive a Notice to Schedule (NTS), which is valid for 6 months and allows you to schedule your CPA Exam section.

- You can now schedule your exam at a Prometric testing center of your choice.

With the recent launch of CPA Evolution in 2024, CPA exam testing and score release dates have been updated for greater flexibility.

In essence, continuous testing is available throughout the year for Core sections, whilst Discipline sections usually have a 1 month exam window every quarter. There is an additional test window in June 2025 for Discipline sections this year to accommodate the credit extensions up to 30 June 2025.

Here’s a quick summary table of the CPA exam windows and the corresponding target results dates:

| CPA Exam Section | Exam Dates Available | Target CPA Results Release Dates |

|---|---|---|

| Core sections (AUD, FAR and REG) | Continuous testing throughout the year. | Typically 1-5 weeks after test date. |

| Discipline sections’ (BAR, ISC, TCP) | Exam window is typically the first month every quarter: | |

| 1-31 January | 14 March | |

| 1-30 April | 16 May | |

| 1-30 June | 17 July | |

| 1-31 July | 11 September | |

| 1-31 October | 16 December |

For full details, check out our guide on CPA exam dates and score release timings.

How much does CPA exams cost?

Whilst the strong career outlook and stability for CPAs is definitely a plus when considering whether to become a CPA, it is also helpful to know upfront of the potential costs involved in the evaluation.

Just like CPA requirements, CPA licensure costs does vary by state. The costs of review courses, study materials, potential retakes and travel costs also need to be factored in. It’s an investment in your future, so plan your budget accordingly.

Nevertheless, here is a helpful range of the potential fees involved in studying for the CPA exams, assuming one exam retake on average:

| Fee Type | CPA exam costs ($) |

|---|---|

| Education Evaluation Application Fee | 90-150 |

| Exam Section Application Fee (for all 4 Sections, plus one retake) | 1,100-1,900 |

| Retake fees (per Section, if applicable) | 50-200 |

| Third party CPA review course | 1,000-5,000 |

| Total | $2,240-$7,250 |

All in all, the monetary costs for preparing and passing for the CPA is quite reasonable and cheaper than others such as CFA Program.

CPA exam preparation strategies

Whilst it may appear daunting at first, here are a few tried-and-tested CPA exam prep strategies to help increase your chances of passing:

- Creating a study plan and schedule: Develop a structured study plan that allocates sufficient time for each section. Break down your study sessions into manageable chunks and stick to your schedule. Remember to budget for contingencies though!

- Choose the right study materials for you: Selecting high-quality study materials is crucial for CPA exam success. Consider using review courses, textbooks, and practice questions from reputable third party prep providers.

- Effective study techniques: Use active learning techniques, such as summarizing material, creating flashcards, and teaching concepts to others. Focus on understanding the underlying principles rather than memorizing facts.

- Utilizing practice exams and mock tests: Practice exams and mock tests are essential for familiarizing yourself with the exam format and identifying areas where you need to improve. Do your practice questions under timed, exam conditions too to simulate the real exam pressure.

Career opportunities after passing the CPA exam

Passing the CPA exam opens a wide range of career opportunities across various industries. Here’s a quick overview of some common CPA career paths and salary ranges:

| CPA career sectors | Type of work and description | Typical salary ranges |

|---|---|---|

| Public accounting | Auditing: Examining financial records to ensure accuracy and compliance. | Entry-level staff accountants can expect $50,000 – $70,000. Senior auditors and managers can earn $80,000 – $150,000 or more, depending on experience and location. Partners in public accounting firms can earn significantly higher. |

| Tax accounting: Preparing tax returns and providing tax planning services for individuals and businesses. | Similar to auditing, with entry-level positions around $50,000 – $70,000. Tax managers and specialists can earn $80,000 – $150,000+. | |

| Corporate Accounting | Financial Reporting: Preparing financial statements and analyzing financial performance. | Financial analysts and accountants can earn $60,000 – $100,000, while controllers and finance managers can earn $100,000 – $200,000+. |

| Management accounting: Providing financial information for internal decision-making. | Cost accountants and management accountants can earn $60,000 – $100,000, with management roles potentially exceeding $150,000. | |

| Government Accounting | Working for government agencies at the federal, state, or local level. | Government accounting salaries can vary widely but are generally competitive, with mid-career professionals earning $70,000 – $120,000. |

| Forensic Accounting | Investigating financial crimes and fraud. | Forensic accountants often earn $70,000 – $150,000 or more, depending on experience and specialization. |

| Consulting | Providing financial advice and guidance to businesses. | Consulting salaries can vary significantly based on the firm and specialization, with ranges from $70,000 for entry-level to $200,000+ for experienced consultants and partners. |

Why become a CPA? Benefits of the CPA designation

- Enhanced career prospects and opportunities: The CPA designation significantly enhances your career prospects, providing access to a broader range of job opportunities and career paths.

- Increased earning potential and job security: CPAs generally earn higher salaries and enjoy greater job security compared to their non-CPA counterparts. The demand for qualified CPAs remains strong across various industries and is expected to grow faster than average (6% annually in the US) in the next 10 years.

- Professional credibility and recognition: The CPA designation is a mark of professional credibility and international recognition. It demonstrates your expertise and commitment to ethical practice, building trust with clients and employers.

- Expanded knowledge and skill set: Preparing for the CPA exam expands your knowledge and skill set in accounting, finance, and business. This comprehensive knowledge base makes you a valuable asset in any organization.

CPA vs. others – A quick comparison

| Qualification | Focus | Ideal for | Key differences |

|---|---|---|---|

| CPA (Certified Public Accountant) | Accounting, Auditing, Taxation | Technical roles in finance and accounting, public accounting | Professional license demonstrating advanced expertise in US accounting standards. |

| CFA (Chartered Financial Analyst) | Portfolio Management, Valuation, Investments | Asset management, equity research, private equity | Gold standard in investment management and research careers vs. expert in US accounting, auditing & taxation. |

| MBA (Master of Business Administration) | Business Management, Strategy | Leadership roles, strategic management | Broad business education vs. specialized accounting expertise. |

| Accounting Degrees | Foundational accounting knowledge | Entry-level accounting roles | Educational prerequisite for CPA; CPA is a professional license. |

| CFP (Certified Financial Planner) | Financial planning, Investments | Personal financial planning | Financial and investment planning focus vs CPA’s audit and accounting focus. |

| CMA (Certified Management Accountant) | Internal Management Accounting, Financial Analysis | Corporate financial management, internal analysis | Internal focus vs. CPA’s external focus (auditing, taxation). |

| Tax Lawyer | Tax Law, Legal Representation | Legal tax representation, complex tax litigation | Legal expertise vs. CPA’s accounting and compliance expertise. |

| ACCA/CA (International Accounting Qualifications) | International Accounting Standards | Global accounting roles | Internationally recognized vs. US-specific CPA. |

FAQs

Can I take the CPA exam if I don’t have an accounting degree?

Yes, you can take the CPA exam and become a CPA even if you don’t have an accounting degree, as long as you meet the academic and experience requirements of the specific state or jurisdiction where you plan to practice.

Even though you can become a CPA without an accounting degree, you do need some accounting coursework and/or business credits. Best to check your state board’s requirements.

What are the most common reasons people fail the CPA exam, and how can I avoid them?

Common reasons include insufficient study time, poor study techniques, lack of practice with task-based simulations (TBSs), and exam anxiety. To avoid these:

1) Allocate ample study time (300-400 hours per section).

2) Use active learning techniques (summarizing, teaching, practice questions).

3) Practice extensively with TBSs to simulate exam conditions.

4) Manage exam anxiety with relaxation techniques and adequate sleep.

How does the CPA Evolution model impact the exam, and what skills are emphasized?

The CPA Evolution model, which became effective in 2024, shifts the CPA exam to emphasize technology skills and deeper analytical abilities. It introduces a core-plus-discipline model, meaning all candidates take 3 Core sections, then choose one Discipline.

Skills emphasized include data analytics, technology integration, and critical thinking. Be sure to check the AICPA website for the most up to date information regarding the Discipline sections.

What are the best resources for practicing task-based simulations (TBSs) on the CPA exam?

Reputable CPA review courses like Becker, Wiley CPAexcel, and UWorld/Roger/Wiley CPA Review offer extensive TBS practice.

The AICPA also provides sample tests and practice questions. Focus on understanding the underlying concepts and practicing applying them in various scenarios, ideally under timed exam conditions.

How can I effectively manage my time during the four-hour CPA exam sections?

Time management is crucial. Allocate time for each section based on its weighting.

Practice timed mock exams to simulate exam conditions. If you get stuck on a question, move on and return to it later. Use the exam software’s features to mark questions for review.

Is it possible to work full-time while studying for the CPA exam, and what are the strategies for success?

Yes, many candidates work full-time while studying. Success requires disciplined time management:

– Create a detailed study schedule and stick to it.

– Utilize weekends and evenings for study sessions.

– Create a distraction-free study environment for maximum focus, with scheduled breaks so you can study more in less time.

– Break down study material into manageable chunks.

– Leverage mobile apps and audio resources for on-the-go learning to squeeze in bite-sized learning.

We hope you found the CPA beginner’s guide above useful. Meanwhile, you may find these related articles of interest:

- CFA vs CPA: Which Is Right for You?

- Beginner’s Guide to CFA (Chartered Financial Analyst)

- Accounting Career Paths: Roles, Salaries & Progression

- Finance Career Quiz: Which Finance Career Fits Your Skills & Personality?

- CPA Requirements: 5-Step Guide On How To Become a CPA

- CPA Requirements By State: A Quick & Complete Guide