The optimal CFA Level 3 study order uses the “sandwich method”: alternate challenging topics (Asset Allocation, Derivatives) with easier ones (Performance Measurement) to maintain momentum.

Study Core readings (65-70% weight) first, then your chosen Specialized Pathway (30-35% weight), finishing with Ethics. Your Pathway choice is locked at registration and cannot be changed after the 14-day cooling-off period, so research all three options before registering.

The best CFA Level 3 study order for 2026 is: Asset Allocation → Derivatives and Risk Management → Portfolio Construction → Performance Measurement → Your Specialized Pathway → Ethics. This sequence uses the “sandwich method” of alternating challenging and easier topics to maintain study momentum.

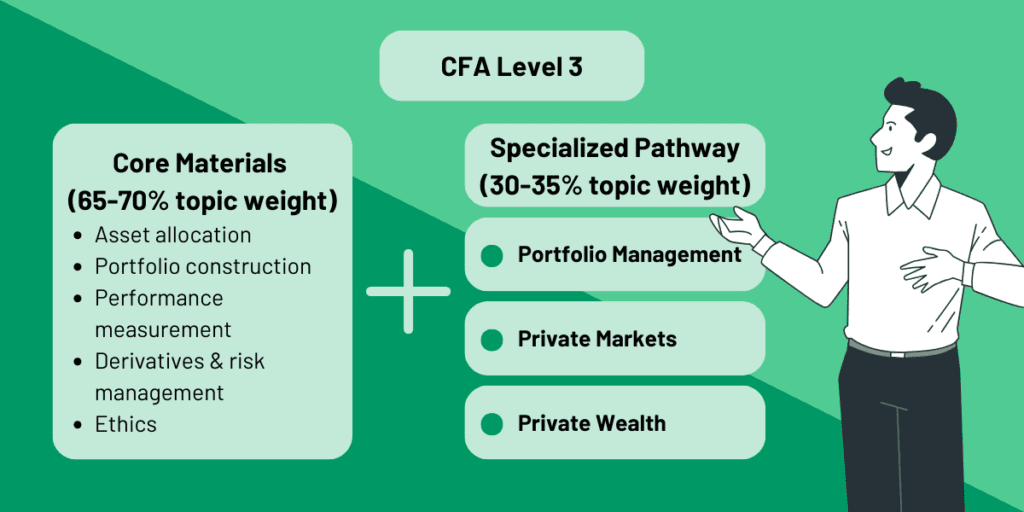

The 2026 Level 3 curriculum has a unique structure: 22 Core readings (65-70% exam weight) that all candidates must complete, plus one Specialized Pathway you select at registration from three options (30-35% exam weight): Portfolio Management, Private Markets, or Private Wealth. Your Pathway choice is locked once the 14-day registration cooling-off period expires and cannot be changed unless you withdraw and re-register. In total, you’ll study 29-30 readings across 6 topics.

This recommended order works regardless of which Pathway you selected at registration. The sequence emphasizes completing Core topics first (which inform all three Pathways) before diving into your specific Pathway material.

The improved 2026 curriculum flow means the optimal study sequence closely follows the natural curriculum order, with strategic adjustments: studying Derivatives earlier to leverage momentum, and completing all Core material before your Pathway to maximize foundation knowledge.

Which CFA Level 3 Specialized Pathway should you choose?

IMPORTANT: Your Pathway choice is made at registration and is locked after the 14-day cooling-off period. You cannot change Pathways mid-study unless you withdraw your registration and re-register (losing your registration fees). Research all three options thoroughly before registering.

Your Pathway choice (30-35% of the exam) should align with your career goals:

- Choose Portfolio Management if: You work in or aspire to institutional asset management, pension fund management, endowment management, or any role managing large pools of capital. This Pathway covers fixed income portfolio strategies, equity portfolio management, and risk management at an institutional scale. It’s the most popular choice and has the broadest career applicability across buy-side institutional roles.

- Choose Private Markets if: You work in or aspire to private equity, venture capital, private debt, real estate investment, or alternative asset management. This Pathway focuses on valuation of private companies, due diligence for private investments, and performance measurement for illiquid assets. Ideal for buy-side careers in alternatives, family offices with PE/VC exposure, or institutional alternatives teams.

- Choose Private Wealth if: You work in or aspire to private banking, wealth management, family office, or financial planning roles serving high-net-worth individuals. This Pathway covers tax planning, estate planning, concentrated stock positions, and behavioral finance in wealth management contexts. Best for client-facing advisory roles, independent RIAs, or UHNW client service.

Before you register, consider:

- Current career path: Which Pathway aligns with your existing role and expertise?

- Target career: If changing careers, which Pathway supports your goal industry?

- Genuine interest: You’ll study 80-100 hours of Pathway material – choose topics that engage you

- Professional overlap: Does your daily work expose you to Pathway concepts? Real-world experience aids exam performance.

Can I change my Pathway? Only within the 14-day cooling-off period after registration. After that, your only option is to withdraw your entire registration (forfeiting fees) and re-register with a different Pathway. If you fail the exam and retake, you CAN select a different Pathway for your next attempt during that new registration.

If you are not sure: Choose Portfolio Management. It has the broadest applicability, most overlap with traditional CFA content from Levels 1-2, and provides the most career optionality if you’re unsure of your long-term direction.

CFA Level 3 Specialized Pathways Comparison

| Pathway | Best For | Key Topics Covered | Study Hours | Career Applications |

|---|---|---|---|---|

| Portfolio Management | Institutional asset managers, pension fund managers, endowment managers | Fixed income strategies, equity portfolio management, institutional risk management, liability-driven investing | 80-100 hours (7 readings) | Most versatile – applicable to mutual funds, hedge funds, pension funds, endowments, insurance asset management |

| Private Markets | Private equity, VC, private debt, alternatives professionals | Private company valuation, buyout analysis, venture capital due diligence, real estate investment, private debt structures | 85-95 hours (8 readings, most content-heavy) | Buy-side alternatives careers, family offices with alternatives exposure, institutional alternatives allocators |

| Private Wealth | Wealth managers, private bankers, financial planners, family office advisors | Tax planning strategies, estate planning, concentrated stock positions, behavioral coaching, UHNW client management | 80-90 hours (8 readings) | Client-facing advisory roles, independent RIAs, private banking, multi-family offices |

Recommended Study Plan for CFA Level 3 Topics (2026’s Curriculum)

The good news is, CFA Institute confirmed that the design of the readings in each study session do not assume that the candidate approaches the study sessions in any particular order.

However, it is worth remembering that Level 3 is quite different from previous levels, as it has a more holistic approach with the additional complexity of 3 choices of Specialized Pathways to choose from.

Here’s my thought process and strategy on CFA Level 3 topic’s study order:

- Leaving Ethics last: Based on previous experience, this helped with last minute memorization and understanding of this rather dry but crucial topic. The key is to budget sufficient time and not rush through.

- Start strong with a challenging & important topic: Having had a look through the updated content this year, Asset Allocation seems like a good one to ease into studying as it is relatively highly weighted whilst still covering the basics.

- Alternating the difficult and easier topics: This “sandwich method” worked for me super well in previous levels to stay motivated. By alternating trickier and easier topics one after another, it gives a sense of progress and momentum throughout your studies. Crucially, it provides the opportunity to catchup time-wise if you’re lagging behind by blitzing through the lighter topics. Difficulty in this sense is judged not just by content, but more importantly the topic weight.

- Flow of topic: This is also important as the order of studying things matter. Basics have to be learned as a foundation to understanding other more advanced topics, and this has been taken into account as well.

In short, this led me to the following suggested CFA Level 3 study order for 2026’s curriculum:

| CFA Level 3 Topic Study Order | 2026’s Curriculum | Estimated study hours | Study timeline (6 months) | Strategic rationale |

|---|---|---|---|---|

| 1) Asset Allocation | Core: Readings 1-5 | 40-50 hours | Weeks 1-4 | High weight (15-20%), foundational for other topics, builds confidence |

| 2) Derivatives and Risk Management | Core: Readings 16-18 | 25-35 hours | Weeks 5-7 | Medium weight (5-10%), calculation-heavy, leverages early momentum |

| 3) Portfolio Construction | Core: Readings 6-12 | 60-80 hours | Weeks 8-15 | Largest topic (includes IPS for individual and institutional investors) |

| 4) Performance Measurement | Core: Readings 13-15 | 25-35 hours | Weeks 16-18 | Medium weight (includes GIPS), lighter topic provides momentum recovery |

| 5) Your Specialized Pathway of Choice | Choose one: Portfolio Mgmt, Private Markets, or Private Wealth (7-8 Readings) | 80-100 hours | Weeks 19-23 | Highest individual weight (30-35%), requires career-aligned focus |

| 6) Ethics | Core: Readings 19-22 | 35-45 hours | Weeks 19-26 (light review weeks 19-23, intensive weeks 24-26) | Medium-high weight (10-15%), best retention when studied last |

| Mock Exams & Review | All Core + One Pathway | 30-40 hours | Weeks 24-26 | 4-6 full mocks including Pathway sections to simulate exam conditions |

In this study order, we focus heavily on flow of topic and the ‘sandwich’ method to build momentum and maintain study pace. We have paired Asset Allocation and Derivatives together first to cover a significant amount of the curriculum quickly, then follow on with Portfolio Construction (heavier topic) and Performance Measurement (lighter topic) which flows together better as well. Then, we finish off with your choice of Specialized Pathway readings and Ethics.

CFA Institute has improved the overall flow of topics for 2026’s CFA Level 3 curriculum, so our suggested optimal flow of topics pretty much follows the natural curriculum’s order, with the exception of studying Derivatives and the Specialized Pathway earlier.

Below is a little commentary that applies to 2026’s CFA Level 3 readings:

1st: Asset Allocation

My strategy here is to start strong with Asset Allocation, simply because it is the introduction to many other topics, rather straightforward with one of the highest topic weight (15-20%). It’s a confidence builder!

Key concepts to focus on this topic area are:

- the various stages of business cycle and its relationship to inflation;

- the implications of inflation for cash, bonds, equity, and real estate returns;

- the effects of monetary and fiscal policy on business cycles;

- shape of the yield curve, and its relationship with monetary & fiscal policies;

- various methods of forecasting asset returns;

- asset allocation basics.

If time permits, these study sessions could benefit from making summary notes for future easy reference. Don’t spend too long a time though and move through these topics quickly for the next few big chapters.

2nd: Derivatives and Risk Management

If you’re new to finance, Derivatives & Currency Management are generally the more challenging chapters compared to Asset Allocation, despite having a smaller number of readings. Derivatives readings are also one of the more calculation-focused ones and very testable. So make sure you allocate more time to properly understand the Derivative concepts here.

3rd: Portfolio Construction

This topic has one of the larger amounts of readings, but don’t let that alarm you too much.

It has overviews to Fixed Income, Equity and Alternative Investments which are all updated from last year’s readings.

What you need to concentrate most of your time on is:

- Reading 9 (An Overview of Private Wealth Management) which focuses on private clients’ (including individual investor policy statement (IPS)).

There is also a large and key chapter on Institutional Investor’s IPS, which you should know well (Reading 10).

Trading Costs and Electronic Markets is relatively straightforward and are facts you need to learn.

Finally, the last reading consists of case studies, where you’ll learn how to apply your consolidated knowledge holistically. This is a good example of the feel of the exam style questions (although in the real exams you’ll just have mini versions of these case study).

4th: Performance Measurement

Performance evaluation is a critical part of the portfolio management process, make sure you are familiar with the ratios for measuring active management (e.g. Sharpe ratio, Treynor ratio, Information ratio, Appraisal ratio, Sortino ratio, Capture ratios).

Investor Manager selection reading is relatively straightforward, but do make sure you know these:

- upside capture ratio,

- downside capture ratio,

- maximum drawdown,

- drawdown duration,

- up/down capture,

- the three basic forms of performance-based fees and how to calculate them.

Interestingly, Global Investment Performance Standards (GIPS) is moved from Ethics here, and definitely worth spending time on. You’ll need to know the guidance on Standards I-VII and their application, as it is a popular area to test on.

6th: Your Choice of Specialized Pathway

Now we are more than halfway through the curriculum, hopefully you chose a topic you are deeply passionate about either personally and/or for your career! It is the biggest topic weight (30-35%), so plenty of focus needed here.

If you chose Portfolio Management, here are the key concepts you need to know:

- cash flow matching, duration matching, contingent immunization, rolldown return, rolling yield;

various durations (money duration, effective duration, key rate duration, modified duration, Macaulay duration, spread duration), convexity;

butterfly trade, condor trade;

various spreads (G-spread, I-spread, Z-spread, option-adjusted spread (OAS)). - various definitions of Value at Risks (e.g. VaR, CVaR, IVaR, MVaR).

Don’t forget the last case study too, it is a likely favorite in the constructed response portion.

If you chose Private Markets, here are the key concepts you should know:

- distributed to paid-in, residual value to paid-in, and total value to paid-in;

- calculations of management fees and carried interest;

- determine the value of a private equity investment for venture capital, growth equity, and buyout situations;

- financial ratios used in valuation of private debt investments;

- compare mezzanine debt and unitranche debt.

If you chose Private Wealth, here are the key concepts you should know:

- the typical fee, revenue, and compensation structures in PWM industry;

- unique characteristics of ultra-high-net-worth individuals vs other clients;

- tax efficiency of investment across various asset types;

- the concepts in Reading 6 (Advising the Wealthy) is prime testing material for constructed-response style questions. Make sure you’re familiar with it!

7th: Ethics

Saving the ‘best’ for last, Ethics constitutes 10-15% topic weight for the Level 3 exam.

If you have been organized, previous year’s notes may help save time here in your studies and you can focus on learning how to answer constructed response questions.

Remember guys, this is the final challenge. For those candidates who are deemed a borderline case, CFA Institute will factor in the candidate’s score on Ethics in its adjustments, so do make time and effort for this section as has strong influence on a pass or fail.

How to implement this Level 3 study order in your 6-month plan

- Months 1-2: Master Core foundations with “sandwich method” (Weeks 1-7)

Start with Asset Allocation (40-50 hours over 3-4 weeks), establishing the portfolio management framework. Then tackle Derivatives and Risk Management (25-35 hours over 2-3 weeks). This alternates a heavier topic (Asset Allocation) with a lighter one (Derivatives) to build momentum. - Months 3-4: Complete major Core topics (Weeks 8-18)

Portfolio Construction is the largest Core topic (60-80 hours over 7-8 weeks) covering both individual and institutional IPS. Follow it with Performance Measurement including GIPS (25-35 hours over 2-3 weeks), a lighter topic that provides recovery before the Pathway. - Week 12-15 Decision Point: Choose your Specialized Pathway

After completing Portfolio Construction, you’ll have built enough Core knowledge to make an informed Pathway decision. Consider: (1) Current and target career path, (2) Topics that genuinely interest you, (3) Overlap with your professional experience. Preview all three Pathway curricula before deciding. - Month 5: Deep dive into your chosen Pathway (Weeks 19-23)

Your Pathway is the single highest-weighted element at 30-35% of the exam (80-100 hours over 4-5 weeks). Start light Ethics review (15 minutes daily) while completing your Pathway material. This “dual-track” approach works because Ethics is independent of Pathway topics. - Month 6: Ethics intensive + Constructed response practice + Mocks (Weeks 24-26)

Weeks 24-26: Ethics intensive study (35-45 hours, approximately 12-15 hours per week). Take 4-6 full mock exams including Pathway-specific sections. Dedicate 50% of mock review time to constructed response questions – practice writing concise, command-word-focused answers. Ideally take the final week off work for intensive mock practice.

Critical for Level 3: Essay practice throughout

Unlike Levels 1 and 2, start practicing constructed response (essay) questions from Week 1. After each topic, write 5-10 full essay answers (not bullet points) within time limits. This skill takes months to develop – waiting until final month is too late.

Total timeline: 26 weeks (6 months) = 350-400 study hours.

Use the 300Hours free study planner to track Core topics, Pathway progress, and essay practice.

Frequently asked questions about CFA Level 3 study order

Hope you found the CFA Level 3 study order above a helpful boost to your Level 3 preparation. Best of luck for exams!

P.S – these resources may be helpful:

Will this be updated for L3 2025 ?

I have registered myself for CFA L3 Feb 25. Any suggestions for the study order for Feb 25 exam?

I took the CFA Level 3 exam in February 2024 and passed it! It’s worth bragging that it only took me about 27 days to study for it (I passed Level 2 in 2018). My study strategy was to first study Ethics as well as the GIPS section, which was fairly easy since we had studied Ethics in both Level I and Level II.

Also, for the rest of the sections, I alternated between the different sections through qualitative + quantitative approach, e.g. I studied Private Wealth Management (qualitative) first, then Fixed Income (quantitative), then Institutional Investors (qualitative), then Equity Investments (quantitative). I put economics at the end due to the fact that I hated it the most! Also, as my PhD thesis was on derivatives, I only spent about an afternoon skimming through it and doing the post-course questions.

The first round of studies took me 12 days. I spent the first round just briefly browsing at the practice questions to understand the basics of how to ask and answer them, and didn’t go through the questions carefully. I then started the second round of revision by doing about 1 or 2 session questions a day and writing the wrong questions in my notebook (hand writing, not typing, very important), which helped me to have a set of answers for similar questions I came across. In fact, when I did the questions for the first time, a lot of my knowledge was even forgotten and I had to go through my notes again to remember, but it doesn’t matter, as long as you can keep studying for 12 hours a day for a month, I’m sure you’ll be able to pass in the end!

12 hours a day for 27 days, means you put in 324 hours of studying hours.

Hi,

I am signed up for the level 3 exam in February 24, and I find it a little difficult to match the titles and/or numbers of the readings to what I find in the Learning Ecosystem (where there is different names and I cannot seem to find numbers).

I dont know if that is because it has been updated or whether I cannot match it, but I would really appreciate some help.

Hi Lena, do check out our CFA curriculum changes summary which I hope helps!

So “Currency Management” is part of the 5-10% weight which is listed as “Derivatives” by CFAI?

Yes.

No, “Currency Management” is part of Economics. You can verify by looking into the official LOS-document provided on CFAI’s website.

Thanks Sophie! I couldn’t agree more with placing Fixed Income readings towards the beginning of one’s Level III studies; Mark Meldrum suggested the same on his YouTube channel in September 2018 and I foolishly ignored his recommendation, studying the books in chronological order instead. Fixed Income was soul destroying…

You’re welcome Jasdev 🙂 Hope it helps your preparation this time and I’m glad you didn’t give up! Best of luck for Level 3, you’re nearly there!