Revolutionizing CFA exam study, Bloomberg Exam Prep provides a robust online platform for all three CFA Exam levels, featuring 10 full-length practice exams for comprehensive preparation.

About Bloomberg Exam Prep’s CFA Program

Bloomberg as a brand needs no introduction – the ubiquitous Bloomberg terminal has been commonplace since the 1980s.

Bloomberg Exam Prep’s CFA Program entered the CFA provider market in 2015 with a Level I online-first approach for CFA virtual learning. Since then, they have expanded its offerings to include CFA Levels II and III, as well as GMAT, GRE, LSAT, and PMP prep products.

Distinct from traditional textbook and lecture methods, Bloomberg’s programs offer adaptive, highly interactive learning experiences. Supported by expert CFA charterholders, these programs provide academic assistance and up to 10 full-length practice exams, comfortably more than what we recommend.

One of many other CFA prep providers

Salt Solutions is one of many CFA prep providers that CFA candidates choose. Here are some recommended partner providers for the CFA exams:

Bloomberg CFA Packages and Offers

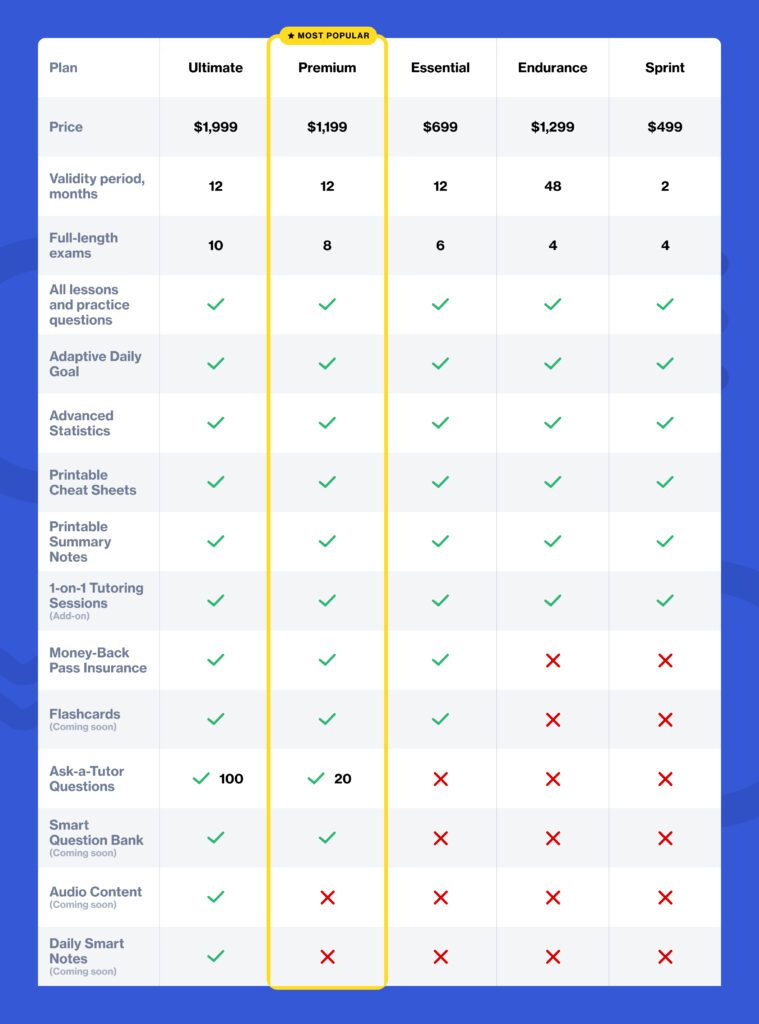

Bloomberg Exam Prep’s CFA study packages

Bloomberg offers a range of packages, ranging from $499 to $1,999. Their ‘Sprint’ package is only for 2 months, so for a full study program, you should only consider packages from Endurance onwards.

How do Bloomberg’s packages compare to other providers?

Bloomberg’s CFA packages are comparable on pricing, but reviews have been mixed. Some candidates like their adaptive approach, while others claim it doesn’t help and confuses their study approach.

The Pass Guarantee is a big part of Bloomberg’s offering. However, we would recommend reading the fine-print before deciding to purchase on that basis. We have a good summary of Bloomberg’s Pass Guarantee terms down below.

Need help choosing the right package for you?

Here are some recommended partner providers that we have reviewed:

Current CFA offers and deals

Here are some offers by CFA providers that we currently recommend – you can view the full list at our Offers page.

Bloomberg CFA Product Details

Study and Review Materials

Study Guide: the entire CFA curriculum in an adaptive learning platform

- Bloomberg’s adaptive online teaching platform transforms CFA study into an efficient, accessible experience. With no heavy textbooks, the platform is optimized for mobile devices, offering unparalleled convenience.

- Additionally, Bloomberg has a companion mobile app if you prefer to study there instead of on your mobile browser.

- The entire curriculum is covered by ‘micro-lessons’, followed by practice. Each micro-lesson covers a small concept, after which your understanding is checked by a few questions, and then you move on to the next concept.

- Interspersed within the learning, you will encounter practice sets so you stay sharp on concepts you have already learned.

- The adaptive algorithm that focuses on learning a variety of topics at once may not be everyone’s cup of tea, as some candidates prefer the usual structure of learning a topic in full before moving onto the next.

Cheat Sheets and Lesson Summaries

- Bloomberg Exam Prep provides printable cheat sheets filled with formulas and definitions — useful for reviewing in the last few days before the actual exam.

- Additionally, there are hundreds of pages of printable concept summaries covering the entire curriculum in a condensed form. They are ideal for skimming or reviewing by candidates who want to study offline or have a paper study guide.

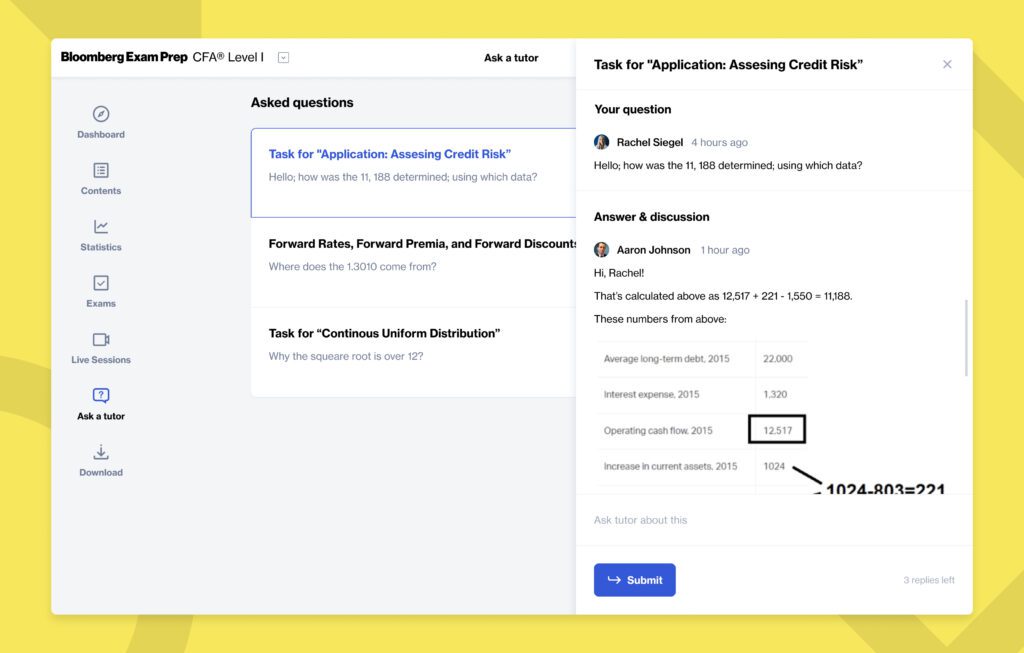

Online Tutoring

Ask-a-tutor questions

If you need more help understanding a concept or question, there’s always an ask-a-tutor help button in the interface. Clicking it allows you to send a quick question to Bloomberg Exam Prep’s CFA-chartered tutors, who will then get back to you, usually within one business day.

Private tutoring

Private tutor sessions with a CFA charterholder are available for purchase. They can be useful when you’re stuck with particular bits of the curriculum or would prefer a bit of live consultation when working through a particularly gnarly topic.

CFA providers with best-rated classes and courses

The quality of CFA instruction can vary a lot. In our candidate ratings, we’ve rated top CFA exam providers specifically by the quality of their CFA classes. You can check out their individual reviews and ratings here:

Practice Questions and Mock Exams

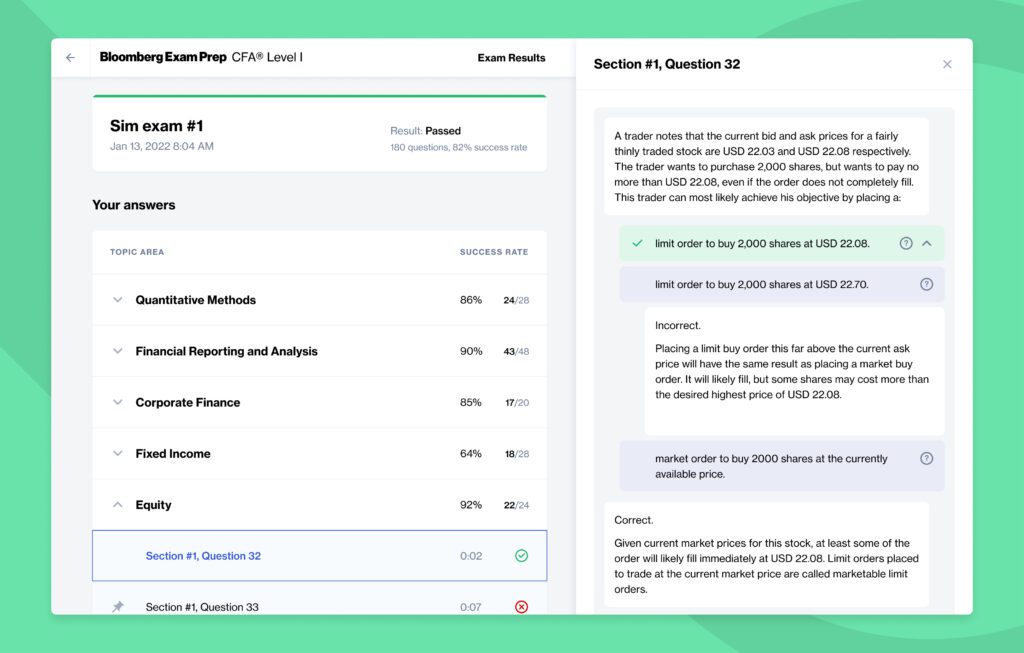

Up to 10 practice exams updated for the latest curriculum

- Right from the start, Bloomberg Exam Prep distinguished themselves from others by offering a maximum of 10 practice exams. We recommend that candidates complete about 4-7 exams, so their offering is definitely more than enough.

- The simulation exams are taken online by default. They can be paused in case you don’t have time to do an entire exam in one sitting.

- The exams are kept up-to-date with the current year’s curriculum. They are weighted to the official CFA Institute topic weightings and timed just like the actual exam.

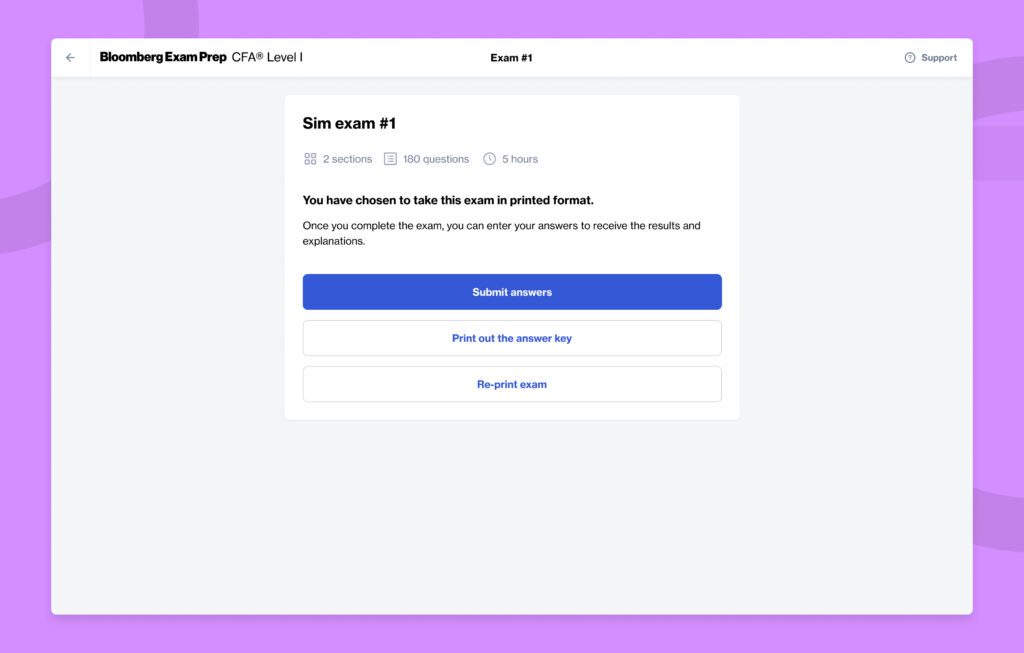

- Bloomberg’s practice exams are also available as printable PDFs for those who want to take the exams offline and submit their answers later.

- Regardless of how you take your exam, Bloomberg provides detailed feedback, not only for every question, but for every answer choice on every question. So not only will you know why the correct answer is correct, you will see why the incorrect answers are incorrect.

For a full guide to practice questions, see our Practice Questions guide.

17,000+ unique practice questions across the three levels

- Bloomberg doesn’t offer a “question bank” in the same sense as some of the other CFA providers do. Instead, questions are shown to candidates as they progress through the material and, of course, during the practice exams.

- There is a lot of practice, too—across the three levels Bloomberg’s courses have over 17,000 fully unique and exclusive practice questions.

- Each of those questions has an explanation for every answer choice.

- In Levels II and III, you will see their exam-level practice questions grouped together into item sets, each with a distinct vignette, just like on the actual exam.

For a full guide to practice questions, see our Practice Questions guide.

Online Platform and Apps

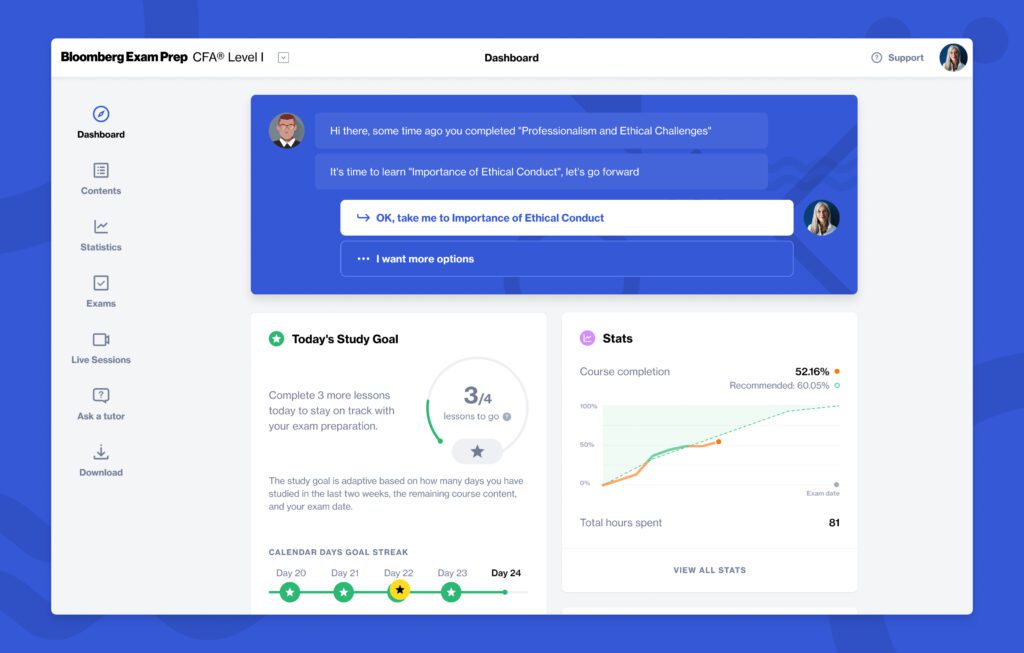

Student dashboard

- Their performance dashboard helps you navigate all of the features of the platform and provides you a place to quickly start your study every time you log in.

- It’s also the place to go for stats about your learning, including course completion, areas covered, time taken, and success rates.

- If you are worried about being ready for your exam date, just follow the daily study goal provided and stop fretting.

‘Next Recommended Topic’ functionality

- The adaptive learning process also recommends the next topic for you to learn based on your performance in the previous lessons.

- Bloomberg Exam Prep claims that by using the recommendation engine, candidates are likely to save dozens, if not more than a hundred, of hours compared to any other CFA prep approach.

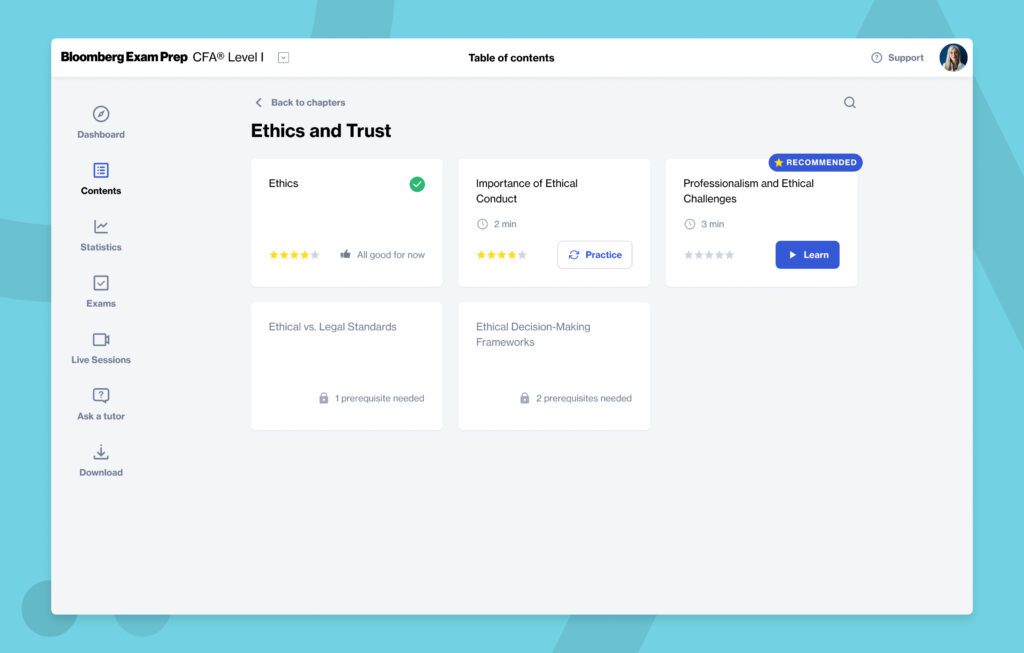

Contents

- The Contents tab lets you navigate through all of the topic areas and readings of the CFA Institute curriculum.

- A handy search feature allows you to find the concept you are looking for with ease.

- If you don’t want to learn what the recommender suggests, you can always choose the next activity yourself.

- You can review topics and readings already learned or see what’s coming up next.

- You can also fast-forward to advanced parts of the course by taking a quiz to unlock them.

CFA providers with the best-rated online platforms and apps

Depending on tech implementation, CFA online learning platforms and apps can range from smooth-sailing to utter crap. Most CFA providers with online-centric platforms offer a trial so you can see whether it suits you. If mobile app support is important to you, make sure you read our guide to CFA apps before deciding on a provider.

Here are some of our recommended partner providers – you can check out their specific ratings for online platforms and mobile apps:

Pass Guarantee

Bloomberg Exam Prep has a “100% money-back guarantee” subject to these conditions:

- If you don’t pass but completed 95% or more of their course, you can get your money back. This is a great study motivator for students to complete their study and be fully prepared for the exam.

- If you do not meet the conditions of the guarantee, you are still entitled to a complementary extension of your plan to study further.

Bloomberg CFA Prep Reviews and Ratings

| Overall rating (360) | 4.1 ★ |

| Level 1 | 4.2 ★ |

| Level 2 | 3.9 ★ |

| Level 3 | 3.6 ★ |

Joaquin Parra • Level 1

In my opinion and as an aspiring Chartered Financial Analyst (CFA), I understand the significance of choosing the right exam preparation tools. After extensive research, I opted for the CFA Bloomberg Exam Prep, and it exceeded my expectations in every way for level I and II (currently preparing).

Comprehensive Content:

The CFA Bloomberg Exam Prep offers a comprehensive and up-to-date study material that covers all three levels of the CFA exam and go far beyond. It aligns seamlessly with the latest CFA Institute curriculum, providing candidates with a solid foundation in key concepts and even gives you more tan you need with useful tool and content that not only helps to achieve to have a good chanfe to pass the exam, but give you material that are highly useful and applicable to the reality.

Interactive Learning:

One of its standout features is the interactive learning experience it offers. The platform boasts a vast array of practice questions, quizzes, and mock exams designed to mimic actual exam conditions. This not only helps gauge your progress but also familiarizes you with the exam format and time constraints, reducing anxiety on the big day. Furthermore, it help me a lot to minimize the stress of not knowing from where to start and planning, and thus with their very well structured interactive learning you would alleviate a loto f workload and focus 100% in the most important thing that is learning the content well to achieve the mastery necessary to give a good exam.

Personalized Learning:

The adaptive nature of the CFA Bloomberg Exam Prep tailors content to your specific strengths and weaknesses. It identifies areas requiring improvement and delivers targeted practice, optimizing your study time – an invaluable feature for busy professionals.

On-the-Go Study:

In today’s fast-paced world, flexibility is key. The platform’s mobile-friendly design allows you to study on the go. Whether you have a few minutes between meetings or a longer commute, you can make productive use of your time.

Expert Instruction:

Behind the CFA Bloomberg Exam Prep are industry experts with a deep understanding of the CFA curriculum. Their clear explanations make complex topics easy to grasp. Moreover, they are readily available to answer questions and provide guidance when needed.

Progress Tracking:

The platform’s analytics and performance tracking tools offer in-depth insights into your progress. This data-driven approach empowers you to make informed decisions about your study strategy. This helped me a lot to realize and cover my weaknesses.

Worthwile Investment:

Considering the depth and quality of the content, the CFA Bloomberg Exam Prep is competitively priced, offering excellent value for your investment in your future. Furthermore, I think that gives you much more tan necessary to prepare the exam, in my case I’ve experienced with practice questions that seems and effectively are much more complicated that the questions you would see in the exam, althought it could be overwhelming and stressful at first, once you made the effort to answer and review them you will realize that not only understand how to answer the topic questions but you Will also realice that you truly understand the concept and in many cases you Will figure it out how to use that knowledge in the real world leveraged by your experience.

In conclusion, In my humble opinion the CFA Bloomberg Exam Prep is a must-have resource for CFA candidates (at least for levels I and II). It equips you with the knowledge and skills needed to pass the CFA exams while instilling confidence in your abilities. With its adaptability, interactivity, and comprehensive content, it stands out as a top choice among CFA exam prep materials.

Embark on your CFA journey with the assurance that the CFA Bloomberg Exam Prep is one of the best tools available to achieve your goal. I wholeheartedly recommend it for CFA’s level I and II candidates combined with the official CFA mock exams provided by the CFA web platform for the last week before exam . Best of luck on your path to becoming a CFA charterholder!

Kind regards,

Joaquín N Parra Sotomayor,

CFA Level II Candidate.-

Write your own review>>

Joshua M. • Level 1

I am reviewing Bloomberg from the perspective of someone who teaches much of this material at a university. I am deeply familiar with much of the material, however, recognized several weak areas coming in to the BOK. I liked the concept of adaptive study materials that could save time. However, although I do appreciate the framework Bloomberg has used, it is severely lacking in multiple respects.

First, it is not nearly as adaptive as one might think. Just because I am highly skilled in Time Value of Money did not mean I got to shorten any of the coverage of that material. It only means that you won’t have to review it as often in the future once you have completed that topic.

Second, the lessons do not prepare one for the questions that assess the material. Each reading topic is broken into micro modules in a learning thread/tree, which makes segmenting study time nice. After completing a lesson there is an assessment. These are typically 3-6 questions in length. For the majority of the modules, the introductory lessons provide very general and overly simplified explanations. These lessons are followed by questions that assess learning topics which are several steps down in the learning thread. They seem to consistently test material before teaching it. In my experience, there are very few quantitative tools taught thoroughly or properly in the lessons themselves, however, they are assessed in full detail. If you answer these questions incorrectly, the system just prompts to give you more review questions in the future, however, it never actually teaches the content. If you answer them correctly, it does not allow you skip over any content (not adaptive). For students that do not know the fundamentals (especially the quantitative), these lessons will not prepare you and you will have to learn it somewhere else. For students that already know the fundamentals, you have to suffer through all the lessons because they are not adaptive, as noted in point one above.

Third, the lessons do not really save time. I have had to reference the original curriculum multiple times do to material not being covered in the lessons. I bought the study program to help me review and save time learning the topics I am less familiar. However, I am not saving any time, wasting time in topics I know and not learning the topics that need to be strengthened. Also, the time calculator that measures your time in the curriculum is not accurate. I have spent 3 hours on lessons and receive credit for 1 hour on numerous occasions. I don’t know how they determine the time count.

Forth, there are a significant number of issues in the content itself. I have encountered numerous typos in the lessons. I have encountered fewer typos in the questions, however, many questions are simply inappropriate. Many questions require additional context that is needed, otherwise two answers could be correct. The context is given in the solution, of course. However, this can be frustrating. Most of the review questions (after you have completed an entire module) are pretty good. However, the reading assessment questions that accompany the micro modules in the learning thread/tree include strange and inappropriate questions that are either overly simplistic or overly complicated (such as using double negatives in wording). I have encountered questions that are simply incorrect and there is no way to report them that I am aware of. I also encountered review questions from other lessons than the one being assessed, which is just annoying.

For me, I was able to do ok because I was already familiar with the majority of the BOK. However, for people learning the material without a background, Bloomberg is a mistake. I especially wanted this review for topics such as the Ethics and GIPS, but Bloomberg left me just having to study the original curriculum and spending more time instead of less. I don’t think this will save you any time in studying, but it is a nice way to break apart the curriculum into pieces. I am willing to forgive the many typos in the lessons, but my biggest complaint is the disconnect between lessons and assessments. Perhaps Level 2 is better, but it is not worth the time and cost risk for me to find out.

Write your own review>>

bschrijen • Level 1

In the world of Finance, the concept of Value hinges on a complex interplay of ‘Return,’ divided by ‘Risk,’ and raised to the power of ‘Time’ — three influential factors that each leave their unique mark on the journey. For many CFA candidates, Time is a precious commodity, and finding a way to optimize Return or mitigate Risk becomes paramount. With a fixed syllabus prescribed by the CFA Institute, Return remains relatively constant, leaving Risk as the primary variable. This Risk encompasses failing the exam, disengagement, demotivation and straying off course.

As I embarked on my journey to become a CFA candidate, my primary goal was therefore to find a way to overcome these inherent Risks. It was during this quest that I stumbled upon Bloomberg Exam Prep. The platform ingeniously transforms the learning experience by gamifying the process, breaking down the syllabus into manageable portions. This turns the daily grind into a joyful journey, ensuring I stayed engaged and motivated.

Another noteworthy aspect of Bloomberg Exam Prep was its ability to provide tailored study plans that adapt to individual performance, thus helping learners maintain focus and avoid straying off the intended path. Additionally, the platform’s mobile-friendly nature of Bloomberg Exam Prep enabled me to seamlessly integrate my studies into their daily routines, whether during breaks or commutes, ensuring a consistent study regimen.

An unforeseen challenge was the solitude of the CFA journey, but Bloomberg Exam Prep’s robust support system countered this isolation. Prompt responses from familiar support team members fostered a sense of community, transforming the solitary path into a collaborative endeavor.

In this regard, my personal experience with Bloomberg Exam Prep was excellent. I successfully prepared for both Level I and Level II CFA exams with approximately 200 hours of study each (not including mock exams), instead of the recommended 300 hours. The outcome was not only passing both levels on the first attempt but often doing so with a comfortable margin, thanks to the platform’s effectiveness.

In conclusion, overcoming the Risks inherent in the journey of pursuing the CFA program while managing daily commitments demands unwavering Discipline. Bloomberg Exam Prep played a crucial role in reinforcing this Discipline, a factor that even those well-versed in finance may occasionally overlook. Throughout my journey, it proved to be a dependable ally, enabling me to prioritize long-term goals over short-term gains and effectively manage the Risks that came my way.

Write your own review>>

bschrijen • Level 1

In the world of Finance, the concept of Value hinges on a complex interplay of ‘Return,’ divided by ‘Risk’ raised to the power of ‘Time’ — three influential factors that each leave their unique mark on the journey. For many CFA candidates, Time is a precious commodity, and finding a way to optimize Return or mitigate Risk becomes paramount. With a fixed syllabus prescribed by the CFA Institute, Return remains relatively constant, leaving Risk as the primary variable. This Risk encompasses failing the exam, disengagement, demotivation and straying off course.

As I embarked on my journey to become a CFA candidate, my primary goal was therefore to find a way to overcome these inherent Risks. It was during this quest that I stumbled upon Bloomberg Exam Prep. The platform ingeniously transforms the learning experience by gamifying the process, breaking down the syllabus into manageable portions. This turns the daily grind into a joyful journey, ensuring I stayed engaged and motivated.

Another noteworthy aspect of Bloomberg Exam Prep was its ability to provide tailored study plans that adapt to individual performance, thus helping learners maintain focus and avoid straying off the intended path. Additionally, the platform’s mobile-friendly nature of Bloomberg Exam Prep enabled me to seamlessly integrate my studies into their daily routines, whether during breaks or commutes, ensuring a consistent study regimen.

An unforeseen challenge was the solitude of the CFA journey, but Bloomberg Exam Prep’s robust support system countered this isolation. Prompt responses from familiar support team members fostered a sense of community, transforming the solitary path into a collaborative endeavor.

In this regard, my personal experience with Bloomberg Exam Prep was excellent. I successfully prepared for both Level I and Level II CFA exams with approximately 200 hours of study each (not including mock exams), instead of the recommended 300 hours. The outcome was not only passing both levels on the first attempt but often doing so with a comfortable margin, thanks to the platform’s effectiveness.

In conclusion, overcoming the Risks inherent in the journey of pursuing the CFA program while managing daily commitments demands unwavering Discipline. Bloomberg Exam Prep played a crucial role in reinforcing this Discipline, a factor that even those well-versed in finance may occasionally overlook. Throughout my journey, it proved to be a dependable ally, enabling me to prioritize long-term goals over short-term gains and effectively manage the Risks that came my way.

Write your own review>>

Bradley Stevens • Level 1

I started using the Bloomberg CFA Prep course in the summer of 2020 while in college and had a positive experience with the online modules. This year, I am now a CFA charterholder. The only two study materials I used were the Bloomberg CFA Prep program and the CFAI practice questions that came with the exam registration.

I studied and worked in finance, so my baseline knowledge helped me to quickly breeze through Level I. That said, the Bloomberg modules are so quick (usually under 10 min per sub-topic) and simple to click through, that it made it easy to budget studying throughout the week. For me, the hardest part of completing the CFA program was staying on track (this was a 3 year endeavor while graduating, moving, and starting two different jobs). The gamification of the Bloomberg program and the practice questions at the end of each topic helped me to reinforce my understanding of the material. Also, I felt that Bloomberg sufficiently condensed the material into the main points, which allowed me to study less than the typical 300 hours per exam that you often read about on the web. For someone with a very busy day job, efficiency was paramount and I think Bloomberg is one of the best providers for return on time invested.

As part of my study plan, I would usually copy the summary takeaways at the end of each module as well any formulas that may be worth remembering. Additionally, I would add any practice questions that I found difficult to my notes and would later review just prior to my exam. I found that the Bloomberg practice questions closely resembled the CFAI ones and I was routinely getting a high percentage correct. Despite the brevity of some of the modules, the material was precise and worthwhile. I personally didn’t utilize the online tutors, but that is an added benefit. Combined with the practice exams, I consider the Bloomberg CFA Prep program a reliable and cost/time-efficient way of going through the lengthy CFA materials. The gamification and quick feedback loops make the program fun and rewarding. At the end of the day, the program sets up each candidate on a path to success. I would recommend using the Bloomberg CFA Prep course as your test prep provider.

Write your own review>>

Raj • Level 1

Likes – This was one of the best interactive courses I have used. It was fun to learn the content due to the way the learning sections were explained and presented and the topic questions were really useful to recap the topics just learned. For Level 1, the topic explanation was brilliant, although there were minor errors which you could clarify with the Tutors through Ask-a-Tutor option. The Mock exam questions for both Levels were outstanding, profound and very detailed and stressed the importance of learning the topic areas rather than memorizing which was critical to be successful throughout the CFA journey, although the difficulty level was probably two notches more than CFA Mock questions and at times lengthier than needed for Level 1 in particular. The tutors were knowledgeable and proficient with their explanations and felt free to give the Ask-a-tutor back for any mistakes being pointed out by me which was helpful to ask further relevant questions. The All lessons summary download and the Cheat Sheet were exceptional. The recommendation by the AI tutor based on the progress was quite good although at times it would present with questions on topics not yet taught and there was also an option to choose topics based on one’s interest and learn. The learning progress bar was simple but intuitive and would urge the reader to do more to increase the bar.

Dislikes – the question explanations didn’t include the corresponding learning outcome statements and there was no option to recheck/redo the questions (except for the Mocks which you can review as many times as you need but Mocks cannot be tried again online but it seems one can download as PDF but I never tried this option), although this didn’t bother me but some might find the LOS link useful.

I’d definitely recommend this course to anyone pursuing CFA and this will work as a great summary for Level 1 & 2 and one can keep on reading as long as possible due to the way it teaches. The Mock questions stress the importance of understanding the concepts rather than relying on one’s Rote skills (Rote skills will not help in CFA exams) so I would recommend reading the material and the CFAI content if possible well before doing the BBG Mocks to get the most out of this course.

Write your own review>>

Pavel V • Level 1

Material is much easier to digest than the handbooks or official material. Interactive app did a good job of keeping track of progress and splitting large topics into smaller lessons.

Mock exams, at least for level 1, are biased towards the computational questions(majority of questions required calculator), which is different from the actual exam. That affects the timing of the mock exams, which was issue with all 6 of my Bloomberg mocks, while on actual exam I finished 15 minutes earlier. I recommend mocks from CFA institute, as they were more representative.

I think this is the best provider to study the curriculum. I spend 230 hrs with Bloomberg and passed from the first attempt. So I am using them to prepare for level 2.

Write your own review>>

Gongerjim • Level 1

I am an experienced professional and am fairly confident I should pass the CFA. I chose BloombergPrep because I felt their money back guarantee signalled confidence in the material.

I’ve actually been shocked by the low quality of the materials. They are full of errors – I have highlighted whole lessons that teach the wrong thing! Mock questions are very different from the actual CFA questions.

Good luck if you are trying to learn this material the first time from the classes – you won’t have a chance. The adaptive learning software tests you on concepts they haven’t taught you. A junior colleague of mine completed the course and fairly predictably failed.

I don’t normally post negative reviews but in my view this is an expensive waste of money and time and I would like to prevent other candidates from making the same mistake.

Write your own review>>

Anonymous Moose • Level 1

The Bloomberg Exam Prep service has a dysfunctional AI, an incorrect time tracker, and errors abound (both spelling and grammar and just straight up incorrect answers that conflicted with the CFA textbook).

Additionally, a lot of the questions they provided would have no chance of showing up on the exam because they were way too long/ esoteric.

I’m not saying you can’t pass using this material, I’m just saying you’ll a) be a lot happier, b) save a lot of time, and c) save your money, if you even just use the CFA Institute provided material instead.

0/10 I would not ever use them again, and I will spend the rest of my working years warning anyone else I know taking the CFA exam not to use them.

Write your own review>>

Richard L. • Level 1

I used BloombergPrep to prepare for my CFA Level I and found the program to be crucial in my success.

The user-friendly interface and algorithm used to unlock various sections of the study plan based on personal preparedness are very effective. As a working professional (working long hours), it was much easier to plan and format my study based on the outline and structure of BloombergPrep’s program.

I spent 90% of my time studying the BloombergPrep program, and the remaining 10% making flash cards to refresh formulas and key concepts. There was minimal time spent studying uses other resources, or reading the official CFA prep material and books.

Level I was a success and I have made a bundle purchase of Level II and Level III to prepare me for the next exams. Also, customer service are very helpful in resolving issues.

Write your own review>>

NIck • Level 1

Do not, at all costs, spend money on this. Total scam, I feel victim to purchasing such software due to fake positive reviews online, the questions are poorly worded, the AI is terrible and some of the answers they provide are flat out wrong compared to materials taught by the CFA institute. Avoid spending money with Bloomberg even if it is your last hope

Write your own review>>

mrbones92 • Level 1

The content is good, but the AI software is quite frustrating. After you have finished a section and you get a few questions wrong further down the line, it resets those topics, undoing your progress. I also think the instructions are too brief as they assume you already know a lot. Therefore a printed curriculum is a must have. I expected more from Bloomberg to be honest.

Write your own review>>

TJ Hooker • Level 1

Bloomberg uses an excellent format with regular questions recapping the topics you’ve learned as you go along. The topics are broken down into ‘micro’ topics which are easy to work though. Also there are a lot of questions as you go along. It’s a great tool.

Write your own review>>

Nikolay • Level 1

Makes you feel ready for the exam during the course of study, however when trying practice questions on CFA website you will eventually find yourself unprepared for the real exam.

Write your own review>>

tolly66 • Level 1

Bloomberg is new to the CFA game, and it shows as there were some bugs with their “Ask-A-Tutor” feature and their predictive analysis. However, the staff quickly replied to all concerns and credited my account accordingly. The practice questions and tests were definitely a HUGE reason why I passed Level 1.

Write your own review>>

Zeid • Level 1

I have used Bloomberg prep for the Level 1 and I aced the exam. I felt like the actual exam was way easier than Bloomberg’s mocks. I will definitely use their services for Level 2.

Write your own review>>

ComplianceGuy • Level 1

The constant testing of knowledge through questions throughout the learning stage helps to ensure that you have grasped the concept before progressing to the next stage

Write your own review>>

Naanull • Level 1

I believe that the format for learning is actually quite good. I also believe that the format needs to improve. As it stands it is a great compliment and a good preparation for the exam, however, as a stand alone it is not sufficient.

Write your own review>>

Oliviakmp • Level 1

Useful online learning, but lacking some basic information. Would use as a supplement but not as a main prep provider.

Write your own review>>

Zentra17 • Level 1

Possibility to reset progress from modules would be great. Currently it only gives the possibility to reset the entire course.

Write your own review>>

far_w • Level 1

Excellent CFA preparation tool. Definitely a must-try. You will find the teaching of concepts as small concise nuggets of information very effective.

Write your own review>>

Penny E • Level 1

Bloomberg is good for practice questions. You still need to read the CFA Institute books!

Write your own review>>

Lance • Level 1

Their CFA preparation materials are plentiful, especially simulation exams. I found the guidance and recommendations very relevant.

Write your own review>>

Quanr • Level 1

Good and straight-to-the-point material. A great time saver.

Write your own review>>

Dirk C • Level 1

Quite decent. Liked the adaptive nature of the course construct.

Write your own review>>

tolly66 • Level 1

According to their timer, I have put in 103 hours of study time already (with an additional 100 hours with other materials). I have taken a practice exam and asked multiple questions from their tutor. Also, I initially attempted to study straight from the CFA Curriculum (CFA Books), so I have a decent comparison. I am studying for Level 1; I don’t have any information on Level 2 or 3 for Bloomberg’s software.

Pros:

- Unlike the CFA Institute books, the Bloomberg software won’t put you to sleep and is great at explaining points of confusion. When I first started with the CFA Institute books, I was having a difficult time with Economics, and the books were not helping. I moved on to other materials and hoped to revisit Economics at a later date. When I purchased the Bloomberg software, Economics was the first subject I went to, and the software made comprehending the lessons easier. Bloomberg achieves this through their question-based approach to teaching materials, which forces users to think about questions and materials and their machine-learning software, which guides you through different lessons based on your previous performance.

- The software also gives you “Practice Questions” within each concept, usually in blocks of 10, which is useful for building endurance. Combined with their machine-learning software, this feature strengthens knowledge retention, as it will direct back to previous readings, to check if you remember key lessons.

- Bloomberg has an “Ask-a-Tutor” feature, which allows you to send questions to CFA charter holders. The response day is usually 24 business hours, which is a fast turnaround.

- The pass guarantee shows that Bloomberg stands behind their product. Also, the 95% completeness clause is an outstanding motivator for test-takers.

- The dashboard shows you the percentage of correct answers within each reading, which helps pinpoint weaknesses and areas of improvement. Also, the dashboard shows how much time has been spent on each topic.

- The support team is quick to respond to software problems and are quite helpful.

- The practice exams have been properly weighted, and it shows how long it took a user to answer each question. You also have the option of printing the exam and inputting your answers manually.

Cons:

- The direction seems completely random at times. When using the CFA Institute books, I keep an organized notebook, arranged by reading/topic. With the Bloomberg software, it will direct you to another topic, while you’re in the thick of a current one. Thankful, you do have the option to ignore the recommendation and stay on your desired topic. You’ll need multiple notebooks to keep all the information organized.

- There were a few questions that had incorrect answers, which I have brought to the support team’s attention. They have taken care of those.

- Sometimes, the “Ask-A-Tutor” feature does not give the amount of detail needed to settle confusing information. You are allowed to ask two follow-up questions without losing additional tutor requests (for my level, I have 20 “Ask-A-Tutor” questions). This shortcoming is probably due to the shortage of instructors during the Bloomberg Prep banner. For the CFA Level I, they only have one tutor available. I believe they will expand their tutoring staff shortly.

Conclusion: You can tell that Bloomberg is a newcomer in the CFA Exam Prep market, but they are doing an adequate job of helping users learn the material. In addition to Bloomberg, I receive Kaplan’s “CFA Question of the Day” in my inbox. Since I started using Bloomberg, my accuracy on Kaplan’s questions improved because I felt more comfortable analyzing the information in each question and using the mental evaluation system the software forced me to develop internally. I recently took a practice exam, and I scored 65%, which is close to passing, and I haven’t even started with the ethics part of my study material. The Bloomberg software has made me feel more comfortable facing the challenging questions that the CFA will throw at me five weeks from now.

Write your own review>>

Innis D • Level 1

Bloombergprep has unique software that guides me from the start to finish all the material including all the practice from learnt material for retention purpose. This old-new approach has some features that worth noted as below:

- You’re supposed to follow the software’s guidance to get through all the material needed and practice questions. For some, this method may work, but maybe due to my age, humble background or other reasons, I cannot optimally utilize this feature, I felt that what I learnt is scattered around in my brain. I have some difficulties relating one topic with another, and I feel comfortable if I can finish one whole topic one-by-one. But with the software throwing me multiple topics simultaneously and adding practice questions from previous material in between… it’s a highly stimulating and interesting way of learning I presume, but it’s just not suitable for me.

- The learning process is done with Question and Answer sessions. It’s like you have your personal tutor with you, explaining everything and asking questions to stimulate your curiosity. It’s quite fun as you will not feel alone while you study, and get to practice answering questions as you go along. The end-of-module practice questions are also a big help to apply what I have learnt.

- I can manually pick what I want to learn, and have a study sequence according to my own preferences by picking whatever topics available that I want to learn at a time

- You need a fast internet connection. With my moderate internet connection, opening the Bloomberg page/module takes quite some time. Added up over months, this is a lot of wasted idle time. I found that if my internet connection was slow, I tended to just give up studying and do something else instead. If your country having a good stable internet connection, it would not be a problem.

- They have a tutor that can answer questions (basic package gets you 20 ask-a-tutor questions). In theory, this takes care of any questions or clarifications you need as you work through the material, but a lot of my questions were about typos or errors in the material. I ended up getting more credits simply because I wasn’t really using my questions – I was helping them debug! Good people behind the platform, but as this is a new product, some minor errors should be expected.

- The package includes 6 full exams. Plenty of exam simulations is always good for practice. I used 4 of them and am quite satisfied with the questions’ quality and the answers provided.

- I ended up spending more than 300 hours using this platform, but mostly due to the waiting time of opening a module/page. I will recommend this provider to younger people who love to learn from their iPad/notebook with a good internet connection.

- Good value for money too!

Write your own review>>

davidsedrak • Level 1

I signed up for Bloomberg’s CFA Exam Prep back in February and using them has helped me focus significantly.

I was studying from Kaplan Schweser material but realized that there was too much material. It became overwhelming to cover.

Bloomberg is all algorithmic and tests you on your weaknesses to help you pass. They offer guarantees on passing for all 3 of their packages and it’s all online based. I’m able to study everywhere, on the bus on my way to work, whenever I’m waiting around, or at my desk. I highly recommend Bloomberg for whoever is looking to save some time.

I’m 78% through the curriculum and have only spent 112 hours rather than the usual 300.

Write your own review>>

Joaquin Parra • Level 2

In my opinion and as an aspiring Chartered Financial Analyst (CFA), I understand the significance of choosing the right exam preparation tools. After extensive research, I opted for the CFA Bloomberg Exam Prep, and it exceeded my expectations in every way for level I and II (currently preparing).

Comprehensive Content:

The CFA Bloomberg Exam Prep offers a comprehensive and up-to-date study material that covers all three levels of the CFA exam and go far beyond. It aligns seamlessly with the latest CFA Institute curriculum, providing candidates with a solid foundation in key concepts and even gives you more tan you need with useful tool and content that not only helps to achieve to have a good chanfe to pass the exam, but give you material that are highly useful and applicable to the reality.

Interactive Learning:

One of its standout features is the interactive learning experience it offers. The platform boasts a vast array of practice questions, quizzes, and mock exams designed to mimic actual exam conditions. This not only helps gauge your progress but also familiarizes you with the exam format and time constraints, reducing anxiety on the big day. Furthermore, it help me a lot to minimize the stress of not knowing from where to start and planning, and thus with their very well structured interactive learning you would alleviate a loto f workload and focus 100% in the most important thing that is learning the content well to achieve the mastery necessary to give a good exam.

Personalized Learning:

The adaptive nature of the CFA Bloomberg Exam Prep tailors content to your specific strengths and weaknesses. It identifies areas requiring improvement and delivers targeted practice, optimizing your study time – an invaluable feature for busy professionals.

On-the-Go Study:

In today’s fast-paced world, flexibility is key. The platform’s mobile-friendly design allows you to study on the go. Whether you have a few minutes between meetings or a longer commute, you can make productive use of your time.

Expert Instruction:

Behind the CFA Bloomberg Exam Prep are industry experts with a deep understanding of the CFA curriculum. Their clear explanations make complex topics easy to grasp. Moreover, they are readily available to answer questions and provide guidance when needed.

Progress Tracking:

The platform’s analytics and performance tracking tools offer in-depth insights into your progress. This data-driven approach empowers you to make informed decisions about your study strategy. This helped me a lot to realize and cover my weaknesses.

Worthwile Investment:

Considering the depth and quality of the content, the CFA Bloomberg Exam Prep is competitively priced, offering excellent value for your investment in your future. Furthermore, I think that gives you much more tan necessary to prepare the exam, in my case I’ve experienced with practice questions that seems and effectively are much more complicated that the questions you would see in the exam, althought it could be overwhelming and stressful at first, once you made the effort to answer and review them you will realize that not only understand how to answer the topic questions but you Will also realice that you truly understand the concept and in many cases you Will figure it out how to use that knowledge in the real world leveraged by your experience.

In conclusion, In my humble opinion the CFA Bloomberg Exam Prep is a must-have resource for CFA candidates (at least for levels I and II). It equips you with the knowledge and skills needed to pass the CFA exams while instilling confidence in your abilities. With its adaptability, interactivity, and comprehensive content, it stands out as a top choice among CFA exam prep materials.

Embark on your CFA journey with the assurance that the CFA Bloomberg Exam Prep is one of the best tools available to achieve your goal. I wholeheartedly recommend it for CFA’s level I and II candidates combined with the official CFA mock exams provided by the CFA web platform for the last week before exam . Best of luck on your path to becoming a CFA charterholder!

Kind regards,

Joaquín N Parra Sotomayor,

CFA Level II Candidate.-

Write your own review>>

KPerry1911 • Level 2

Bloomberg CFA Prep Review

I am writing this review to share my experience with Bloomberg’s CFA Prep program since it helped me finally get over the Level 2 hurdle. Bloomberg prep does offer a free trial, like other providers, but my goal is to provide the perspective of someone who used it and was able to pass Level 2 and currently using it in my prep for Level 3 in Feb ’24. I passed Level 2 after multiple attempts and decided to try a different approach by using Bloomberg Prep, given the question intensive format. In this review, I will discuss the program’s format, features, and its effectiveness in helping me prepare for my CFA exams.

Initially, I was skeptical of Bloomberg Prep’s format, which consists of short lessons followed by questions. However, I decided to give it another try and noticed significant improvements in the organization and structure of the program, since a previous trial several years ago. The current format is more organized, with clearly defined subtopics, and learners have the option to choose between learning objectives and practice questions for specific topics. This micro-lesson format allows for flexible studying, accommodating limited time availability.

One standout feature is the dashboard that tracks progress and sets daily goals to complete the material by a specific target date. The dashboard also provides performance analysis in various topic areas and assesses how well users are doing on exam-level questions. While I expressed concerns about whether all Learning Outcome Statements (LOS’s) were covered in the content, I received assurance from the providers that all LOS’s are addressed in the micro-lessons.

Aside from lessons and practice questions, Bloomberg Prep offers additional resources, including practice exams, Ask a Tutor questions, and the ability to report errors in the material. The providers are prompt in addressing inquiries. While there are minor errors, like those found in materials from other providers, I have not discovered anything that would significantly impact my learning experience.

I felt like the mock exams provided by Bloomberg Prep were representative of the actual CFA Level 2 exam. However, once time is up, you are unable to complete any additional questions, just like the real thing. Considering that this is practice I suggest an improvement where learners could complete the exam even after the time limit expires, allowing for more completed practice. Despite this, I was satisfied with the Level 2 Mocks.

While Bloomberg CFA Prep played a role in my success, it was not the sole factor. It was very instrumental in testing understanding of concepts, which is crucial for success at Levels 2 & 3. This may be particularly valuable for those repeating Level 2 who may have already covered all topics and need more in-depth review. As I progress through the Level 3 material, the program’s mixed question format, including constructed response questions with feedback, helps reinforce comprehension.

In conclusion, I recommend Bloomberg CFA Prep for those preparing for CFA Level 2, particularly for repeat takers seeking a tool to assess their understanding. Utilizing mock exams, including those from Bloomberg Prep, CFA Institute, and other sources, is a crucial part of study strategy. Best wishes and success on your exams!

Write your own review>>

bschrijen • Level 2

In the world of Finance, the concept of Value hinges on a complex interplay of ‘Return,’ divided by ‘Risk’ raised to the power of ‘Time’ — three influential factors that each leave their unique mark on the journey. For many CFA candidates, Time is a precious commodity, and finding a way to optimize Return or mitigate Risk becomes paramount. With a fixed syllabus prescribed by the CFA Institute, Return remains relatively constant, leaving Risk as the primary variable. This Risk encompasses failing the exam, disengagement, demotivation and straying off course.

As I embarked on my journey to become a CFA candidate, my primary goal was therefore to find a way to overcome these inherent Risks. It was during this quest that I stumbled upon Bloomberg Exam Prep. The platform ingeniously transforms the learning experience by gamifying the process, breaking down the syllabus into manageable portions. This turns the daily grind into a joyful journey, ensuring I stayed engaged and motivated.

Another noteworthy aspect of Bloomberg Exam Prep was its ability to provide tailored study plans that adapt to individual performance, thus helping learners maintain focus and avoid straying off the intended path. Additionally, the platform’s mobile-friendly nature of Bloomberg Exam Prep enabled me to seamlessly integrate my studies into their daily routines, whether during breaks or commutes, ensuring a consistent study regimen.

An unforeseen challenge was the solitude of the CFA journey, but Bloomberg Exam Prep’s robust support system countered this isolation. Prompt responses from familiar support team members fostered a sense of community, transforming the solitary path into a collaborative endeavor.

In this regard, my personal experience with Bloomberg Exam Prep was excellent. I successfully prepared for both Level I and Level II CFA exams with approximately 200 hours of study each (not including mock exams), instead of the recommended 300 hours. The outcome was not only passing both levels on the first attempt but often doing so with a comfortable margin, thanks to the platform’s effectiveness.

In conclusion, overcoming the Risks inherent in the journey of pursuing the CFA program while managing daily commitments demands unwavering Discipline. Bloomberg Exam Prep played a crucial role in reinforcing this Discipline, a factor that even those well-versed in finance may occasionally overlook. Throughout my journey, it proved to be a dependable ally, enabling me to prioritize long-term goals over short-term gains and effectively manage the Risks that came my way.

Write your own review>>

Bradley Stevens • Level 2

I started using the Bloomberg CFA Prep course in the summer of 2020 while in college and had a positive experience with the online modules. This year, I am now a CFA charterholder. The only two study materials I used were the Bloomberg CFA Prep program and the CFAI practice questions that came with the exam registration.

I studied and worked in finance, so my baseline knowledge helped me to quickly breeze through Level I. That said, the Bloomberg modules are so quick (usually under 10 min per sub-topic) and simple to click through, that it made it easy to budget studying throughout the week. For me, the hardest part of completing the CFA program was staying on track (this was a 3 year endeavor while graduating, moving, and starting two different jobs). The gamification of the Bloomberg program and the practice questions at the end of each topic helped me to reinforce my understanding of the material. Also, I felt that Bloomberg sufficiently condensed the material into the main points, which allowed me to study less than the typical 300 hours per exam that you often read about on the web. For someone with a very busy day job, efficiency was paramount and I think Bloomberg is one of the best providers for return on time invested.

As part of my study plan, I would usually copy the summary takeaways at the end of each module as well any formulas that may be worth remembering. Additionally, I would add any practice questions that I found difficult to my notes and would later review just prior to my exam. I found that the Bloomberg practice questions closely resembled the CFAI ones and I was routinely getting a high percentage correct. Despite the brevity of some of the modules, the material was precise and worthwhile. I personally didn’t utilize the online tutors, but that is an added benefit. Combined with the practice exams, I consider the Bloomberg CFA Prep program a reliable and cost/time-efficient way of going through the lengthy CFA materials. The gamification and quick feedback loops make the program fun and rewarding. At the end of the day, the program sets up each candidate on a path to success. I would recommend using the Bloomberg CFA Prep course as your test prep provider.

Write your own review>>

Raj • Level 2

Likes – This was one of the best interactive courses I have used. It was fun to learn the content due to the way the learning sections were explained and presented and the topic questions were really useful to recap the topics just learned. For Level 2, the topic explanation was great, although there were minor errors which you could clarify with the Tutors through Ask-a-Tutor option. The Mock exam questions for L2 were good, profound and very detailed and stressed the importance of learning the topic areas rather than memorizing which was critical to be successful throughout the CFA journey, although the difficulty level was probably two notches more than CFA Mock questions . The tutors were knowledgeable and proficient with their explanations and felt free to give the Ask-a-tutor back for any mistakes being pointed out by me which was helpful to ask further relevant questions. The All lessons summary download and the Cheat Sheet were exceptional. The recommendation by the AI tutor based on the progress was quite good although at times it would present with questions on topics not yet taught and there was also an option to choose topics based on one’s interest and learn. The learning progress bar was simple but intuitive and would urge the reader to do more to increase the bar.

Dislikes – the question explanations didn’t include the corresponding learning outcome statements and there was no option to recheck/redo the questions (except for the Mocks which you can review as many times as you need but Mocks cannot be tried again online but it seems one can download as PDF but I never tried this option), although this didn’t bother me but some might find the LOS link useful.

I’d definitely recommend this course to anyone pursuing CFA and this will work as a great summary for Level2 and one can keep on reading as long as possible due to the way it teaches. The Mock questions stress the importance of understanding the concepts rather than relying on one’s Rote skills (Rote skills will not help in CFA exams) so I would recommend reading the material and the CFAI content if possible well before doing the BBG Mocks to get the most out of this course.

Write your own review>>

Luke • Level 2

I was excited to try the new Bloomberg CFA Prep as a supplement to my studies being an avid viewer of Bloomberg TV.

What I found impressed me, as did the very different learning styles that I have enjoyed to date. I am quite impressed with the functionality and how it has focused me on the core concepts as otherwise one can be considerably slowed down while getting through all the CFA readings. The tool is certainly intuitive and easy to use across all platforms, although I did note that you may get a better return on your investment when using a computer over tablet or phone in terms of metrics.

Bloomberg CFA Prep is extremely interactive and constantly encourages one to practice, not just at the end of each module but also throughout the delivery of well-articulated content with insightful questions, intriguing analogies, and fun explanations to help with remembering key ideas. Topics and subjects are broken down into bite-size modules with explicit interconnections while each module is summed up clearly before moving to the end of module quizzes. Personally, I like the option to be able to quickly check why alternative answers may not be correct. There is a feeling of accomplishment with the completion of each short module. While one can choose to focus on a selected area of interest at a time, it appears that the logic behind the Bloomberg Exam Prep virtual instructor is to guide you through the interconnected modules, build on key concepts and then apply similar ideas across topic areas. Competency is then tested and improved over the longer term with exam-style practice questions and the tool’s intelligence to bring you back to areas for further improvement with alternative scenarios. You don’t get bored.

Client service has been exemplary in relation to the administration as I had hoped with any Bloomberg product. The Bloomberg Prep Team has been willing to answer all my questions, take on feedback, and reply promptly to concerns. I would give the product 9 out of 10, as minor improvements can always be made. Perhaps some kind button for the student to flag an idea, equation, or explanation if one wishes to return to at a later date.

Luke A. White

Write your own review>>

Jonhwang • Level 2

Interesting lesson structure, engages without making factual information difficult to digest.

Write your own review>>

Raj • Level 3

Likes – This was one of the best interactive courses I have used. It was fun to learn the content due to the way the learning sections were explained and presented and the topic questions were really useful to recap the topics just learned. For Level 1 and Level 2, the topic explanation was brilliant, although there were minor errors which you could clarify with the Tutors through Ask-a-Tutor option. The Mock exam questions for both Levels were outstanding, profound and very detailed and stressed the importance of learning the topic areas rather than memorizing which was critical to be successful throughout the CFA journey, although the difficulty level was probably two notches more than CFA Mock questions and at times lengthier than needed for Level 1 in particular (See dislikes for Level 3). The tutors were knowledgeable and proficient with their explanations and felt free to give the Ask-a-tutor back for any mistakes being pointed out by me which was helpful to ask further relevant questions. The All lessons summary download and the Cheat Sheet were exceptional. The recommendation by the AI tutor based on the progress was quite good although at times it would present with questions on topics not yet taught and there was also an option to choose topics based on one’s interest and learn. The learning progress bar was simple but intuitive and would urge the reader to do more to increase the bar.

Dislikes – the question explanations didn’t include the corresponding learning outcome statements and there was no option to recheck/redo the questions (except for the Mocks which you can review as many times as you need but Mocks cannot be tried again online but it seems one can download as PDF but I never tried this option), although this didn’t bother me but some might find the LOS link useful. Level 3 Mock questions were some times open-ended and included more Justify questions as opposed to a variety of LOS command words such as “Discuss”, “Formulate”, “Describe”, “Identify” etc.,. and all explanations were too detailed due to the nature of the command word Justify. To be fair, there were some but not a lot like Justify. again, this required more knowledge and memory of the topic areas than possibly necessary, therefore, I may not necessarily say this was a big problem but more variety would have been better for practice.

I’d definitely recommend this course to anyone pursuing CFA and this will work as a great summary for Level 1 & 2 and one can keep on reading as long as possible due to the way it teaches. The Mock questions stress the importance of understanding the concepts rather than relying on one’s Rote skills (Rote skills will not help in CFA exams) so I would recommend reading the material and the CFAI content if possible well before doing the BBG Mocks to get the most out of this course.

Write your own review>>

Bradley Stevens • Level 3

I started using the Bloomberg CFA Prep course in the summer of 2020 while in college and had a positive experience with the online modules. This year, I am now a CFA charterholder. The only two study materials I used were the Bloomberg CFA Prep program and the CFAI practice questions that came with the exam registration.

I studied and worked in finance, so my baseline knowledge helped me to quickly breeze through Level I. That said, the Bloomberg modules are so quick (usually under 10 min per sub-topic) and simple to click through, that it made it easy to budget studying throughout the week. For me, the hardest part of completing the CFA program was staying on track (this was a 3 year endeavor while graduating, moving, and starting two different jobs). The gamification of the Bloomberg program and the practice questions at the end of each topic helped me to reinforce my understanding of the material. Also, I felt that Bloomberg sufficiently condensed the material into the main points, which allowed me to study less than the typical 300 hours per exam that you often read about on the web. For someone with a very busy day job, efficiency was paramount and I think Bloomberg is one of the best providers for return on time invested.

As part of my study plan, I would usually copy the summary takeaways at the end of each module as well any formulas that may be worth remembering. Additionally, I would add any practice questions that I found difficult to my notes and would later review just prior to my exam. I found that the Bloomberg practice questions closely resembled the CFAI ones and I was routinely getting a high percentage correct. Despite the brevity of some of the modules, the material was precise and worthwhile. I personally didn’t utilize the online tutors, but that is an added benefit. Combined with the practice exams, I consider the Bloomberg CFA Prep program a reliable and cost/time-efficient way of going through the lengthy CFA materials. The gamification and quick feedback loops make the program fun and rewarding. At the end of the day, the program sets up each candidate on a path to success. I would recommend using the Bloomberg CFA Prep course as your test prep provider.

Write your own review>>

KPerry1911 • Level 3

Bloomberg CFA Prep is worth a try if it fits your learning style

Write your own review>>