CPA pass rates are a critical metric for any candidate. They offer a benchmark, an insight into the exam’s difficulty, and a tool to help refine your study strategy.

Let’s look at what these historical pass rate trends mean for each section (Core and Discipline), and some solid tips for each section to improve your CPA preparation.

Overview of CPA pass rates since 2024

The CPA exam consists of 3 Core sections and 1 chosen Discipline section. Each section requires a scaled score of 75 or higher to pass.

While there isn’t a single “overall” pass rate for all four sections combined in one sitting (as candidates take them individually), the weighted average pass rate across all sections typically hovers around 45-55% annually.

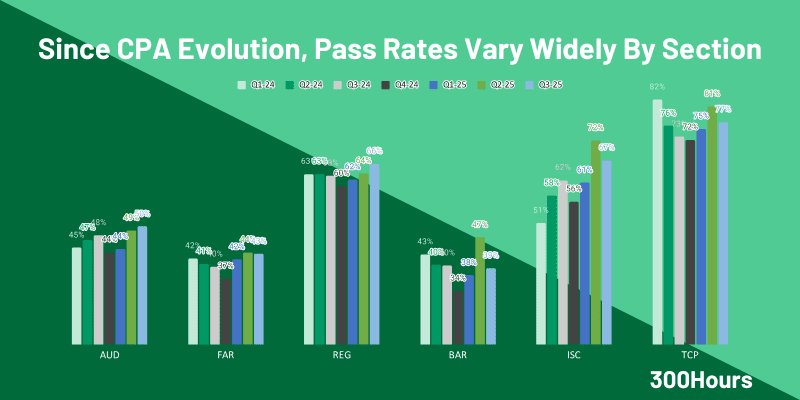

Given CPA Evolution in 2024 marked a big change in patterns, let’s focus on post 2024 trends for the most relevance:

- Core sections (AUD, FAR, REG) have largely maintained their historical relative difficulty, with FAR remaining the lowest and REG often the highest:

- AUD pass rates ranges from 44-50%;

- FAR pass rates ranges from 37-44%;

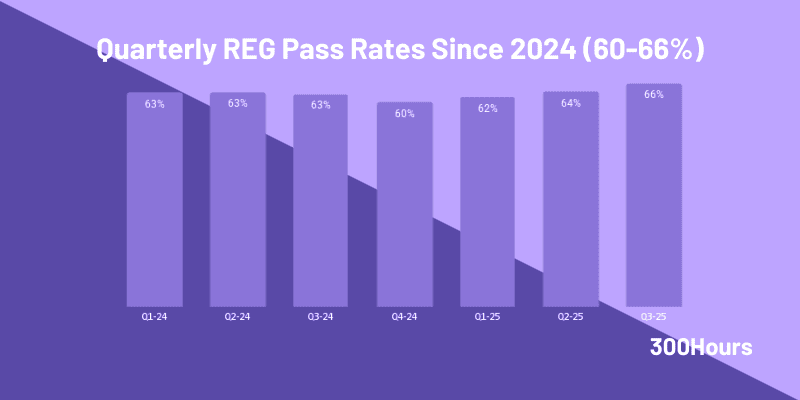

- REG pass rates ranges from 60-66%.

- Discipline sections are new since 2024, and are starting to establish their own trends. BAR (linked to FAR content) seems to be the most challenging Discipline, while TCP (tax specialization) shows consistently high pass rates. ISC falls in the middle, generally more accessible than BAR:

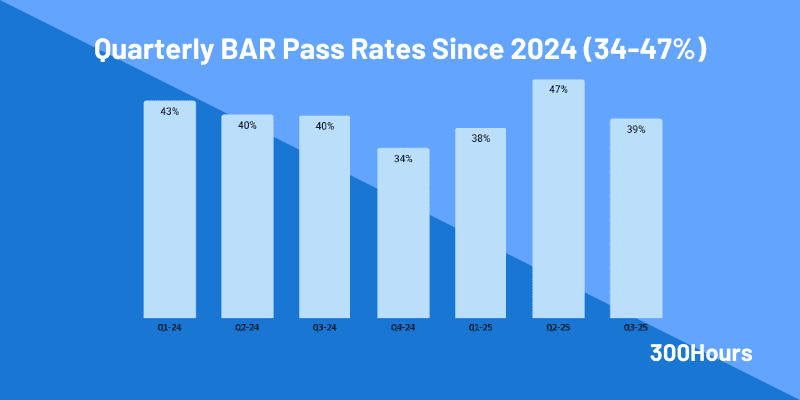

- BAR pass rates ranges from 34-47%;

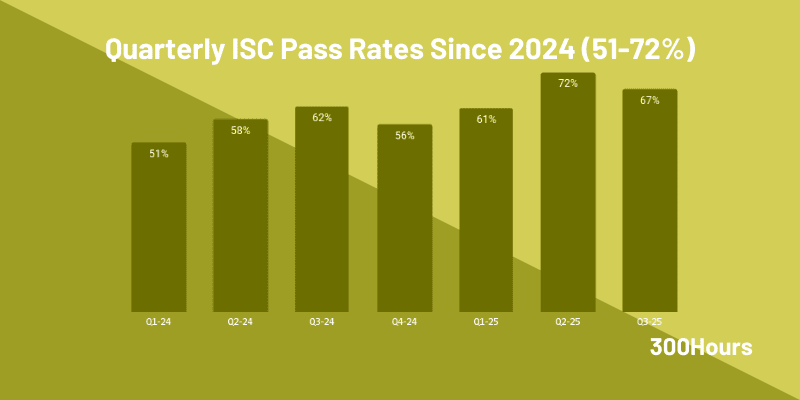

- ISC pass rates ranges from 51-72%;

- TCP pass rates ranges from 72-82%.

First-time vs. repeat candidate CPA pass rates: Why the difference?

Official data from NASBA indicates that first-time test-takers generally have a higher pass rate for individual sections compared to candidates who are retaking a section.

In Q4 2024, 51% first-time testers passed a section, whilst 39.3% retakers passed a section in the same quarter. This trend is driven by several key factors:

- Fresh knowledge & momentum: First-timers often have recently finished relevant coursework, keeping academic concepts fresh and allowing for immediate, intense study post-graduation.

- Initial preparedness: They typically sit for the exam when they feel fully prepared, having completed a comprehensive review course and dedicated the recommended study hours.

- Challenges for re-takers:

- Targeted study: Re-takers often focus only on weak areas, potentially missing broader review.

- Motivation & momentum: A prior failure can impact morale, and re-fitting study into ongoing work/life commitments can be harder.

- Deeper gaps: Some retakes stem from significant knowledge deficiencies that require more extensive re-learning.

- Demographic / study advantages: First-timers may benefit from holding advanced degrees or having fewer years between graduation and testing, both of which correlate with higher success.

Core sections pass rates (AUD, FAR, REG)

These three sections form the foundational knowledge required for all CPAs. Their pass rates reflect the breadth and depth of traditional accounting principles and the varying nature of the material.

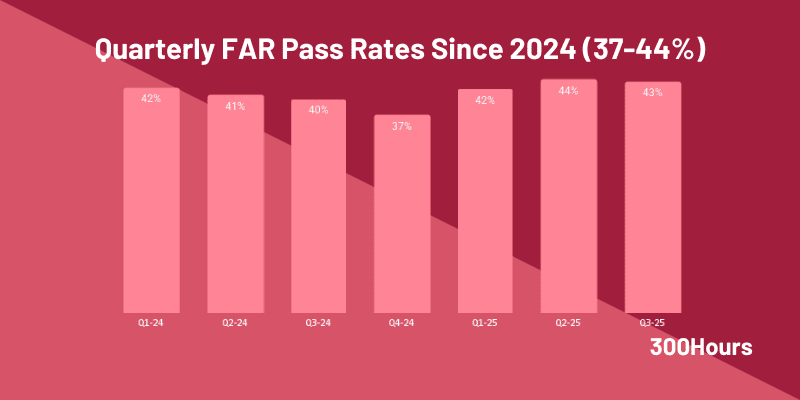

FAR (Financial Accounting and Reporting)

| Quarterly pass rate range since 2024 | 36.8%-43.5% |

| Key exam section topics and format | Arguably the most extensive CPA exam section, FAR covers a broad array of complex financial accounting topics. This includes U.S. GAAP, IFRS consolidations, business combinations, and specialized accounting for governmental (GASB) and not-for-profit (NFP) entities. The format heavily emphasizes Task-Based Simulations (TBSs) alongside Multiple Choice Questions (MCQs), demanding not just memorization but a deep application of intricate rules. |

| Known for | Often cited as the ‘most difficult’ CPA exam section due to overwhelming volume and the sheer depth of detail required for mastery. Most candidates find GASB/NFP particularly challenging due to their unique rules that deviate significantly from standard corporate accounting. The TBSs are seen as highly complex, demanding strong analytical and research skills to navigate the authoritative literature. |

| Tips to pass this CPA section | Many candidates advise tackling FAR first to get the toughest section out of the way. Allocate the most study hours (often 150-200+) to this section, practice TBSs religiously, and accepting that perfect memorization is impossible – focus on conceptual understanding. |

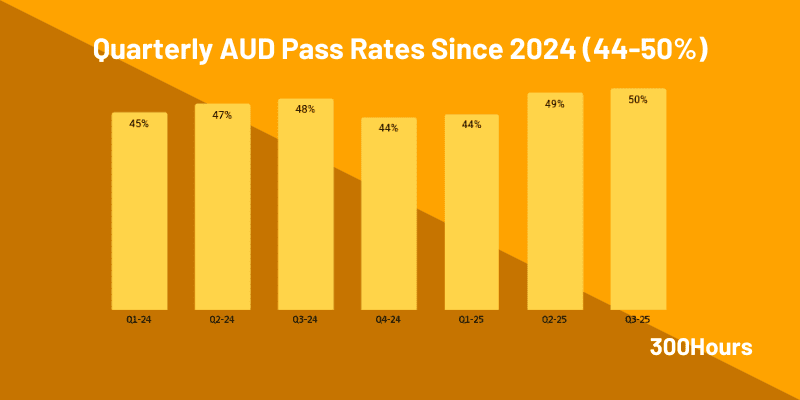

AUD (Auditing and Attestation)

| Quarterly pass rate range since 2024 | 43.5%-50.0% |

| Key exam section topics and format | AUD focuses on the principles and procedures of auditing and attestation engagements. It covers U.S. Generally Accepted Auditing Standards (GAAS), professional responsibilities, ethics, internal controls, and the various types of audit reports. The section requires candidates to apply professional judgment and critical thinking to evaluate audit evidence, identify risks, and understand the entire audit process from planning to reporting. This exam section includes both MCQs and TBSs. |

| Known for | Frequently described as less about rote memorization and more about “thinking like an auditor” and understanding the logic behind the rules, i.e. application is key. The language in AUD questions is often perceived as nuanced and tricky, leading to it being called “subjective” or “vague” by some. Many candidates find internal controls, assertions, and understanding different types of engagements challenging. While directly relevant for audit careers, it’s also crucial for understanding financial statement credibility. |

| Tips to pass this CPA section | Truly understand the “why” behind audit procedures, the subtle differences between various reports, and the flow of an audit. Practice MCQs extensively to internalize the question style, focusing on understanding relationships between concepts, and developing strong critical thinking skills. |

REG (Regulation)

| Quarterly pass rate range since 2024 | 60.4%-66.1% |

| Key exam section topics and format | REG primarily covers federal taxation for individuals, corporations, partnerships, and property transactions, alongside business law concepts (e.g., contracts, agency, secured transactions) and professional ethics. It tests the candidate’s ability to apply complex tax rules and legal principles to diverse scenarios. This section is composed of both MCQs and TBSs. |

| Known for | Often the highest Core section pass rate, and seen as the most “learnable” Core section due to its highly rules-based nature, i.e. more memorization, less application. While the sheer volume of tax law is substantial, it’s quite feasible to pass by putting in the study hours as it is a lot of remembering and rule applications. The calculations are generally straightforward compared to FAR. Many candidates, especially those with a background or interest in tax, find REG to be more engaging and structured. |

| Tips to pass this CPA section | Creating mnemonics for tax rules, doing countless practice problems to solidify application, and focusing on the most heavily tested areas within tax law. |

Discipline section pass rates (BAR, ISC, TCP)

The Discipline sections, introduced with CPA Evolution, allow candidates to specialize in an area. These pass rates offer insights into their relative difficulty and candidate preferences.

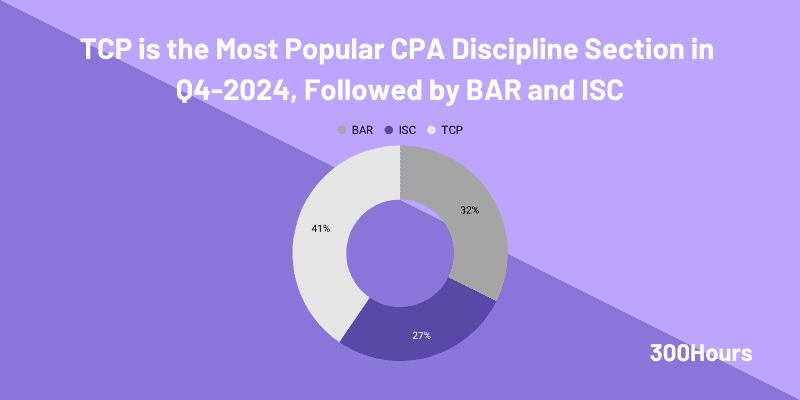

Interestingly, NASBA released the split of candidates’ choices of Discipline sections for Q4 2024 as follows:

Let’s look at each Discipline section’s historical CPA pass rates in turn:

BAR (Business Analysis and Reporting)

| Quarterly pass rate range since 2024 | 33.7%-47.3% |

| Key exam section topics and format | BAR delves deeper into complex financial reporting, governmental accounting, and business analysis, significantly expanding on concepts introduced in FAR. It covers advanced financial statement analysis, highly technical accounting and reporting topics, and in-depth governmental accounting standards for state and local governments. The section features a mix of MCQs and demanding TBSs, often requiring intricate application, calculation, and interpretation of financial data. |

| Known for | Widely recognized as the most challenging Discipline section, often directly labeled as “FAR Part 2” due to its substantial overlap and advanced treatment of FAR topics, particularly governmental accounting. Consistently the lowest pass rates across all sections reinforces its demanding nature. Highly relevant for those pursuing careers in financial reporting, technical accounting, or financial analysis. |

| Tips to pass this CPA section | A very strong mastery of FAR is crucial for success in BAR. So, don’t attempt BAR until FAR foundation is strong. Allocate lots of study hours to this section and assume it is similar in difficulty to FAR. |

ISC (Information Systems and Controls)

| Quarterly pass rate range since 2024 | 50.9%-72.0% |

| Key exam section topics and format | ISC focuses on the intersection of information systems and internal controls within an accounting context. Topics include information security, IT governance, data management, data analytics, business processes, and Systems and Organization Controls (SOC) reports. This section integrates technology, business processes, and audit concepts. It primarily uses MCQs and TBSs. |

| Known for | Often perceived as one of the more “approachable” or “logical” Discipline sections, especially for those with an aptitude for technology or a background in IT audit/consulting. The ISC material is often less calculation-intensive and more framework and concept-driven compared to BAR or TCP. It requires understanding the principles of IT governance, cybersecurity, and how systems impact financial reporting. Career relevance is high for those aiming for IT audit, cybersecurity, or technology-focused accounting roles. |

| Tips to pass this CPA section | Focus on understanding the flow of information systems, familiarizing oneself with IT terminology, and utilizing study materials that break down technical concepts clearly. |

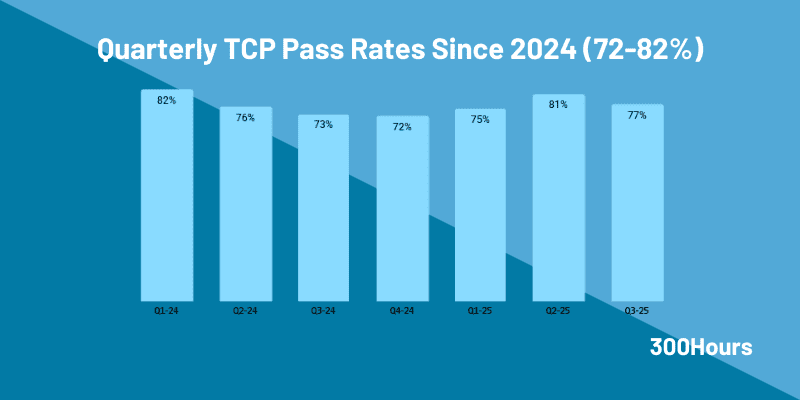

TCP (Tax Compliance and Planning)

| Quarterly pass rate range since 2024 | 72.2%-82.4% |

| Key exam section topics and format | TCP is a specialized Discipline section that significantly expands on the tax topics introduced in REG. It covers advanced individual tax planning, complex entity tax compliance and planning (for corporations, partnerships, and S-corps), and international tax considerations. The exam includes both MCQs and TBSs, often presenting intricate tax scenarios that require detailed calculation and the application of numerous tax laws. |

| Known for | TCP consistently holds the highest pass rate among all CPA Exam sections (Core or Discipline), making it a popular choice. Many candidates who specialize in tax or genuinely enjoy tax find TCP to be the most manageable and even enjoyable section. While the content is undeniably detailed and demands mastery of complex tax laws, its focused nature means less breadth compared to FAR. Often deemed as very “doable” if they possess a strong tax foundation from REG and dedicate sufficient study time. Highly relevant for careers in public tax, corporate tax, or personal financial planning. |

| Tips to pass this CPA section | Ensure a solid grasp of REG before attempting TCP, focusing heavily on practice problems for various tax scenarios, and prioritizing this section if tax is a strong suit to secure an early pass. |

So, how difficult are CPA exams?

The CPA Exam’s difficulty is immediately apparent in its pass rates, which consistently hover around 50%. This isn’t a curve; it means roughly half of all candidates don’t meet the minimum scaled score of 75 required for passing. But what makes it so challenging?

Beyond rote learning, focusing on real world competence

The CPA Exam demands rigorous application of knowledge, not just recall. Especially with the 2024 CPA Evolution, there’s a strong emphasis on higher-order cognitive skills. You’re not just recalling facts; you’re expected to apply, analyze and evaluate.

This is particularly evident in the Task-Based Simulations (TBSs). These are complex, multi-step problems that test real-world application, often requiring research within authoritative literature. They make up a significant portion of your score (50% in most sections, 40% in ISC). Add to this the strict 4-hour time limit per section, and efficient problem-solving under pressure becomes critical.

CPA vs. other designations

Candidates often wonder how the CPA exam’s difficulty compares to other rigorous financial designations like the CFA designation or the FRM certification. Understanding their different “benchmarks” is key.

Organizations like Ecctis (formerly UK NARIC) often assess the academic equivalency of qualifications like CFA or FRM (e.g., comparable to a Master’s degree).

The CPA Exam, however, is fundamentally a professional licensure exam. Its difficulty is set internally by the AICPA and NASBA to ensure candidates possess the practical competence needed to practice public accounting in the U.S. Its focus is on fitness for the profession rather than a direct academic comparison.

Candidate perspectives: CPA vs. CFA difficulty

Here are some nuanced perspectives from candidates who’ve conquered both the CPA Exam and the CFA Program on their comparative difficulty:

- Content vs. process: Many find CPA content somewhat more manageable if they have an accounting background. However, the requirement to pass four sections within the 30-month window makes the overall process feel like an intense sprint.

- Background influence: Without an accounting degree, the CPA can feel as challenging as the CFA. Conversely, a finance background might provide an edge for the CFA.

- Study hours: The typical 300-400 hours needed for all four CPA sections often equates to the study time for just one CFA level, suggesting a higher time commitment per level for the CFA.

- Eligibility & structure: CPA has stricter eligibility requirements (e.g., 150 credit hours, accounting focus) to even sit for the exam. The CFA has fewer levels, but each level is a massive commitment.

Key takeaway: Both are incredibly rigorous, but their difficulty lies in different demands. The CPA often requires a rapid, high-pressure mastery across multiple areas, while the CFA involves a deeper, more protracted immersion in finance. Many who have completed both tend to lean towards the CFA Program being harder overall.

FAQs

Do CPA exam pass rates account for candidates who only take 1 section versus those aiming for all 4?

CPA exam pass rates are calculated per section, based on all candidates who sit for that specific section in a given period, regardless of whether they are aiming for all four sections or just retaking one.

There isn’t a published pass rate for “passing all four sections on the first try” or a similar metric, though it’s estimated to be around 20%.

If a CPA section’s pass rate is very high (e.g., >70%), does that mean it’s an “easy” section to pass?

No CPA exam section is “easy”. A high pass rate doesn’t mean less difficulty, but rather more prepared candidates.

A pass rate reflects the percentage of candidates who achieved a scaled score of 75 or higher. This scaled score isn’t just a raw percentage of correct answers; it’s a statistically adjusted score that accounts for the varying difficulty of different exam forms. A 75 consistently represents the same standard of minimal competence.

How long does it typically take a candidate to pass all four sections of the CPA Exam, considering these pass rates?

Most successful candidates take 12 to 18 months to pass all four sections. This timeframe is driven by:

– Study commitment: An average of 300-500 total study hours (80-120+ per section) is recommended.

– 30-month credit window: All jurisdictions grant a rolling 30-month window to pass all four sections, starting from the date you pass your first section. (Prior to 2024, this was typically 18 months, which pushed candidates to a faster pace. The extension to 30 months provides more flexibility but candidates still often aim for a quicker completion to maintain momentum.) This window dictates the maximum time you have before previously passed sections begin to expire.

Is there a “minimum passing score” in addition to the pass rate, and how do they relate?

Yes, the minimum passing score for every CPA Exam section is 75 (on a scaled score from 0-99). This score is a fixed standard of competence.

The pass rate is simply the percentage of all test-takers who achieved that scaled score of 75 or higher in a specific period. The scaled score is not a raw percentage of correct answers but adjusted for question difficulty across different exam versions.

What’s the recommended study time (in hours) per section based on historical pass rates and content difficulty?

While precise hours vary by individual, general recommendations based on historical difficulty and content volume are:

– FAR & BAR: 150-200+ hours

– AUD & TCP: 100-150 hours

– REG & ISC: 80-120 hours

These are our guidelines. You might need more or less depending on your background, review course, and study efficiency. The lower the historical pass rate, the more likely you’ll need to hit the higher end of these estimates.

Hope you found the above statistics and analysis helpful. Meanwhile, here are other relevant articles that may be of interest:

- Complete Guide to CPA Exams

- CPA Exam Dates & Score Release: Your 2026 Master Plan

- CPA Career Path: Roles, Progressing & Specializing as a CPA

- CPA Salary – How Much Do Certified Public Accountants Make?

- CPA Requirements By State: A Quick & Complete Guide

- CPA Requirements: 5-Step Guide On How To Become a CPA