As a CFA candidate, you may have heard occasional horror stories about some candidates being subjected to CFA Professional Conduct investigations due to a misconduct (perceived or actual).

To help alleviate your concerns, this article explains:

- what CFA Institute’s Professional Conduct Program (PCP) is about;

- how a disciplinary process works;

- what to do if you’re being investigated; and most importantly

- how to avoid any CFA PCP investigations in the future.

Let’s dive in!

- What is CFA Institute's Professional Conduct Program?

- What happens during a CFA professional conduct investigation?

- How does the disciplinary proceedings work?

- What kinds of disciplinary sanctions could be imposed?

- What do I do if I'm under a CFA investigation?

- What are the odds of sanctions once a CFA Institute investigation starts?

- How to minimize the risk of getting a PCP investigation?

What is CFA Institute’s Professional Conduct Program?

CFA Institute upholds the Code of Ethics and Standards of Professional Conduct (Code and Standards), exam rules, regulations, and the CFA Institute Bylaws. This is done to protect the integrity of the CFA membership, designation, and examination.

The CFA Professional Conduct Program (PCP) administers a multi-level, peer review disciplinary process for CFA Institute, using the Bylaws and Rules of Procedure as guidance for:

- conducting investigations into allegations,

- determining violations,

- conducting disciplinary proceedings,

- imposing sanctions, and

- disclosing violations.

Peer review means a group of professionals in a given field – in this case, CFA charterholders – are charged with reviewing or evaluating a colleague’s performance or work to ensure it meets the standards of the profession. The multi-level aspect provides a process of checks and balances to ensure fairness and consistency.

What happens during a CFA professional conduct investigation?

The PCP investigates both exam and industry-related conduct:

- Exam-related conduct includes any activity or conduct related to participation in CFA Institute programs and any conduct that could compromise the reputation, integrity, validity, or security of the exams.

- Industry-related conduct includes any activity or conduct, excluding exam-related conduct, governed by the Code and Standards.

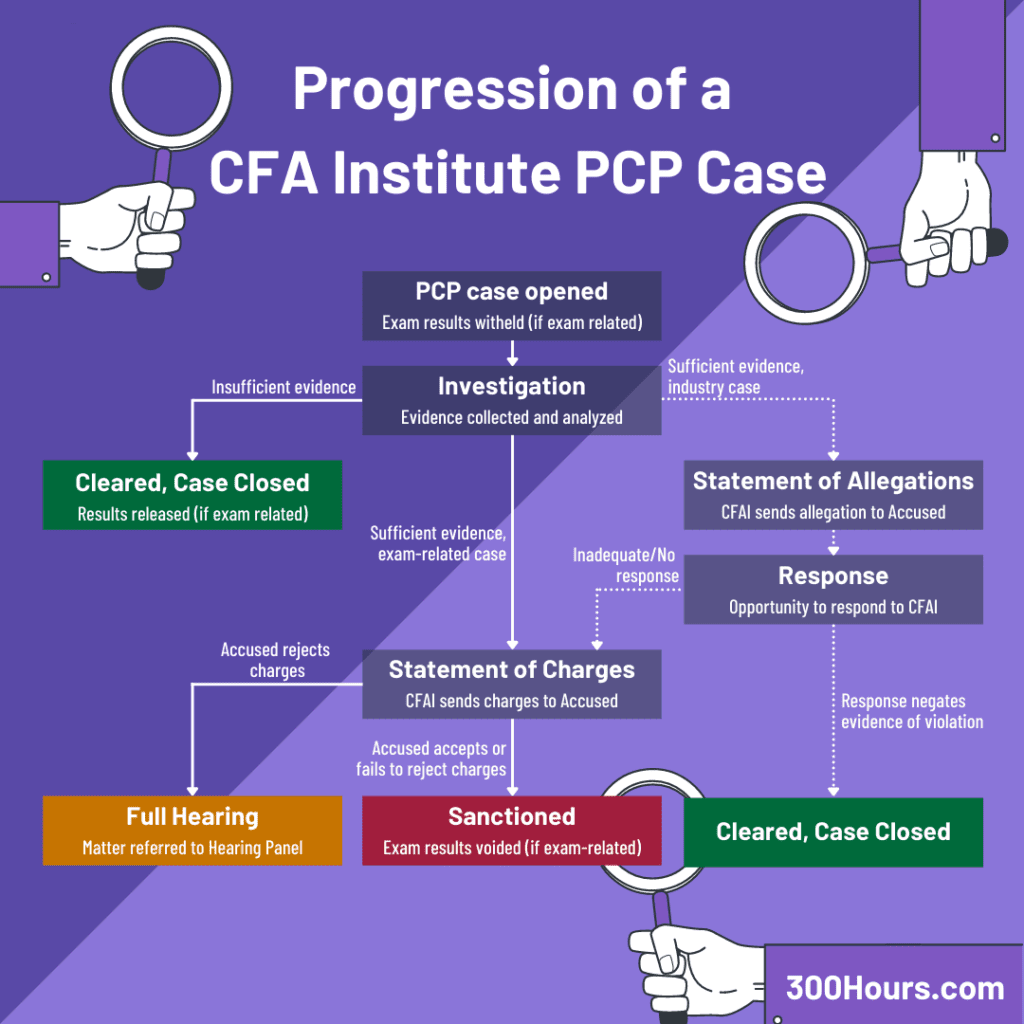

Broadly speaking, a PCP investigation happens in 3 steps:

- Investigate the allegation, once a CFA notice of investigation is sent

- Conduct disciplinary proceedings

- Implement disciplinary sanctions

As part of an investigation into a person’s conduct, PCP is authorized to contact any third party that it believes may be able to provide relevant information or assistance to an investigation.

During such information requests, it may be necessary to identify the person under investigation, or provide the third party with a copy of related reports, and/or identify the conduct under investigation.

This is worth bearing in mind, since a PCP investigation may involve revealing the identity or (potential) conduct of the person under investigation to other parties such as an employer.

How does the disciplinary proceedings work?

All disciplinary proceedings are conducted by members of the Disciplinary Review Committee (DRC) in accordance with the Rules of Procedure. The DRC consists of volunteer CFA charterholders from around the world.

Here’s a simplified flowchart to summarize the process for both exam-related and industy-related proceedings:

What kinds of disciplinary sanctions could be imposed?

The accused member or candidate may accept the recommended sanction or request a disciplinary hearing conducted by members of the DRC.

Here’s the list of possible CFA Institute PCP sanctions and what they mean:

| PCP CFA sanctions | Description |

|---|---|

| Private Reprimand | A written admonishment that includes only the conduct, excluding the person’s identifying information; it is not disclosed to third parties |

| Censure | A written admonishment that includes the conduct and may include the person’s identifying information; it is disclosed to third parties upon request. |

| Suspension of Membership | Termination of a person’s memberships, or opportunity for memberships, in CFA Institute and any member societies for a specified period. |

| Suspension of the Right to Use the CFA Designation | Termination of a person’s right to use the CFA designation for a specified period. |

| Revocation of Membership | Permanent or indefinite termination of a person’s memberships, or opportunity for memberships, in CFA Institute and any member societies. |

| Revocation of the Right to Use the CFA Designation | Permanent or indefinite termination of a person’s right to use the CFA designation |

| Summary Suspension | Automatic termination of a person’s memberships, or opportunity for memberships, in CFA Institute and member societies, as well as the right to use the CFA designation or participate in a CFA Institute Exam Program. |

| Suspension from Participation in CFA Institute Exam Program | Termination of a person’s participation in the CFA and/or CIPM exam programs for a specified period. |

| Prohibition from Participation in CFA Institute Exam Program | Permanent or indefinite termination of a person’s participation in the CFA and/or CIPM exam programs. |

Note that:

– A list of industry-related disciplinary sanctions issued since January 2000 are published on the CFA Institute website.

– Individuals who have received disciplinary sanctions of private reprimand or who have been sanctioned for exam-related conduct do not appear on the list.

– That said, sanctions for exam-related matters result in an automatic voiding of exam results.

Interestingly, industry-related disciplinary matters represents a relatively smller portion of the issues, with majority of CFA PCP investigations being exam-related issues.

Let’s take a look at some available statistics:

Industry-related PCP cases

The above chart shows the industry-related PCP cases closed per year, and their resulting action (if any).

A few interesting observations across industry cases from 2013-2020:

- Most industry cases are self reported, with an average of 325 cases closed a year.

- Most of the outcome results in no disciplinary action (67% on average), although cautionary letters (22% on average) and Summary Suspension apply in more severe cases (4% on average).

- Other disciplinary action includes: Permanently resigned, Revocation, Prohibition from the CFA Program, Timed Suspension, Censure and Private Reprimand. These form the minority of outcomes.

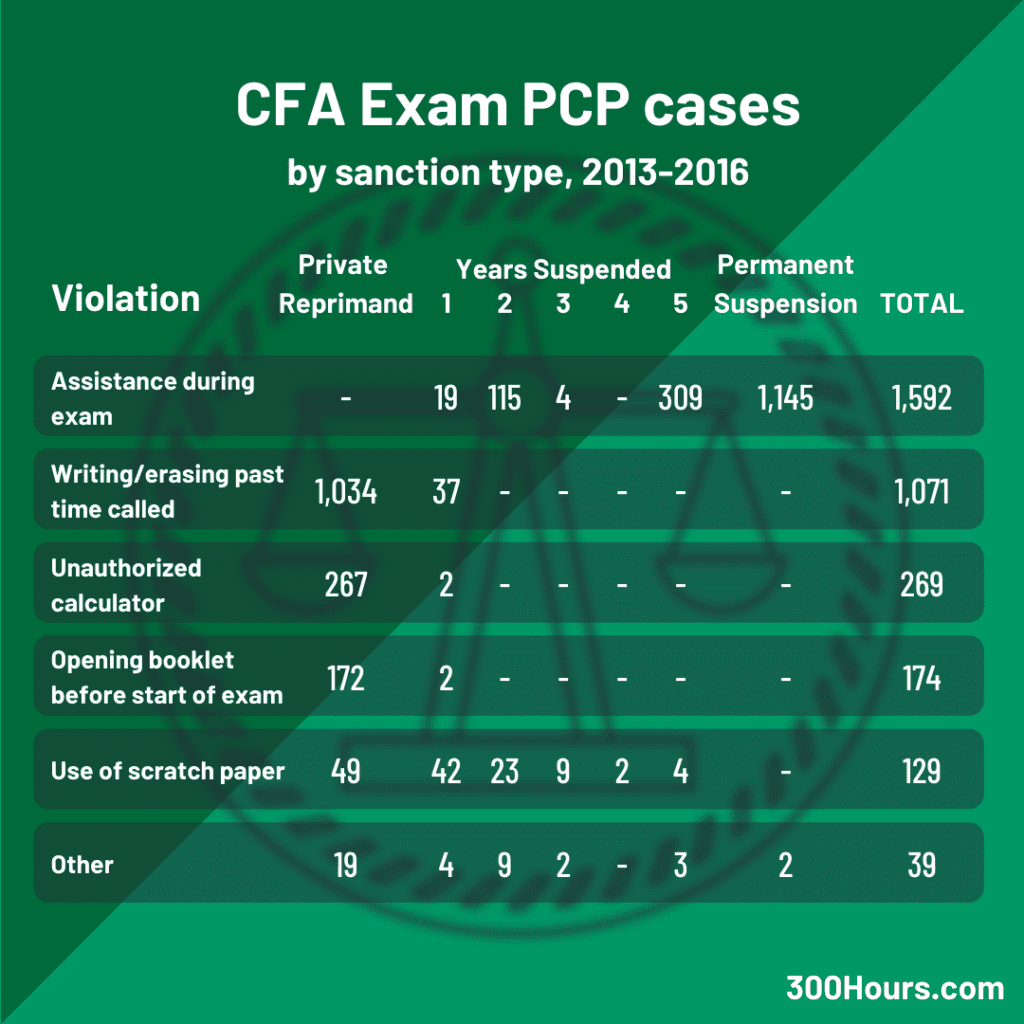

Exam-related PCP cases

Note that the data for exam-related PCP cases are not comparable with industry cases for a few reasons:

- CFA Institute only released 4 years of historical data for exam-related PCP cases from 1 Jan 2013 – 31 Dec 2016.

- The dataset only shows sanctions imposed, but excludes cases where no disciplinary action was taken (either due to insufficient evidence or good defence).

The top 5 causes for exam-related PCP sanctions are:

- Assistance during exam (e.g. looking or the appearance of looking at other candidates’ exam). This is 48% of the sanctions issued during 2013-2016, with permanent suspension from CFA program the most common outcome given the serious nature of the misconduct.

- Writing/erasing past time called is next in line, with 32% of the exam-related sanctions, most of it resulting in a Private Reprimand.

- Bringing unauthorized calculator is surprisingly common (8%), with most of it resulting in a Private Reprimand.

- Opening question booklet before start of exam (5%) mostly results in a Private Reprimand as well.

- Use of scratch paper (4%) isn’t allowed during the exam. Scratch paper includes writing paper, calculator keystroke card, desk top, or any other surface. Note that this rule is now outdated with CBT exams (see below).

However, note that with the new CBT exam format from 2021, most of these issues (except #3: bringing unauthorized calculator) may no longer apply nor be an issue.

For example, for CBT exams:

– scratch paper/whiteboard/erasable writing tablet will be provided during the exam, which you have to return to the proctor when the exam is over.

– calculator cases and keystroke cards are allowed to be brought into the test room.Check out our CFA exam day checklist for the latest information.

What do I do if I’m under a CFA investigation?

Candidates typically get notified of a PCP investigation via email about 1 month after the exam.

It is totally normal to be freaking out, stressed and/or angry at such allegations, especially if they are not true. Allow yourself to feel those feelings for a while.

However, you need to accept that while this process can take a few months on average to complete, and there will be a delay to your CFA exam journey. It is a stressful and unpleasant position to be in, but do approach this matter calmly for your benefit.

Assuming you’re innocent, our advice is to:

- listen to the allegations respectfully, and then deny it if you didn’t do it.

- treat the process as a court of law, and focus on the facts when providing evidence to defend yourself.

- try putting yourself in the investigator’s perspective, and approach the matter logically and be civil.

- review your written answers/evidence to them thoroughly before sending, and not be in an emotional state when doing so!

The panelist are people too (volunteer CFA charterholders in fact), so hopefully they would understand what you’re going through, you have to take a shot at fighting your case if you’re innocent because no one else can.

One of our readers also wrote in about his personal experience of a PCP investigation with sage advice – check it out!

What are the odds of sanctions once a CFA Institute investigation starts?

We have some old 2017 data from CFA Institute on this, which is no longer published now.

Nevertheless, the statistics below is a useful guide on how strict this procedure is, and more importantly, why it’s best to avoid being investigated in the first place.

Looking at the historical cases that have been opened in the past exam cycles, there’s only a tiny percentage of cases where the case resulted in no disciplinary action – less than 2%.

Cases that end with anything worse than a cautionary letter will result in having your exam invalidated.

Statistically speaking, if the CFA Institute has opened a case against you, you’ve got:

- About 98% chance of receiving at least a cautionary letter

- 70-80% chance of getting your CFA exam results invalidated

- Approximately 50% chance of getting banned from future CFA exams, from 1 year to a permanent ban

- 20-30% of getting banned permanently from all future CFA exams

The best chance of staying safe is to never give CFA Institute a reason to open a case against you.

How to minimize the risk of getting a PCP investigation?

The potential career impact, stress and delay to your CFA exam journey just isn’t worth it.

To avoid industry-related PCP investigations, frankly you just need to abide by the Code and Standards, or any criminal activity really.

To minimize the risk of getting an exam-related PCP investigation, here are a few things we can learn from historical exam-related cases:

- Do not look around the exam room when your exam is in progress, as this may give the appearance of cheating (see next point). Focus on your computer screen or the ceiling, if you must.

- Don’t cheat in any shape or form, or have the appearance of doing so. Looking or glancing at another candidate’s exam or giving the appearance of doing so violates the exam rules and regulations.

- Only bring what is allowed in the CBT exam room, and only the approved CFA calculators.

- Stop writing when the exam time is up, although we expect this to be completely eradicated with the new computer based exam format (CBT), which automatically stops the exam when time’s up.

- Treat the proctors respectfully. Or anyone really.

- Don’t share or discuss past exam questions with anyone.

Have you personally been involved in a CFA professional conduct investigation? How was your experience like? Do share it with us in the comment below.

Meanwhile, here are some related articles which may be of interest: