- This topic has 4 replies, 5 voices, and was last updated Jul-226:46 pm by

cfyay.

-

AuthorPosts

-

-

Up::10

Hi guys,

Q14 at the end of Reading 43 in the curriculum – the answer adds on bid-offer spread in the calculation of the total holding period cost, even though you already have the round-trip trading commission given and could just do AMC + round-trip % = total holding period cost, according to the formula given earlier in the curriculum.

The answer to this question they’ve instead given the formula:

total holding period cost = AMC + round trip trading commission + bid-offer spread on purchase/sale

is that not double counting the bid-offer spread?

I turned to the CFAI portal and everyone else is equally stumped…there’s nothing in the errata so which formula is right?

-

Up::4

Took a few days to dig up the curriculum to have a look at this! We would be able to answer faster if you could include screenshots / copy-paste the relevant bits you’re referring to for next time?

Again, I would say that the wording is a bit confusing. When I read your question I thought “no doubt about it, commission ≠ bid-ask spread, so the question is correct” but wanted to check the curriculum to be sure.

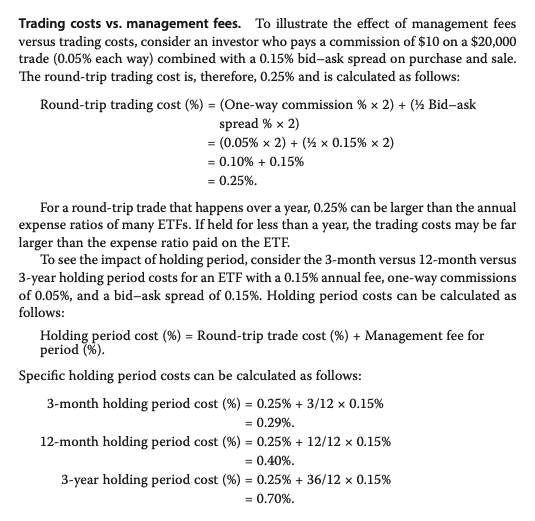

I’m assuming “the formula given earlier in the curriculum” you’re referring to is this:

That shows round-trip trade cost.

The end-of-chapter question on the other hand states round-trip trading commission.

So the curriculum is both right on the notes part and the end-of-chapter question part.

The ’round-trip’ bit simply means that the ETF was bought and sold – it isn’t a specific, defined set of costs.

-

Up::3

Just like a retail bureau de change, exchanges can make money from commission and/or bid-ask spreads (hence ‘no-commission’ FX counters still can make money).

So no, the round-trip trading commission in your example does not include bid-ask spreads, so it’s not double-counting.

-

-

AuthorPosts

- You must be logged in to reply to this topic.