Here’s a no-nonsense guide on all the realistic CFP exam fees you will need to budget for.

First, we will look at the average total cost of preparing for the Certified Financial Planner qualification (and the relevant assumptions).

Then, we will delve into the details of the 6 individual components of these costs, before finally discussing some money-saving tips and what best to spend your money on efficiently.

Let’s go! 🙂

- CFP exam cost heavily depends on coursework requirements

- 1) CFP calculator

- 2) CFP registration fees

- 3) CFP coursework or Capstone only

- 4) CFP exam prep cost

- 5) Other potential CFP certification costs: Travel, retake & rescheduling costs

- 6) CFP Board's application & annual membership fees

- How to reduce CFP exam fees: Discounts, scholarships & free resources

CFP exam cost heavily depends on coursework requirements

The average cost of the CFP exam is mostly influenced by the educational requirements of CFP. To be helpful in this budgeting exercise, we are going to:

- exclude the cost of acquiring a Bachelor’s degree. This helps comparability with other finance designations;

- include the fees you need to prepare for the CFP exam itself; and

- include the costings you need to complete the CFP coursework requirement.

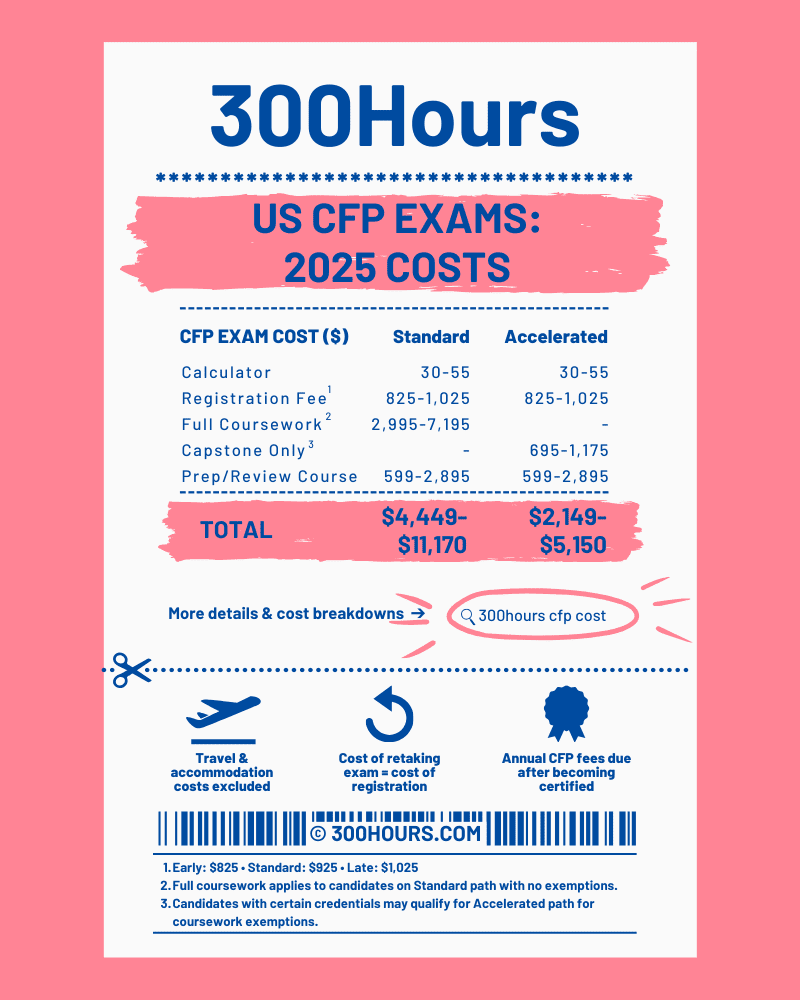

With the assumptions above, the total cost of CFP exams ranges from:

- $4,450-$11,200 assuming full coursework requirements; or

- $2,150-$5,150 assuming an accelerated path with coursework exemptions (only Capstone required).

The two most significant factors that affect the cost range are:

- whether a candidate qualifies for coursework exemptions through other qualifying credentials (“Accelerated Path”, explained further below)

- whether a candidate chooses to use third party study material or not.

Let’s go through each of the 5 key cost components so you can further narrow down the cost estimates for your situation.

1) CFP calculator

Unless you have studied for other finance exams such as CFA, CAIA or FRM where similar calculators are used, this is something most CFP candidates need to budget for as a required item. That said, it is not a huge cost item, averaging $30-55 for a calculator of your choice.

These are the approved calculator choices for the US CFP exam:

- Hewlett-Packard: HP 10B, HP 10Bii, HP 10Bii+, HP 12C, HP 12C Platinum, HP 17Bii+

- Sharp: EL733, EL733a, EL738

- Texas Instruments: BA II Plus, BA II Plus Professional, BA II Plus Business Analyst

Here are the prices of each of the 4 most popular CFP exam approved calculators:

- Texas Instruments BA II Plus: $30

- Texas Instruments BA II Plus Professional: $53

- HP12C: $35

- HP12C Platinum: $40

Not sure which calculator to choose? Check out our BA II Plus vs. HP12C guide →

2) CFP registration fees

In the US, CFP exam fees varies between $825-$1,025 depending on how early you register:

| CFP exam registration fees | US$ |

|---|---|

| Early registration (deadline is typically 6 weeks before registration closes) | $825 |

| Standard registration | $925 |

| Late registration (final week before registration closes) | $1,025 |

For more details, check out the latest CFP exam dates and registration deadlines here.

3) CFP coursework or Capstone only

One of the key requirements to qualify as a Certified Financial Planner in the US is meeting the Education requirement of:

- A minimum of a Bachelor’s degree; and

- Completion of the financial planning coursework prior to taking the CFP exam.

As mentioned earlier, to aid comparability across finance qualifications, we are assuming the Bachelor’s degree as a given minimum that most CFP candidates already have or made plans for. Thus, this is excluded from the CFP exam costing exercise here.

Instead, a large component of the cost driver for most CFP candidates is the CFP coursework requirement. And it depends whether you’ll need to complete the full coursework (Standard path) or qualify for most of the coursework exemption (Accelerated path).

Standard path: full CFP coursework

Focusing on the costs of online CFP coursework programs, most reputable CFP coursework providers typically offer 7 courses (including Capstone) which include a combination of these topics:

- Professional Conduct and Regulation

- General Principles of Financial Planning

- Risk Management and Insurance Planning

- Investment Planning

- Tax Planning

- Retirement Savings and Income Planning

- Estate Planning

- Psychology of Financial Planning

For candidates who don’t qualify for the Accelerated path, completing the CFP coursework requirement online typically costs between $2,995-$7,195 depending on choice of providers.

Here’s a quick summary of the range of costs from 13 online CFP coursework providers (self study or instructor-led):

| CFP coursework provider | 7 Course Fees (US$) |

|---|---|

| The American College | $5,395 |

| Boston University | $4,395 |

| Bryant University / Boston Institute of Finance (BIF) | $2,995-$3,995 |

| Butler University | $5,243-$5,593 |

| California State University | $4,665 |

| College for Financial Planning (Kaplan) | $5,350-$5,550 |

| North Carolina State University | $3,250-$4,250 |

| Seton Hall University | $5,950 |

| University of Georgia | $3,250-$4,250 |

| University of Texas | $3,250-$4,250 |

| Dalton Education | $5,295-$7,195 |

| Brett Danko | $6,650 |

| Zahn Associates | $4,265 |

Accelerated path: Capstone course only

More importantly, you can bypass most of the coursework requirement if you have any of the following additional credentials:

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

- Chartered Financial Consultant (ChFC)

- Chartered Life Underwriter (CLU)

- Licensed Attorney

- Doctor of Business Administration

- Ph.D. in Financial Planning, Finance, Business Administration, or Economics

- CFP certification from outside the U.S. from the Financial Planning Standards Board (FPSB) affiliate in your country

If you qualify for this exemption, the only portion of coursework you need to do is either:

- a Capstone course (a financial plan development course); or

- a Capstone Alternative course (only if you qualify for the Accelerated Path and already met the CFP experience requirements)

The only difference between a Capstone course and a Capstone Alternative is that the former requires 45 hours of classes prior to working on the financial planning case study, whereas the latter can move directly into working on case study without the required classroom hours.

Online CFP Capstone course typically ranges from $695 to $1,175. See table below for more details.

| CFP Capstone course provider | Capstone Cost (US$) |

|---|---|

| The American College | $1,175 |

| Boston University | $995 |

| Bryant University / Boston Institute of Finance (BIF) | $695 |

| Butler University | $799 |

| California State University | $795 |

| College for Financial Planning (Kaplan) | $750-850 |

| North Carolina State University | $1,000 |

| Seton Hall University | $850 |

| University of Georgia | $995 |

| University of Texas | $1,000 |

| Dalton Education | $925 |

| Brett Danko | $950 |

| Zahn Associates | $695 |

4) CFP exam prep cost

Interestingly, unlike the CFA Program, the CFP Board doesn’t provide the curriculum or textbooks for CFP exam preparation.

Instead, they define the necessary body of knowledge through 8 key topic areas, leaving the specific learning materials to other approved institutions, e.g. college, universities or third party prep providers. This approach emphasizes a broader, more flexible pathways to learning the core concepts and becoming a Certified Financial Planner.

Given this, while it is possible (but tough) to pass the CFP exams on a standalone basis, we would highly recommend investing in third party study materials and/or review courses to provide structure, core study materials and practice exams to improve your chances of passing.

Many CFP candidates have found that a structured course or review session helps consolidate their knowledge and learn valuable exam techniques.

On average, third party CFP exam prep materials or review courses costs between $599-2,895 depending on the option chosen. Some CFP exam prep provider also offer discounts if you purchase the 7-coursework and exam review materials together.

Here is a quick summary of the main types of third party study material packages offered by each CFP prep provider. Note that even within these categories, some courses offer more than others and may not be comparable in terms of quality and/or pricing.

| CFP exam prep provider | Core (Self Study) | Premium (Self Study + Review Course) |

|---|---|---|

| Bryant University / Boston Institute of Finance (BIF) | $995 | $1,795 |

| Brett Danko | $1,395 | $2,195-$2,895 |

| College for Financial Planning (Kaplan) | $599 | $1,399 |

| Dalton Review | – | $1,495-$2,295 |

| Zahn Associates | – | $1,195 |

* Self study packages typically include study notes, recorded lectures, question bank and practice exams. Premium courses (online-based) include learning materials in self-study package, plus review sessions.

5) Other potential CFP certification costs: Travel, retake & rescheduling costs

CFP Board offers in-person and remotely proctored testing in the US. For those who go for in-person exam, you may need to travel some distance to a test center, and/or make accommodation arrangements to stay overnight nearby. These additional costs – if applicable – needs to be taken into account as well.

Another significant cost consideration would be exam retake fees and the associated study material costs. Each CFP exam retake costs another $825-1,025 in registration fees and perhaps another $325-$2,895 if you need to purchase the latest study materials. Worth mentioning that if you purchased study materials or review course with a “pass guarantee”, you only pay for the course/study materials once until you pass, subject to their terms and conditions.

Finally, there is also a standard $500 postponement fee applicable if you need to defer your original exam appointment.

6) CFP Board’s application & annual membership fees

Finally, if you have passed the CFP exam and met all the other requirements to be a Certified Financial Planner, you are eligible to apply for your CFP mark.

There would be a non-refundable $200 application fee plus an ongoing annual membership fee of $455 in order to use the CFP mark.

How to reduce CFP exam fees: Discounts, scholarships & free resources

- Register early: Signing up before Early registration deadline saves $100 off the Standard CFP registration fee of $925. We also recommend candidates to register early in order to have sufficient study time to maximize your pass chances. Refer to our latest key CFP exam dates here.

- Apply for CFP scholarships: These scholarships are offered by CFP Board or third parties and each have different eligibility requirements you need to check if you meet the criteria for application. The scholarships may cover the coursework, exam registration fee and/or review course.

- Use our Free Resources & Guides: We have many helpful and free resources to help you pass your CFP exams, such as our BA II Plus and HP12C epic calculator guides.

- Finally, check our Offers Page for CFP study material sale & discounts: Third party study materials can be a valuable time-saver and excellent, complementary study resource to the curriculum. It is worth checking out the CFP section of Offers page before purchasing.

Hope this helps with CFP certification cost budgeting. How much did you spend so far on your CFP exam preparations? Leave a comment below!

Meanwhile, you may find these related articles of interest: