Forum Replies Created

-

AuthorPosts

-

Up::8

In very broad terms:

Weak efficiency = share prices reflect all historical information

Semi-strong efficiency = share prices reflect all historical information + reflect all publicly available information

strong efficiency = share prices reflect all historical information + reflect all publicly available information + reflects all information held privately by the directors

In other words, semi-strong is not JUST publicly information, it is the continuation of the weak (it includes the weak efficiency AND is further expanded by publicly available information).

By the same logic, the strong efficiency (includes the weak efficiency AND the semi-strong efficiency AND is once again expanded by the privately held information).

If semi-strong efficiency is broken, the the strong efficiency must be as well!

in reply to: NPV and IRR #99342Up::8This is a theoretical question, where the principles are important, not actually the numbers themselves.

Important facts:

- initial cash outflows are the same for the 2 projects

- both projects have equal lives of 5 years

- both projects have the same cash flows over the 5 year period

Keeping these things in mind, lets go over the options:

a) The project with the cash flows occuring in the earlier periods will be subject to less fluctuation when discounting because the effect of “time value of money” will be for 1-2 years rather than for 20 year for example. This is true regardless of the interest rate chosen (5%, 25%, IRR, required rate of return). Keep in mind that IRR is interest rate where NPV = 0. With all things being equal as per the important things 1. 2. and 3. stated above, then the project with the higher IRR rate will be the earlier project (Project Jones), not Project Smith. This is because to compensate for the lower effect of time value of money, you will need higher interest rate to achieve IRR (where NPV = 0). Lets say, with 30% discount rate, you can achieve NPV = 0 for the Project Jones, but you will only need 25% discount rate needed to achieve IRR (NPV = 0) for Project Smith. The numbers are made up, they dont matter as long as you get the principle. Therefore, this option is FALSE.

b) This is a general statement. The thing about general statements is that they have to hold true regardless of the circumstances (that is why they are general statements and not specific statements). With that in mind, the easiest thing to “TEST” the validity of a general statement is to go the “EXTREME”. Lets say, what if the Interest rate is 1000000000%? Of course with such high interest rate, the discounting of cash flows regardless of whether they are in years 1-2 (Project Jones) or 4-5 (Project Smith), the effect will still be ENORMOUS. The decision criteria for NPV is choose projects with POSITIVE NPVs. Now the cash flows will be minimised by the discounting, but what about the initial investment (i.e. cash outflow)? It occurs today (no discounting effect). Therefore, even at RIDICULOUS discount rate, such as 1000000000%, it will still be the same amount. Therefore, there is a range of interest rates where the project should be rejected (even if that range is ridiculous). This goes for both Project Jones and Project Smith. Therefore, this option is CORRECT.

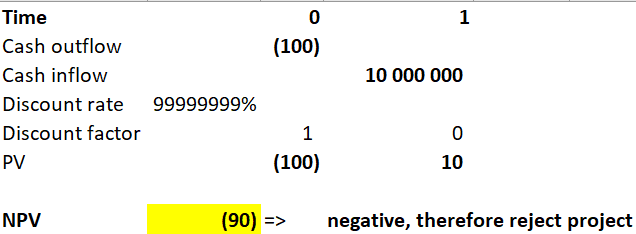

Please see example below, where the initial investment today (time 0) is 100 dollars and it will bring you a cash flow of 10 million in 1 years time. Sounds good, right? At discount rate of 99999999%, however, the project will still be loss making (negative NPV) and will be rejected. This is to illustrate that there is, in fact, a range of interest rates where the project will be at a loss.

c) Again, general statement. Because of the “important facts” mentioned above, Project Jones will always be more beneficial than Project Smith because of time value of money (receiving the same inflows of cash flows earlier rather than later). This holds true for all, interest rates.

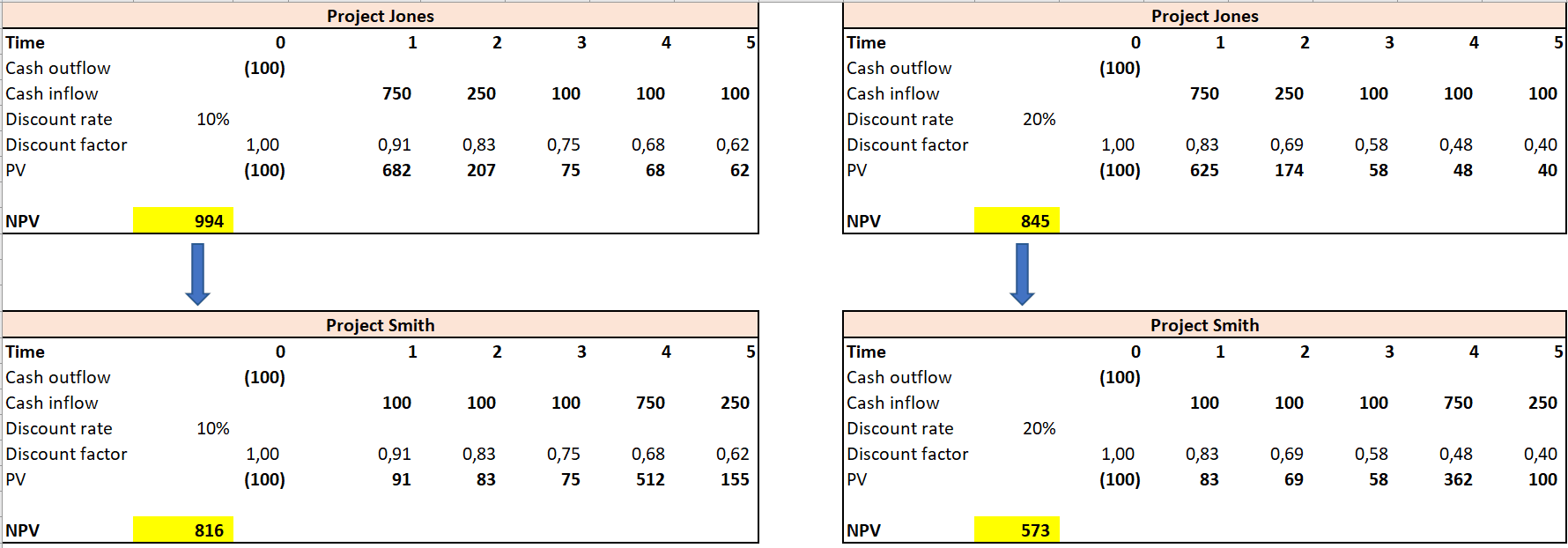

Please see attached an illustration which fulfils the criteria:

- same initial cash outflow of 100 for both projects

- same life of 5 years

- same total cash inflows over the 5 years (1300 total inflows)

With interest rate of 10%, project Jones will have NPV of 994 whereas Project Smith only 816. With 2 mutually exclusive projects (i.e. you can only invest in 1), you will invest in the one with the higher return (NPV) => therefore Project Jones. With interest of 20%, NPV of Jones is 845 whereas NPV of Smith is only 573 (again Jones win). This holds true for ALL possible interest rates! Note that the proportion of the cash flows in year 1-2 may not be 75% as mentioned in the QUESTION, but it doesnt matter, the principle still holds true. This is only true because of the restrictions (same cash outflow, same cash inflow, same lives, only different timings). Therefore, Project Smith will NEVER be better all these things being equal and this statement is FALSE.

in reply to: NPV and IRR #99464Up::3

in reply to: NPV and IRR #99464Up::3it is difficult to explain concepts and generalisations using words and makes for a very lengthy answer @zee hope the numerical examples help the person asking, picture does paint a thousand words 🙂

-

AuthorPosts