So you’ve decided to undertake the CPA exams.

The CPA exam is a significant challenge, requiring a strategic approach to pass. While some candidates attempt to wing it, a well-structured study plan is one of the most effective way to manage your time and master the vast amount of content. That’s where a great study planner comes in.

Borrowing from our famous CFA study planner tool, we have adapted it for our CPA readers due to the many requests we received. Our new CPA study planner tool is designed to provide a clear, personalized roadmap through your exam prep. It takes the guesswork out of planning and helps you build a schedule that fits your life, ensuring you cover every topic you need to succeed.

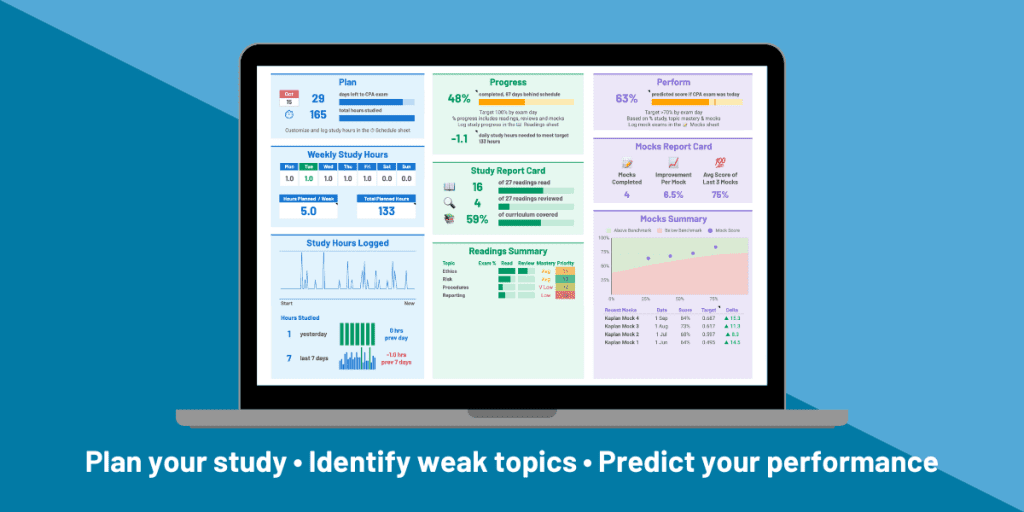

In short, our personalized CPA study planner will help you:

- Predict your CPA exam score

- Benchmark your practice test scores against historical candidate data

- Track all your study efforts and stay accountable

- Map the curriculum you’ve covered, identify weak spots, and auto-prioritize your next steps

Let’s check it out!

- What makes the best CPA study planner?

- Generate your own free CPA study planner

- PLAN: Master your study hours and never fall behind

- PROGRESS: Know what you’ve covered, and focus on what’s important

- PERFORM: Benchmark your mocks. Predict your CPA exam performance

- Fill in this form, get your personalized CPA study planner now!

- Sample CPA study plans & schedules

- Generate your own free CPA study planner

What makes the best CPA study planner?

Passing the CPA exam requires a solid framework. While we’ve touched on this informally in previous articles, this guide will give you a concrete method for creating a tailor-made study plan that works for you.

We designed our study planner with two core principles in mind:

- Low input: Our goal is for you to spend your time studying, not managing a spreadsheet. The planner is ready to use immediately. Just plug in as much or as little information as you want; it’s built to make the most of the data you provide.

- Optimize for passing: Every feature of our planner is designed with one purpose: to help you pass the exam. Its interface guides you toward the most important topics and motivates you to work smarter. This means the planner will highlight areas that will earn you the most points, and it includes features to help you predict your performance on exam day.

Ultimately, it’s about putting in minimal work to get a maximum chance of passing. Nothing else matters.

Generate your own free CPA study planner

More than 200,000 readers have successfully used our planner. You can generate your own in less than a minute.

The generator below will create a personalized CPA study planner for you with 3 core features:

- PLAN: Shows you whether you’re on-track with your exam studies and all important dates

- PROGRESS: Show you which CPA topics you should be focusing your time on, factoring in the amount of reading and actual exam weightings to really show you the most efficient topics to be addressing

- PERFORM: Benchmarks your mock exam scores to show you if your scores need improving to ensure a pass

This is available for all CPA exam sections, based on the latest CPA exam blueprint, so you can generate one for yourself for whichever CPA exam you’re planning to take next.

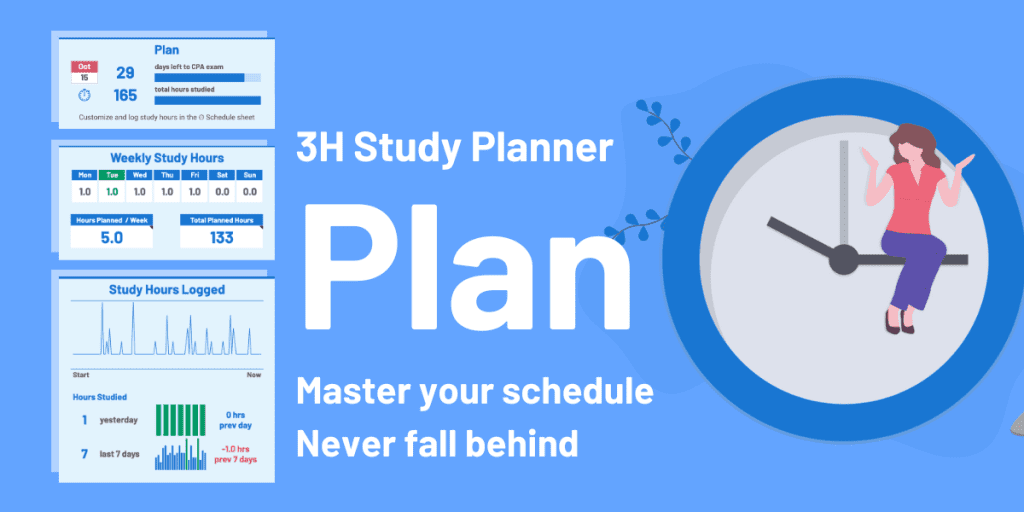

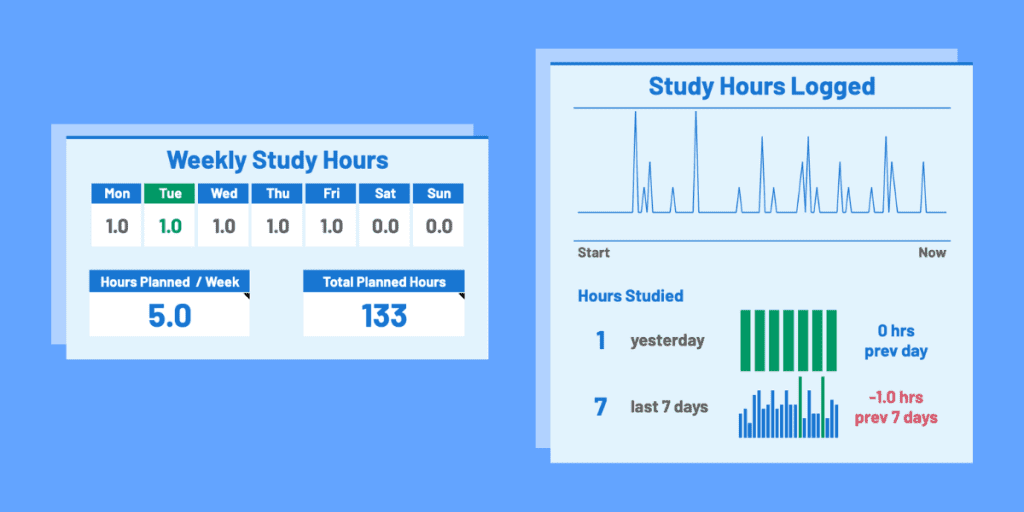

PLAN: Master your study hours and never fall behind

You can check your study progress at any time, and see if you’re on track to complete all your studies before your exam day.

The planner also cross-checks the remaining days left to your exam with your progress, alerting you if you are falling behind.

It also charts your study hours, showing your progress against past periods.

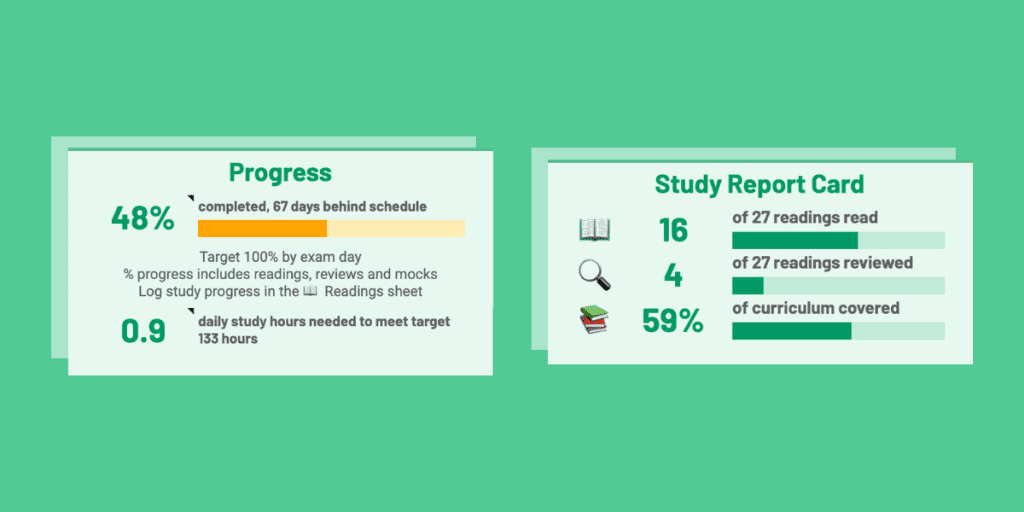

PROGRESS: Know what you’ve covered, and focus on what’s important

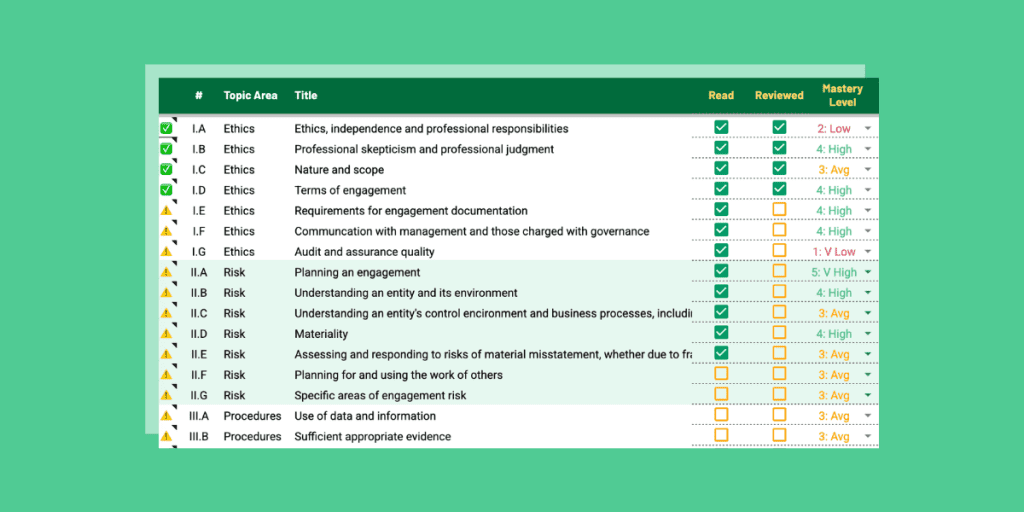

Know exactly how much you’ve covered

Exam weighting is built into every assessment in the study planner. Throughout your studies you will have a progress % showing how much of the exam you’ve covered, and how far ahead – or behind – you are.

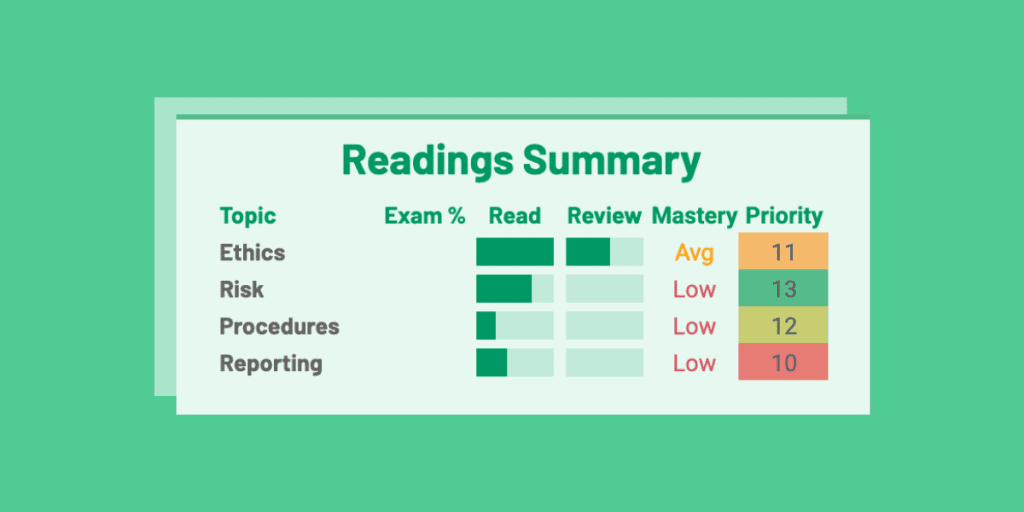

Focus on your important topics

The planner also considers exam weights, difficulty and progress to highlight topics that you should prioritize.

Helps you stay disciplined

As you progress through the CPA curriculum, reviewing topics and completing mock exams, marking your progress as ‘done’ in the planner contributes towards your sense of achievement and helps you maintain a more disciplined approach to your CPA exam studies.

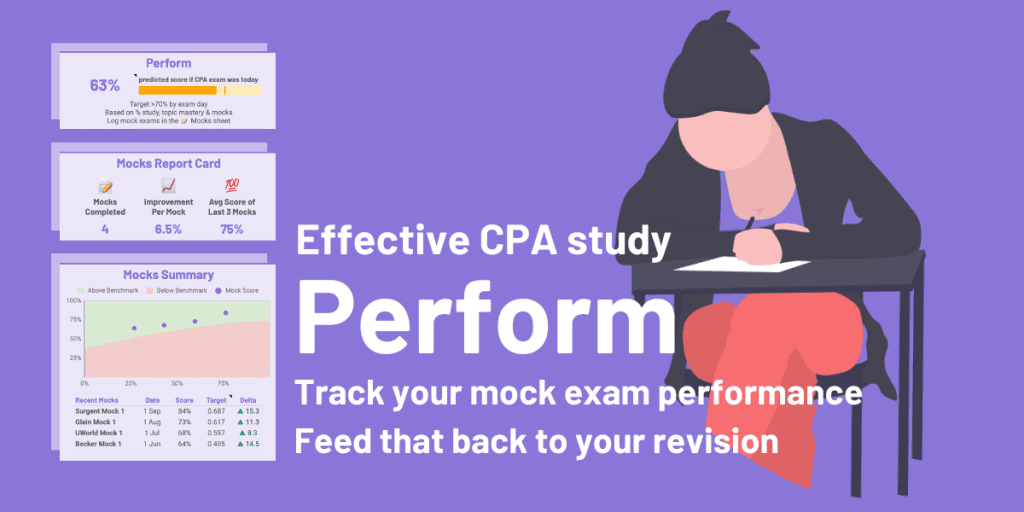

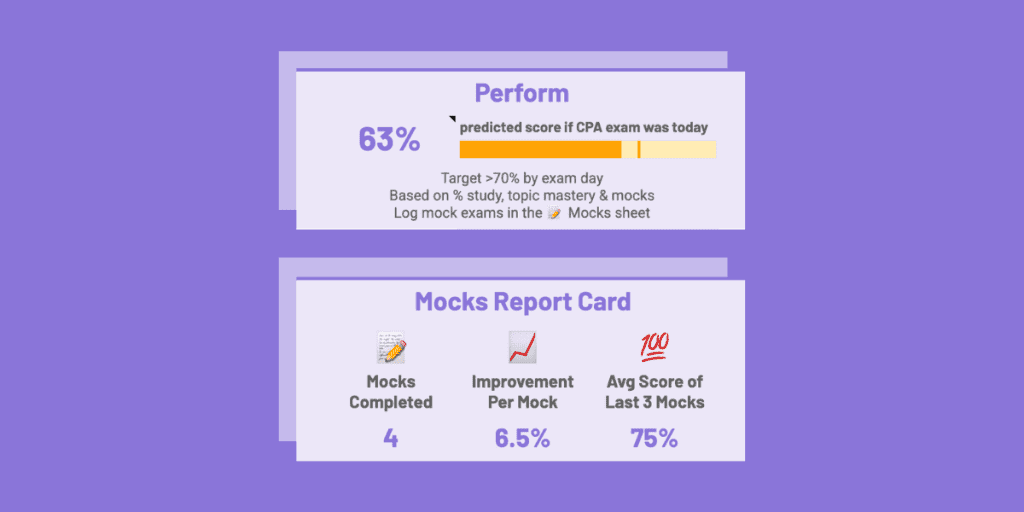

PERFORM: Benchmark your mocks. Predict your CPA exam performance

We predict…you’ll pass your CPA exams.

Combining past candidate performance data and your study data, we can even attempt to predict your CPA exam performance.

Of course, this is just a prediction, and not a guarantee!

Auto-benchmarked against past candidates

As you enter your mock exam scores, these are auto-benchmarked to show you if you are scoring well against historical candidates performance.

We have past candidates’ actual CPA results, so we can create a reliable benchmark to show you if you’re trending towards a pass, or you need to step it up.

This better informs you if your scores need improving, and helps reassure you if your scores are on a good trend.

Fill in this form, get your personalized CPA study planner now!

What do you think? I hope you found this simple framework useful for your study planning, and that you now have your online planner to use. Share this with a friend who is revising for the CPA exams too!

But what if you need some help with planning out a schedule? We’ve got you covered too.

Sample CPA study plans & schedules

One of the most common questions CPA exam candidates ask is “How should I structure my study time?”

The answer really depends on how many hours you can consistently commit each week and how quickly you want to pass.

But how you structure your study time is just as (if not more) important as how much time you put in. Without a clear plan, it’s easy to fall into one of two traps: either you study inconsistently and fall behind, or you burn yourself out trying to do too much CPA exam prep without direction.

A structured study plan means that because you know exactly what to work on each day or week, you waste less time deciding what to study next. And as we’ve already mentioned, making steady progress often feels a lot more achievable when broken into small goals or milestones.

All of this helps you to manage the stress involved in studying and means you’re less likely to panic or cram when your timeline is mapped out clearly.

The CPA exams are broad, deep, and can be mentally demanding, especially since most candidates are balancing prep with jobs, school, or family. That’s why your study plan should provide a concrete roadmap that fits your life and keeps you on track from day one to exam day.

Let’s take a look at some example study plans to fit the requirements of different types of candidates. You can use these to develop your own study plan by adjusting as needed to fit your needs.

Example 1: Full time CPA study plan

- Study Commitment: 25-30 hours per week

- Time to complete all 4 exams: Around 4-6 months

- Ideal for: Recent graduates or candidates with full time availability who want to pass quickly

| Week | Focus |

|---|---|

| 1–4 | FAR – Learn core content, complete 800–1,000 MCQs, 10–15 SIMs |

| 5 | FAR – Full review, mock exam, performance tracking |

| Exam: Week 5 or 6 | |

| 6–8 | REG – Learn core topics + entity taxation, 600–800 MCQs, SIM practice |

| 9 | REG – Final review + practice test |

| Exam: End of Week 9 or start of Week 10 | |

| 10–12 | AUD – Focus on audit process, opinion types, and internal controls |

| 13 | AUD – Final review + mock |

| Exam: Week 13 or 14 | |

| 14–17 | Discipline (BAR / TCP / ISC) – Core concepts + analytics or planning focus |

| 18 | Discipline – Mock exam + final review |

| Exam: End of Week 18 | |

Example 2: Working professional CPA study plan

- Study Commitment: 10-15 hours per week

- Time to complete all 4 exams: Around 8-12 months

- Ideal for: Those working full time who can commit around 2 hours per day.

| Week | Focus |

|---|---|

| 1–8 | FAR – Study 4 topics per week, build MCQ foundation, 2 SIMs/week |

| 9 | FAR – Review weak areas + mock exam |

| Exam: End of Week 9 or start of Week 10 | |

| 10–16 | REG – 3–4 hours/week on tax, law, ethics + 400–600 MCQs |

| 17 | REG – Final review + practice test |

| Exam: Week 17 or 18 | |

| 18–24 | AUD – 2–3 modules/week + audit MCQs and SIMs |

| 25 | AUD – Review and mock |

| Exam: Week 25 or 26 | |

| 26–33 | Discipline – Slow-build on BAR, TCP, or ISC depending on background |

| 34 | Discipline – Final review, mock, flashcard drill |

| Exam: Week 34 or 35 | |

Include a catch up week or buffer week every 6-8 weeks where possible.

Example 3: Slow and steady CPA study plan

- Study Commitment: 5-10 hours per week

- Time to complete all 4 exams: Around 12-15 months

- Ideal for: Parents, part-time students, or those with high demand or unpredictable work schedules

| Week | Focus |

|---|---|

| 1–13 | FAR – Core learning (1 topic every 8–10 days), integrate low-stakes MCQs, handwritten notes, and recap sessions |

| 14–15 | FAR – Deep dive into weak areas, additional MCQs + review |

| 16 | FAR – Mock exam + final polish |

| Exam: Week 17 or 18 | |

| 19–20 | Rest or light review (optional reset phase) |

| 21–29 | REG – Gradual learning of tax law, property transactions, and business law; reinforce with flashcards + 1–2 SIMs/week |

| 30 | REG catch-up week or light review |

| 31 | REG – Full review and diagnostics |

| 32 | REG – Mock exam and focused revision |

| Exam: Week 33 | |

| 34–41 | AUD – Slow-paced study (1–2 topics/week), emphasis on audit reports, internal controls, and MCQs |

| 42 | AUD – Final review week |

| 43 | AUD – Mock exam |

| Exam: Week 44 | |

| 45 | Rest or low-intensity week (catch-up, flashcards, or break) |

| 46–53 | Discipline Section – TCP / BAR / ISC based on your path; focus on comprehension before practice |

| 54 | Deep topic review + simulations |

| 55 | Mock exam + final touch-ups |

| Exam: Week 56 | |

Exam timing

No matter your pace, aim to take each exam within 3–5 days of completing your final full-length mock. That’s when recall is strongest and performance is most likely to match your practice.

Want a week-by-week breakdown? Try this 12-week FAR plan

To give you a more detailed sense of what a section-specific study schedule can look like, here’s a sample 12-week plan for FAR (the section most candidates find the most content-heavy). This plan is based on studying somewhere around 10 hours each week.

| Week | Topic Focus | Key Learning Objectives | AICPA Blueprint Reference | Estimated Study Hours |

|---|---|---|---|---|

| 1 | Intro to FAR & Conceptual Framework | Orientation, exam setup, conceptual foundations | Area I: Conceptual Framework and Financial Reporting | 8 |

| 2 | Income Statement, Balance Sheet, and Cash Flows | Structure of financial statements, SCF format | Area I: Financial Statements & SCF; Area II: Select FS Accounts | 10 |

| 3 | Revenue Recognition (ASC 606) | 5-step revenue model, key recognition criteria | Area II: Revenue Recognition (ASC 606) | 10 |

| 4 | Inventory, PP&E, and Intangibles | Measurement & valuation, depreciation/amortization | Area II: Inventory, PP&E, Intangibles | 10 |

| 5 | Leases, Bonds, and Investments | Lessee/lessor accounting, effective interest method | Area II: Leases & Bonds; Area III: Investments | 10 |

| 6 | Deferred Taxes & Pensions | Temporary vs permanent differences, defined benefit plans | Area III: Deferred Taxes & Pensions | 10 |

| 7 | Governmental Accounting – Basics | Fund types, journal entries, modified accrual | Area IV: Governmental Accounting – Basics | 8 |

| 8 | Governmental Accounting – Advanced Topics | Encumbrances, budgetary accounting, CAFR | Area IV: Governmental Accounting – Advanced | 8 |

| 9 | Not-for-Profit Accounting | Contributions, net asset classifications, expenses | Area IV: Not-for-Profit Organizations | 8 |

| 10 | Review Week | Targeted topic review, SIM walkthroughs, MCQ performance | Area I–IV: Comprehensive Review (MCQs, SIMs) | 10 |

| 11 | Mock Exam + Final Review (Part 1) | Full-length practice exam, score analysis | All Areas: Full-Length Practice Exam + Performance Analysis | 12 |

| 12 | Mock Exam + Final Review (Part 2) | Final simulations, confidence building, rest | All Areas: Final Mock + Confidence Review | 12 |

Generate your own free CPA study planner

More than 200,000 readers have successfully used our planner. You can generate your own in less than a minute.

The generator below will create a personalized CPA study planner for you with 3 core features:

- PLAN: Shows you whether you’re on-track with your exam studies and all important dates

- PROGRESS: Show you which CPA topics you should be focusing your time on, factoring in the amount of reading and actual exam weightings to really show you the most efficient topics to be addressing

- PERFORM: Benchmarks your mock exam scores to show you if your scores need improving to ensure a pass

This is available for all CPA exams, so you can generate one for yourself for whichever CPA exam you’re planning to take next.

Hope you found the study planner useful 🙂 Meanwhile, here are other related articles which may be of interest:

- How to Pass the CPA Exam: Your Actionable CPA Game Plan

- CPA Salary – How Much Do Certified Public Accountants Make?

- CPA Exam Dates & Score Release: Your 2025-2026 Master Plan

- Is CPA Worth It? Full Pros, Cons & ROI of Getting A CPA License

- CPA Pass Rates: How Hard Is The CPA Exam?

- CPA Requirements By State: A Quick & Complete Guide